GRAINS FAIL TO HOLD OVERNIGHT RALLY

Overview

A somewhat disappointing day for the grains, but wasn’t necessarily bad.

Overnight we were roaring higher, as both corn and soybeans were trading above last weeks highs.

However, we came down well off those highs. Trading lower for part of the day before bouncing back to end the day slightly higher.

So it disappointing as we closed well off the highs, but it was nice to see us manage to close green across the board.

Why couldn’t we hold the overnight rally?

Mostly technical selling and farmer selling. Farmer selling often occurs after a rally from these lows.

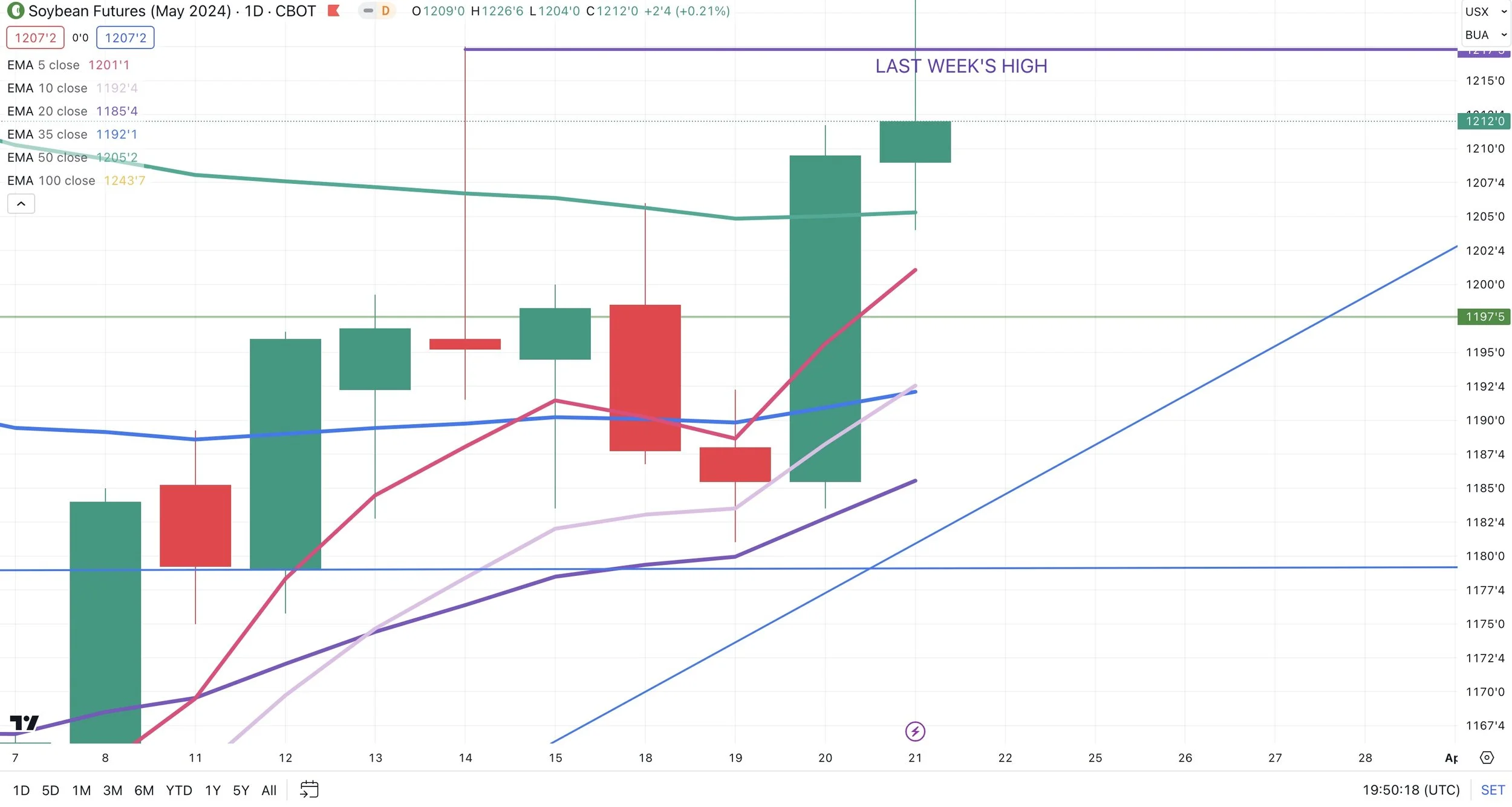

Overnight soybeans were up +17 cents trading as high as high as almost $12.27 before closing at $12.12. Failing to close above last week's highs of $12.17.

Overnight corn was up +6 cents to $4.46 but closed at just under $4.41. Also failing to take out last week's highs of $4.45.

Adding pressure to soybeans, the bean oil market broke really hard off of it's highs. This was mainly due to palm oil breaking due to expectations of bigger production.

Yesterday the Feds left interest rates unchanged but signaled cuts. This led to the stock market rallying to new highs and pressured the dollar. Which is somewhat friendly for the grains.

Soybeans have found some support from Argentina rains. As they have experiencing flooding. They already have a great crop. But getting rain now doesn’t do anything but delay the bean harvest. However this isn’t expected to cause too much concern as Argentina looks to get drier for the next week.

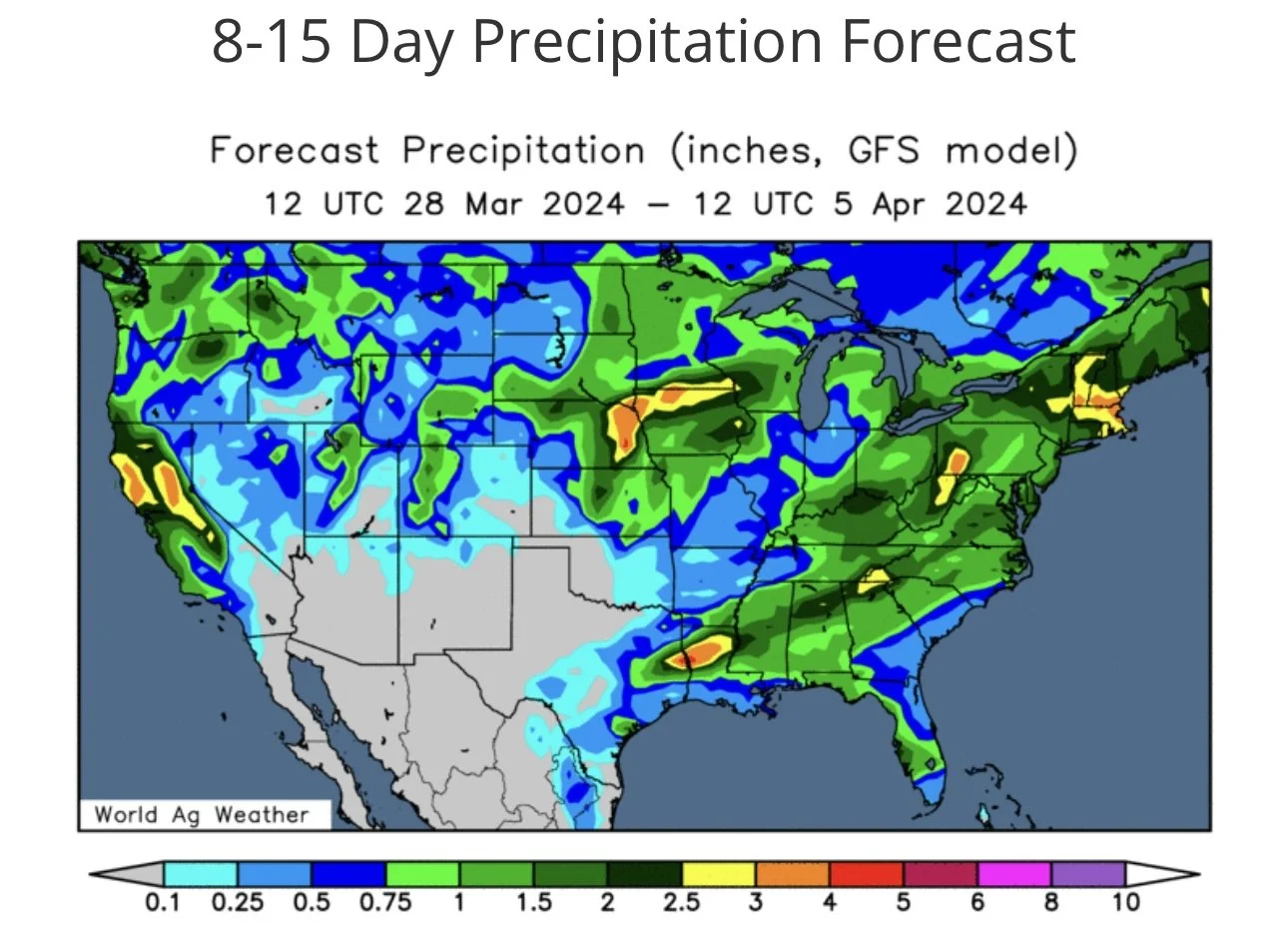

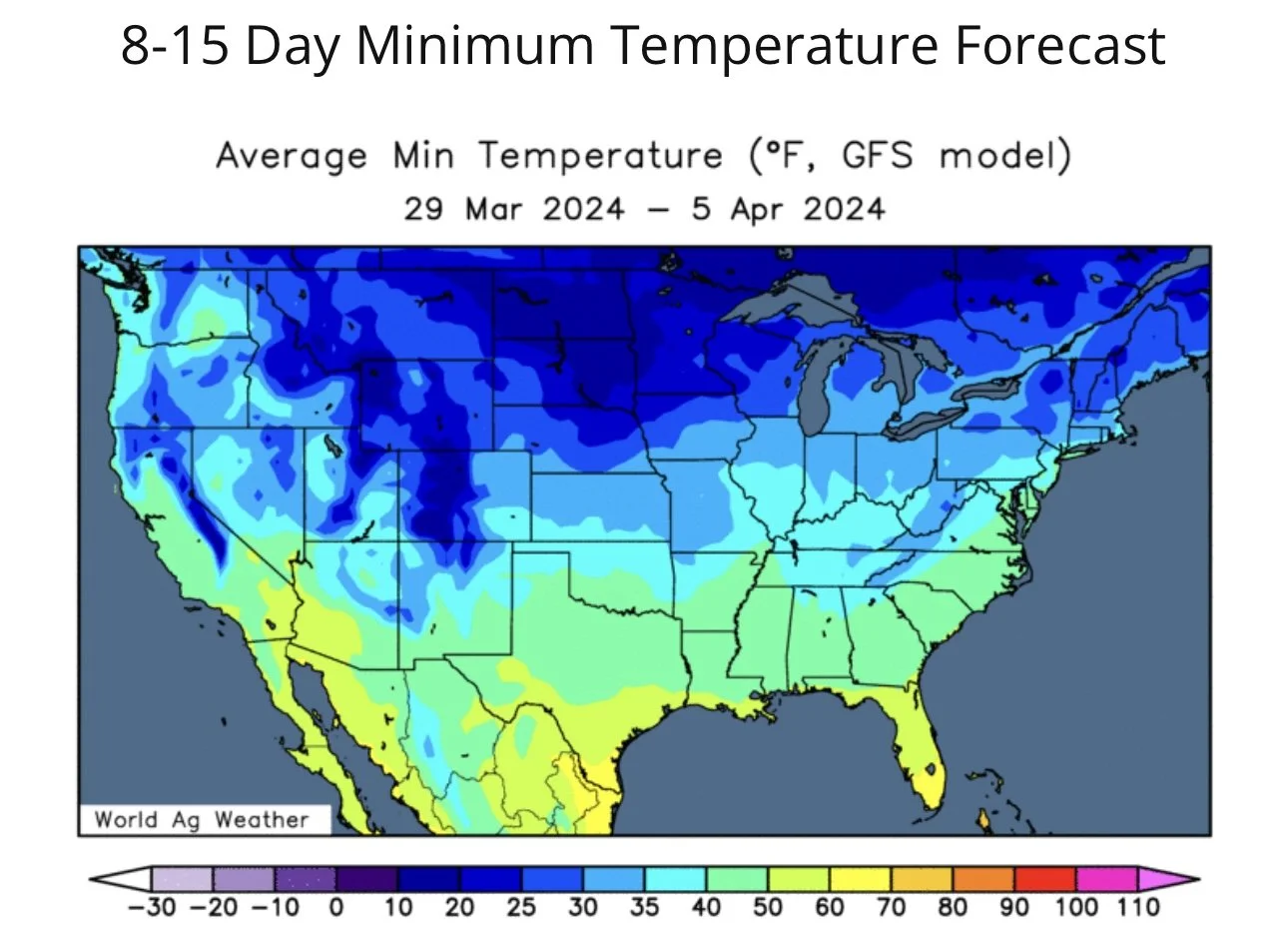

The upper midwest is expected to get several inches of snow early next week along with far colder temps than we have been seeing.

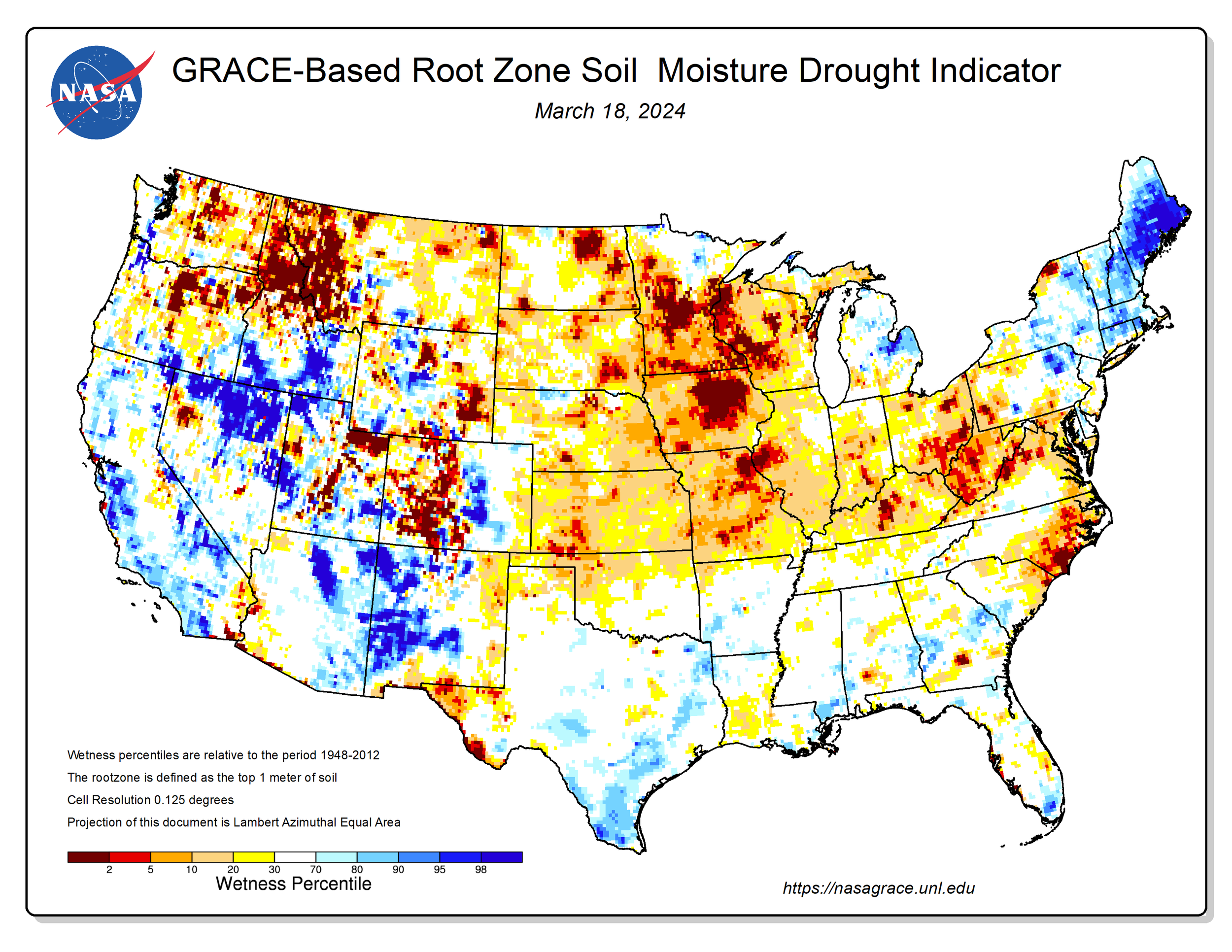

This is going to take away a lot of that early planting talk, and give the soil a much needed refresher.

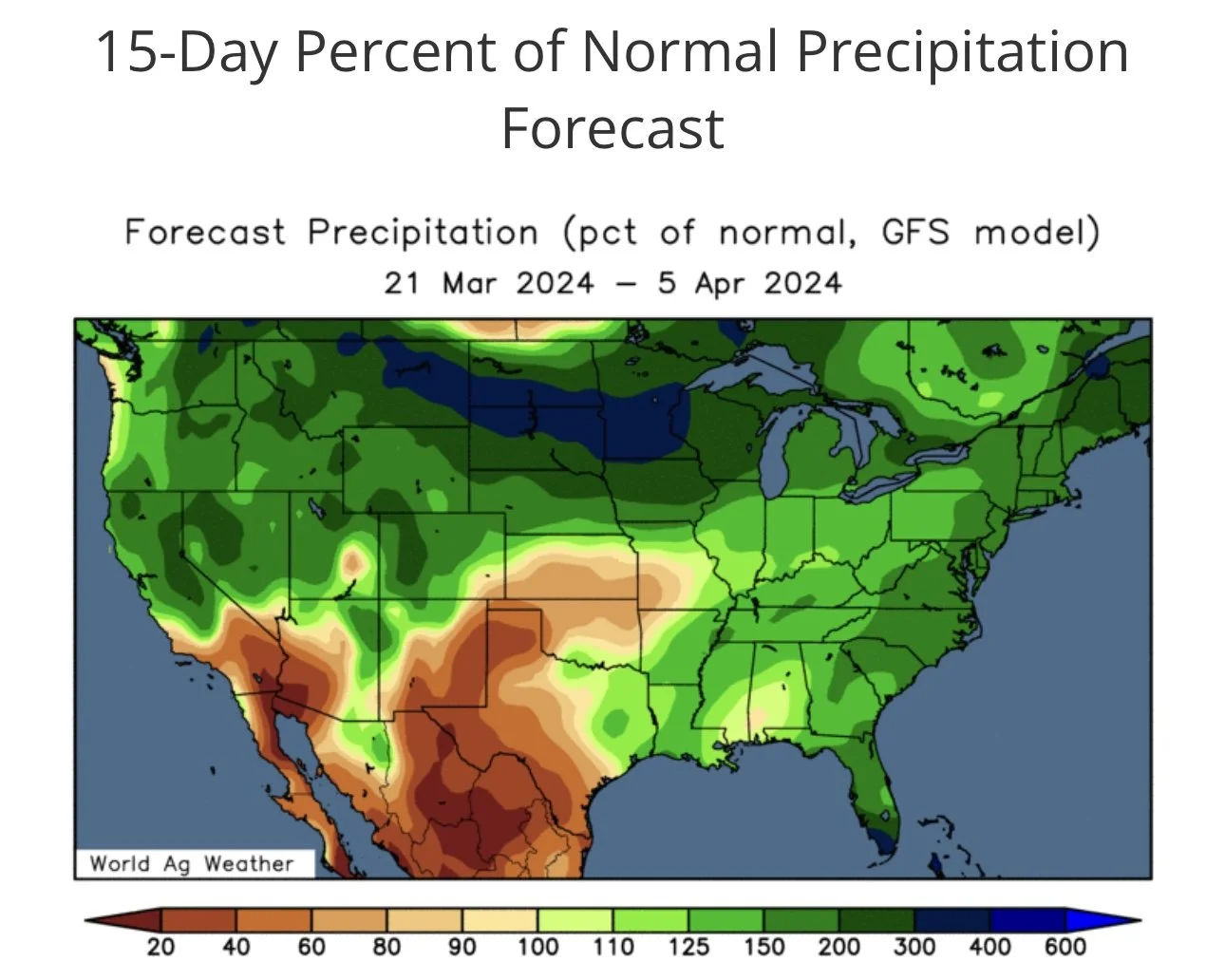

Here is the 2 week forecasts and the soil moisture situation.

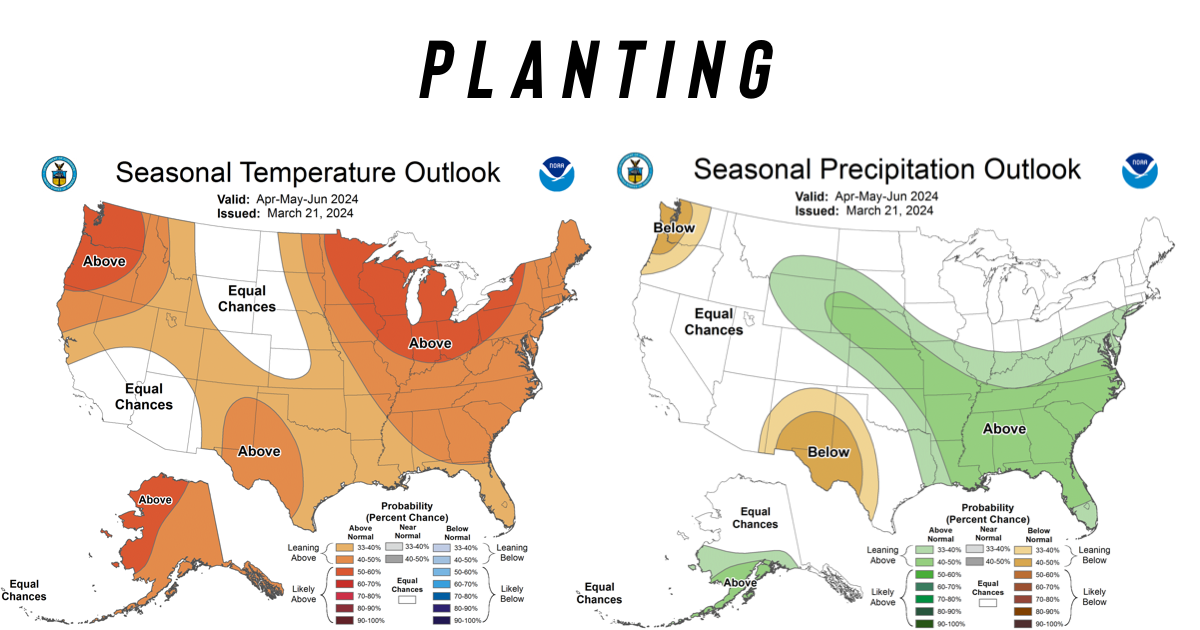

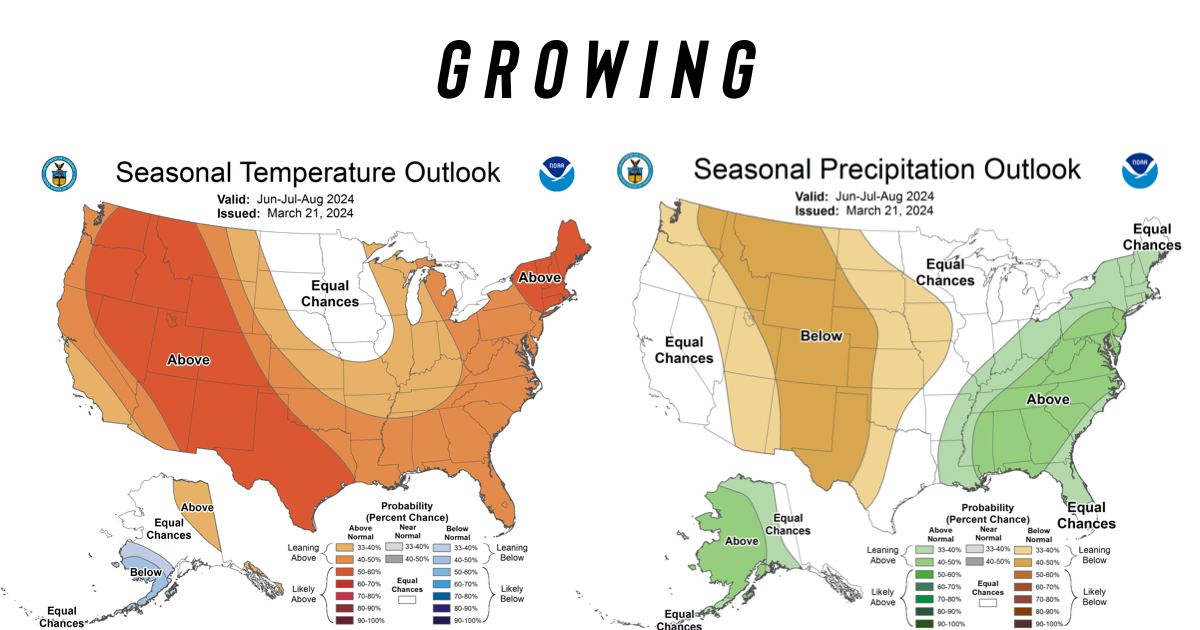

The US climate prediction center says that El Nino is rapidly getting weak. They expect a transition to La Nina. La Nina will support the odds of having a drier and hotter summer than normal and carry into fall as well.

Although we are getting a cold snap, the outlook for planting season still looks far hotter than normal.

The forecasts also have this planting season now shifting to wetter than normal. Perhaps we won’t get this crazy early planting everyone has been talking about.

However, looking towards the growing season that precipitation is suppose to die out for the western corn belt. The heat is expected to remain.

A week from today we have a major USDA report.

It will include the survey of farmers for their planting intentions as well as inventory. This will give the market a ton of fresh news and data to chew on. This will likely be a huge market mover.

The markets will be closed the day after this report for Good Friday.

Today's Main Takeaways

Corn

Corn manages to close higher.

Brazil is getting rain. This is helpful for their second crop corn. Negative for prices.

Even with this rain, April will be the key time frame that makes or breaks this crop. One rain won’t save the crop, but it will definitely help.

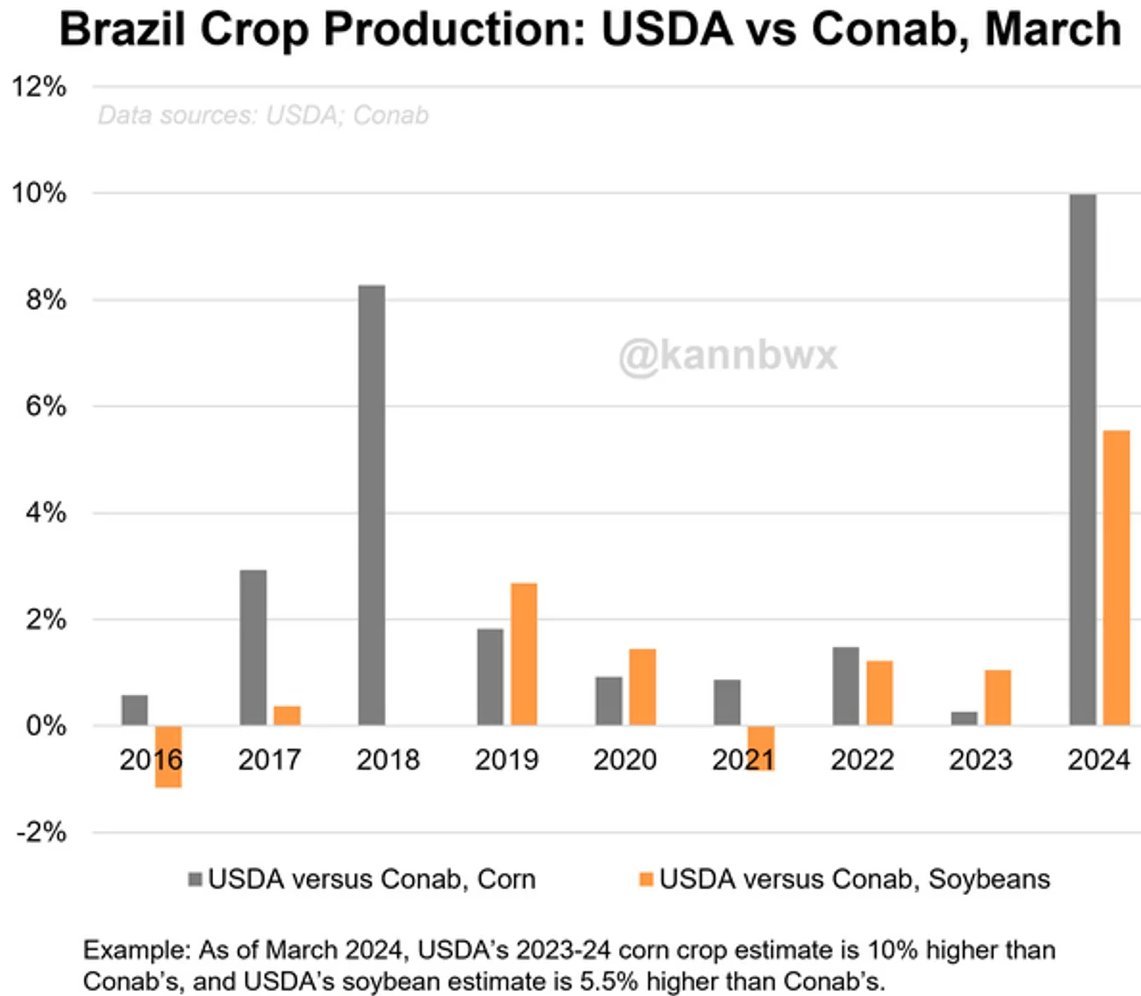

Nonetheless, this corn crop is far smaller than the USDA currently has it pegged at.

They have 124. The CONAB has 112. The largest difference ever. It's not even close.

I do not know how much smaller the USDA will make their estimate. It likely will not get as small as the CONAB's 112. But the trend is still smaller.

A lot of the early planting talk has went away due to the upcoming cold spell and snow.

If we do still get early planting, we will take it on the chin. Still something to be aware of.

The funds are still short over -250k contracts of corn. A top 3 shortest position ever. Plenty of room to cover.

There are many reasons why the funds would want to continue to cover here. We are going into planting season here soon. Acres are unknown. We don’t know if we will raise a record crop or get hit with a drought. There are simply too many uncertainties for the funds to want to hold this short of position.

As for this upcoming report. This report has the potential to be very negative.

What is the cheapest way to defend against lower prices if you are scare about the report?

If you have unprotected bushels or are undersold, there is nothing wrong with rewarding a rally IF it makes the most sense for your operation.

Typically we want to be making sales in late spring to early summer.

If you want to hedge, here are two options you could consider if you are worried that this report is going to cause a sell off. Puts are also currently cheap. We do not want to overspend on protection at these lower levels.

1) A put that expires the day of the report. A New Crop December $4.65 put that expires March 28th is roughly 4 cents.

2) A longer dated put that will give you protection for 36 days. A New crop December $4.65 put that expires April 26th is roughly 8 cents.

Futures and options are risky and not for everyone. So please give us a call if you have questions or want to discuss a strategy that would fit best for you. (605)295-3100. Because some but not all of you should be using this specific strategy.

The chart looks friendly. I need a close above last weeks high of $4.45 to confirm more upside.

Corn May-24

50% Off Before Your Trial Ends

Comes with 1 on 1 tailored grain marketing planning. Lets take back that edge from big ag.

Soybeans

Soybeans close green but -15 cents off of their highs.

The recent rain in both Brazil and Argentina is beneficial for soybean futures. Rain now does not help that crop, it just delays the harvest.

Overall things still look friendly for the soybean market.

We have this massive crush. Yesterday we sold soybeans to China. There is still uncertainty surrounding this Brazil crop. The funds are still holding one of the shortest positions of all time.

One thing I am being cautious of is potential high acres this year.

With the profit margins currently looking better for soybeans rather than corn, along with the cash, good crush margins, and a tighter balance sheet. There is a chance that we see the gap between corn and soybeans acres narrow.

Last year we had 94.6 million for corn & 83.6 million for soybeans.

In the USDA outlook forum we saw 91 million for corn & 87.5 million for soybeans.

This could add pressure looking long term for beans. However, a lot of estimates I am seeing for the March 28th report have soybeans at 86 million. Which would be a sizeable increase from last year, but slightly lower than what the USDA outlook forum had.

This acre report probably has more potential to be negative than it does potential to be positive. Something to keep in mind.

Here is some estimates from Ag Market.

Tuesday I mentioned different strategies you can use if you are nervous about the report. Essentially this is the same strategy as I mentioned in corn today.

The two routes would be a put option that expires the day of the report or a longer dated put option. When we get puts down at these levels, we actually hope they go to zero and that futures rise so we can make better sales. But if prices do drop, these puts will add a little bit to your bottom line and help you be more comfortable.

Give us a call if you have questions or want to discuss. (605)295-3100.

Bottom line, I do not like making sales here. However, there is nothing wrong with spreading out your risk especially if you are undersold. Taking advantage of a +80 cent rally is never the worst idea in the world.

I do believe we will see higher prices later this year. $14 seems like a stretch today, but remember last year when we were trading at $11.30. Not many aside from us thought we'd see $14 that year, but we did.

We want to be making new crop sales closer to summer or even a little later in the soybean market. Typically you make sales in corn before soybeans, because soybeans typically top out later than corn due to the difference in the key growing time frames.

The soybean chart actually looks very friendly. We need a close above last week's highs of $12.17 to confirm more upside.

We have been talking about moving average cross overs a lot.

When the smaller moving averages such as the 5-day crosses over the bigger ones, it is often considered a buy signal by many.

Currently the 5-day (red line) has crossed above the 10-day (pink line), the 20-day (purple line), and now the 35-day (blue line).

The 10-day (pink line) has now crossed the 35-day (blue line).

We closed above the 50-day for the first time since December (green line).

All of the moving averages are now pointing up. From a technical standpoint, very friendly.

I included a close up image of the chart so you can see the moving averages.

Soybeans May-24

Wheat

Wheat was well off the highs and well off the lows, closing slightly higher on the day.

The big news from earlier this week was that the EU might add tariffs to Russian wheat. They still have not voted on this. So nothing new there.

This cold snap that we are going to see is not expected to have a major impact on the winter wheat crops here in the US. Overall the crops are still sitting far better than they were last year.

We are still in the time frame where there is simply a lack of news to drive the wheat market.

As for the report next week, most estimates I am seeing have total wheat acres down from last year's 49.6 million. The USDA outlook forum had 47.0. Most estimates are floating around the 46 million area. So perhaps this report could be neutral to somewhat friendly for wheat. As wheat is not stealing any acres away from other grains like cotton especially with the difference in the price changes we have seen the past few months.

The wheat market still sits over +20 cents off their recent lows. But from a technical standpoint I have not seen anything that confirms the low will hold like we have seen in corn and beans.

Although I believe wheat prices will be much higher in the future, I am remaining patient not trying to catch a falling knife.

To confirm a bottom is in, I'd need to see a close above last week's highs of $5.56 which is only a dime away.

May-24 Chicago

May-24 KC

Cattle

We continue to chop around near those recent highs.

There is still a chance this market could go keep going higher, but there is nothing wrong with rewarding that rally we had to start the year.

On feeder cattle, we did break that uptrend but I haven’t seen any confirmation that the highs are in.

If you want to discuss different strategies to use please give us a call (605)295-3100.

Tomorrow we get the Cattle on Feed report.

Live Cattle

Feeder Cattle

Cotton

Bulls need to hold 90.00 if we don’t want to see more downside.

That's the support zone.

A case of old resistance turned to new support.

May-24 Cotton

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/20/24

MORE SHORT COVERING LEADS TO MORE SHORT COVERING

3/19/24

WHEAT LEADS WITH RUSSIA TARIFF RUMORS

3/18/24

ARE YOU PREPARED FOR 160 OR 190 BU CORN?

3/15/24

BULLISH & BEARISH FACTORS DRIVING GRAINS

3/14/24

ARE YOU COMFORTABLE WITH THIS VOLATILITY?

3/13/24

RALLY TAKES A PAUSE

3/12/24

CONAB A LOT SMARTER & SMALLER THAN USDA

3/11/24

CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24