HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Overview

Grains lower for the 6th day in a row. Intially, grains were higher despite the phenomenal corn crop ratings, but we gave back all of the gains ending the day lower.

Part of this recent rally was due to the idea of us being too wet which brought uncertainty. That uncertainty is gone now.

Yes a good chunk of crops were not planted in good conditions. But the market does not care "yet".

The effects of a crop planted in the mud, the nitrogen losses, compaction issues, poor root structure. The true impact of those issues will not be known until later in the growing season.

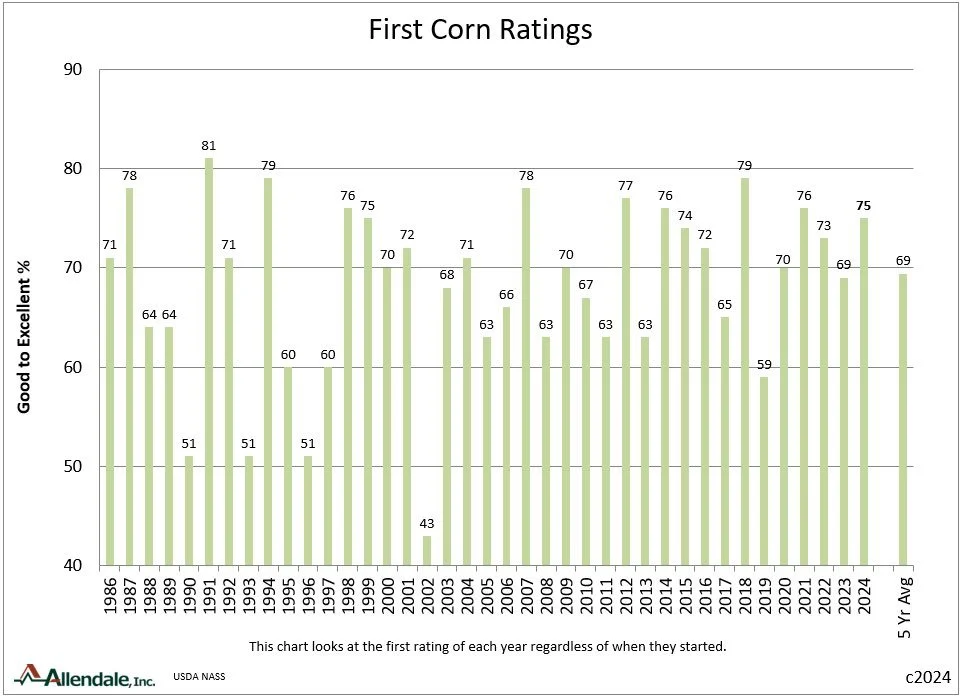

Corn crop ratings came in at 75% G/E. The 6th best in the past 20 years.

Above the 70% estimates and last years 69%. The 5 year avg is 69% as well.

(Chart Credti: Karen Braun & Rich Nelson)

Right now the market is pricing in the possibility of a trendline yield crop.

What is often more important than crop ratings themselves is the price action after. Yes, we had a poor close on the charts and the charts do look vulnerable. But the fact that corn opened lower then was trading higher after these numbers provides some optimism.

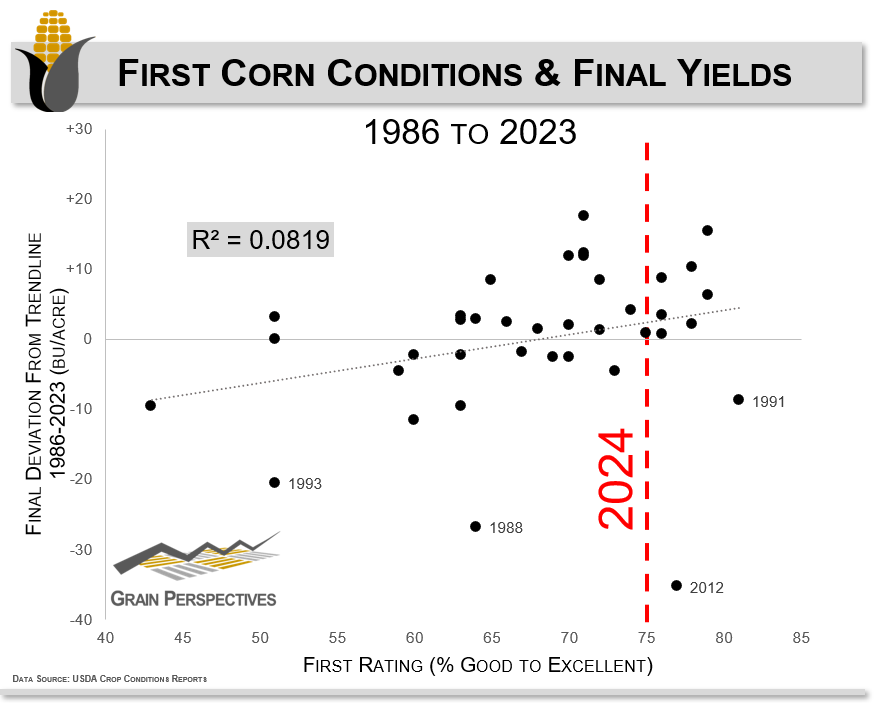

Do these strong initial ratings matter?

75% is good, but it's not amazing. We have seen a lot of years where we are at 70% and there isn’t really any direct correlation from initial ratings to final yields.

I mean these numbers are calculated by local experts. Just 2-3 people per county using an eye test on the crops and sending back the results. They don’t use anything scientific. No satellites, no surveys, no hard data. But this is what the market trades.

However, what history shows is that when crop ratings are 75% or better to start, we have seen near or above trendline yield every year except 2012 and 1991.

(Chart Credti: Mathew Pott)

On the flip side, we have never seen a record yield when corn planting was less than 50% as of May 12th. This year we were not at 50% as of May 12th.

Personally, I don’t put too much into these initial ratings. The initial ratings don’t provide any hard data and we have an ENTIRE growing season ahead where anything can happen.

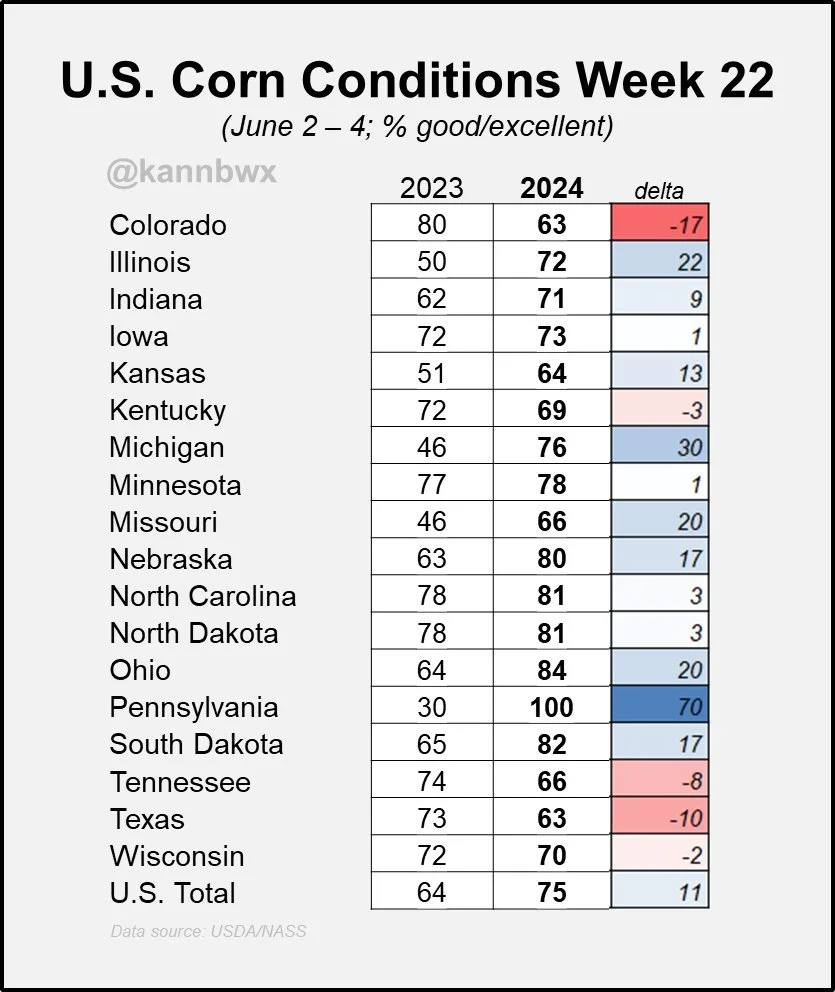

From Karen Braun:

"US corn crop health is better than average, but overall conditions in Crop Watch 24 fields are below average, mostly due to emergence issues related to spring rains. The best conditions are in Indiana and Ohio, but Nebraska isn’t looking great"

Short term no, there is no reason for this market to magically see a major rally. That would take a weather or demand event. But this downside move was overdone.

For now, a majority of this bearishness in corn and soybeans is priced in. I don’t see how or why traders would continue to push this thing lower and lower. It is simply too early and the market knows the potential problems we could have later this year. Still too much possible uncertainty. It is going to be hard for big money to find a bullish story right this second, but we all know how quickly the tides can change especially when you plant these crops in the mud...

BEFORE YOUR TRIAL ENDS

Last chance for one of our biggest offers of the year. Comes with 1 on 1 market plans.

Today's Main Takeaways

Corn

Corn planting is 91% complete.

Which means rain now is bearish. There will be 0 more discussion of delayed planting. Only the impact this wet spring had.

Wet springs bring a ton of potential problems from an agronomy standpoint.

Although yes, this wet of spring has completely fixed out subsoil moisture. Which will make us easier to handle a drought.

But the problem is still that if we lack rain and get heat AFTER mudding a crop in, it can make things exponentially worse for this crop.

We just had the wettest May on record.

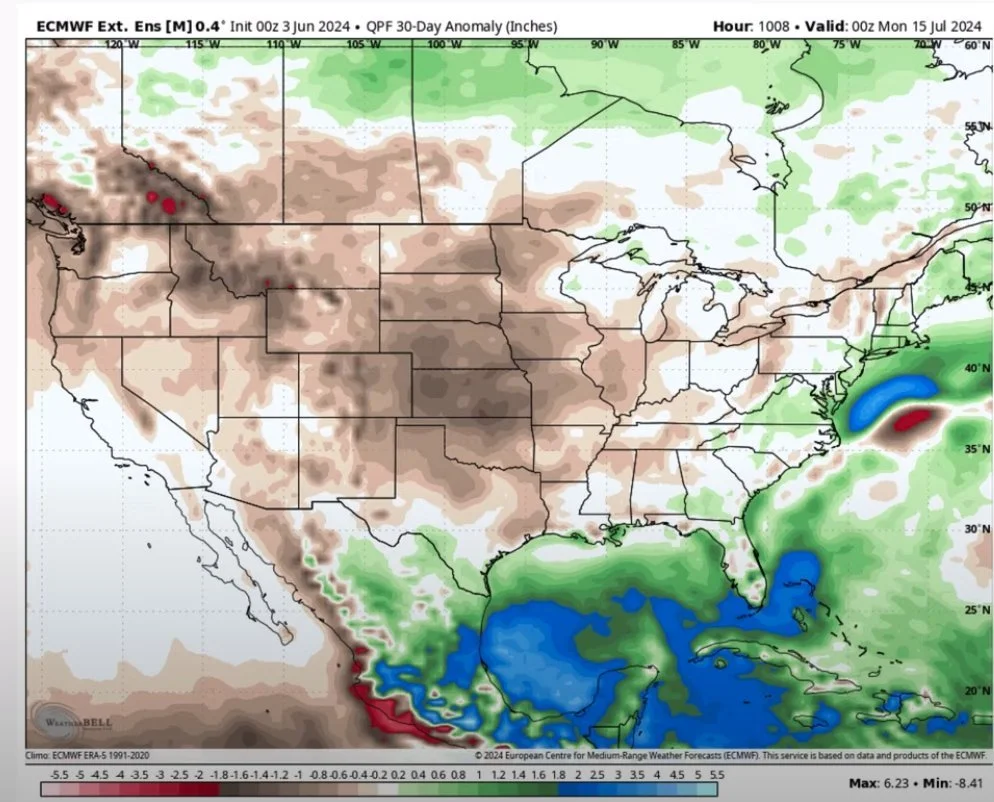

Now we are shifting dry for the summer.

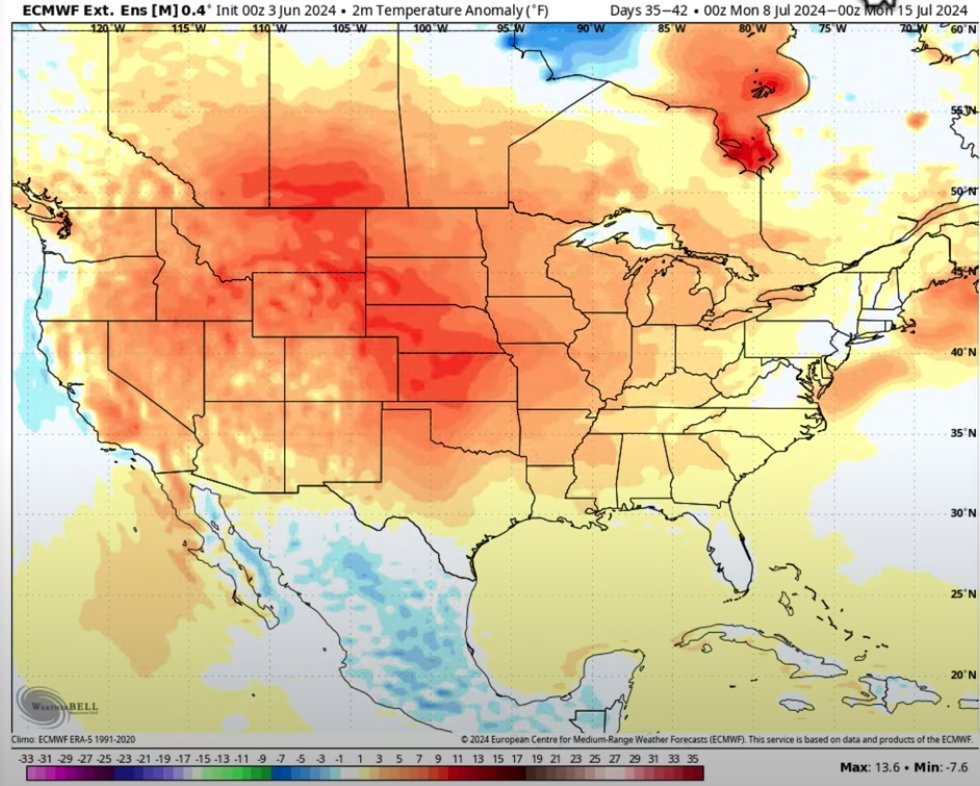

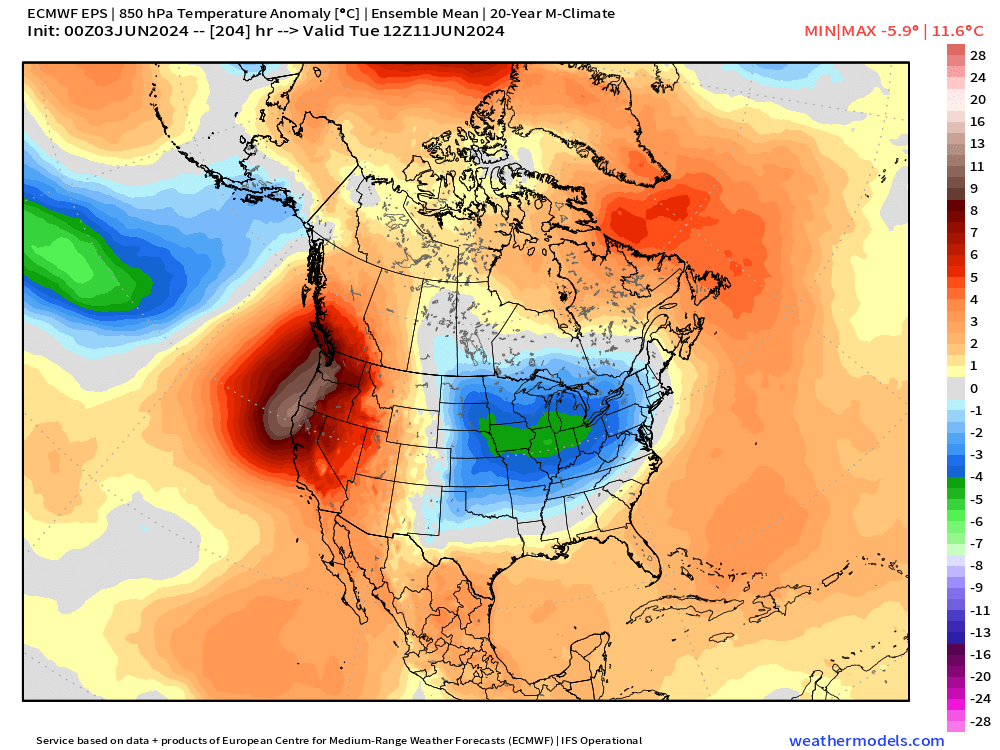

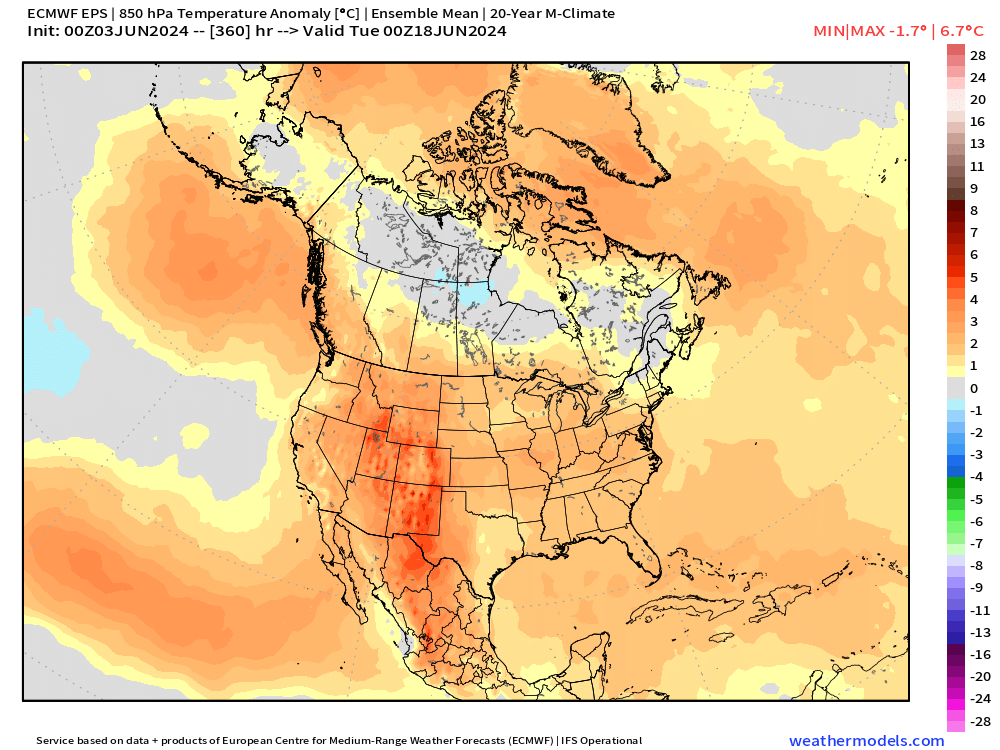

Take a look at the 30-day precip & 2-month temp forecasts.

From BAM Weather:

"Day 8 on the top. Day 15 on the bottom. A pattern change is coming and it is going to feature legit heat risks. Not the "it gets hot every year" heat."

Below is the temperature anomalies.

Bottom line, this market could be tough for a few more weeks. I do not think we will go much lower, but at the same time we do not yet have a story to rally a major amount.

I still think we will see higher prices. The funds are now short -170k contracts and I could still see them flipping long at some point even if its later in the year.

We could certainly get another weather scare. A real one. Remember, the effects of a wet spring are shown in growing season.. not planting season.

If the rally happens, it'll likely be fast and then crash. As it'll be a supply-driven one. So be prepared if we get one.

If you are uncomfortable or undersold, please do yourself a favor and grab some puts. Not everyone should get puts, but for a lot of you it makes sense protecting the downside. Protect wherever you have the most risk.

If acres wind up impressing and we don’t get any production problems by the end of the month, we could certainly be looking at $4.25 July corn. But we still believe there is a high probability to at some point this growing season trade $5 Dec corn.

On Dec corn we NEED to hold $4.59 otherwise we could get another leg lower.

July Corn

Dec Corn

Soybeans

Soybeans planting is at 78% planted vs our 73% average.

We did not get crop ratings for beans, their first ratings will be next week. Just like corn, we could get some strong numbers out of the gate so don’t be shocked if we do.

The biggest problem right now for soybeans is demand.

We have 0 exports for next year. We have the worst new crop book of sales in the past 20 years.

The US is competitive in the corn export market, but not the soybean market. As Brazil is still able to offer a lot cheaper beans than what we can.

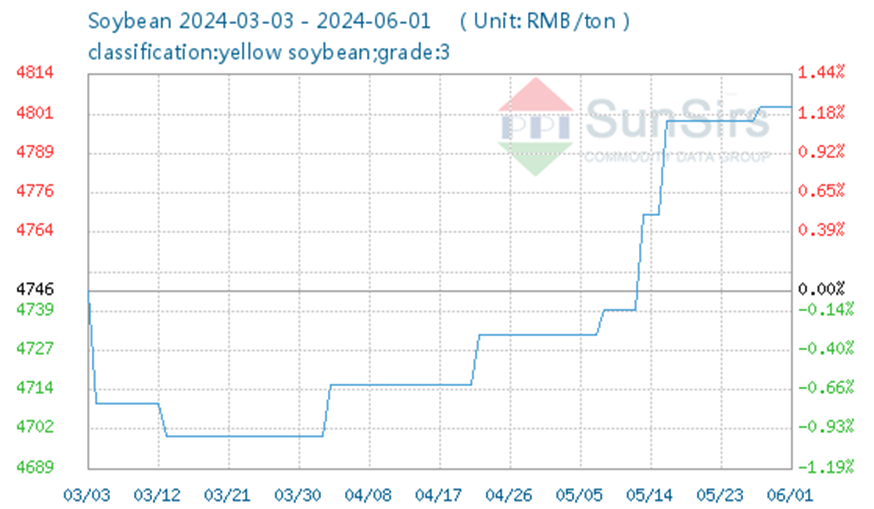

From Wright on the Market:

"Obviously, the price of beans in China is the most valuable single indication of the price outlook for soybeans. This chart is the price trend of soybeans in China the past 3 months."

Soybean futures in China are 4,655 yen per MT, which is $17.50 per bushel.

Just like corn, we have an entire growing season ahead filled with uncertainty.

We all know just how fast these markets can change. One moment the sky is falling, the next it feels like we won’t stop going higher.

To start May, we rallied +90 cents in 4 days.

Since May 28th, we have dropped -80 cents in 6 days.

That just shows you how fast this bean market can turn.

I have been recommending either small sales or puts for protection for most of you the past few weeks. Despite prices being now lower, puts are still a good idea for a lot of you (not all). If you are undersold or uncomfortable, it probably makes sense to grab puts and protect the downside. If you are oversold or have made quiet a few sales, right here wouldn’t be the worst place to perhaps considering re-owning a few bushels. Really depends where you are at in your marketing.

It is called hedging, not guessing. Call us to go through your situation 1 on 1. (605)295-3100.

I see higher prices, but if Mother Nature cooperates and doesn’t give us any sort of weather premium and if demand stays poor, it could get ugly. Right now the summer outlook still favors hot and dry which is supportive, but we all know how fast weather can change.

July Beans

Wheat

Wheat lower again despite the Russia concerns.

Like I mentioned Friday, most of this Russia news is priced in and will take additional news to continue to rally.

However, according to Russia's grain union, they could declare a nation wide state of emergency due to the frost damage. So far 3.7 million acres have been damaged due to frost. Several local regions have already declared emergencies.

The emergency declaration could come as early as the end of this week, but there were no details as to what it is going to mean. Will it mean export restrictions?

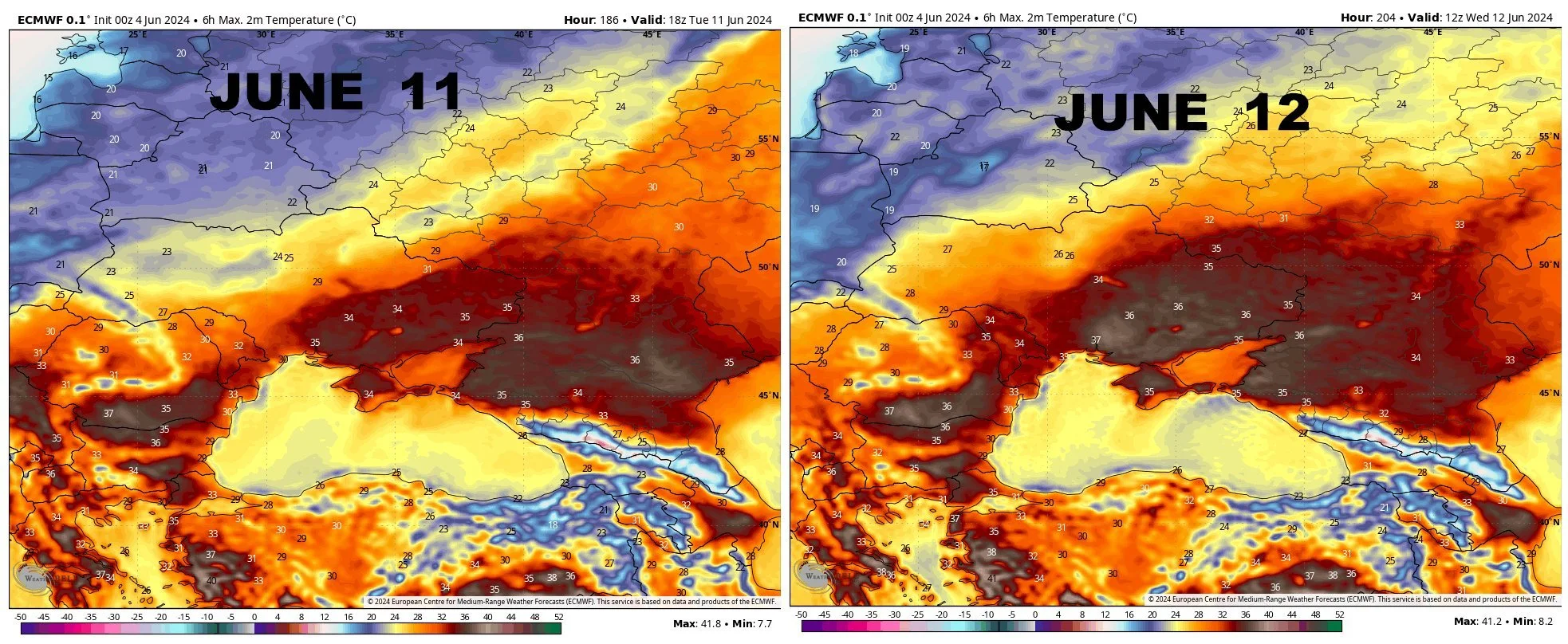

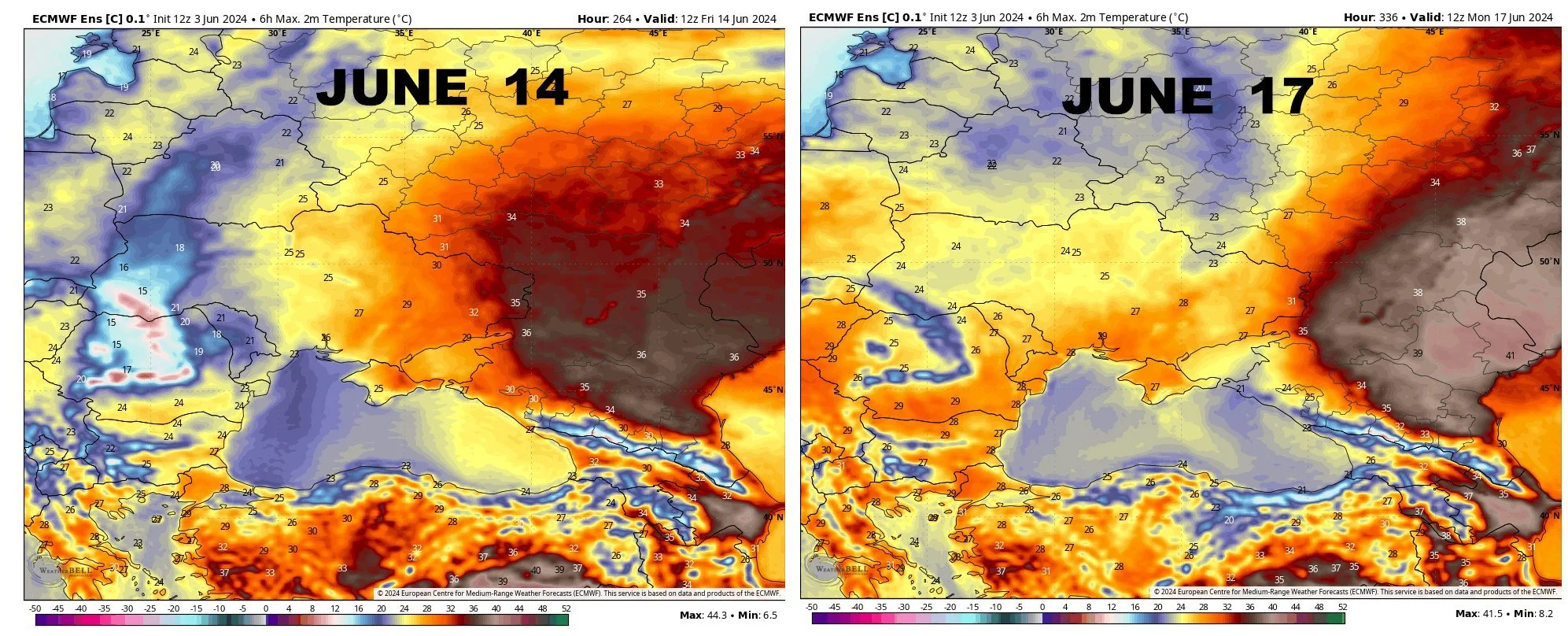

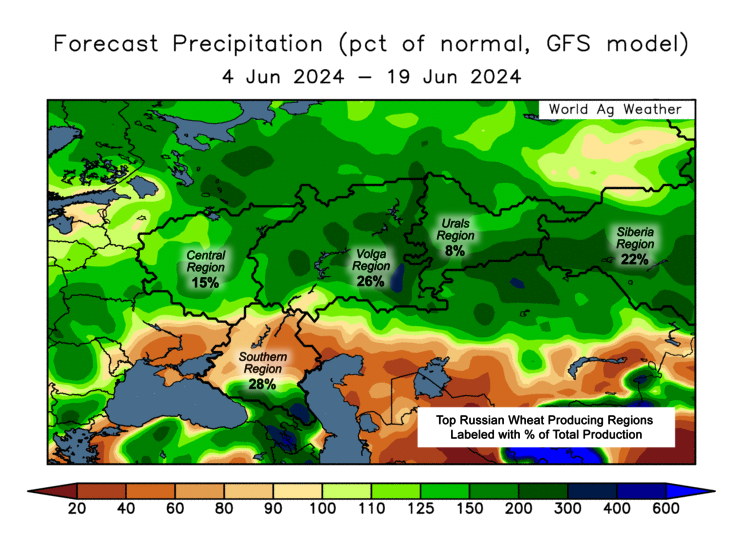

The bigger story in my opinion is the drought in Russia.

SovEcon lowered their estimate to 82.1 MMT, down from 85.7 MMT as the estimates continue to fall. The estimates for this crop back in March were north of 90 MMT. Right now nearly every group is saying low 80's with some well respected ones even in the 70's. Meanwhile the USDA is at 88, which will have to come down.

I want to note that this Russia crop is made in June, not May. But there is obvious concerns and the forecast right now looks HOT.

Just feels like this wasn’t the last Russia bull headline we are going to get.

(Top Map Credit: WXRISK WEATHER)

We will likely need some more news from Russia or confirmation as to how poor this crop really is to continue the rally.

Long term this wheat market still has tremendous upside.

However, we alerted our first sell signal May 22nd. If you are someone who knows you will have to move wheat off the combine, cannot hold wheat for a year, needs cash flow etc. If you don't have staying power for whatever reason, and have yet to reward any of this rally. You still have the ability to do so. We are still well over $1.00 off the lows.

If you're someone who can hold wheat for +1 year, then I like being a little less aggressive and more patient.

For that first group who can’t hold, you can still either:

Make some sales and do nothing.

Make a sale and grab a call if you think we are going higher (the scenario is you either make a good sale and lose the value of your call, or make money on your call).

Or lastly you can simply buy puts to protect you from the downside if you don’t want to make a sale yet.

Comes down to your operations needs. Give us a call if you want to talk it through. (605)295-3100.

This chart does look like more of a correction than it does a new downtrend, but if you are nervous and are not yet hedged this is a good spot to consider doing so.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24