FUNDS DON’T WANT TO BE SHORT GRAINS

Overview

Grains higher, led by yet another massive rally in wheat. As both corn and wheat make new highs for the move.

Wheat traded to it's highest levels since last August, now up +$1.50 from the $5.38 March lows. Closing at $6.87.

Corn traded to it's highest levels since the first week or two in January. +50 cents off those $4.22 February lows. Closing at $4.72 1/2.

Soybeans are still down about -30 cents from last week's high close of $12.49 closing at $12.19 1/2 today. But still +75 cents off the April lows of $11.45.

The big news has been the funds.

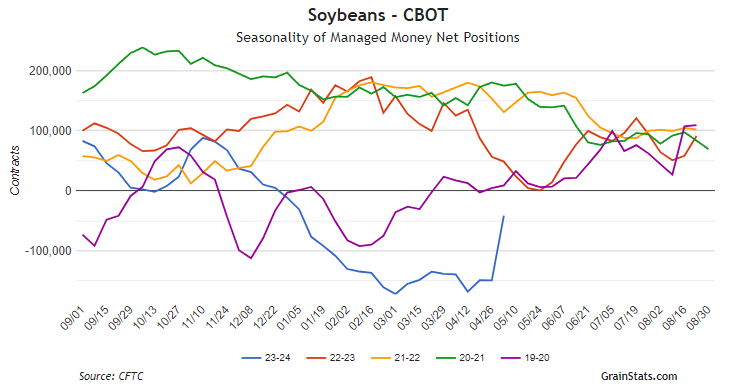

They were holding massive record shorts this year, but they have covered a record amount the past few weeks.

For the week that ended May 7th, it was the largest fund buying since July 2017 for the ag complex.

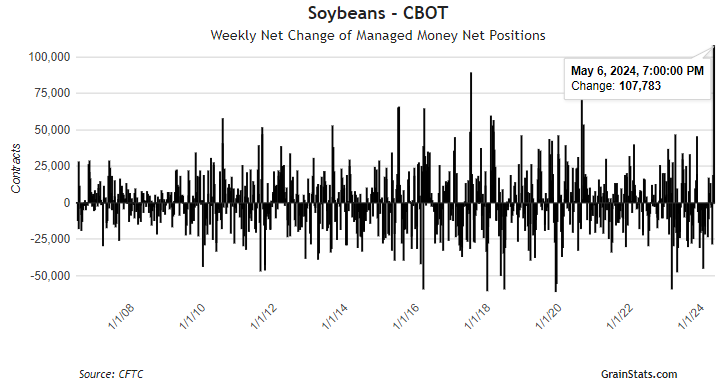

They covered a one week RECORD in soybeans. Covering +107k contracts in just 5 days.

They are now short just 40k contracts.

Chart Credit: GrainStats

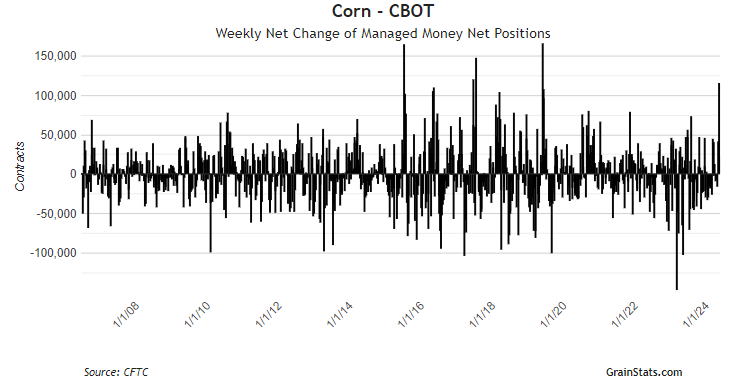

For corn, they covered a massive +100k contracts. Not quiet a record, but close.

Since February, the funds have covered +200k contracts.

They are still short 100k contracts, and corn has already rallied +50 cents. Which is great, because they have more room to cover.

If we were to see a week like this happen again, the funds would actually be long. After holding a record short not long ago.

Remember, the funds have never not got long at least one point during the year for corn.

Chart Credit: GrainStats

Funds exiting their shorts in grains is not bearish.

Where we go from here will come down to weather, but if Big Money does not want to be short anymore there is a reason.

They see the potential for prices to go higher. They do not want that upside risk anymore.

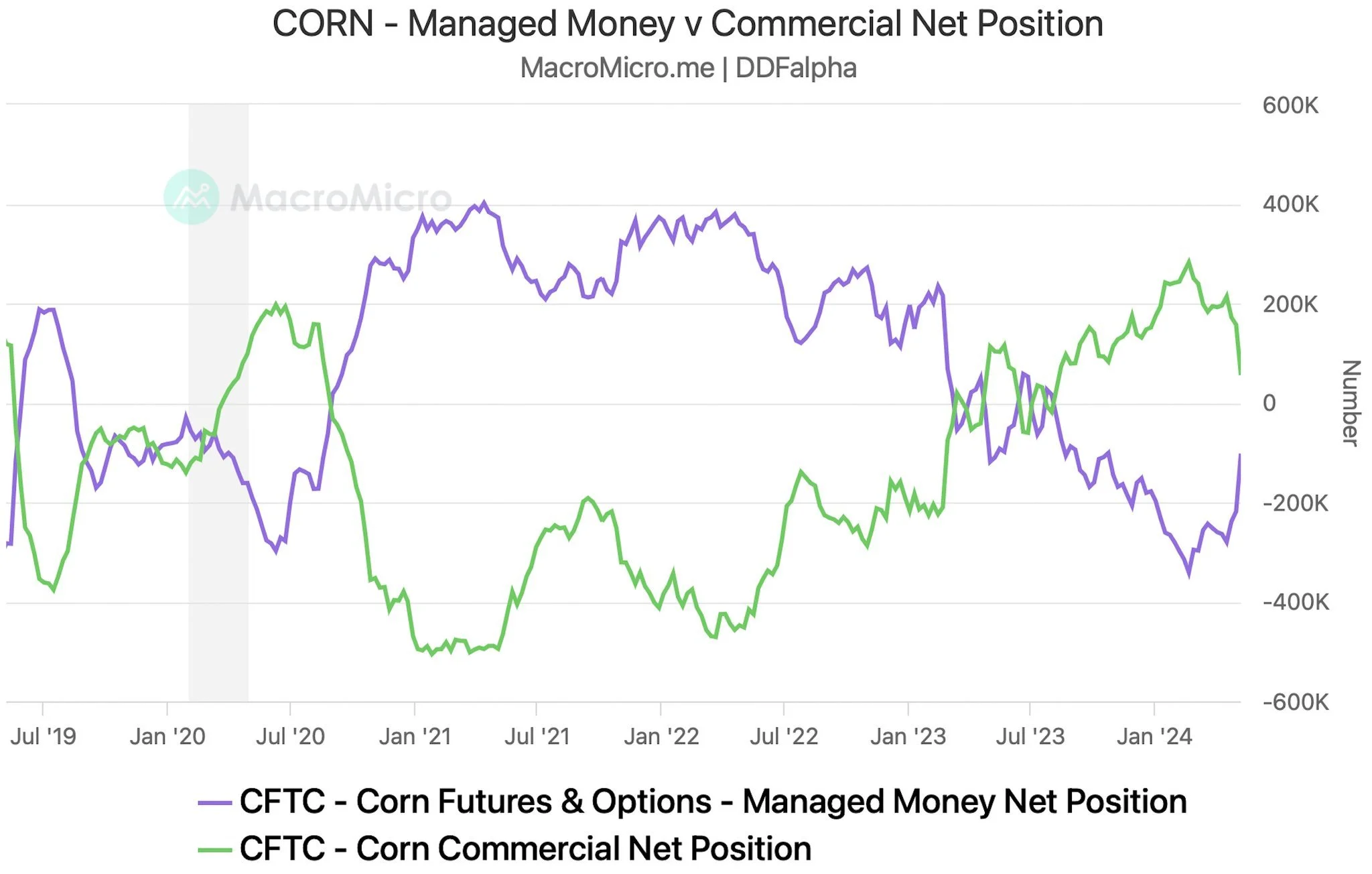

We have seen a ton of farmer selling recently. If you look at the CFTC data, producers added 100k shorts while the funds bought 100k longs. So the funds are literally buying the farmer selling.

The market is finding an equilibrium as it should. Heading into a growing season where there is an equal amount of upside and downside risk.

Chart Credit: Darrin Fessler

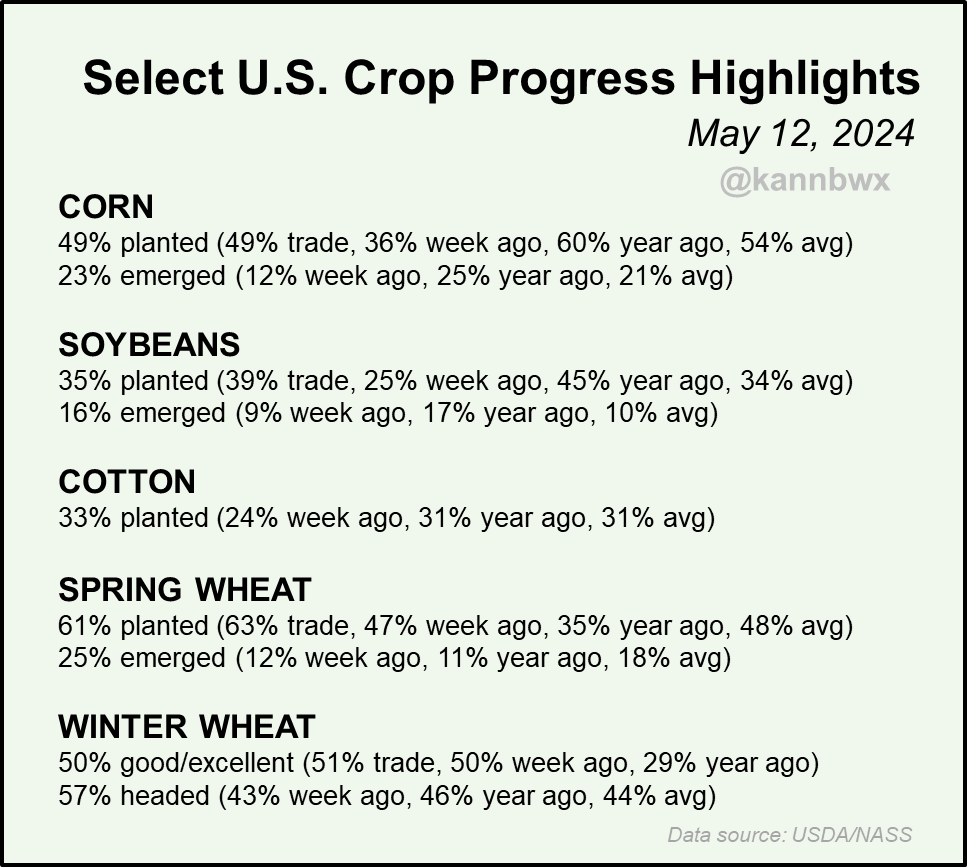

Planting

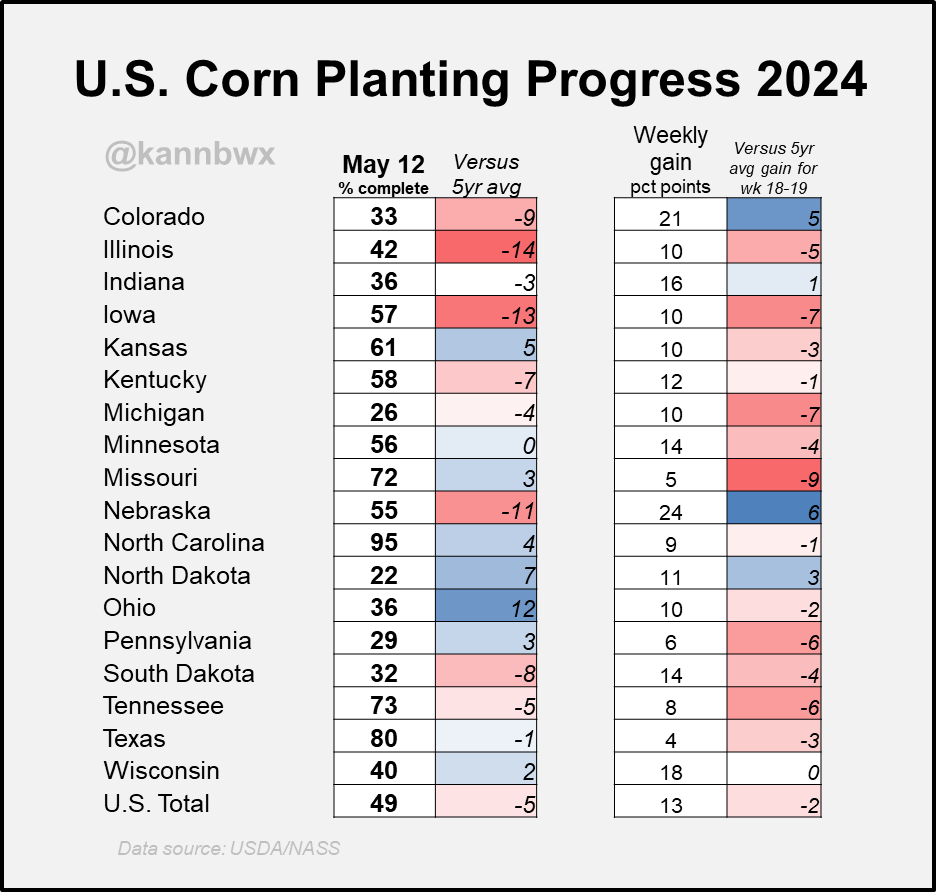

Planting is the 4th slowest in the past 25 years.

The worry right now is that we are pushing the crops into a less favorable window. The concern is not "if" we will get the crop in the ground.

Corn right on the estimates, but now 5% behind average.

Soybeans right on average pace, but a lot slower than expectations.

Spring wheat slightly slower than estimates, well ahead of average.

Winter wheat ratings unchanged, despite estimates thinking we'd see improvement.

The biggest concern is those leading corn growers of Iowa and Illinois. Both are 13-14% behind.

Chart Credit: Karen Braun

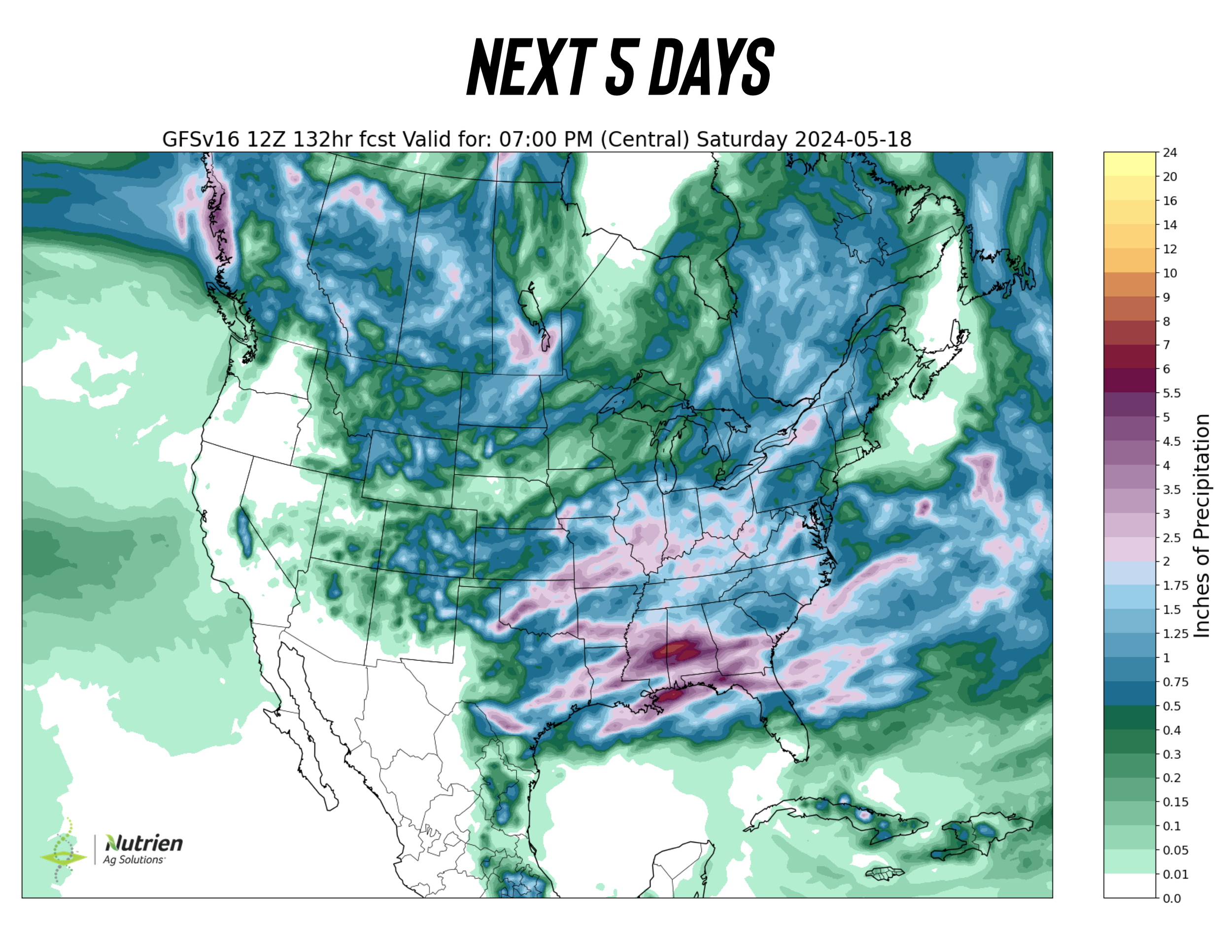

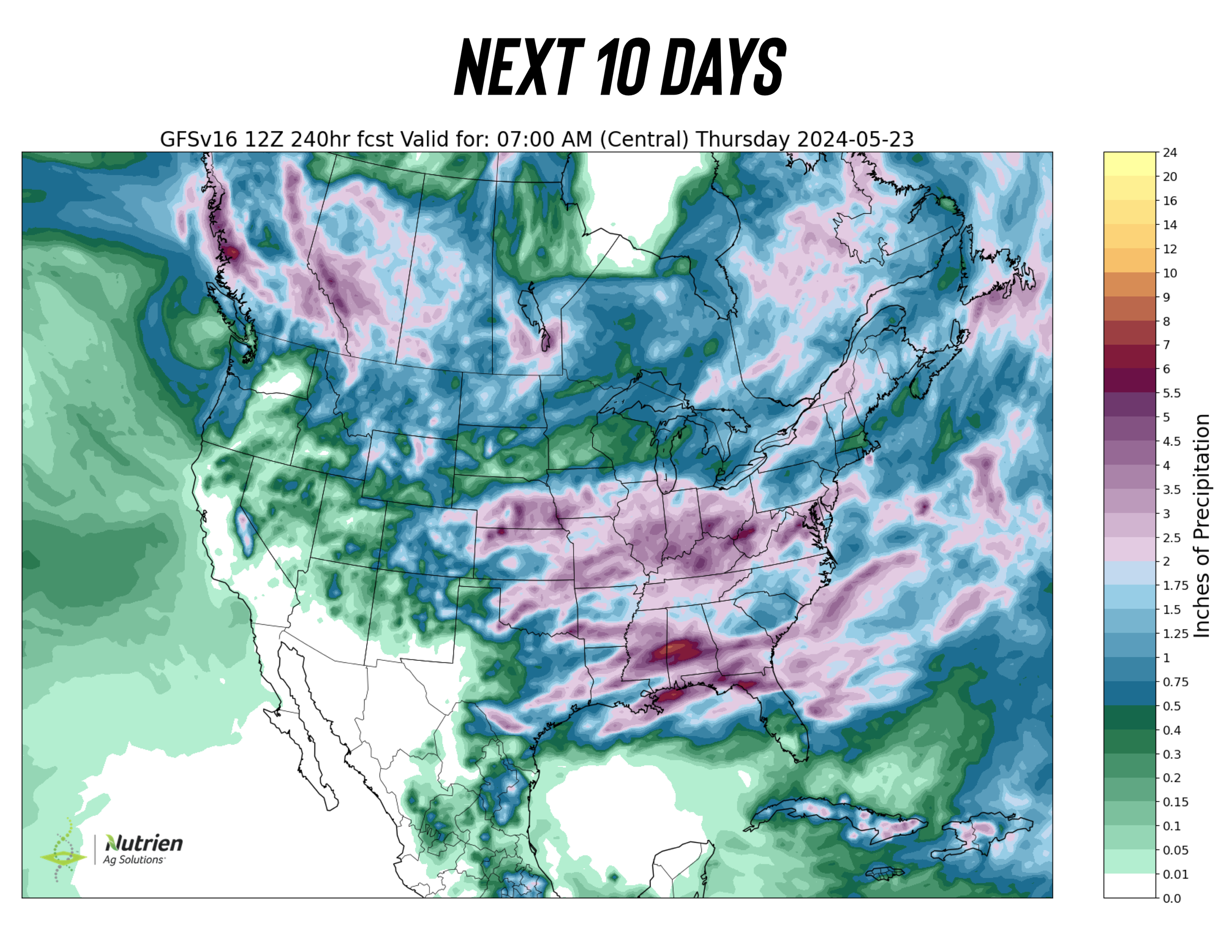

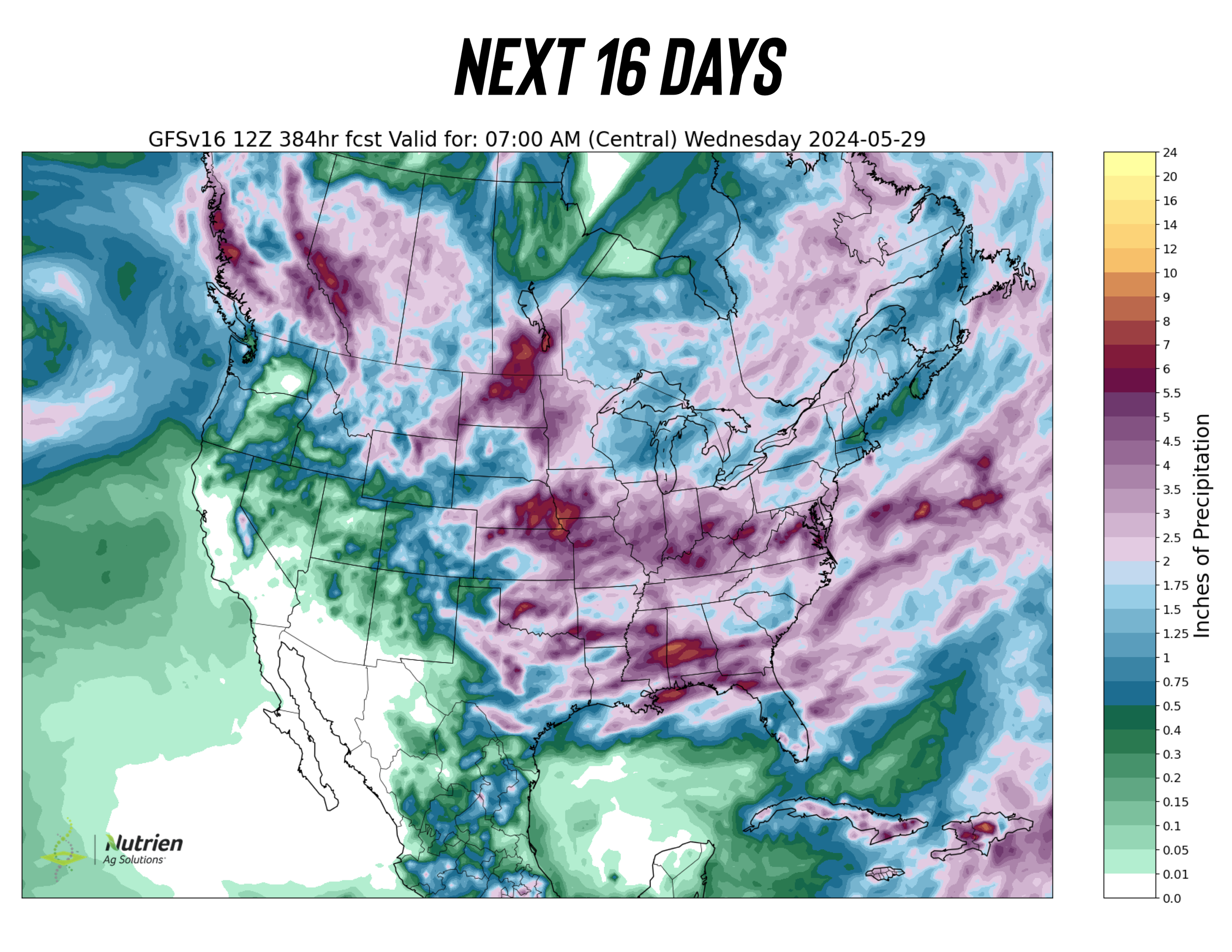

Right now it doesn’t look like the rain is going away. As the next two weeks suggest more rain. Two weeks from now is June.

There is the potential for some areas looking at June before they see any real major progress.

This is far from 2019, but is still a concern.

Along with that, we have farmer sentiment sitting at multiple year lows. Which means it could take higher prices to convince some growers in the wettest areas to continue.

To add on top, we just saw near record short covering from big money. It is very rare for the funds to hold an even position. Which makes me think we have plenty of more buying ahead...

PLANTING SALE

Take advantage before your trial expires. Comes with 1 on 1 market plans.

Today's Main Takeaways

Corn

New highs in the corn market.

The USDA report was not that crazy bullish.

But everyone was expecting bearish, so negative numbers were priced in. Yet the numbers were on the friendly side.

We saw carryout closer to 2 billion rather than 2.5 billion like they suggested it would be in February.

We are likely going to see some acres shift from corn to beans, which is friendly for corn prices.

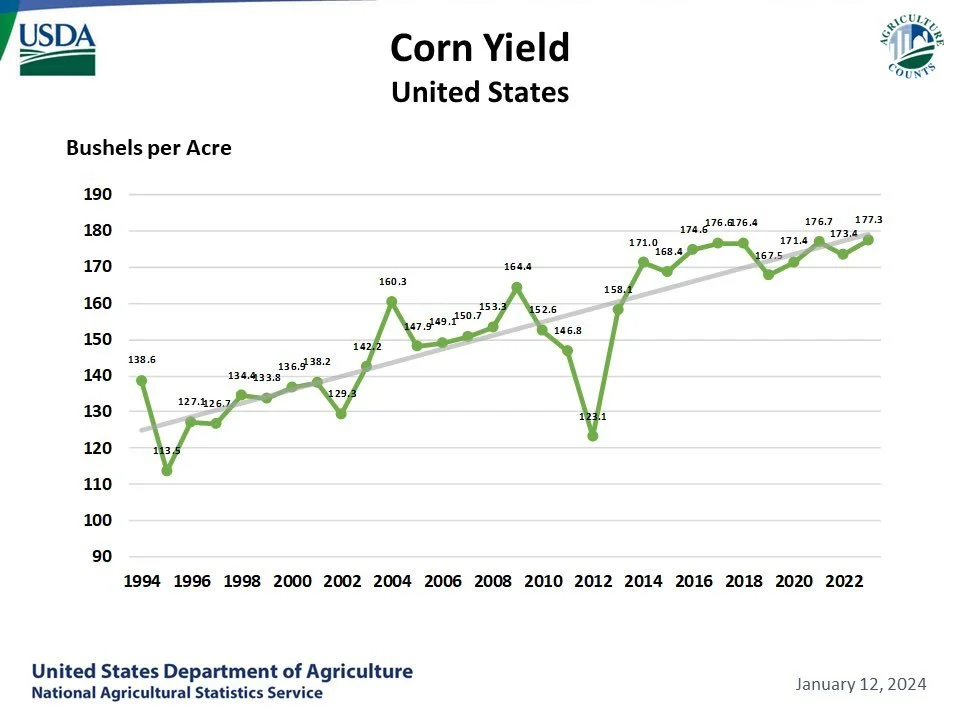

The USDA showed 181 yield as expected.

However, a 181 yield is not likely.

Trendline yield has been stagnant for the past decade. With the 3 year average being 175.8 and we have never made it over 177.

Right now we are looking at a carryout of 2.1 billion. Not bullish at all. But if yield were to drop closer to that 177 range which would still be near the record, our carryout would fall below 2 billion.

Now yes, there is a chance for acres to come in closer to 91 million instead of 90 come that June report.

Let's say acres go up 1 million, and yield drops to 179 (still a record) our carryout would still remain about the same at 2.1 million (If exports remain the same).

The market is going to need a weather problem if we want to avoid a lot lower prices come fall. Without a weather problem, we could see prices much lower later in the year.

Nobody knows if we will get a legitimate weather and crop problem, but what we will get is a weather scare.

We have this planting which is delayed, pushing crops into less favorable windows and creating compaction issues.

When we get this wet of a spring, the rain the rest of the growing season has to be consistent otherwise we will run into some bigger problems. Right now the outlook for a brutally hot and dry summer due to La Nina is 50% by June and 75% by July.

The market does not actually need a real problem, it just has to believe it could happen.

Then we still have Brazil. Since bean planting was delayed, so is this corn crop. This crop has been pushed into a lot less favorable window.

Take a look at just how dry it has been.

I think prices are going higher from here.

However, this $4.93 level is not a bad spot to take some risk off the table for Dec 24 corn. Some would have you making 10% or so of guaranteed bushels for 2024.

I like to wait for a trigger rather than a target, but my next target to take some more risk off is $5.03 for Dec 24. As that is the next resistance and gap fill from New Years. Just 10 cents away.

On July corn, my first target is $4.85 which is a good spot to make a few sales. As that is the implied move to the upside. We chopped in a 25 cent range for two months ($4.35 - $4.60) so the implied move on a breakout is another +25 cents at $4.85. Although I do think we go a little higher than that, that is a decent target to ease into things.

We want to wait and see what Mother Nature brings. Typically we go higher from here and into mid-June and want to have most of our sales made by July 4th most years.

This is why we had been preaching those courage calls in place the past few months, to give you the courage to makes sales on a rally.

July Corn

Dec Corn

Soybeans

Soybeans had a bearish USDA report Friday, yet we traded higher as the market fully expected this and had priced in a negative one before. Hence the 2-day sell off before.

Often times when we get bearish news but go higher, it is a signal we are going higher. Just like when we get bullish news but go lower, that is a sign to sell.

The big thing today is news that Biden is expected to release tariffs on China. The problem and risk here is if China retaliates. This could mean less buying of US soybeans. This is a potential problem as China is by far the biggest buyer of beans.

On the USDA report, one concern is that we have production up a lot from last year and a 450 million bushel carryout with a demand number that some think is generous.

Basically the opposite story from corn. Beans are going from a very tight situation to a more larger one.

However, we all know just how fast things can change if yield drops a few bushels. We are getting into a time of year where the balance sheets can change drastically either way.

But there is certainly risk in this bean market. If we somehow get this massive crop. If Brazil actually manages to produce a record 169 crop (USDA is at 154 for this year). There is a chance beans could struggle later this year.

On the flip side, there is just as equal of chance we go much higher.

The funds no longer want to be short. As they covered a record amount. This alone is a sign. That Big Money isn’t betting their money that we are going lower.

We have flooding in southern Brazil. We have an entire growing season ahead of us. Beans are made in August, and right now the La Nina probability for extreme dryness and heat only goes up the closer we get to July and August.

Now I do like having puts on unsold bushels for soybeans. It is simply smart risk management.

If making a cash sale makes sense for your operation, by all means do so.

Personally I am waiting for a trigger for sales, but do like protecting the downside. As I see more potential downside in soybeans than corn heading into growing season. Give us a call if you have questions (605)295-3100.

That $13 area is still a great target for those that want one.

July Beans

Wheat

Wheat rallies again.

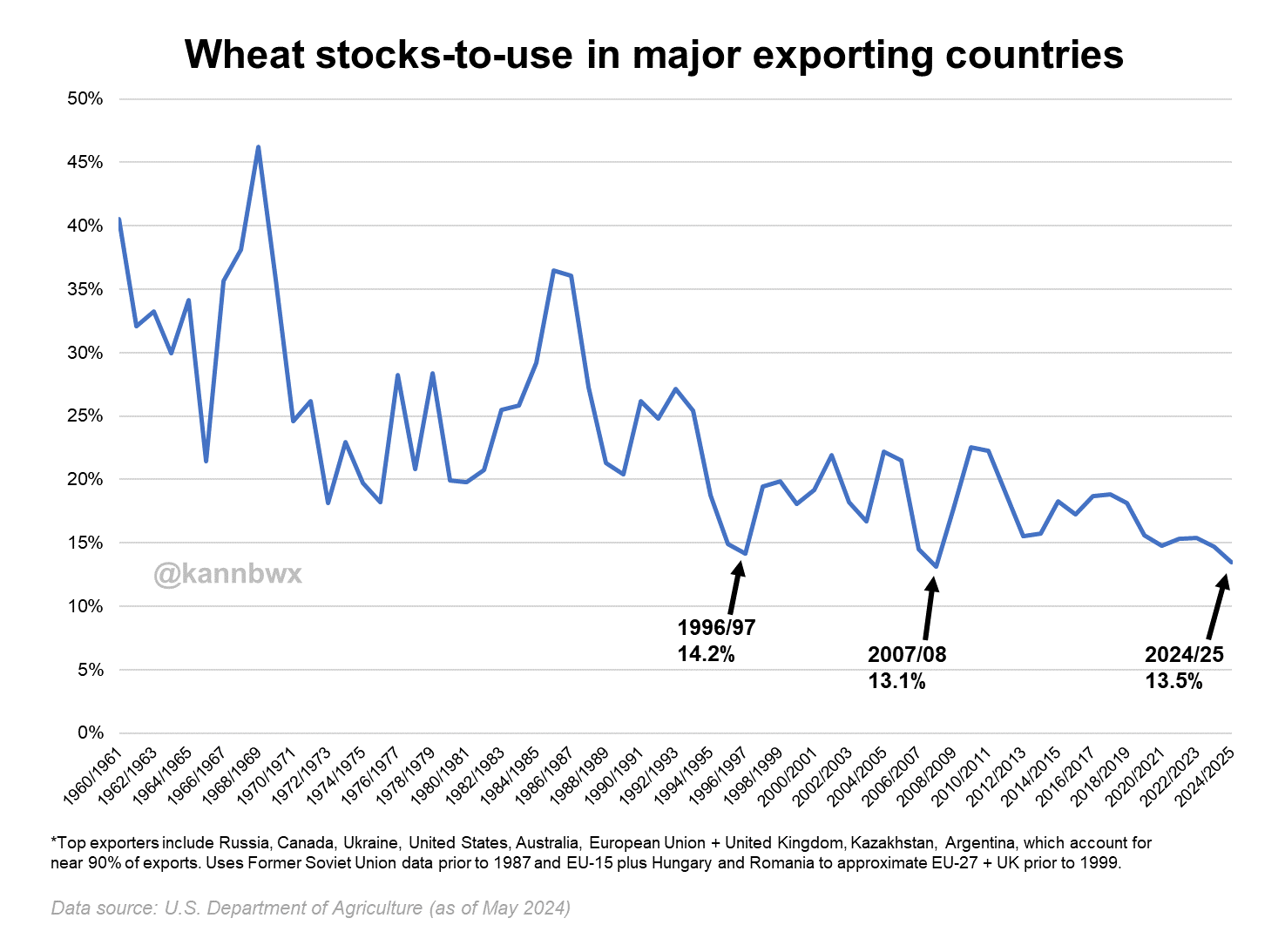

Some people are looking at the wheat chart and then looking at the USDA numbers and wondering how this is even possible, as we do not have a shortage of supply or production on paper.

But we have seen a rise in global prices, and global wheat production is having problems around the world.

This is something we have been talking about for months. That wheat was a sleeper.

Russia is the center of the headlines. They had all that dryness and heat, now they are seeing damage from multiple freezes. Some are already saying this crop could be as low as 81 million metric tons. Well below the initial 91 million forecast.

Then we have France. They have their worst crop in 4 years. Their acres were already reduced -10% and their crop is rated just 63% G/E compared to 93% last year.

We have some rain in the eastern corn belt that could cause issues for soft red wheat. Wheat can endure a lot, but can struggle if it stays too wet for too long.

India's wheat stocks are down -10% from last year. The lowest they have been since 2008.

Lastly, look at this. Wheat stocks to use in major exporting countries have hit 17 year lows. Remember 2008 anyone?

This wheat market still has so much potential to go so much higher. But it does not have to.

If you need to move cash wheat, reward this rally. For those with no storage or know they will have to move wheat off the combine, reward this rally.

If you are scared we are going to continue to rally higher and don’t want to miss the boat, re-own some sold bushels with calls if you want to stay in the game.

That way if the market tanks, you made a great sale and only lose the value of your calls. If the market continues to go higher, your call will make you even more money.

This market has rallied $1.50. An example would be spending 15 to 20 cents on calls to guarantee you lock in $1.30 of this rally. Worst case here you lose the 15 to 20 cents.

If you didn’t make the sale and didn’t get the calls and we were to give back half of the rally, you would lose out on 80 cents instead.

If you are scared to make a sale, then grab a put option instead.

It is called hedging, nobody has a crystal ball.

Give us a call if you want to go over your operation 1 on 1 (605)295-3100.

We are very close to my next target on July Chicago. The 62% retracement of $6.99 (Known as golden retracement). I think that is a great spot to take some risk off for some of you. On KC wheat that same retracment is at $7.46.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24