NEW BEAN LOWS.. HOW LOW CAN CORN GO?

Overview

New lows in soybeans, as we again break below $12 and this time take out the previous lows. Down -43 cents the past two days.

Corn and wheat held in there but corn had an outside down day which is typically a negative indicator as we took out yesterdays highs and closed below yesterdays lows.

Disappointing week following what looked to be potential reversals earlier in the week as from a technical standpoint we made key reversals. Corn and wheat are both still holding their key reversals thus far despite the lower action today.

Here were the price changes for the week:

The grains were actually stronger overnight, however they went under immediate pressure following the release of the non-farm payroll numbers this morning. This led to a surge in the US dollar. With our export demand already being weak, the rally in the dollar didn’t help things.

Then we have Argentina. They are looking hot and dry through early next week, but are expected to get rains late next week. If they do not get these rains, we will probably see another decline to the Argentina crop conditions. The past week alone we saw their good to excellent crop ratings drop -6% in soybeans and -5% in corn. Their crop is still obviously in better shape than last year, but the bears main argument has been that Argentina is supposed to make up for the losses in Brazil.

Despite the recent drought concerns, we actually saw USDA attache to Argentina RAISE their corn production estimates to 57 million metric tons. Which is 2 million higher than the USDA has. The reason was because of "higher planted area and beneficial weather ahead".

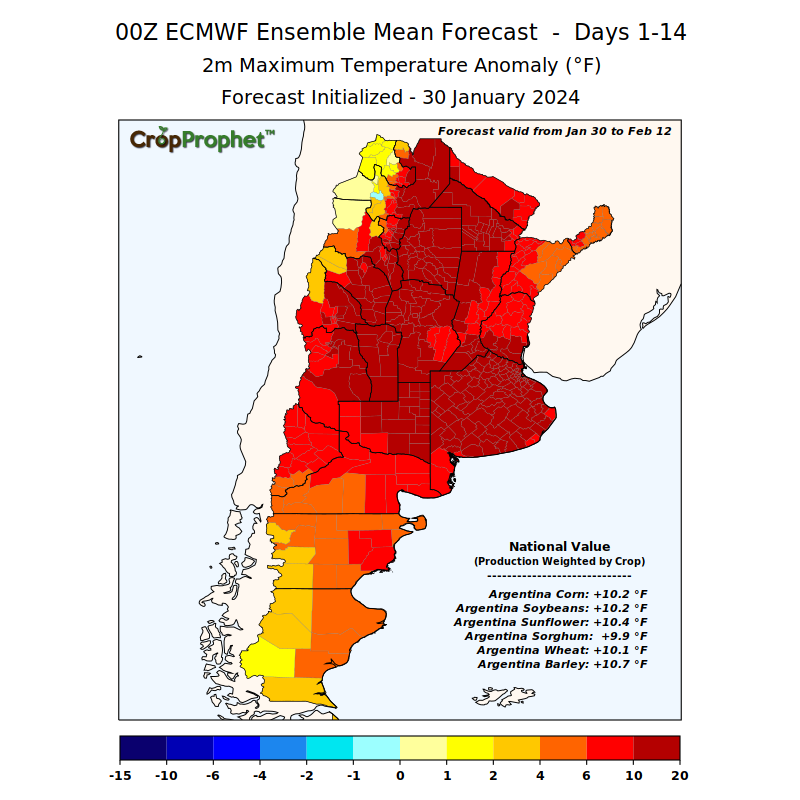

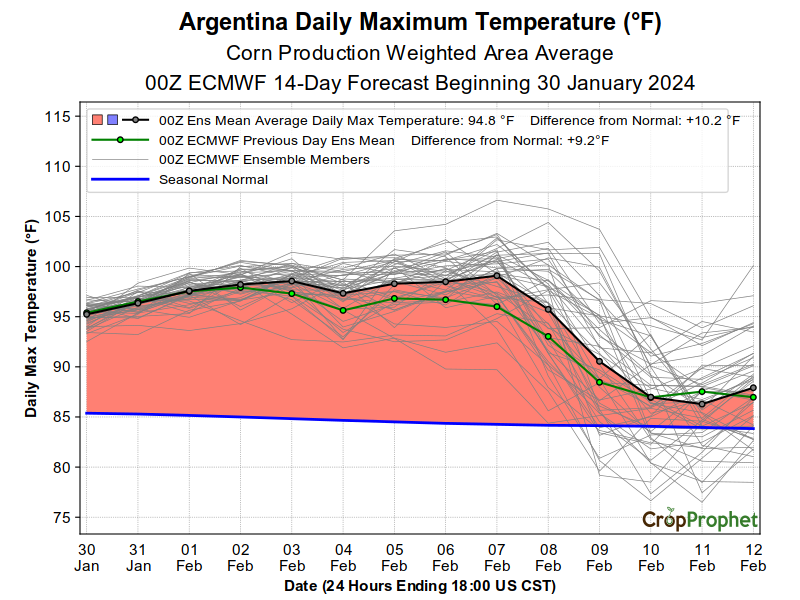

Here are the forecasts:

Here is what a few in the industry had to say:

Brian Wilson, Options Trader:

"When the funds are short they are eager to sell on 'forecast' of rain during drought. When they are long they buy on 'forecast' of rain until rain actually falls. This is a recipe for disaster when wrong."

Jason Britt, President of Central States Commodities:

"The BAGE report shows that corn is 46% pollinating and 34% sinking while soybeans are 59% flowering and 23% setting pods in Argentina.... Not really the best times to be the driest and hottest it's been all year I wouldn’t think. Oh yeah there is rain coming... I forgot."

Crop Prophet (2 Days Ago):

"The ECMWF forecasts a long stretch of near 100 degree for corn production weighted daily maximum temps. Our yield model indicates significant yield declines."

Gro Intelligence SA Yield Forecasts

This next data is from Gro Intelligence. You can read their full article here.

Since they launched in 2020 they say they have accurately predicted the final Argentina yield forecast models within 92% for corn and 94% in soybeans five to six months in advance of the official government estimates.

They went on to say that their forecast models show corn yields in Argentina have dropped more than -10% and soybeans have dropped -8%... since mid-January.

Then they essentially went on to say that Argentina estimates will see a major setback and that the USDA Brazil estimates might actually be somewhat in line due to the recent rain. Afterall, the talk for the past few months has been that the losses in Brazil will be more than offset with the gains in Argentina.

Keep in mind, Argentina is the worlds #3 exporter for corn after Brazil and the US and they are the #1 world exporter for soybean meal and soybean oil.

Guess we will see how accurate they are. But could be very friendly for bulls if it realizes to be true.

There is some talk that the USDA is going to shave their Argentina crop estimates, with others saying that this could lead to the funds wanted to cover some of their massive shorts head of the report. The report is February 8th.

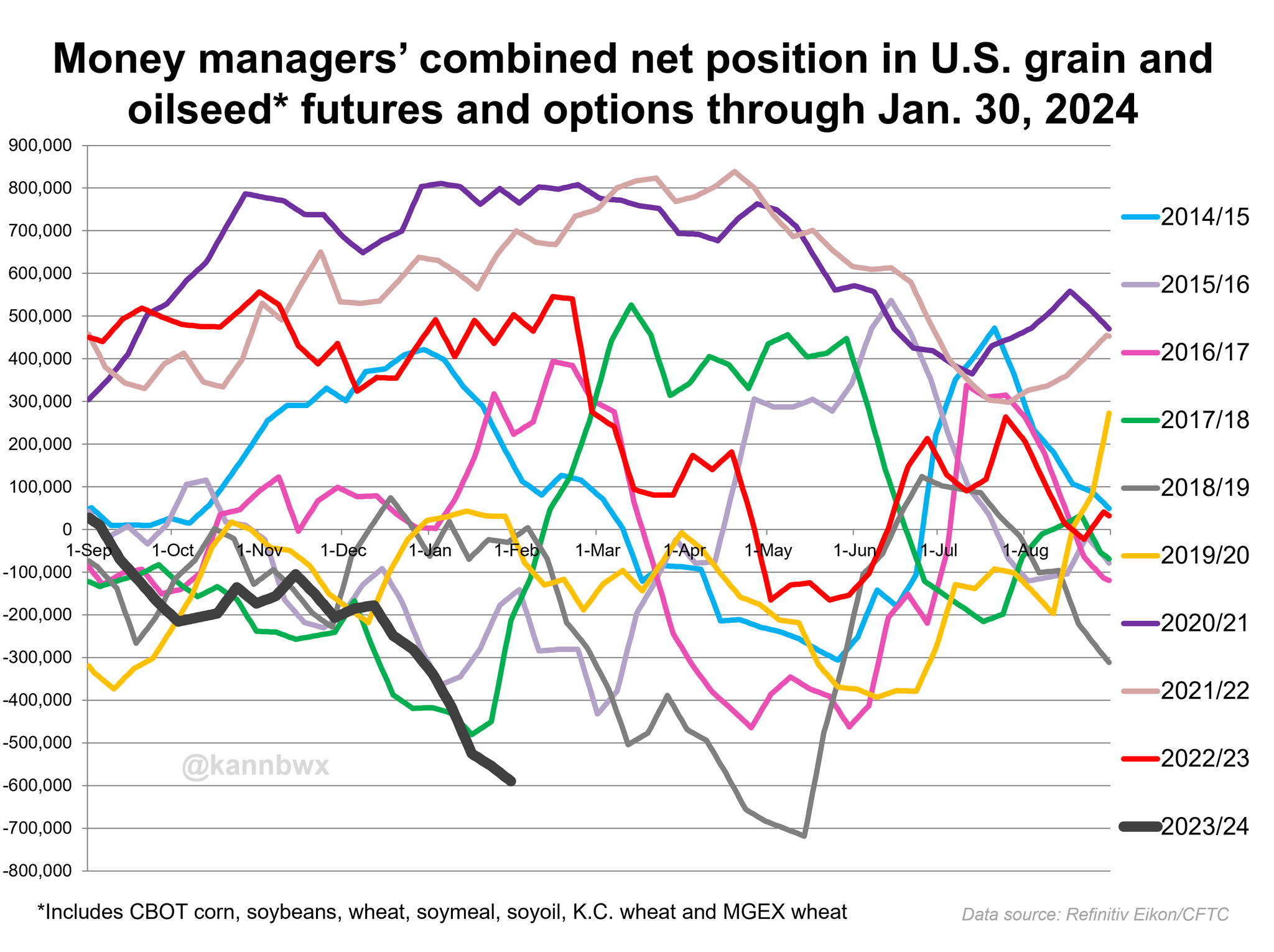

The Funds

The funds are now the shortest they have been across the grains and oilseeds since May of 2019.

Chart Credit: Karen Braun

What happened in May 2019?

In corn, we rallied over $1.00

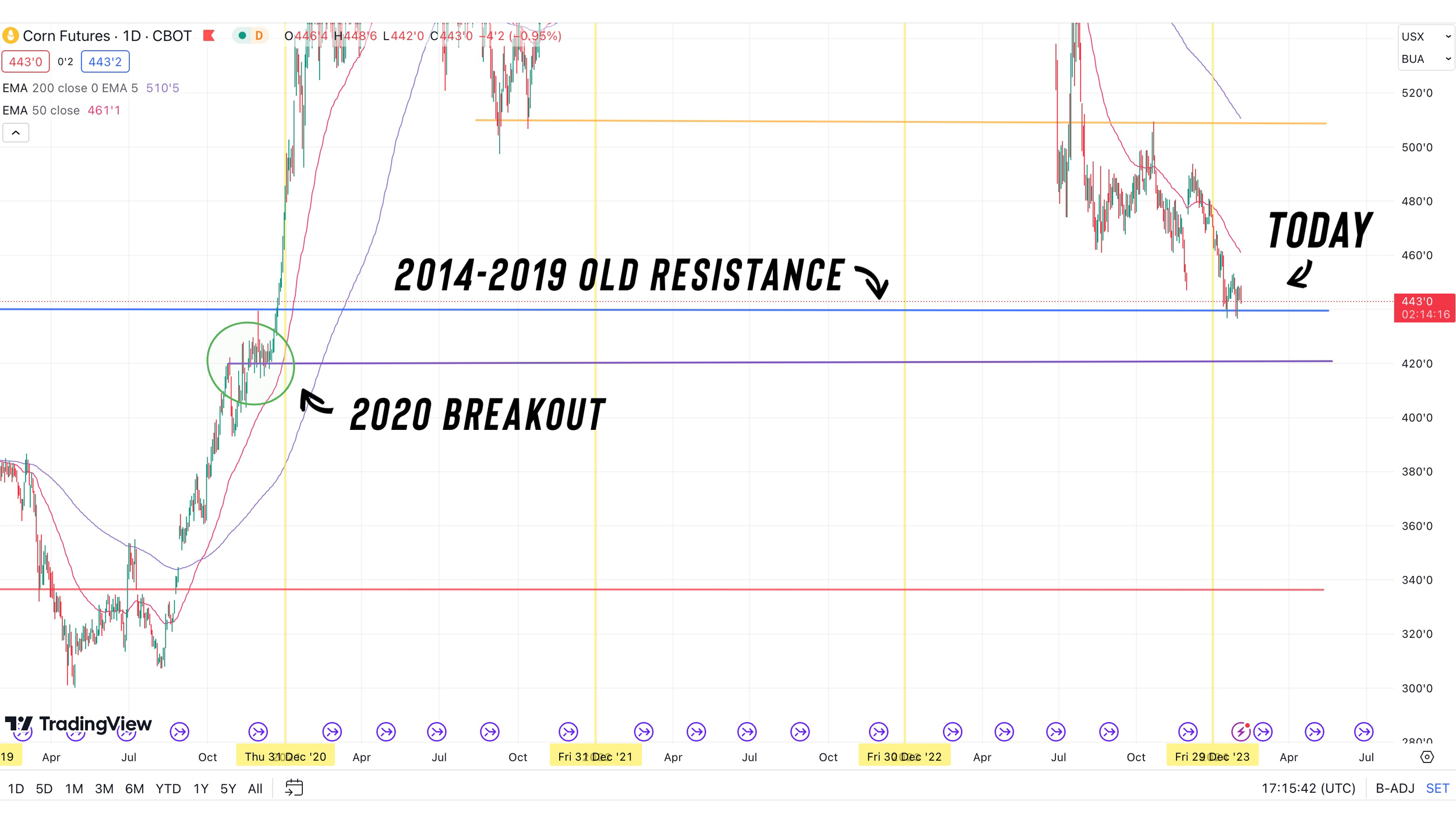

Here is the chart:

Now yes, the rally in 2019 was largely due to the flooding and delayed planting and I'm not saying corn will rally $1. But the point is that we tend to find both the tops and the bottoms of the market when they hold their largest positions.

The funds will cover eventually.. but when, and how fast?

From DTN:

"Overbought-oversold indicators such as stochastics and RSI's are showing bullish divergence in both March corn and March soybeans. This indicates a market whose downside momentum is waning."

From Mark Gold of Top Third:

"If I were the funds, I would look for a spot to cover shorts. If not today, then Monday."

Now let’s jump into the rest of today’s update…

GET 50% OFF BEFORE YOUR TRIAL ENDS

Comes with 1 on 1 grain marketing planning & tailored recommendations.

Today's Main Takeaways

Corn

Corn lower today as we took out the past two days lows but still manage to hold the January 30th lows of $4.37.

As mentioned, we had an outside down day which is negative on the charts.

I am still in the camp that Brazil corn acres and yields will be smaller when it is all said and done, but it doesn’t have to shake out that way. Then we have Argentina, who could possibly wind up being another bullish wild card as well. Time will tell.

How low can corn go?

Well if we take a look at history, we spent most of the 2014 to 2019 time frame in a $1.50 range.

We usually found our highs somewhere around $4.40 and our lows would be anywhere from $3.00 to $3.50

So typically we see old resistance turn into new support.

Right now we are trading right above $4.40, right where we typically used to make our highs from 2014 to 2019. (the blue line)

When we had that breakout during 2020, where did we breakout from? We broke out from right around the $4.20 level. (the purple line)

So if old resistance does indeed turn into new support, seeing support and lows at this $4.40 level would make sense. If we were to continue lower, perhaps we do look to test that area where we originally broke out in 2020, which would be around the $4.20 area.

Here is a little closer look.

Now could we go lower? It is possible. Do I think it will happen? No. What is a way that it could happen? The only route I see us going back to that old range would be if we produce this monster crop here in the US and raise above trendline yields. Possible? Yes. Probable? I don’t think it will happen, but that is our risk and something we need to be aware of. We are already sitting on this massive carryout, if we get a bumper crop it only only add to that.

As for the upside, short term I do still think $4.60 is a very attainable target. If we can find support at this $4.40 to $4.20 level soon and if the funds decide they want to cover. So if you have to move something in the next few weeks, $4.60 would be a decent target if we can get a mini bounce.

Historically, yes February is a bad month for futures. In fact, we have never once made our lows in February or March. But we have a few times made them in January. Will have to see if those $4.37 lows from January 30th hold.

At the same time, in the past 23 years, we have only made our highs in the January to March timeframe TWICE. Both occurred in January (2001 and 2013).

So bottom line, is this the place to be making sales? No not at mutli year lows. Typically we want to be making sales in spring to early summer time. When supply is at it's lowest and if or when we get that weather scare that leads to at the very least a small rally. Because we "almost" always get one.

I have a bullish tilt especially at mutli year lows and with the funds holding record shorts. Realistically I still think we could probably climb back into the $4.90 to $5 range here by spring. Will that have to happen, no, nobody knows what will happen. All you can do is manage risk and play the cards the market deals us.

If you are in the camp where you think things can go lower, then maybe consider puts to give yourself a bottom line. But do not overspend protecting multi year lows. We like the idea of grabbing courage calls rather than protecting lows here. Courage calls will give you that "courage" to pull the triggers on sales when we get that rally because you added to your bottom line.

Of course, you and your neighbor are going to be in entirely different situations. For one of you, you should be getting calls. Maybe the other one shouldn’t be doing anything. So please give us a call if you want specific advise. That is what we are here for. (605)295-3100.

Last thing to keep in mind. The funds are short a near record amount of corn. If history has shown us anything, their largest positions are accumulated at the tops and the bottom of markets. Right now it seems like everyone is bearish. We typically find our bottoms right when everyone thinks we are lower. Same thing when we rally. We typically make our highs when everyone thinks we won’t stop going up.

Taking a look at our chart, the outside down day is a negative indicator. So short term do not be surprised to see some additional pressure to the downside. We still need to break out of this long term downward trendline to confirm more upside.

Corn March-23

Soybeans

Soybeans make another low following the potential reversal earlier this week.

Today's action was a lot of technical selling. Yes the possible rains in Argentina and the dollar rallying didn’t help, but those weren’t the reason.

Soybeans took another leg lower because we failed to $12, which was a key psychological support level. We have said the past few days if we failed to hold, it would be a negative indicator and probably lead to more selling.

Right now, the funds are looking at the forecasts in Argentina. They show rains. Like the quote from Brian I mentioned earlier, the funds will continue to add to their shorts if there is a sign of rain in a drought. If they were long instead, they will usually stay buyers until it "actually rains". But that's not the case. They are heavily short.

It was announced today that depsite Brazil's recent beneficial weather, StoneX lowered their soybean estimate down to 150.35 million. Which is roughly a 5% decline from last years crop. The USDA is still at 157...

So what is going to determine the way beans go from here? For starters the funds. For them to switch to buyers, they will need a reason.

Some reasons they could do so? South America production. This is going to be heavily debated for the next few weeks. If Argentina continues their drought, it could spark some buying. If it rains, the funds will remain short until they get hard facts from the fields.

US new crop acres will be heavily debated moving forward but won’t be as heavy of a factor quiet yet. Then the last wild card is Chinese demand. This is something the bulls would really like to see.

As I mentioned below yesterdays short audio, the next level of support is around $11.75. Which from the looks of it right now, looks like it will happen unless we again bounce out of here like we did on Tuesday.

However, for that to happen we will probably need a weather scare out of Argentina or some other demand driven catalyst. Then if we cannot hold $11.75, I hate to say it but there is a still a big pocket of air down to our summer lows of $11.45. Hoping we bounce before, but we need to realize that's the downside risk here.

I like protecting the downside on soybeans more than I do on corn. There is far more downside risk in beans and unlike corn we aren’t sitting at mutli year lows. So if you are nervous about the downside or under sold it could make sense for you to lock in a floor and protect yourself. But make sure they are cheap. Please reach out to us if you have questions or need help (605)295-3100. We would be more than glad to help completely free.

Another thing to keep in mind. We are at a time frame where the path of least resistance could very well be lower until we start getting real results from the fields in South America. Unless the forecasts start to provide support, we will be waiting for the field results to be the next major factor. So do not be surprised to see prices struggle for a month or so.

Long term is a different story. There are plenty of reasons we could move higher, and I do believe we will be higher. The funds hold heavy shorts and there are a few different factors that could catch them on the wrong side. But keeping in mind that there is still plenty of uncertainty surrounding South America production and US new crop acres so it is tough to hand pick where we will find the lows.

Soybeans March-23

DON’T MISS OUR 50% OFF SALE

Lock in the offer before your trial expires. Comes with 1 on 1 marketing. Learn all of the tools to beat big ag at their own game.

Wheat

The wheat market continues to be in no mans land. One day we are higher, the next we are lower. We can’t seem to break out of this range we have been stuck in since September.

Overall, the wheat market is seeing virtually zero fresh news or headlines for either side to chew on. Which can lead to choppy sideways action.

Biggest thing bears are looking at right now?

Well aside from Russia having a cheap stock pile of grain that everyone knows about. It is the improved winter wheat crop here in the US.

The drought data showed that only 17% of winter wheat crops are in severe drought. Compare this to last year's 58% and that's a big difference.

Like I said, there is not much going on that is going to impact the market right here. Russia is keeping a lid on the rallies because they will continue to sell cheap grain to fund their war. Then we also have Europe wheat prices taking it on the chin a bit which doesn’t help our exports here in the US.

Bottom line, wheat is still a sleeper. We have been saying this for a while and sound like a broken record I'm sure. But we have been caught in a small range for months now. There are plenty of potential bullish wild cards. For now I am remaining patient.

Taking a look at the chart, we got so close to breaking the bearish downtrend today before ending -12 cents off our highs. Bulls need to break above that blue line. If you notice the triangle we are in, we are nearing the end of it. A break past those blue lines could lead to a breakout in either which direction.

For KC wheat, we are stuck in this range. Still looking for a break past either of those highs or lows to get a good idea of the next direction.

Mar-24 Chicago

Mar-24 KC

Cattle

Live cattle soared to a 3-month high. I have been saying for a while I thought this market had room to run. Could we go test those 187.500 highs? We broke that downtrend, so the charts look pretty solid.

The bullish weekly high close could definitely lead to more technical buying next week.

At these levels, we do run the risk of running into resistance soon. So although I think there could be more room to run, now would not be a bad time to consider some hedge coverage with the lingering demand concerns.

Still like the idea of having corn feed needs covered in the cash market through the month.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23