ARE THE HIGHS IN?

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Are the highs in?

This is a question that we get all the time. Are the highs in, should I have sold my grain last week, etc. All the questions that come with any time the market sets back a little bit.

I usually try to side step the question about straight market direction, because without adding components such as time to the question you can answer correctly but still look like you are wrong.

For example without the time portion it is easy to say that grains will make new all time highs in the future. But that’s not much of a statement unless I make it more specific and say that we will see soybeans make new all time highs by X date.

So back to the question are the highs in? Let's reverse the question and provide some statements that are expanded a little bit and add a little time component to it and let's dive into some real answers.

CBOT Wheat will take out the highs it had in the past 12 months if one of a couple things happens overseas:

If Ukraine attacks in a way that disrupts the shipment of Russian wheat. Russia has nearly 50 MMT of wheat to ship

Attacks on the Danube.

Bottom line is that wheat could take off behind further escalations. The above two likely cause prices to soar in a hurry. Possibility exists that we would take out the 2022 highs. Meaning new all time highs in CBOT wheat.

Wheat will provide a huge opportunity to sell calls and buy puts. The combination of which will allow one to get much higher than the highs that we put in. No date as to when, but when I see the opportunity I will let our subscribers know.

Take at some of the option closes. Keep in mind that this is after selling off 30 cents or so on Friday.

September wheat closed at 6.971/2. Yet a 6.45 Sept put and a 8.00 Sept call are about the same price. The put is within 53 cents of the close, while the 8.00 call is over 1.02 above the close.

When you look at Courage Calls CBOT September wheat provides the perfect example of why we want to own the calls before things get excited. 9.00 calls that expire in a little over a month are a little over 5 cents, 10.00 calls are 3 cents, 12.00 calls are a little over a penny.

If wheat takes off look for bull spreads to work like magic. The shorts are too heavy in the front month and that’s where all of the action will go.

Take a look at the carry that CBOT presently has.

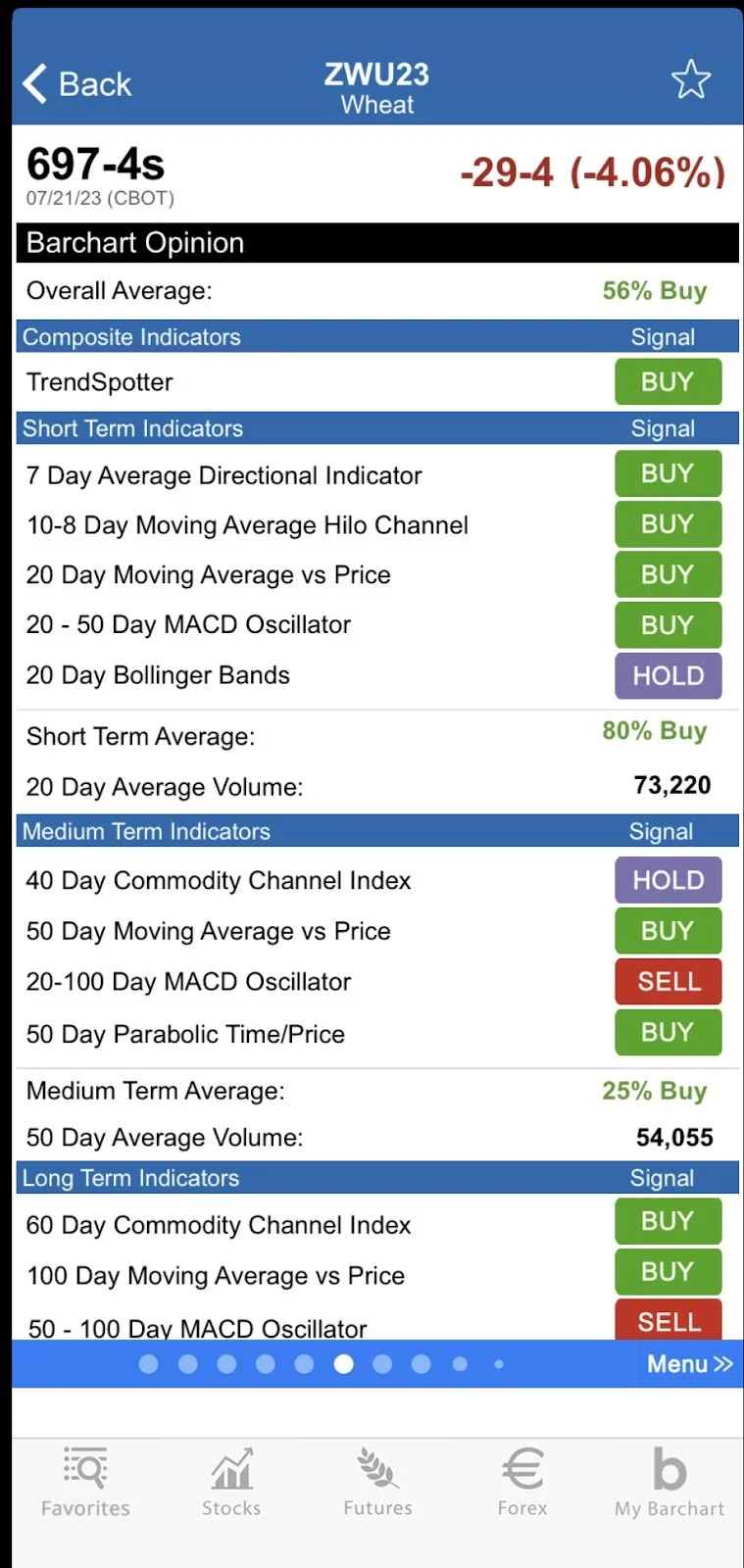

Here is a snippet showing some of the technical indicators that Barchart.com has.

If #1 or # 2 from above happen, look for CBOT to lead the wheat markets higher in the short term.

Historically, every major wheat rally has always started with CBOT wheat leading, via inverting and gaining on MGEX and KCBT. Do not be surprised if CBOT wheat goes to a premium against the hard wheat’s of KCBT and MGEX. Don’t look for it to stay and right now as we sit at a major discount it doesn’t seem possible. But the funds are not holding a big short in KCBT or MGEX, it is in CBOT wheat. So when they exit don’t look for a wheat rally to shake out any differently than it historically has. CBOT will lead and then the quality wheat’s will take over

We are not competitive in exports, we don’t have excess wheat to export and the bottom line is that any major rally will be very tough to sell because we will be getting reminded of the 2008 as well as last year’s rally.

Options will get stupid expensive which will provide the opportunity to sell calls above the market to buy puts. The timing will make pulling the trigger very tough. But this will be a huge opportunity. Make sure you have hedge accounts open. For more info on opening an account you can give me a call at 605-295-3100.

Soybeans will make new all time highs, IF

If soybean yield comes in below 50 bushels per acre in the August, September or October USDA crop reports look for soybeans to make new all time highs on a weather scare for the South America crop in late 2023 into early 2024.

If soybean yield shrinks below 48 look for soybeans to make new all time highs within days of the USDA report that prints that yield number. Look for a reversal lower shortly after.

If we have a soybean yield that comes in at 52 bu or better per acre, then we likely won’t make new all time highs until we see a major weather scare rally in the May-August of 2024 time frame. We will need for SAM to have a smaller crop then they have had.

Demand itself could take soybeans to new all time highs no matter the yield.

DON’T MISS OUR HUGE DISCOUNT

Make sure you lock in this offer before it’s gone and before your free trial expires. It is available for a limited time only. Become a price maker. Not a price taker.

RIGHT NOW: $350/yr

WILL BE: $800/yr

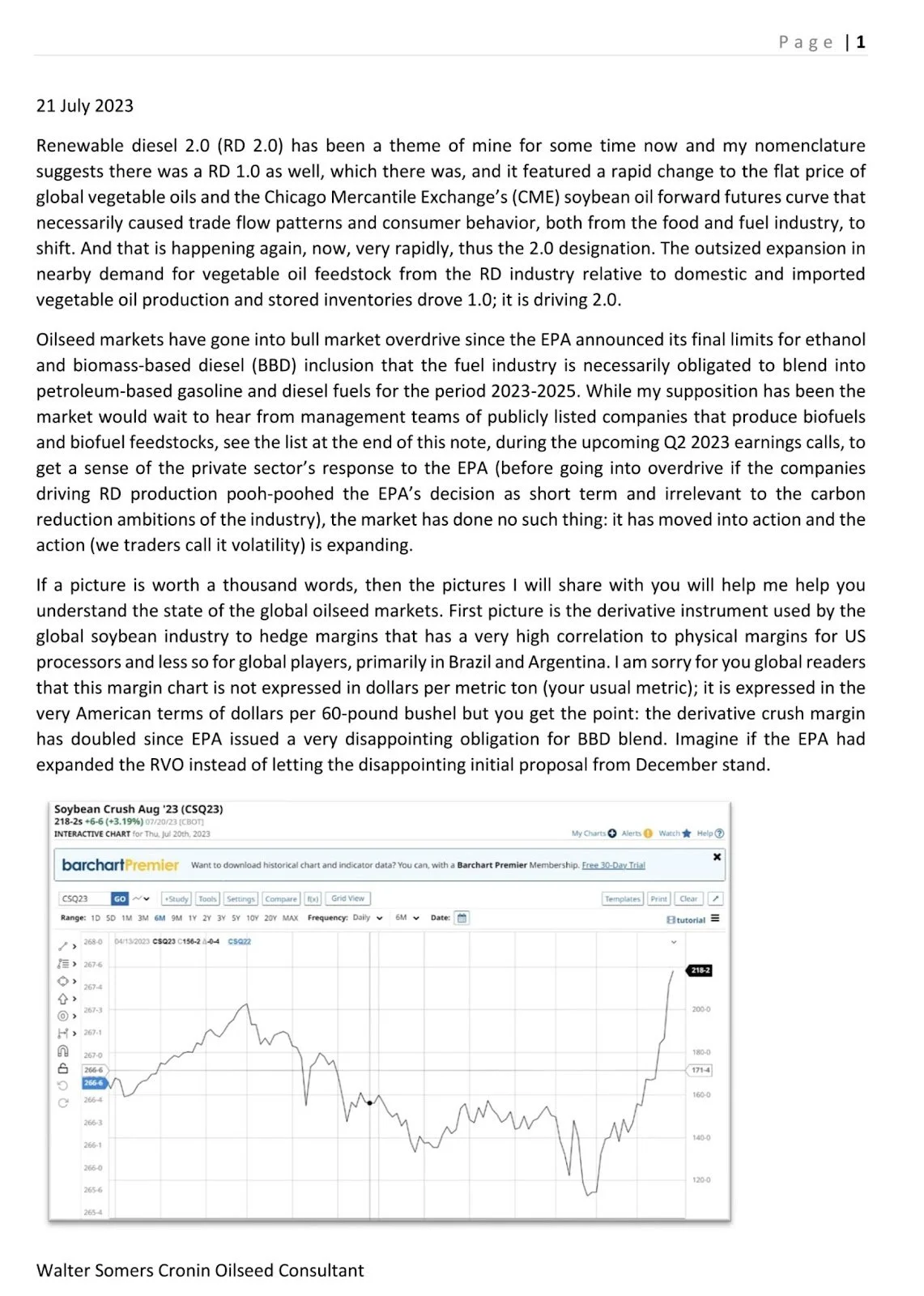

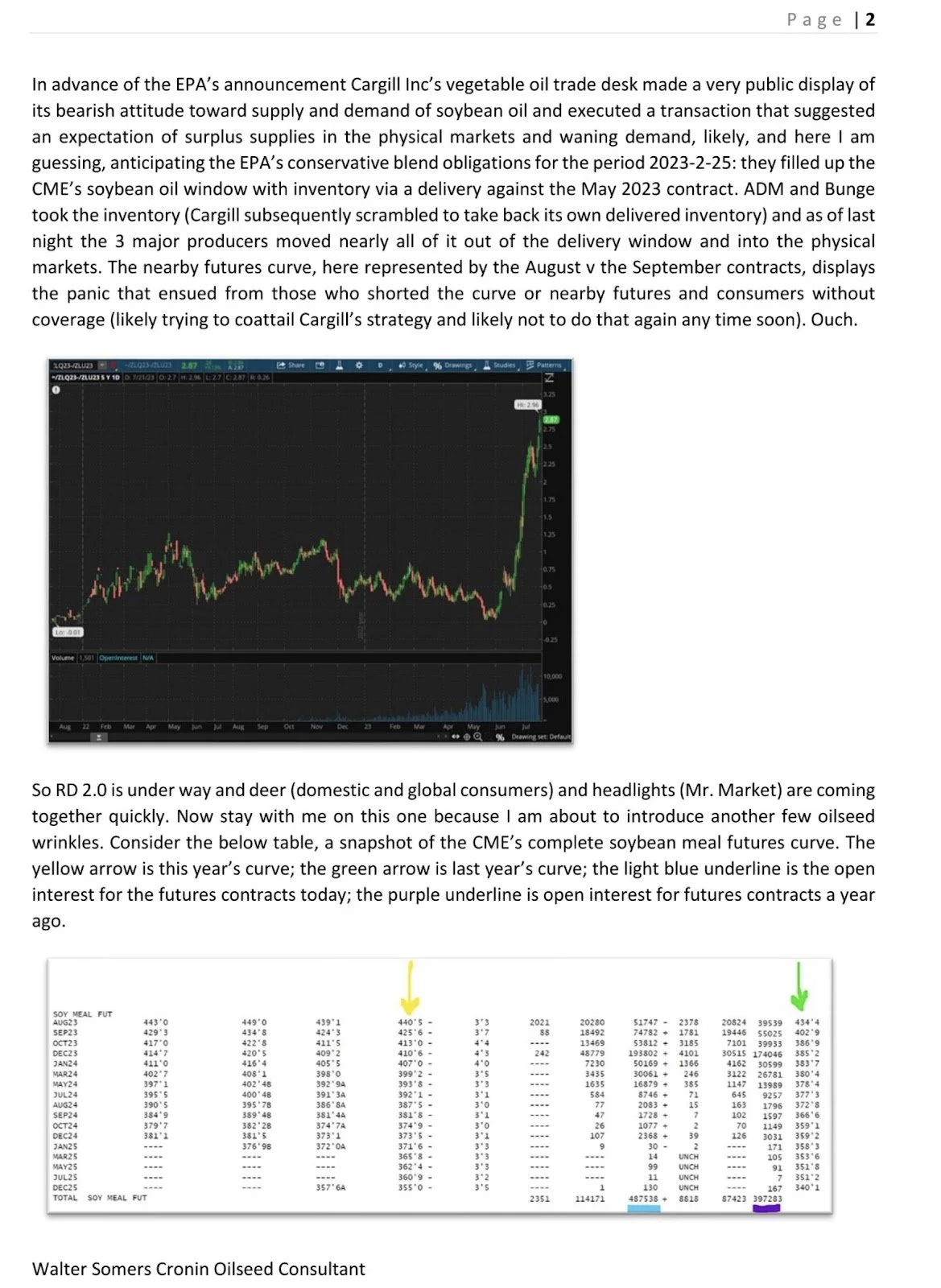

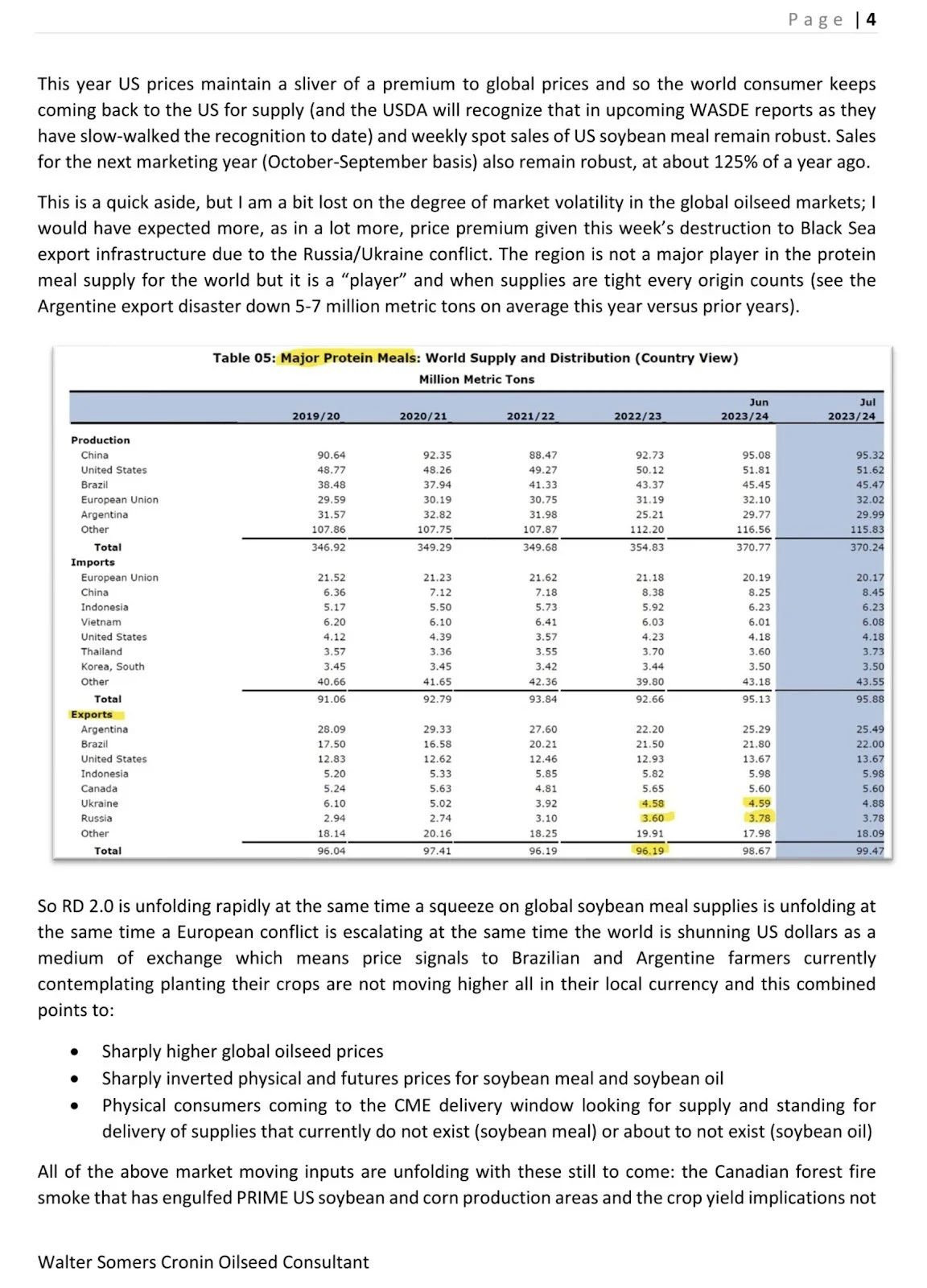

Take a look at this article from Walter Cronin.

Just because I listed various reasons why we could go higher doesn’t mean you should sit and hold. You need to be comfortable and have your own opinion.

One methodology that I have noticed Wright on the Market utilizes is to sell grain such as soybeans and wait for the major rally. Once we get the major rally they buy puts and try to make money on the way back down. This strategy holds merit and works for some. The benefit is one isn’t waiting and waiting as sometimes timing of calling the markets can be way off.

Another methodology that works well is timing cycles or making sales after we have been up for some time. Roach Ag does a good job of utilizing sell signals that tend to sell after we have rallied. But the drawback is one can sell way too soon. However, utilizing a combination of recommendations is only going to help one do a better job of spreading out risk. The one thing I don’t recommend is to switch it up as that is a way to always be chasing what worked in the past.

If you want to talk about your situation please give me a call at 605-295-3100 and together we can come up with a strategy that allows you to be comfortable.

Corn Price outlook is dependent on a couple major things.

Corn yield

Market is trading something in the 173-178 type of yield.

If yield ends up north of 178 our excess supply might create enough demand that in 2024 we are having a demand lead rally

168-173 should give us a chance to test the 6.00-6.50 area

Sub 168 should give us a high probability of 6.50 and higher

Demand

Russia-Ukraine

Brazil

One has to question why Brazil farmers are not selling this record crop. Perhaps the crops isnt as big as some are saying.

2024 acre war

One of the biggest things in the past year has been corn basis volatility. The past year we had a huge shortage in western feedlots and ethanol plants all the way from Texas up into Nebraska. So the corn pull had basis in the west on fire from time to time. Most of Texas looks like it will have its best crop in a long time, if not ever.

The excess supply in some areas is going to help demand bounce back in areas that have been deficit supply.

Bottom line is we have many more bullish cards in the deck then we do bearish cards.

So unless you absolutely need to make sales, try to find a different grain price risk management method to make you comfortable. If you are scared that prices are going to fall and not bounce then buy yourself a put and get a floor in for prices.

If you don’t have a hedge account you can open one here: https://www.dormanaccounts.com/eApp/user/register?brokerid=332 or you can give me a call at 605-295-3100 and I will give you more information to see if it is a fit for you.

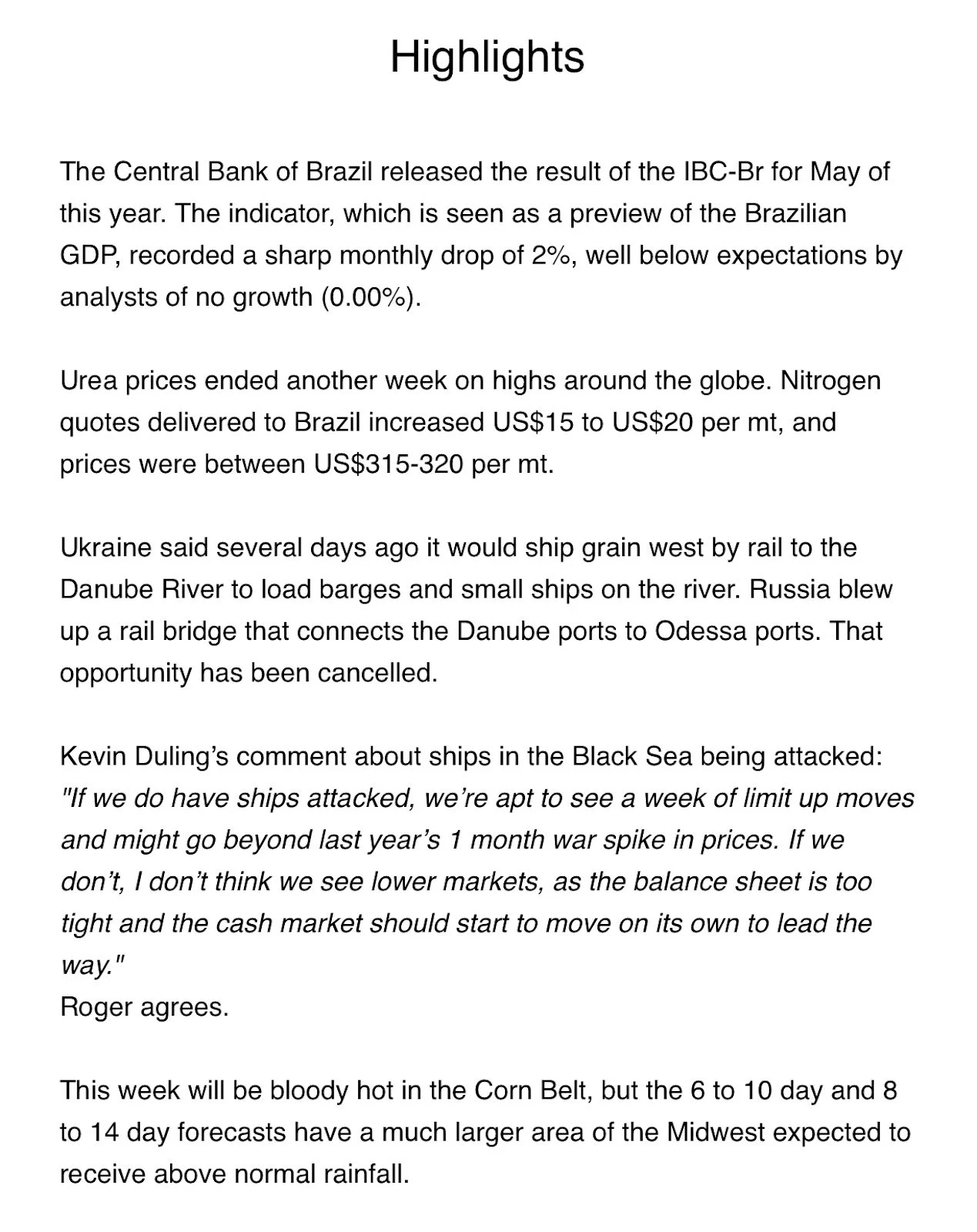

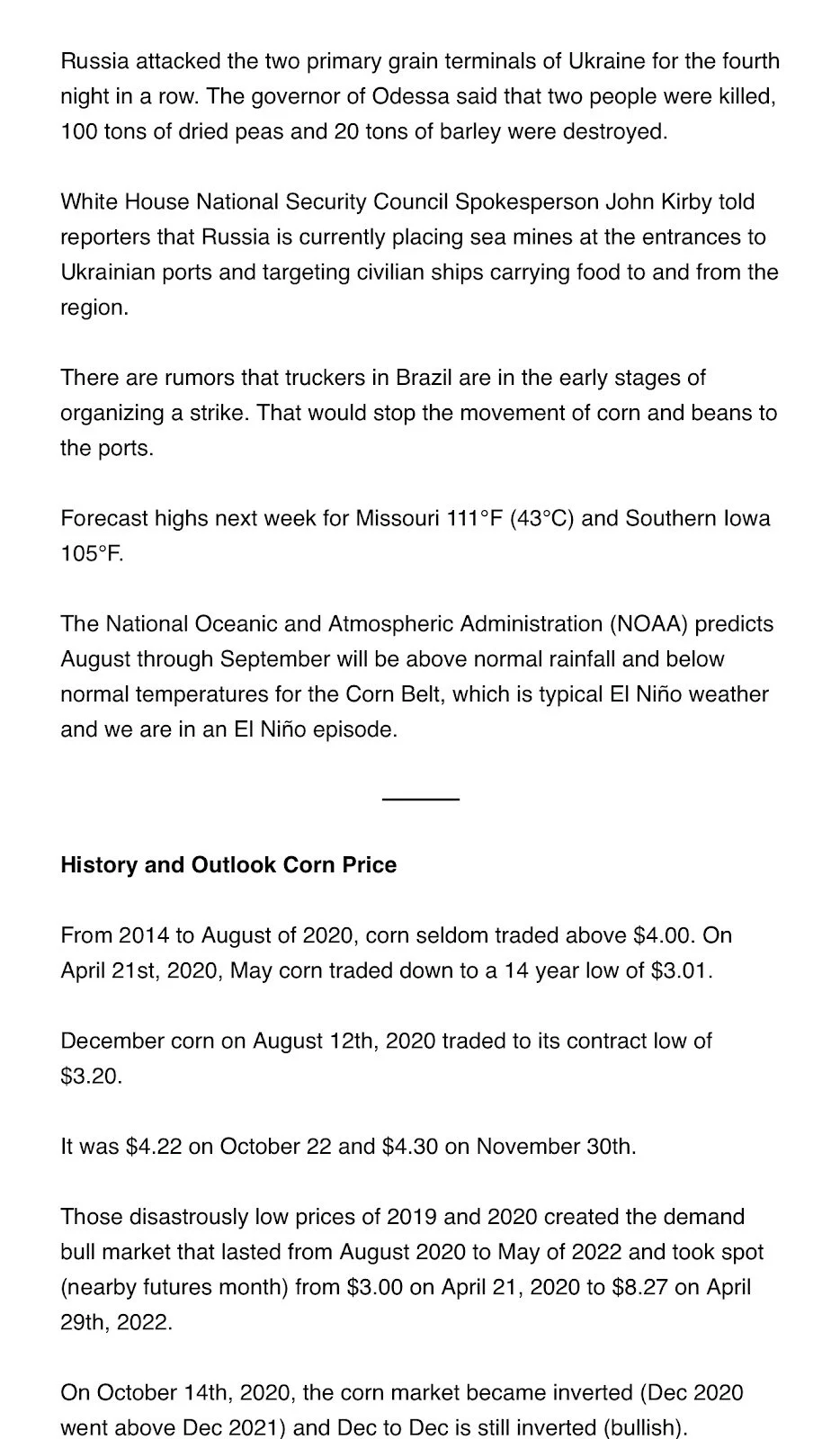

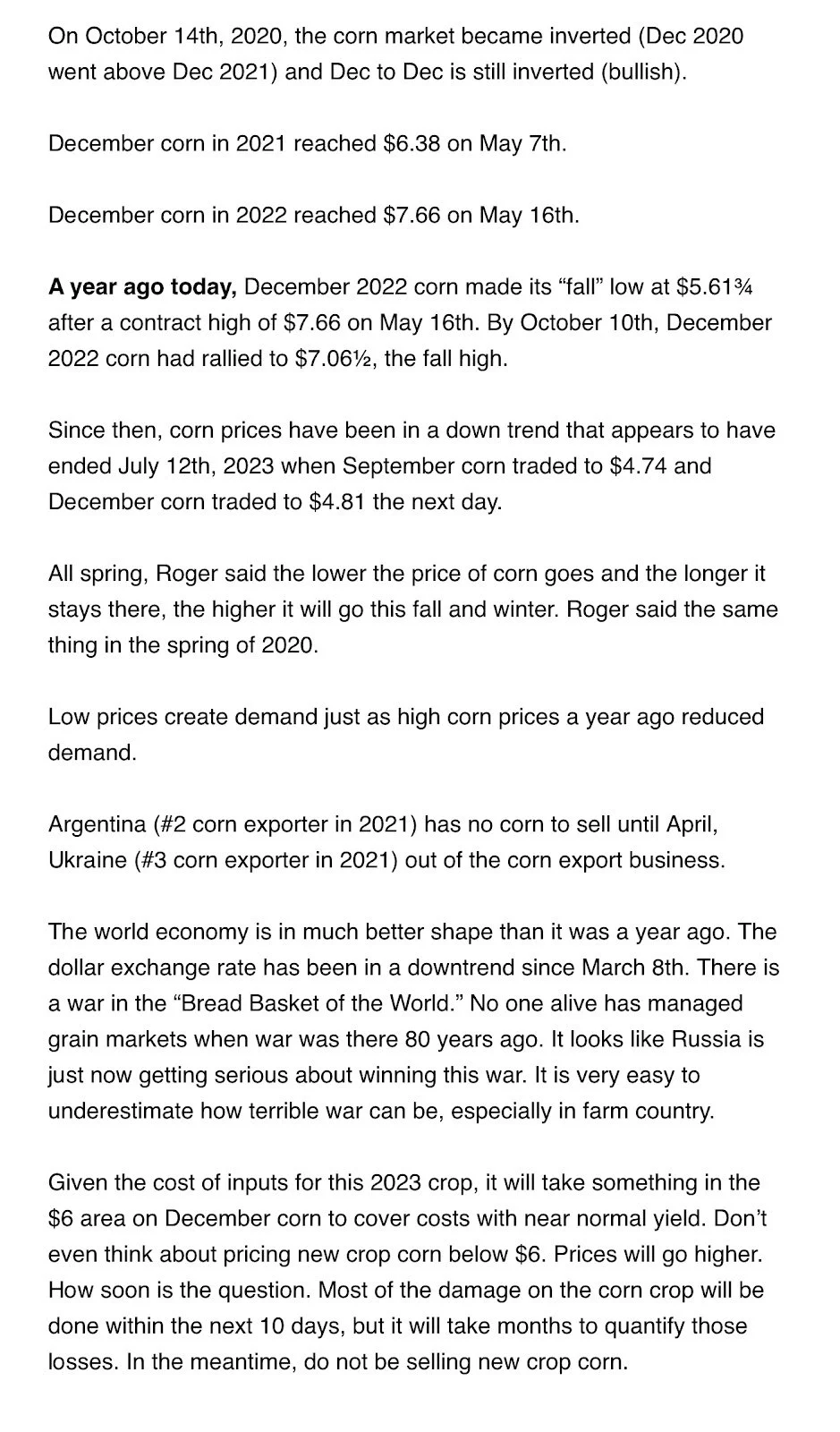

If you need more information on what we think will be happening to the grain markets just take a look at some of the recent writings from Wright on the Market. Which you can find below. Notice the comment of “see a week of limit up moves…”

I agree with Roger’s statement “Don't’ even think about pricing new crop below $6.00. Prices will go higher. How soon is the question.”

But just because I agree with Roger doesn’t mean that is the right plan of action for you and your operation. Everyone needs to consider your situation such as cash flow needs, bin space, risk/reward etc. So if you're in that situation where you find you have to sell for whatever reason and you want to talk it over and see if there are different strategies that might make sense for your operation please give me a call 605-295-3100.

CHECK OUT PAST UPDATES

7/21/23 - Market Update

RALLY TAKES A BREATHER

7/20/23 - Audio

BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update

WHEAT RALLIES & CORN MAKES KEY REVERSAL

7/13/23 - Market Update

GRAINS BOUNCE BACK AFTER BEARISH REPORT

7/13/23 - Audio

DROUGHT & DOLLAR ERASE YESTERDAY’S LOSSES

7/12/23 - Audio & Report Recap

FULL USDA REPORT BREAKDOWN

7/11/23 - Audio

WHAT TO EXPECT IN TOMORROW’S REPORT

7/10/23 - Market Update

CORN & BEANS STRONG AHEAD OF REPORT

7/9/23 - Weekly Grain Newsletter