GRAINS FADE OFF EARLY HIGHS

AUDIO & MARKET UPDATE

Bombing on Odessa, market doesn't care

Drought monitor showed overall decrease, but increase for midwest

Canada remains dry, supporting Minneapolis. There is talk about 2021 comparison.

Technical selling in both corn and beans

Option volatility is still high. Which means the market is still worried

For some of you, putting in a floor might make sense

Options strategies

Sfs market continues to be weak near side

Cattle market continues to want to go up. Is the trend your friend

Raising floor prices

Heat continues to come

Listen to today's audio below

OUR SALE ENDS TOMORROW

Lock in this discount before it’s gone and your free trial expires. 24 hours left.

$350/yr vs $800/yr

Become a Price Maker. Not a Price Taker.

Overview

Markets mostly lower here today, after showing some initial strength. As at one point November beans were trading 13 cents higher while August beans made new contract highs, but ultimately led us to the downside, with November down 22 cents. Chicago wheat was up 17 cents at one point as well, before closing down 7 cents.

Overall there isn’t a ton of fresh news. The lack of fresh news for bulls to chew on can ultimately lead to lower prices on days like today.

Export sales this morning were good for beans, okay for corn, and in the middle of the range for wheat. We did see another flash sale of beans.

Yesterday the Feds raised interest rates for the 11th time in 17 months. However, Powell said that we have a long way to go to get inflation to 2%, which indicates further increases in the future.

We saw another bombing in Odessa, but the market doesn’t seem to care about that anymore.

We got the newest drought monitors today. Overall, they showed improvement across the US, but the midwest showed a little bit of increase in drought. So that was fairly neutral.

Minneapolis wheat was the strongest of the grains today, up 8 1/2 cents. A lot of the strength was likely due to the persistent dryness over in Canada. As there are a lot of people starting to make comparisons of 2021 now.

From Wright on the Markets,

"July will likely be the driest since 2014 for the corn belt since 2014. While April to July will likely be the driest since 2012 or 1988. If August is moderately drier than normal, April to August would be the direst since 1988 with a low chance to be the driest since 1936."

From Jason Britt of Central State Commodities,

"To me the trade is severely under estimating how much this extreme heat in much of the Midwest is taking a toll on corn and soybeans right now. Going out on a limb, but the drop in crop ratings Monday may be shockingly bad. Too many conversations with customers to not feel that way."

Weather looks to continue to be very hot at least through the beginning of August. This should support both corn and beans moving forward if it stays that. I think the break in beans on days like this will be bought back fairly soon barring any shift in the weather. But there was talk about some potentially below average temps after the first week in August, which was another reason for the profit taking and lower prices.

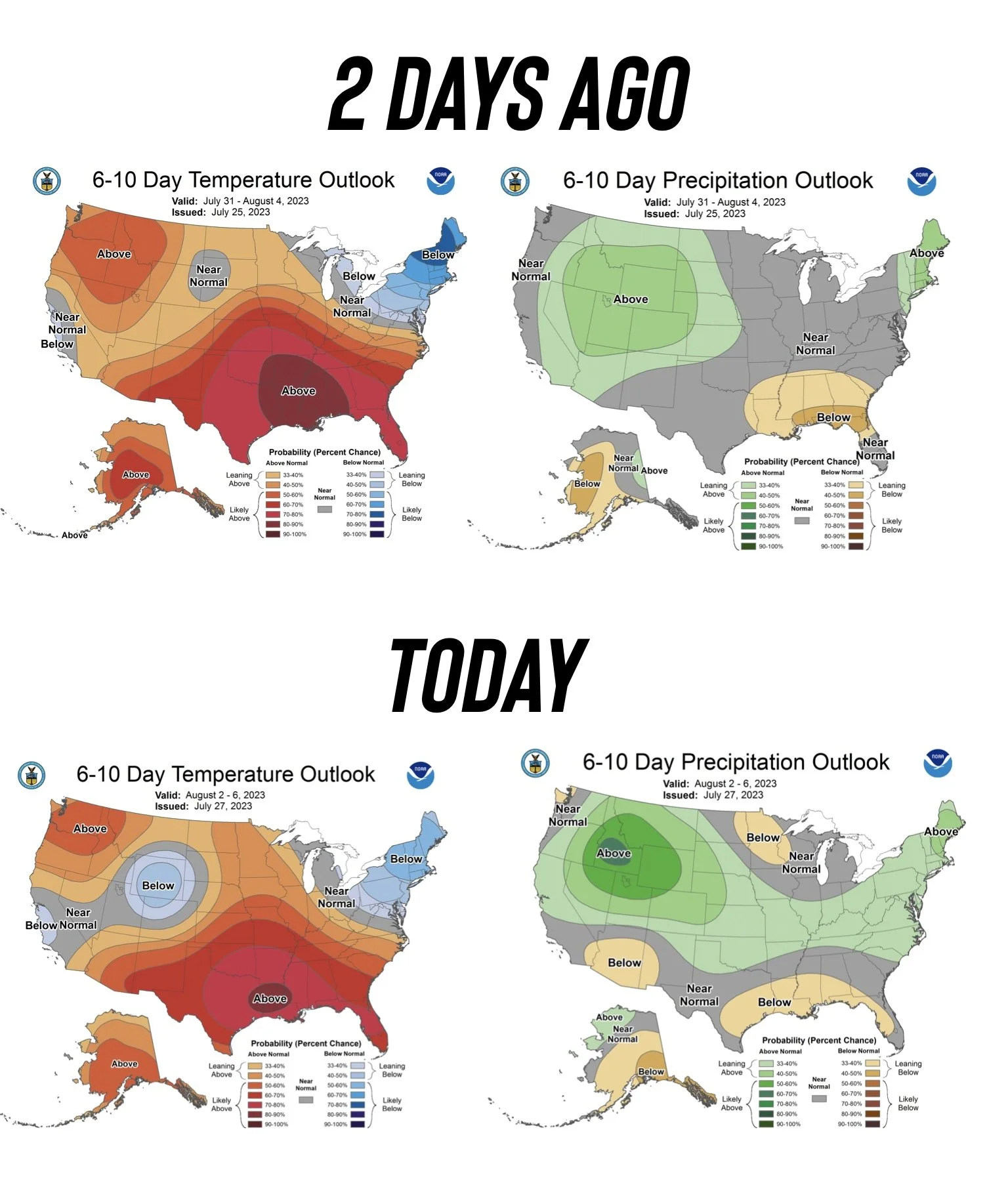

Temperatures remain scorching, however, the market is now pricing in some rains around and after August 6th. Here is the current 6 to 10 day outlook from today vs the outlook from two days ago. This was a big reason we saw pressure in the beans.

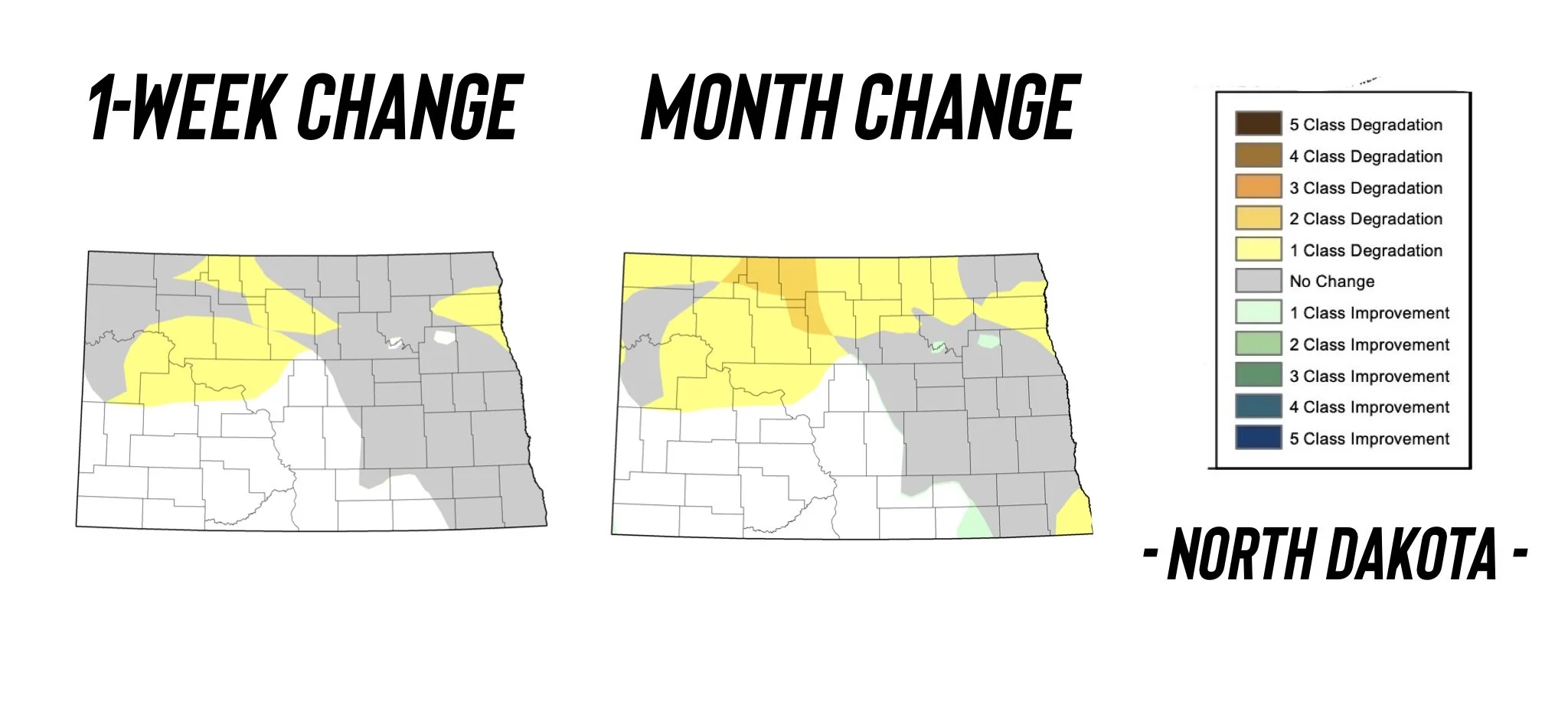

Drought Change

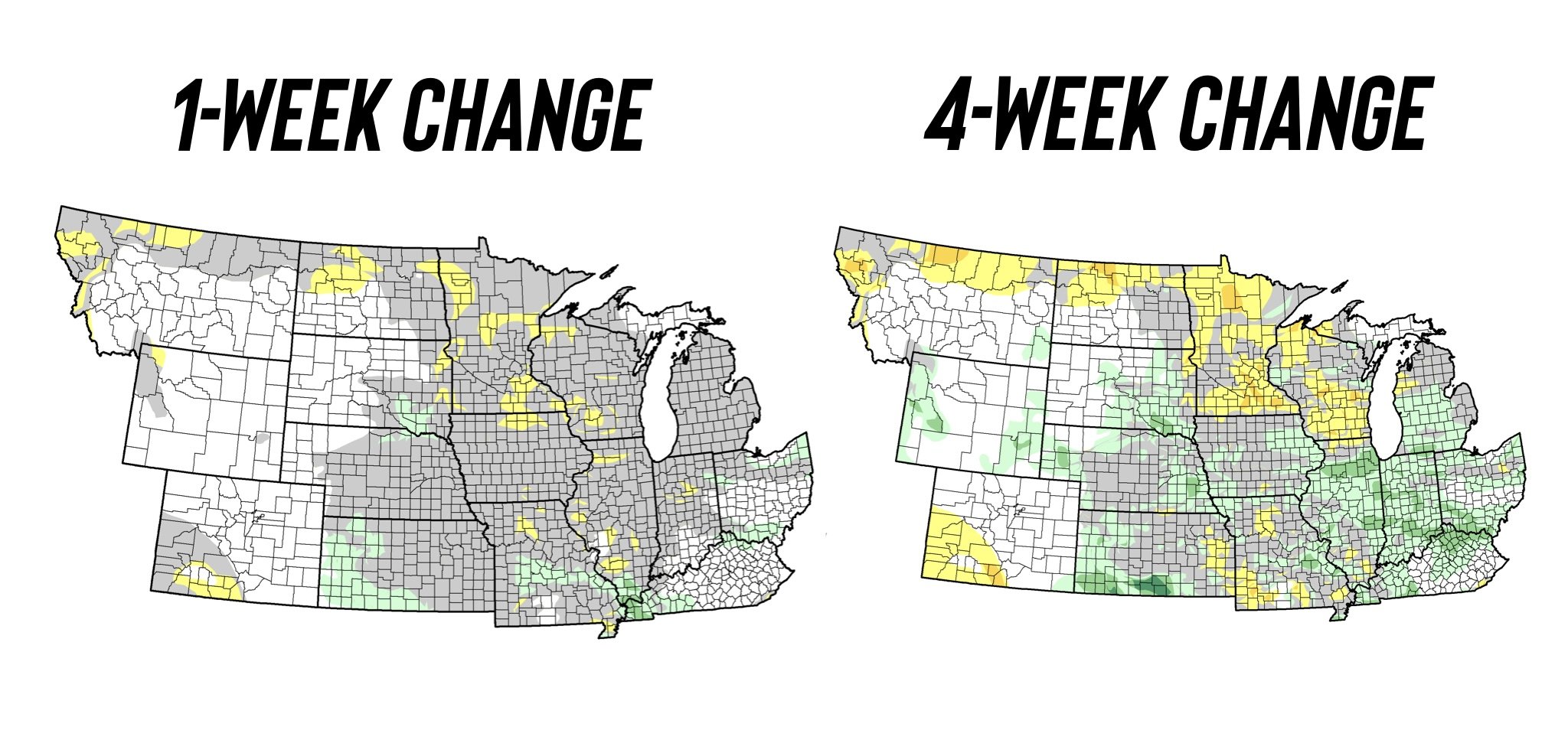

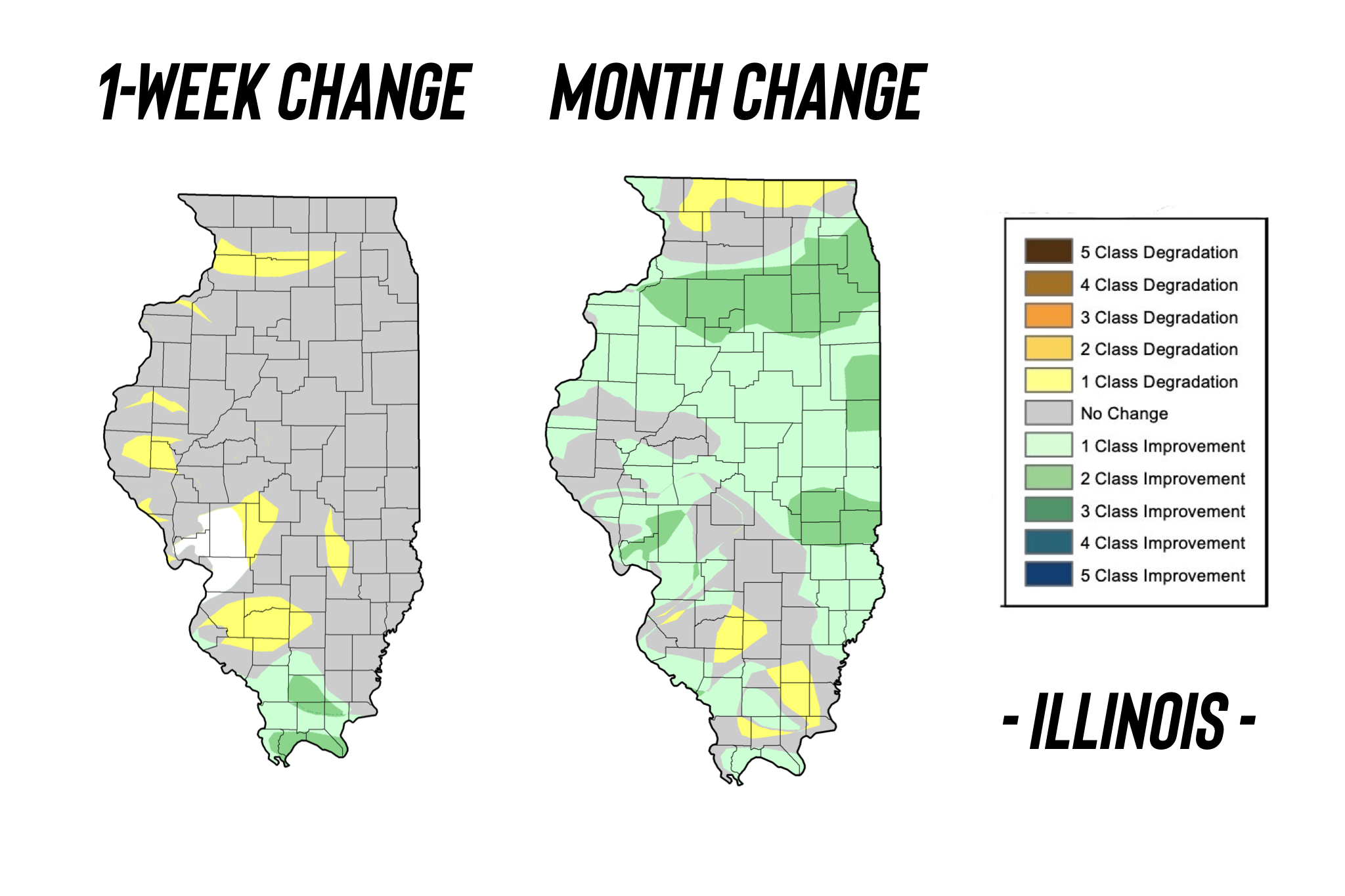

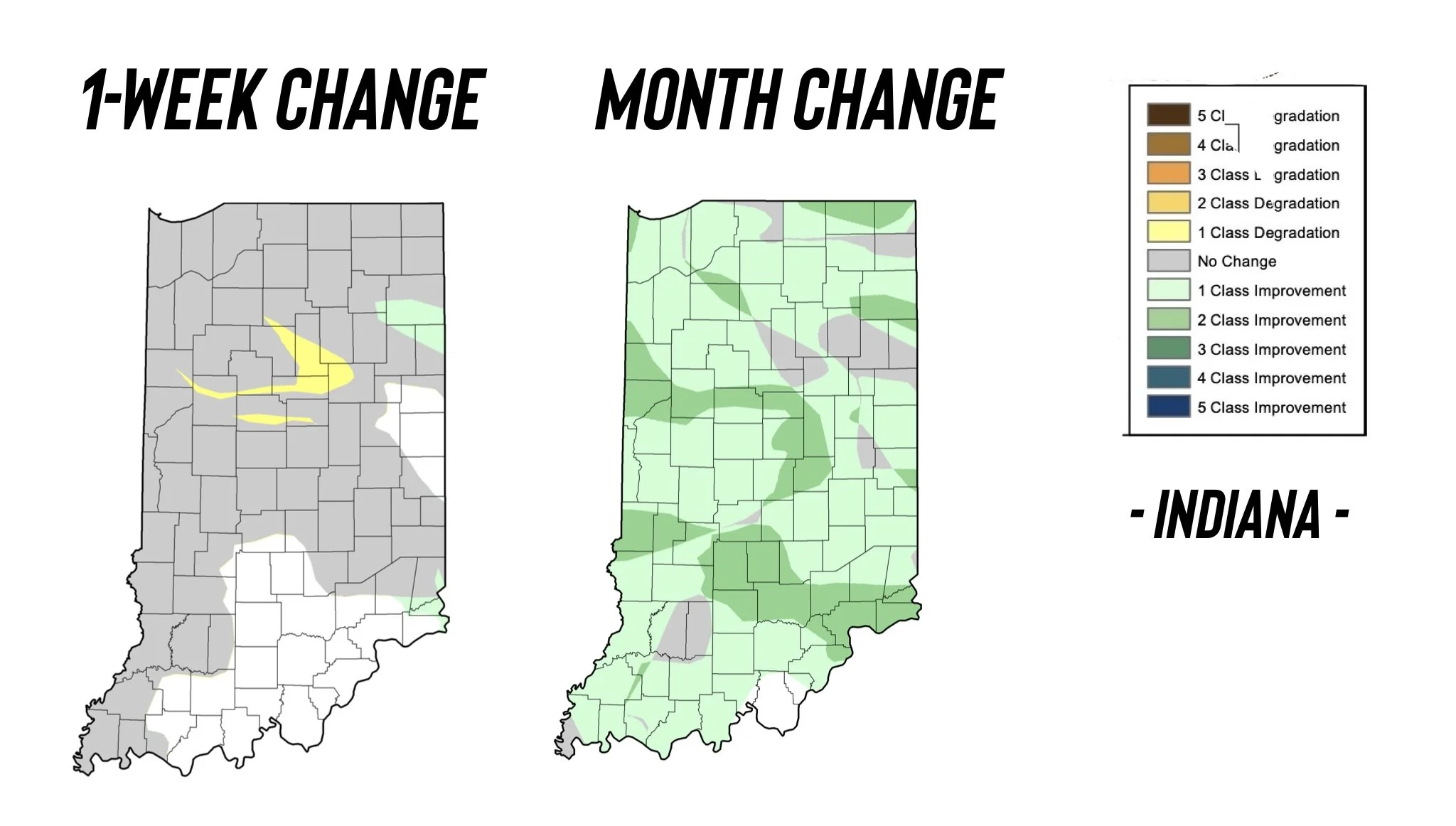

Here are a few states that have seen some notable changes. States such as Kansas, Ohio, and Indiana have improved. While the upper Midwest such as North Dakota and Minnestoa have continued to see more drought.

Today's Main Takeaways

Corn

Corn follows the rest of the grains lower, posting it's third straight day of lower prices. Corn is now roughly 30 cents off of it's recent highs, but still 60 cents off of it's July 13th lows.

The lack of war news has traders taking their foot off the gas pedal as of late. But the weather still looks pretty bullish as we push into the beginning of August. However, as mentioned, the forecasts have added in some rains which didn’t help prices today.

The biggest concern with corn is simply demand. As we just haven't been seeing much growth in demand. The USDA is expecting a near 1.6 billion new crop bushel increase from last year. Without some big increase in demand, this increase in production makes the balance sheet look worse.

The other concern that goes with that is the expected production from Brazil. Argentina fell 15 million metric tons, but Brazil's jumped just as much if not more potentially. So these are the things bears are looking right now.

However, some major weather concerns, war, or that increase in demand is what bulls are hoping for to keep prices elevated.

If the war were to somehow end tomorrow (highly doubtful it ends anytime soon) corn would take it on the chin probably pretty heavily. But if we get further attacks that disrupt Russia exports, then it would be the opposite story.

As mentioned, the weather remains severely hot. So I look for that to at the very least provide support moving forward. We will get the USDA yield updates on August 11th, we will also start seeing estimates from crop tours such as the Pro Farmer tour in about a month.

The USDA's 177.5 yield is still far too high. Conditions still look a lot worse than last year. So I think at the very least we see that brought back down to last year's 173 range when it's all said and done.

We are currently sitting right at the $5.40 support, and holding our 10 day moving average which is an area we have found support at in the past. Current upside targets are $5.56 and then the $5.75 range (we topped out at $5.72 a few days ago).

Corn Dec-23

Soybeans

Beans take it on the chin after trading much higher overnight. Overnight we saw August beans make new contract highs with a high of $15.80 3/4. However, they came well off of those highs. Ending the day at $15.32.

Just a fun fact. According to Karen Braun, this recent rally was a 24% jump over the course of June and July. (June 1st to July 25th). There is only 3 other years where we have seen a bigger rally over those two months. 2012 we rallied 27%, 1974 was 50%, and 1973 was 25%.

As mentioned, bulls are happy we have seen a few export sales.

Weather right now is still pretty bullish with all of the heat going on. The biggest question this heat is bringing is just how much will this effect yield?

Well that depends. August is the make or break month. However, currently I don’t think anyone thinks bean yield is at 52 bpa. If anything it is probably closer to 50 than 52. Currently, there is talk that the market is pricing in a 2.5% cut. Which would bring us to 50.7 bpa. If August brings more concerns and that gets lowered to a 5% cut, that would bring us to 49 bpa, which the market is not expecting.

If it stays hot and dry throughout even the beginning of August, we could be going a lot higher from here. If August brings above average rainfall, the opposite probably happens.

Bottom line here is we don't know what the weather holds. These things shift on a dime.

We are still over $14. Just a short month and a half ago we were trading $11.30. Although if weather stays hot and dry, we could easily see $15. You need to put yourself in the best position to make you comfortable.

I have asked this question all week. But would you be more upset if you sold and we rallied to $15, or didn’t and we dropped back to $12. I still think it is a good idea to make old crop sales if you have any. As well as taking some risk off the table for new crop. There is a ton of uncertainty. If you sell, you can always buy a call to try to make money on the way up, or after we have rallied you get buy a put to try to make money on the way back down.

If you have any questions or need any help don't hesitate to shoot us a text or call at (605)295-3100.

Soybeans Nov-23

Wheat

Wheat futures trade mixed, while Chicago trades lower despite additional attacks on Odessa from Russia. Definitely still some war risk premium, as Chicago still sits well above it's 100 & 50 day moving averages.

As mentioned, Minneapolis was the strongest of the grains today. A lot of strength coming from the continuation of dry weather in the upper midwest and Canada.

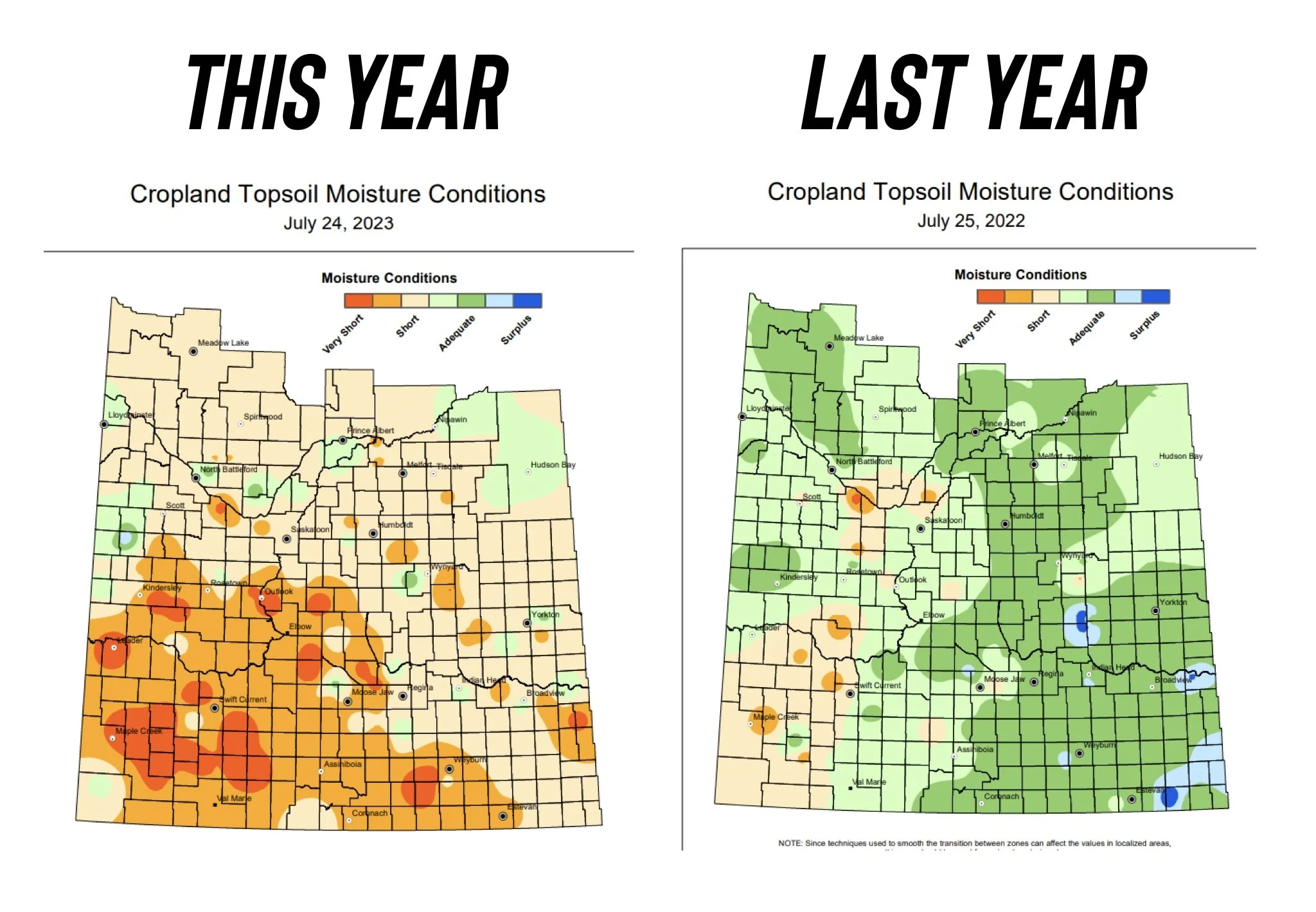

Here is a top soil moisture comparison from this year to last year.

The first day of spring wheat crop tours in southern and east central North Dakota are showing yields that are slightly worse than last year, but still better than the 5-year average. So far the participants showed yield of 48.1 bpa after surveying 130 fields. Last year after day 1 they had 48.9, while the 5-year average is 40.2 bpa. Day 2 showed a yield of 45.7 vs last years 47.7. So yesterday's were slightly better by 0.8 bpa while today's were worse by 2 bpa.

When the war headlines and buzz fade, so do wheat futures. It is hard to get super bearish on wheat despite the constant led downs, because we never know when Putin will pull the next trick out of his hat.

There are just so many question marks and nobody has the answer to them. Will Ukraine start to retaliate? Nobody knows. Without some additional war headlines, we might struggle to hold on to any major rally.

The other big question is, does the market really believe that Ukraine can export nearly all of it's grain through European channels on truck and rail and not use the Black Sea ports?

Although some think we can see $10. Minneapolis wheat just hit an 8 month high a few days ago. We are still over $9 and far off our May and June lows. Still don't think it is a bad idea for some of you to spread out your risk and reward the rally while we are over $9. The same goes for KC wheat anytime we push into the upper portion of that range we have been trading all year long.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Social Media

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

7/26/23 - Audio

WHAT HOLDS MORE GRAIN? A TRUCK, RAIL, BARGE, OR VESSEL?

7/25/23 - Market Update

GRAINS MIXED BUT WELL OF LOWS

7/24/23 - Market Update & Audio

WAR, WEATHER, & WHEAT LIMIT UP

Read More

7/24/23 - Audio

WAR & WEATHER SURGE GRAINS

7/23/23 - Weekly Grain Newsletter

ARE THE HIGHS IN?

7/21/23 - Market Update

RALLY TAKES A BREATHER

7/20/23 - Audio

BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update