GRAINS MIXED BUT WELL OF LOWS

Overview

Overnight we saw some strength following yesterday's limit up action in the wheat. But then we eventually saw prices take a breather, as we didn’t get any further headlines or attacks on Ukraine which calmed the market down.

The lower prices was essentially a turnaround Tuesday to go along with some profit taking following yesterday's rally.

However, prices did bounce nicely off their early lows. As Chicago wheat bounced 24 cents off it's lows and managed to close green. Corn ended down just 3 cents and 11 cents off it's lows. Soybeans were taking it on the chin early, down 20 cents at one point, but rallied to close the day down just 4 1/2 cents. So ultimately not a terrible close. Although corn and beans did both fail to make new highs. Will have to see if we can carry that late strength into tomorrow.

Weather is still hot and dry for the most part, so that continues to look supportive.

We included this in yesterday's write up, the crop progress yesterday was on the friendly side of things. With corn being left unchanged. The trade estimates thought we would see improvement. Beans came in 1% lower than last week as well as the trade estimates. Spring wheat came 2% below last week and the estimates. Winter wheat harvest came in at 68% complete. This is behind our average pace of 77% and the 2nd slowest for this date only behind 1993. Will this have any impact on double crop bean acres?

With the current weather situation, I'd have to imagine we see these numbers come in slightly lower next week as well. We would love to see what you guys feel the hot weather is doing to your crop. Please email or text us with pictures and include your area.

We will have to see if the funds look to cover some of their shorts in corn and wheat. Unless we get some grain moving out of Ukraine or an improvement in the forecasts, I think we should be well supported.

Expect some heavy volatility with everything going on. Weather and war markets create emotional markets.

Recommendations?

The volatility has created a lot of opportunities to buy low and sell high. Lots of guys day trading are making 30 to 40 cents buying low and selling high. That is why we like having hedge accounts open. If you would like to open one, click here or give us a call (605)295-3100.

There is nothing wrong with putting in a floor and spending a little bit of money to get comfortable. We don't mind scaling into puts.

Over the last few days, I noticed some highly respected advisors such as VanTrump and Roach Ag have been making sales. So bottom line, several popular advisors have jumped on the bandwagon of making sales or buying puts. We prefer everybody be comfortable. We are more on the bullish bandwagon. But for guys that aren’t comfortable, here is an example of what we did for a client of ours that joined a few weeks ago to help tailor his situation to his needs.

Example:

We had this customer who wanted to make sales a couple weeks ago and was nervous that the market would keep going down, we talked him out of making sales and we bought 25% of his production in puts today with a plan on following up the next several days depending what mother nature and war does. So he raised his minimum price and put in a floor.

We are dealing with weather and war and the emotion that goes along with both of them. Do what makes you comfortable.

Sunflowers

With the Russia & Ukraine situation development, Banghart Properties has buyers starting to look for new crop sunflower offers. If you have any, please give Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Today's Main Takeaways

Corn

Corn ends a volatility filled day down just 3 cents, after trading 14 cents lower at one point. As mentioned, mostly profit taking following the rally, as the market was somewhat disappointed that we didn’t get further escalations to the war overnight like some thought we could.

Corn is still up 84 cents from our lows just a few weeks ago even with the minor losses today.

There are two factors in the market right now with he potential to drive prices higher. War is the main factor driving wheat. Weather in the corn belt is the main factor driving soybeans. Both of these factors are driving corn.

Do the funds really want to step in here and add to their short position with the potential war lurking over their heads? As well as weather. One wouldn't think so, but it didn't stop them from pushing wheat into the ground the past year.

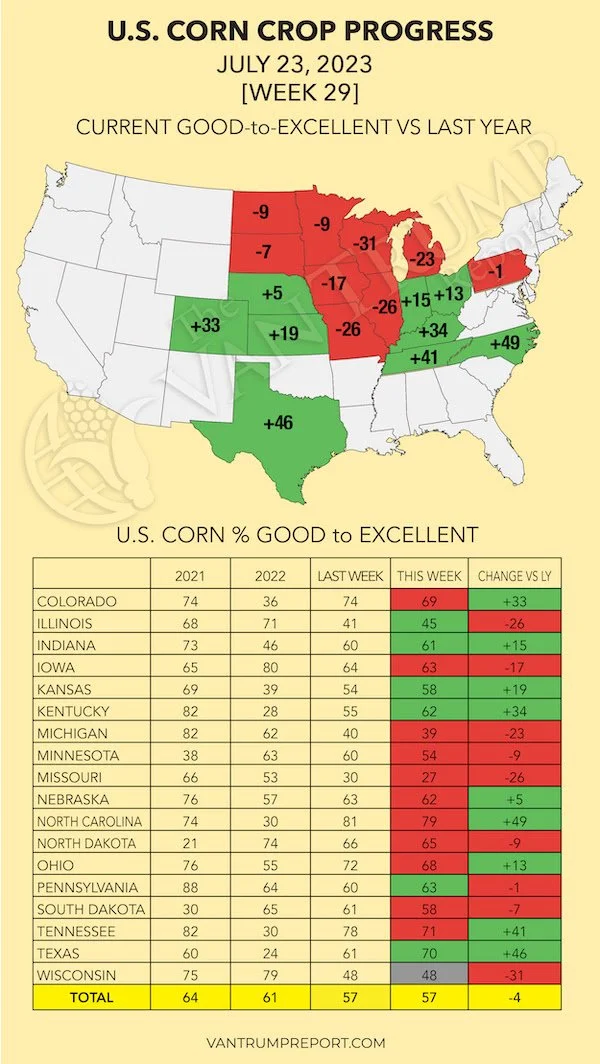

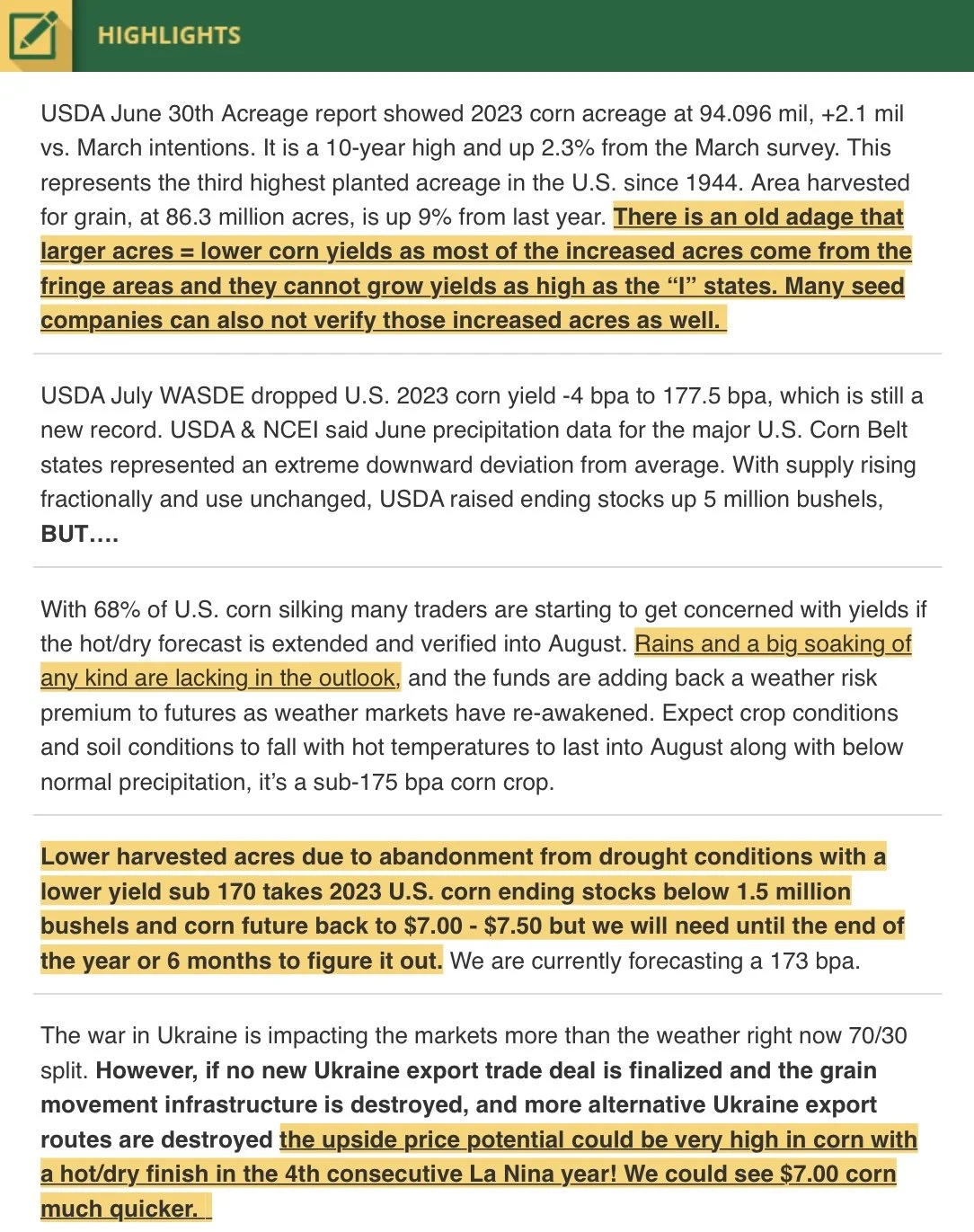

As mentioned, crop conditions yesterday came in unchanged. While getting worse in 11 of the top 18 corn producing states. When these numbers are plugged into Pro Farmer's Crop Index, this current crop is still 2.3% worse than last year. Yet the USDA still has corn yield 4.5 bushels an acre higher than last year. If we took this 2.3% off our last year's corn yield just for an example, that would bring us to 169 bushels an acre this year.

Below is a graphic from Kevin Van Trump. It shows the state by state and changes compared to last year. We have states like Illinois and Iowa far worse than last year.

So no, I don’t think we are anywhere close to the yield the USDA currently has at 177.5 bushels per acre. I fully expect some further cuts to yield down the road. With a solid chance we come in even below last year's 173 as well.

Here is what Farms.com Risk Management had to say. They are another advisor who is in the bull camp. They essentially say that there is a chance we see yield sub 170. Check out their website here.

Wright on the Market is another advisor who we closely follow and tend to agree with his arguments. He said to not even consider selling new crop below $6. We tend to agree with him, but every situation is different. This is why we prefer to focus on every operation finding its comfort level vs trying to outguess the markets. For some of you, it might make sense to put in a floor here at these levels. For others, it might not. It all comes down to you. Which situation would you be more upset about? You sell too early and we rally, or you don’t sell and we fall $1?

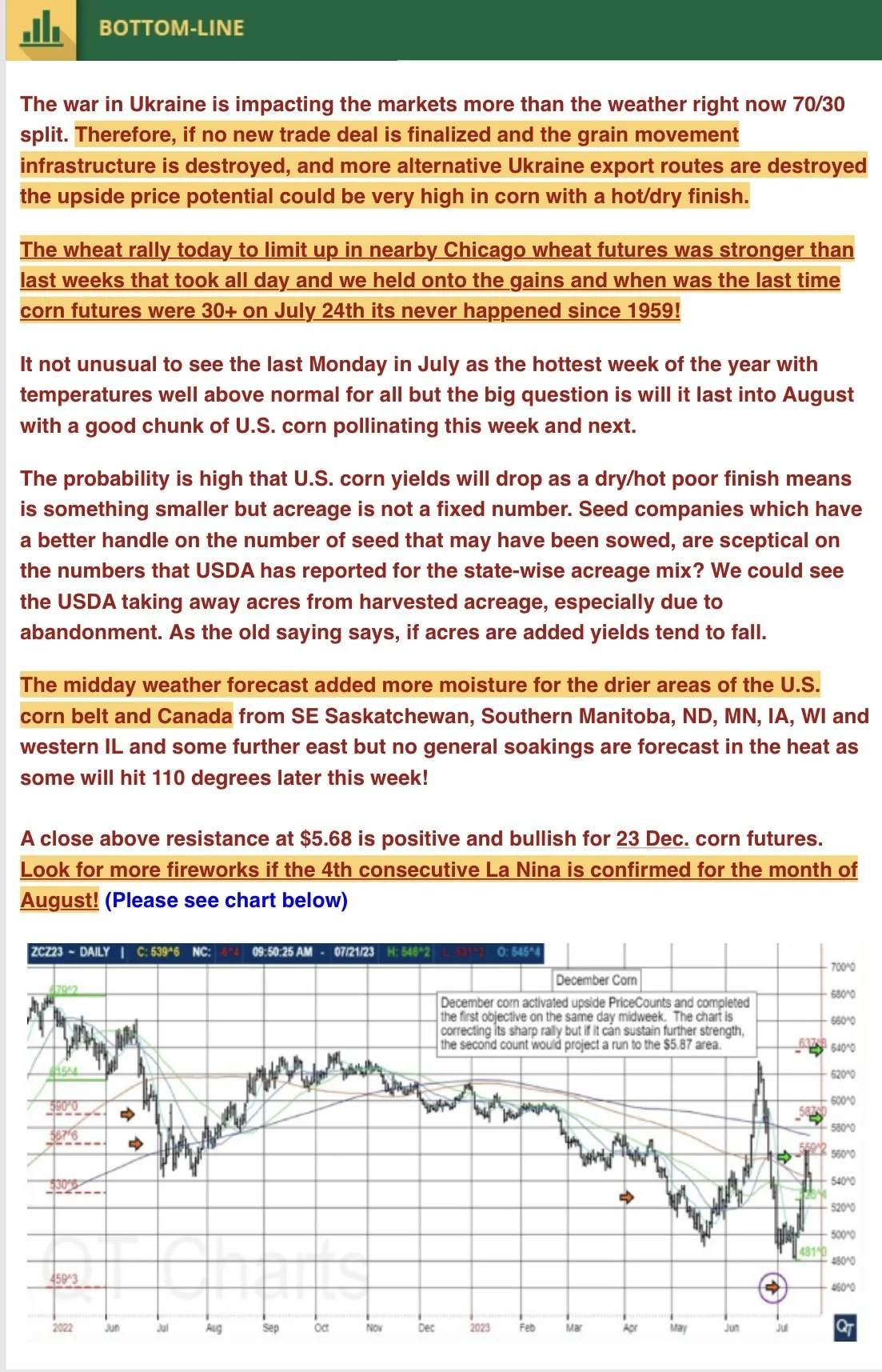

My next upside target is still $5.75, which we have gotten very close to the past two days. Weather and war will be the deciding factor. But for now, both remain bullish.

Corn Dec-23

Soybeans

Beans followed corn and wheat higher yesterday but some additional support with a sale to China. As yesterday beans traded at their highest levels since last December and bulls have their eyes set on contract highs.

Today beans give a little bit of that back, closing down 4 1/2 cents, but this was well off our lows.

We all know the weather is starting to really heat up this week. Here is the average max temperature throughout the end of July. nearly the entire US including the corn belt expected to see some pretty severe heat.

Although yes, this should support beans. It is still early for setting pods. So this won’t mean quiet as much as it would if this was happening the first few weeks of August.

As mentioned, crop conditons came in lower than expectations for beans yesterday. Again, I assume these numbers continue to fall looking at next few week with the heat we've been seeing.

Here is a state by state breakdown from Kevin VanTrump. Similar to corn, if you take a look at Illinois and Iowa, we are far worse than last year. With both of them being 17% worse.

The report yesterday also showed 56% of beans were blooming and 20% were setting pods. Which are both ahead of schedule.

If weather from now until early-mid August stays this hot and dry, we could very easily see $15+. But there are a lot of factors at play that we cannot control. Such as above average rain to start August as beans are nearing their pod stage. The weather will push us to new highs and $15 if it stays dry, if we get a lot of rain and cooler temps, we could just as easily go right back to $13.

Soybeans just traded at their highest levels all year long. I don’t see any reason for them to stop now, as we are nearing contract highs, unless weather turns bearish. (Contract high is $14.48).

Just because I think we will trade $15 within the next month or so doesn't mean you shouldn’t be rewarding the rally. I still recommend making any old crop sales if you have any. I also don’t mind making some new crop ones as well if that is what helps you become comfortable.,

Just like I mentioned earlier. What would you kick yourself more for? You sell right now, and all of the sudden we rally to $15 and you miss that extra $1? Or you don’t sell now, the weather turns bearish and we go right back to where we were not too long ago. Which was $11.30. It all comes down to your needs.

If you sell and we go higher, that is the perfect opportunity to grab puts and make money on the way down that you didn’t on the way up. If you want specific advise or anything at all, as always don't hesitate to shoot us a call or text at (605)295-3100.

Soybeans Nov-23

OFFER ENDS FRIDAY

Our offer that gives you access to all of our exclusive updates ends in 3 days. Make sure you subscribe so you don’t miss our future updates.

$350 vs $800 a year

Wheat

Wheat traded to 5-month highs yesterday off the back of Russia sending more attacks Ukraine's way.

Wheat prices started off the day taking it on the chin, but Chicago managed to rally after being down 20 cents and ultimately closed green. We mentioned yesterday and in Sunday's newsletter that we expected Chicago to be the strongest short term here.

More upside in wheat isn't out of the cards. We may not see quiet as big of an explosion in prices as we did last year simply due to the initial fear factor not being there in the markets. But if Ukraine attacked in a way that disrupts Russia's exports, it could be a massive deal. But, at the end of the day nobody knows how the war will shake out, and most think it is unrealistic that Ukraine will retaliate in such a way.

However, that is something the trade is very aware of. They are worried that we might see Ukraine now start to attack and retaliate against Russian ports and ships carrying grain.

To go along with the war headline, we still have the global weather issues that have been sitting on the sideline while the war stole the show.

We have a crop in the EU that is getting hit with hot and dry weather. We have a ton of concerns for areas such as Canada who have also been dealing with some pretty extreme drought. Australia is another one who has suffered from the effects of El Nino and drought.

Wright on the Market had this to say about recommendations for the wheat market:

"We recommend you sell old wheat and new wheat in the area of $8 for the Soft Red Winter and $9.50 to $10 for the hard wheats to eliminate downside risk. Sell the wheat, sleep well and hope the price of wheat continues higher so you can buy high strike price puts and make money on the way down you did not make on the way up."

Going forward, it is all weather and mostly war here for the wheat market. Do what makes you comfortable, because there is no telling how this will shake out.

Taking a look at our charts, we saw some key break outs yesterday. Chicago finally managed to crack $7.58 resistance and break out of that downtrend. KC sits $1.80 off their May lows, as we finally broke out of that range we had been trading in all year long. Minneapolis finally broke that magical $9 resistance that had kept a lid on prices for over a year. With prices well over that $9 now, if you are worried about the downside. Here wouldn't be the worst place in the world to take off some risk, even though we could go higher with more war headlines, still some uncertainty there.

Chicago Sep-23

KC Sep-23

MPLS Sep-23

Check Out Past Updates

7/24/23 - Market Update & Audio

WAR, WEATHER, & WHEAT LIMIT UP

Read More

7/24/23 - Audio

WAR & WEATHER SURGE GRAINS

7/23/23 - Weekly Grain Newsletter

ARE THE HIGHS IN?

7/21/23 - Market Update

RALLY TAKES A BREATHER

7/20/23 - Audio

BEING COMFORTABLE NO MATTER HOW THIS SHAKES OUT

7/19/23 - Market Update & Audio

THE RALLY CONTINUES

7/18/23 - Audio

WEATHER & WAR

7/17/23 - Market Update

RUSSIA EXITS GRAIN DEAL. BUY THE RUMOR SELL THE FACT

7/16/23 - Weekly Grain Newsletter

MANAGING THESE VOLATILE MARKETS

7/14/23 - Market Update