CORN & BEANS STRONG AHEAD OF REPORT

Overview

Grains closed mixed with corn, beans, and Minneapolis wheat all trading higher, led by a near 30 cent rally in beans. While Chicago and KC end the day lower.

Corn and soybeans were higher with pre-report positioning. They hit the markets so hard at the end of last week, so the trade was thinking that perhaps the USDA throws in a surprise and they wanted to lighten up their shorts before the report. So essentially some profit taking on the shorts.

Wednesday we will get the USDA Supply & Demand report. I break down some of the numbers later.

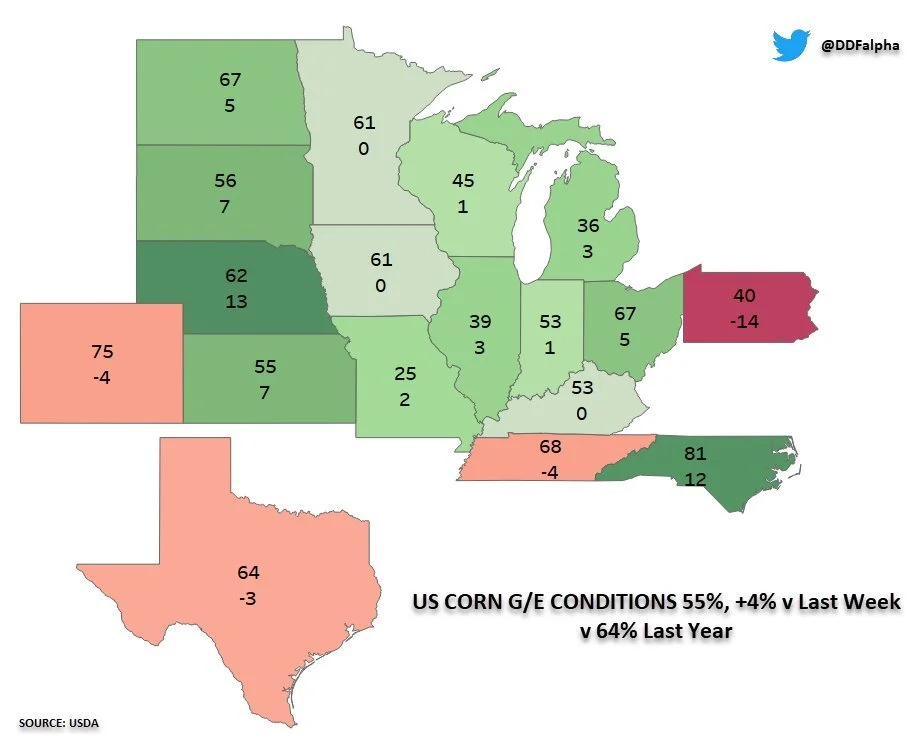

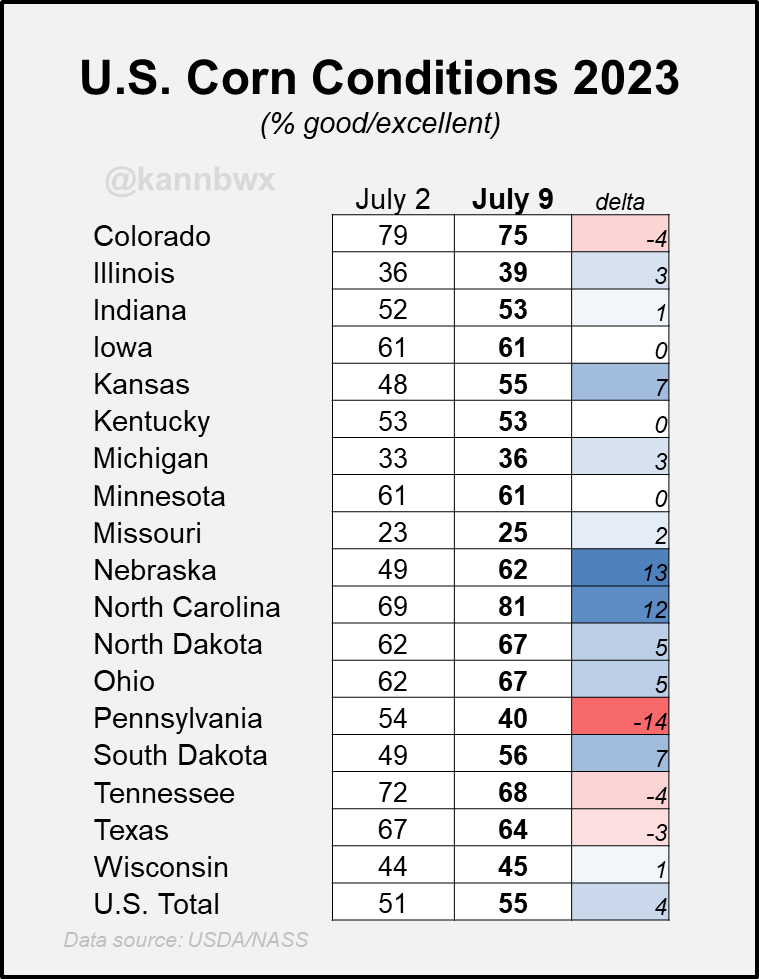

Crop conditions came out after close today. Corn conditions came in a lot better than the trade was guessing they would. As they jumped from 51% to 55% rated good to excellent. The trade had 53%.

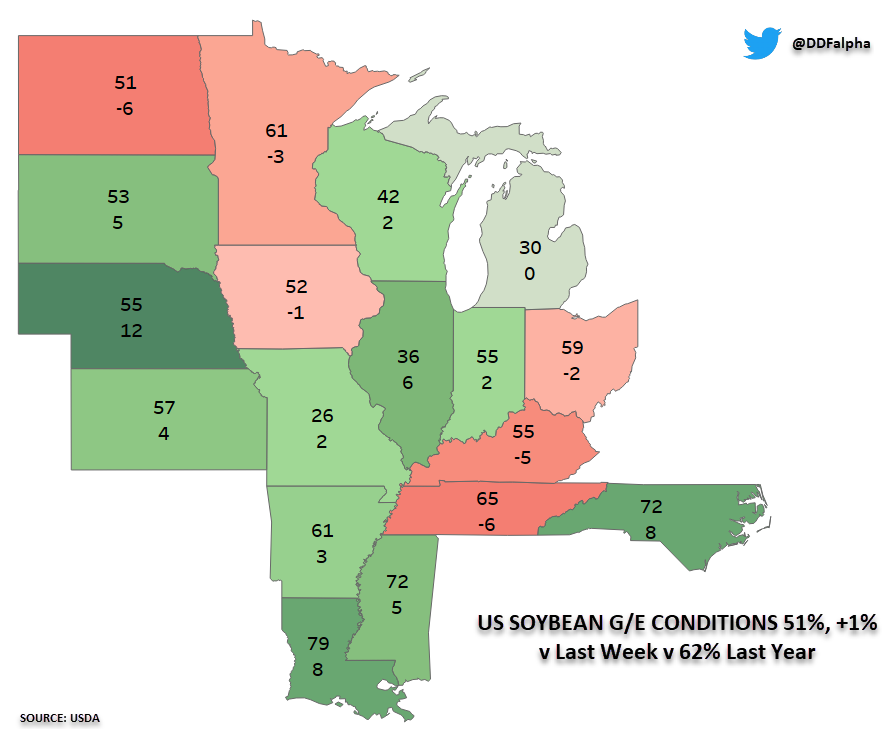

Soybean condition also slightly improved by 1%. From 50% to 51%, but the trade was expecting an even larger increase. As the trade had their number at 52%.

Spring wheat conditions dropped again, as the trade was expecting improvements. Going from 48% to 47%, while the trade has 49%. Winter wheat harvest continues at a slow pace, sitting at 46% complete, below the trades estimate of 51% and last years 62%.

(Full crop condition numbers below)

Highly recommend reading to the end of today's update as I include an amazing write up from the highly respected Roger Wright where he goes over whether you should be looking to get courage calls or profitable puts and how to utilize them.

***

In case you missed it, read Sunday's Weekly Newsletter

Are ou Comfortable With What's About to Happen? - Read Here

Crop Conditions & Progress

Corn 🌽

Rated G/E: 55%

Trade: 53%

Last Week: 51%

Last Year: 64%

Beans 🌱

Rated G/E: 51%

Trade: 52%

Last Week: 50%

Last Year: 62%

Spring Wheat 🌾

Rated G/E: 47%

Trade: 49%

Last Week: 48%

Last Year: 70%

Winter Wheat 🌾

Harvested: 46%

Trade: 51%

Last Week: 37%

Last Year: 62%

Average: 59%

Pre-Report Overview

In the July report the USDA isn’t known for making any significant yield changes. But traders are expecting yield drops to both corn and beans come Wednesday.

As the trade estimates show corn at 176.6, down from 181.4 bushels per acre. While beans are projected to come in lower as well, with the average trade estimate being 51.4 bushels per acre. Down from the original 52 bpa.

These trade estimates are not what they think the final yield will be. They are a guess as to what they think the USDA will print Wednesday.

I highly doubt we hit trend line yield for either. Of course, things change, weather changes, and I could be wrong. But given the current circumstance I just don’t think that is in the cards for either corn or beans.

Typically in July, it is a fairly boring report. There are plenty of years where they do nothing to yield. The chart below is from Standard Grain. It shows the past yield changes to both corn and beans in the July report.

As you can see, in 2019 we saw a slight decrease to beans by 1 bpa. Aside from that, we have to go all the way back to 2012 where we saw a massive 20 bushel decrease to corn and a 3.4 drop for beans.

As highlighted in his image above, we did see reductions to the May or June report in 2022, 2019, and 2013. But those were not drought years. Those were years where we saw reductions simply to late planting worries.

This year doesn’t really have any good comparisons. It is in a year of it's own. So given that we don’t have any good years to compare this to, that opens the door to some surprises Wednesday.

Below are the trade estimates:

Today's Main Takeaways

Corn

Corn futures finding some consolidation following their recent massive sell off and after posting fresh multi month lows last week. As we have found a little bit of support right under that $5 mark.

Despite all the bearish tone and headwinds corn has faced with the awful report the other week, corn actually only lost 1/2 a cent last week. Which was a surprise given everything that has transpired and is going on.

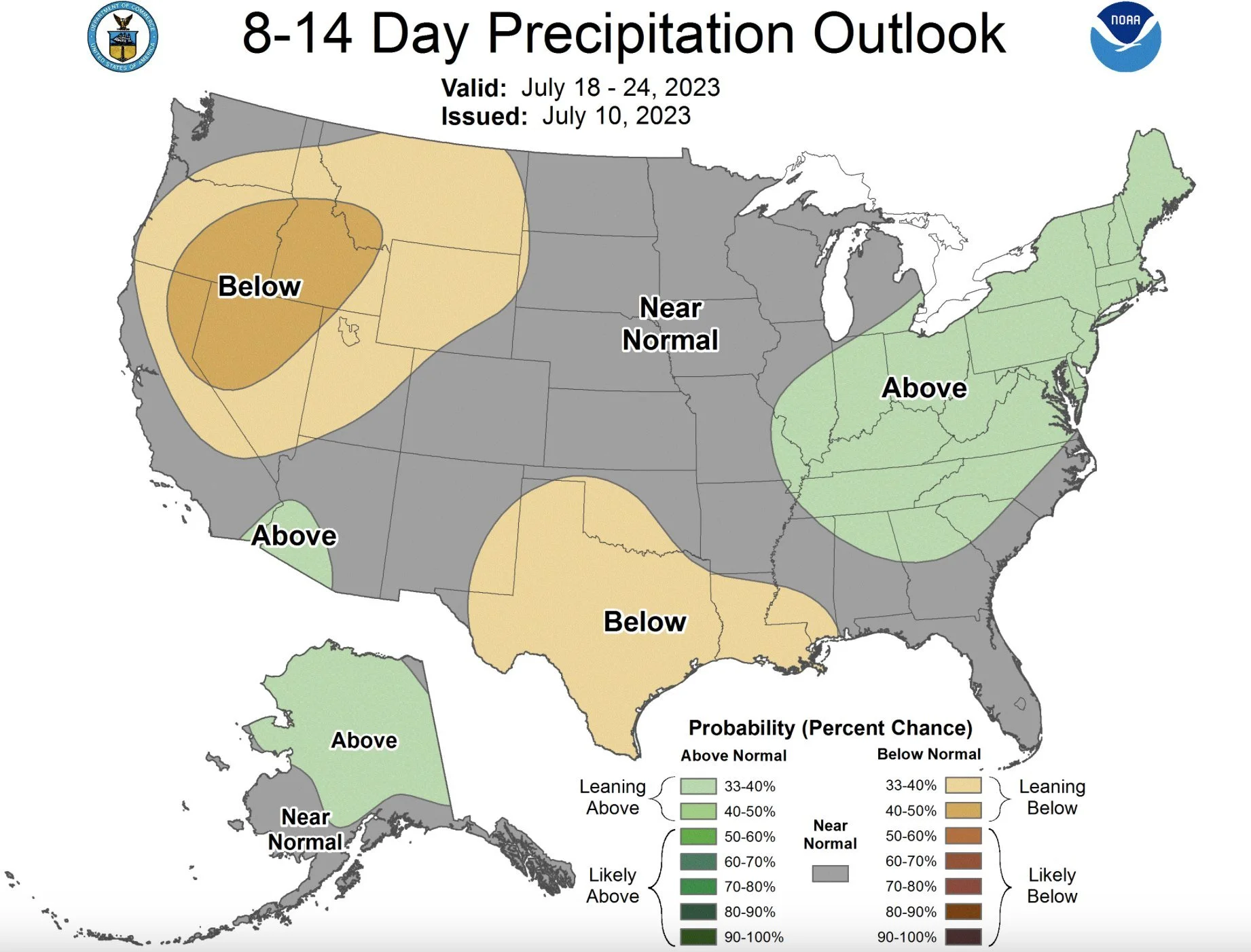

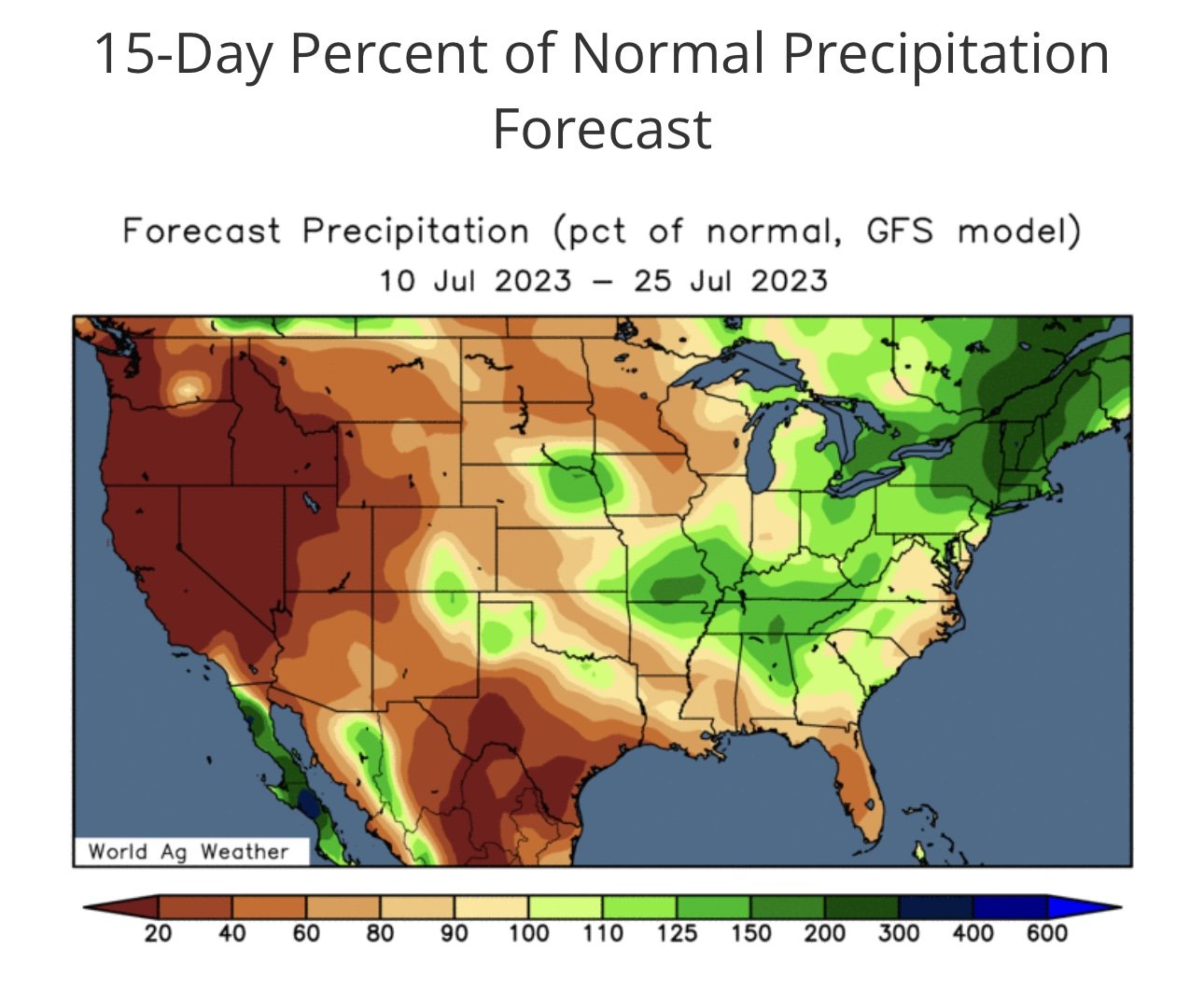

The weather remains pretty bearish overall. We saw some better than expected rains over the weekend in areas such as Illinois and Iowa. With some rains in the forecasts over the next week which should help the crop. Looking later this month, it does look like the corn belt will progressively start to trend warmer and drier towards the end of July, with this weather pattern moving west to east.

One thing bulls are looking at is the fact that corn in China traded to $9.60 a bushel last Friday.

Tomorrow it is going to be all about pre-report positioning as well as how the trade reacts to the newest crop conditions. As the crop conditions came in at 55% rated good to excellent. Up from 51% last week and above the average estimate of 53%. So I would not be surprised at all to see some pressure tomorrow.

Here are some state by state breakdowns:

Chart Credit: Darrin Fessler

Chart Credit: Karen Braun

So far, it seems like the consensus is that we will see a pretty bearish report on Wednesday for corn.

As mentioned, typically the USDA isn't known for making yield changes in this report. But it looks like this isn't going to be one of those years. I would be little shocked if the USDA did opt to leave it unchanged, I just don’t see that happening, but of course there is always that chance.

Bears are making the argument that the USDA won’t lower the yield because of the good weather we have had thus far in July. To go along with he fact that USDA typically doesn’t make any changes in the July yield. Usually they wait until August.

The trade is estimating 176.6 bushels per acre. If we do get a decrease to yield, it would be the first July report since 2012 that we do so.

So we know there is a good chance we see a yield drop. But the bigger story might be the demand side of things. It might be a little hard for the USDA to avoive printing another somewhat bearish new crop balance sheet. While yield will come below trend line, acres are higher and demand will likely come in lower. This is the main reason for everyone bearish outlook on the report.

Even though the USDA did adjust its acres higher, if the USDA comes in with a yield 176.9 or lower, it would make the total new crop production lower than the 15.265 billion estimate they had last month. The current estimate for production is at 15.234 billion bushels for Wednesday.

So with this, perhaps. the report and balance sheet side of things won’t be as bearish as everyone thinks it will be. But going forward, bulls will definitely need to find a better demand story if we want to pick up some momentum and climb higher. If we don’t, there is a chance we could just continue to chop around in this range until harvest.

Going forward, don’t be caught off guard if the report is as bearish as everyone is saying it could be. Because it very well could be. A bearish report could result in another leg lower. Now if the report isn’t bearish or prices relatively hold even with a bearish report, I would look at that as a great buying opportunity. I have already noticed a few other advisors placing buy signals at these levels, which is an idea I don’t mind.

Even though there are actually quite a few negative factors surrounding corn, I think the potential strength we could see in soybeans will be enough to pull us higher.

Corn Dec-23

Soybeans

Soybeans led the grains today, with a 28 cent gain. Recapturing the losses last week.

Last week soybeans lost 25 cents, while corn only lost 1/2 a cent. The opposite of what most people would’ve expected given the report we had the Friday before. Soybeans were definitely oversold, and last week's price action didn’t make a ton of sense.

Today was all about pre-positioning ahead of the report. As most people think we will get a pretty bullish report as traders prepare for a very tight new crop balance sheet.

2023-24 carryout is estimated at right below 200 million bushels, which is about 150 million lower than our June report of 350 million. Bulls make the argument carryout is actually closer to that 150 range rather than that of 200. Will the USDA make that kind of adjustment Wednesday, probably not. But the argument is that they need to start working their way towards that. Bulls don’t think we have the yield nor the acres.

The crop conditions showed some slight improvements in the beans, not nearly as much as we saw in the corn however. As soybeans improved by 1% to 51% rated good to excellent. This was actually not as big of an increase as the trade was expecting. As they were expecting the number to be 52%.

Here are the state by state breakdowns:

Chart Credit: Darrin Fessler

Chart Credit: Karen Braun

As mentioned earlier, we usually don’t see the USDA make any significant yield changes in the July report. The trade is estimating a slight 0.6 decrease to 51.4 bushels per acre in the yield. I wouldn’t be surprised to see this go either way. If they do make a change, it will be lower, perhaps in the 50.5 to 51.5 range.

Looking forward after the report, we take a look at August. Which we all know is the key month for soybeans. I'm hearing more and more talk about potentially drier and warmer forecasts for the month. So there are talks about the crop problem we thought we were going to have in corn, actually happening in beans.

After the extremely bullish report the other week, we failed to push past that $14 level, topping out at $13.91 for a brief moment. The market correctly stayed below that level. Despite the decrease in acres, the trade was thinking that there was still a chance to make the balance sheet work if we got good weather and were able to make a decent crop.

Do I think we will see prices above $14? Yes it is a very real possibility. But for us to be able to do so, we will have to see that hot and dry weather in August that is being talked about. Even the "thought" of that type of weather would likely be enough to help us make another push higher past that $14 range. IF we get that weather scare and break $14, we have some room to run. I think we even have the possibility to see $15 if all of the cards play out right. I am not saying that this will happen, but it is a possibility.

Even though I think we have so much upside potential in beans, we need to keep in mind we are over $2 off our lows from not too long ago. So do what makes you comfortable. If you want specific advise, shoot us a call at (605)295-3100.

How will we know when the rally is over? I listened to a good market analysis this morning from Shawn Hackett. He said the biggest thing to watch for would be if or when we start importing beans from Brazil. If we take a look back at 2012, our rally in corn came to an end when we starting importing from Brazil.

Soybeans Nov-23

Enjoying Your Trial?

Take advantage of our 4th of July sale before your trial ends.

$350/yr vs (Normally $800)

Become a Price Maker. Not a Price Taker.

Wheat

The wheat market closes mixed, with very little change as the market continues to chop around.

Overall, there is nothing too exiting going on in the wheat market. Sure, we have the Russia and Ukraine situation where we seem to be getting updates daily. But the market is sick and tired of that story. It is not much of a market mover until we get a real final decision on if the deal will be extended or not. Putin keeps bluffing that they won’t extend it, but I think they ultimately do. Turkey's President is trying to play peace maker and work out a deal to get it extended 3 months. The current deal expires a week from today, so will be something to watch.

As mentioned, the crop conditions were fairly bullish for wheat. As spring wheat came in lower again despite the trade guessing improvements. Winter wheat also continues to fall well behind the usual pace.

Going forward, Minneapolis might be one of the markets to watch. As there is a ton of potential weather premium left in the spring wheat market.

I mentioned the market analysis I listened to from Shawn Hackett earlier in the soybeans section. He also said this about KC and spring wheat:

"If you take a look at the spring and KC wheat spread, it has started to move up over the last few weeks. If we get a major crop problem here in the US, we could see spring wheat trade at a $1 or even $2 premium to that of KC wheat."

He then went on to talk about how Russia already has some irreversible damage to their crops due to the hot and dry weather. Keep in mind, Russia produces just as much spring wheat as North America does.

We have weather issues globally that I think will continue to be supportive. We have the dryness in Canada. With the forecasts still looking very hot and dry for the northern plains and Canadian prairies as we head into a very crucial time period for defining yield.

According to Arlan Suderman, the spring wheat condition index score is at 329. This is the 7th lowest all time for this week, going all the way back to 1986.

Taking a look at the report, the USDA will give us its first spring and durum wheat estimates to go along with some updated winter wheat production numbers.

The trade is thinking we could winter winter production bumped due to the recent rains we have been getting.

The demand side of the balance sheets will likely remained unchanged for the most part.

Going forward, the wheat market still might be a sleeper. Of course if Russia decides to not renew the deal we will get a good boost. But I'm not overly optimistic on that happening. Hopefully we have made our lows and can start to look to climb higher.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

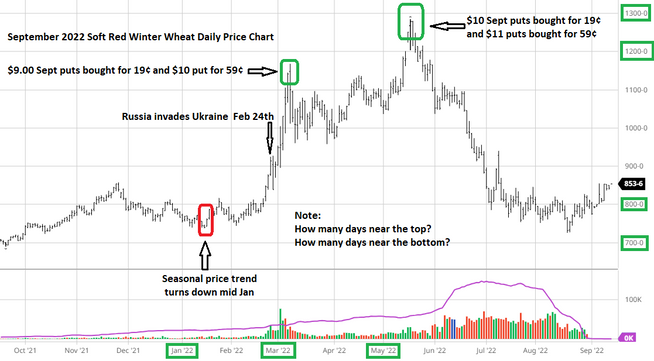

Courage Calls or Profitable Puts?

From Wright on the Market,

Every year, you must lock-in the futures price on your corn, beans, and wheat.

None of us want to make that pricing decision because we all know we will be wrong, at least for a few days, and most likely for a week or even several months.

Marketing Plan A: HTA and Courage Calls (The Choice of Many Farmers)

Lock-in the cash price or futures with your merchandiser and buy Courage Calls.

If the price moves lower, priced bushels do not lose money.

If the price goes higher, the calls increase in value.

It is a win-win because, no matter which way the market moves, half of the decision was correct. The call options provide the “courage” to sell the crop with the merchandiser.

Why doesn’t everyone do that?

Some folks do not understand how options work.

Options take cash to buy. Merchandisers will buy the calls, but charge a service fee.

The buyer of the call options must pick the day to sell the call. Once again, big stress. You know you will be wrong for at least a few days.

There is a deadline to sell the calls because options expire and cannot be rolled.

It is estimated 90% of the calls expire worthless and the buyer loses 100% of his investment.

Marketing Plan B: HTA and Profitable Puts

Lock-in the cash price or futures with your merchandiser and wait for the market to tell you what to do.

If the price moves lower, priced bushels do not lose money.

If the price goes higher, you can capture that extra price with the purchase of put options.

If the price goes higher yet, you can capture that gain with the purchase of more puts.

If the price goes higher a third time, you can capture that gain with the purchase of more puts.

When the futures price declines, the puts increase in value. When futures are about as low as you think they will go, sell the puts, add the profit to your HTA price.

Advantages of Puts over the Calls.

If futures do not go higher, no money is invested in the puts; calls expire worthless.

The use of puts will preserve the opportunity to capture the top of the market; once the call is sold, you are done.

The futures market spends weeks and often months near the bottom, but only a few hours or days near the top. It is much easier to maximize option profit with puts than it is with calls.

Summary 2022 Soft Red Winter Wheat Market Using Puts

Wheat seasonal trend turns down mid-January. Producers contracted with HTA in the $8.00 area.

When the war started, open orders were placed to buy $9, $10, $11, $12, $13 puts. Some clients chose to pay 19¢ for each option and some chose to pay 59¢ for each option.

The contract high was $12.85 in May. The $9 and $10 puts were bought for 19¢. The $10 and $11 puts were bought for 59¢ each.

The September 2022 wheat options expired August 24th.

Here the daily price chart for September 2022 soft red winter wheat:

Note the Option Premium (market value) of the three put options. Some clients bought the $9 and $10 puts for 19¢ and some bought the $10 and $11 puts for 59¢.

With the potential for corn and beans to test 2022 highs and some folks think corn could drop below $4, using HTAs and puts to capture the extra profit eliminates most of the marketing stress.

To improve your marketing, you need to do some things you never did before.

I highly recommend checking out Wright on the Markets website Here

Weather

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/9/23 - Weekly Grain Newsletter

ARE YOU COMFORTABLE WITH WHAT’S ABOUT TO HAPPEN?

7/7/23 - Market Update

GRAINS SLIDE WITH FAVORABLE FORECASTS

7/6/23 - Audio

OPPORTUNITIES IN THE MARKETS

7/5/23 - Market Update

WHEAT SURGES WHILE CORN & BEANS DISAPPOINT

7/5/23 - Audio

THE HEAVY VOLATILITY CONTINUES

7/3/23 - Audio

ARE THE MARKETS GOING TO BLOW UP OR FIZZLE

7/2/23 - Weekly Grain Newsletter

WEATHERING THE STORM: WHAT’S NEXT FOR CORN & BEANS?

6/30/23 - Audio & Report Recap