GRAINS CONTINUE THEIR REBOUND

Overview

Grains posting another strong day, following our strong close we saw on Friday. Led by beans and wheat, who are both working their way well off our recent lows.

The biggest thing this week will of course be the USDA report on Friday, and how the trade positions itself ahead of the report. This will include the quarterly stocks and prospective plantings acres. We will have estimates out later this week.

We do have to keep in mind that the USDA outlook forum had rather large numbers, so we will get some big estimates. So there is the risk there that we see the USDA come in with some unrealistic but huge numbers. So we shouldn’t be too caught off guard if the report does come in bearish.

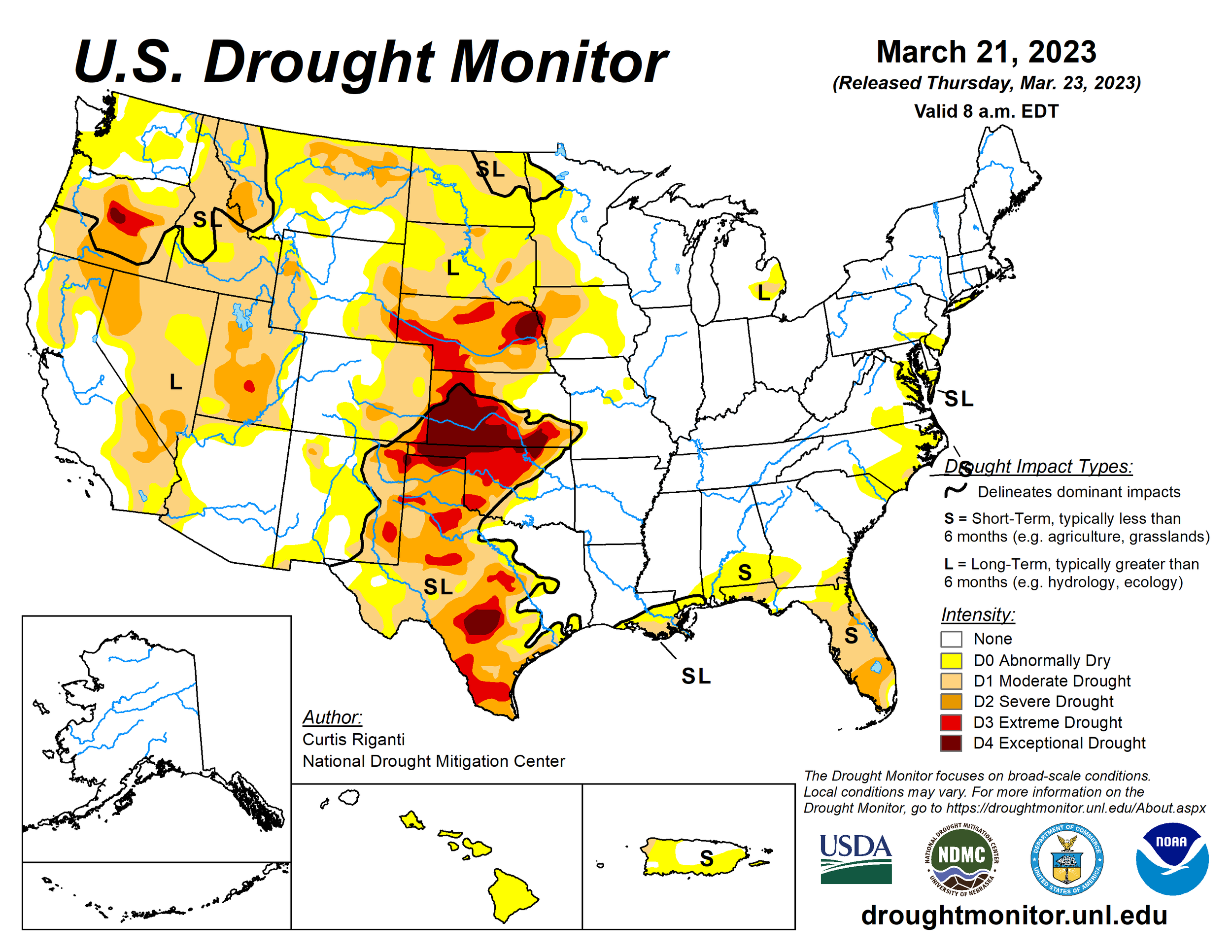

Following the report, the trades focus will start to shift back tino trading weather and demand. We will be watching if we continue to see strength from Chinese appetite this week following their recent purchases. Weather will also be a larger factor, currently its a mixed bag. Will we see some areas delayed in planting due to snow cover, or will we see dry weather set in as we transition from La Niña to El Niña. There has been more talk recently about possible drought in the corn belt.

Read Yesterday's Weekly Grain Newsletter

What Have Funds Already Factored In? - Read Here

Some Factors This Week

USDA Report & the price action leading into the report.

Weather, will we get more snow causing planting delays? Or will we get warmer weather.

Chinese demand, will China continue to buy on daily flash announcements. This morning we had a flash sale to unknown.

Russian news. Will there be any more follow up news from the potential banning of wheat and sunflower exports.

Today's Main Takeaways

Corn

Corn posts another solid day, closing up over 5 cents on the day and 11 cents off its early lows. As May corn trades at its highest levels since late February.

We saw another flash sale of corn this morning, this time it was 204k metric tons to unknown. Adding on to the recent purchases we've seen from China.

As of Friday, the CTFC showed the funds were short a little over 40k contracts of corn.

Corn harvest is almost half of what it was last year in Argentina at 5.4% vs 10% last year. Safrina corn planting in Brazil is 96% complete.

A few things bulls are looking at;

Recent strength in exports.

Very poor Argentina crop. Current corn harvest is almost half of what is was last year at 5.4% vs 10% last year.

Overall uncertainty in Ukraine exports.

Wet conditions in parts of the U.S., with the chance to cause delays or reduce acres.

To counter act that argument, bears on the other hand are arguing that U.S. exports are still trailing and exports may need to be trimmed. Additionally, some are arguing that the crop in Argentina is done deteriorating from here, which could mean that the crop is entirely factored in already.

The big thing this week will of course be where the numbers come in Friday. As for the prospective planting report, we saw Farm Futures magazine release results from their farm survey. Their results had acres at 87.7 million, down from 88.6 million last year.

This number is also a lot lower than hat the USDA Ag Forum Outlook had. As they had 91 million new crop planted acres.

Taking a look at the quarterly stocks report, we need to keep in mind that the quarter from December to February could show some pretty poor exports. So we could see the repot show demand down by a lot compared to the same quarter last year.

Going forward, there is still the possibility for some weather rallies down the line to go along with other global headlines and fundamental factors. The next two months will be crucial to Brazil's corn planting as they are wrapping up. We also have an entire U.S. growing season ahead of us.

So the bottom line is we need to be prepared for the chance that the report Friday could print some poor numbers resulting in some selling. But following the report, the markets will go back to trading weather and demand.

From a technical standpoint, corn has made a nice reversal off our lows, as we broke through the resistance of $6.37 to $6.40 range. If we can break past the $6.50 level I don't see why we wouldn’t look to test the $6.60 range and our long term moving averages.

Corn May-23

Soybeans

Last week beans took it on the chin, at one point down nearly 80 cents or so. But Friday and today provided support, as November beans are almost 40 cents off their lows made Friday at $14.05, closing today at $14.42.

As of Friday, looks like the funds are still long by a good amount in both beans and meal. Holding roughly 110k contracts or so.

One of the biggest things pressuring beans is still the massive crop we have in Brazil as well as cheap exports coming from the country.

We also had Brazil's President scheduled to meet with China's President Tuesday. Which some perceive as a slightly bearish micro headline. But Brazil's President got sick and canceled the meeting.

Taking a look at Argentina, the USDA currently has their estimate at 33 million which will likely be lowered. It’s looking like most see this number closer to 25 million, which is well below the last two years of 44 and 46 million.

As mentioned in the corn section, we saw survey results from Farm Futures magazine. They had soybean acres at 89.6 million. This number would be a record high and higher than last year's 87.45 million.

The USDA's number in their Ag Forum Outlook was forecasted at 87.5 million acres which is just about where we came in last year. There is a chance we see this number come in slightly higher Friday with the wet weather.

However, if we take a look at the quarterly stocks report, we could see some bullish numbers with strong demand for exports and domestic crush.

Going forward, there could be some more bullish factors in store down the line as we work our way off our recent lows. But we have to remember the climb to the top isn’t going to be a straight line. This week could be a volatile one as we approach the report.

Taking a look at the chart, beans have made an impressive reversal. We will have the see if the funds will look to liquidate a few more of their longs before the report or not. Bulls would like to stay above that bottom long term trendline and eventually get that break out of this short term downtrend.

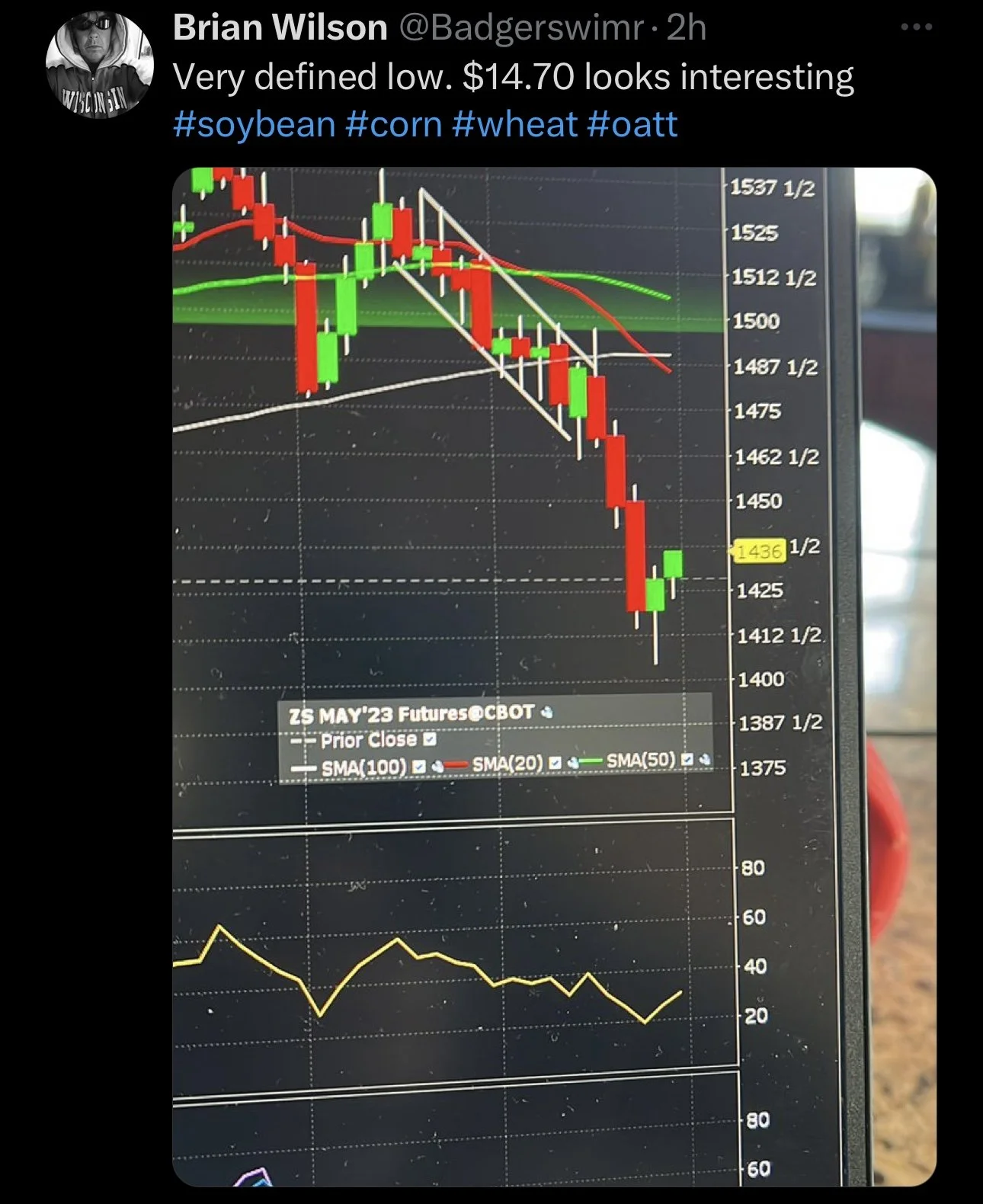

From Brian Wilson (Respected Soybean Trader on Twitter)

"To me, November beans are short term overbought, long term oversold."

Soybeans May-23

Wheat

Wheat seeing some follow through strength from Friday, as wheat futures close up 9 to 16 cents with Minneapolis leading the way.

Outside of the report, the other big thing to watch for in the wheat market this week is if we get any follow up news regarding Russia halting their wheat and sunflower exports. So far we haven’t got any major updates.

To sum it up, the reason we saw wheat futures rally to close out the week was that Russia is considering halting wheat exports as the prices were simply too cheap for Russia, to the point where farmers couldn't afford to grow wheat. This in turn sparked some fund buying from their massive short position.

Just the thought of Russia halting exports (even if it doesn't happen) might be enough to cause a short covering rally, with the funds holding as short of a position as they are.

Taking a look at the report, prospective plantings for winter wheat acres were last reported +3.7 million higher. However, some are arguing winter wheat acre estimates are a tad too high and we see this number lowered. To add on to this, with the high insurance levels and poor crop conditions, some are saying we won’t see nearly as many acres harvested as were originally expected. We also have some wet field conditions that could lead to fewer spring wheat acres.

The quarterly stocks report is mostly a wild card. Some are expecting demand to come in higher than last year.

From Ag-Trader News,

Ukraine's farmers are planting less acres than last year. The International Graincs Council forecasts Ukraines grain output at 47 million metric tons, which is roughly half of what it was before the war. The government warned that the 2023 combined harvest for grain and oilseed could fall down to 63 million metric tons, which is a big decline from last year's 70 million that was harvested.

Going forward, weather and war headlines will continue to be the factors at play. Bulls are looking for one of these to get rid of the bears and the heavy short position the funds hold.

Taking a look at the chart, we are getting close to testing that bottom trendline resistance. A solid break above and I like our chances of going to test the the upper downward trendline.

Chicago March-23

KC March-23

MPLS March-23

Education

From Wright on the Markets

FOB = Free on Board; it is the price of a product loaded on the buyer’s wheelbarrow, wagon, truck, train or ship.

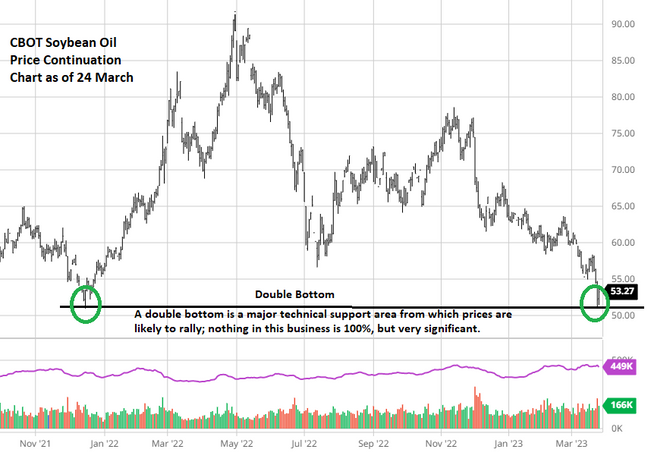

The FOB soybean oil cash price in South American markets has declined below $1,000 per mt (45.3¢ per pound), the lowest price in more than two-years. The CBOT soy oil futures price is down to 53.27¢ per pound.

The Argentine FOB Up River and Brazilian FOB Paranaguá outright prices are $988.55 per mt for May shipment, the lowest level for a front-month loading since January 27, 2021, more than two years ago.

So far in 2023, FOB soybean oil prices in both SA origins have dropped by nearly 20%, while CBOT futures have also lost 15% since January 1.

Despite severe drought-related crop losses in Argentina, the world’s largest exporter of soybean oil, traders’ attention has been on a record crop in Brazil, falling energy markets, world economic jitters and slow demand from key destinations, mainly China and India.

India suspended its tariff for 2 million mt of soybean oil imports last spring when Malaysia and Indonesia restricted palm oil exports. Indian buyers took advantage of the tax-free imports and loaded up last summer and autumn. CBOT bean oil price peaked at 91.4¢ a pound 29 April 2022 in anticipation of huge exports and future demand for Sustainable Aviation Fuel (SAF). Note the price action of soybean oil since late 2021:

There is a day coming when soybean oil will begin a price rally that will shock the world with its strength. The beginning may be at hand (signaled by the double bottom) or it may be a couple months away, but it will happen and, when it does, soybean meal will eventually be cheaper than it has been in a decade, maybe two decades.

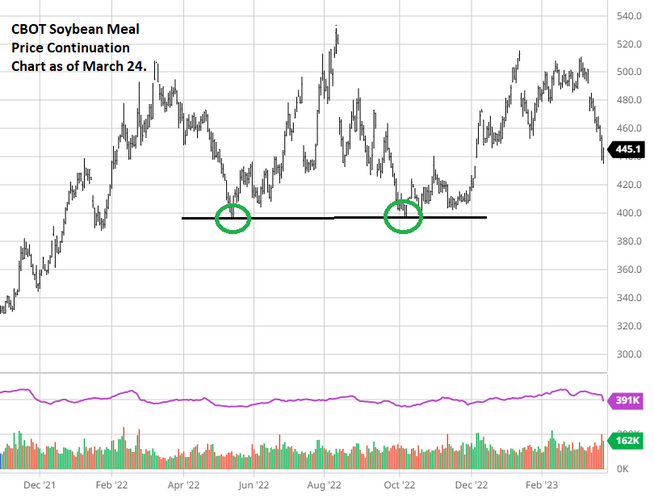

CBOT soybean meal traded below $400 per ton in 2022 in May and October 2022, making a double bottom which launched the rally to above $500 per ton two months ago. Note the price action:

Will the double bottom do for bean oil what it did last year for bean meal? We will find out soon.

Enjoy Our Stuff? Try 30-Days

Try our 30-day trial to receive every update & audio via text message and email.

Crude Oil

Crude continues to move up off its lows, up nearly $4 today. Getting close to testing that long term downtrend. I could see us running into resistance there as I still think we could see more downside. But perhaps crude did put in it's bottom.

Highlights & News

La Nina has offically ended, but there is a 50% chance that an El Niño event occurs letter this year.

The UK's annual food price inflation hit 18% in February. Which is the highest since 1970.

Bloomberg fears that a global biofuel boom could lead to a shortage of vegetable oils.

Farm Futures Survey shows lower U.S. corn and higher bean plantings.

Russia could extend fertilizer export limits until November.

Check Out Past Updates

3/26/23 - Weekly Grain Newsletter

What Have Funds Already Factored In?

3/24/23 - Audio & Market Update

Russia Halting Wheat & Sunflower Exports?

3/23/23 - Audio Commentary

Chinese vs The Funds

3/22/23 - Market Update

Beans & Wheat Sell Off Continues

3/21/23 - Market Update

Beans & Wheat Continue to Disappoint

3/19/23 - Weekly Grain Newsletter

Mother Nature & Black Swans

Social Media

South America Weather

Argentina 4-7 Precipitation

Argentina 8-15 Precipitation

Argentina 15-Day Percent of Normal Precipitation Forecast

Brazil 8-15 Precipitation

U.S. Weather

Source: National Weather Service