USDA REPORT TOMORROW. ARE YOU PREPARED?

AUDIO COMMENTARY & MARKET UPDATE

Report has potential to set the stages for months

Be comfortable knowing this report could end our lows or keep sending us lower

What does the market think is “not possible”?

Ways to manage your risk ahead of the report

Exact hedging strategies to use for your situation

How to take advantage of the USDA volatility

What to do if you’ve made sales, need to make some, need protection etc.

Who should be waiting and who should be using calls or puts before the report?

Listen to today’s audio here (Write up below)

Last Chances for Sale

This will be one of your last chances to lock in this opportunity before your trial expires. Don’t miss it. With a subscription you get access to call us 24/7 for tailored marketing advice. Marketing isn’t one size fits all.

Everything: $399 vs $800/yr

Pre-Report Breakdown

A pretty disappointing day ahead of tomorrow’s USDA report. As all the grains close essentially lower. March beans were up +13 cents early on but closed unchanged. Corn was slightly lower while wheat took a little beating.

We got our first flash sale of the year this morning, with a sale of 175k metric tons of corn to Mexico.

The weekly export sales were terrible across the board.

We have a brutally color storm moving across the midwest with temps below 0 degrees. In areas that don't have snow cover, there is the potential threat of winter kill for the wheat crops. However the market doesn't see this as much of an issue.

Then tomorrow we have the highly anticipated USDA report.

It seems like nearly everyone is expecting a fairly bearish report.

This report can bring surprises. So what are some surprises to look out for?

The trade is expecting US yield to come in unchanged from November. No one is expecting yield to increase. So yes, that is a possibility and a risk. Especially considering all of the areas where it looked like they wouldn't have much of a crop end up having a decent one.

On the other side of things, I am hearing some talk that they might lower soybean yield slightly by a tenth of a bushel. Now this wouldn’t be crazy bullish by any means, but this would make a slight impact to our already tight carryout situation.

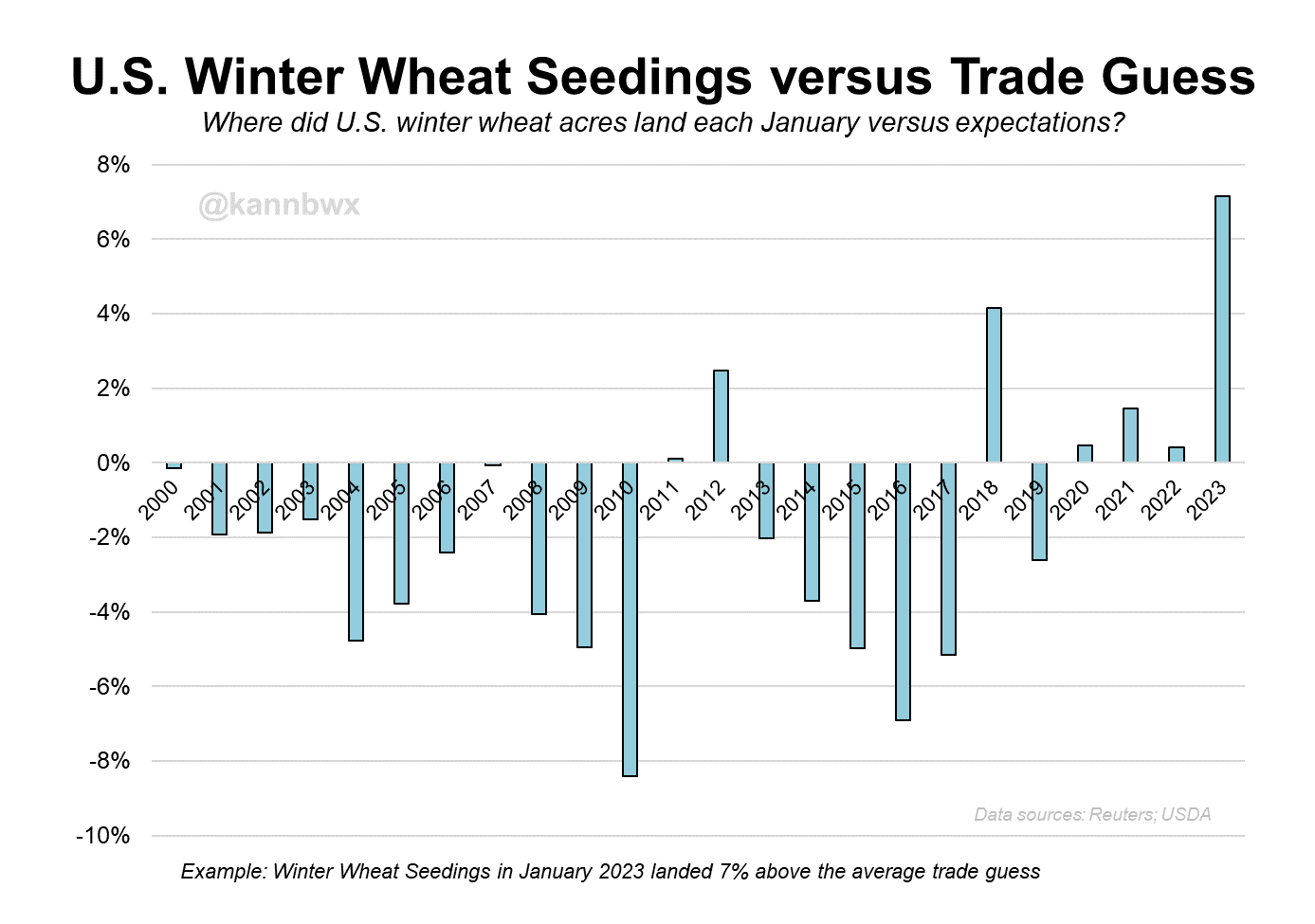

Wheat seedings is another one to look out for. This has brought some surprises over the years. Last year the market was shocked as they came in +7% higher than the expectations.

Here is a chart from Karen Braun that shows the history of winter wheat seedings.

Now let's take a look at US ending stocks. The trade sees basically no changes to soybeans and wheat, with a slight decrease to corn.

For reference compared to 2022/23 the estimates reflect the following year over year changes: +55% for corn, -8% for beans, and +15% for wheat.

The biggest thing everyone will be watching for is South America, Brazil in particular.

This morning Brazil consultancy Patria Agronegocios put out their estimates and they are some of the lowest I have seen. They have beans at 143 vs their previous estimates of 150.7.

Yesterday the CONAB had their numbers at 155.27 for beans and 117.6 for corn.

How does this stack up vs the USDA pre report estimates?

USDA trade estimates have 156.26 for beans and 125.33 for corn.

Now everyone and their dog expects the USDA to come in higher than CONAB did. So for beans it seems like most expect us to come in right around the estimates.

For corn however, there is a big discrepancy. CONAB had 117.6 and trade is looking for USDA at 125.33.

We also have a very wide estimate range. For corn the range is 117 to 129. (Last month was 129). So even if the USDA comes in "slightly" higher than CONAB did corn, there is a chance that number is still lower than the 125 estimates.

For beans, the trade range is 151 to 161 and CONAB came in with numbers fairly close to what the trade is expecting from the USDA. CONAB at 155 and USDA at 156.

So nobody is expecting to see aggressive cuts at all to this Brazil crop. If we did, that would be a very bullish surprise and completely catch the market off guard.

So what do I think?

What I am hoping happens, and what I think will happen are completely different different.

I am hoping they make this huge cuts but let's be honest. They probably won’t. If they do make cuts, it is probably more likely to occur in the corn rather than the beans based off of where CONAB came in.

I don't think there is a very good chance of the USDA coming in lower than CONAB. But for corn, they wouldn’t have to come in lower than CONAB for it to be a bullish number.

For yields in the US, they likely come in unchanged just like everyone thinks. I think there is a slight chance for bean yields to come in a hair lower but I wouldn’t bet the house on it.

I am also being very aware that there is a chance the USDA slightly bumps both corn and bean yields. If you take a look at the trade range for US corn yield, there is more risk of a big number than a small number with the ranges being 174 to 176.5 compared to November's 174.9.

The funds seem pretty content holding their short positions across all of the grains.

I would like to see a bullish report catch them off guard and force them to cover, but that's just hopeful thinking.

There is a chance this report is negative and pushes us lower from here. However I think after this report, if it does push us lower, it will set those new lows and give us some footing before we head higher into spring.

At one point you just have to ask the question that at what price will the sellers get exhausted? The funds are extremely short corn, and we are at very oversold levels. So even if the report isn’t necessarily "bullish" if we get a lack of bearishness it might be enough to spark us a little higher and create that bottom.

After this report, if it does not cause the funds to cover, that is what we will need if we want to see prices crawl out of this slump. A reason for them to cover, whether is be demand, weather, China etc. We will need a catalyst.

Bottom line, yes we all want this to be a bullish report. But the goal in your grain marketing is to get to a point of such comfortability that you don’t care what the market does. You have your operation set up to where you make money no matter what happens.

If you have questions ahead of the report or after, please give us a call and we would gladly walk you through everything, get to know your operation, and help you come up with a game plan. (605)295-3100.

Make sure you listen to today's audio above where we go over exact strategies every different situation should be utilizing ahead of the report.

Now let's take a look at the charts.

Corn 🌽

So far we have still held those lows above that $4.50 psychological support level, which is a level bulls really need to hold if we don’t want to trigger selling even further down.

If $4.50 does not hold, the market may want to try and test the old 2015 to 2016 highs of $4.38

What do bulls need? You need to crawl back above $4.70.

Corn March-23

Soybeans 🌱

Pretty disappointing day on the chart today. Yes we did not lower and we did not take out the recent lows. But we closed 13 cents off of our highs. That $12.50 area remains stiff resistance as we have bounced off of it several times the past few days.

We are heavily oversold and sit below all major moving averages.

Unless tomorrows report surprises and we bounce out of here, I don’t see a ton of reason why couldn’t look to test the $12 level as I have that area as our next major support.

I am hoping we bounce before, but we need to realize that is our risk.

If that level weren’t to hold, bears would be looking towards those summer lows of $11.40.

The first upside target is our 20-day moving average at $12.84. Then we have that gap we left at $12.98 is the bulls target to get things back over $13.

Soybeans March-23

Wheat 🌾

Wheat remains in no man's land.

Stuck in the middle of this recent range.

Bulls still need to take out the recent $6.39 highs.

Chicago March-23

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23