AI THINKS WE ARE GOING HIGHER. DO YOU?

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

The time is now? Is a question many have asked in regards to if we have made our bottom.

A week ago the talk was when is the bleeding going to stop. Now after a few days rallying the talk has turned to have we made our lows. Timing on markets can be even harder than calling the direction. Many times the timing doesn’t happen until the towel gets thrown in.

Did many throw in the towel last week, before we bounced a bit? Did the Chinese news of cancellations cause guys to raise the white flag?

The price action late in the week should remind us of why we don't want to fear sell. It reminds us of why we don’t want to make sales at multi month or yearly lows.

If you are a buyer you have an opportunity to get coverage, don’t be greedy. Remember that farmers don’t have to sell, end users need to either buy, close, or find a replacement product. It makes sense to get coverage at these levels, especially considering farmer wealth, along with the fact that every year more farmers naturally transition from being price takers to price makers.

For those of you that made grain sales. If you did it at the lows you have put yourself in a tough situation. Especially if we start to rally on some sort of weather scare. For some of you to get comfortable you might want to ask to see if wherever you made a sale at will turn the sale into a minimum price contract. For those of you that have hedge accounts consider buying calls, or waiting for a price dip to buy a call.

The bottom line is you should be prepared should that rally come. You want to be prepared ahead of the rally, don’t wait and panic after we rally. If you want to wait for the rally, then try to make some money back after the fact via buying puts trying to make money on the downside.

My preference is for those that made good sales earlier to now buy calls ahead of the May USDA report and ahead of the KC wheat tour. For those that sold lately and are under water already it becomes a personal choice that is difficult. You can spend a little money owning calls now, which gives you the risk that you fall below breakeven. Or you wait for a rally and then you try to pick a top or stair step into buying puts which will help you eventually get the top.

If you have questions on which strategy might work best for you please feel free to give me a call at (605) 295-3100

We mentioned above about the timing of markets. Vince Irlbeck from the Facebook group commodity technical trading room has agreed to do some short audio’s with timing.

Here are the first couple. Here is a cattle audio.

Here one with some dates to watch for July corn.

Make sure you go and join Vince’s Facebook group here. He puts out various charts on various commodities. He has done a good job in calling market direction and timing as well as helping educate farmers in technical trading.

Short Selling

Everyone in the grain market has known that the funds have been short a massive amount of wheat for some time. But in the past couple of days stories have been out where JP Morgan has made a prediction that a ban may take place on “short selling” because of what has happened to the banks. This ban wouldn’t be for commodities nor grains, but for stocks in an attempt to not blow the fear up and to kept shorts from manipulating markets.

First off it seems like they could use this in grains, as the funds shorting wheat is a little manipulative. Just look at the fund shorts versus open interest in CBOT wheat. I mentioned in my audio comments earlier in the week that it didn’t appear that our rally in wheat was from short covering, because otherwise we should have seen CBOT wheat leading KC wheat, but the price action was the opposite.

I think our wheat rally is the market realizing just how bad of a winter wheat crop we have.

The other observation in regards to a possible ban in short selling is what it will do to markets. If you take away shorts, you are left with just buyers and those that already own. So does putting a ban on short selling simply lead to market manipulation by others? And is that market manipulation an upward risk on baias? Does that lead to price support to grains and commodities?

Bottom Line Is We Remain Very Bullish

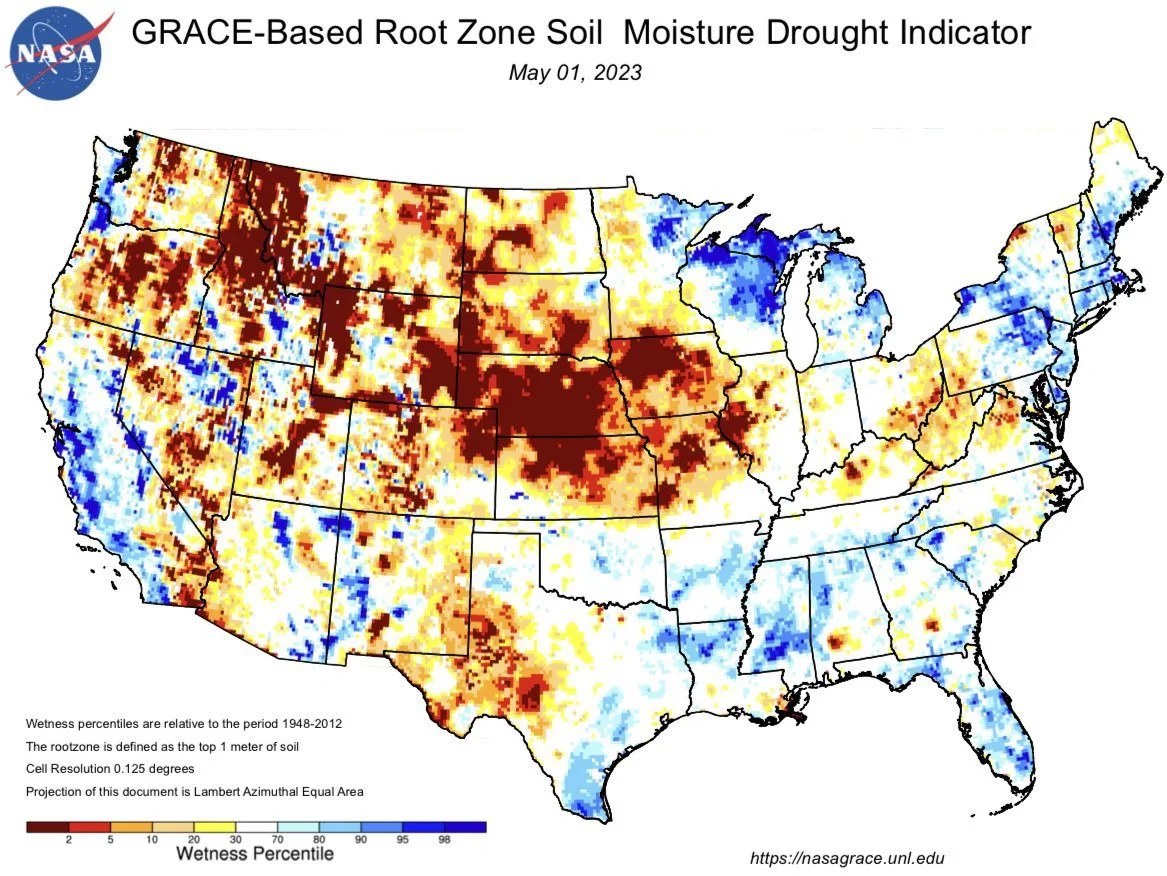

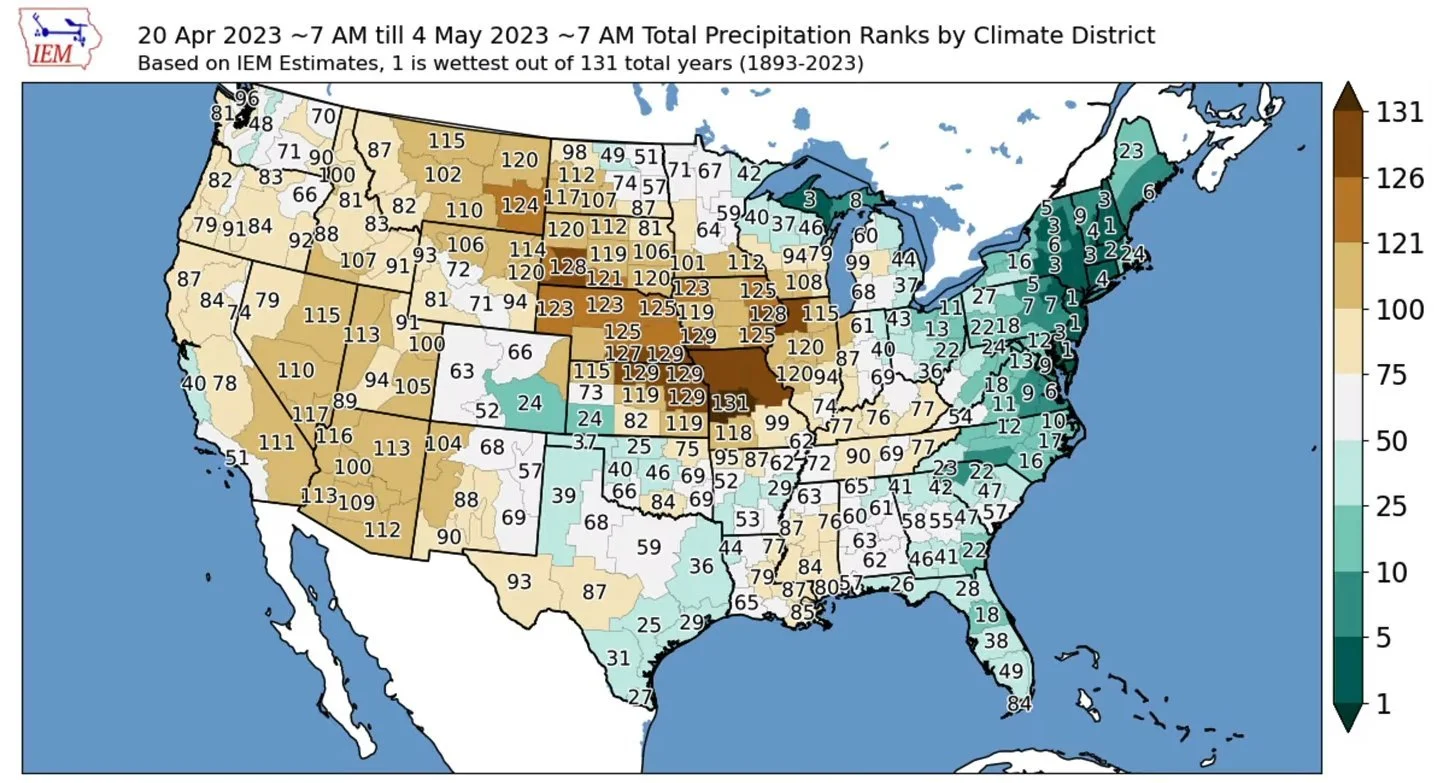

We have had zero phone calls from any farmers telling us about the perfect conditions that they have. While we get numerous calls/emails/texts daily reporting how dry it is and how much of the land just hasn’t got much of a recharge for the subsoil.

We believe we will get a weather scare and the weather advisors we follow continue to talk about how fast we have switched from La Niña to El Niño with the negative PDO

“According to NCEI's Global Annual Temperature Outlook, it's near certain (>99.0% chance) that 2023 will rank among the 10 warmest years on record, with a 96% chance this year will rank among the top-five warmest.”

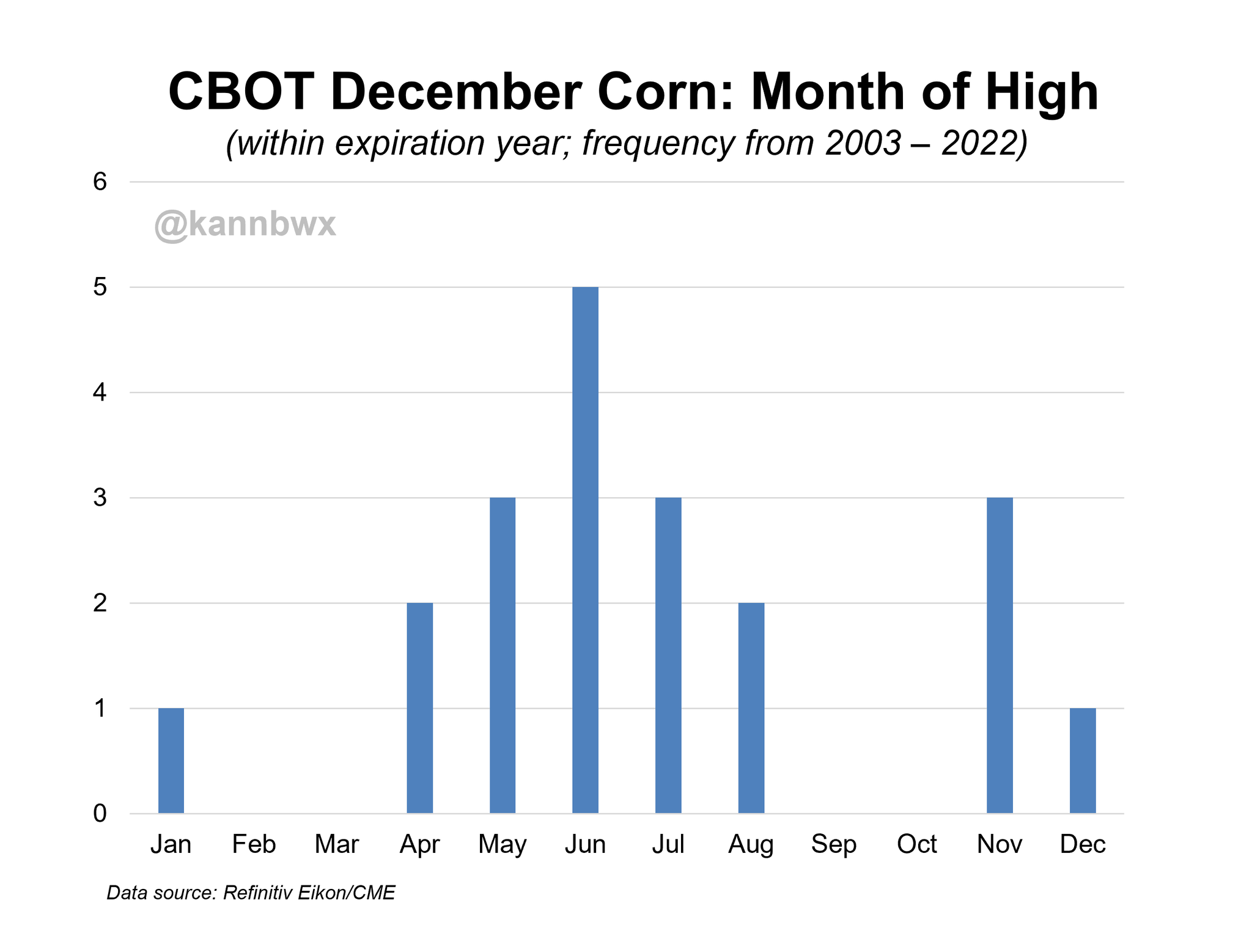

Below is a 20 year graph showing when new crop corn has made it’s highs. We believe this will be year 14 when we make our highs in May-June-July-August.

2012 we made our highs in August the day of the USDA crop report.

INPUTS - Diesel

We like the idea of getting inputs locked in, we believe that the price action this past week was giving another opportunity to those that didn’t lock in some inputs previously.

We feel like a global recession is already somewhat priced into current prices. If the recession doesn’t happen then there is plenty of upside. If you need help with this make sure you see our previous announcement with information on opening hedge accounts.

Please give me a call 605-295-3100 for more thoughts. Here is link to Doorman Trading to open an account if don’t already have one: https://www.dormanaccounts.com/eApp/user/register?brokerid=332&utm_source=substack&utm_medium=email

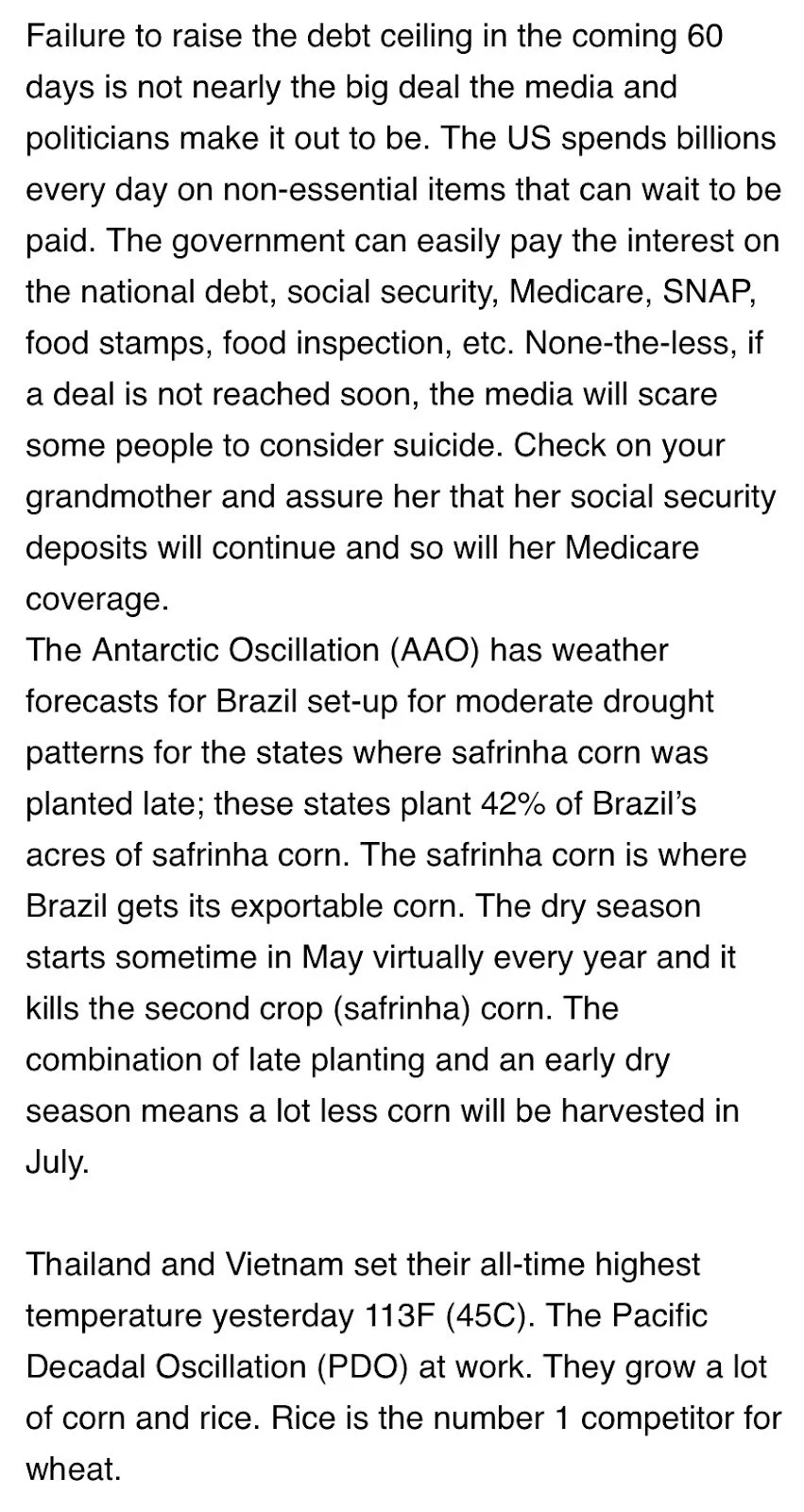

Screenshot from Wright on the Market.

Here are a couple good points that I noticed in his write up from Sunday a.m.

We have put this graph out on social media several times in the past week. We will be monitoring this going forward.

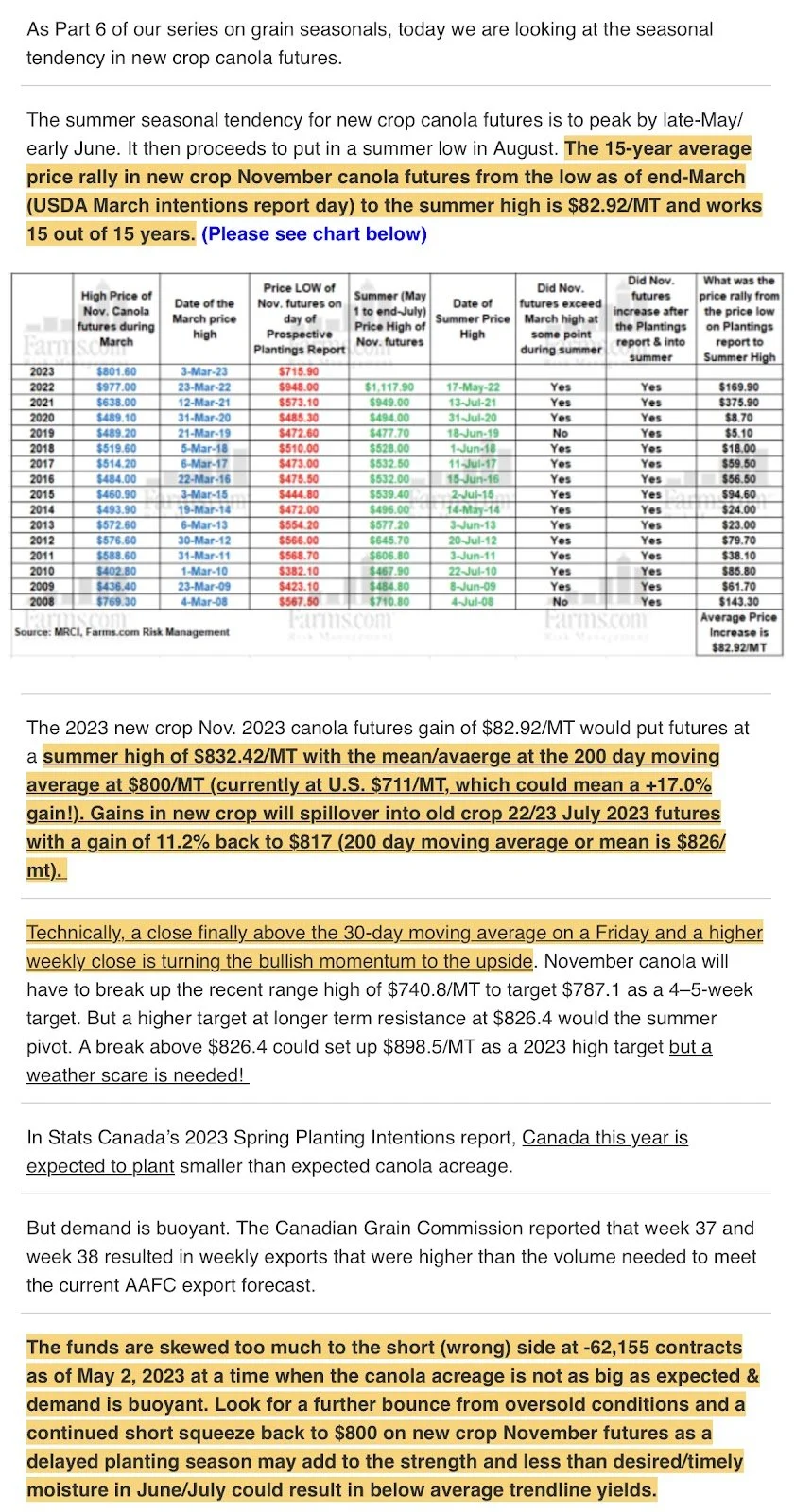

Here is a screen shot from farms.com risk management. It is on new crop canola seasonals.

At the end of the day the more big farmers I talk to from various parts of the corn belt, the more I research, the more I think about the short fund position in corn and wheat, the more I look at the big picture which includes a lack of coverage from end users. The more bullish I get in regards to price potential. I realize that there is risk that we have seen our highs and that Mother Nature will be nice. But so far that isnt how I see this market shaking out.

I think we see our highs in the next few months. The price action lately reminds me of 2012. The difference between back then and now is really demand. In 2011-2012 we had massive demand destruction because of high prices, I don’t see that as the present case. Our present rally or leg up in prices started from demand in 2020 and into 2021. It was demand driven.

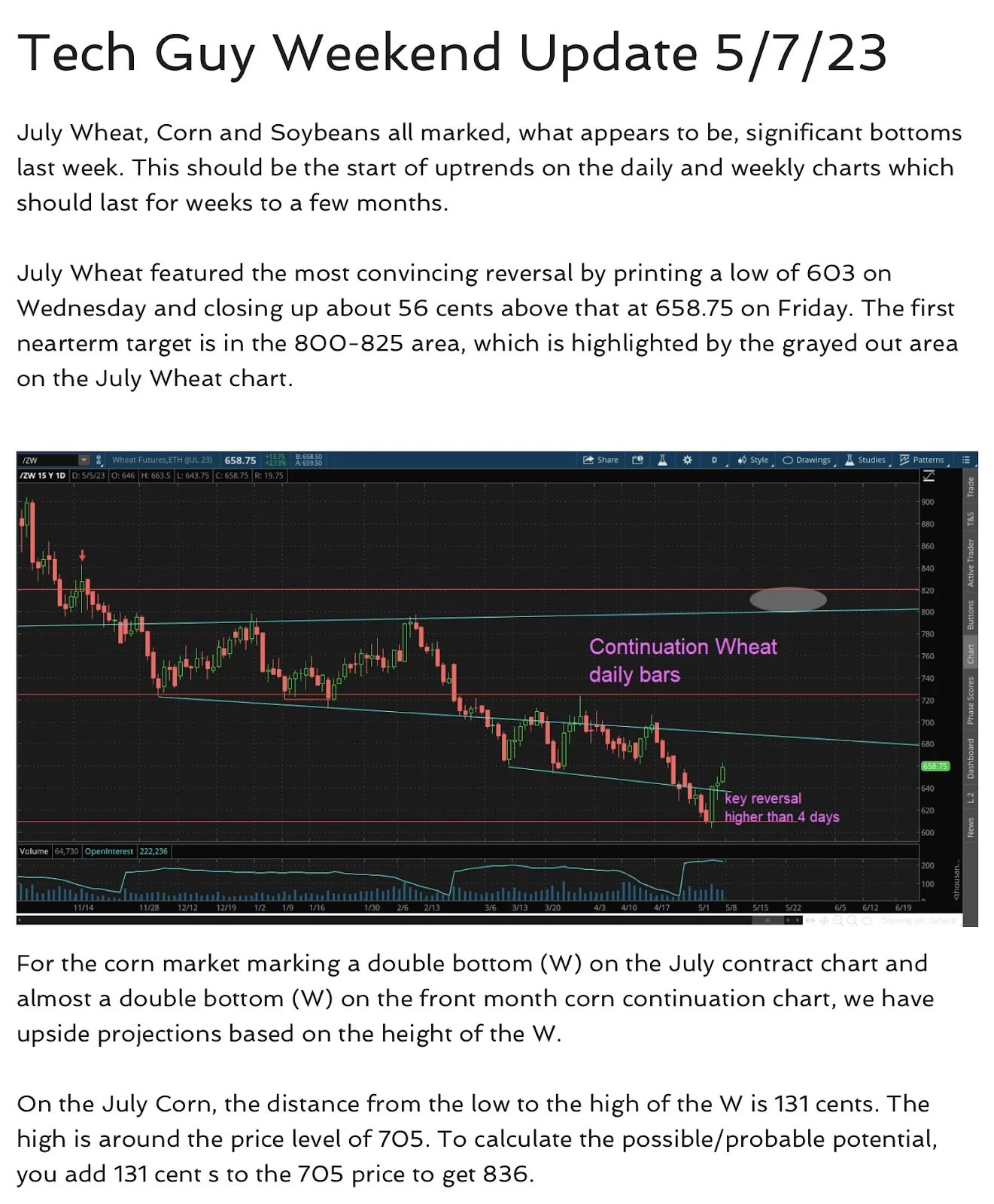

Take a look at the below with some targets that the Tech Guy has from Wright on the Market.

I believe that it is just a matter of time before our grain markets get another perfect storm. Mother Nature seems to be game to at the very least add some scares, the funds seem to be game via being short at what looks like is a bottom, add possible lower interest rates in the future, and reality that it doesn’t appear that we are having a global recession but rather expanding economies that equal to demand growth. The combination of all leaves us feeling that the Tech Guy’s 19 soybean targets might end up being cheap. It goes without saying that if our weather guys are right and 2023 corn yields take it on the chin that the world will not be prepared.

OUR BIGGEST SALE EVER

Lock in our yearly or monthly option for a massive discount before our sale and your free trial ends. Sale ends May 12th.

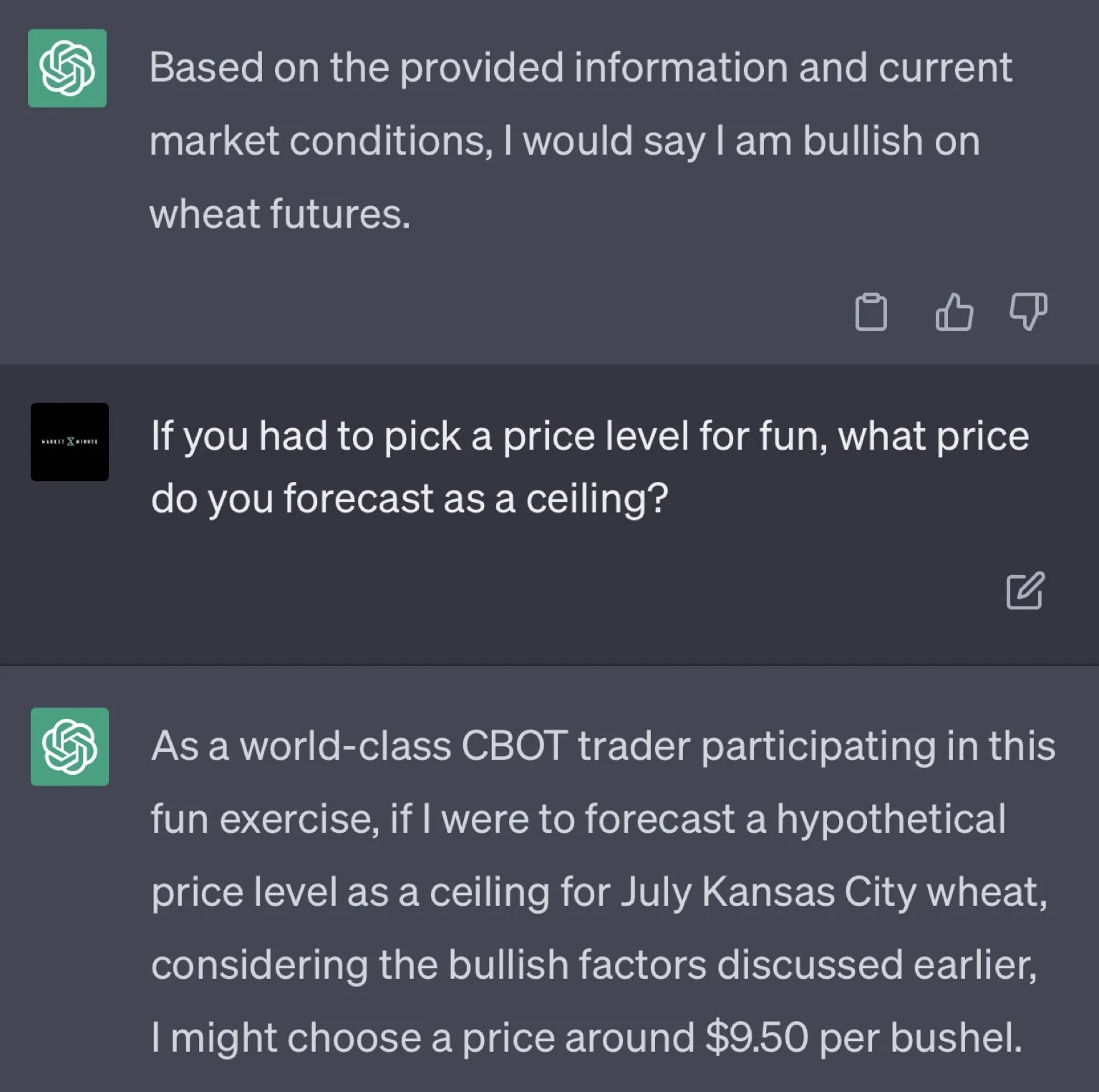

AI's Thoughts On The Grains

Yesterday we asked the popular AI tool ChatGPT it’s opinion on the wheat market. 🌾

Here were the results... 🥁

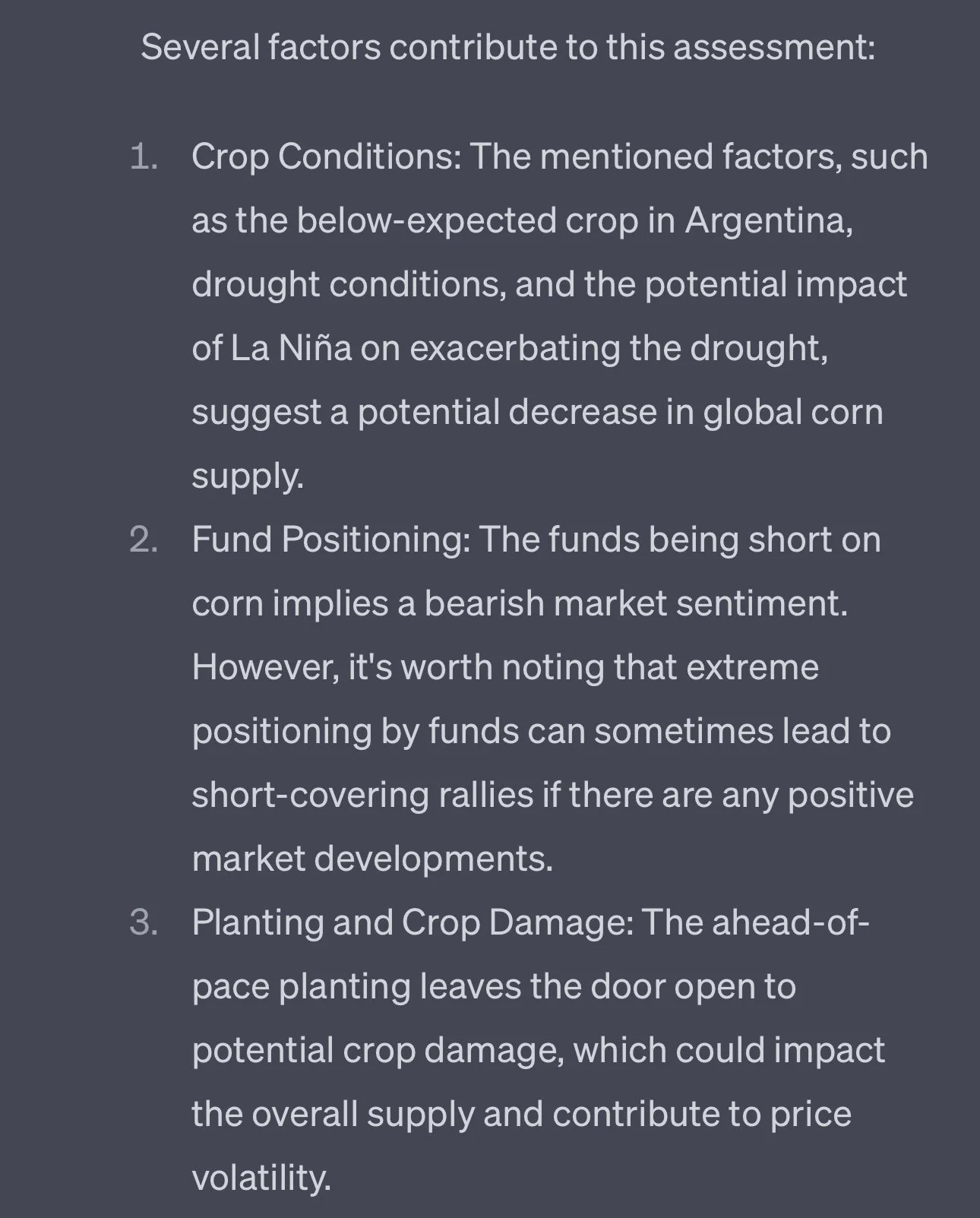

Corn 🌽

We posted that to social meda, and we had a ton of guys ask us to do one for both corn and beans. Per request, here is it’s outlook on the corn market.

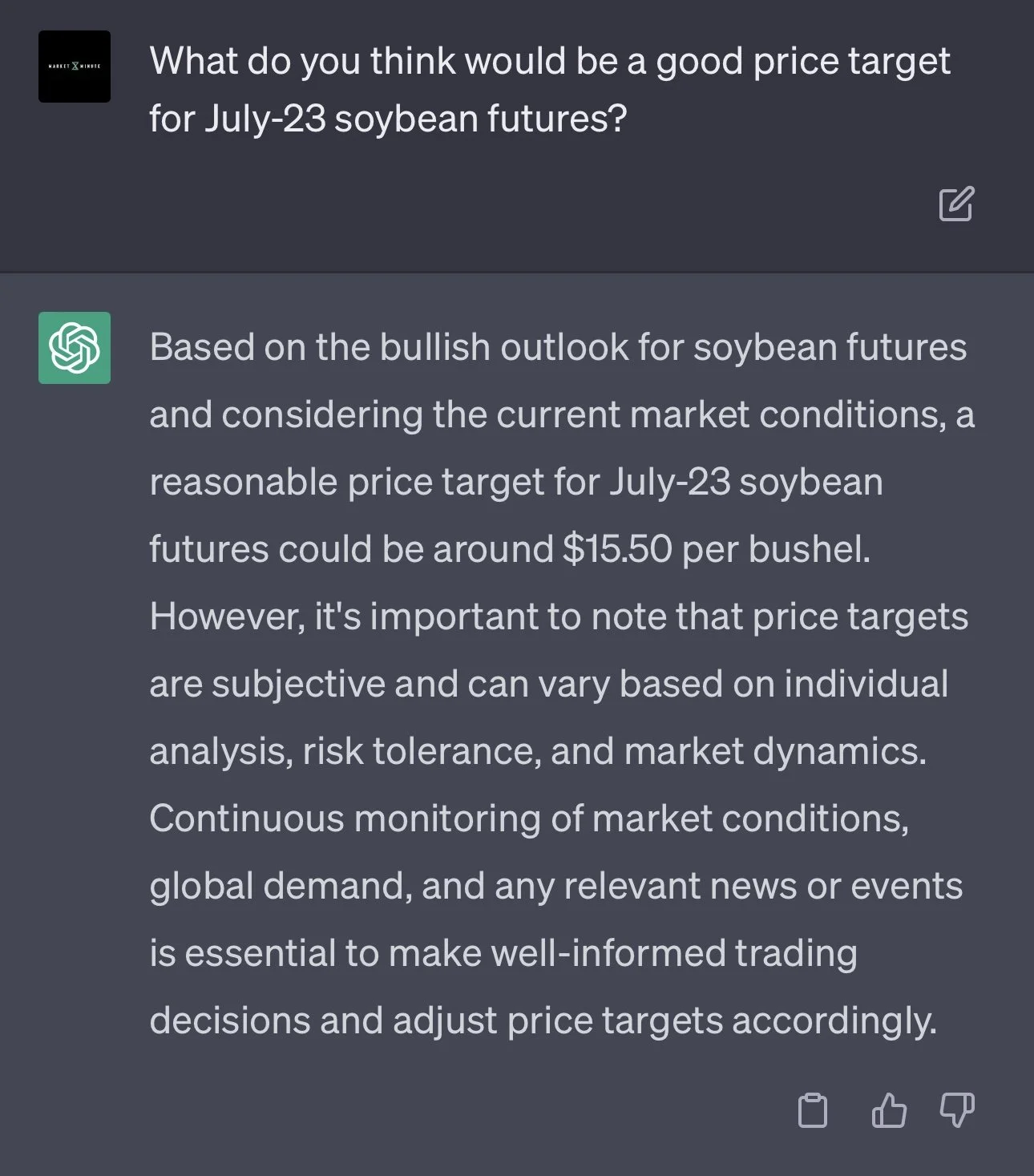

Beans 🌱

Lastly, here was it's opinion on the bean market.

The Charts

Corn 🌽

Beans 🌱

Chicago Wheat 🌾

KC Wheat 🌾

A Few Past Updates

5/5/23 - Audio

If This Was Short Covering, Why Didn’t Chicago Lead Us Higher?

5/4/23 - Market Update

Grains Rally Off Lows

5/3/23 - Audio

Wheat Prices Catch Fire

5/2/23 - Market Update

Grains Fade Off Highs

4/30/23 - Audio

Why We Will Be Thanking The Market For Lower Prices

4/27/23 - Audio

Will Markets Reverse Second You Throw In Towel?

Thanks for reading

If you have any questions don’t hesitate to give us a call at (605) 295-3100 anytime