CROP TOUR BOUNCE

AUDIO COMMENTARY

Grains get good bounce

Sold more grain to China

Crop tour starting in poor areas

Strong day but didn’t do anything technically

Still no confirmations of bottoms

What should you do as far as marketing?

Those that have big insurance payments coming

If gotta sell off combine, add puts on pops

Illinois tour will show huge crops

Could tour be news that puts in a bottom?

Still plenty of risk lower

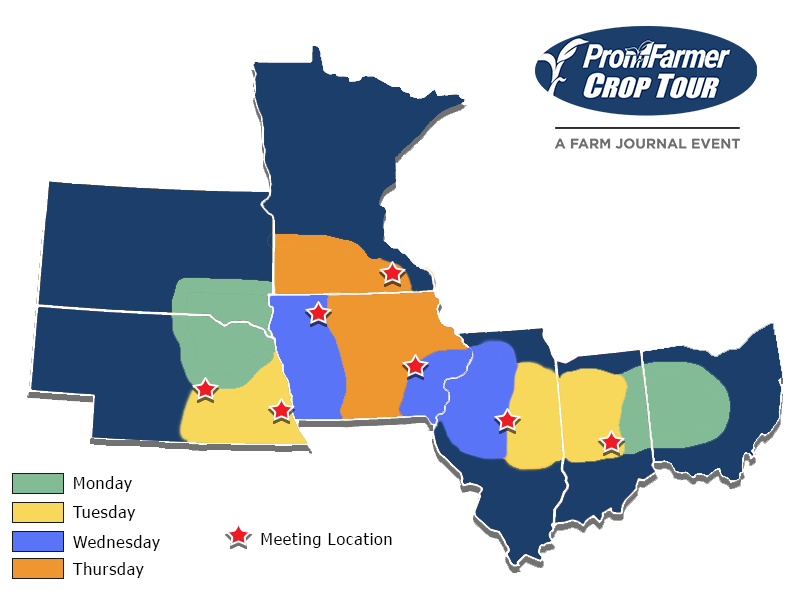

Order of Crop Tour route below*

Charts below*

Listen to today’s audio below

Before Your Trial Ends..

Save over 50% off: CLICK HERE

CROP TOUR ROUTE

CHARTS

Corn

Strong day, but we did not do anything on the charts.

All we did was close right at the $4.00 resistance.

We have not closed above the $4.03 resistance August 6th. So a close above there would look good.

A close above $4.09 would look really good.

To be confident the bottom is in, I still want to see $4.23-26. Until then, the trend is still lower so the risk is still lower.

If our new key support of $3.90 fails, $3.80 is up next. That has been my downside target July.

I don’t think we get as low as $3.40-50, but that is still a very real risk. That is where other bear market years often found support. That support also coincides with our long term upwards trendline. (Circled in yellow)

Beans

Great pop today, but just like corn we did nothing on the charts. One day does not make a trend. Still in a very clear downtrend.

China will tell us the bottom is in when they start buying real heavy. Until then, risk is lower.

A break out of that May downtrend would look friendly and then maybe we can talk about a bottom potentially being in.

We are right at that trade war resistance I had been talking about the past few months.

The bottom could be here, or it might be another $1.00 lower. That is the risk.

In other bear market years we bottomed anywhere from $8.50 to $9.50.

Regardless of where prices are, you’ll know the bottom is in when China buys hot & heavy.

Wheat

Wheat stuck in no mans land. Trapped in this 30 cent range. Once we break out it’ll look very friendly. A break below and we see another leg down.

To be confident we found a bottom, I still want to see us over $5.67

My current targets are $6.00 & $6.25

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

8/16/24

RISK REMAINS LOWER. MANAGE YOUR RISK

8/15/24

DEMAND, BIG US CROPS & BRAZIL DROUGHT

8/14/24

DEAD CAT BOUNCE

8/13/24

POST USDA SELL OFF

8/12/24

USDA REPORT: BEARISH BEANS. SMALLER CORN CARRYOUT & RECORD YIELDS

8/9/24

USDA REPORT MONDAY

8/7/24

HUGE USDA REPORT MONDAY

8/6/24

WHEAT UNDERVALUED? CORN YIELD? WHAT TO DO WITH GRAIN OFF COMBINE

8/5/24

GRAINS STRONG WHILE WORLD PANICS

8/2/24

GRAINS RALLY, YIELD ESTIMATES, CHINA STARTS TO BUY

8/1/24

MARKET EXPECTS A PERFECT CROP?

7/31/24

CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24