DO THESE BRAZIL RAINS MATTER?

Overview

Grains lower again here to close out the up and down week.

Off the back of hot & dry Brazil forecasts, Sunday night we saw soybeans gap open higher as they rallied 35 cents higher on Monday. We also saw corn rally double digits.

This rally came to a halt Wednesday when they added some rain to the forecasts. As today was the third day in a row where soybeans have taken it on the chin due to some rains in Brazil.

Despite being up 42 cents on the week on Tuesday, these past 3 days gave back that entire rally as soybeans actually closed lower on the week.

Corn is slightly higher on the week, but stuck in that same range we've been in since August.

The wheat market continues to struggle to find any momentum to the upside, as the wheat market traded lower nearly the entire week.

Weekly Price Changes:

Brazil weather worries give, and they take. This was the reason for the early week rally and the late week sell off.

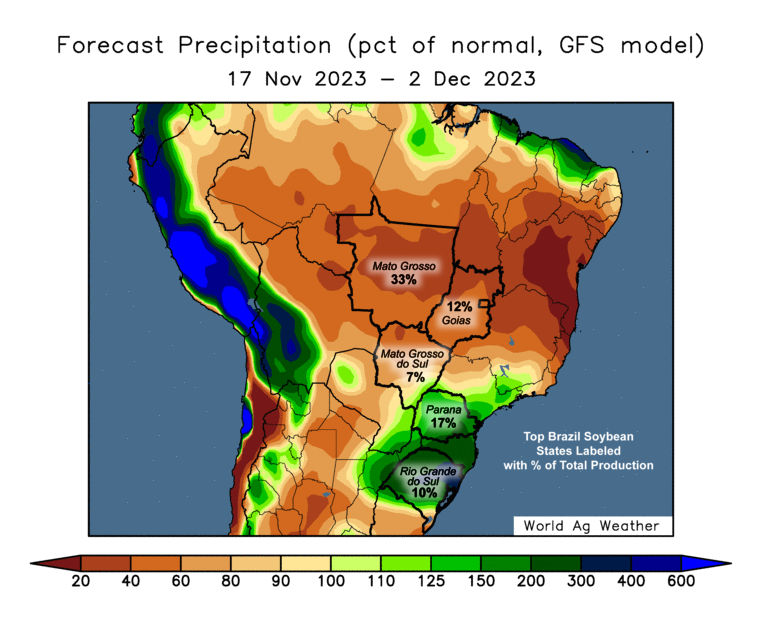

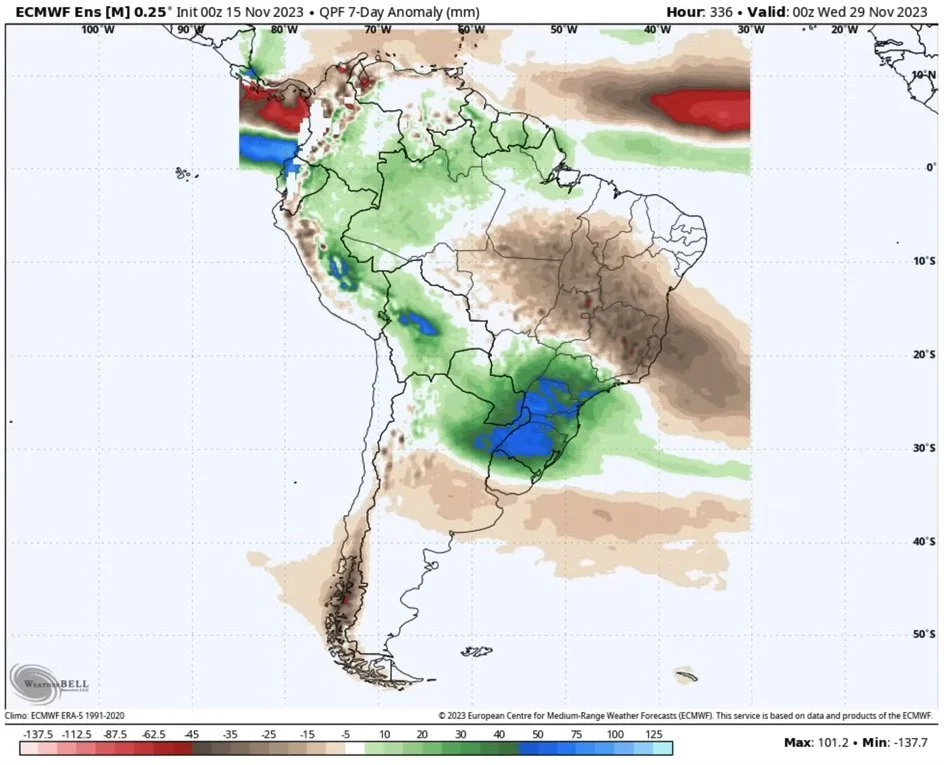

The dry areas in Brazil are forecasted to receive some rain over the next week or two. However, after these rains it looks like it will quickly return to hot and dry once again.

We have had forecasts like this in the past, only for the rain to disappear. Guess we will have to see how this round shakes out. If these rains do not materialize over the next 10 days, these weather concerns will pick right back up.

Either way, we could be in for a big move come Sunday night. How Brazil's weather shakes out will determine the direction of that move.

As we mentioned the past few days, rain in November for Brazil will not make or break this crop.

How much it rains over the next 10 days will not even be as remotely close to important as how much it rains in December.

Yes, short term the market is going to trade these forecasts and it is and will be the most dominant factor. But if we are talking about the real damage or liveliness of the crop, right now is not going to determine how this crop pans out. This heat and dryness has certainly not helped, but one rain is not going to magically make a crop. Where the crop is made will be in December and January.

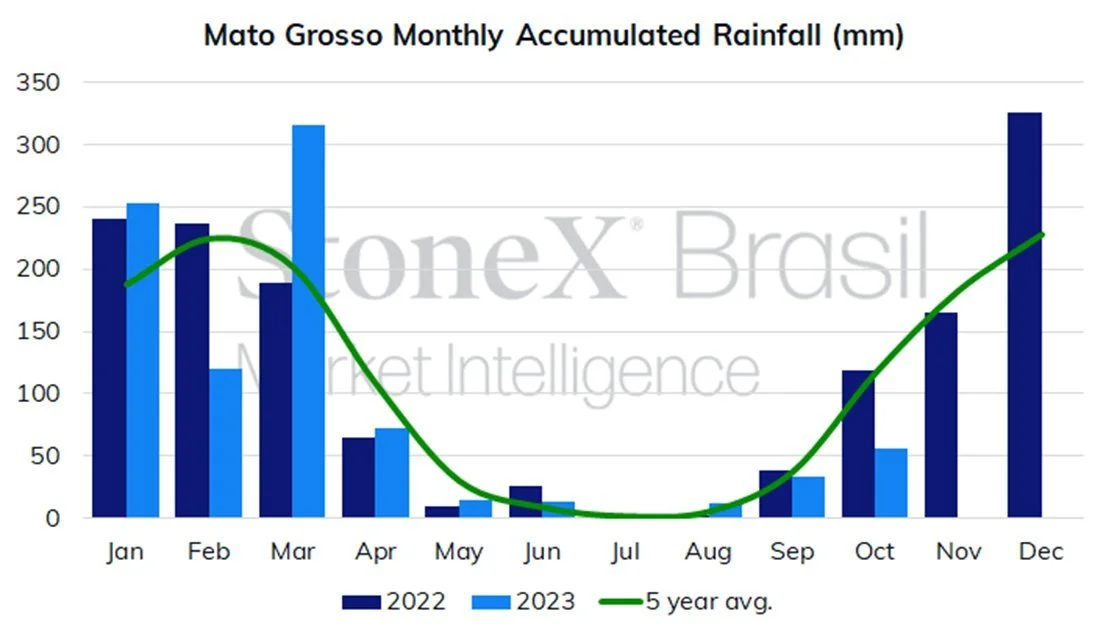

Look at this chart (from October). It shows how much rain Brazil gets each month. As you can see, December will be the key month that determines if their crop is a monster one or one that fails.

My entire point here is that these rains don’t necessarily make a huge difference here. What the weather looks like a month from now from will be huge for the markets.

And from what I've seen so far, the long term outlook does not look favorable.

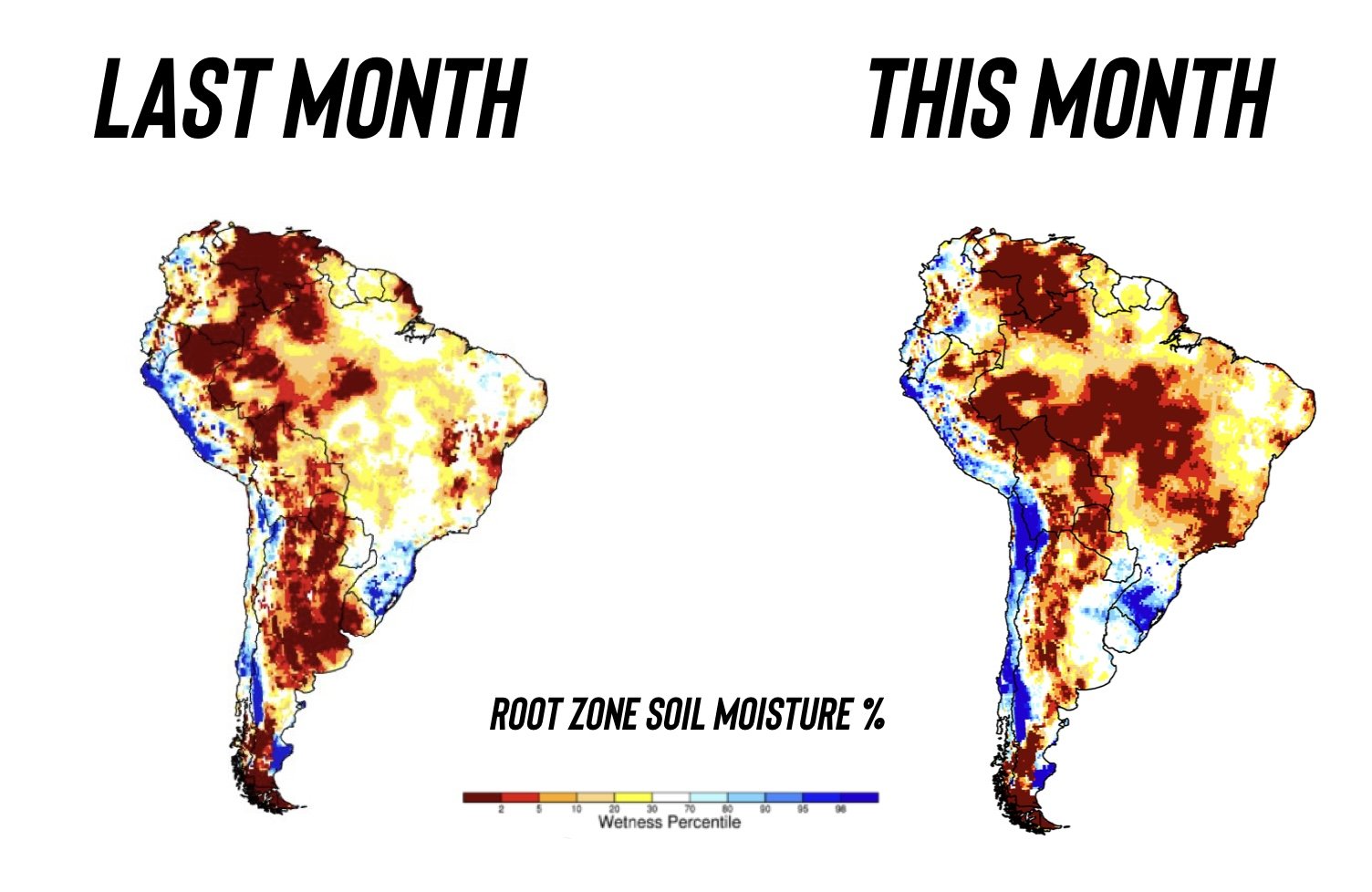

The forecasts ahead are calling for hot and dry over the next month. This root moisture chart will be one to monitor closely if it stays that way.

Here is the change from just a month ago vs today.

Imagine the impact this will have if they don't receive good rains in the months that matter the most.

From Reuters:

Some farmers in Matto Grosso, Brazil are abandoning soybeans for cotton due to the extended dry conditions in the state.

From Water Street Solutions:

"The Euro (model) has taken large amounts of moisture out in the last 12 hours. Some of the biggest changes I have ever seen. Remember, after next Friday it is back into the oven!" (Talking about Brazil)

Jason Britt - President of Central State Commodities:

"China is praying for rain in South America. They are under bought if their crop falters at all"

THIS OFFER IS GONE SOON - 50% OFF

Lock in this huge discount before your trial ends. You don’t want to miss all our future updates & audio. Become a price maker. Save over $400 a year using the link below.

Today's Main Takeaways

Corn

Corn lower for the second day this week. Despite the heavy losses in beans yesterday, corn was able to hold strong.

There isn’t a ton new to discuss in the corn market as we have been stuck in the same range since essentially August outside of the one time we peeped our head above $5 back in October.

We had some strong export sales yesterday so bulls were happy about that. Even though the recent rain forecasts in Brazil have pressured the market, there is still some obvious concerns.

We could eventually get more South America worries due to the late second crop corn planting in Brazil, but that crop is still a few months out.

So overall, there just isn't that one main catalyst there for bulls to send corn on a major rally.

Those two possible catalysts are Chinese demand and South America concerns.

Nearby, Chinese demand doesn’t appear to have an overly strong outlook. But looking long term that could certainly change. China would likely run to grab our corn at these levels if there is any sign of a hiccup in Brazil production.

It is still too early to decide how South America will shake out, but has the potential to be a bullish factor.

Bottom line, I don’t see us having a major rally out of the gates here but I also think our downside is somewhat limited. We have been stuck in a 40 cent range for 4 months now.

Our downside is probably around the $4.50 range if we fail to hold here. But I do think there is a good chance the lows are still in, but bulls will need a catalyst if they want to convince the funds to unwind that massive short position.

Taking a look at the chart, bulls want a close over $4.80 to see more upside. We haven’t had a close above since October and have rejected off that level on 5 separate occasions. A break through could bring $4.92 (our 100-day moving average) and then $5.

Recommendation

For those of you with basis contracts on corn that need to be rolled or priced in the next week or so. We will give some recommendations next week for different situations, but we do highly reccomended that you call and talk to Jeremey at 605-295-3100 because every situation is very different. We are not into blanket one size fits all recommendations. Some of our competitors are and here is what one of them said yesterday regarding the topic.

HINT for those that want to become PRICE MAKERS. We don’t want to be aggressive doing basis contracts when we will have to roll them at a carry. Doing basis contracts just because isn’t a solution and longer term when done in a carry market such as corn presently is in is a receipt to keep being a Price Taker.

Here is what Wright on the Market said:

"While we are on the topic, let’s talk corn. For those with no place to store corn, or corn on a December basis contract, sell the corn and buy a March corn call. The roll from December to March is nearly 19¢! Seriously, sell the corn if your basis is firm and buy a call option. Lance pointed-out you can buy a March $5 call for 15¢, less money than the roll to March will cost. Of course, with a call option, your potential loss is limited to what you pay for the call."

Corn Dec-23

Soybeans

Soybeans give back all of their early week gains. Monday & Tuesday brought over 40 cents of gains. Wednesday we traded to nearly $14. Then yesterday and today combined for nearly 45 cents of losses.

Soybeans have now broke 60 cents off those highs from Wednesday. So perhaps even if these rains in Brazil do materialize, a lot of that may already be priced into the market now.

If the rains disappear? We have to make up for that lost weather premium. Remember the forecasts after these rains look pretty disappointing. If they disappear the weather concerns will return fast.

I’m far from a weather man, but from what I've seen I do believe that we will probably get those rains. Will they make a massive difference to this crop? Probably not. But the trade often trades rumors rather than facts.

As mentioned, the fact is that November is no where near as close to important as December. If December is anything like what the past few months have been for Brazil, the upside is massive. But it is still too early tell.

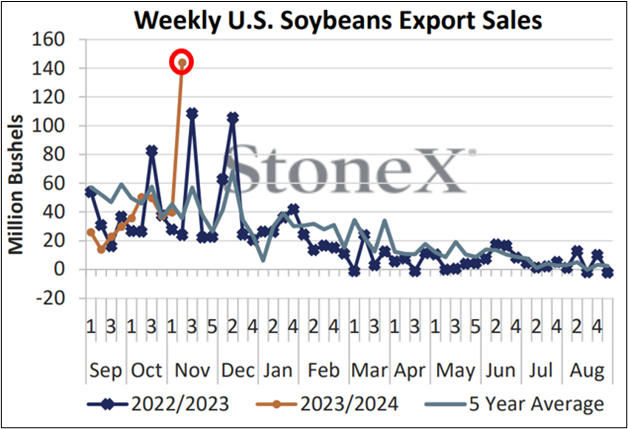

Aside from Brazil, demand remains superb. We had weekly export sales hit an all-time high record.

Bottom line, South America is a wild card that still has the potential to send beans to $15 plus. If it disappoints, we rally. If it outperfoms, we fall.

However, even if South America doesn’t have an awful crop, the long term (years) outlook for beans is still much higher prices due to demand and other factors that we discussed in yesterday’s audio which you can listen to here.

Short term, we can go lower from here if the rains fall. I think the rain is mostly priced in, but we could still have some more downside risk here early next week.

As for the meal situation, Argentina does not have anything left. That has driven the soybean market more than anything. That situation is still tight and remains bullish.

Taking a look at beans. My next level of support I have is $13.27 as we broke below the 50% retracement of $13.45 and our moving averages. We do however still remain in an uptrend.

For those of you that are worried the soybean fireworks are over and the bean meal situation is over, there is nothing wrong with putting in a floor here.

For most of us, we look at this break as a probable re-ownership opportunity knowing there could be more fireworks to come.

Soybeans Jan-23

BECOME A PRICE MAKER

Get 50% off a year for a limited time.

Wheat

The wheat market continues to be the weak link amongst the grains, as the wheat market traded lower essentially all week long.

Wheat continues to struggle to hold together any momentum whatsoever as the funds still have their food on wheats' neck, continuing to hold their sizeable short position.

We got another week of awful weekly export sales. We also saw the International Grains Council raise their world wheat production number for the upcoming year.

On the other hand, there were a few bullish headlines.

In South America we have wheat production estimates on the decline. As StoneX BRazil cut their Brazilian estimate from 10.53 to 9.29 million metric tons.

Buenos Aires Grain Exhange also lowered their Argentina wheat crop estimate from 15.4 to 14.7 million.

Australia is cutting their production estimates as well.

European wheat areas are seeing too much rain which could lead to a drop in both acres and yield.

Overall, there isn’t a ton for bulls to chew on nearby, as we continue to chop near the bottom of our recent range.

But the wheat story is still a sleeper. As we have said in the past, the wheat market is in a marathon, not a sprint. I am not expecting a rally here tomorrow, or the next day, or next week. But long term there is still plenty of upside.

We still don’t like the idea of selling at multiple year lows. If you do make sales, we like the idea of re-owning. Still remaining patient waiting for the funds to flip that switch and for global headlines to give us better pricing opportunities ahead.

Taking a look at the charts, we need to hold those September 29th lows that we hover just about a dime above. Bulls still need to see $6 to build any sort of excitement or momentum in this market.

From Wright on the Market:

"Specifically on wheat, there is a reasonable probability the war in Eastern Europe will provide an event that will shoot wheat futures higher. We know world wheat production will be reduced this year due to the very strong El Niño. The past 4 years, the world has produced substantially less wheat than it consumed… four consecutive years! How long can that continue? "

"Maybe $9.80 is out of reach, but there is certainly another $1.50 to $2.50 coming in all three wheats. The market is paying less than 9¢ to store KC wheat from Dec to March, so move the cash wheat to town with the firm basis, put it on a basis contract, get the cash advance when needed, or sell the wheat and buy futures to make better use of your money, or sell the wheat and buy a call option. I like the March $6.30 or $6.40 call for about 35¢. The seasonal trend is up until March."

Chicago Dec-23

KC Dec-23

Check Out Past Updates

11/16/23

WAYS TO OUTPERFORM THE MARKET

Read More

11/15/23

FINDING THE RIGHT GAME PLAN

11/14/23

DEMAND & SOUTH AMERICA

11/13/23

CORN & BEANS RALLY. WHY THERE IS MORE UPSIDE

11/10/23

WHY BRAZIL COULD PUSH THE GRAINS HIGHER

11/9/23

USDA REPORT RECAP

Read More

11/8/23

GRAINS FIRM AHEAD OF USDA REPORT

11/7/23

GRAINS LOWER AS TRADE PREPARES FOR USDA

11/6/23

BEANS CONTINUE BULL RUN AS HARVEST WRAPS UP

11/3/23

BEANS RALLY & CORN HOLDS OFF NEW LOWS

11/2/23

EVENING THE PLAYING FIELD

Read More

11/1/23

CORN CONTINUES LOWER & BRAZIL CONCERNS

10/30/23