MARKET DOESN’T BELIEVE THE USDA

Overview

Grains higher across the board.

Seems like the market is calling BS on the USDA's Brazil numbers.

Keep in mind, these April reports generally are considered useless. The ones that actually matter will be in the following months.

Soybeans for example had a somewhat bearish report, yet we bounced a dime off the lows yesterday and rallied today. We are now +20 cents higher than where we were trading right before the USDA report was released.

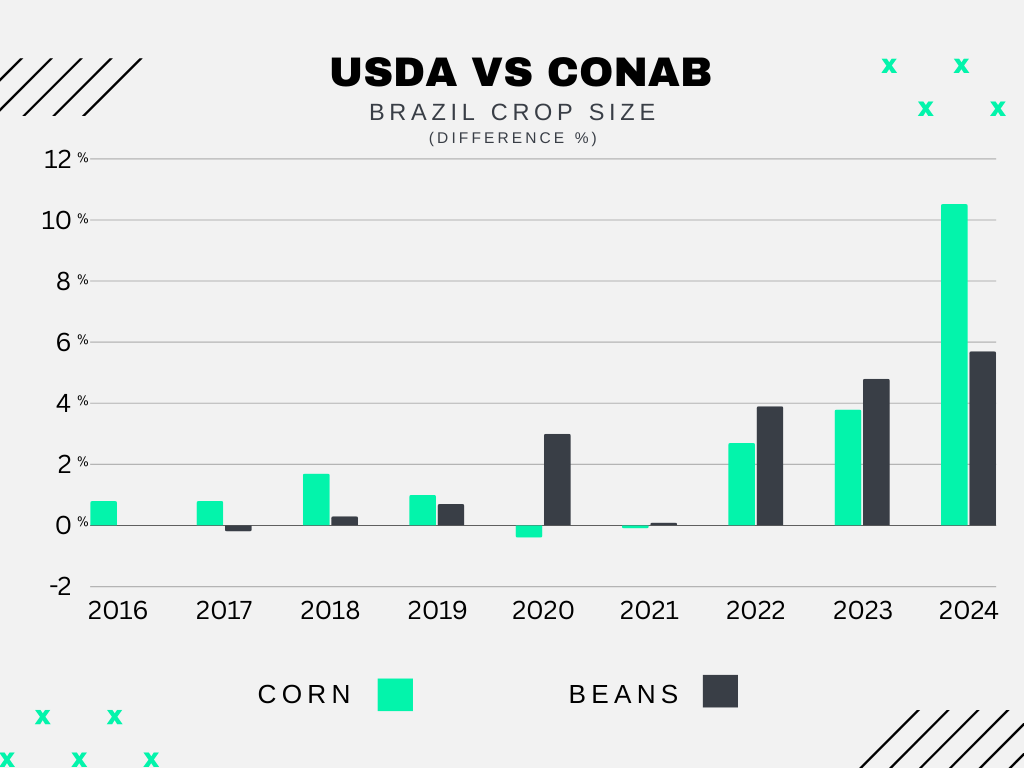

In yesterday's report the USDA opted to leave both the Brazil corn and bean numbers unchanged.. while CONAB continued to drop theirs. The difference between the USDA and CONAB's numbers is the largest discrepancy ever and it is not even close. The USDA's bean crop is +5.5% larger and the corn crop is a massive +10.5% larger.

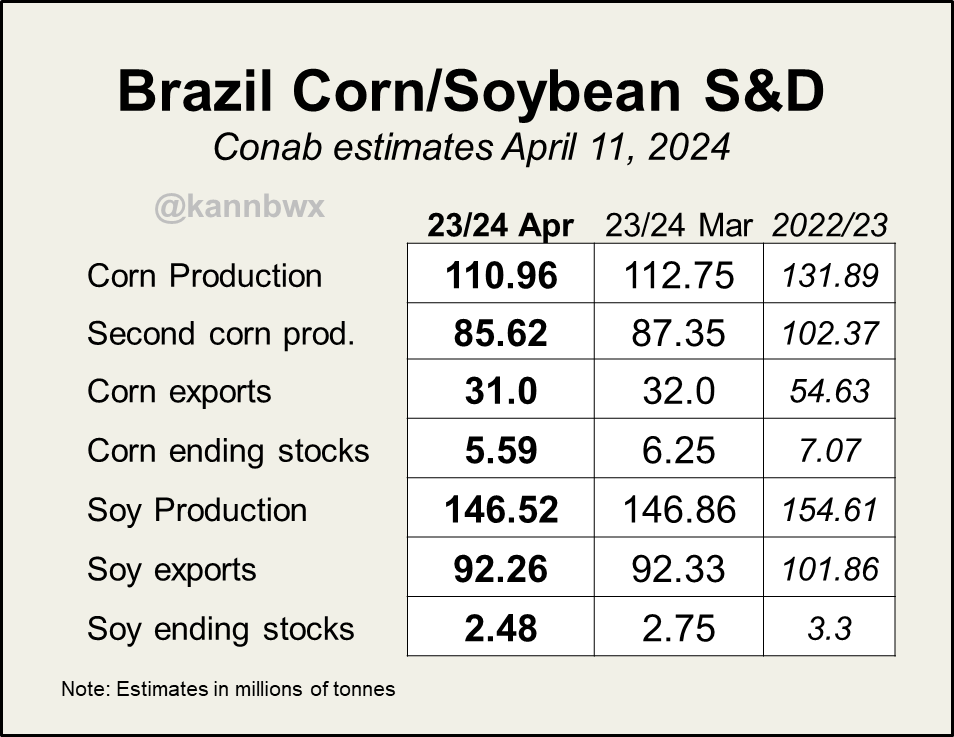

Here are the numbers.

Although US carryout came in higher across the board than the estimates, we did see corn carryout shrink from last month which was supportive.

The markets will very soon start to enter a weather market as we get deeper into planting and growing season.

The eastern corn belt has been getting some rain which could slow things, but overall short term the market faces risks from early planting due to mostly favorable weather, which could add pressure.

Long term looking towards late spring and early summer, the trade will realize planting is going good because it is dry.

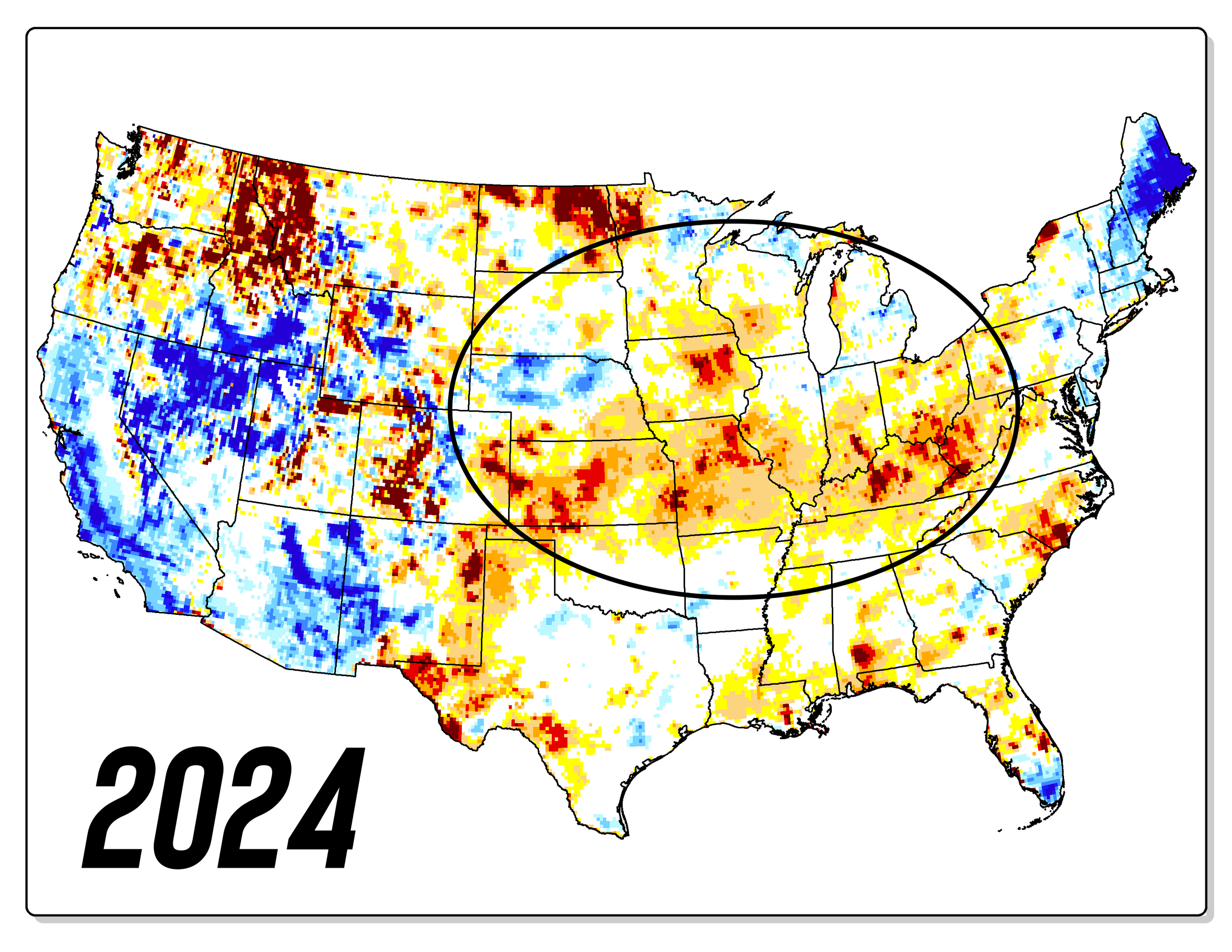

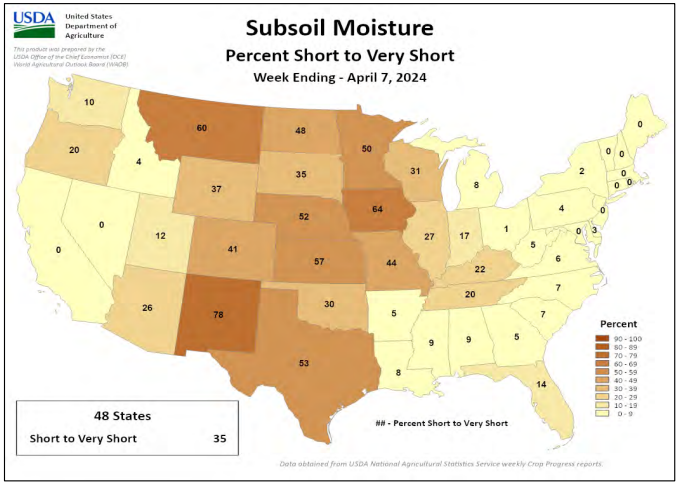

Just look at our sub soil moisture situation.

Many areas have received needed rain, but there is still some obvious concerns heading into growing season.

At this point in the year, this is the first time where we have really lacked soil moisture in the I-states.

Overall US subsoil is only 65% adequate, down from 69% last year.

However the top corn grower Iowa’s subsoil is 36% adequate vs 66% a year ago.

Top soybean grower Illinois’ subsoil is 73% adequate vs 93% a year ago.

Top wheat grower Kansas subsoil is 43% vs 17% a year ago.

It is not even summer yet, but there is some obvious concerns looking towards summer.

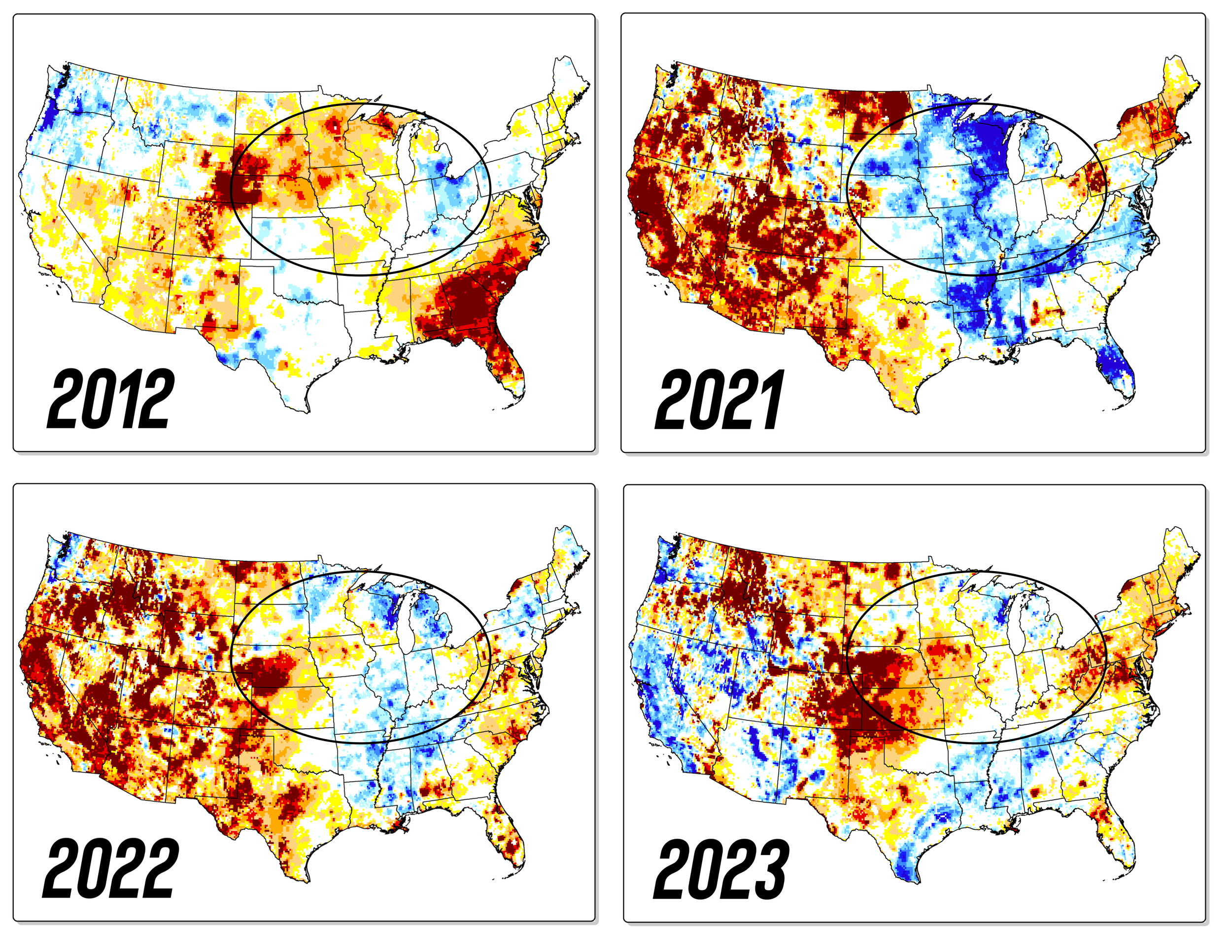

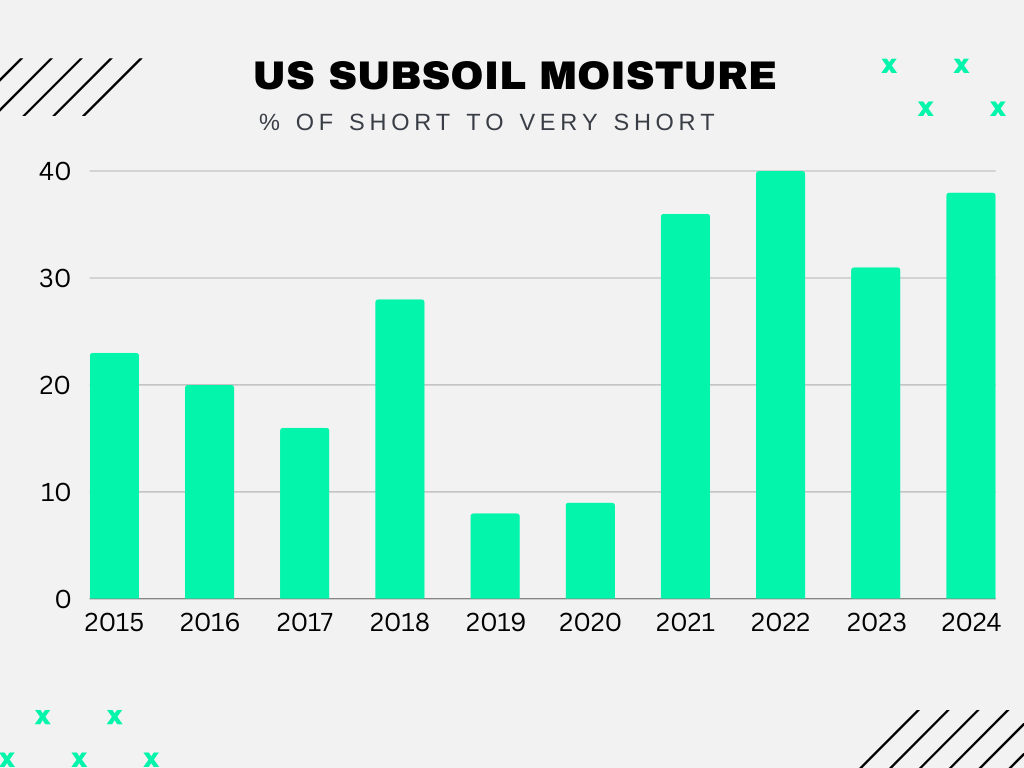

This is even more important given the fact that we have lacked moisture for the past 4 years.

This compound makes a drought scare all that more possible.

There are many areas who have not fully recovered from the past years.

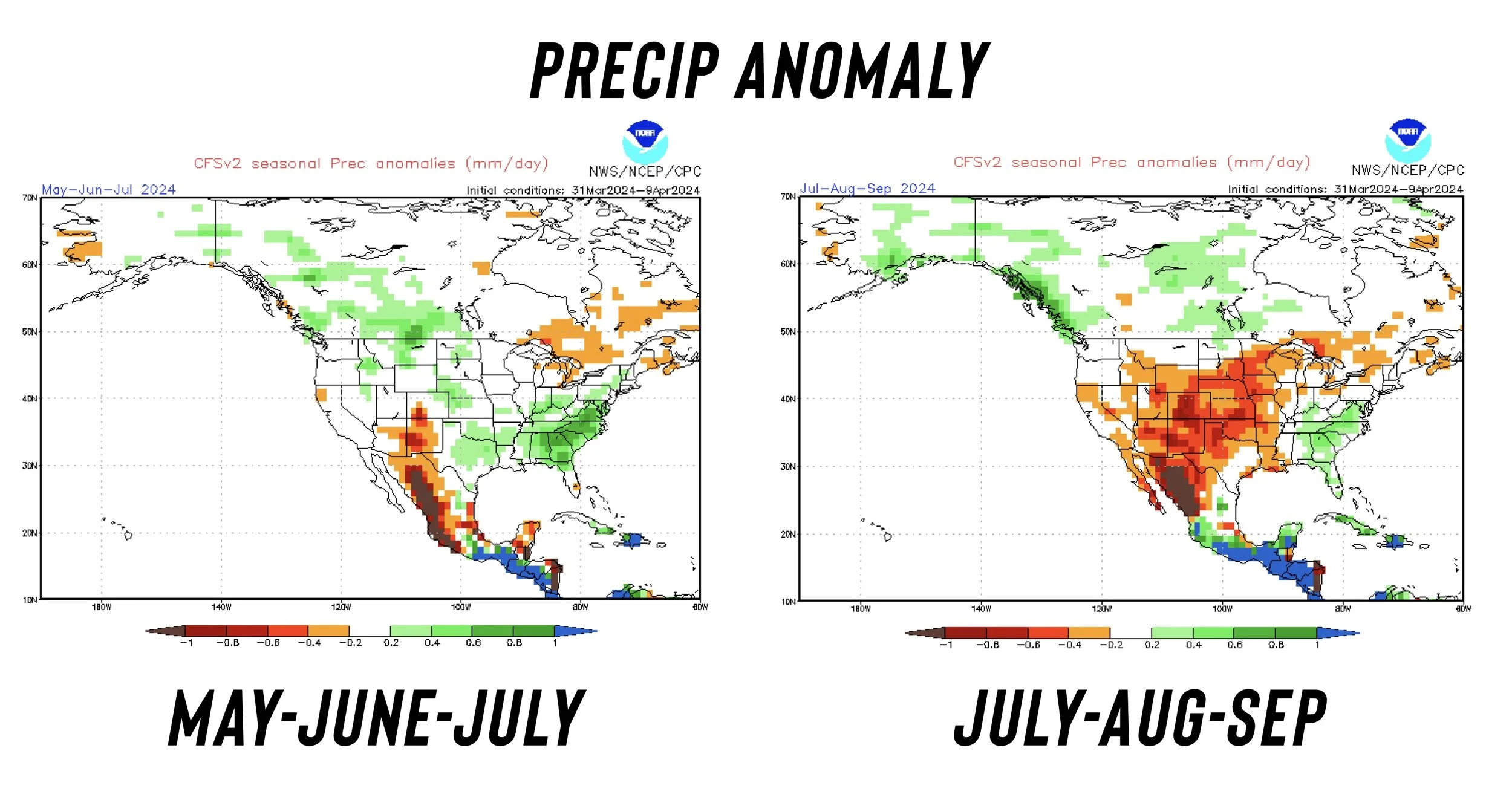

The forecasts for the key growing time frames for both corn and beans also lean hot and somewhat dry.

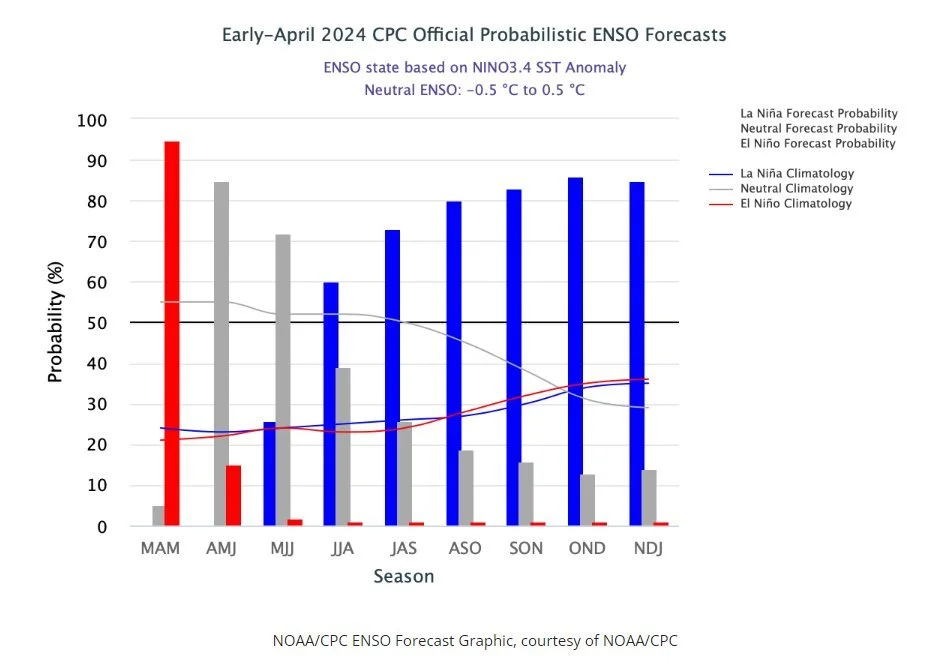

The US climate prediction center believes there is 60% chance we see La Nina form between June and August. This is up from the original 47% prediction in January.

A La Nina would bring drier and hotter conditions than normal across the corn belt.

Take a look at the precipitation anomalies for summer.

Fairly normal for May and June, but then the rain looks to be nonexistent come July and August.

Let's dive into the rest of today's update where we go over what all of this means for each of the grains...

USDA SALE ENDS TOMORROW

Make this the year you beat big ag at their own game. Create a 1 on 1 plan of attack for your marketing. Lock in the offer before your trial expires.

Today's Main Takeaways

Corn

Corn higher after yesterday's neutral to slightly negative report.

The USDA left the Brazil crop unchanged at 124. The CONAB again lowered theirs to now 110. That is a MASSIVE difference.

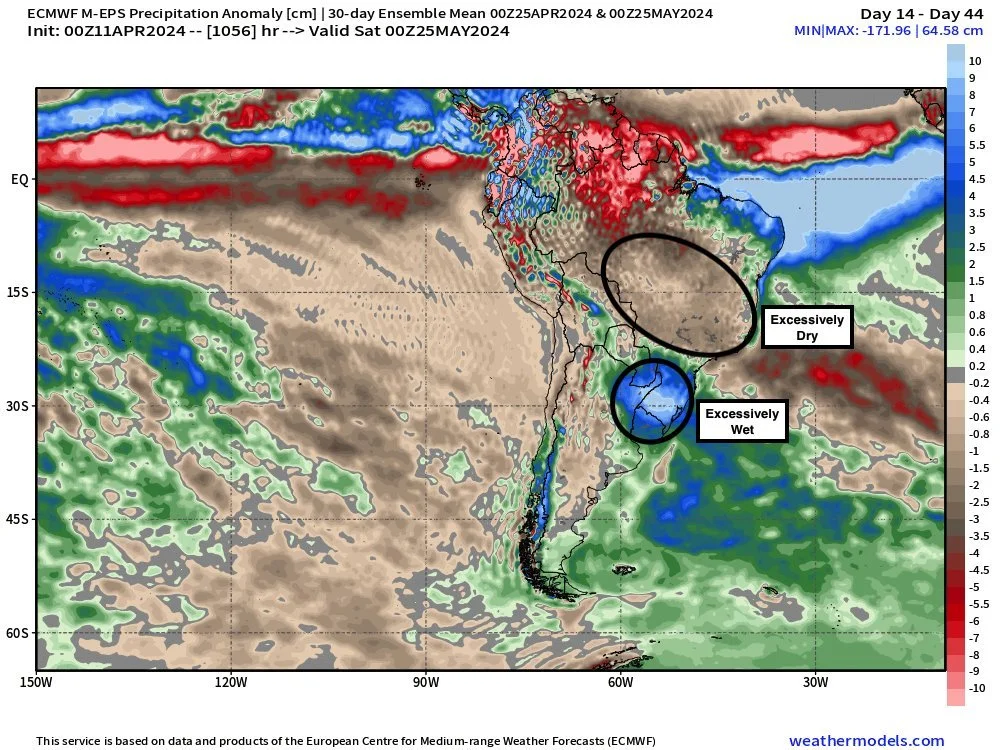

Once we get into early May, weather will not make an impact on this second corn crop. But right now, the outlook for the next 30 days is very dry. This could definitely add more risk to that crop that the USDA refuses to acknowledge is smaller.

To add on to this, Argentina has a great crop but out of nowhere that crop is now being hit with disease problems which has many lowering their estimates.

Projected acres from the USDA is currently at 90 million.

Will we see higher acres come June?

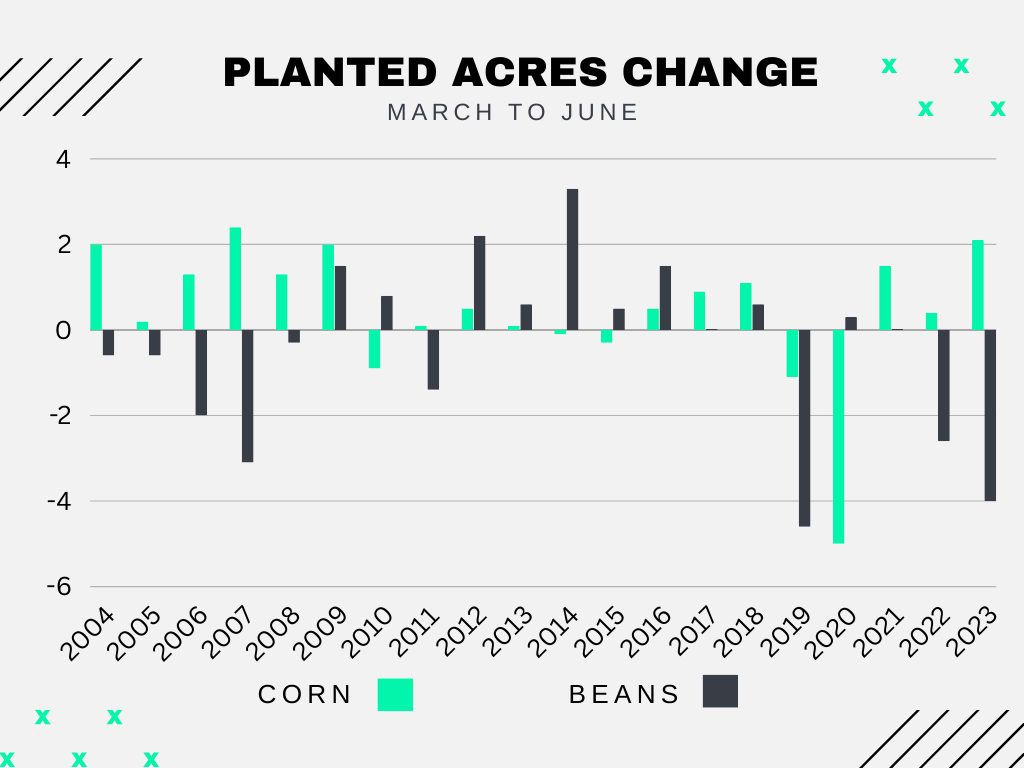

It is a very plausible possibility. Corn acres from March to June tend to come in higher. Coming in noticeably higher 12 of the past 19 years. Only coming in noticeably lower 3 times.

If we get a good planting season it would bump up the chance of us seeing a slight increase. However I do not seeing us going much beyond 91 million.

91 million is still a lot less than years previous and this 90 million is the number we get to work with until the end of June.

We are entering the weather market.

Funds are still near record short. We have a lot of unknowns ahead. So I think we see the funds cover some of those shorts. They can always re-short if they get a more clear picture, but until then they don’t have a reason to pummel more shorts.

Now on the other hand, they don’t have a reason to rally this market.. yet. Soon they will.

Short term, if we get early planting it could keep a lid on prices.

Looking towards late spring to early summer, we get some sort of a weather scare every single year. Nobody knows how big that rally will be, but we always get a scare that creates an opportunity. And I believe that scare will be drought.

We already lack moisture and that lack of moisture has been building for the past few years.

We do not have to actually have a drought, all we need is the thought of drought to create an opportunity.

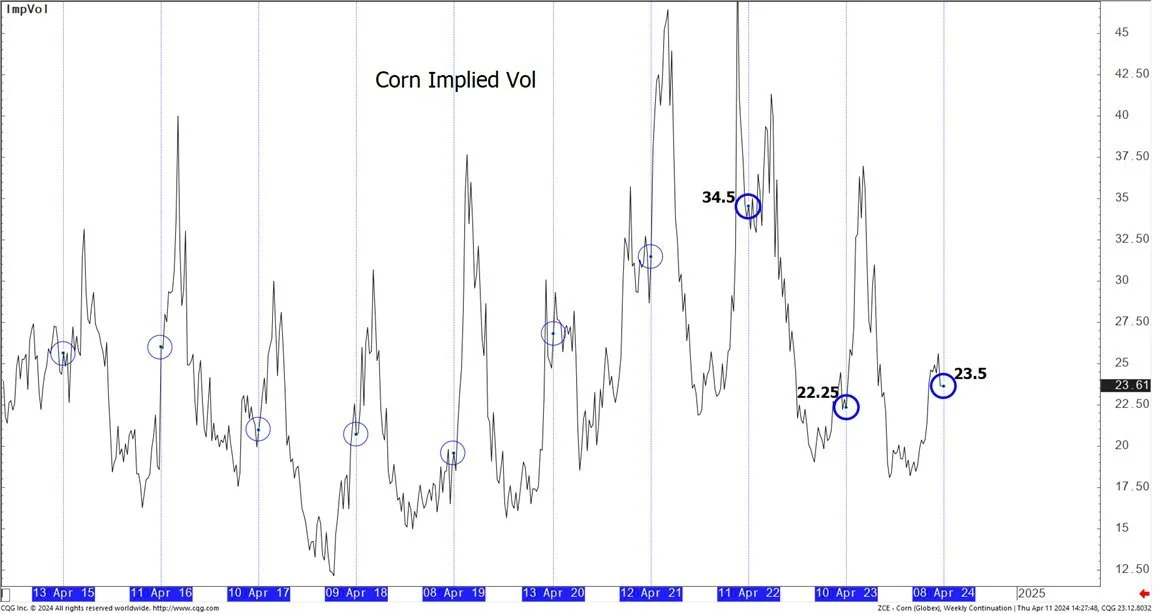

Weather season will create more implied volatility. This is why we like courage calls here to give you the courage to make a sale on that scare rally.

Look at this chart that shows implied volatility for corn. The climb almost always occurs from now until early summer.

Implied volatility increases the price of options because they are pricing in bigger price swings. Give us a call if you have questions or want to talk. (605)295-3100.

Bottom line, waiting for higher prices and opportunities.

A break above $4.45 would get the bulls excited and open the door to higher prices.

Corn May-24

Soybeans

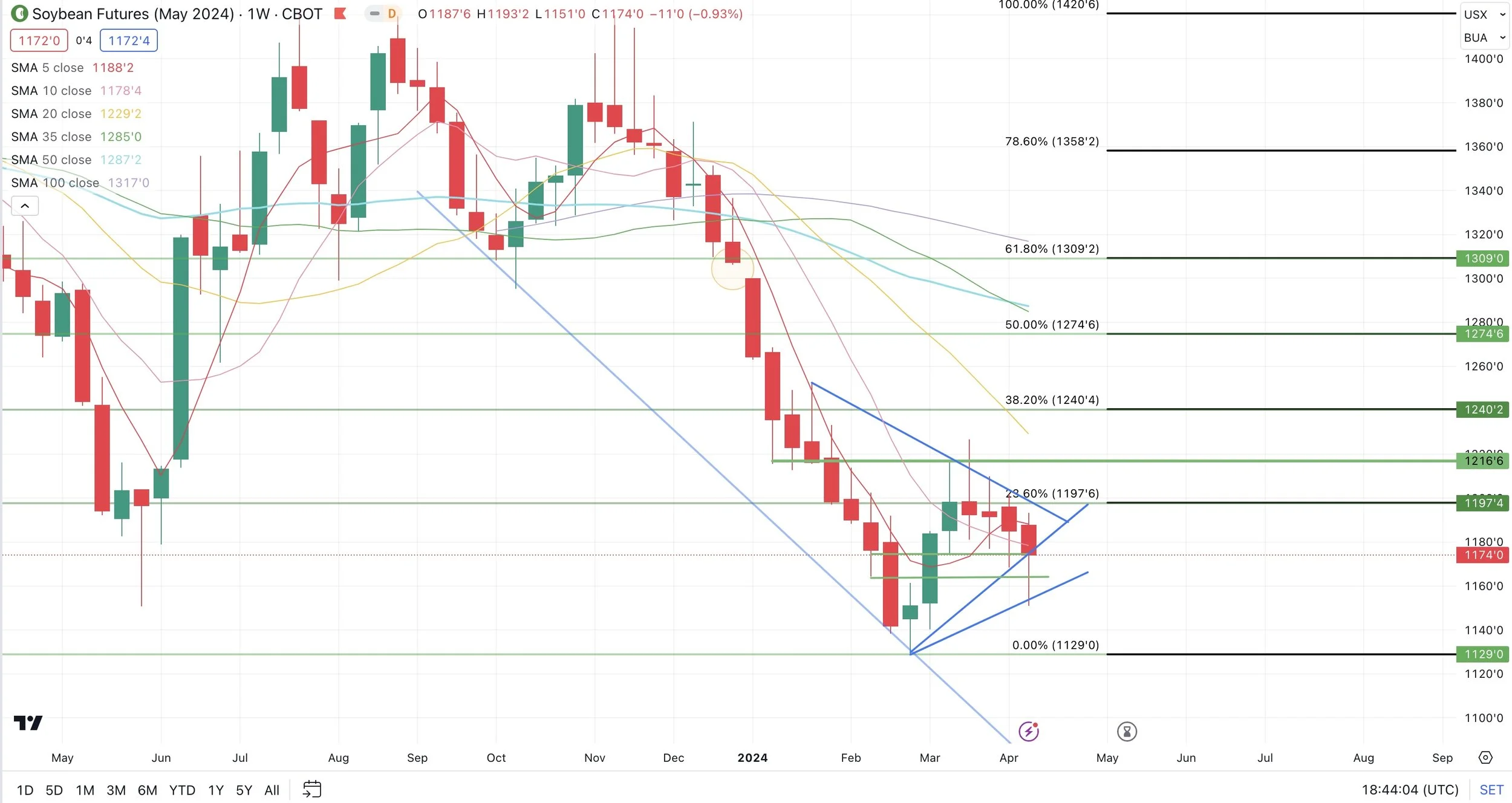

Soybeans higher than before the report despite having arguably the most negative report.

Soybeans are higher after posting 4 straight days of losses this week.

In yesterday's report we saw the USDA leave the Brazil crop unchanged which was negative. But we also saw carryout increase by +25 million bushels which was also a slight negative.

YET the market is trading higher today. I see this as a pretty friendly sign. We get a negative report yet the market shakes it off and trades higher.

We saw another flash sale of soybeans this morning. The 3rd one in a row. This isn’t usually the time of year where we get a lot of flash sales, so this is a positive sign.

The difference between the USDA vs CONAB's Brazil number is the largest ever.

To put this difference into perspective, it is like adding or forgetting a major state in the US. 300 million bushels, nearly the size of our entire US carryout.

Brazil soybean basis has increased roughly +90 cents the past few weeks. This still has me thinking that this crop is smaller than the USDA is leading on.

To add on to this, despite seeing an increase in carryout we still have a pretty tight situation here in the US. If this crop sees any struggle or we plant less acres than is currently priced in, things could get very tight in a hurry.

We also have crush demand which is not going away. The sustainable aviation fuel is more of a multi year supportive factor that will take some time to play out, but it is friendly long term.

Then we have the funds, still holding a massive short position. Far shorter than they typically are for this time of year.

Bottom line, I see higher prices long term. The path higher isn’t going to be a straight line. We want to be making our sales in summer or sometimes a little later when we get that weather scare and aren’t sure what we are going to raise.

Short term expect some heavy volatility, up and down. But hold tight.

Soybeans May-24

Wheat

The wheat market follows the rest of the grains higher.

The USDA report yesterday was essentially a wash.

The US carryout numbers were slightly negative while the world carryout numbers were surprisingly friendly. As wheat world numbers were the only one to come in below the trade estimates.

Overall the winter wheat crop here is far better than last year, but dryness in the plains is now becoming a very real concern. Roughly 60% of the growing area was drier than normal the past 30 days and there is very little rain in the forecasts. Many including myself think we will see crop ratings take a hit come Monday which would be a supportive factor.

Many areas have been getting rain, but Kansas for example has not. Since March 1st, the rainfall deficit in parts of Kansas and Oklahoma has been the driest in something like 90 years.

Currently in winter wheat areas drought covers:

Kansas: 81%

Colorado: 35%

Oklahoma: 50%

Texas: 45%

Nebraska: 28%

South Dakota: 31%

Montana: 91%

IF KC wheat country continues to miss out on rain, expect KC wheat to lead us higher for now.

The technicals on the KC wheat chart are also starting to turn around. July KC wheat closed above its 50-day MA for the first time since July the other day.

If KC wheat can take out $6, it could spark more technical buying.

Russia's wheat areas are also seeing some dryness and heat.

Lastly we have French wheat conditions at their worst levels since 2020. Sitting at 64% rated G/E compared to 94% last year. I do not see this as a major factor as France isn’t a huge player in the global wheat market, but it's friendly.

Bottom line wheat has plenty of upside potential. It might not happen as soon as you would like, but higher prices will come eventually. I am remaining patient.

May-24 Chicago

May-24 KC

Sunflowers, Millet, & Milo

Our partners at Banghart Properties professional grain marketing have new crop act of god contracts available.

Sunflowers, millet, and milo.

On farm pickup.

Call Wade (605)870-0091 or Jeremey (605)295-3100 for more details.

Cattle

Cattle market continues to struggle.

Personally I still think this market could suffer more pain. The charts look pretty terrible from a technical standpoint.

Give us a call if you want to go through any strategies. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24