FUNDS CONTINUE TO SELL

Overview

Grains ended last week lower on Friday with some pressure from the options expiration. That pressure continuing into the new week here today with grains all lower once again. Grains tried to rally overnight but the rally was short lived as they all closed well off their highs.

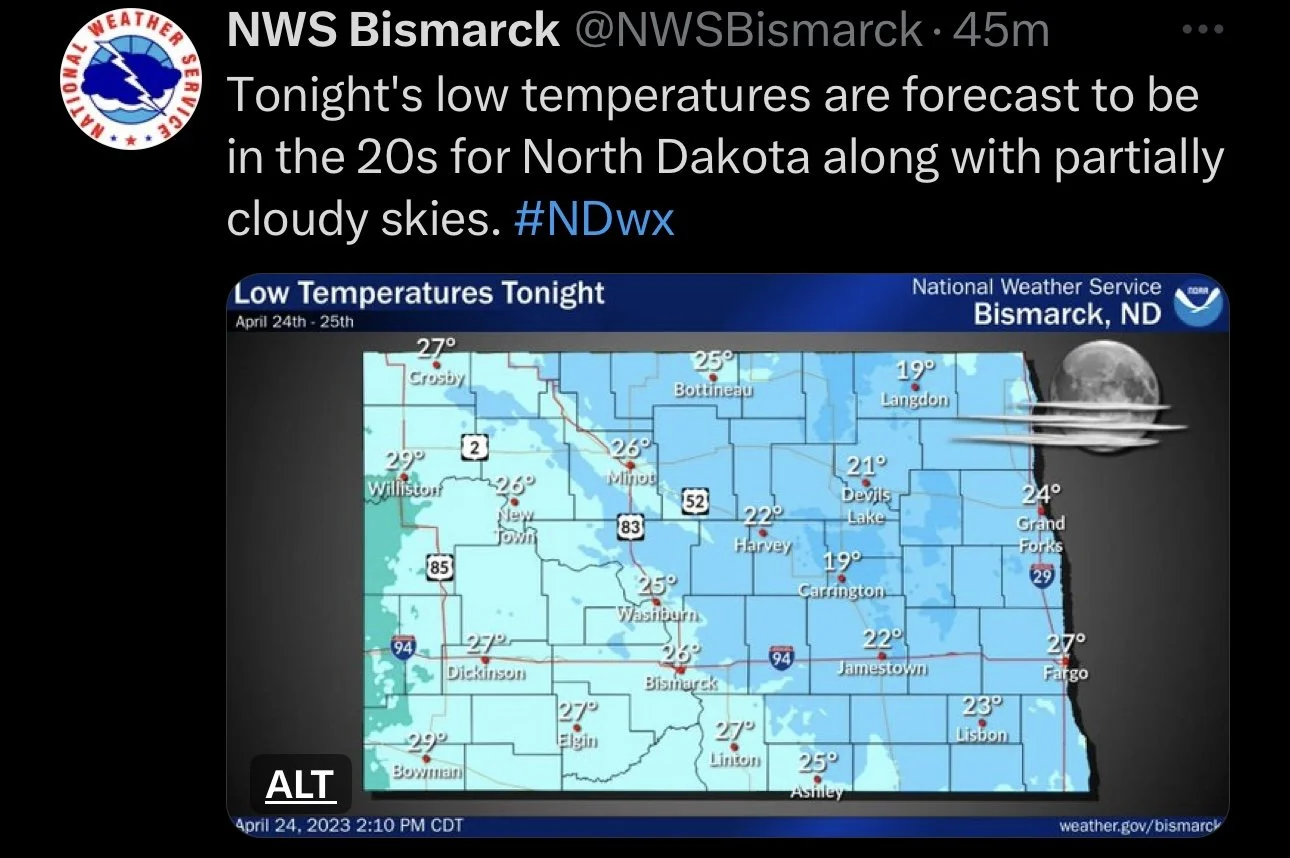

We did see some pretty cold temps across plenty of growing regions over the weekend, but that must not have mattered to the funds. The extent of the damage won't be assessed until the end of the week. Next week's forecasts are also indicating colder weather.

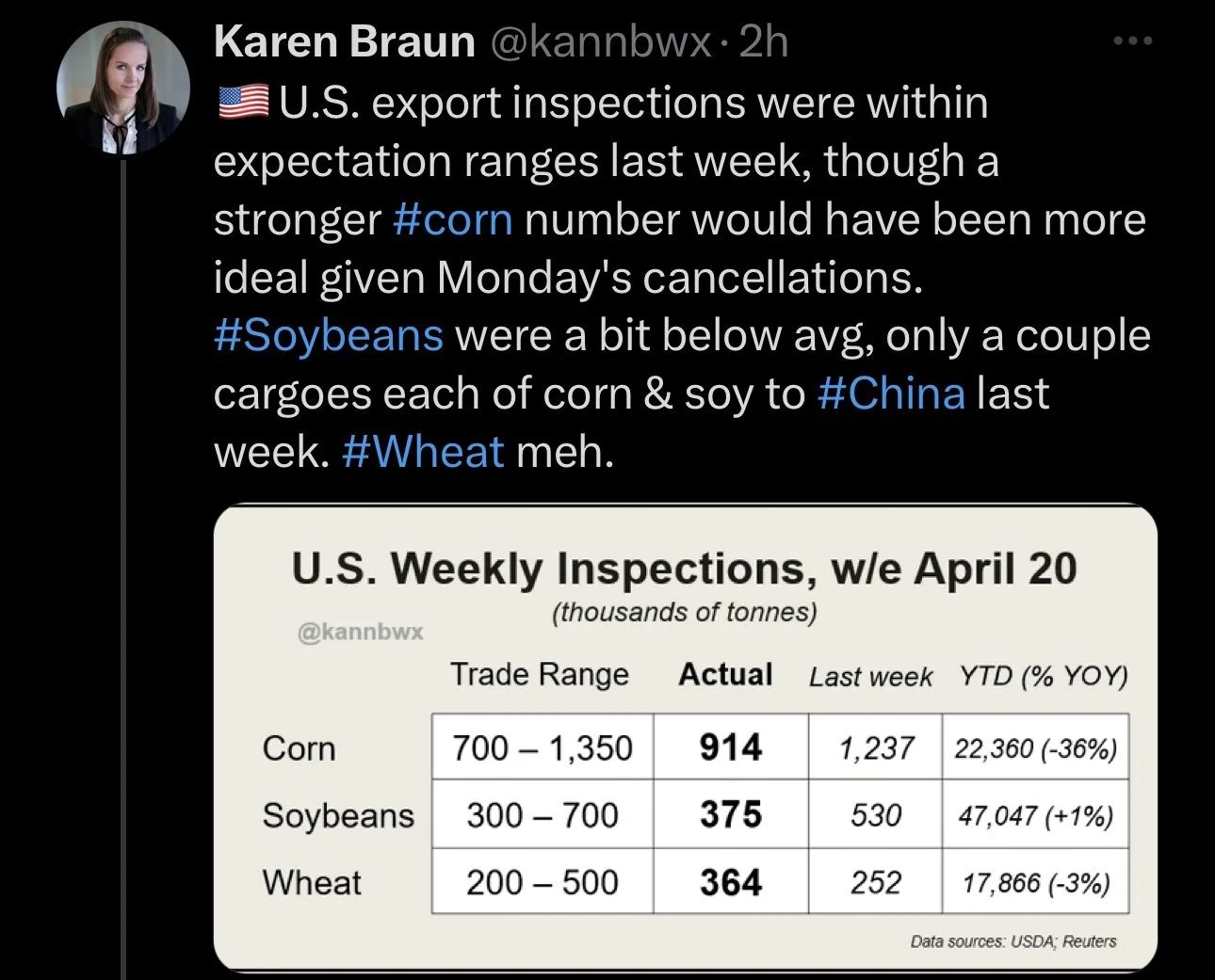

We saw the USDA cancel 327,000 metric tons of corn sales destined for China. This was the first daily corn cancellation since February 3rd, 2022.

Russia continues to suggest they will be exiting the Black Sea agreement.

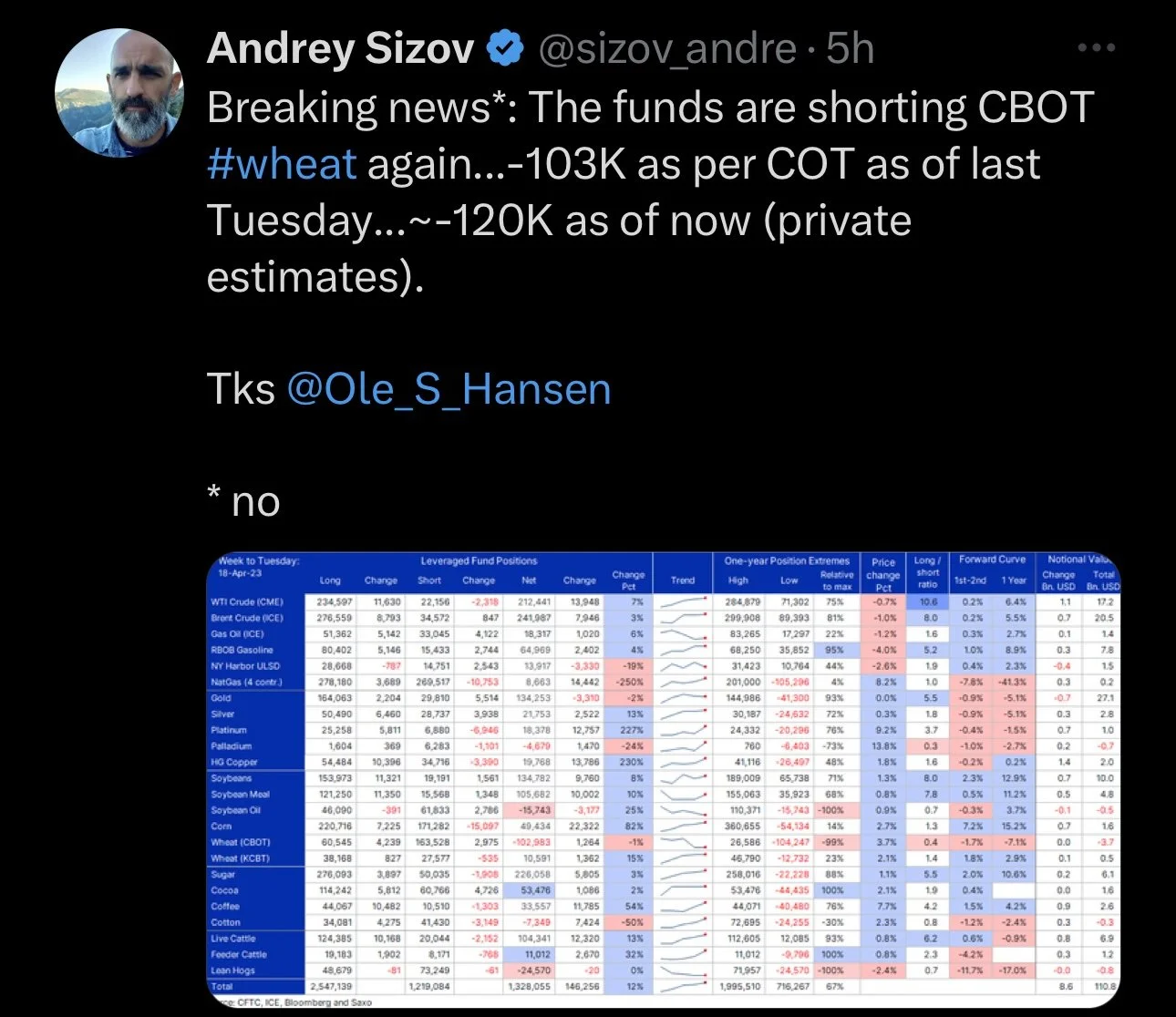

The pressure today was the funds just wanting to exit, as they have continued to be sellers. Today was the fourth day in a row where the funds were sellers across the board.

Export inspections didn't provide any support either, as they were pretty lackluster across the board.

I think last week's sell off was a little over done across the board. Will have to see if we get a turn around Tuesday tomorrow.

***

Read Yesterday's Weekly Grain Newsletter

Do You Have Enough Patience to Wait for All-Time Highs

Read Here

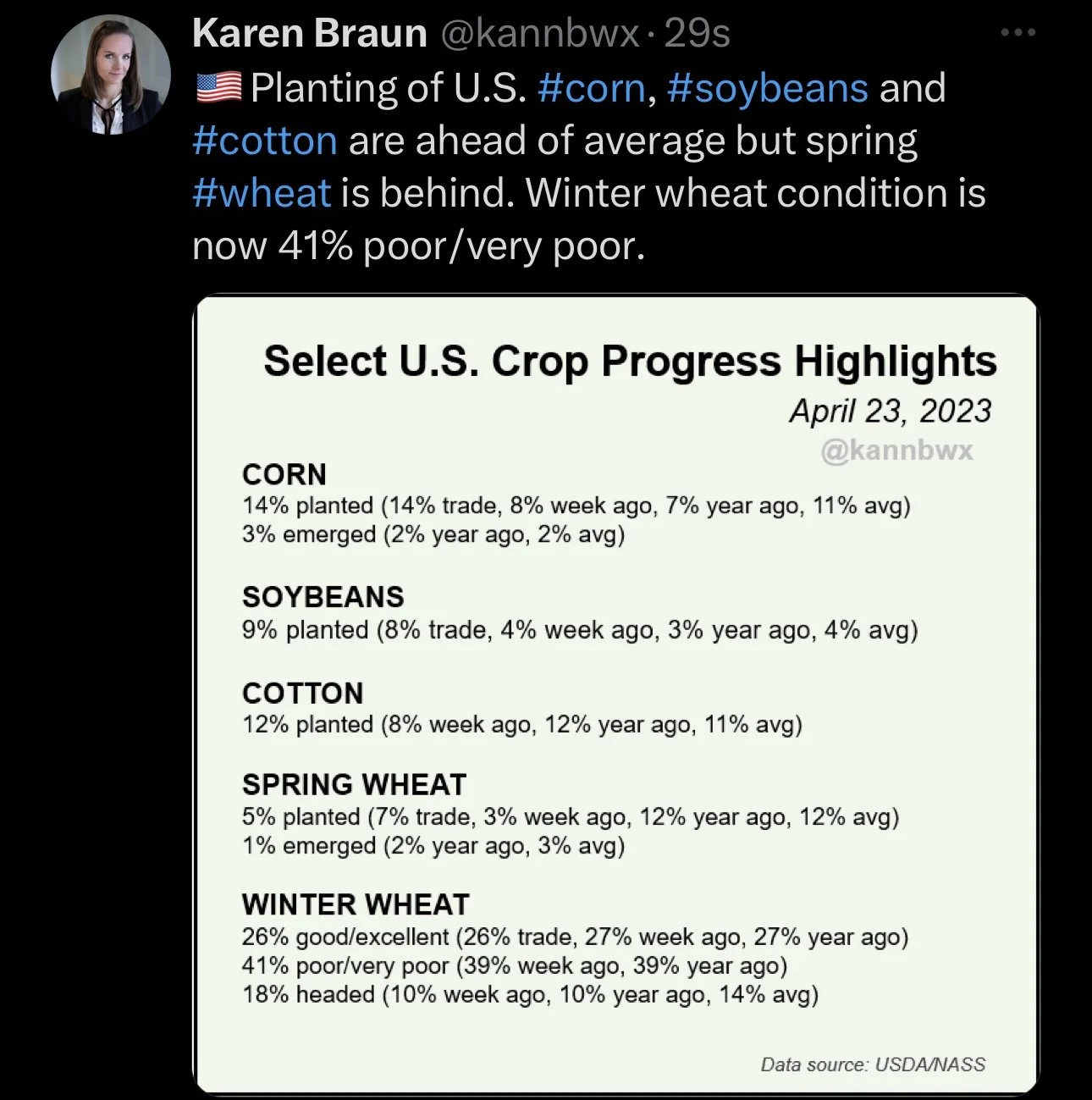

Crop Progress & Conditions

Corn 🌽

14% planted (Last Week 8%) (7% Last Year) (11% Average)

Beans 🌱

9% planted (Last Week 4%) (3% Last Year) (4% Average)

Spring Wheat 🌾

5% planted (Last Week 3%) (12% Last Year) (12% Average)

Winter Wheat 🌾

26% rated good to excellent (27% Last Week)

This is the lowest number on record.

41% rated poor to very poor (39% Last Week)

Second worst on record.

Today's Main Takeaways

Corn

Corn ends the day down nearly 8 cents adding to its losses from last week.

News broke out this morning that the USDA cancelled a sale of old crop corn to China, which messed up the old crop, new crop spreads.

Weather across the corn belt remains cooler than normal for the next week or so as planting season gets underway.

Before today, old crop basis has continued to improve in the US. The spread action last week was also a very bullish indicator across the markets. The inverse spreads suggest that end users still need grain for the summer.

One things bulls continue to debate is the US planted acres and yield. The USDA was looking for over an extra 1 million acres of corn to come out of Minnesota and the Dakota's, but with the winter weather and wet fields bulls are arguing we see this number walked back. Bulls also argue that the 180 yield estimate is a little too far fetched

3 Things We Need For A Bull Market

From The Van Trump Report,

#1: Funds wanting to be bullish and adding more length.

#2: Demand needs to be noticeably growing larger.

#3: Supply-side compilations. Meaning widespread weather worry.

Going forward, we still think the corn market has a ton of potential to go higher. Spreads have been very bullish. Our fundamentals are bullish. And we think we go higher into late spring and early summer.

Taking a look at the chart, we broke below our near term uptrend we had created. As we tested that long term upward trend line from August. Bulls would like to hold that level of support.

Corn July-23

Soybeans

Soybeans close down 13 cents today, adding on to last week's losses.

The biggest issue surrounding beans right now is that beans are trading at a huge discount over in Brazil. But they don't have the storage capacity to hold this record crop. Cash prices are up to $3 a bushel cheaper in Brazil, which has led to some Brazilian bean purchases from the US.

As we saw two cargoes of Brazilian beans going into the US, which isn't surprising with the cheap prices in Brazil but has beans under pressure.

Bears are also pointing to the fact that we haven't seen the spike in Chinese demand like bulls were hoping for.

Rosario Grain Exchange estimates that 2% of Argentina's soy acerage will be abandoned before harvest.

From the Van Trump Report,

There's some interesting or somewhat fresh demand story in the mix for new crop beans with all the buzz around renewables and the new crush plants being built. Meaning we still have a bit of fund interest in the soybean market, we have a future demand story in the mix, and we have perhaps some more sizable supply side concerns with the production losses in Argentina and the logistical and political concerns that can often arise in south America complicating the export business.

Going forward, the bean market will continue to be influenced by of course US weather, Chinese demand, possible logistic issues in Brazil, and the funds.

Weather here in the US will always be a mixed bag, but this is around the time of year we will start adding some more weather premium. Yes, we have a record crop in Brazil, but the biggest problem is actually getting that crop out of the country. If an importer wants beans as soon as possible this spring he might look to the US to buy them, due to the terrible logistic problems in Brazil and drought in Argentina.

It’s tough to be a bull on days like today, but seasonally we go higher from here. We expect beans to climb higher from here and into summer.

Taking a look at the chart, beans also broke a key support, as we broke that upward channel. We have some heavier support at the $14.22 level if we were to continue falling. But bulls would like a bounce and climb back into that channel.

Soybeans July-23

Wheat

All classes of wheat close lower again today, with Chicago seeing the most red, down 16 cents. While KC closed down 8 cents and Minneapolis closed down almost 3 cents. Chicago wheat is now back lower to where it was before its reversal higher.

Russia continues to hint that they will not renew the Black Sea deal when it expires next month. As they basically came out and said they were going to scrap the entire deal with Ukraine. Which had wheat trading higher by nearly a dime overnight. But that rally eventually broke, some think the Russians sold the rally. The deal expires the 18th of May.

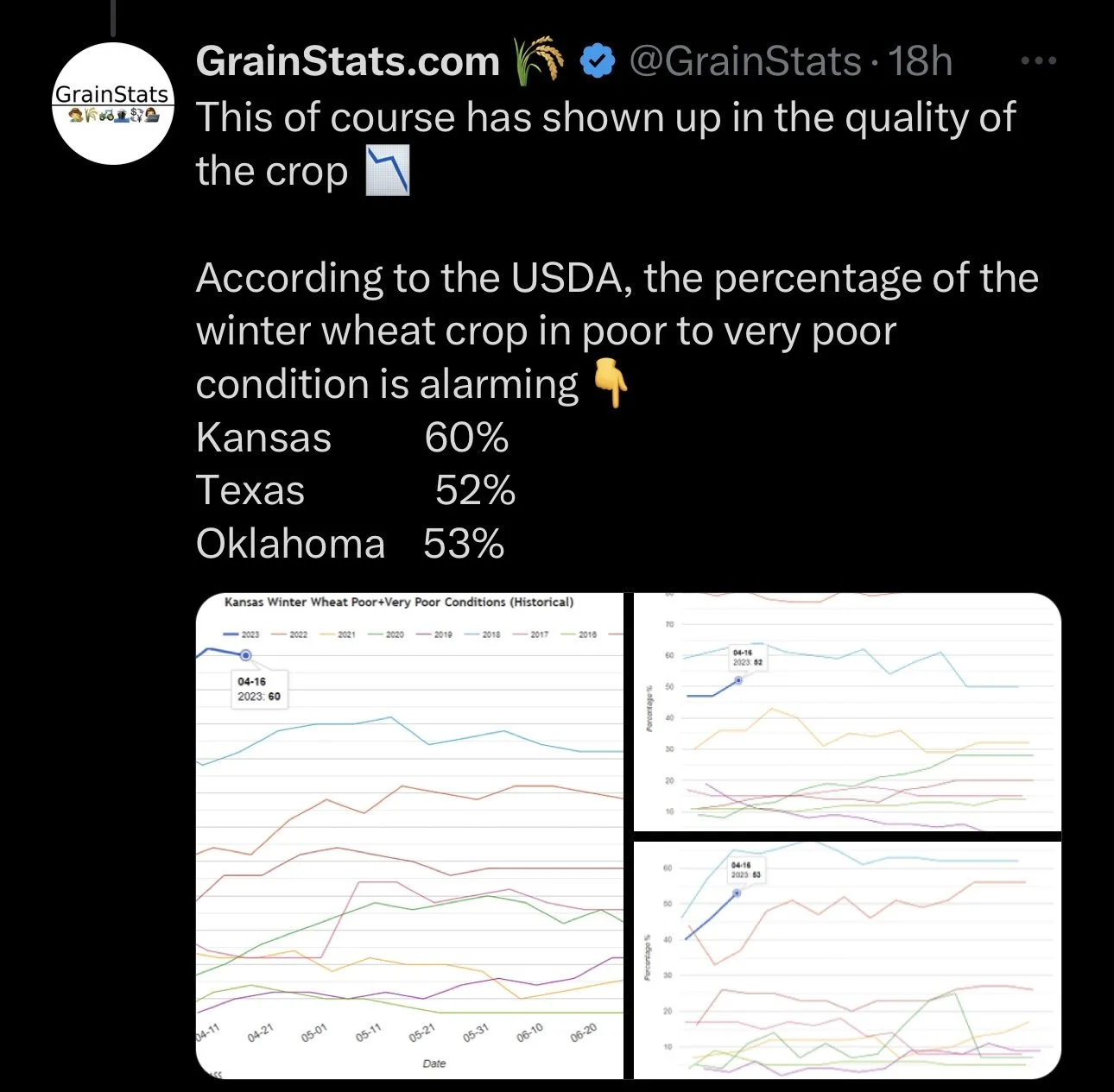

Over the weekend we saw areas in the dry southern plains see below freezing temps, which further threatens the vulnerable winter wheat crop here in the US. As we saw temps as low as 20 degrees or so in parts of Kansas. Forecasts are currently looking for below average temps through the beginning of May. It will take a few days to assess and see how much damage was done to the crop.

It’s a little bit surprising to see KC wheat under so much pressure today, given the fact we might have just got some freeze. But the trade has decided to ignore that. I think the problem in KC wheat is one that's getting worse and not better. We have also seen the rain forecasts shift to a little less rain than they originally had. The big question is how much rain do we actually get from these forecasts, as the long term perception forecasts have been anything but consistent. We also have to wonder if the overly wet spring wheat areas will dry out enough to get the crop planted.

After close today we got the updated crop conditions. They showed winter wheat conditions at 41% poor to very poor, which is the 2nd worst behind only 1996. While 26% of the crop was rated good to excellent. This is tied for the lowest number on record.

I have been a bull in the wheat market for some time, and the market continues to prove us wrong, giving back every rally we get. But now isn't the time to switch sides. We have a terrible crop here in the US, and there is still plenty of war and weather wild cards left in the deck to ultimately push us higher.

Taking a look at the chart, the market continues to leave bulls scratching their heads. As we again make new lows, sitting in a clear downtrend.

Chicago July-23

KC July-23

MPLS July-23

Corn Basis

From Wright on the Market,

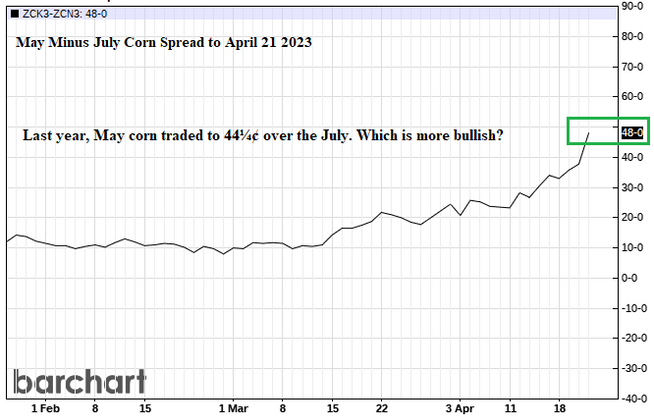

Eugene mentioned in the Weekly Basis yesterday that May corn gained 14¢ on the July corn last week. May corn closed the week 48¢ over the July.

In 2022, May went 44¼¢ over the May on 3 March. May corn traded to $8.27 and July corn to $8.24 on April 29, 2022.

What those two facts should be telling you is the July corn price can reasonably be expected to come to May price as the May futures fade away.

Of course, many merchandisers will tell you that should not happen, but why is May 48¢ above July?

Traders long May corn want to accept corn deliveries or they are just speculating on the spread and have no intention of taking delivery of corn. Certainly, many of those traders long May corn are speculators as well as commercial hedgers. If the majority are speculators, they will be selling May corn this week to avoid any chance of being assigned delivery on Friday, first notice day for May deliveries.

If May corn weakens down to the July futures price this week, then we will know cash corn is readily available and July corn need not rally.

With May corn gaining 10¼¢ on the July on Friday, is it reasonable to think May corn will crash this week? It is possible, but a little common sense needs to be applied if you have corn in the bin or on a basis contract.

If you have May corn basis contracts, congratulations, you just hit a home run. Thirty years from now, you should be telling your grandchildren about the 2023 corn market.

But, should you roll from May to July today or maybe as late as Thursday? You have a big bird in the hand (48¢). Do you want to go for the two birds in the bush (more than 50¢)? It is reasonable to expect some profit taking on the spread today, but I would be sorely tempted to wait for late Monday or Tuesday to decide to roll early in the week or wait until Wednesday or Thursday to roll.... but you already hit a home run.

We have said many times, inverted markets are bullish indicators until, at the least, the new crop is made. The market wants your corn and beans now because the available supply does not meet the demand. Therefore, the cash price must rise enough to reduce demand to meet the available supply.

On Thursday, we did not have enough $6.64 corn to allow May futures to decline more than a half cent on Friday. July corn settled at $6.15¼ on Friday, down 10¾¢. Do you think we will have enough $6.15 corn in June and July to meet the demand? Brazil will still be jammed with soybeans in July, waiting for new crop corn harvest, Argentina and Ukraine have no corn to export. A little common sense needs to kick-in here.

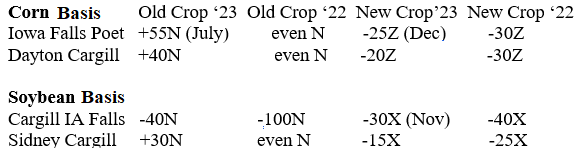

Take a look at basis for this date 2023 compared to 2022 for corn and beans:

At every location for every delivery period, the basis is firmer this year than last year. That means futures are too cheap. Does that mean futures have to go up? No. But it does mean the demand for corn is much stronger than what the futures market has priced into it. The futures market is trading gloom and doom economics, increasing interest rates, fear of everything going bad. What does any of that have to do with the demand for corn and beans now? Maybe later this year or next year, but how many months has the market been trading gloom and doom?

The fact is the US economy contracted the first six months of 2022 and has been expanding ever since.

I highly recommend checking out Wright on the Market below

Seasonality in KC Wheat

From Farms.com Risk Management,

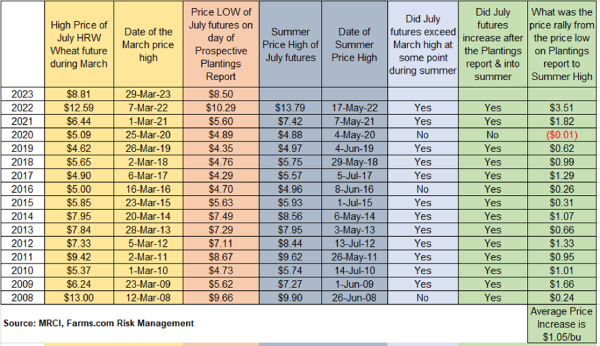

The seasonal rally tendency for new crop July KC HRW wheat futures is to rally thru the early part of the year and peak by summer/mid-June. The 15-year average price rally from the low of the USDA March intentions report day, to the summer high is $1.05/bu and works 14 out of 15 years. (Please see chart below)

The low historically is during mid-Aug/mid-Sept, while the highs (looking at the 30 year-average) could be any time from late-April to early-June. Looking at just the prior 5 years, the summer high has been in late-April.

The 2023 new crop July 2023 gain of $1.05 would put futures at a summer high of U. S. $9.66/bu (currently at U.S. $8.255/bu) and could see a gain of +15.7%.

Technically, July KC HRW wheat futures are trading in a sideways range of $8.00-$8.70. $8.8725 is its ceiling. A close above $8.8725 could cause a rally with a 2–3-month target of $10.04/bu.

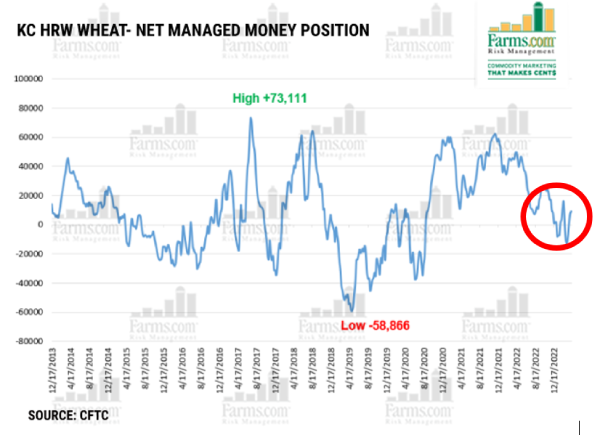

Kansas produces 25% of the total UI.S. HRW production, but a drought for the last 8 months is resulting in a very high abandonment of acres with some forecasting as much as 30% and average production will fall from 300 million bushels to 200 million. Kansas led the downside with 60% of its winter wheat rated P-VP with 57% of Kansas is in drought, along with 43% of Oklahoma, 29% of Nebraska, and 18% of Texas. Add the fact that the Black Sea Grain Imitative may not get renewed on May 18th and the risk to futures is to the upside longer-term as funds continue to ignore the fundamentals near-term as they continue to worry and sell for the wrong reasons as the macroeconomic clouds continue to gather.

Bottom Line

Post COVID seasonality has not been the same as pre COVID for all commodities, but a looming economic recession continues to overshadow grain fundamentals. The U.S. Wheat Quality Council Tour on May 15th will provide for insight on the devasting drought in the Western Corn Belt that have many talking a repeat or worse than the 1930’s “Dust” Bowl. A cancellation of the Black Sea Grain export initiative on May 18th should also force funds to add back some sort of “war” risk premium but the USDA in the coming months also needs to chime in with lower yields and harvested acres.

The funds are no longer short and have started to go long and there is plenty of room to go record long so there are plenty of reasons to remain bullish for the next 30-60 days but need a technical break out above $9.00 or the 200-day moving average at U.S. $8.73/bu.

ENJOY OUR STUFF? TRY A FREE TRIAL

Try our free trial to receive every single one of our updates. Every update & audio sent via text message and email.

Check Out Past Updates

4/23/23 - Weekly Grain Newsletter

Do You Have Enough Patience to Wait for New All-Time Highs

4/21/23 - Market Update

3-Day Sell Off Continues

4/21/23 - Audio Commentary

Ugly Day On the Surface, but Spreads Tell Different Story

4/20/23 - Audio Commentary

Patience & Seasonal Opportunities in the Market

4/19/23 - Market Update

Grains Pressured Across Board

4/18/23 - Audio Commentary