CROP TOURS, BRUTAL HEAT, & NO RAIN

Overview

Grains rally across the board following yesterday’s disappointing price action, as all grains close double digits higher. More impressively in the bean market, started last night off down 14 cents but managed to climb back nearly 30 cents off our lows and end the day 14 1/2 cents higher.

Weather and war were the main driving factors today, as the concerns for bean yield loss and this hot and dry weather push beans higher, while war escalations push wheat higher.

We also saw a private jet in Russia carrying the head of the Wager Group crashed. The same group who recently lead the rebellion against Putin. Some are saying it was shot down. Adds more uncertainty to the entire war situation.

As for the war news, we saw Russia launch missile and drone attacks on both the port of Odesa as well as the Danube River. This was seen as a retaliation attack from when Ukraine attacked Russia.

The weather remains brutally hot for the next day or two but looks to cool off a bit as we head into the weekend.

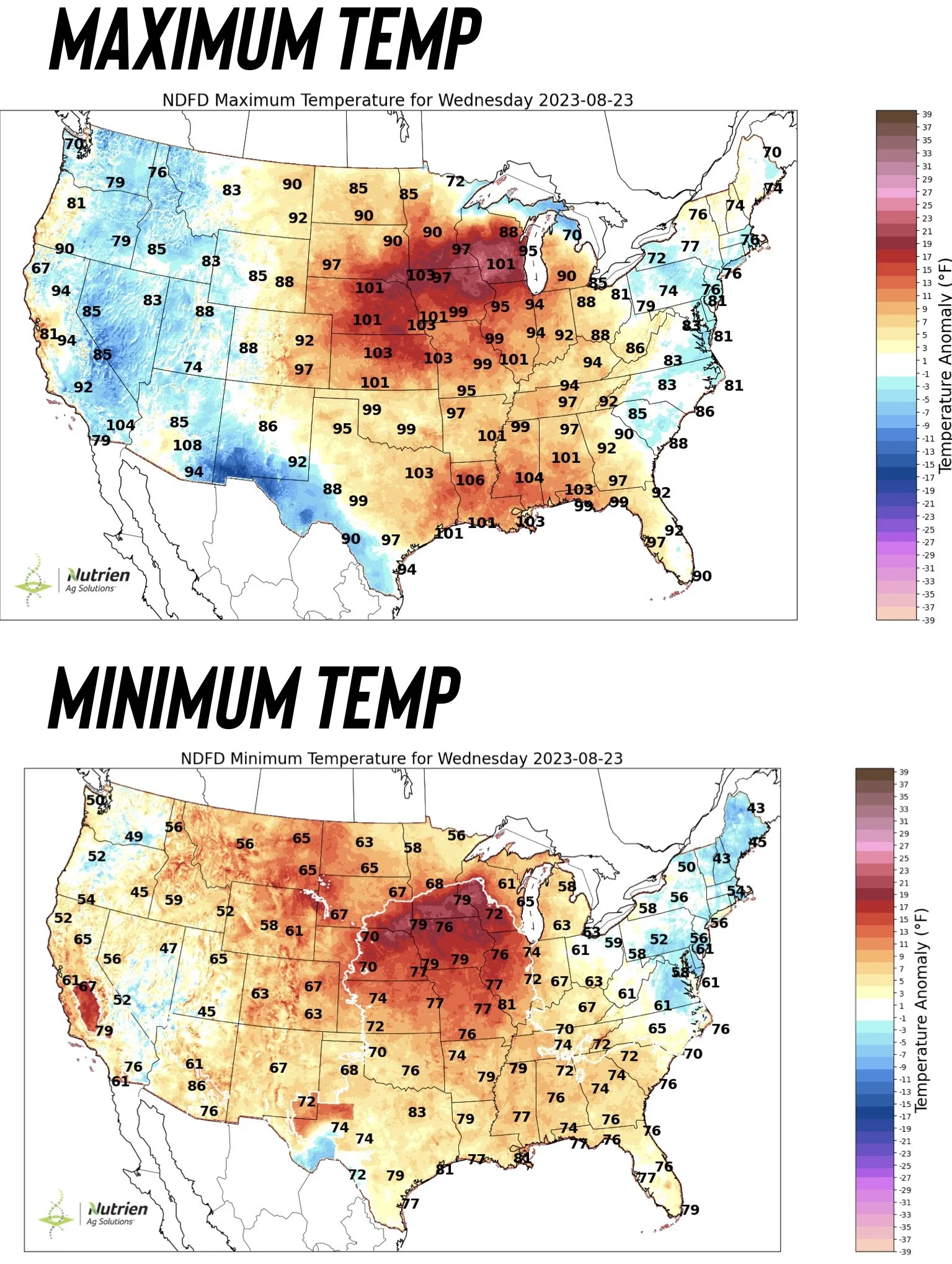

Here was the maximum and minimum temperatures for today. This certainly isn’t helping the crops. The night time temps, if too hot, can be critical.

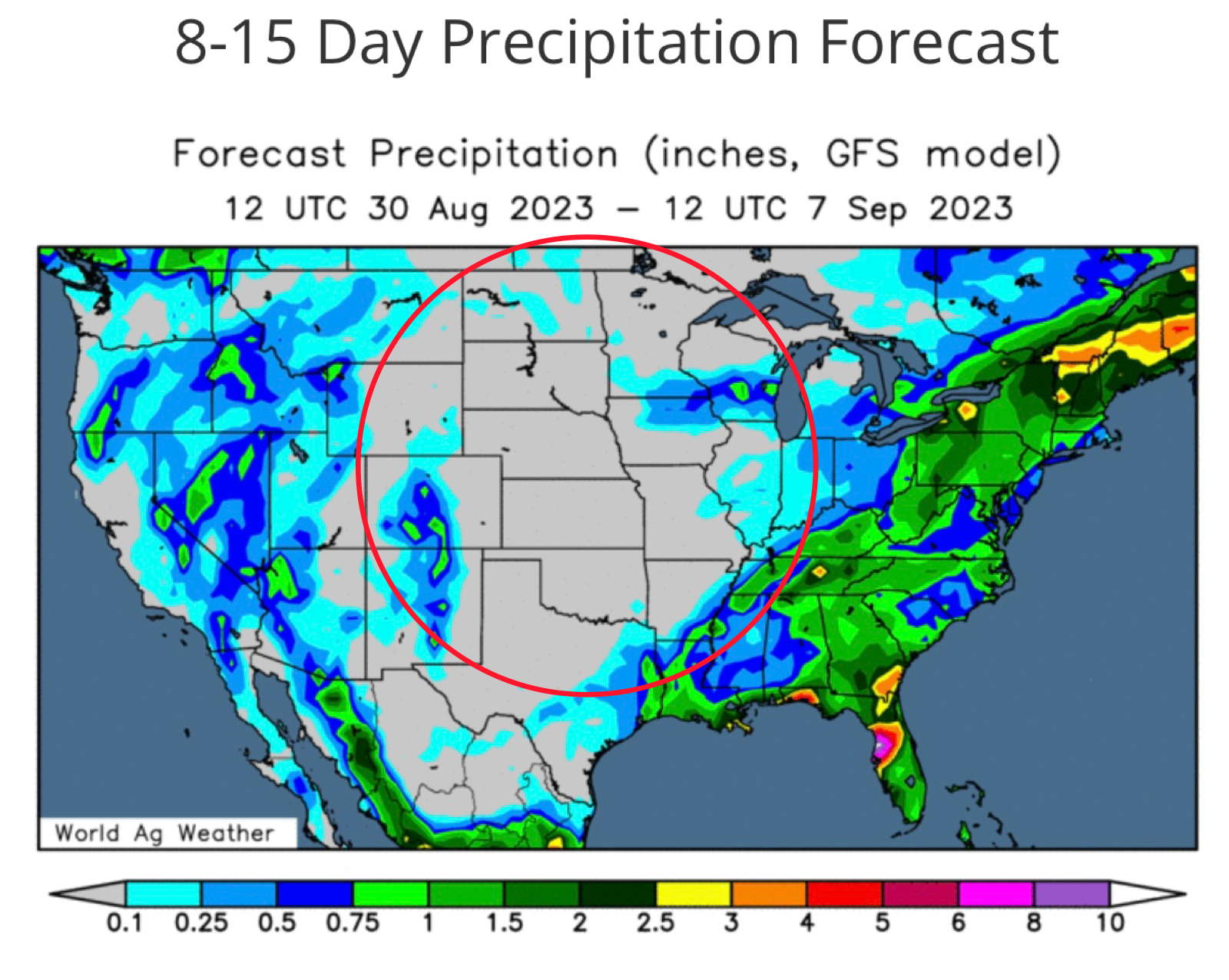

But just as importantly along with this heat, the corn belt is expected to see nearly zero precipitation over the course of the next 2 weeks.

Take a look at the 8 to 15 day precipitation forecast.

I touch on this later, but beans need moisture towards the end of their maturation cycle to prevent yield loss.

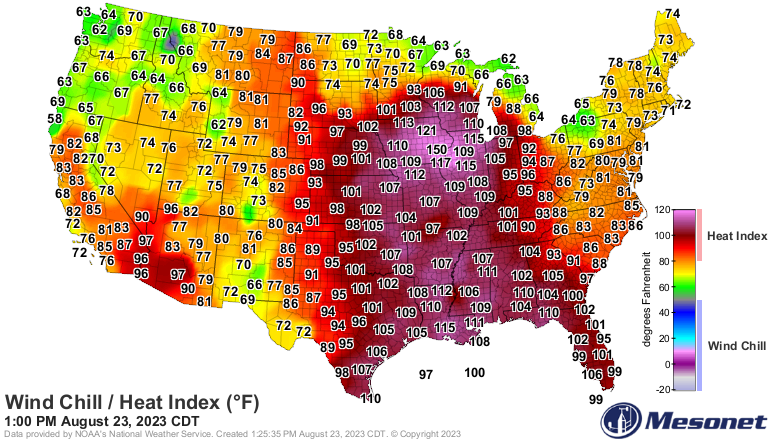

Here was the heat index today. This isn’t actual temperatures. This is just how "hot it feels". Was that 150 degrees a typo? Absolutely brutal heat for those on the crop tours.

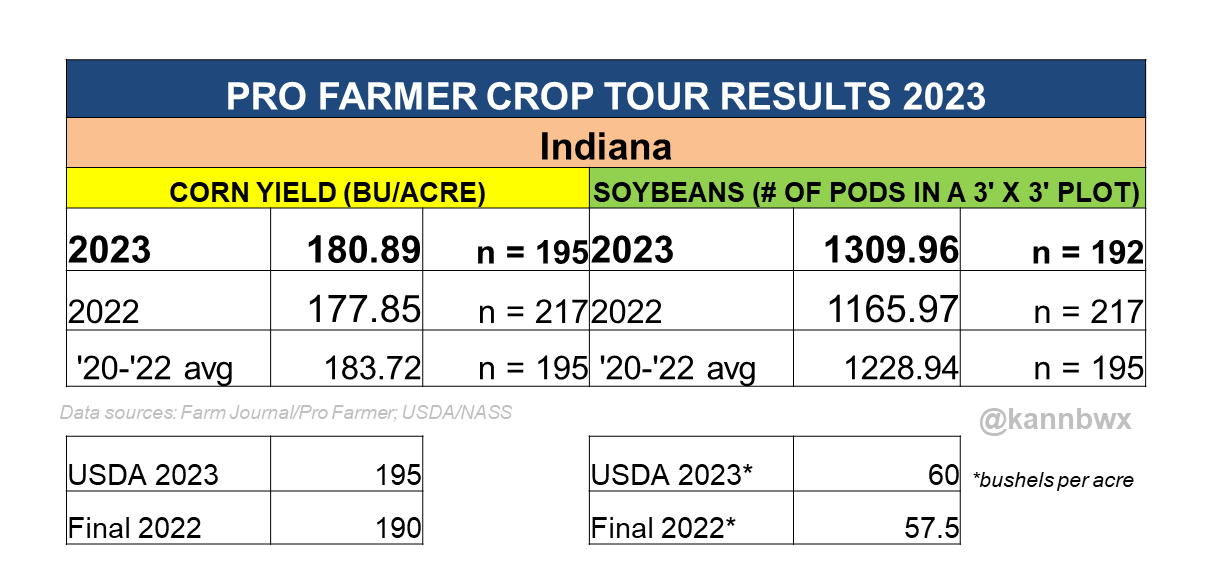

As mentioned yesterday, day 2 of the crop tours weren’t as great as day 1 was, but they weren’t bad. They came in better than last year. Making the first 2 days of the crop tours both coming in better than last year.

Nebraska corn yield came in at it's 2nd lowest for the tour since 2017, but still better than last year. Their bean pods were below last year and the 3 year average.

Indiana corn yield came in below average but also above last year's. However, their beans were solid, showing well above average pods.

So overall, day 2 was mixed. But how does the crop tours line up with final yield historically?

Below is a "cheat sheet" that tells us how far off the tours are usually from the USDA's final number.

For Indiana, they are typically 3.5 bpa too low compared to final yield. Yesterday they came in with 181 bpa. If we add that 3.5 we get 184.5. Which is still FAR below the USDA's current 195 estimate. But is about on par with the states 3 year average.

For Nebraska, the crop tour is usually 14 bpa too low. If we take the 167 bpa we got yesterday and add 14, we get 181. Which is still slightly below the USDA's 184.

Here were the results.

From Wright on the Market,

"These much better than expected Pro Farmer yields will make it very difficult for the harvest reports to be 'better than expected'. That means we can be confident that the fall low will be made before harvest begins"

Today the crop tours are touring Illinois and Iowa. Our two largest growers. The numbers out of these fields will be a big deal.

I don’t think the rest of the crop tours will show as good as numbers as day 1 and 2. So I expect us to start getting more spotty results, which should ultimately support prices.

From Karen Braun,

Karen Braun who is on the tours said that on her 9 stops in West Central Iowa, corn yield was 159 bpa. Last year on her exact same route, the yield was 188 bpa, and was 200 bpa in 2021. We could in for a surprise come 8pm tonight when the numbers are released.

From Darren Frye of Water Street Ag,

"Wow. No way we will stay above 170 as a nation the way Illinois and Iowa are coming in. The crop is on it's way to the grave and limping in at that!"

Tomorrow the tours will finish up, hitting the rest of Iowa and then southern Minnesota.

Taking a look to next week, we get crop conditions on Monday. I have a feeling these are going to be hit pretty hard.

Heartland Farm Partners is predicting a 3% to 5% decline Monday due to this week's weather.

Here is another bold prediction from Jason Britt, the President of Central State Commodities. He is predicting that corn ratings drop by at least 7% and that beans will drop anywhere from 8% to 10%.

I actually don’t disagree with these predictions. We are definitely going to a rather big drop. I think it will shock some people the amount of damage this week's weather has done. We are hearing a lot of talk about just how quickly the crop is deteriorating in the midwest, especially with these type of high overnight temps.

Overall, we saw a great close on the charts across the board. We got some good follow-through strength from yesterday's lows. As we mentioned yesterday, we expect a strong closeout to the week barring any bearish surprises from the crop tours.

Bottom line, this past week has been hot and dry. Future outlook remains dry. We will have to see how these crop tours pan out, but expect a drop in ratings come Monday.

YOUR LAST CHANCE TO LOCK IN THIS SALE…

This sale ended over a week ago. Since you were on a free trial we were still giving you access. Today is your last chance to take advantage of it before it’s gone. Don’t miss our future updates.

Exclusive to those on a free trial.

Become a Price Maker. Not a Price Taker.

$299/yr vs $800/yr

Today's Main Takeaways

Corn

Corn rallies off the back of war and weather headlines. Closing up over a dime and taking out yesterday's highs, which is a good sign. Corn is only down roughly 2 cents on the week.

Lately, corn has struggled to keep any momentum to the upside as we still sit below $5 and haven’t had a close above in 3 weeks as of today.

Demand is still the biggest concern and thing keeping a lid on corn futures.

From what I’ve seen on social media, I think we will see these Pro Farmer crop tours support us to close out the week. Today we have Iowa and Illinois, then tomorrow we have the rest of Iowa and Minnesota. We all know the issues Minnesota has faced with their weather.

As mentioned, I fully expect crop conditions to take a pretty big hit come Monday. How big? That’s to be determined, but we can definitely expect one.

Seasonally, we do down until late September from here. So that is something to keep in mind.

I have noticed a few other advisors placing sell signals for corn and wheat.

Bottom line, I expect this week's heat, the crop tours, and crop conditions Monday to help us put in a bottom here at least short term.

Taking a look at the charts, they are starting to look better. As we took out yesterday's highs with ease. We still remain in a downtrend from May. I would still like a close above $5 to confirm a bottom here. As I have mentioned the past two weeks, if we were to continue lower, $4.60 would be the level of support. On the other hand, we still have that gap to the upside sitting at $5.25 which I think will eventually be filled.

Corn Dec-23

Soybeans

Beans rally following the last two days of disappointment. As beans are now up about 8 cents on the week.

The biggest things bulls are looking at here is the weather story. As I pointed out, we are seeing extremely hot temperatures across the midwest this week.

But just as important as the heat heat, is the lack of moisture we are seeing. There is practically no moisture whatsoever in the forecasts throughout the first part of September.

Towards the end of soybeans maturation cycle, they need moisture. Without moisture, a dry end to pod fill can still result in huge reductions to yield.

From 247AG,

"Soybeans need moisture towards the end of their maturation cycle, not only to avoid aborting seeds, but also for adding to seed size and weight."

So the weather situation is bullish for now. The drastically hot temps are expected to cool down, but if we don’t see any moisture we will still very likely run into problems.

Not only do we not have moisture, but this heat that is disappearing this week is supposed to make a return in September.

Demand has been very strong as of late, and the fundamental situation for soybeans is still really bullish looking both short term and long term.

Now yes, typically it is very tough to see beans lead the way going into harvest. So there is some concern there. But demand and weather might just be enough to keep the support there.

We are also looking at the potential to see some problems over in the South America crop, as the trade will start to begin to pay closer attention to those problems as we move forward later in the year.

Similar to corn, I fully expect the crop tours to come in not quiet as good as they have the past two days. There is even the potential there for them to disappoint.

Additionally, I'm still expecting a rather large cut to crop conditions next week which should ultimately provide some support.

Seasonally, we are in a time where we start to trend lower until lower October. But I wouldn’t be surprised to see us test those highs we had Sunday night.

There is nothing wrong with getting comfortable. If you need to make sales, then by all means do what you have to do. Although I do believe we have more upside if the cards are dealt right, there is an equal amount if not more downside risk. I would rather sell the higher priced beans than the lower priced corn, and perhaps buy beans on paper. Keep in mind, we are still over $2 off our lows from a few short months ago.

I expect us to be well supported for at least the next week or so with all of the weather concerns and demand being as strong as it is.

Short term I have my eyes set on Sunday's highs of $13.81, and this weather story and potential worse than expected results from the crop tour could very easily push us to those levels.

Taking a look at the charts, we are still in a long term uptrend. One thing we do need to be aware of is the potential head and shoulders formation. Support remains at the $13.41 level, which is the area we found support the past two days.

Soybeans Nov-23

Wheat

Wheat futures finally gain some momentum on today's rally, as we get our first back to back green days since August 7th.

One thing bears are pointing at is that we saw some higher Russian wheat estimates from SovEcon. As they raised their estimate from 87 to 92 million metric tons. However, bulls just as quickly point out that this number is just slightly higher than what the USDA has and isn’t a major change. Nonetheless, winter wheat was harvested in July, it is very late in the season to be making such huge production adjustments. Keep in mind, roughly 70% of Russian production is winter wheat, while the remaining 30% is spring wheat.

We saw yet more war headlines which I already touched on. The market often loses interest from war headlines fairly quick as of lately, so we will have to see if we can keep any of this war premium or not. There is still the potential for plenty of war wild cards either way.

Another thing bears are looking at is demand, as the US demand story is one of the weakest we have seen for the better part of 50 years, and the funds have just seemed disinterested in the wheat market for nearly a year now.

Seasonally, this is about the time where wheat starts to turn around and make it's lows for the year. As we have said countless times the past week or two, the wheat story is still one that is going to take some time to unfold. Whether that be weeks or even months from now. But eventually all of the global problems will start to unfold.

Weather and war continue to dimish wheat supplies. We have the Canadian problem, Australia, Ukraine, amongst others. There is a lot of things there that all have the potential to rally wheat. But for now, we just don’t have a major catalyst to justify this huge rally. But we will.

I did notice other advisors had placed buy signals for wheat. I think we are very close to putting in our lows for the wheat market if we have not already done so. I believe we are due for a post-harvest rally.

If we take a look at the charts, we still have a potential double bottom across the board that has held thus far.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Updates You Might’ve Missed

8/22/23 - Audio

DON’T PANIC. TODAY REINFORCED HIGHER PRICE OUTLOOK

8/21/23 - Audio & Market Update

MARKETS PLAYING LEAP FROG

8/20/23 - Weekly Grain Newsletter

WHY THIS IS MORE THAN A DEAD CAT BOUNCE..

Read More

8/18/23 - Market Update

GRAINS BOUNCE. WEATHER REMAINS BULLISH

8/18/23 - Audio

WEATHER,WAR, & MANAGING RISK

Read More

8/16/23 - Audio

CAN DEMAND & WEATHER LEAD TO A BOUNCE?

8/15/23 - Audio

GRAINS LOWER WITH IMPROVEMENT TO CROPS

8/14/23 - Audio

BEANS RALLY BUT CONDITIONS IMPROVE & WHEAT DISAPPOINTS

8/13/23 - Weekly Grain Newsletter

WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio