FUNDS & WEATHER PRESSURE GRAINS

Overview

Grains see a little continuation weakness from yesterday. As the funds are still hesitant to commit to longs in corn and wheat. The main pressure in the markets is coming from a warmer forecast in the upper Midwest to tag along with some profit taking following our recent rally.

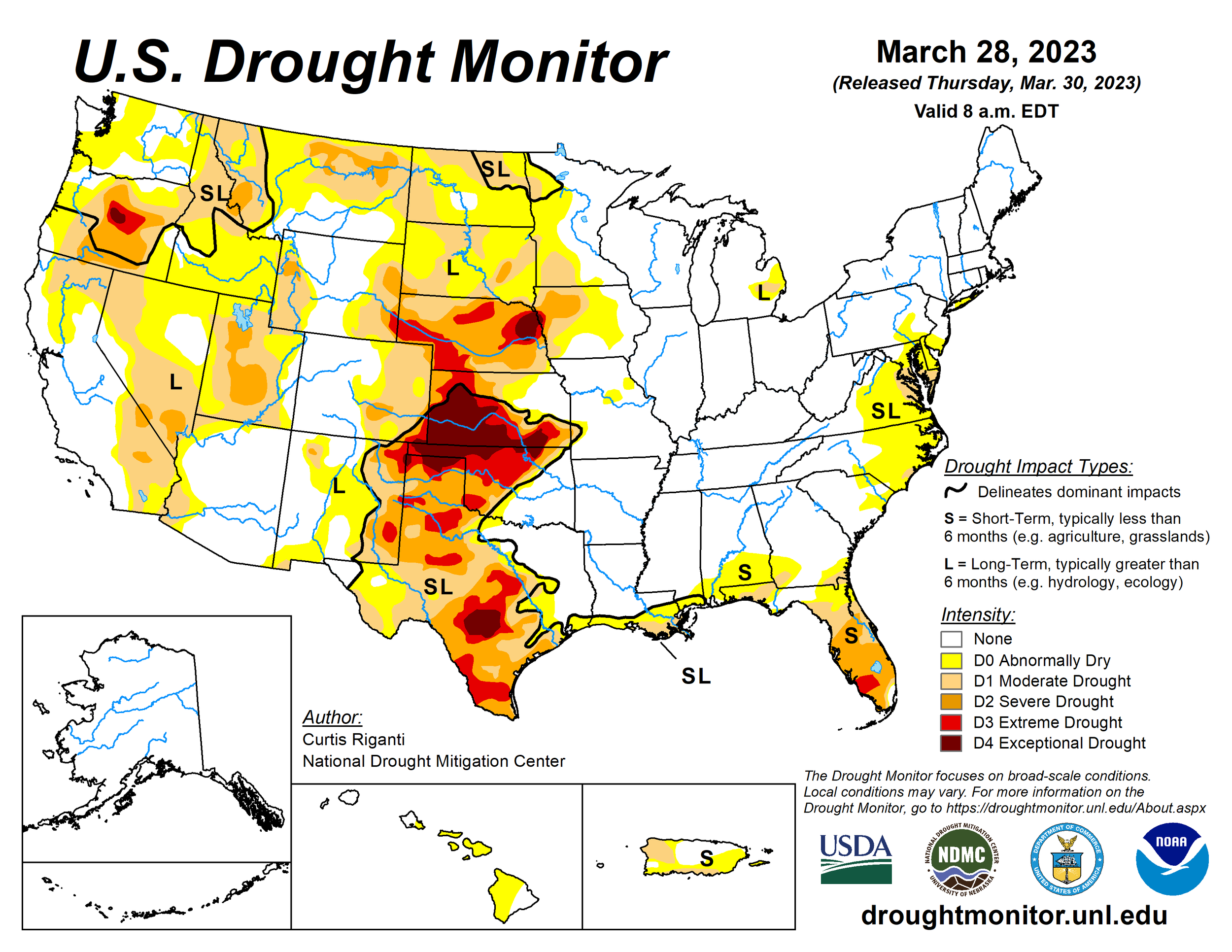

Taking a look at the weather, it looks like we might be getting some better weather and warmer temps for the midwest, following a heavy round of thunderstorms. Northern growing regions are getting more snow today but should be warming up next week.

Funds

On yesterday's lower price action we saw the funds sell across the board. Selling 5,000 corn, 3,000 beans, 8,000 meal, 2,000 oil, and 2,000 Chicago wheat. The funds current positions are short 12,000 contracts of corn, long 110,000 contracts of beans and 96,000 meal. While being short 11,000 oil and still short a heavy 94,000 wheat.

Just a reminder that the markets are closed Friday with good Friday and Easter weekend. Then we have the USDA WASDE report when we return next week.

Listen to yesterday's audio

Why Today Was Bullish Despite Lower Prices

Listen Here

USDA REPORT SALE

We extended our biggest sale ever until the USDA report next Tuesday, April 11th. Get a massive discount on our yearly or monthly option. Receive every one of our updates and audio via text message & email.

Today's Main Takeaways

Corn

Corn holds up the best amongst the grains today. Despite the funds looking to liquidate more contracts. Being pressured by the forecasts showing warmer temps and less precipitation for most of the corn belt.

Bears are looking at the improves planting theater as well as the lack of exports yesterday to go along with higher estimates from South America adding some bearish tone. Demand is another big thing the bears continue to question, as some are arguing the Chinese purchases may be done for a while as they wait for Brazil.

However on the other hand, bulls are looking at Brazil's harvest only being 65% or so complete. With a lot of acres planted late this year. So the argument is that China will ultimately have to again turn to the U.S. for business.

We need to keep in mind we have a long weekend with Easter, and a USDA report Tuesday when we come back. So we shouldn’t be too surprised if we see some pressure until then, as the funds may be looking to reposition ahead of the report and long weekend. Especially given our recent rally, we could see some profit taking.

Going forward, the corn market has potential to see some strength if we continue to see spring planting weather worries. As we have an entire season of weather ahead of us.

Corn May-23

Soybeans

Beans lower again here today, with May trading down 6 1/2 cents.

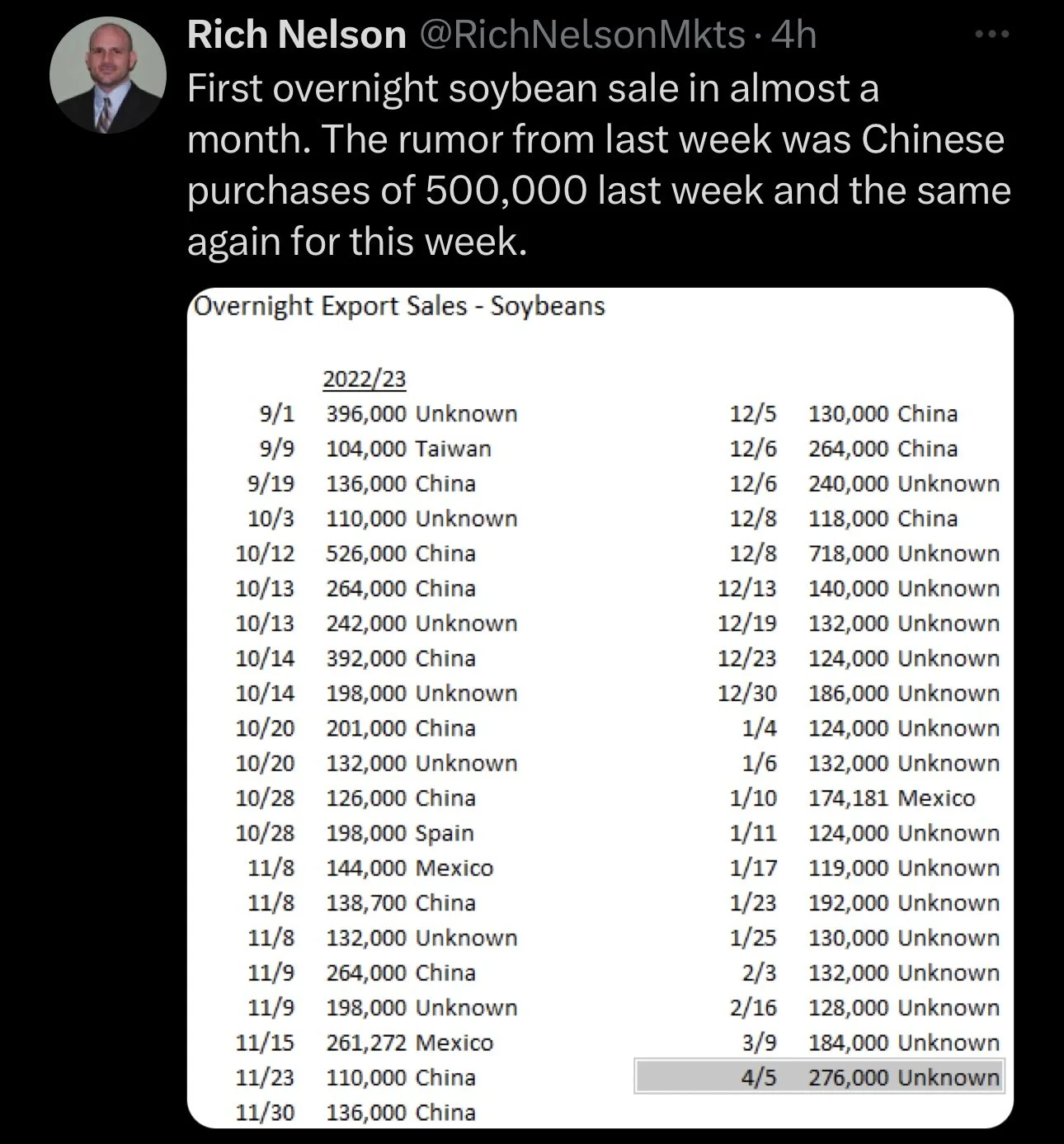

We saw our first overnight soybean sale in almost a month.

Beans are seeing some pressure with the improved outlook in the forecasts here in the U.S. which are looking to promote some planting. We also have the record crop in brazil that's inching along, sitting at about 80% complete.

To add on to that, we have the new Argeninta peso program which could incentivise producers to sell crops to exports. Lastly, as mentioned in the corn section, we have a long weekend ahead of the USDA report with the chance to see the funds move things around.

On the flip side, bulls would like to make the argument that demand might just be strong enough to hold things together. As we have the chance that we see the USDA move both exports and domestic crush demand higher.

With one of the worst weather seasons we've ever seen in Argeninta, Argentina meal exports are looking like they will fall below Brazilian meal exports for the first time in 20 years.

Taking a look at South America harvest. Brazil is roughly 80% done, while harvest in Argentina is just getting started. There is a 40% yield drop expected for the crops in Argentina.

The wild cards for beans are how many acres we actually see planted in the U.S., and how upcoming weather will affect yields.

Short term I could see us run into some more selling before the report, but long term we could definitely see a more bullish demand driven story develop.

Soybeans May-23

Wheat

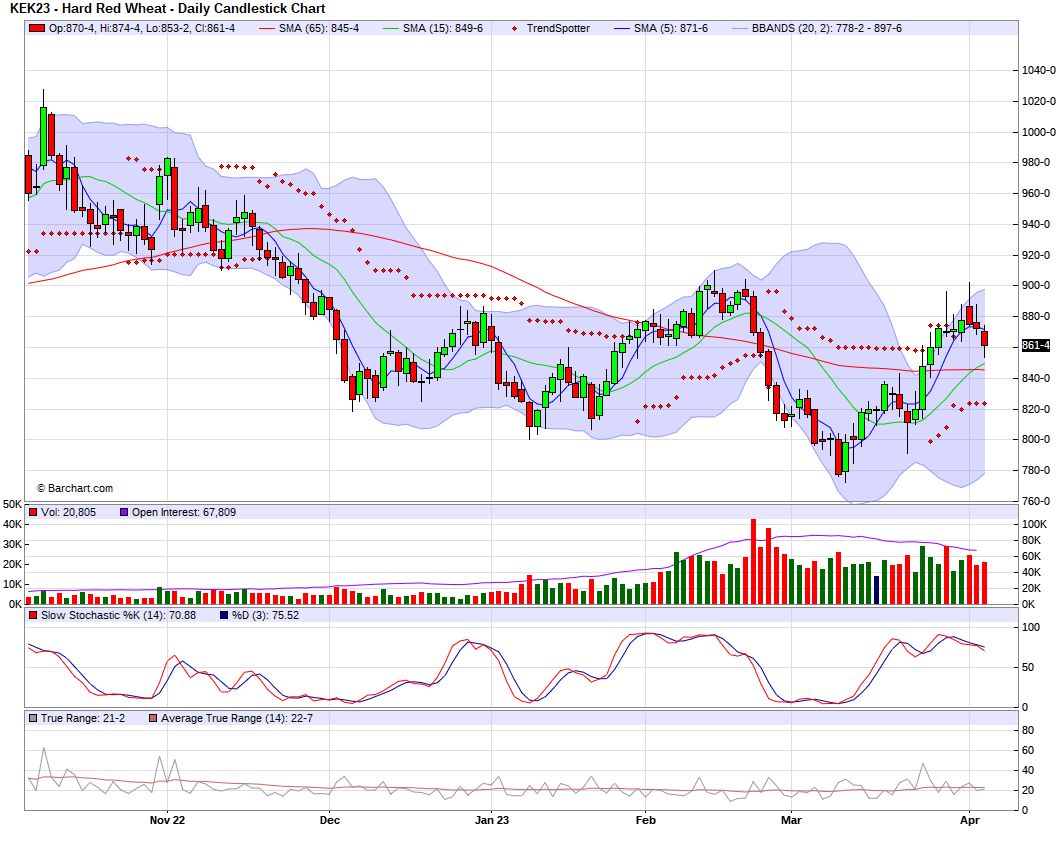

Wheat futures pressured the most today, trading anywhere for 9 to 15 cents lower.

Wheat is trading like we just got a crop saving rain and pattern change for rain and that’s just not reality.

We saw another company join Cargill and Viterra, with Louis Dryfus joining their exit from Russia. Which will go into effect July 1st. These 3 companies account for around 15% of Russia's grain exports.

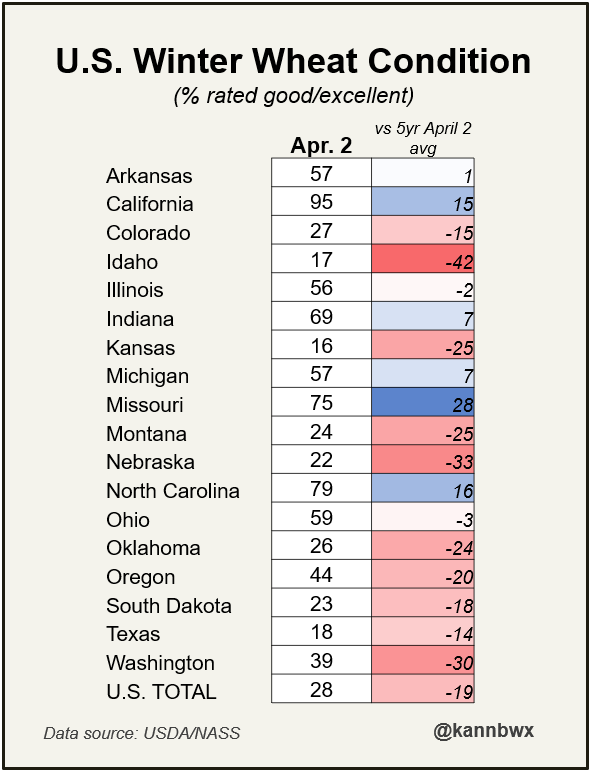

Bulls continue to look at the extremely poor conditions for winter wheat here in the US, where we saw overall conditions come in at a mere 28% rated good to excellent. Which was the worst initial new crop condition report we have seen since the 80's.

So the past two days we saw wheat trading lower on essentially nothing, outside of the funds wanting to do anything besides buy wheat. Have we seen any marginal weather improvement for the crop? No we haven’t.

Well, is the selling over? It's tough to say. We have plenty of bullish factors that all have the possibility to push us higher. Perhaps we do see more downside from here, but I think we could see a reversal sooner than later. Bulls are still waiting for the tables to turn and the funds to spark a short-covering rally. But it’s a big question as to when we actually see that weather or war story ignite things.

Brian Wilson a well respected grain trader on Twitter had this to say on wheat, "When the funds disregard extreme fundamentals they will get punished. Their day is coming. They better hope rains come and they help."

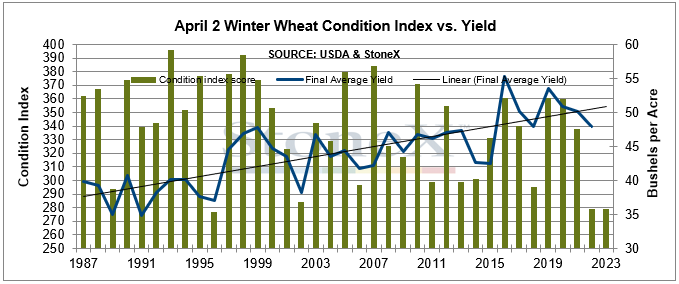

We also saw this week's winter wheat crop condition index score tie last years levels for the second lowest conditions on record for the start of the growing season. This chart shows the history of this index score.

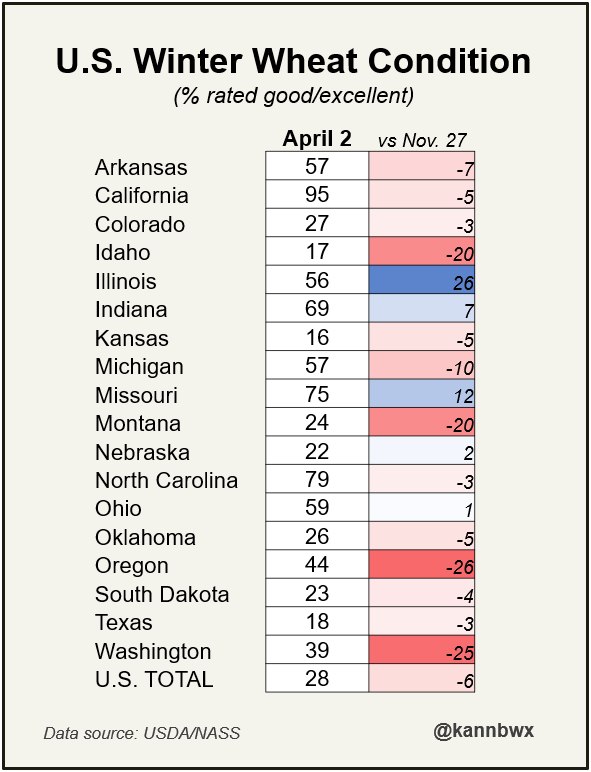

Here are a few charts showcasing the winter wheat conditions. The first one compares this year to the 5-year average. The second compares this week's ratings to the numbers we saw in late November.

Chart Credit Karen Braun

Chicago March-23

KC March-23

MPLS March-23

Is There Heavy Money Betting Against Corn?

From Wright on the Market

There was some bearish talk about the huge number of September $4.50 corn puts being bought for 3¢ a bushel the past week and continued this week. The point being made is that heavy money is “betting” on September corn being below $4.50 this August. Not necessarily.

Point #1 is if corn futures decline 25 cents in the before July, those puts will double, maybe triple, in value even though the futures price will be 60¢ above the $4.50 strike price.

Point #2, a lot of investors with even more money than the put buyers are betting corn will not be below $4.50 because they are writing (first time seller) those puts and are risking corn going to zero cents a bushel. Yes, that is correct, the writers could lose $4.50 a bushel and the most they can make is the 3¢ a bushel the buyers paid for the puts.

Whose corn market knowledge do you want to put your money on in that situation? The buyers risking 3¢ or the sellers risking (in theory) $4.50. Of course, corn will not get to zero value, but it was $3 just three years ago this month… April 21st to be exact as called by Alan Bonifas in November of 2019.

Grains Q1 Recap & Outlook

From Farms.com Risk Management

Grain commodities saw some losses last quarter but made a quick recovery as the funds were selling for the wrong reasons

The Goldman Sachs Commodity Index, in the last quarter reached completed a 50% retracement of the entire 2020 to 2022 advance before bouncing back to close around the mid-point of the range. For Q1 of 2023, the index was down 6%, and from one year ago is down nearly 21% on a closing basis. We would not be surprised to see the commodity sector try to stage a continued corrective advance over the next three months.

Nearby corn futures lost 3% this past quarter but realistically has been treading water since the end of September of 2021! Year over year, the corn market is down nearly 12%. The quarterly grain stocks estimate released on Friday was a reminder to many that we have little room for any production slippage. Until we have a better look at the 2023 growing season, downside potential should be limited in this market, and in fact, a bit of weather risk premium should be in order during the next couple of months.

KC wheat futures did extend down to the lowest point traded in a year, but thanks to a recovery over the past few weeks, finished the quarter down just 1%. Compared with the close a year ago, this market is down 15%. Seasonally, wheat should track generally lower into July, but seasonal patterns have been skewed for some time now, and we would not be surprised to the exact opposite. A push back north of 9.00 would appear in the cards, and a return to the 10.00 level is by no means out of the question.

Chicago wheat has been significantly softer (pun fully intended) than its KC cousin. For the quarter, the contract lost 12.5% and is down 31% from the close on March 31st of 2022. While recent strength has not been quite as robust as KC, it would appear that we have pressed this market far enough to the downside as the funds were too short at -100,000 contracts until we know more about global crop production in the Northern Hemisphere this coming year. A corrective rebound to at least 8.50 and a possible challenge of the 9.00 level would not be out of line this next quarter.

Nearby soybean futures lost 1% for the quarter but only after a V-shape recovery back above $15/bu. Compared to a year ago, the market is down just 7%. During the past several months, the U.S. has been the dominant supplier of soybeans in the world, and there has been a well-publicized crop disaster in Argentina. Those days are drawing to a close, and South America should be the global provider for the next several months. That said, as with corn and wheat, there is no overabundance in global inventories. Until we have a better look at acreage and summer weather in the Northern Hemisphere, bears will have a challenging time pressing this market lower.

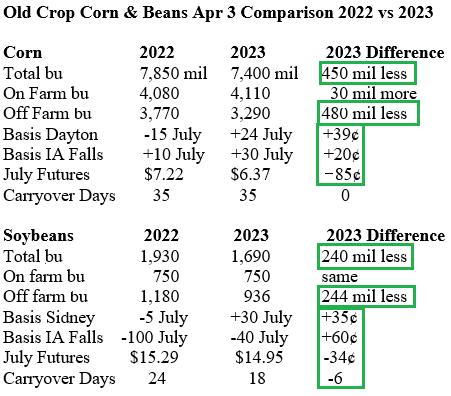

Comparing Last April

From Wright on the Market

We consider the biggest short-term bearish threat is another banking “crisis” to scare the markets. We put the risk of that happening at 50/50, but if that does happen, the sell-off will be short-lived and recovery will be more quickly than the sell off we suffered through three weeks ago.

Maybe we can take some comfort from the news Federal Reserve officials are expressing confidence they have nipped a potential financial crisis in the bud. Now they face a difficult judgment on whether the US economy is contracting and, if so, whether it is fast enough to lower inflation. This type of economic management is the same as a crop farmer restricting yields a bit so he does not have to pay so much income tax. Believe it or not, there are farmers who say they do that.

During April last year, May beans gained $1.70 and May corn gained 97¢ from the first trading day to the high later in April. Please take a long look at the following comparison to assess the current.

Sure, farmers have 30 million more bushels of corn than a year ago, but, my goodness, the commercials have 480 million fewer bushels. I am sure you agree we would rather see those extra bushels in the possession of farmers rather than grain merchants. The other big difference of the two years is the war in the most productive wheat area of the world was a new experience a year ago; it is old news now. Again, the expectation of an event will move the market more than confirmation of an event. The expectation was the war would substantially reduce Ukraine’s crops in 2022. It did with about 15% less production and a whole lot less exports. But we can expect at least one or two more market boosting events this year from that war, which will most certainly extend through the 2023 growing season.

Other Highlights & News

Through March, Minnesota had its third snowiest winter on record.

Argentina grain inspectors have been on strike since last Thursday. Their union announced the strike is to get higher wages to counter inflation.

Argenitna revealed the details for their third expanded currency exchange rate. The program is now called the Agro Dollar.

Check Out Past Updates

4/4/23 - Audio Commentary

Why Today Was Bullish Despite Lower Prices

4/3/23 - Market Update

Beans Over $1 Off Their Lows

4/2/23 - Weekly Grain Newsletter

How the USDA Report Was a Game Changer

3/30/23 - Audio & Market Update

Are You Comfortable Heading Into USDA Report?

3/28/23 - Audio Commentary

Is Momentum Changing in the Markets?

Social Media

U.S. Weather

Source: National Weather Service