GRAINS CONTINUE TO BOUNCE

Overview

Beans lead the way up +15 as grains continue their slight rebound. Beans post their highest daily gain since December 11th and have now actually taken back all of the losses since the day of the brutal USDA report.

Although they haven't amounted to much, corn is green for the 4th day in a row, the longest streak since the end of November into early December.

Wheat closed a dime off of it's highs, ending unchanged and breaking it's 4 day rally.

Why have the markets found some footing? Mainly it's just the funds. The sharp 3 week downtrend was mainly due to fund selling, and it seems like they view this area as a decent spot to stop the selling and reevaluate.

However, we haven't seen a big wave of buying either which is slightly depressing and creates choppy trade. But it's better than the blood bath we have seen recently.

South America weather remains mostly cooperative, the weather Brazil sees over the next month and a half will likely dictate their crop size.

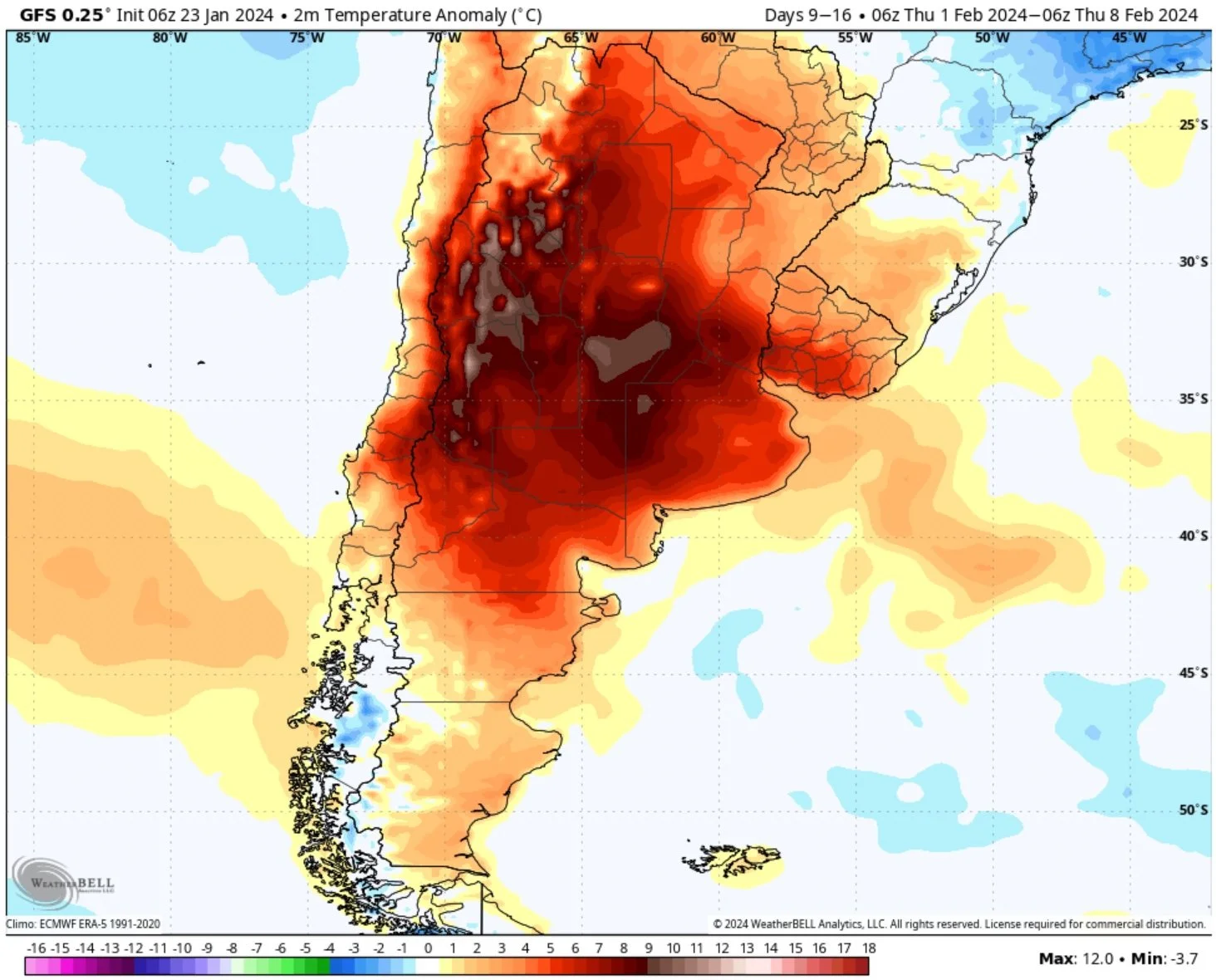

Part of the reason for the beans rally today was Argentina. Argentina is having an amazing crop, but they are expected to see some really hot and dry weather the next two weeks. If rain doesn’t come, we could certainly be looking at some stress in their crops that are mostly in great shape.

For context, right now is their version of July in the US for their growing season. So a lot of those recent rains are evaporating with the heat.

Here is the next 7 days.

Election Year vs Non Election Year History

Friday we took a look at how election years are typically great years for the grain markets. You can read Friday's full update HERE.

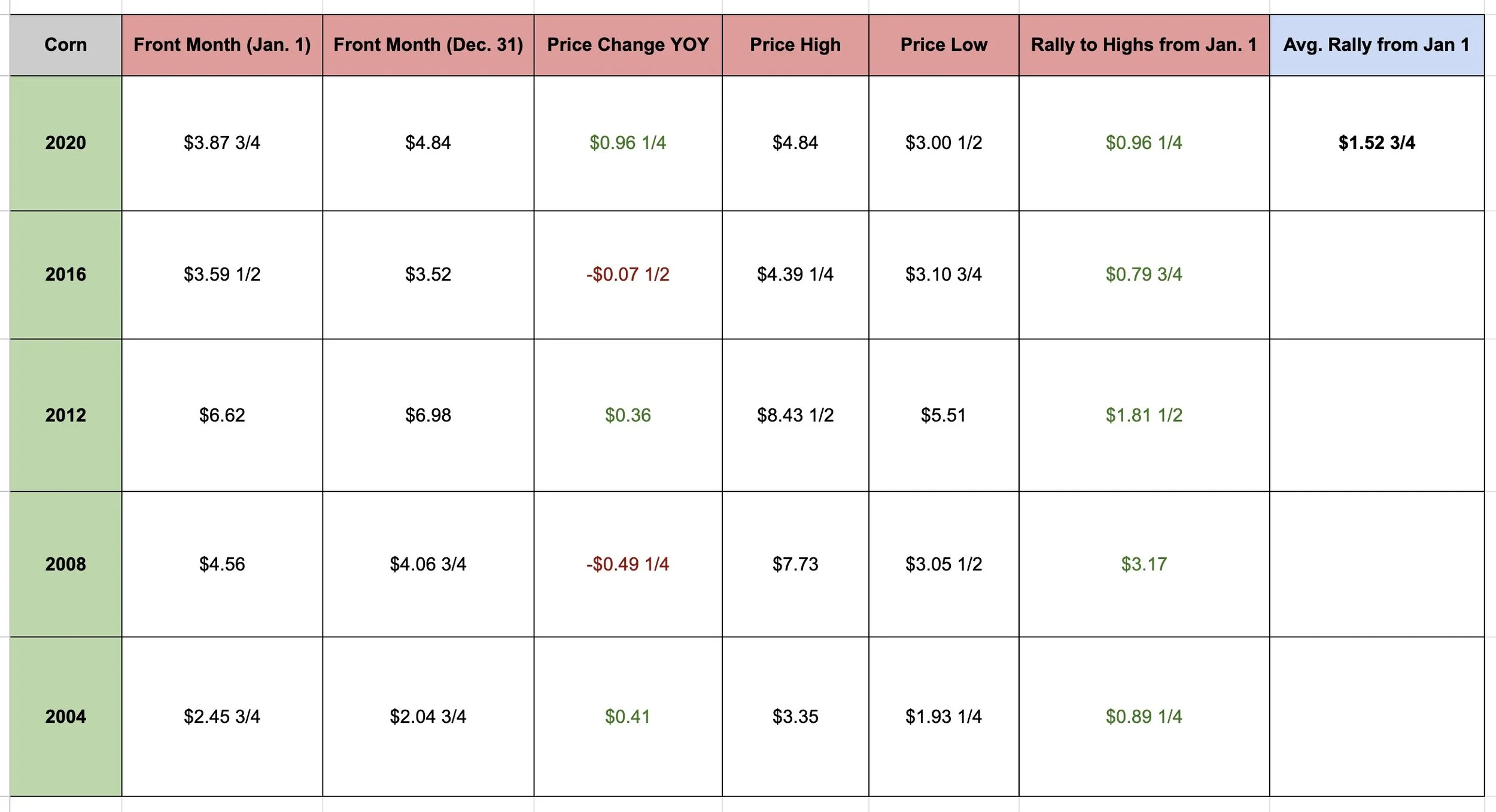

Our average rallies from January 1st to our highs for the year during election years are as follows:

Corn: +$1.52 3/4

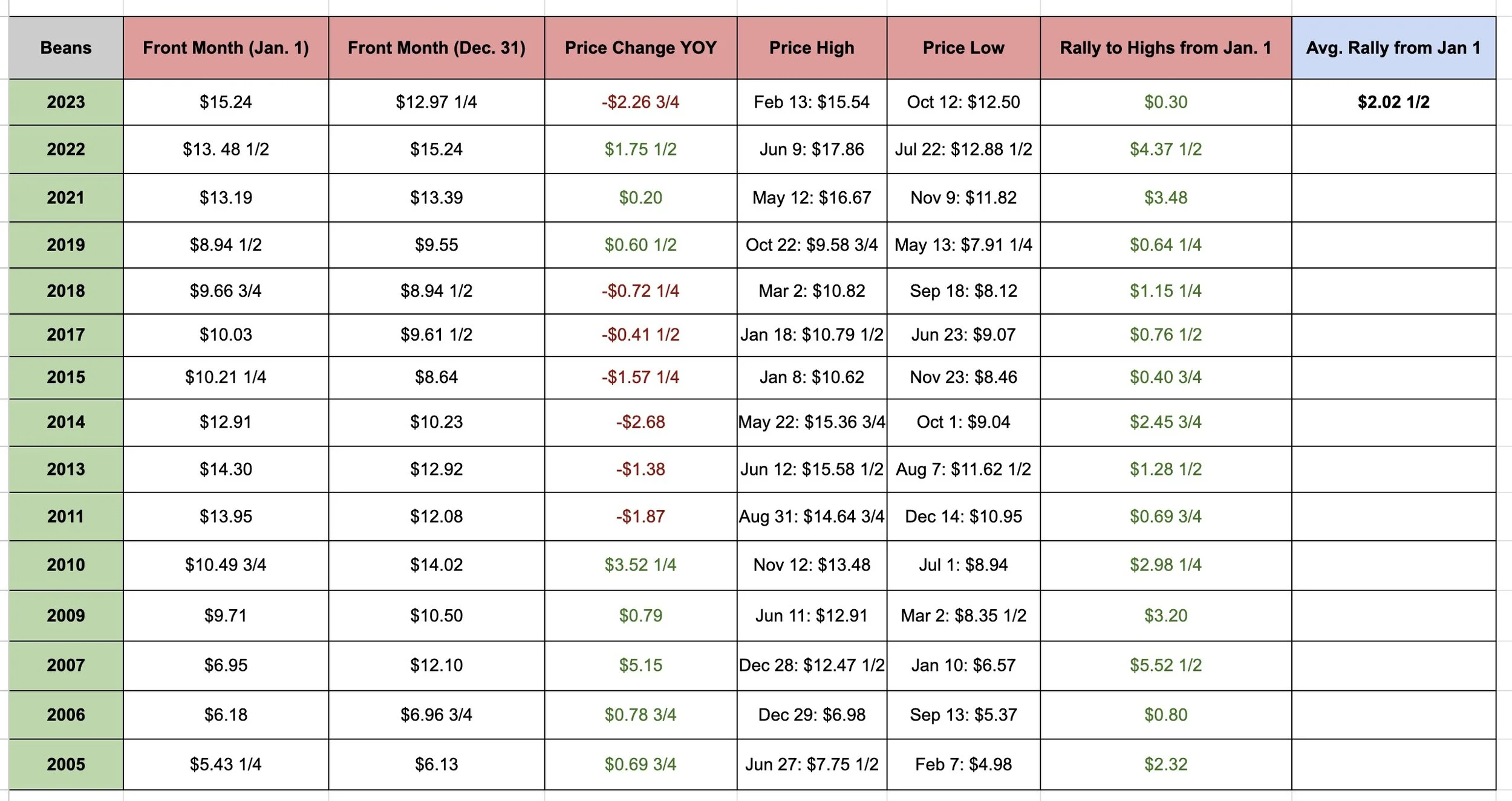

Beans: +$3.89 1/2

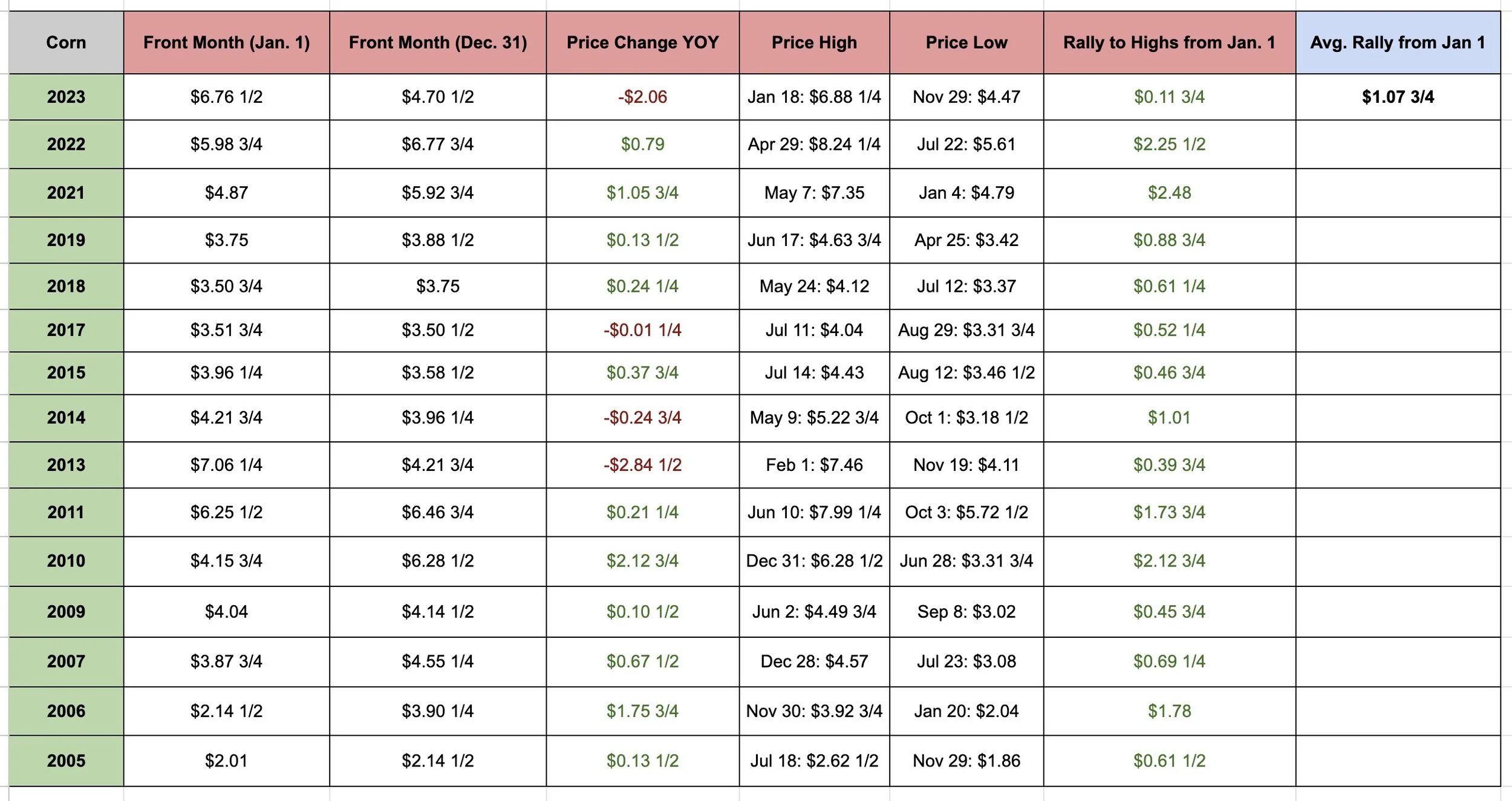

So what about "non-election years"?

Well, the difference may surprise you.

Corn: +$1.07 3/4

Beans: +$2.02 1/2

The difference? For corn that's $0.45 cents. For beans it's a big $1.87

Here is the data:

Election Years:

Non-Election Years:

Now of course this doesn’t mean grains "have" to rally like the average election year or rally at all. A lot of people would be extremely happy with even HALF of our typical rally which would be $0.76 cents in corn and $1.45 in beans.

How much we rally will depend on a few things. South America and what that crop looks like. Demand from China. And what kind of crop we produce here at home and how much weather cooperates or if we get a big weather scare.

But historically, yes election years outperform non election years. Since it's an election year, expect something out of the ordinary to happen. Typically these surprises wind up being friendly for our markets.

Some may say "2008 and 2012" don’t count. Which yes is a valid argument because 2008 was the ethanol boom and 2012 was the drought year.

If you take out 2008 and 2012, our average rally for corn is still $0.88 cents and beans is still $3.25. If we added those to today's prices we would be looking at $5.35 corn and $15.65 beans.

Of course this is all hypothetical and food for thought. But I do believe this election year will bring higher prices. How high is to be determined.

Near Record Fund Shorts

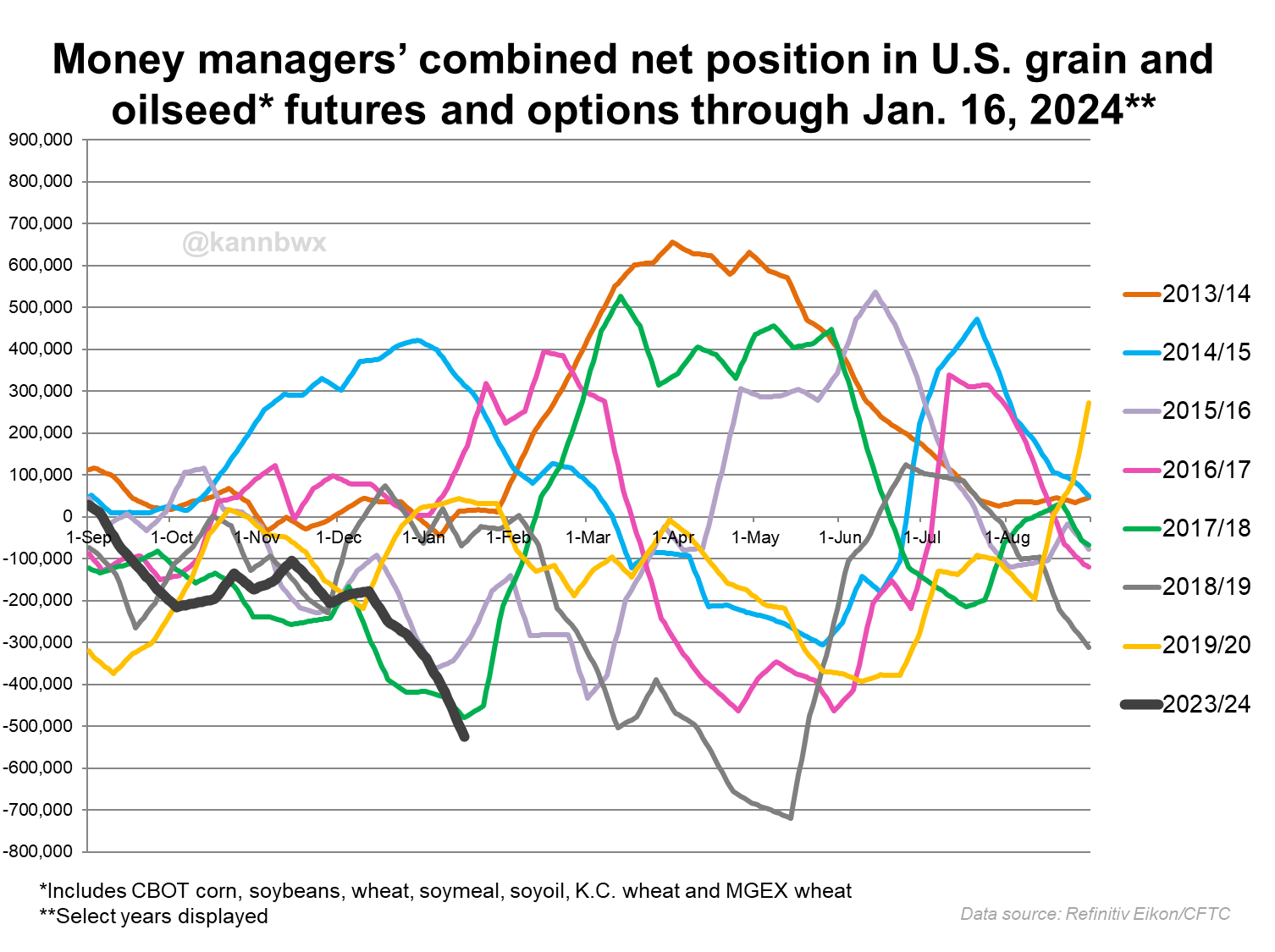

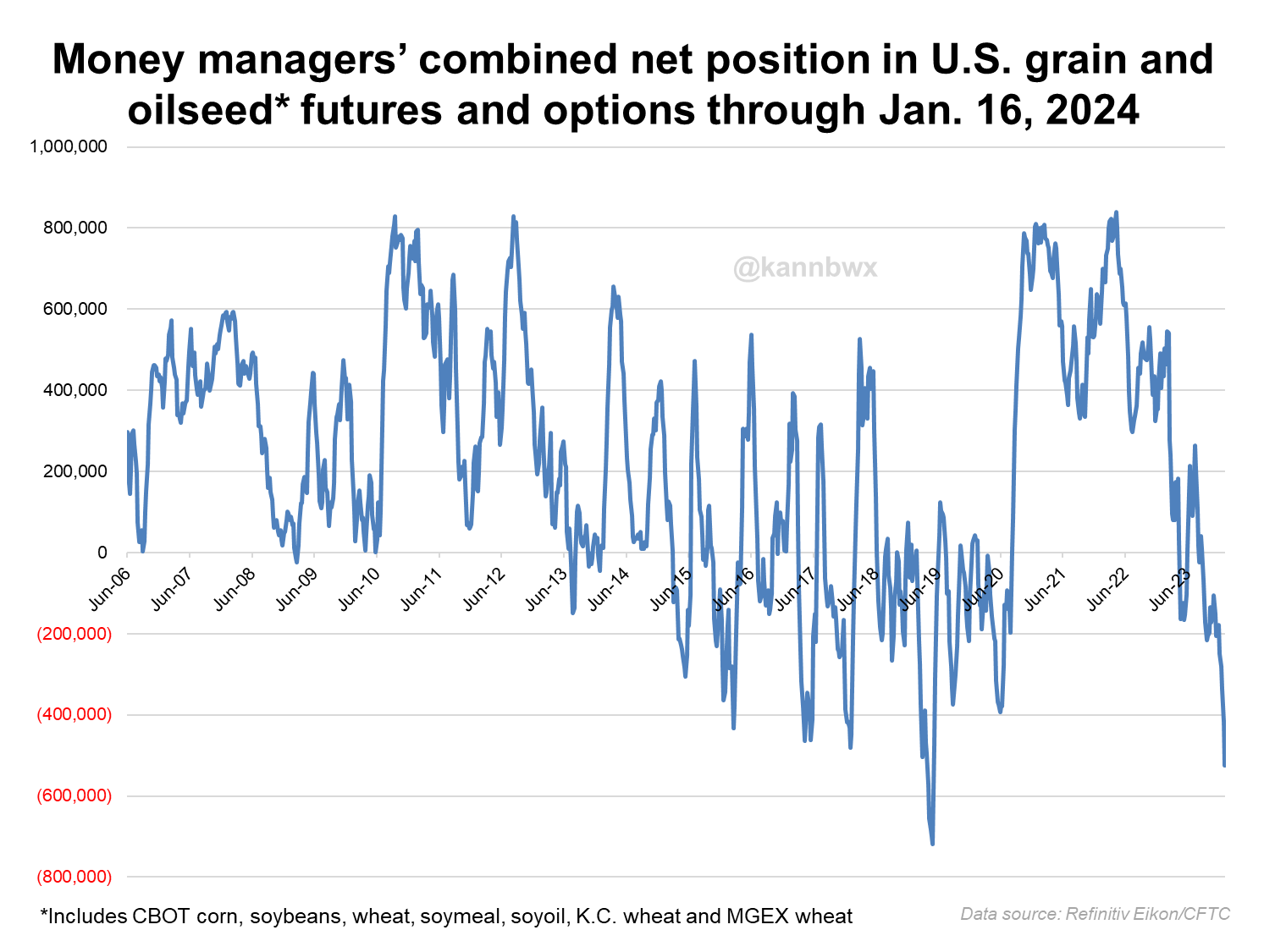

The funds hold some of the shortest positions on record. They hold a net short position across all 7 major grain and oilseed futures for the first time since September of 2019.

What happened the last time the funds were this short?

Take a look at these charts below from Karen Braun and others.

As you can see, right around this area is typically where the shorts max out at. Aside from 2019.

2018 is the most similar to this year so far. In 2018 it didn't take long for them to start buying a ton. As come March, they were holding near record longs.

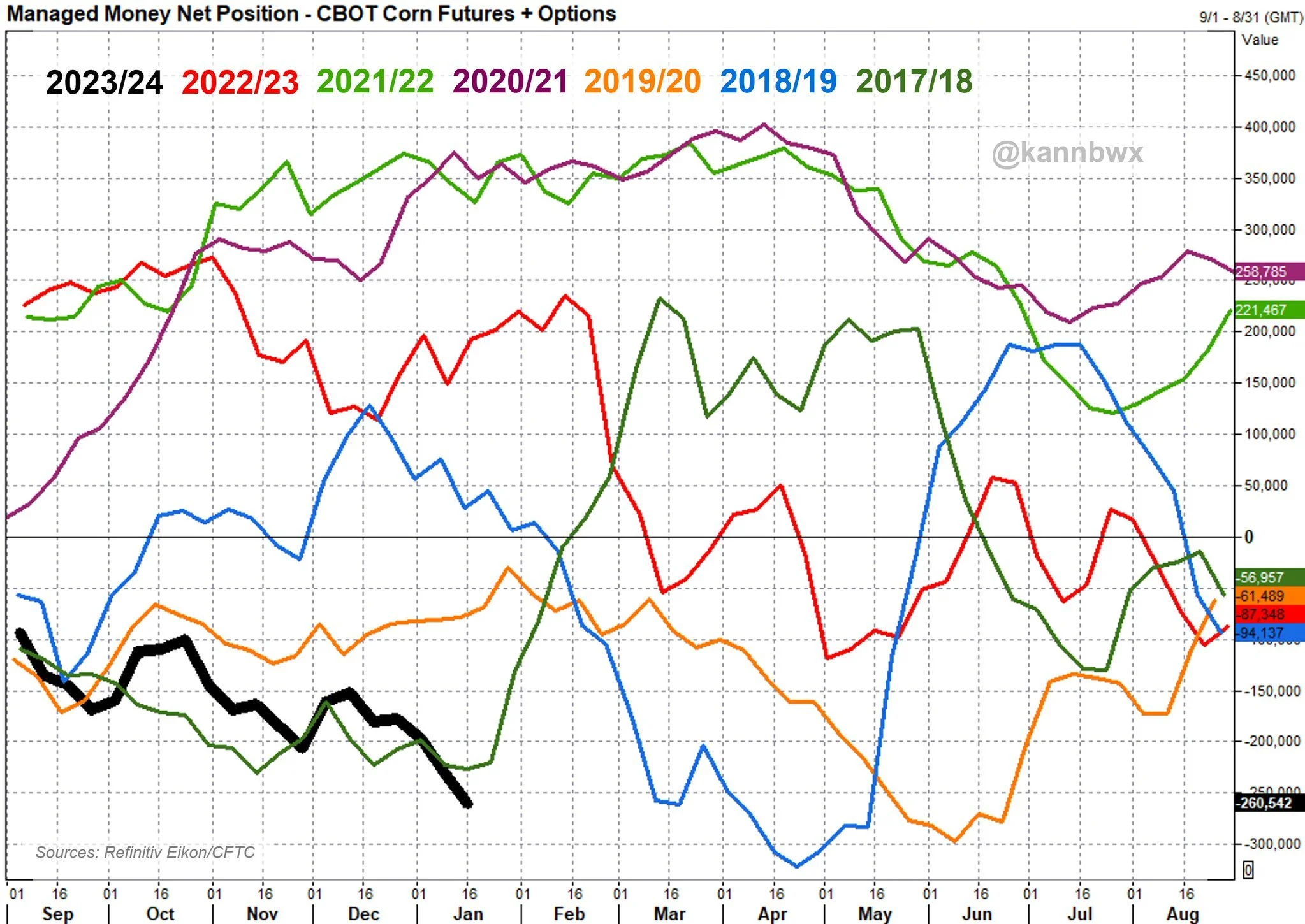

Now I wanted to take a look specifically at corn as the funds are short over -260k contracts. Among the shortest on record. Only 2 years have they been shorter, those were 2019 and 2020.

Their biggest short in 2019 was -322k and in 2020 it was -297k.

For this time of year however, the funds hold the shortest on RECORD.

Back in 2019, the held record shorts, they then had to cover those come May and we rallied over +$1.20

2017 was the 2nd shortest they have been at this time of year. Back then the funds went from -225k to +225k from January to March and we rallied +30 cents.

Nobody knows when they will decide to cover, or if they want to continue selling here before they do so. But we do know that when they decide to, there is a lot of buying to done.

Now let's dive into today's update..

HOLIDAY SALE

Since you are on a trial we are extending your access to the biggest offer of the year. Lock it in before your trial expires. Comes with 1 on 1 grain marketing plans & tailored recommendations.

SALE: $399 vs $800 per year

Today's Main Takeaways

Corn

Corn slighty higher today, trading in a tight 6 cent range. We missed last week's highs by less than a penny so positive action.

Here are a few things bulls are looking at.

Farm futures acre estimates for the US came out today. They see US corn acres down -2% from last year to 92.8 million acres.

Then we have the brutally hot temps and lack of rain now showing up in Argentina. We also have a continuation of people working their estimates lower for the Brazil crop. The USDA is at 127 while most are throwing numbers in the 115 to 120 range. I mean even CONAB has theirs at 117.5 million. You'd think Brazil's USDA would have a better guess than the USA's right?

The farmer group called Aprosoja is rumored to announce this week that they believe second corn crop planting will be -50% less than a year ago. That would be a very big story for corn if true.

I have been saying this for a while, I still do not think the second corn crop will be as big as some think. It is still a potential bullish wild card. I simply think we will be looking at less acres and yield when it's all said and done. How long until the market realizes or this info materializes if true? It's anyone guess. We probably won’t get much until they start getting into the fields.

The reason I believe there will be less acres is because soybeans were planted so late in most areas, and some areas have to replant later on. So producers may not want to take the risk of the late non favorable weather. Especially with prices being a lot lower than they have been in the past few years. But so far, the market doesn’t seem to care.

My problem with the corn market and the only real thing holding us back from a rally is our carryout. It's still over +2 billion bushels. We don’t have amazing demand, and right now there isn’t a weather scare to add premium.

As we have been mentioning, the risk is that we grow a big crop this year. With our already massive carryout, another big crop would not bode well for prices. However, it is far too early to call for anything regarding our US crop.

Bottom line, we need a reason for the funds to cover. They are holding near record shorts. Eventually they will be forced to cover. When is the main question. But it appears like the sellers have ran out of steam for now.

Seasonally we rally from here. Historically we rally when the funds are this short. The odds favor higher prices.

As mentioned yesterday, now might be a great time for some of you to own courage calls. When we get that weather scare rally (which we likely will) it will help you elimate the emotions of making sales and balance the fear and greed.

You will be more comfortable making sales knowing that you added to your bottom line on the way up. Keep in mind, we do not want to chase a rally. It needs to be before. That is why it is called hedging, not chasing.

For others if you are scared to make a sale or have unpriced bushels and are worried that prices could continue to fall. Look at buying a cheap put. If you don’t think you are going to raise it, that is when you buy puts. It is never a bad idea to lock in a floor.

These two options may not be what is right for you. Some should be buying calls, some puts. It all comes down to your operation. Please give us a call (605)295-3100 if you have questions or want help deciding what route to take.

We also go over courage calls more in yesterday’s audio. In case you missed it you can listen to it here.

On the charts, bulls still need to climb about $4.60 and break out of this downtrend to have some real hope that the lows are in.

Corn March-23

Soybeans

Beans rally for the first time in what feels like months. Our biggest rally of the year thus far, as bulls look for a bottom. We took out last week's highs and are trading higher than we were the day of the USDA report. Very positive as it looks like the trends are starting to change.

We saw more estimates drop for Brazil's crop. With more and more estimates falling into the 145 range while the USDA sits at 157 million.

Others such as the farmer group Aprosoja in Brazil have their number at 135 million. I think that's a tad low, but I suppose it's possible. Nonetheless, I think the USDA will have to work that 157 number closer to 145 or 150. Weather in Brazil over the next month and a half will determine how big of a crop they produce.

So far, the early harvest esults from the fields have been slightly disappointing. But they have a long ways to go as they sit around 6% to 7% complete.

As mentioned, weather in Argentina is expected to hot and dry for the next few weeks, they have an amazing crop going on there right now so we will have to see if this has any effects or not.

If they do not get rain, they could run into some real problems. As mentioned, it's basically July for Argentina. So they still need rain.

Overall, I think South America production is getting smaller rather than larger.

When should you be buying courage calls vs buying puts?

Courage calls is a tool to consider for some of you. Especially at these levels where most as well as myself think we could see higher prices. If you are someone who feels like they may get greedy and struggle to pull the trigger on sales when we do get that weather scare rally, having courage calls helps give you the confidence to make sales then because you already added to your bottom line on the way up. If you add to your bottom line with courage calls, it helps remove the emotion from making sales and helps balance out fear and greed.

For others, if you are scared to make a sale, then that is when you should be buying puts. If you don't think you are going to raise it. It is also never the worst idea in the world to keep cheap puts under unpriced bushels if you are someone who is nervous that our markets could continue to fall.

If you need help deciding which route you should be taking, please give us a call at (605)295-3100 and we will gladly get to know your operation and help guide you. Not everyone should be buying courage calls and not everyone should be buying puts.

Bottom line, we have finally strung together a few good days and stopped the bleeding. From a technical standpoint things are looking good as well, as the trend is turning higher.

I think higher prices are in store but we will have to see if this recent rally gets sold and if we can hold our recent lows. Our next big resistance is in the $12.53 to $12.60 area. If we can get some follow through strength I don’t see why we couldn’t look to close that gap left on New Years at $12.98.

We are +40 cents off the recent lows, but I still want to be aware that if we fail to hold $12 there is still a big pocket of air to the downside.

Soybeans March-23

Wheat

Disappointing day for wheat bulls. We nearly had 5 green days in a row which would’ve been the longest streak since that early December rally. But we closed a dime off our highs ending unchanged. So from a technical standpoint, that is a negative sign.

One potentially positive thing we saw was the preliminary estimates for US acres. They had total wheat acres down -3.2% from last year. But the real headline was spring wheat acres. They are expected to be down a massive -20% from last year. Again, these are just preliminary estimates, but they are friendly.

Bulls are looking at the tighter global balance sheet we have, weather problems over in Europe, and risks to Russia's exports (the worlds leading exporter).

On the other hand we have less winter wheat acres being planted but some of that is being offset with an overall better crop here in the US. There is talk that Russia might produce yet another bumper crop to add on to their stock pile.

We are still in a time period where there just isn’t a ton of news surrounding the wheat market.

Overall, wheat is still a sleeper and we could see much higher prices.

I did not like today's price action, but it still looks like we have put together a small uptrend. We still need to take out $6.38 on Chicago for the bulls to get really excited. Currently remaining patient.

Chicago March-23

KC March-23

Livestock

Positive action in cattle today as the run continues.

From a technical standpoint, the cattle market still looks great. and I still think we have some more room to run higher from here.

Live Cattle April-24

Feeder Cattle Mar-24

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23