NEW LOWS IN CORN & USDA PREVIEW

Overview

Corn and soybeans lower ahead of tomorrow’s USDA report as corn makes a new contract low. Trading to the lowest level in 3 years.

Tomorrow we don’t just have the USDA. We also get the CONAB numbers in the morning (South America's USDA) along with Stats Canada. So we will get a good data dump and tomorrow will be very interesting.

It is currently the Chinese New Year, so do not expect much business to be done out of China right now.

So why were lower today?

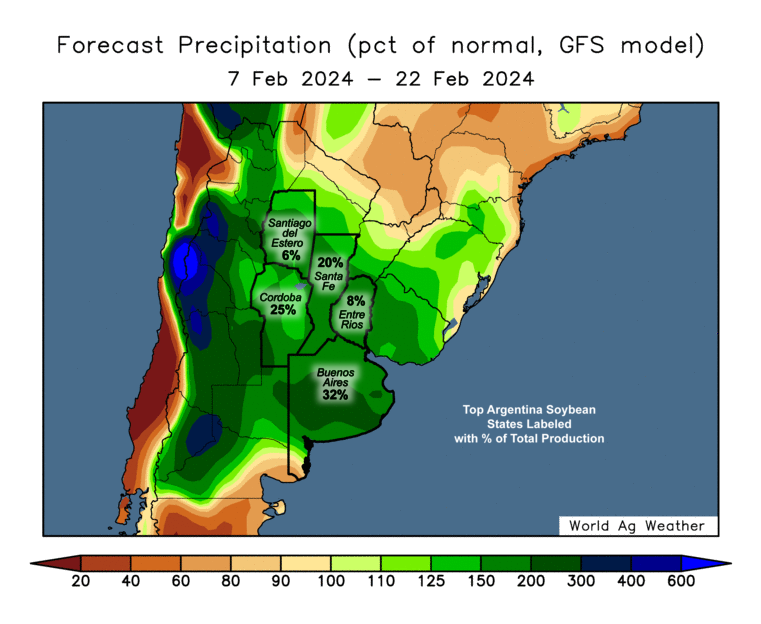

Argentina is expected to see some good rains that are expected to continue throughout the weekend to go along with cooler temps.

Then we have the funds and traders doing some pre-report positioning. Despite a lot of bearishness already priced in, the funds continue to pound the grains lower and won’t take their finger off the sell button. As we haven’t gotten any short covering.

The funds are now short nearly -300k contracts of corn. Which is a massive amount. The most ever for this time of year and the most since 2019.

From Mark Gold of Top Third:

"When they cover this stuff, I certainly wouldn’t want to be the first one to sell it."

USDA Preview

Let's take a look at the numbers for tomorrow.

First we have South America. Despite the recent drought concerns in Argentina, the USDA sees their production getting bigger from last month. The estimates are:

Argentina Corn: 55.7 vs 55 last month

Argentina Beans: 50.8 vs 50 last month

Then despite the weather being pretty friendly in Brazil recently, the analysts see Brazil's crop coming in smaller than last month.

Brazil Corn: 124.3 vs 127 last month

Brazil Beans: 153 vs 157 last month

There is a big range for the Brazil bean numbers of 148 to 157. However, the second lowest estimate is 150.4 and 10 of the 16 analyst estimates came in at 153 to 154.

If we were to come in exactly at these estimates, total Argentina and Brazil corn production would be down -2 million metric tons from last month to 180 million. But +9 million higher than last year's 171.

As for soybeans, total production from Argentina and Brazil would be down -3.2 million from last month to 203.8 million but still far higher than last year's 185 million due to Argentina expected to have double the bean crop this year (25 last year vs 50 this year).

There is not major changes expected from the USDA. The CONAB numbers might be more interesting, so see where they see Brazil production. Keep in mind CONAB last month had their numbers at 155 for Brazil beans and 117 for Brazil corn.

Don’t be surprised to see both the USDA and CONAB play this slow. They tend to always do this and might want to wait for more real results from the fields.

From Farms.com Risk Management:

"USDA & CONAB are notorious for being slow to adjust production lower. In last year's Argentina crops that were cut in half by drought, it was not until the summer that the USDA acknowledged lower numbers! Look for a similar pattern in this year's Brazil crops." "Look for the USDA to forecast a Brazilian soybean crop below 150 million metric tons by March crop report and below 145 by the summer of 2024."

Next we have the US carryout.

There isn’t expected to be any major changes here, although corn is expected to see small cut while soybeans and wheat are both expected to be fractionally higher.

Lastly, we have the world ending stocks.

Just like the US numbers, there is not expected to be any major changes from last month.

All 3 are expected to come in just slightly lower than last month.

Argentina Rain

January is typically the rainest month for Argentina. But rainfall was -18% less than normal this January and even lighter than it was in January last year.

90% of their rain in January this year came in the first half of the month.

So they had a very dry second half of January.

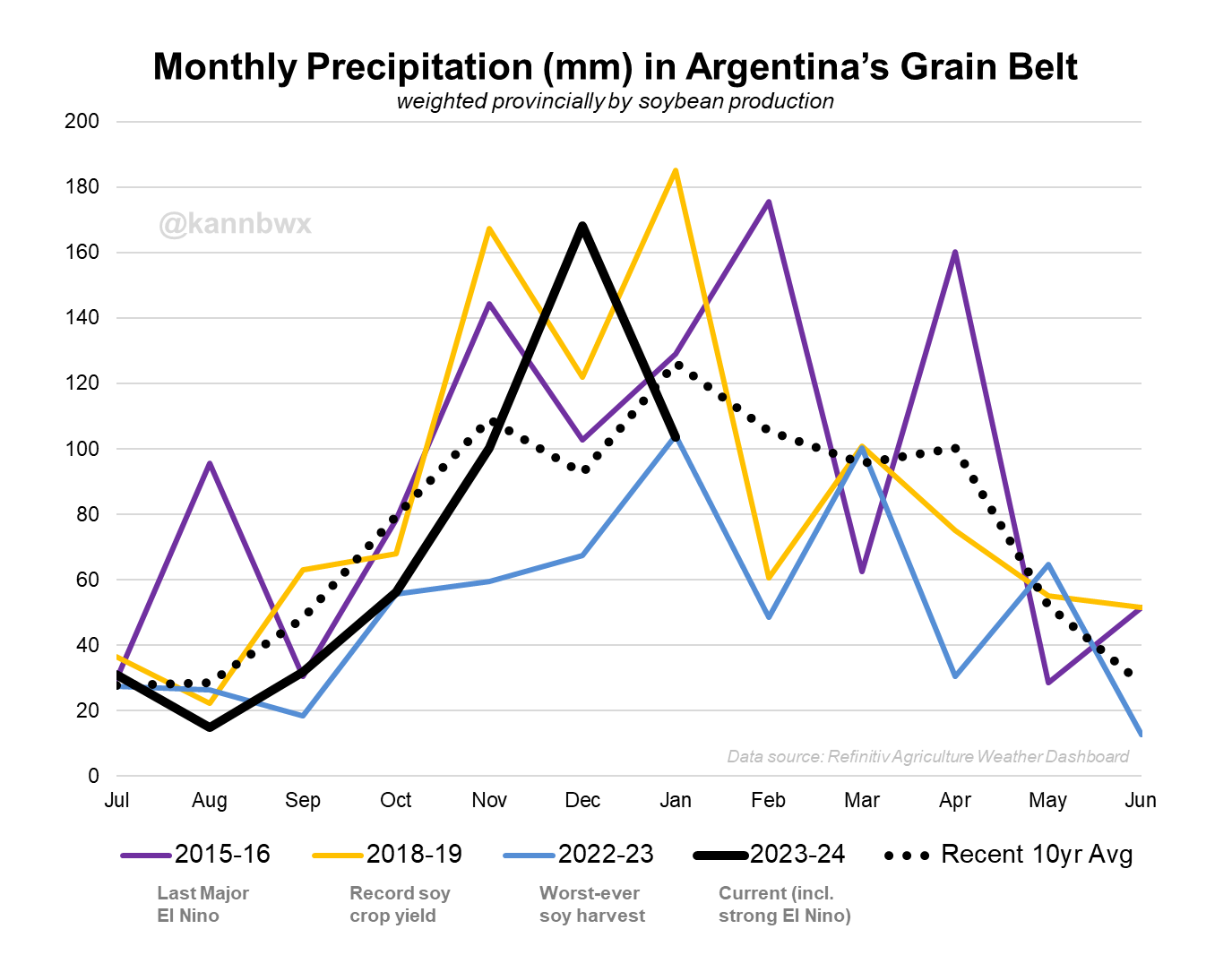

Below is a great chart from Karen Braun that shows their seasonal rainfall in their worst, best, current, and major El Nino season.

December was among the wettest on record, while January was on par with their year they had their worst crop ever.

Now their early rainfall helped a ton. Soil moisture in January was some of the highest in the past 5 years. So this early rainfall could certainly help them withstand this recent drought.

Just something to watch. If it continues to be dry, they will have problems. But for now it does look like they will be receiving good rain.

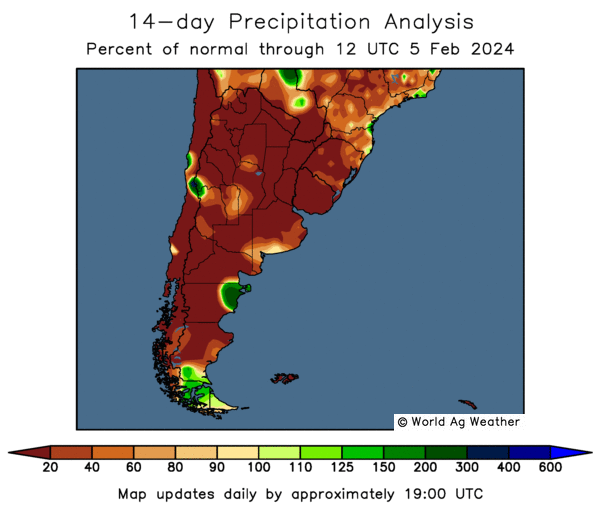

Here is the past 2 weeks of rainfall compared to normal vs the next 2 weeks forecast. A very big change.

I am not a South American crop expert, so I have no idea how much damage has been done. They have definitely seen some real damage, but their early rain should go a long way. Total South America production is still probably getting a little smaller, but overall will more than likely be bigger than last year.

The question is, how much of this rain is too late? And well did their crops hold up with the early rain?

One thing to keep in mind there is some like Gro Intelligence saying that Argentina yields have already dropped by -10% since mid-January.

These upcoming rains will be very crucial as Argentina is in a critical stage for their crops.

Past 2 Weeks

Next 2 Weeks Forecast

US Summer Forecasts

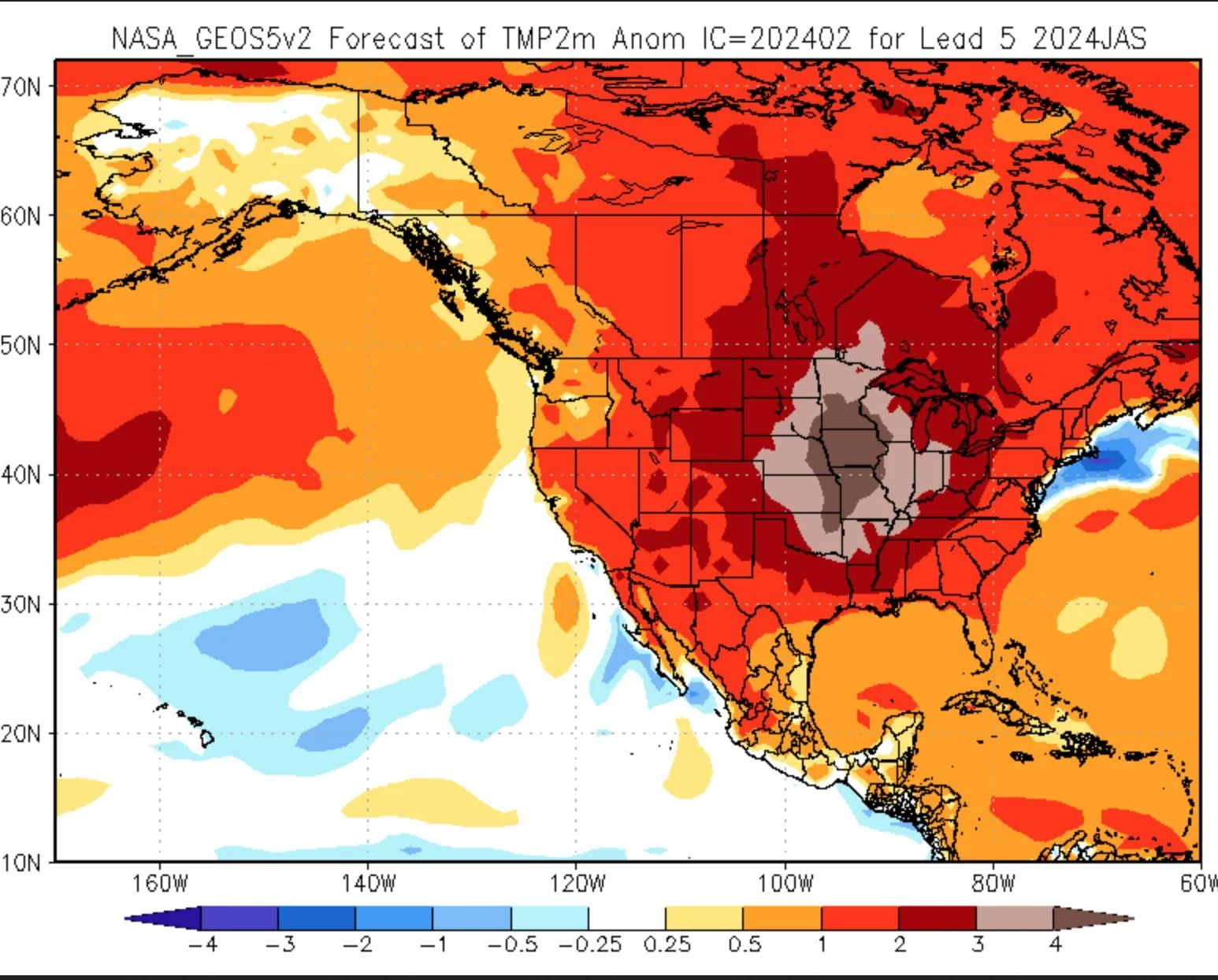

We are far far away from any US crop drought talks. But I found this interesting.

Allen Motew the director of QT weather said,

"They say corn is made in July, beans in August."

"For what it's worth here's some long range resemble modeling. Says what July precip anomaly may look like. Nebraska, Iowa, Illinois, Wisconsin, not looking pretty."

He also added a heat model and said,

"Yikes! Summer heat from one model. Stay tuned. Not looking pretty."

But of course, it is still far too early to even think about that and despite the drought concerns this year, we raised a great crop. Something to watch in the coming months.

Let's jump into the rest of today's update..

Today's Main Takeaways

Corn

Corn makes yet another new contract low as we continue to trade in a tight range and slide lower. Corn just can’t find any strength. Unless we get a friendly USDA report, it seems like the path of least resistance is still to the downside.

As mentioned, we were lower today because the forecasts in Agrentina are showing rain following their 2 week drought.

Brazil farmers still have 20% of last year's second corn crop to sell, and have sold less than 15% of this year's crop. The lowest percentage in the past 5 years. Do they think this second crop corn will be worse than the current estimates suggest? But this also means they have more crop to sell.

As mentioned, the USDA is looking for a smaller Brazil crop and slightly bigger one in Argentina. I am still in the camp that Brazil's second crop corn could very well end up being smaller. As there are plenty of estimates in the 115 range while the estimates for tomorrow’s USDA is 124.

How should you be managing risk ahead of the USDA report?

If you are oversold, it might make sense to own courage calls. If you are undersold, adding some protection is never the worst idea in the world. You don’t want to over spend on protection especially at 3 year lows, but puts are about as cheap as they will get right now. I would get a shorted dated one and add some short term protection if you are going to be forced to sell something in the next few weeks. Please give us a call if you want help or have questions. We'd be more than happy to help you. (605)295-3100.

I am waiting for that seasonal rally to make sales. We have never made our highs in February or March for the year. Now I am not saying we cannot go lower from here within the next month or so. February is typically a bad month for corn futures along with the insurance pricing being set from the average price in February. But I do not think this will be one of those years where we make our highs in January and trend lower the entire year. As that has only happened twice.

We want to be making our sales in April, May, June, and July. "Almost" every year we get some weather scare rally in spring or summer. Perhaps this one could be the Brazil second corn crop situation. Or perhaps we get a ton of rain like we did in 2019 or run into a drought. Nobody knows what will cause the rally. All we know is that the funds are holding their shortest position ever for this time of year. For higher prices, all it takes is one reason for them to cover.

Another thing that could cause some short covering is buying from China. But do not expect any business here short term as they are on holiday mode.

I am aware that we could certainly trade lower from here, especially if the USDA report isn’t in our favor. Typically this report doesn’t provide a ton of new value to either side. Do not be surprised if we go lower and look to test the $4.20 range which I pointed out on Friday if this report is negative. That is where we originally broke out in 2020.

Here is the chart again in case you wanted to view it.

I am hoping we can find some support soon. But right now there just isn’t a reason for the funds to cover. But with their historic short position, all it takes is one catalyst.

Corn is very oversold here, but we could still go lower. I have support at $4.20 which we could very easily test. Bulls need to break out of that downward trend from June (blue line) to get some technical buying and momentum in our favor.

Bottom line, if the report is friendly the funds have a lot of buying to do. If it is negative, they will continue to add to their already historically short position until they find a different reason to cover which could possibly not happen until March, April, or even May.

***

Here is something to think about.. There has been a lot of talk that corn can’t go up until more farmers have sold. That may be true, but it is only true to the extent that the farmers allow it to be true. Because farmers can continue to build bins and not have to sell while buyers either have to buy it, replace it, or shut the doors. So once more farmers realize this and are not forced to take part in the give my grain away program, then higher prices are able to happen??

Corn March-23

Soybeans

Despite being down a dime today, the action in soybeans was somewhat friendly. We bounced 10 cents off our lows and created a double bottom on the charts.

Just like corn, we were lower because of the rains forecasted for Argentina to go along with pre-report positioning from the funds.

Tomorrow they are looking for the USDA to drop the Brazil crop -4 million to 153. There are several sources still calling for a crop below 150. Will that happen tomorrow? Doubtful.

StoneX dropped thier Brazil bean estimate to 150.4 million, down -2.5 from their last estimate.

Brazil harvest is moving along well, with most early reports from the fields being somewhat disappointing. However, most aren’t convinced the crops will be bad enough to have total South America production even close to as low as last years due to the gains in Argentina.

Unless we get a bullish USDA report, it might be hard to see major strength short term. We need China to come in here and start buying which won’t happen for a little bit with the holiday.

The next major market movers will be the actual results from the fields in Brazil, and then eventually we will start talking about US new crop weather. Until then we could be in for sideways prices or perhaps a little lower prices.

How should you manage risk ahead of the report?

Similar to corn. If you have made sales or are oversold, I like the idea of courage calls to help give you the courage to make sales when we get that rally. If you are behind on sales or will have to be making sales, I like protecting the downside on soybeans more than I do corn simply because of the downside risk soybeans have. Because there is certainly risk. Make sure you don’t overspend and keep your protection cheap. If you have questions please shoot us a call at (605)295-3100.

Looking forward, we could simply chop around until we see exactly how much this Brazil crop was hurt due to the dry conditions this past fall or until we get a different factor such as China buying or US weather talk.

I wouldn’t be surprised to see us look to test the $11.75 level. If that level doesn’t hold, keep in mind there is another potential -30 cents to the downside with our summer lows of $11.45. But this still isn’t the best time to be making sales. Prices aren’t just going to go straight up, and we will probably trade a little lower from here. But I am still being patient waiting for that seasonal rally or catalyst to make the funds cover.

Soybeans March-23

GET 50% OFF BEFORE YOUR TRIAL ENDS

Comes with 1 on 1 marketing planning.

Wheat

Wheat gets a nice little bounce today but we are still completely stuck in no mans land. As we continue to trade sideways with no indication of a break out either direction.

Overall, still not a ton of news surrounding wheat.

The USDA report isn’t expected to provide much for bulls or bears to chew on with very little changes expected for both the US and world ending stocks numbers. But we will get the Stats Canada numbers tomorrow.

Global weather is leaning slightly bearish, as North America, China, Australia, and Russia are all seeing pretty cooperative weather right now. With the talk here at home that our winter crop is going to look a lot better than last year.

Not much else to say on the wheat market. I still view this market as a sleeper. The funds have been short for forever but we just haven’t seen any major cards get drawn from the deck that will make them want to cover.

Still staying patient waiting for the market to gather some strength. If you take a look at the Chicago chart, we are nearing the end of this triangle. If we get a break out to either direction, it could accelerate the movement and finally break us out of this brutal sideways range. Let's hope its a break higher.

Mar-24 Chicago

Mar-24 KC

Cattle

Cattle market might be getting tired, but the charts still look strong. Testing those highs doesn’t look all that unreasonable. If we take out yesterdays lows, that would be a signal that perhaps we have found our highs.

On feeder, the weak corn is helping add support.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24