ANOTHER CHINESE CANCELLATION PRESSURES GRAINS

Overview

Grains heavily pressured across the board today with the exception of KC and Minneapolis wheat as they continued to be supported by the slow planting progress and poor crop conditions.

Both corn and beans gave back roughly 50% of our recent rally with today’s heavy losses. KC wheat on the other hand continues it’s bull run for the 5th trading day in a row, up nearly $1.20 from the lows last Wednesday.

The big news this morning which had corn under pressure was the USDA reporting yet another flash cancellation of corn to China. This time cancelling 272k metric tons, making it the 3rd cancellation since April 24th.

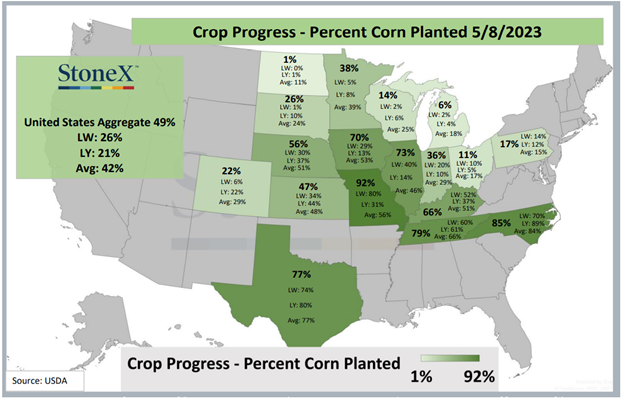

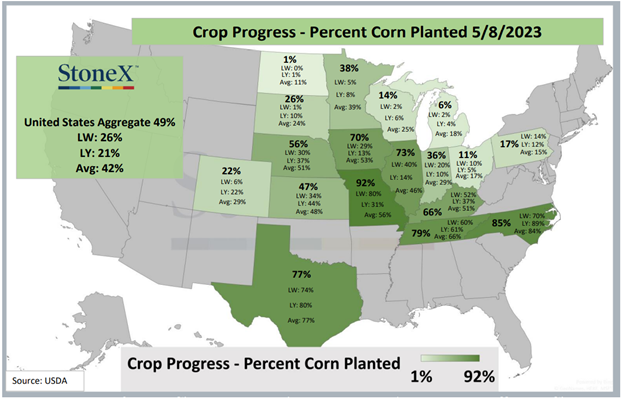

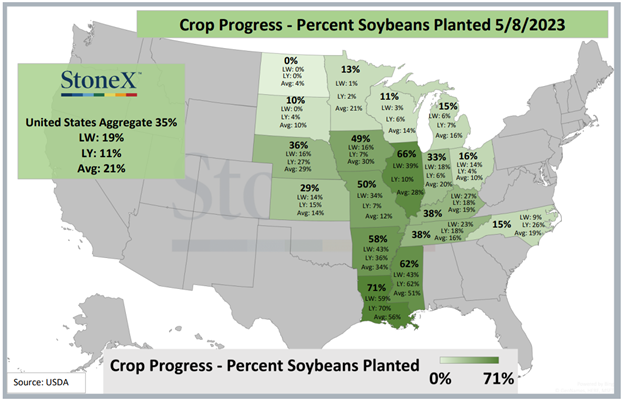

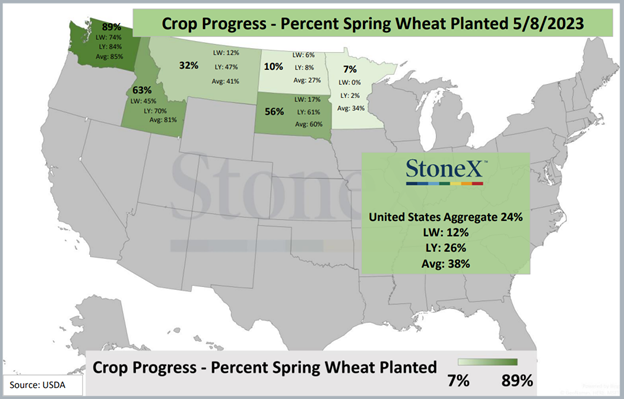

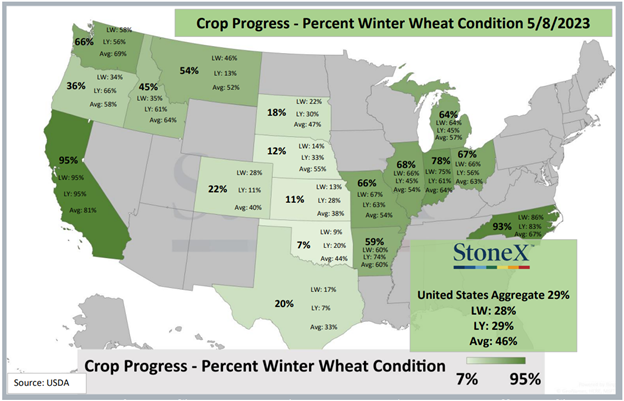

Yesterday we got crop progress and conditions (Full data at the end of today's write up). But the main takeaways there were that both corn and beans are running ahead of pace which didn’t help prices today, while spring wheat is falling very far behind. Coming in at it’s 4th slowest pace ever. Winter wheat conditions also saw their poor to very poor rating increase another 2%. Now sitting at 44% rated poor, which is the worst for this week since 1996 and the worst for any week since 2014.

Planting Progress

Bean 35% vs 21% average

Corn 49% vs 42% average

Spring Wheat 24% vs 38% average

North Dakota had only 1% of corn planted and 0% of beans planted, and they are expecting more rains which could further delay planting.

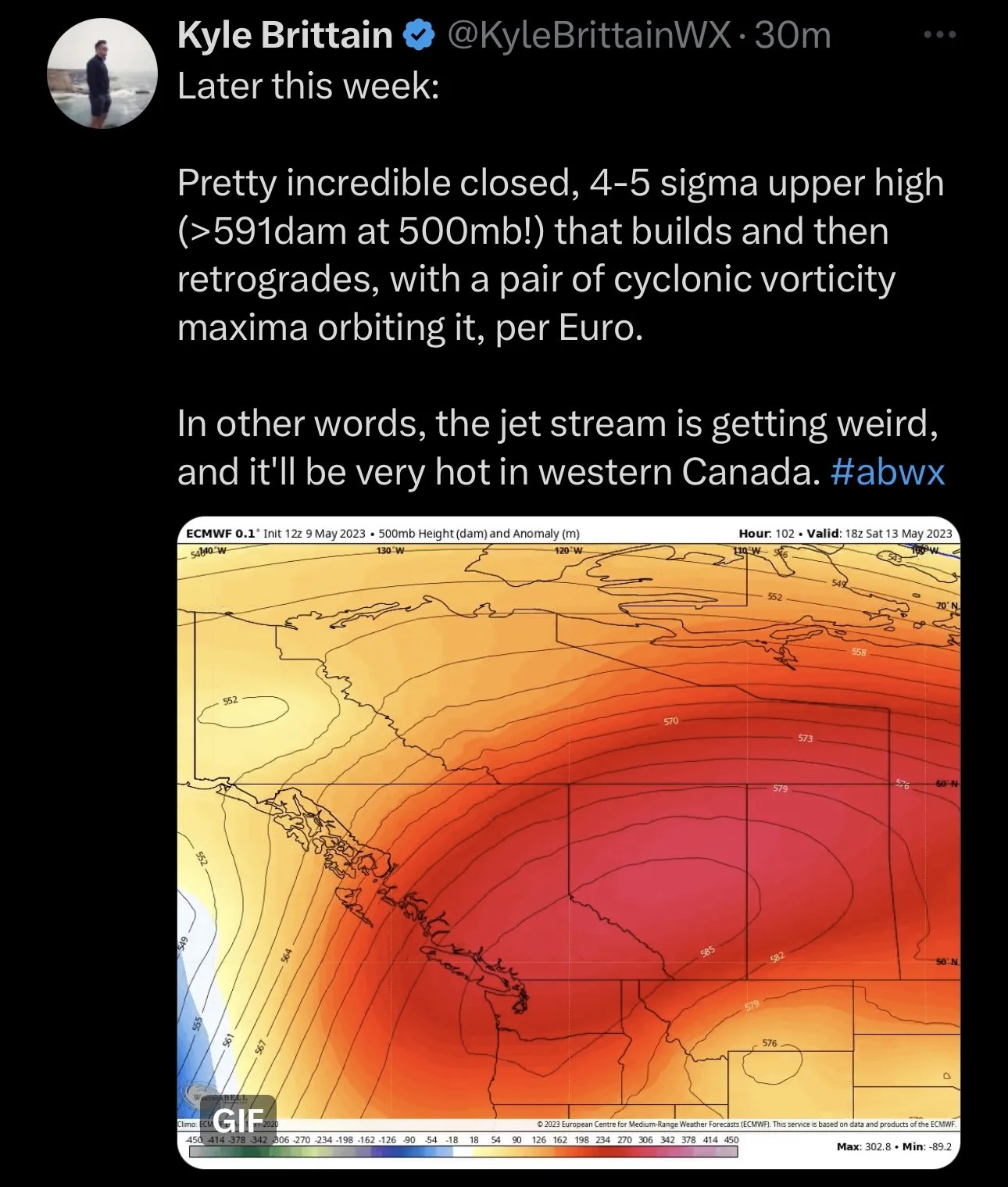

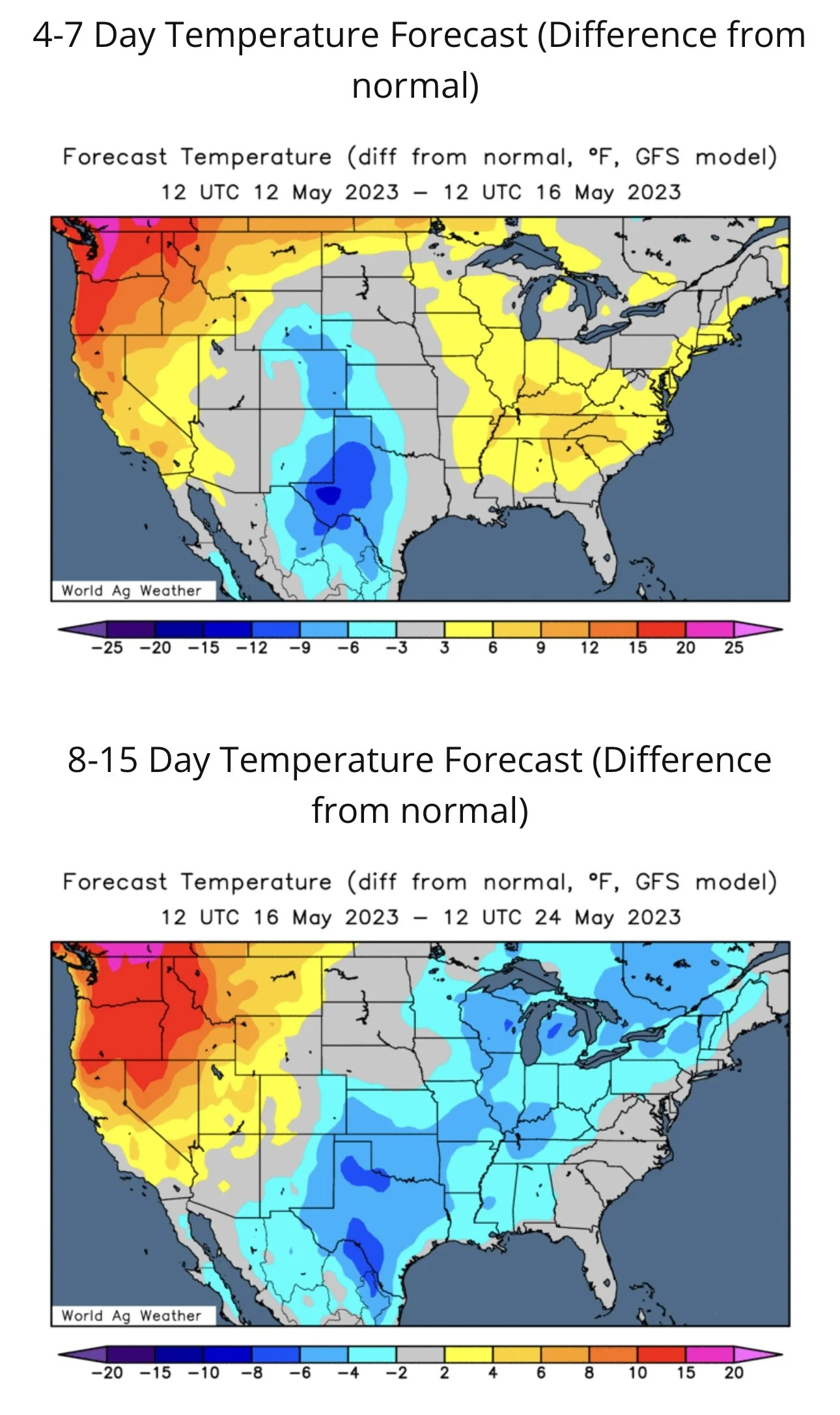

We have some dryness in the Candian plains, as people are starting to watch this a bit more.

Russia looks like they are pulling the plug early on the grain agreement. But this didn’t seem to provide any support whatsoever. With the funds so short corn and wheat, we could see a quick snap back if Russia decides to do something unforeseen or we get a weather scare. But this week comes down to the funds positioning ahead of the report and what we actually get from the report.

Just a heads up that our biggest sale ever ends Friday. Take advantage before it’s gone.

Today's Main Takeaways

Corn

Corn takes it on the chin today, as we gave back roughly half of gains from our recent rally. As corn closed down nearly 12 cents on the day.

As mentioned, the big thing today that added some weight to corn futures was yet another cancellation of Chinese corn sales. This is now the 3rd one in a little over 2 weeks. This was the main thing that started the lower price action across the grains.

Some are saying that the recent cancellations could up our carry-outs on the corn market on Friday's report.

We mentioned this yesterday, but the commitment of traders Friday showed the funds were heavily short corn. As they sold over 100k contracts last week, making it just the 4th time they've done so over the course of a week. As they now hold their shortest position since August of 2020.

So my biggest question there is, do the funds really want to be that short as we are heading into a growing season with a ton of potential wild cards left in the deck? That is a lot of volume to unload if we get a weather or war wild card.

Looking ahead of the report, with them being so short one would think they possibly look to off load such a short position ahead of the report.

Bulls continue to look at the obvious concerns in Ukraine and Russia which could ultimately wind up providing support. But then again, this is a big if, as no one knows what is up Russia or Putins sleeve.

Crop progress came in a tad hotter yesterday. Fast pace was expected, so this wasn’t anything surprising but definitely didn’t help prices out today. As total planting came in at 49% complete vs our average of 42%. Keep in mind, fast planting is an indicator that it is dry. We still think the markets will look at the drought card later this year and summer, and that alone could very likely be the catalyst that pushes us higher.

We will provide estimates for the USDA report later this week, but we don’t want to be surprised if we do indeed get a slightly bearish report. If we do, expect some short term downside. But I think the break will be bought right back up soon after if we do.

Our current outlook is still that we believe corn will make its lows sometime near the end of May. Could be a little sooner, could be a little later. Only 1 time in the last 2 decades has corn made its highs in January. I have a hard time believing this year will be the second time.

Keep in mind, we don’t have a whole lot of weather premium built into these markets just yet with an entire growing season ahead.

Corn July-23

Soybeans

Beans hit the hardest on today's lower price action. As July loses 19 1/2 cents at close.

Funds are starting to trim their long bullish position, as possibly looking to create a more neutral position ahead of Friday's big report.

One of the biggest things bears continue to look at that has been mentioned several times in the past is simply the massive crop out of Brazil and cheap exports.

Planting came in well ahead of schedule yesterday. As beans came in at 35% planted vs 19% last week and vs our usual pace of 21%. This very fast start was one of the contributors to beans sell off today.

States that are running the farthest behind are of course North Dakota, Minnesota, and Wisconsin as the rains and wet fields have put a damper in their ability to plant.

Today’s big losses weren’t necessarily pinpointed to one thing. Beans haven’t really had anything major supporting them on our recent rally, hence they had the most weakness today. On this recent rally they were more or less just following corn and wheat higher on the short-covering rally and war headlines.

With the Argentina problems in the rearview mirror (for now), it is just tough for bulls to get a big rally here unless we see a greater demand and weather story to elevate prices.

However, looking long term the fundamentals for the bean market are still very strong. But I wouldn’t be surprised to see some pressure short term, especially if the USDA report doesn't shake out the way bulls hope it will.

The biggest thing in the soybean market might just be staying patient, and waiting for that demand story to brew down the line. As Chinese demand, logistic issues in Brazil, the awful crop in Argentina, and a long-term renewable story here in the US are all factors that have the chance to support us down the line but aren’t factors that are going to make us go on a bull run here short term.

Soybeans July-23

Wheat

Wheat futures mixed again here today. As Chicago trades a dime lower and KC ends the day up by double digits. Today’s action in the wheat was reasonable given our crop progress and conditions we saw after the close yesterday.

The crop condition showed that winter wheat is still taking a hit, especially in areas such as Kansas, Oklahoma, and Colorado. We did see the good to excellent rating bumped 1% higher. But the poor to very poor rating more than offset that, as it rose from 42% to 44%. So the bottom line there is, some crop may have gotten slightly better, but even more crops got worse.

For comparison, that 44% is the worst for this week since 1996 and the worst for any week since 2014.

The top producing state of Kansas shows that just a small 11% of their crop is in good conditions, while a whopping 68% is sitting poor. Oklahoma is right on par with Kansas as well, as their crop sits just 7% rated good to excellent and 64% rated poor to very poor.

Not only did we see the already poor crop here get worse, spring wheat planting is very slow compared to our average pace. As planting came in at just 24% complete compared to our typical 38% we see. North Dakota and Minnestoa are the two states running the furthest behind.

Kansas is supposed to get some heavy rains here, but I still just don’t think it is going to make a whole lot of an impact as it might just simply be too late. But if we do get rains, keep in mind that the trade sometimes likes to overestimate the impact of these. So we could see some pressure even if these rains do a whole lot of nothing.

Bulls continue to look at the problems surrounding the Black Sea agreement. As exports have stopped slowing out of Ukraine. But this didn’t provide much support at all on today's losses. The deal is set to expire in just over a week on May 18th.

Going forward the themes remain the same. Weather and war. With the funds as short as they are Chicago, the bulls are still optimistic we see one of those two factors create a short covering rally and help us break out of this downtrend. I think KC wheat will likely continue to be the strongest of the wheats especially when the Kansas crop tours get rolling along, as it will again remind the trade of how poor things have been.

Taking a look at both the Chicago and KC chart. First we have Chicago. We continue to find very strong resistance at that long term downward trendline from last May. As we have struggled to break that resistance multiple times. Now as for KC, we got a nice break past that downward resistance from October. If we can break past this next resistance bulls have their eyes set on $9, which I think is very reasonable (Our AI from Sunday's write up had $9.50).

Chicago July-23

KC July-23

MPLS July-23

Is Fast Planting Actually Bearish?

Corn planting is off to a fairly fast start. Which on the surface has added some pressure. But what is the reason for this fast planting? Fast planting means it is dry.

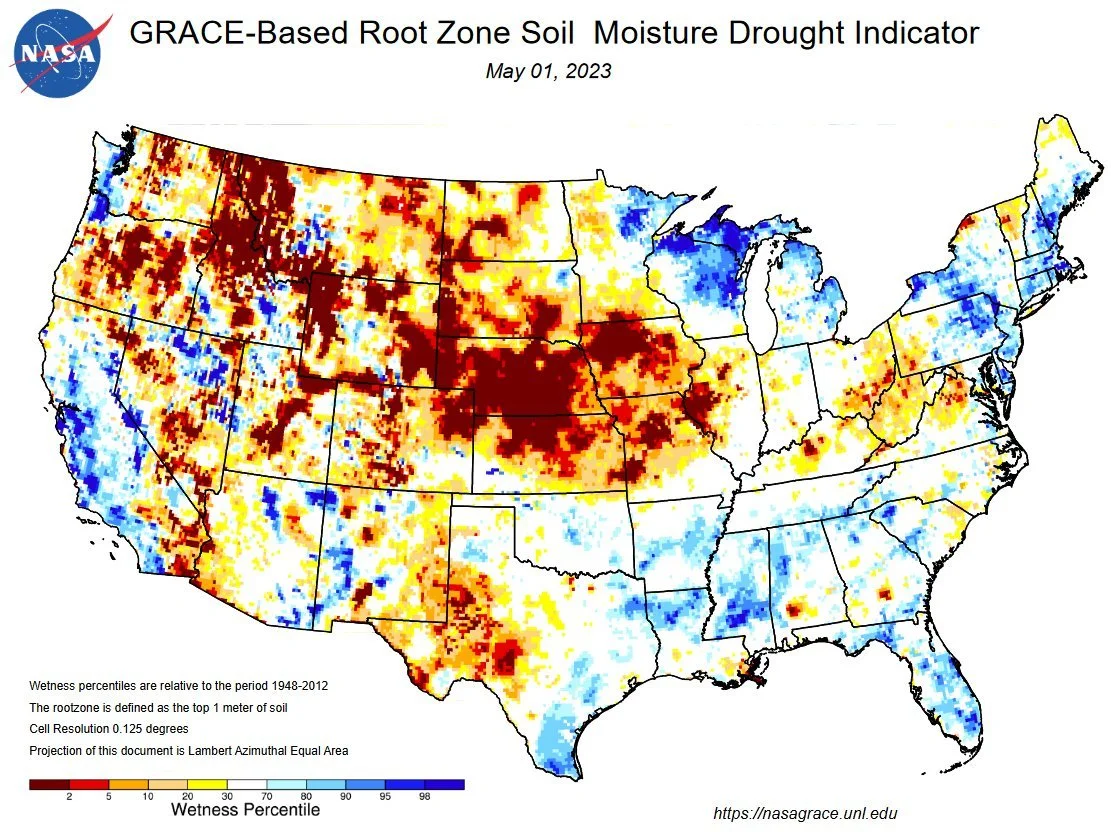

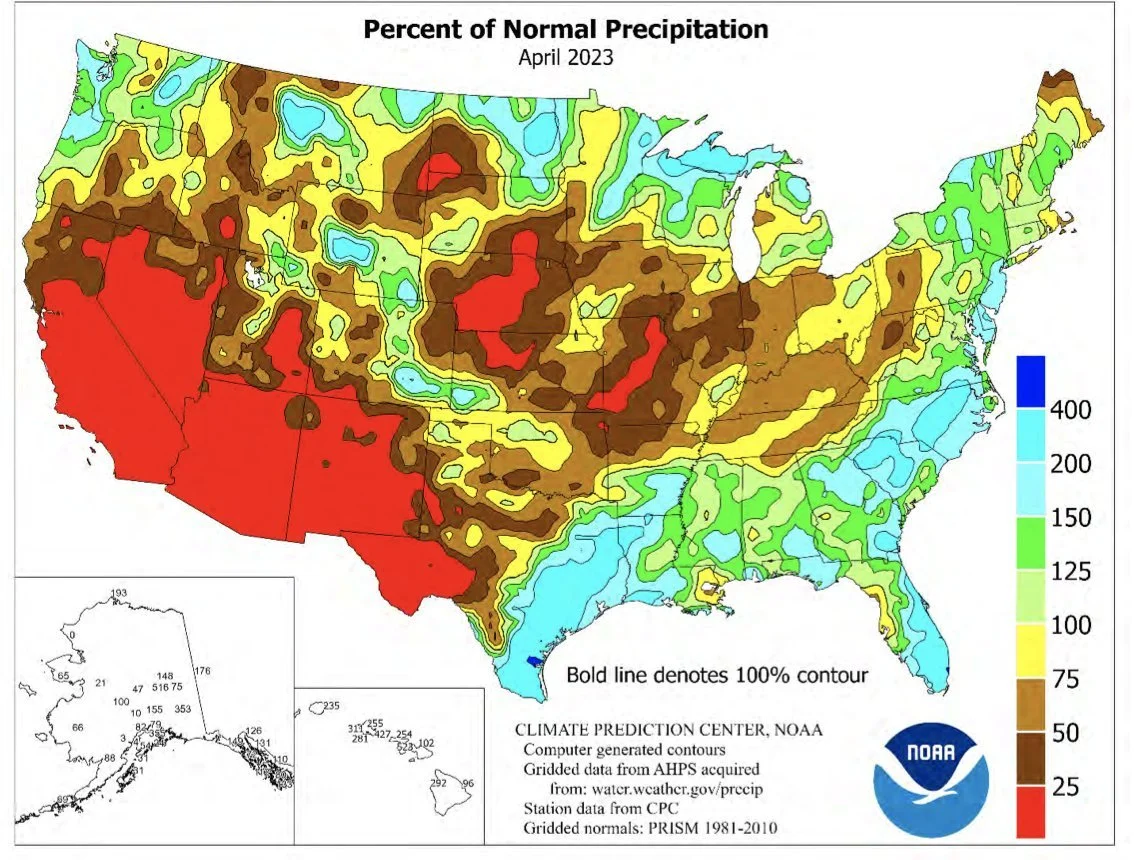

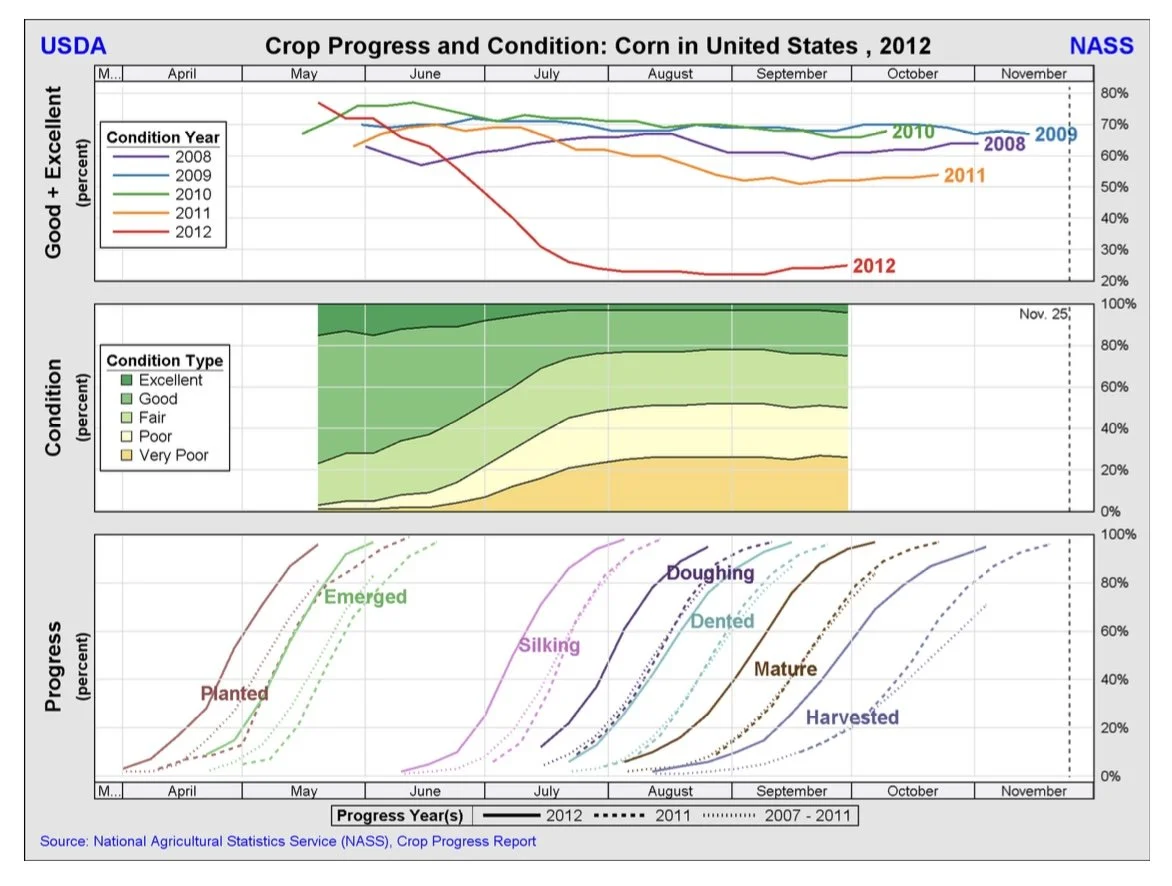

We have talked about drought and comparing this year to that of 2012 several times.

If you take a look at our corn belt progress and then take a look at the drought monitor, planting is moving fast because it is dry in most of the corn belt.

Remember how fast of a start we had to planting in 2012?

We were essentially complete by mid-May. Then the drought kicked in and conditions started to fall in June.

Crop Progress & Conditions

Corn 🌽

Planted 49% (Trade 48%

Last Week 26%

Last Year 21%

Average 42%

Beans 🌱

Planted 35% (Trade 34%)

Last Week 19%

Last Year 11%

Average 21%

Spring Wheat 🌾

Planted 24% (Trade 28%)

Last Week 12%

Last Year 26%

Average 38%

Winter Wheat 🌾

Good/Excellent 29% (Trade 30%)

Last Week 28%

Last Year 29%

Poor to Very Poor 44% (Worst for the week since 1996)

Last Year 39%

Last Week 42%

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. We have a USDA report Friday, with that comes uncertainty. If you want help managing your risk you can give us a call anytime at (605)295-3100 or set up a hedge account below.

Check Out Past Updates

5/8/23 - Market Update

KC Wheat Continues Its Rally

Read More

5/7/23 - Weekly Grain Newsletter

AI Thinks We Are Going Higher. Do You?

5/5/23 - Audio Commentary

If This Was Short Covering, Why Didn’t Chicago Lead Us Higher?

5/4/23 - Market Update

Grains Rally Off Lows

5/3/23 - Audio Commentary

Wheat Prices Catch Fire

5/2/23 - Market Update

Grains Fade of Highs

4/30/23 - Weekly Grain Newsletter