BEANS EXTEND 4-DAY RALLY

Overview

Grains close today fairly strong, with beans leading the way again as traders position themselves ahead of the big report Friday.

The big story today was Cargill and Viterra were planning to stop exporting grain from Russia. Cargill handles around 4% of Russia's annual grain exports. The exit is planned for July 1st when the 2023/24 season starts. Viterra is one of the largest exporters of Russian wheat. This was a big reason we saw wheat firmer this morning.

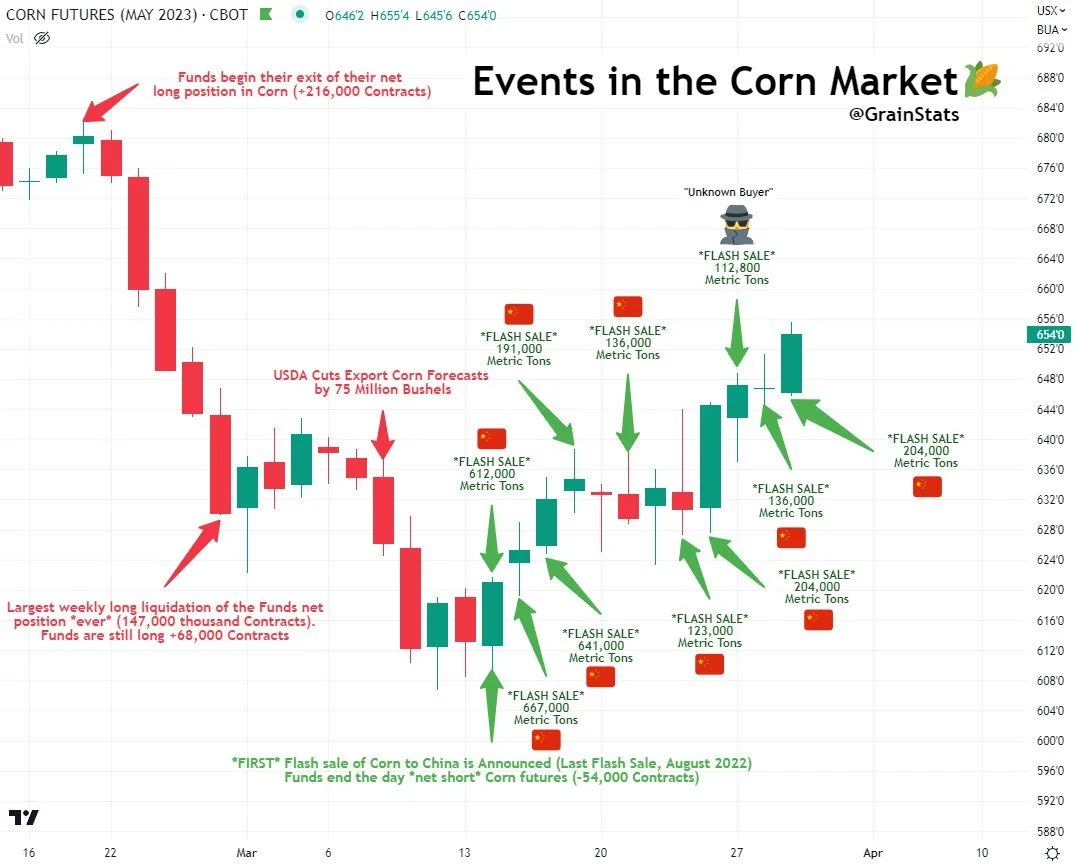

We saw our 10th flash sale of corn in the past 14 days.

The thing everyone is watching this week is of course the USDA report Friday.

Listen to Yesterday's Audio

Is Momentum Changing in Markets - Listen Here

USDA Estimates

We have the quarterly stocks predicted to come in a lot smaller than recent years. With corn estimated to be the smallest in 9 years (-10% YOY), beans 2 years (-10% YOY), and wheat 15 years. (-9% YOY).

Now this is bullish that stocks are this small compared to year ago. But what is more important is where they come in at, if they come in below like January maybe our supplies is less than we realize.

Acres on the other hand are estimated to come in on the bearish side. With corn estimated at 90.88 million acres (+2.6% YOY), beans 88.24 million acres (+0.9% YOY), and wheat 48.85 million acres (+6.8%). If we take a look at the trade range for beans, its the smallest trade range we have seen in 16 years. This small trade range does open the door for some surprises.

The Numbers

Cheat Sheet

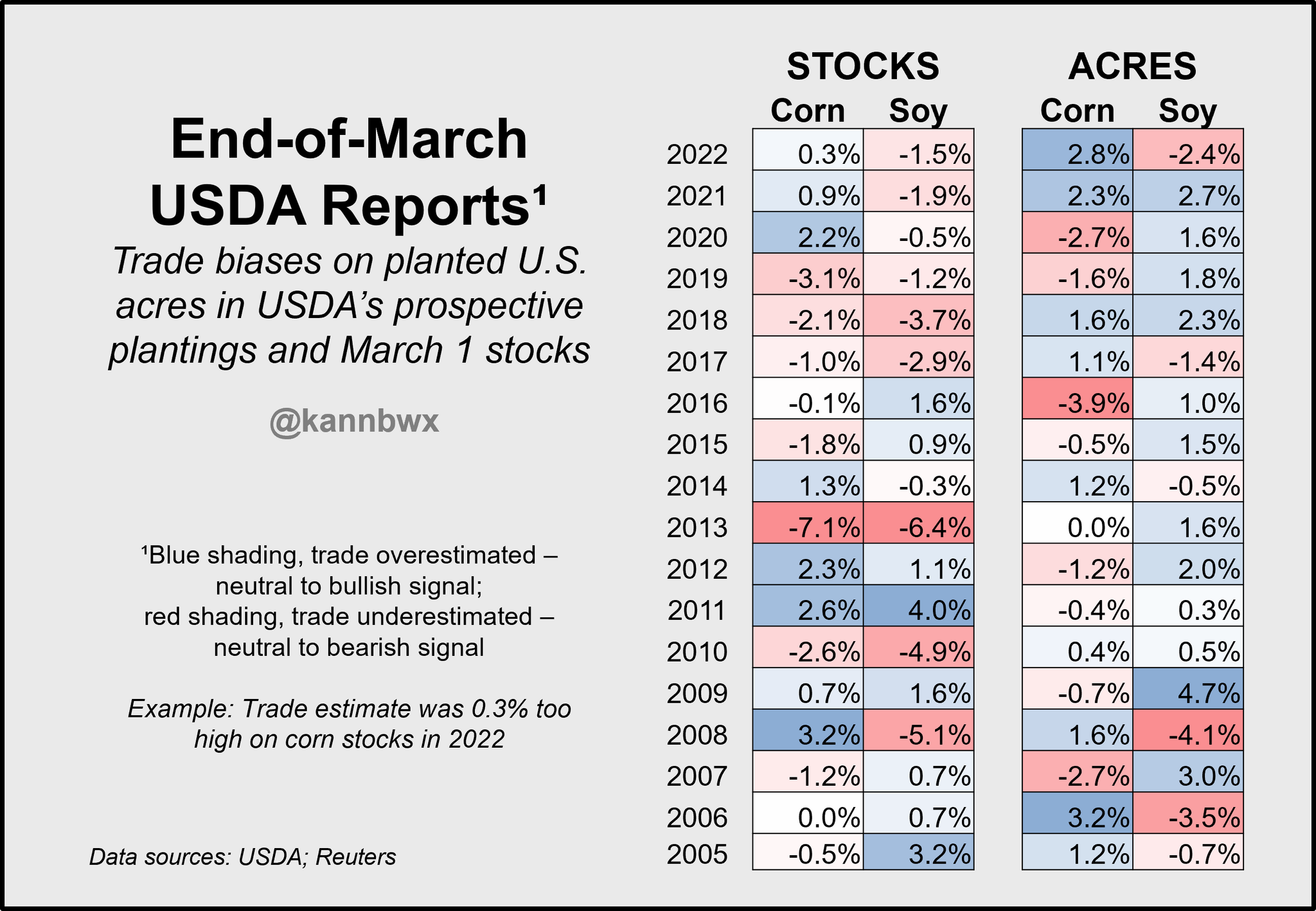

Here is the March 31st USDA report outcome for the U.S. corn and soybeans the last 18 years.

The shading identies bullish & bearish numbers.

Blue = Bullish

Red = Bearish

Chart Credit Karen Braun

Today's Main Takeaways

Corn

Corn ends the day up over +3 cents, closing 5 cents off their high of $6.55 1/2. Closing higher for the 4th day in a row.

Bulls are looking at yet again another sale of U.S. corn to China. This time it was 204k metric tons. The past two weeks alone we have seenover 3 million metric tons of sales.

Aside from the flash sales, bulls are still looking at the production problems in Argentina. It looks like the crop may have stabilized around the 35 million metric ton range, but that number is still well below the USDA's 40 and last years 49.5.

Other factors that are being watched is the war headlines and Brazil's second crop corn acres.

The report Friday is looking for quarterly stocks to come in at 7.47 billion bushels, which is 4% lower than last year and the smallest for the March 1st report in 9 years.

As for acres, the current estimate is 90.9 million new crop acres. Which is higher than last years 88.6 but lower than 2021's 93.3 million.

Looking at the chart, we've broken every resistance on this reversal. Next upside target is $6.60 and our long term moving averages.

Corn May-23

Soybeans

Beans contiue their rally from their lows, now over +70 cents off their lows ($14.05) from just last Friday, closing higher for the 3rd session in a row. Closing up +9 1/2 cents at $14.77 1/4.

The strength in meal has provided a ton of support through this rally, as the trade continues to worry about the production failures out of Argentina. On the flip side bears point to the massive crop in Brazil and the cheap exports coming form Brazil.

Taking a look at the report, we have estimates showing acres up about 1% from last year at 88.24 million acres. But we also have the narrowest trade range we've seen in the past 16 years. Which opens the door for possible surprises come Friday. So there is some talk about acres coming in a tad lower than expected, which makes some sense given the report is using early data from producers who were looking at better corn insurance guarantees.

The quarterly stocks are predicted to come in at 1.742 billion bushels. Which is a 10% decrease year over year and the smallest in 2 years.

The report will be an interesting one, with the possibility for surprises either way.

Looking at the chart, we have seen a phenomenal reversal the past three days. Short term I think we might be slightly overbought and wouldn’t be too surprised to see some selling sometime in the near future, but long term is a different story. Bulls would like to break out of the short term downtrend.

Soybeans May-23

Wheat

Wheat started off the morning trading 26 cents higher but ultimately ran into some profit taking and selling after touching $7.24. Closing at $7.05 and 19 cents off its highs. While KC and Minneapolis both see small losses of 2 to 5 cents.

The reason for the firmness early on was the Cargill and Russia headline we mentioned earlier. Essentially Cargill and V Viterra are planning to stop exporting grain from Russia. Now this isn’t scheduled to happen until July 1st. But nonetheless, perhaps we see others follow. We have to keep in mind that Cargill handles roughly 4% of Russia's annual grain exports and Viterra is one of the largest exporters of Russian wheat.

Now taking a look at the report. There is really a lot in the air here. On one hand we have acres projected to come in 8% higher on the year, the biggest yearly increase since 1996. As all wheat acres are forecasted at 48.85 million, which is down from the Ag Forum Outlook's original guess of 49.5 million. But still a lot higher than last years 45.7.

On the other hand we have wheat stocks predicted to be the smallest in 15 years. As quarterly stocks are estimated at 930 million bushels, which is -100 million lower than last year.

So it all depends on where the numbers actually come in at. But we shouldn’t be extremely surprised if the report has a bearish reaction if stocks don’t quiet come in as low as expected and if acres do indeed come in that high. But we could also just as easily see a bullish reaction if acres come up short and stocks come in even lower than expected.

Taking a look at Monday, we will also get the first official USDA crop condition report for 2023 winter wheat. The last report on conditions was for November 27th. Where we had 34% rated good to excellent, and 26% rated poor to very poor.

Notable Changes in Weekly Wheat Conditions;

(Good to excellent %)

Kansas unchanged at 19%

Colordao down -8% to 28%

Texas down -5% to 18%

Illinois down -4% to 58%

Oklahoma up +5% to 34%

Nebraska up +3% to 22%

Ohio up +4% to 58%

Aside from the report, bulls are looking at the continuation of small war headlines. As there is talks that there is increased combat around Ukraine's largest nuclear plant.

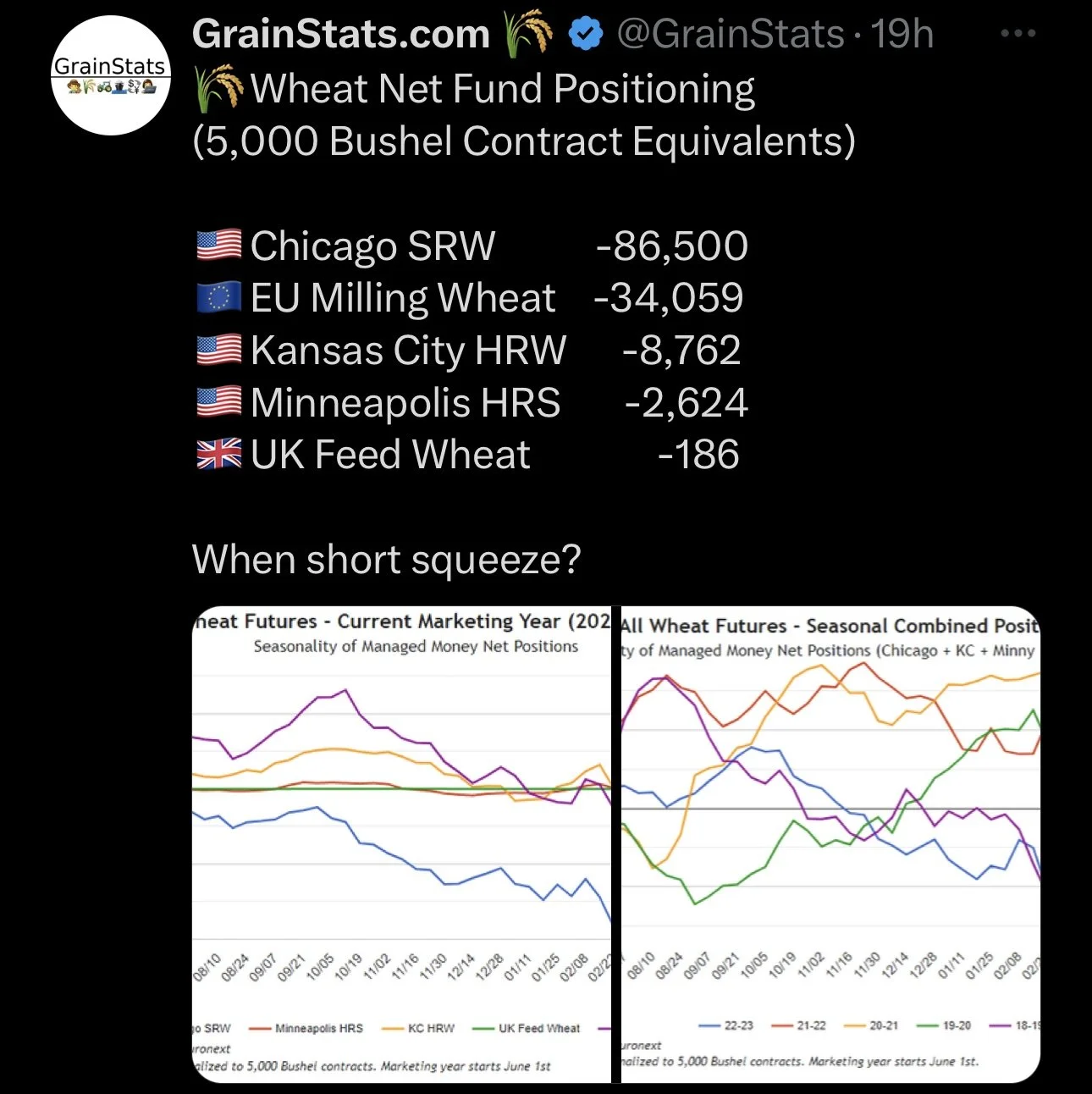

Funds are still very short wheat. The real question is when will we see the short squeeze? I still think we are one major bullish catalyst from seeing the funds look to buy and ultimately pushing wheat a lot higher. As there are plenty of weather and war wildcards ahead.

From a technical standpoint, we finally got that break above our first resistance downward trendline. Next upside target is $7.13 and then the upper trendline.

Chicago March-23

KC March-23

MPLS March-23

Fund Flow Outlook & Forecast

From Farms.com Risk Management

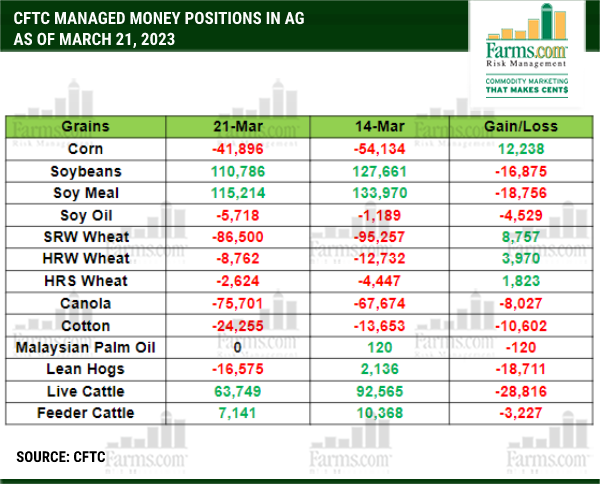

Today we are talking about the managed money fund flow and why they started selling at the end of February? Since our ringing the bell for a bottom in the grain markets on March 1, 2023 nearby corn futures have closed higher despite all of the volatility and bearish headline export news. The funds started liquidating the grains for the wrong reasons!

Headline news of a U.S. banking failure triggered long fund liquidation which led to more margin liquidation until the fear and panic subsidized the funds had overshot the mark and got too oversold in a very short period of time.

At the start of the year the managed money crowd was the 3rd longest in the grain complex only to 2021 and 2022 but the rug was pulled out from underneath the grain complex and they decided to sell but they got too aggressive with their selling as they overshoot the downside mark despite unchanged fundamentals and by the 3rd week in March they got short corn, wheat, soyoil and record short canola. (Please see chart below)

At the end of the day why would the funds want to be short corn going into the market moving USDA reports this Friday or for that matter the 2023 planting and growing season. Throughout this brief period of irrational chaos investors were selling banks stocks (have since recovered but still down 22%), buying Bitcoin and parking money into AI stocks sending the Nasdaq up 7%.

Let the short squeeze continue as end of month and end of quarter short covering should lend support to higher futures with an upside overdue bounce back to the mean or average at the 200-day moving averages.

Soybean meal futures have held up the best despite the correction still trading above its 200-day moving average while soybean futures despite the $1.00 drop on price is trading back above the 200-day moving average.

Their Bottom Line

The funds were selling the grain complex for the wrong reasons in the month of March as the macro truck headwind weighed and forced them get too aggressive and overshot the mark to the downside near term despite unchanged fundamentals. Panic selling, fear and margin liquidation all contributed to the irrational sentiment.

Look for a continuation of the technical short covering rally as we enter month end and end of quarter ahead of the USDA market moving reports this Friday. The mean or average for nearby futures will come back into play (May 23 corn futures $6.606, soybean futures $14.563, canola $847, Chicago Wheat $8.25, KC $8.98, MW $9.426, cotton $87.58, oats $3.954) as the bearish momentum has turned bullish with the potential for a limit move higher this coming Friday!

These were just a few snippets of their full write up, click here for their full write up and check out their website for some of their other stuff

Highlights & News

Ukraine grain exports for the 2022/23 season are down almost -18% to 36.9 million metric tons.

South America is expected to harvest 2.65% more corn this season compared to last.

Cotton was sharply higher yesterday, closing at its highest level since early March. More cotton acres means less corn and beans.

Insiders are saying that the Russian government is buying domestic wheat for government reserve to prop up local prices more so than to ensure food security.

Enjoy Our Stuff? Try 30-Days

Try our 30-day trial. All updates & audio sent via text message and email.

Check Out Past Updates

3/28/23 - Audio Commentary

Is Momentum Changing in the Markets?

3/27/23 - Market Update

Grains Continue Their Rebound

3/26/23 - Weekly Grain Newsletter

What Have Funds Already Factored In?

3/24/23 - Audio & Market Update

Russia Halting Wheat & Sunflower Exports?

3/23/23 - Audio Commentary

Chinese vs The Funds

3/19/23 - Weekly Grain Newsletter

Mother Nature & Black Swans

Social Media

Chart Credit GrainStats

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service