LOWER LOWS & DROUGHT TALK

Overview

Corn and beans both make new lows following yesterday’s friendly price action. Despite wheat being down hard early, it managed to rally back as yesterdays key reversal remains in place.

We were lower today due to technical and fund selling which stemmed from a lack of fresh news in the market for the bulls to chew on.

Weather in Brazil isn’t a problem, which can be a negative problem for grain prices. Soybean harvest and second crop corn planting both continue to move along at an above normal pace.

The weather in Argentina is also favorable right now, following their recent hot and dry temps which likely did a little damage. But the crop is still far better than last year, which isn’t hard to do.

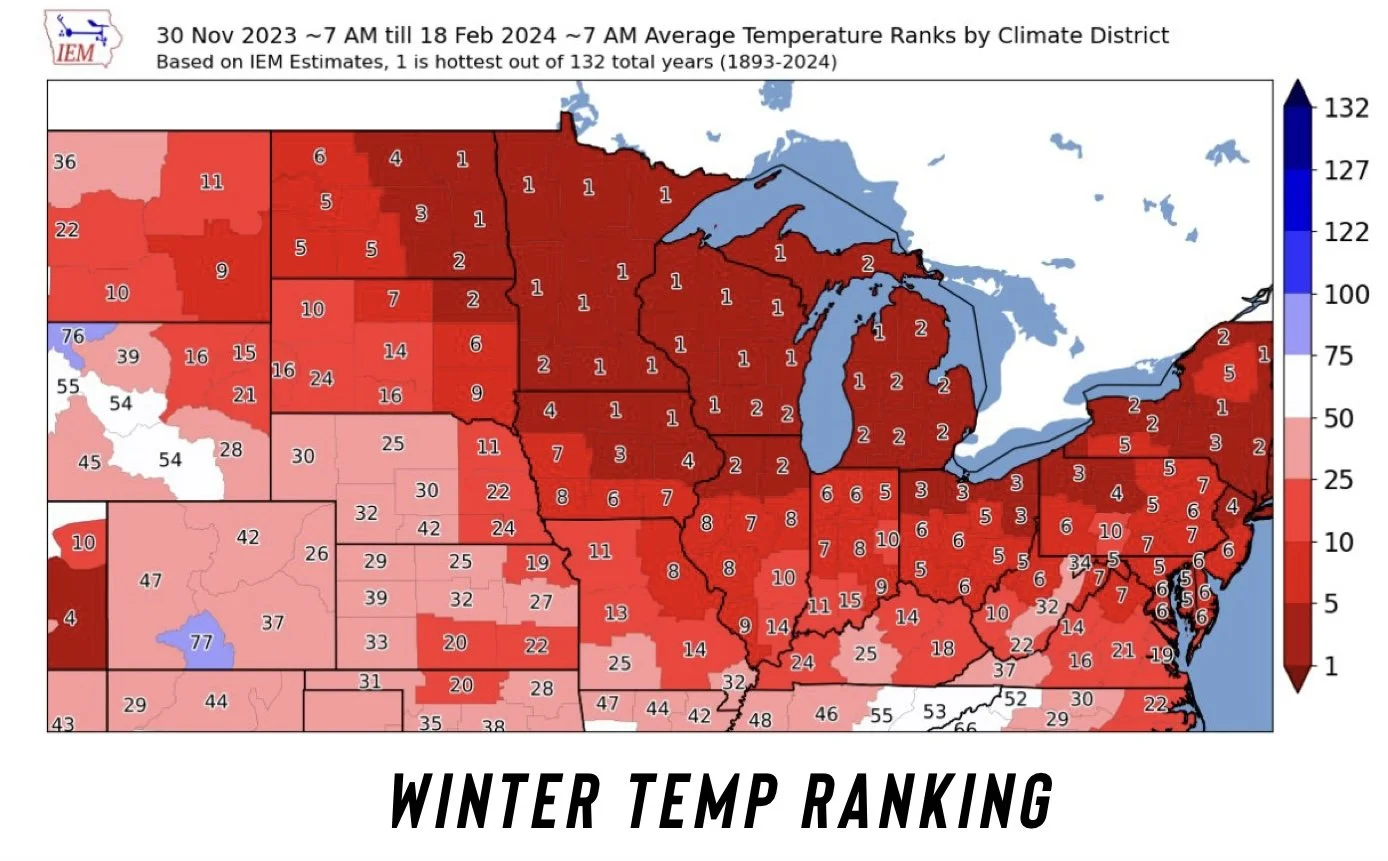

It's still too early for US weather to have an impact, but it is starting to look like winter is coming to an end. We have had the warmest winter in 132 years and this warm weather looks to continue.

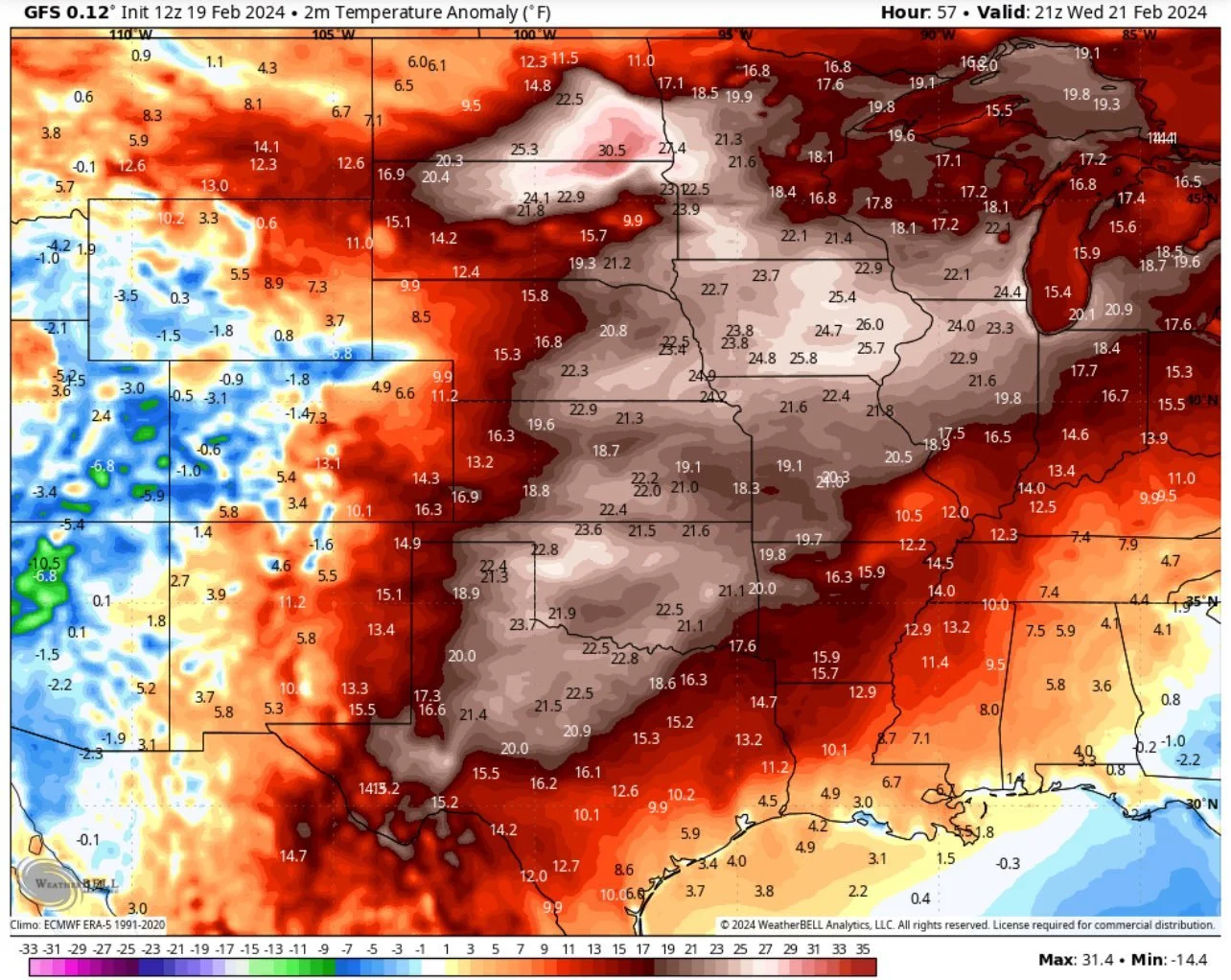

Take a look at how this winter shapes up with history. Warmest on record.

Now with this, yes this could lead to early planting because there will be little frozen ground and rain will absorb better.

However, on the flip side, the lack of snow is a negative factor for soil moisture.

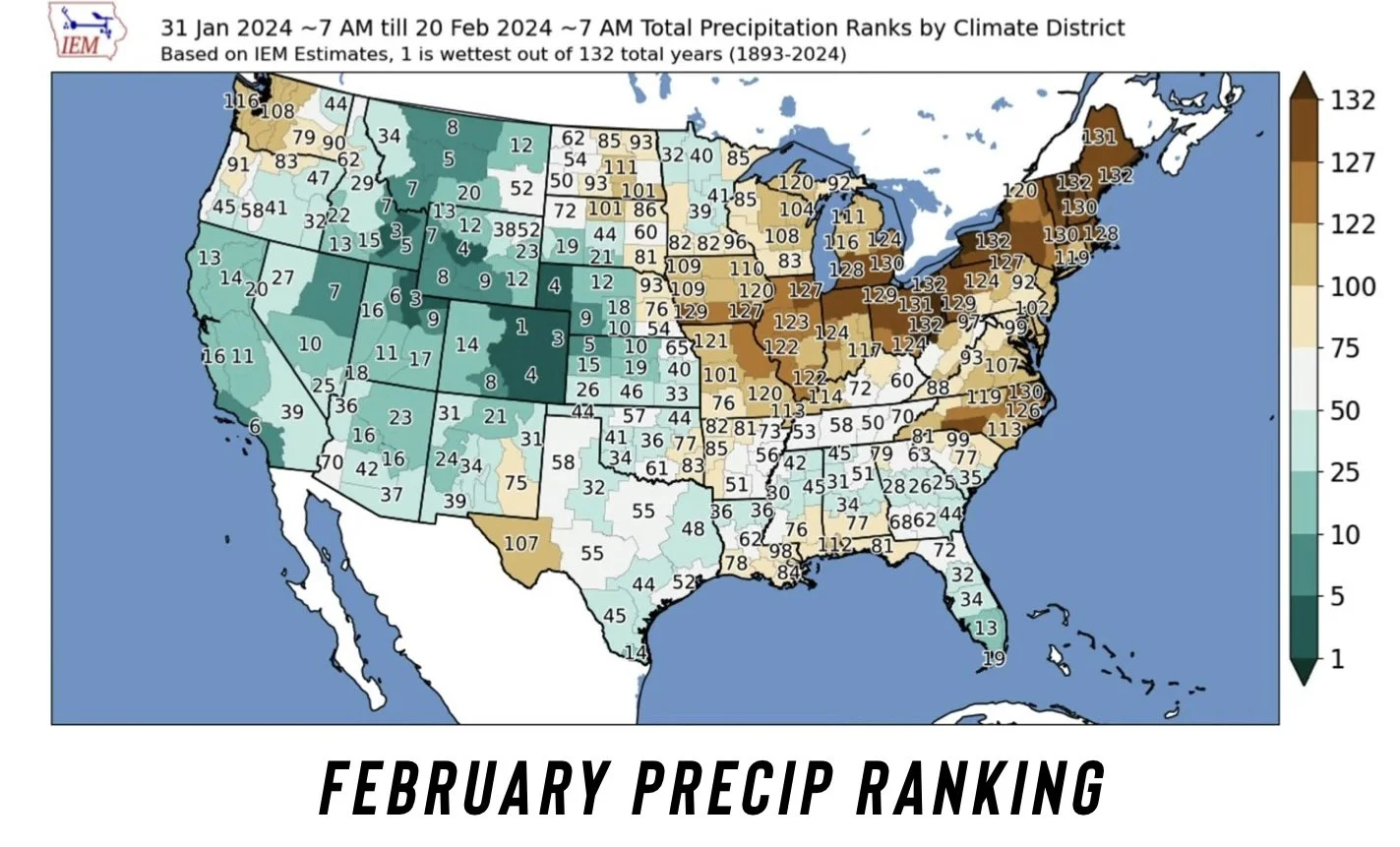

Take a look at how dry this February has been. For the I-states, it's one of the driest on record.

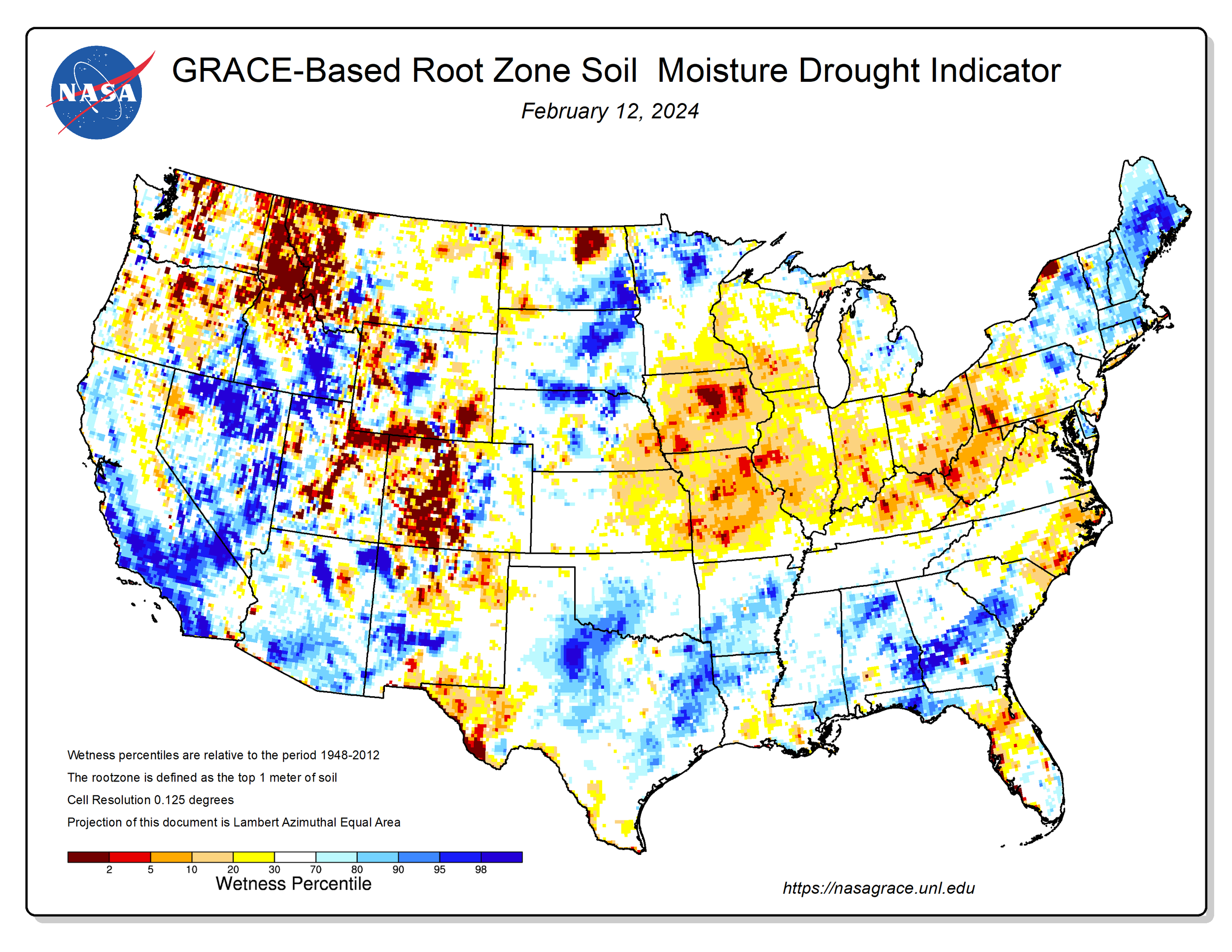

Lack of soil moisture is already starting to show, the snow was supposed to help this.

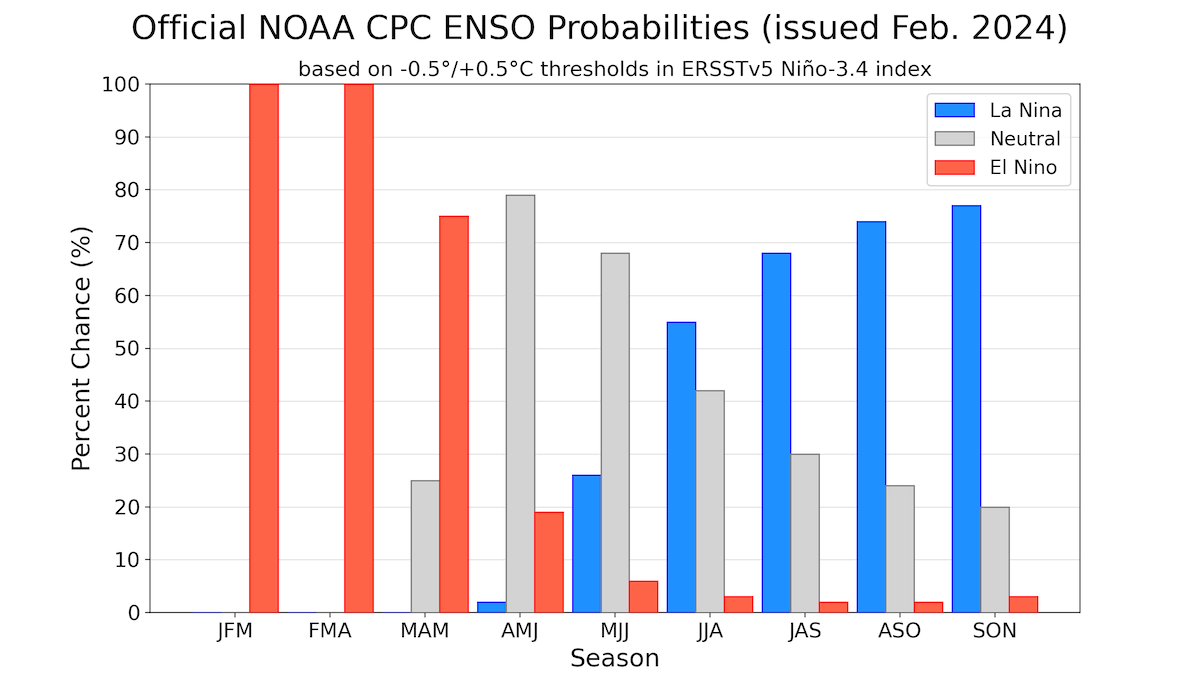

Now take a look at this next chart. It is the ENSO probabilities. Which is constantly updated and gives us the probabilities for La Nina and El Nino.

If you look we are still in El Nino. Which means it should be wetter and cooler. But it has not been.

We are not even into La Nina yet. Which is expected to bring drier hotter weather.

This is expected to begin around May.

So far this month temperatures have been anywhere from 20 to 30 degrees warmer than normal.

What if this trend continues into the summer?

Don’t tell me we won’t be getting at the very least a weather scare, whether the actual damage comes to fruition or not.

They are called "futures" markets for a reason. They price in things that will happen in the future.

Take last year for example. We raised a great crop, but even so we still got that mid-summer weather scare that rallied us substantially in a matter of weeks.

Now let's jump into the rest of today's update…

GET 50% OFF BEFORE YOUR TRIAL ENDS - HERE

Comes with 1 on 1 marketing planning & tailored recommendations. Let’s take back that edge from big ag.

Today's Main Takeaways

Corn

Corn makes yet another new low following some optimistic action yesterday. As we closed today at $4.10 nearing that critical $4.00 level.

Why do we continue to fall?

Simply because we don’t have a reason to go higher, yet. The funds hold their shortest position ALL TIME in corn. Short -315k contracts of corn. They do not have a reason to cover here. Why would you exit a winning position if there isn’t anything to drive us higher? So that is what corn is still missing. A catalyst.

Could the funds add another 50k or even 100k more contracts on to their position? It is possible. But that is a very unlikely scenario especially as we head into the US planting and growing season. There is simply too much risk for them to continue to pile on that much more.

Now this doesn’t mean corn can’t lower. We could still see a little bit of downside. But overall, I think the heavy bleeding is over for the most part. At least until we get into the US season and until we see how the crops in South America actually look.

If you take into consideration the 23% inflation since 2020, $4 corn today means that we are basically trading at $3 corn. What typically happens after drastic lows or highs are made? We move in the other direction.

When the funds are "forced" to exit these positions, it could be messy for them as they all try to hit the exit door at the same time.

What happens if we get a weather scare here in the US or if South America's crop disappoints? They will be forced to cover.

There are some people calling for a 2012 repeat. We realize this is something that happens every year. It happened last year, and usually this talk turns into a weather scare.

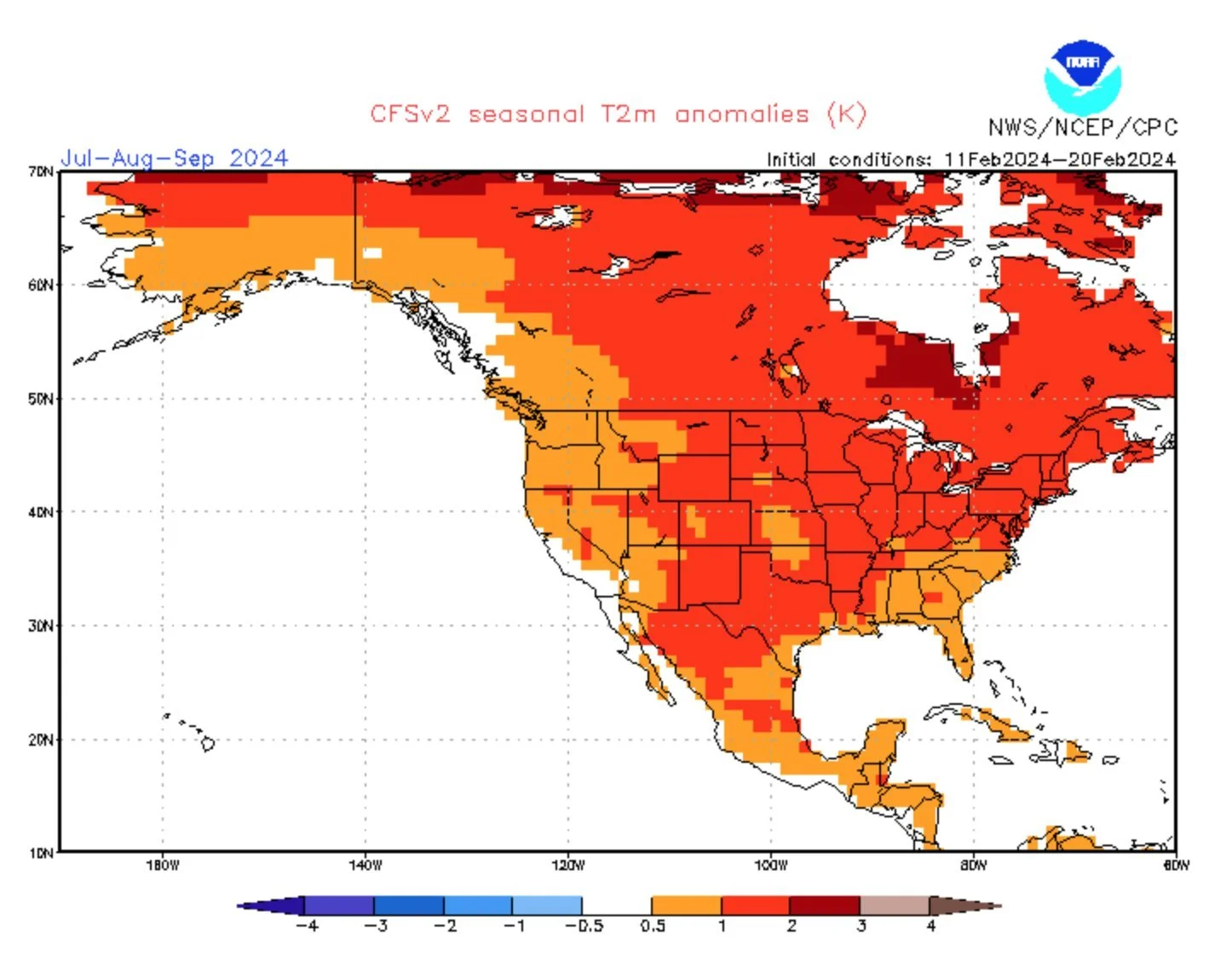

Whether this will actually happen remains to be seen. But what we do know is that right now it is hot and dry and the long term forecasts also point to hot and dry.

This map is from QT Weather, he said:

"Hotter than normal summer for almost all of North America still potentially in the cards."

Still staying patient. Remember, it's always darkest at the end of the tunnel. Now is still the time for some of you to be getting courage calls. Whether you have made sales or if you know you will be scared to pull the trigger on sales when do rally. Courage calls will give you the courage to do so while adding to your line when we get catalyst that forces the funds to cover.

If you have grain to move in the next 1 or 2 months, the charts continue to point to new lows. So if you are in that situation and need to move it and you have a good basis or the basis is locked in already, you should simply price the bushels and buy a call if you want to keep re-ownership.

If you can hold on and think basis will get better, you could buy a put to add a floor under the price of futures. We like using either the April or May put because we do not want to be spending a ton of money protecting these levels and hope that is the time frame where we will get that seasonal bounce.

We hope history repeats itself, but as we mentioned in yesterdays audio.. Hope is not a marketing plan.

If you want help or want to get a plan of attack together give us a call or text (605)295-3100.

If we can’t find a catalyst for the funds to cover, we will probably remain stuck in the $3.80 to $4.20 range. Looking towards spring and summer and if we get that weather scare type of rally which I think we will, and if we start to see some greater demand, prices could potentially crawl back into the $4.80 to $5.00 range. Next big support remains at that physiological $4.00 level.

Corn March-23

Soybeans

Soybeans also continue to fall, posting new lows following the past two days of higher prices.

The reason for the lower prices is the same as it is in corn. The funds and a lack of a reason to go higher.

As mentioned, weather in South America is a non threat right now. For the most part we are now just waiting for the actual results from the fields.

While we wait, estimates for the crops continue to come in lower. Rosario grain exchange just dropped their Argentina estimate by 5% today.

Kevin Van Trump made a good point today. He said that for a bull market you need 3 main things.

#1: A weather or supply story

#2: Demand

#3: Fund interest

Right now we don’t have any of these. Which in result leads to lower and lower prices.

A weather or supply story could certainly unfold later this year. Whether it comes from South America production being smaller than previously thought, or a scare here during the planting or growing season in the US.

Short term until US weather and acreage debate becomes more relevant, the only argument we will have is that the current South American numbers are being over stated. I mean the USDA has 156, CONAB has 149, and various sources have a number even lower than that. The market does not have a sub-149 crop priced in.

Now what we will certainly need is demand. Van Trump said: "a strong demand story, one that makes the market worry that demand is going to stay strong and outpace supply even if prices rally".

Then we all know where the funds stand. They are short a record -130k contracts of beans.

With the funds now this short, and with prices as low as they've been in almost a year, perhaps we can start to see some better demand. Long term the sustainable aviation fuel situation is very bullish for demand, but that's a story that could take a long time.

Just like in corn, we could very well get that weather scare that creates a rally and pricing opportunity.

Or maybe we get a similar story to that of 2016 for Brazil.

Remember, it took them until the very end of February to realize the Brazil crop wasn’t there. Who is to say it couldn’t happen this time? This is the first real scare they have seen since.

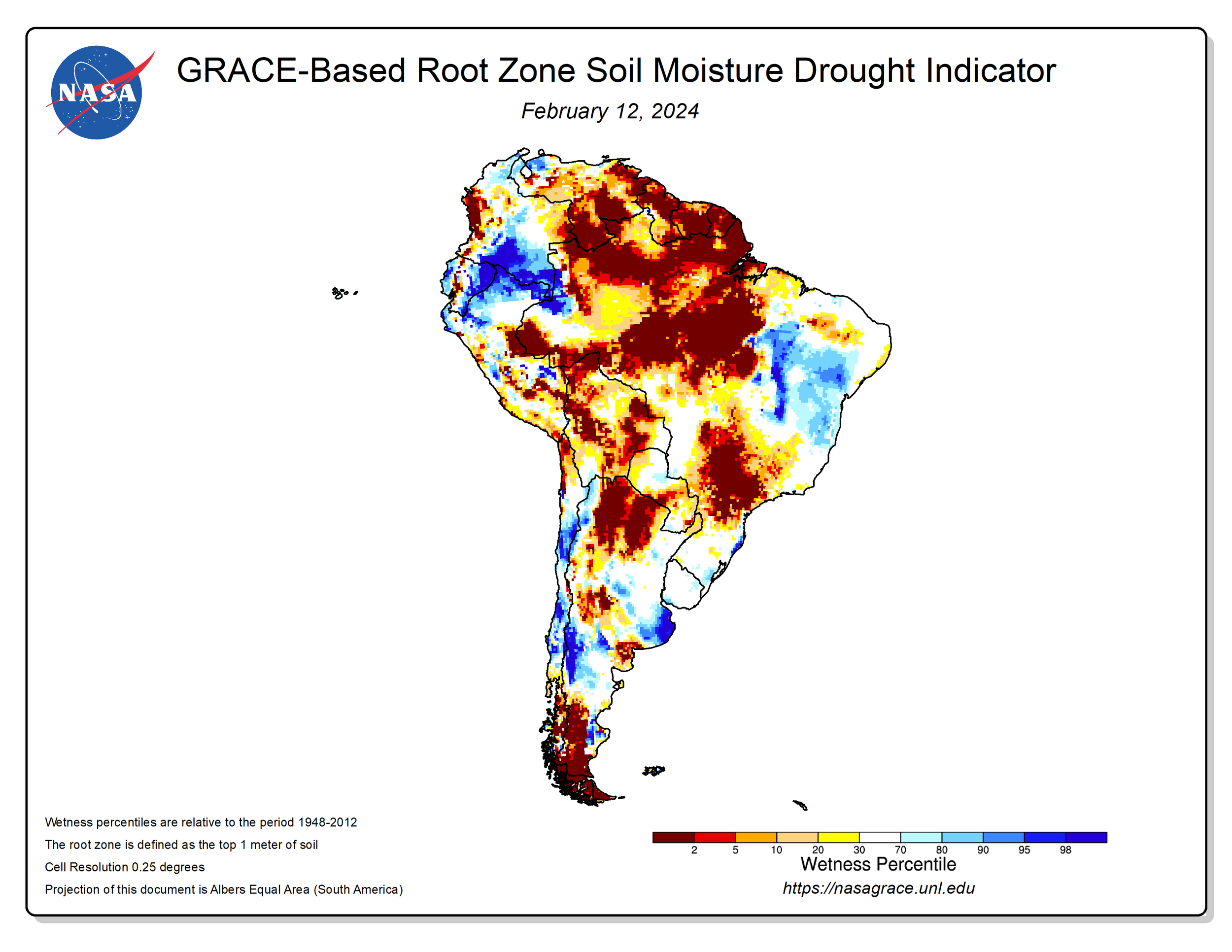

From BAM Weather:

"Pattern of extremes increasingly likely to return for South America.

In many ways and in comparison to 2016 (our last strong El Nino), the atmospheric set up ahead lends to more extremes similar to how we started the season."

He then basically said that the next 6 weeks are supposed to see some extremes once again.

Take a look at the soil moisture situation from February 2016 vs today.

Some would say that this year's situation is the same if not worse. Guess we will have to see how the crops turn out the next few weeks.

As mentioned in corn as well, if you have to move something in the next 1 or 2 months, and have a good basis or basis is already locked in, you should be pricing bushels and buying calls if you want to re-own.

If you can hold in and think basis will improve, look at grabbing puts to add a floor. But do not overspend.

If we take into consideration the inflation adjusted prices since 2020 of 23%, we would be looking at $9 soybeans. Most would consider $9 soybeans cheap. There is an old saying that says "cheap prices cure cheap prices".

I mentioned this last week. But remember when we were trading at $11.45 last summer? How many of you thought we'd see $14 beans? There wasn’t that many. But we were one of the ones who told you it was possible.

If you want to talk about your operation or want to discuss marketing strategies please feel free to give us a call (605)295-3100.

Looking at the chart, we need $11.58 to hold or we will likely test that $11.45 low from last year.

Soybeans March-23

Wheat

The action in wheat wasn’t bad actually. Yesterday we had a bullish key reversal. To start the day we were down -8 cents, but we rallied back and were fractionally higher. This was even more impressive given the fact that corn and soybeans were getting hit hard.

Now the real test is if we can get some follow through. As this reversal is still in tact so far. We really would like some follow through strength. That could lead to more technical and fund buying.

Biggest hurdle wheat faces is still ample global supplies and global competition. Aka cheap abundant supply in Russia.

The biggest story in wheat is the news about the US planning major sanctions against Russia. However, most do not see this having a major impact on Russia's exports.

Then we have a few other wild cards in the mix. We have the warmer weather here in the US, which is melting snow cover and bringing up potential drought talk.

For wheat, I am still remaining patient for better opportunities later.

If you find your self in a difficult situation and aren’t sure what to do, give us a call (605)295-3100.

Looking at the chart, yesterday's strong reversal is still a good signal that perhaps we have finally found some footing in this market. Or at the very least stopped the heavy bleeding.

The rally may not come soon or on the time table but you want it to, this market is more of a marathon. Stay patient.

Mar-24 Chicago

Mar-24 KC

Cattle

There is some signs of weakness and topping in this cattle market. I did not like price action as we closed well off our highs after making new highs. The charts look like a market that could potentially be topping.

We are not here to outguess the markets. We are here to practice good risk management.

Last week I recommended to hedge on paper and take advantage of this rally with a long put to keep your upside open and give you a floor.

I still like this strategy as there is a chance we go to test those highs, but realize this could also potentially be the top.

Depending on your risk to reward appetite, it might make sense to establish a floor with some puts as I personally like taking risk off the table on this rally.

Give us a call if you have questions or want help discussing a game plan. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/20/24

HOPE ISN’T A MARKETING PLAN BUT HISTORY REPEATS ITSELF

2/16/24

HAVE ENOUGH OF YOUR NEIGHBORS THROWN IN THE TOWEL SO WE CAN BOTTOM?

2/15/24

BASIS CONTRACTS & USDA OUTLOOK

Read More

2/14/24

SELL OFF AHEAD OF USDA OUTLOOK: STRATEGIES TO CONSIDER

2/13/24

LA NINA, FUNDS, & USDA OUTLOOK FORUM

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24