WHAT’S THE BRAZIL STORY?

BLACK FRIDAY SALE

Our Biggest Offer of The Year. Don’t Miss It.

Overview

Grains mostly lower ahead of the holiday tomorrow. Remember the market is closed tomorrow, and Friday is a short day (markets close at noon CT).

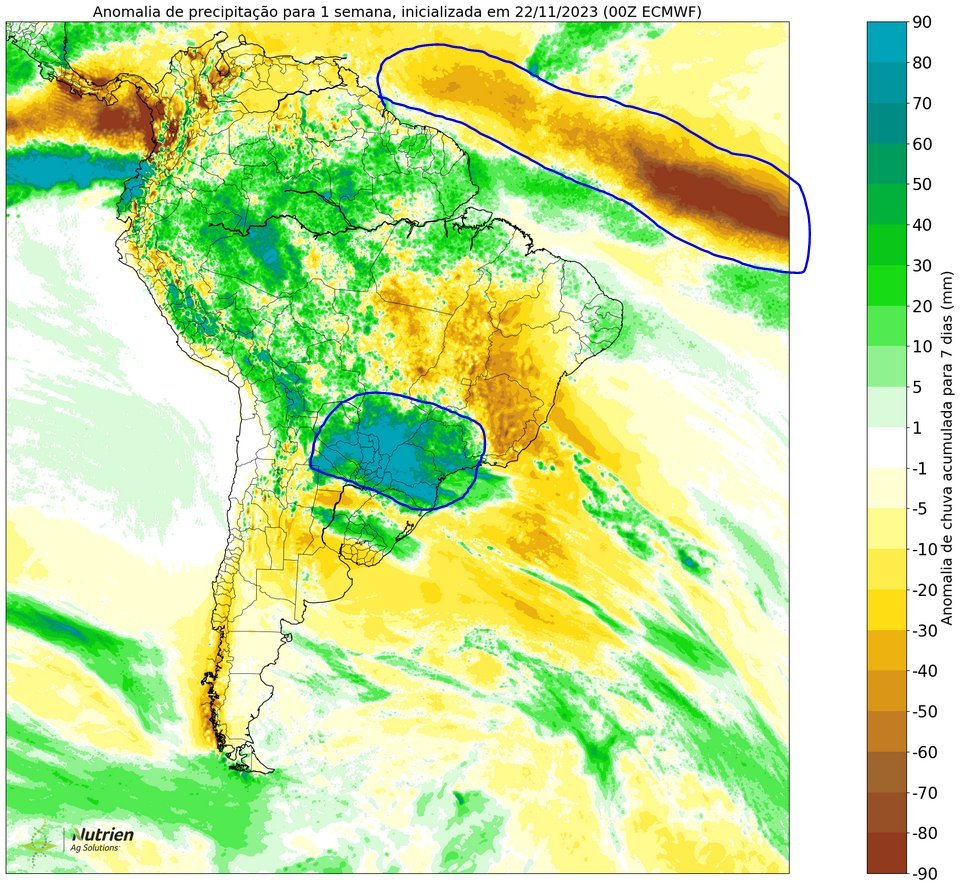

Beans were pressured the hardest. Most of the selling came from the forecasts adding a few showers to northern Brazil over the few days. These rains are not a trend changer, but are providing a little bit of relief. Enough to see some profit taking here, given that beans are up nearly $1 since October 11th.

We had a few flash sales this morning. Usually we get corn or bean sales, but today it was China buying wheat. We also saw some corn get sold to unknown. There is some chatter about China making bean purchases as well but nothing has been confirmed.

The funds remain heavily short corn and wheat, while long beans. Looks like they wanted to reduce some risk in their long bean position ahead of what will be a near 4 day weekend.

We all know the biggest headline out there right now is Brazil weather.

Even with the obvious concerns, Agroconsult just pegged Brazil to have a record 161.6 million metric ton crop this year. Above last year's 159.7 million. This of course added more pressure to beans today.

Why did they raise their number despite the concerns?

They said it was largely due to the near 3% increase in planted areas as well as the belief that there will be greatly improved yields down south where they have been receiving an awful lot of rain. So their thought process here is that the improvements south will outweigh the losses more north.

However, I wouldn’t be so sure that this heavy rain will "improve" yields.

Here is what 247 Ag had to say:

"We call this a wet sandwich. Nearing 80 days of too much rain in Southern Brazil. Most chatter has been about the drought to the north. Significant losses will be seen where it is too wet in the South. Together, very significant. These are nasty trends."

Jason Britt - President of Central States Commodities:

"Totally agree that this is being overlooked big time. I have more farmers tell me they have lost more yield in wet years than dry. (excluding an all out drought of course)."

We have been saying for the past few weeks that December weather will be FAR more important than this November weather we have seen. If December is anything like November, Brazil will be in for a major problem.

But then again, I’m far from a weather man. Here is what Darren Frye of Water Street Consulting had to say:

"December in my opinion will worsen and continue into early January. 40% of the crop in Brazil has been battered by drought conditions. While the other 25% of the crop has been pummeled by too much rain. If the weather veriies that I expect then yield losses will surpass 20% (33 million metric tons). World balance sheet will tighten to 85 to 90 million and US acres have a battle in the spring of 2024. Stay tuned."

Not a bad argument. It is still a tad early to say their crop is made or destroyed. Anything can happen from now until January. But what we do know is that so far, growing conditions have been anything but favorable. Too much rain, the crops drown. Not enough, they die. Would hate to see what happens if this trend continues in the months it actually matters (December & January).

So what's the current outlook for Brazil?

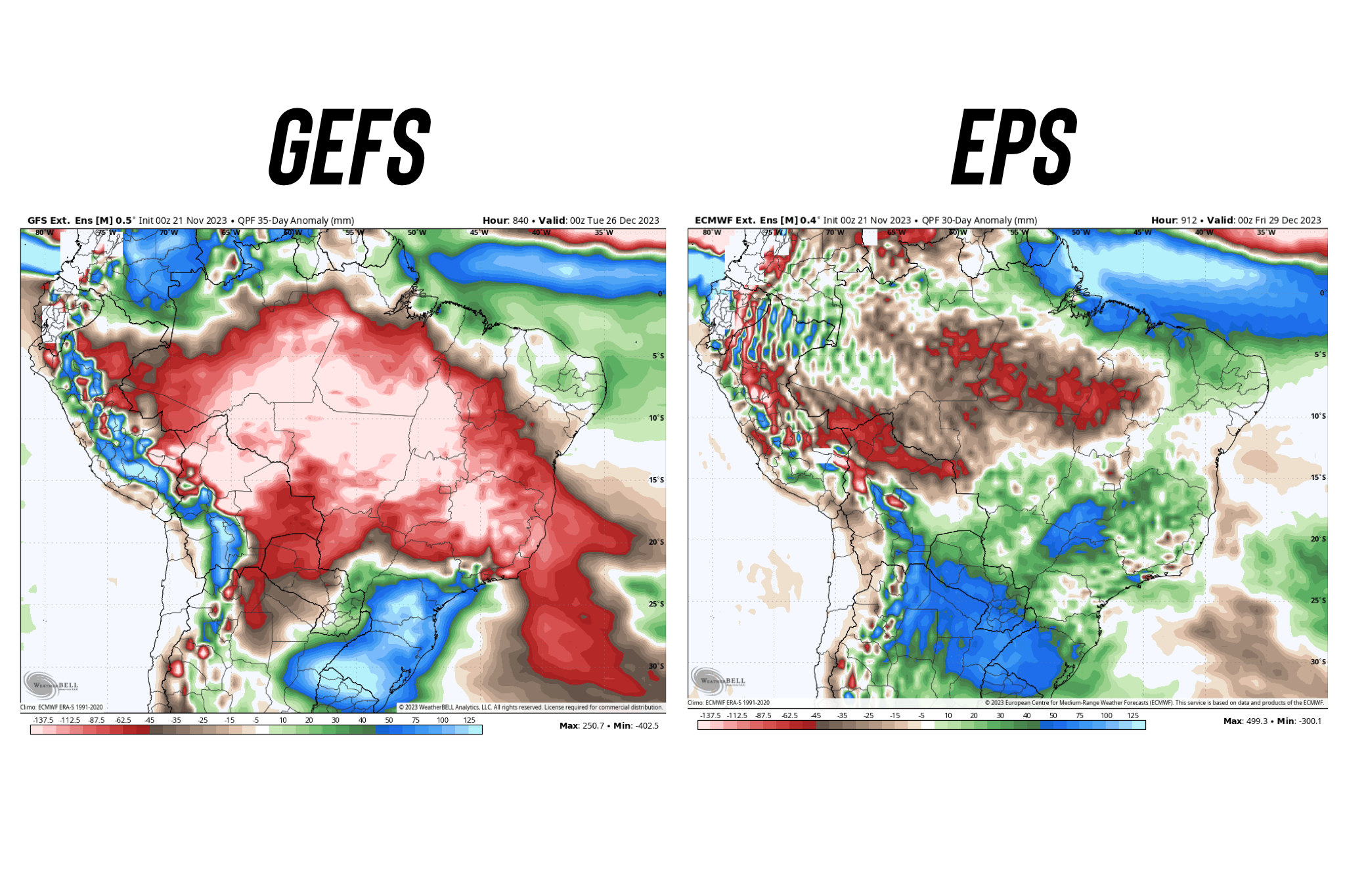

Well, it's a tale of two stories. If we take a look at these forecasts, one is the GEFS and the other is the EPS.

The GEFS suggests it will be much drier while the EPS suggests we are in for a wet pattern change.

Who knows which one will be more accurate. But if the last few weeks tell us anything, the GEFS has been far more accurate.

Today's Main Takeaways

Corn

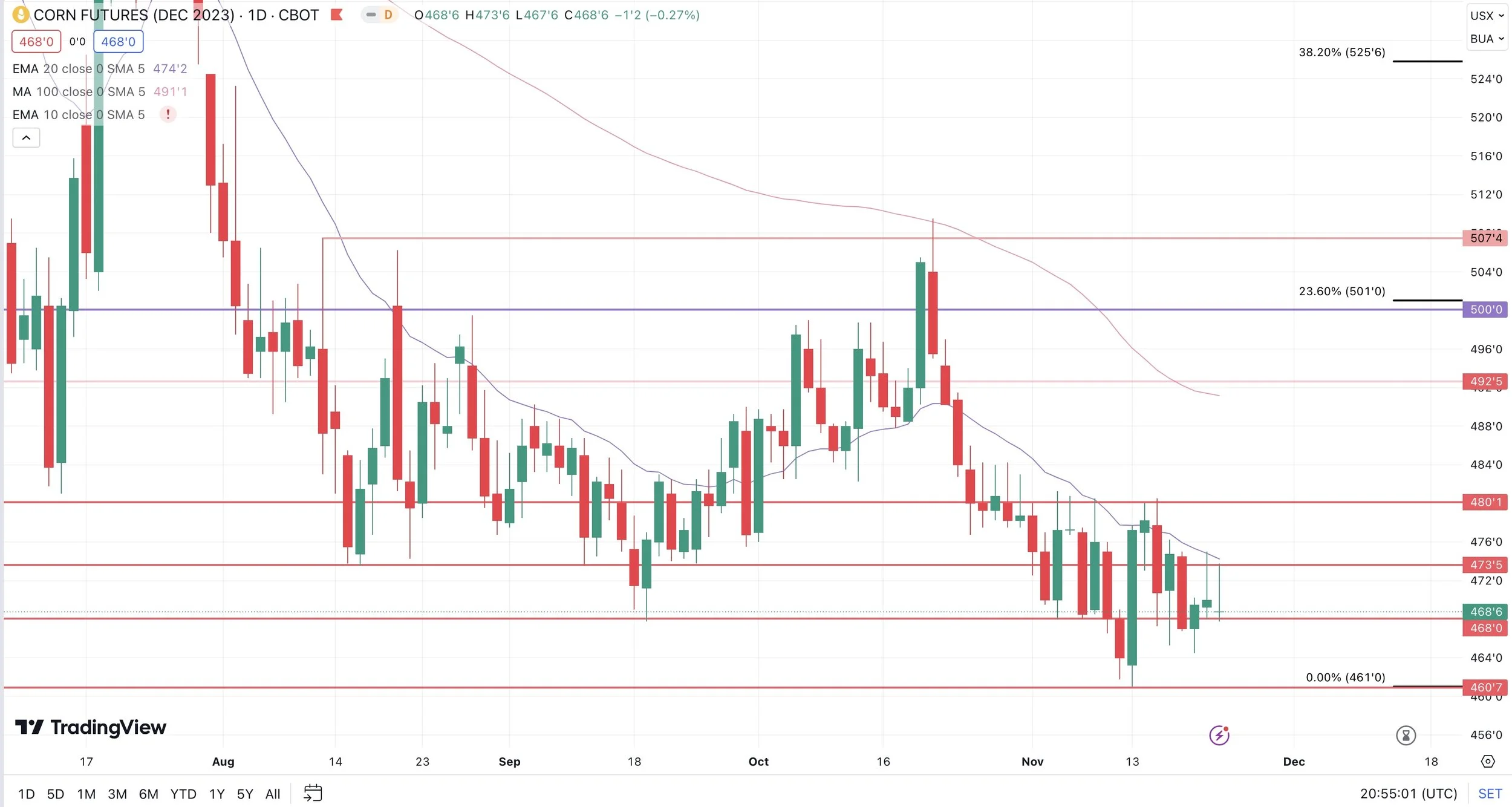

Corn continues to chop around near the bottom of it's recent range.

Overall, there just isn’t that catalyst there that bulls need to break out of this slop.

The biggest thing will be South American weather and Chinese demand

Nobody truly knows how the whole South America production story will shake out.

But I do eventually believe we will start to see demand come and think we will see the funds cover their shorts.

Yes I think we will go higher from here, but do not expect some crazy rally. It won’t be anything like the price action we saw this summer.

The path higher will be a very slow and steady grind higher. Remember, we do have a massive carry out. So it's not suppose to be an easy path.

Corn NEEDS back over $4.80 and ultimately back over $5 if we want to see us break out if this desperate range here. If we can crawl back to $4.80 it could lead to sone positive momentum, a break above $5 likely leads to short covering from the funds.

Basis Contract Recommendation

Here was our recommendation we had yesterday in our audio update:

We have seen a lot of chatter regarding corn on basis contracts the past few weeks. I have seen various recommendations from other grain market advisors.

Our generic recommendation for those of you that have corn on basis contracts that needs to get priced or rolled, is to price the corn and then simultaneously buy March futures. THEN MAKE A PLAN as to HOW you will exit the March corn.

Those of you that have followed us or worked with us don’t have any corn on basis contracts that doesn’t already have future’s not set. We believe in being proactive if we are using a basis contract in a market that has a carry.

If you do a basis contract in a carry market, have a plan that will price the contract prior to delivery or immediately once delivered. Once grain is delivered on a basis contract you are long futures in your buyers hedge account. So why let the buyer use your money, just because you failed to be proactive enough to price your contract?

ROLLING BASIS CONTRACTS IN A CARRY MARKET IS GIVING MONEY AWAY. It is a mistake to DO basis contracts in a carry market.

When should you do basis contracts?

The bigger the inverse the more reason one has to lock in basis. The larger the carry the higher the cost of rolling basis contract, thus the bigger the mistake.

Once delivered one should ALWAYS price basis contracts immediately to take payment while utilizing futures accounts to establish your final price. Many times one might want to be buying one of the cheaper months, just as one would want to roll to one of the cheaper months with upside potential thus adding the inverse to your bottom line.

One of the highest price corn contracts that I have ever had a farmer get was doing just this. In the spring of 2012 corn was trading about 5.00 to 5.50 on the Dec of contact, while the old crop corn was trading around 7.00…..so he does a basis contract but immediately roles it all the way to the DEC futures so now he has a 2.00 plus over basis,…..then a few months later he sells his corn getting around 10.00 a bushel for it….

The highest cash bid we had that year was 7.80…..but this price maker was able to utilize his knowledge of spreads and basis

There where others guys that sold the futures at a higher level then him, but his cash contact was about a 1.80 higher then any one else sold…….oh…..and this was for nearly a half a million bushels…

You can listen to the full audio HERE

Corn Dec-23

Soybeans

Beans take it on the chin today.

After Monday's bear trap where we bounced 40 cents off the lows, we said do not be surprised to see us do the exact same thing to the upside and create a bull trap. Which is exactly what we did yesterday, as we closed well off the highs and continued lower today.

Why were beans so much lower today?

There is a few key reasons, most of which we already touched on.

Agroconsult raised their estimate for Brazil. They are predicting a record crop.

Brazil has been getting slight rains, with a few more added to the forecasts.

Profit taking and the funds. We have had a $1 rally over the past few weeks. Now we have a 4 day weekend. The funds did not want to risk any weather changes in Brazil this weekend. So overall, it was some rains in Brazil, resulting in the funds positioning themselves ahead of the long weekend in case more rains get added.

One supportive factor I could see playing out is Chinese demand. They very well could start to become concerned about the supply out of Brazil.

Bottom line. Expect some crazy volatility in the bean market with all of the factors at play.

This Brazil situation has the ability to push us to $15+ beans or $12 beans.

I think the forecasts still look very threatening. But it's still too early to tell.

We failed to get a break out from this downward trendline, as we have now created a head and shoulders pattern which can often be a negative indicator. So from a pure technical standpoint, we could see some pressure here.

But overall, what happens over in Brazil will ultimately trump technicals.

Downside risk here? Next support is $13.45. Bulls need a break above $14 if we want to destroy the poor technical outlook.

For those of you that are in a profit taking style of grain marketing, this volatility has created a ton of opportunity. If you wanted to make 20 cents on beans, you could have been doing it nearly daily the past few months.

Say a guy bought beans on Nov. 10th at $13.40, you could have sold 3 days later at $13.80, bought them back when we dropped, then sold again on the rally.

Soybeans Jan-23

Wheat

Wheat closes well off of it's highs today. At first it looked like we would be getting two very solid days in a row for the wheat market after seeing a strong bounce yesterday and fighting off new lows. But in typical wheat fashion we gave us today's gains, still holding on to yesterday’s however.

Yesterday we saw wheat higher from two main headlines.

The first is war. As there were some further escalations. The second and probably more impactful one was that the Australia crops are seeing no improvement.

As for war, unless something massive happens, the trade will likely continue to ignore most of these headlines as they are a thing of the past. Sure it could happen and we could get another war led rally, but I wouldn’t hold my breathe waiting for that.

Short term, if wheat wants any major rally we will probably need to see some unexpected weather or war wildcard. We would need enough of a reason to get the funds to want to cover their shorts. But right now, that is simply not there.

Looking long term I do believe they will get that reason and wheat will be much higher. But that day is not today. It could take some, a long time, but eventually wheat will take off.

What would it take to get the funds to cover? From a technical standpoint, we would more than likely need to see prices +40 cents higher before the funds decide to consider puking their longs. Very possible, but again, this could be a marathon.

Chicago Dec-23

KC Dec-23

Check Out Our Junior Price Maker Program

Check Out Past Updates

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23

DO THESE BRAZIL RAINS MATTER?

11/16/23

WAYS TO OUTPERFORM THE MARKET

11/15/23

FINDING THE RIGHT GAME PLAN

11/14/23

DEMAND & SOUTH AMERICA

11/13/23

CORN & BEANS RALLY. WHY THERE IS MORE UPSIDE

11/10/23