WHEAT LEADS WITH RUSSIA TARIFF RUMORS

Overview

Decent day for the grains as wheat leads the way higher for the 2nd day in a row while soybeans are lower for the 2nd day in a row as well.

Wheat has seen a nice 2 day bounce, as the wheat market is +25 cents off it's lows from yesterday.

Some of the strength has come from farmers protesting in the EU as they are upset with cheap imports from the Black Sea. To deal with this, the EU is considering putting tariffs on Russian wheat of $103 a metric ton.

This could certainly help level the playing field with the Russians if it happens, but the EU doesn’t import a lot of grain from Russia.

Both corn and soybeans have seen a little pressure from the rains in Brazil. As they are expected to get rain for the next 10 to 14 days.

These rains aren’t bearish for soybeans. They are negative for the soybean crop as it could delay harvest. If Brazil can’t get beans out, this could lead to other countries looking to get business from the US. On the other hand, these rains bearish for corn as they are good for their second corn crop with the drought concerns they’ve been having.

Safras Mercado of Brazil came out with their new estimates. They have Brazil beans at 148.6 MMT vs the USDA's 155. Brazil bean harvest is now 62% complete.

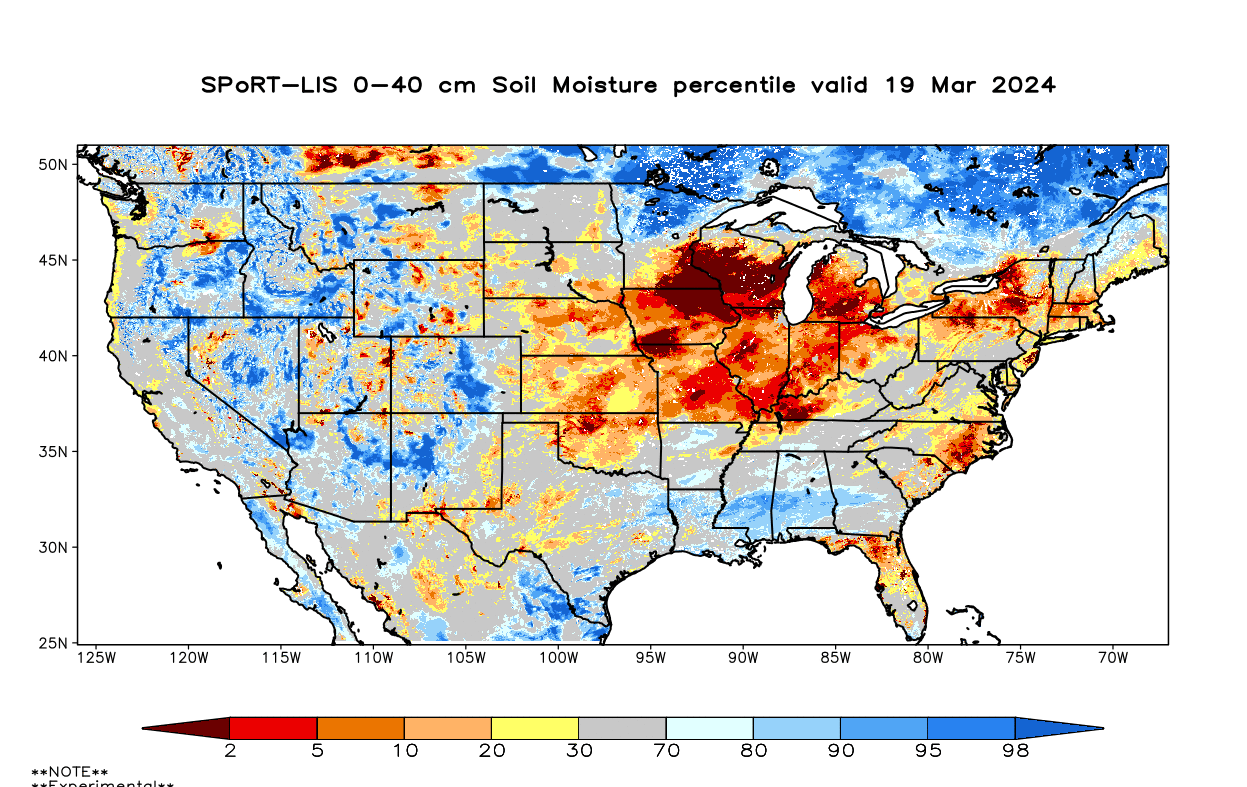

Precipitation is finally expected for the US, and a lot of it in areas such as Iowa who have suffered from a lack of precipitation all winter thus far.

This will likely replenish some of that lack of soil moisture and might lead to a little less talk about early planting.

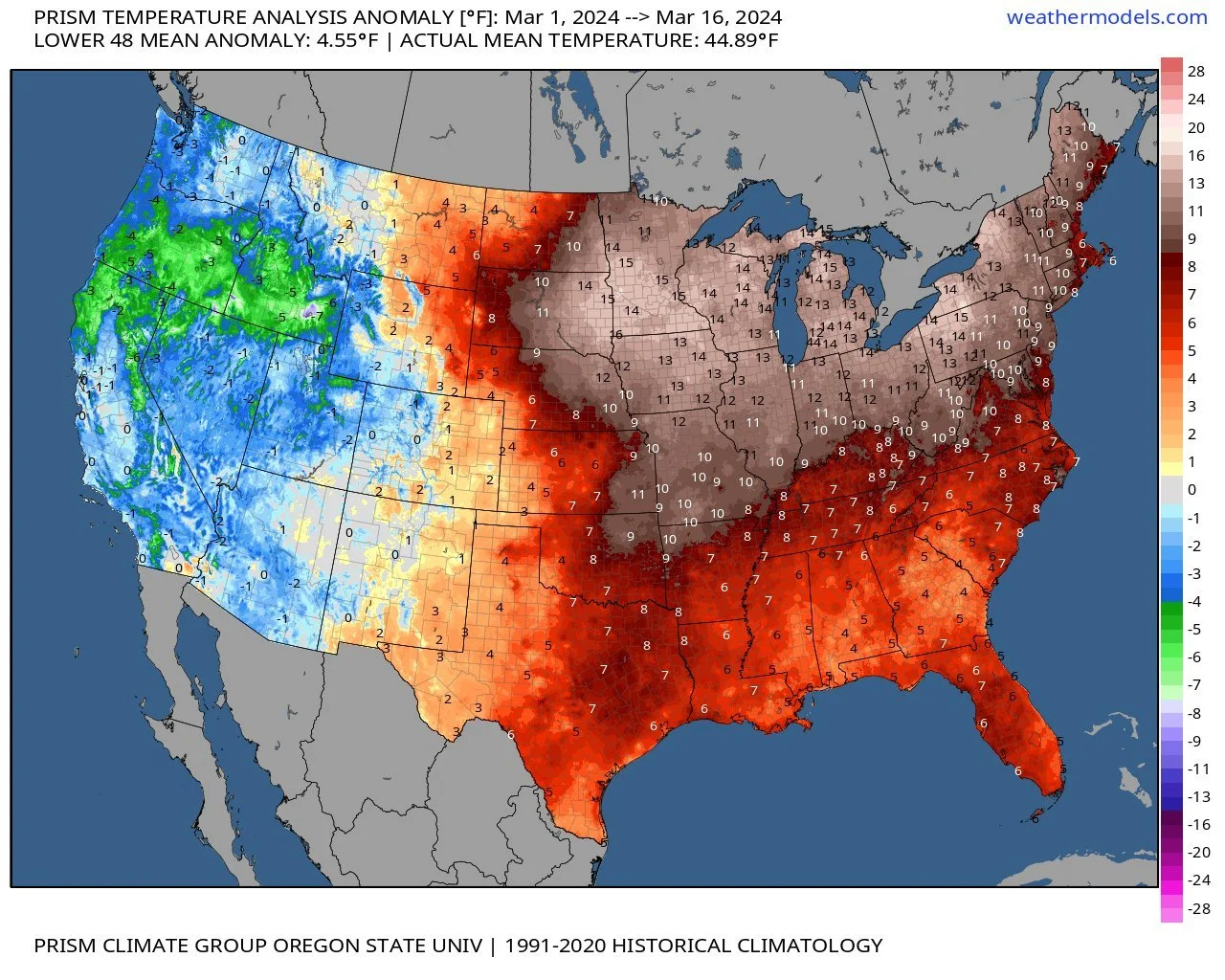

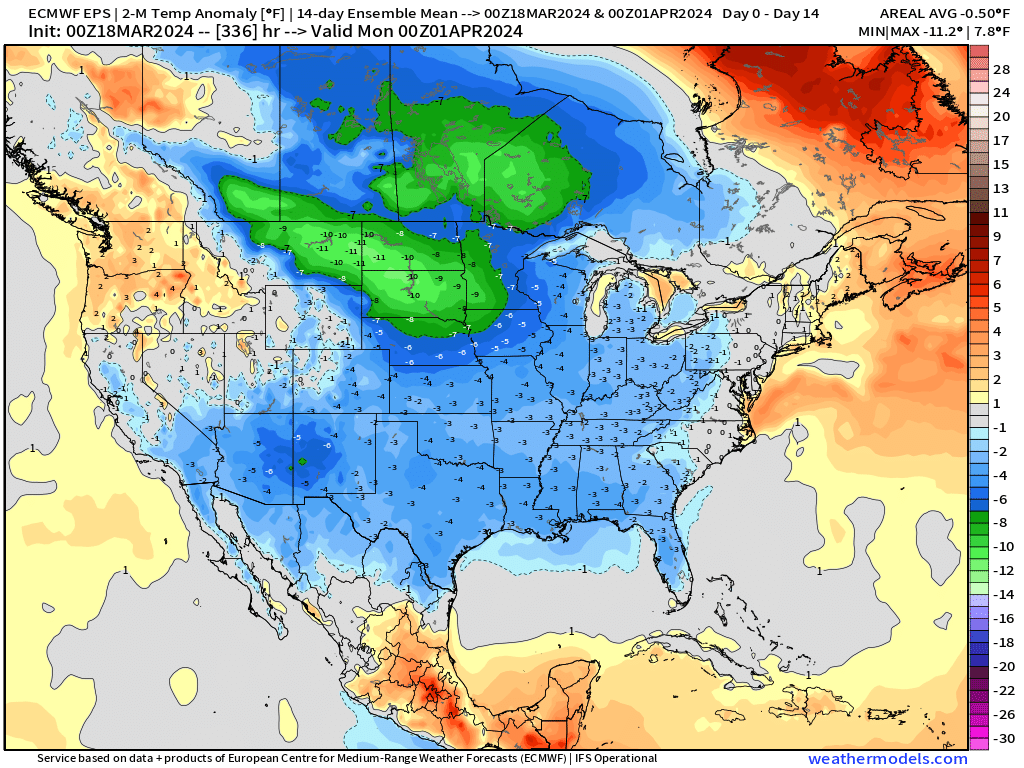

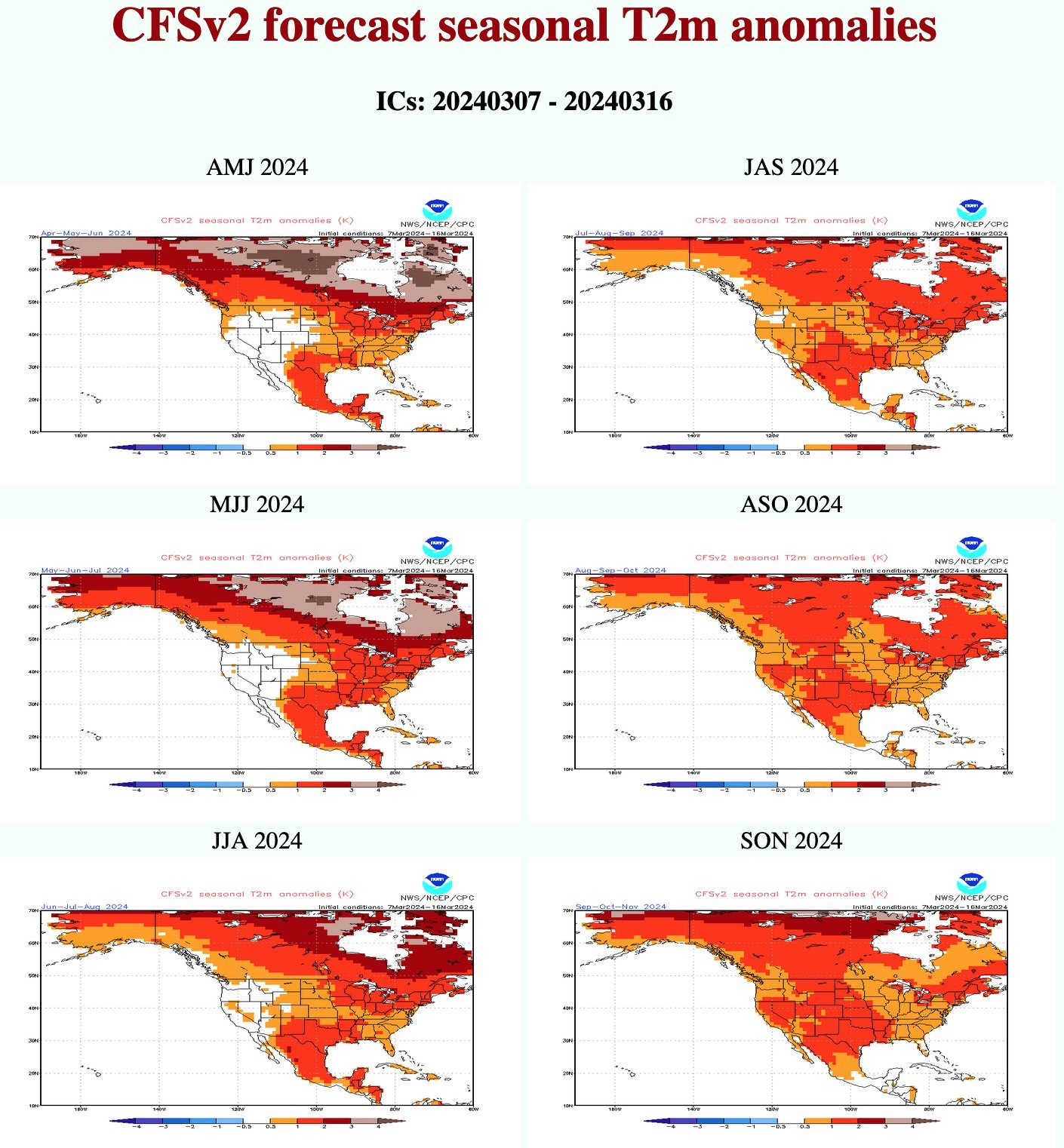

There will also be a huge difference in temperatures.

The 1st map is the temp anonomly for the first 2 weeks of March. Far warmer than normal.

The 2nd map is the temp anomaly forecast for the next 2 weeks. Colder than normal.

We have the USDA stocks and acres report in 9 days on March 28th. There is a lot of talk about higher acres. Personally I think we will see short covering heading up into that report. That report is expected to be a major market mover as always.

The estimates for this report are all over the board. The USDA currently has 91 million corn and 87.5 million for beans but most estimates I've seen have corn around 93 million and beans around 86 million.

These numbers would still have corn down from last year's 94.6 and have beans up from last year's 83.6. Most spring wheat estimates are in line with last year, but I don’t think spring wheat is gaining any acres over cotton.

Miss Our Sale?

Our St. Patty’s Day sale ended yesterday. Since you are on a trial we giving extended access. Comes with 1 on 1 completely tailored marketing planning.

Today's Main Takeaways

Corn

Corn continues to bounce around. We still sit +30 cents off those lows we made.

As mentioned, some of this recent pressure is coming from Brazil rain.

Even with the rain, Brazil still has a chance to be a positive factor for our markets. I don’t think this rain will "save" the crop, but yes it could help a lot.

The USDA is still +11 million higher than the CONAB (124 vs 113).

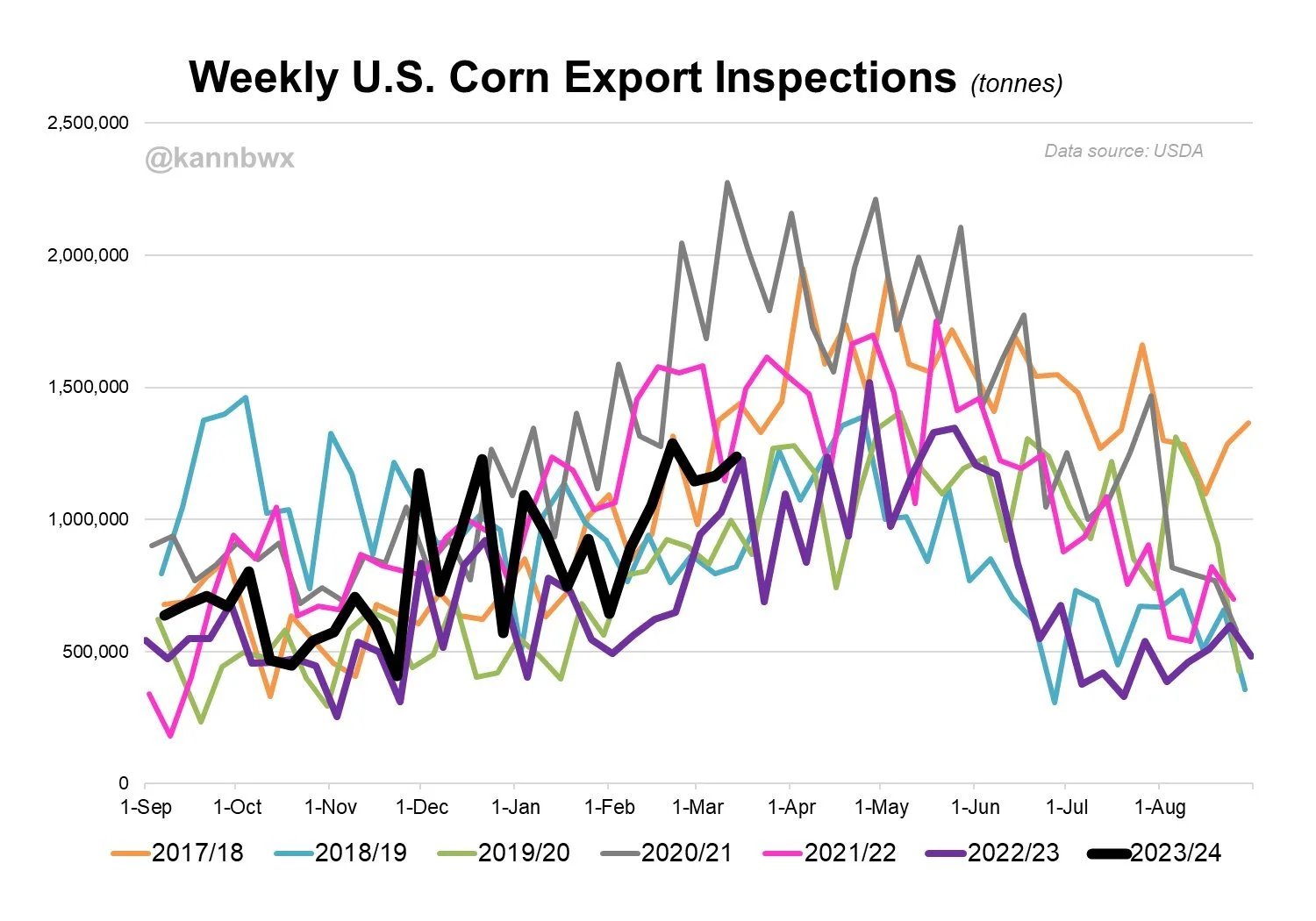

Export inspections were solid for corn at 48.8 million bushels. This remains at a pace above the USDA estimate. Total inspections are up over +31% compared to the USDA estimate.

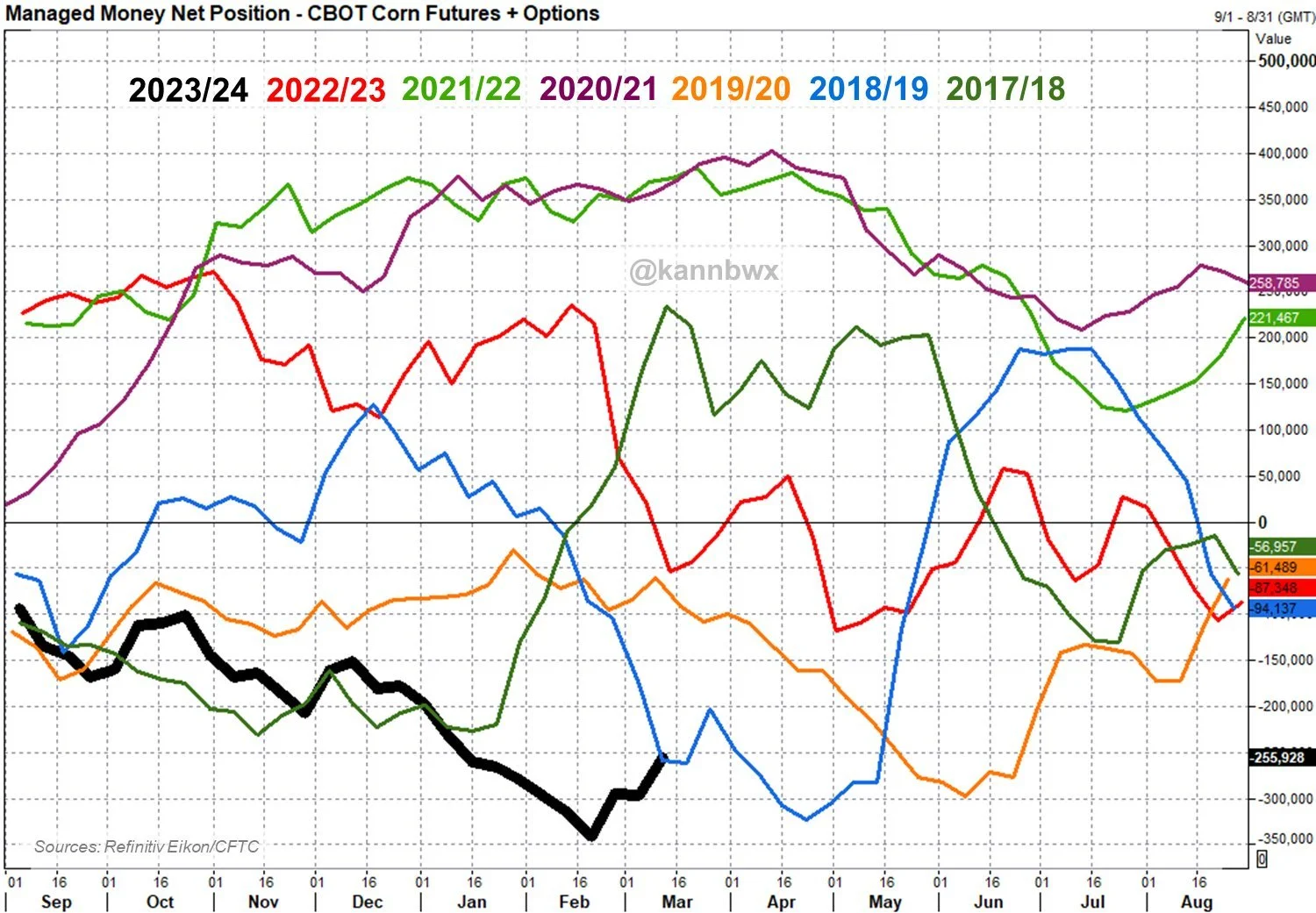

Chart Credit: Karen Braun

The funds actually boughg 41k contracts of corn last week. They are no longer "record" short. But still hold a top 3 shortest position all-time.

Plenty of room to cover.

Chart Credit: Karen Braun

Short term I do still think we see the funds continue to cover their short position.

They have plenty of reasons to be nervous. We are going into planting time. We have no idea how many acres we will get. We have no idea if we will raise a record crop or get hit with drought.

Longer term is a wild card.

Right the now the forecasts for summer look very hot and dry.

Here is some seasonal temp anomaly forecasts.

So I do believe we have a strong chance to get a weather scare.

However, the risk looking long term is if we see normal production along with acres around what most will expect. If planting gets going early, acres will be even higher.

This short covering rally we have seen has been stalled by producer selling. Nothing wrong with some rewarding a rally, but this has kept the rally from getting real exciting.

There is a chance, but it doesn’t seem extremely likely that we will see our carryout drop below 2 billion. So rallies should be respected, but I still see more upside from here. The action we have seen in this market is some of the best we have seen in a long time.

If you are someone who will struggle to pull the trigger on a sale, consider a cheap call strategy such as courage calls. This will help you make the sale on a rally.

For now, the bottom is in. Long term, there are too many moving parts.

The risk long term still remains if we grow a good crop, acres are high, and we wind up with a 2.5 to 3+ billion carryout.

Short term we have Brazil and US production uncertainties which could provide a pricing opportunity come late spring or early summer. Last year, we got that drought scare in June. In 2016 they didn’t realize the Brazil crop was small until April.

Bottom line, I do not like making sales here if you don’t have to. We want to make sales when we don’t know what we are going to raise.

Give us a call if you want to discuss a strategy that would fit best for you:

Jeremey: (605)295-3100

Wade: (605)870-0091

Taking a look at the chart, we need a close above $4.45 to confirm more upside (which was last week's highs)

Corn May-24

Soybeans

Soybeans now -30 cents off the recent highs but still +60 cents off the recent lows.

Soybeans have seen some pressure from Brazil rains, which doesn’t make a ton of sense. As at this point rain won’t do anything expect delay harvest. So if anything, this rain is bullish for beans here.

There are a wide variety of guesses for this Brazil bean crop. With all of the differences and with the USDA having one of the highest ones out there, I still doubt the USDA is the closest when it's all said and done. So overall I see this crop getting smaller rather than larger.

Soybeans also saw pressure from the lackluster weekly inspections report.

The main thing dragging soybeans lower has been soy oil.

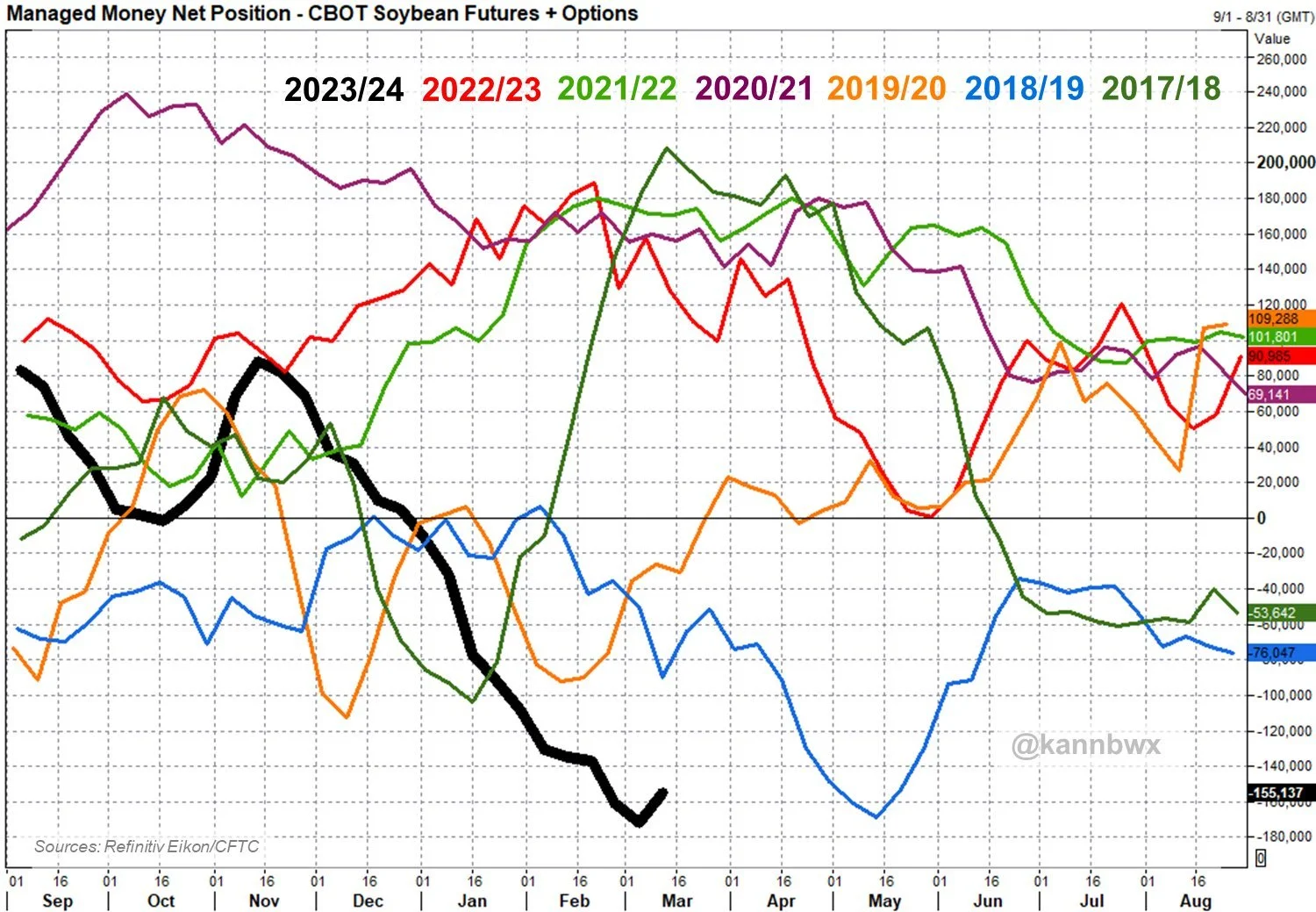

After 17 brutal weeks, the funds were finally buyers of beans. Ending that streak.

Still holding one of the shortest positions all time. Just like corn, plenty of room to cover.

Chart Credit: Karen Braun

The NOPA on Friday was very strong. Another record for the month.

There is a lot of advisors and analysts who think the USDA could be 50 million to even maybe 100 million light on their crush numbers for beans.

This is probably somewhat built into the market, but if we can get some exports to follow it up, it would be very friendly and open the door to higher prices.

As for the acre report March 28th, there is some talk about potentially higher soybean acres with the depressed corn prices.

Bottom line, I don’t see us going back to those recent lows relatively soon.

I do not like making sales here, but there is nothing wrong with sprinkling in a few increments here and there on a rally especially if you are undersold.

We have rallied +90 cents from the lows to the highs. If you are holding a ton of bushels, it might make sense to spread out your risk.

If you do not have a ton, I prefer waiting as I firmly believe we could see a lot higher prices.

I do like keeping a floor under unpriced soybeans. We have the acre report out in 9 days. One route you could consider is buying a put that expires March 28th, the day of the report.

Right now a March 28th $11.70 put is roughly 12 cents and a $11.60 is roughly 9 cents.

Another option would perhaps be a longer dated put. One that expires in over a month from now.

A May $11.70 put is roughly 20 cents and a $11.60 is roughly 16 cents.

Give us a call if you have questions on spreading out your risk, adding floors, or anything else. (605)295-3100.

Disclaimer: Futures & options are risky and not suitable for everyone*

Soybeans May-24

Wheat

Surprisingly wheat has been the leader to start this week, as prices have rebounded around +25 cents the past 2 days.

As I mentioned, the biggest news surrounding wheat is the potential EU tariffs on Russia.

This could help level the playing field when it comes to global competition. Because right now, the biggest thing keeping a lid on our wheat prices has been the stiff competition with Russia sitting on a cheap stockpile of wheat.

I don’t see this as a game changer, but it could change the game a little bit.

Export inspections for wheat were the lowest in the last 6 weeks. So a further downward adjustment to wheat export estimates could very well happen.

The funds do not hold nearly as short of a position in wheat as they do corn and beans. So I don’t expect massive short covering.

We have also got some support from war tensions in the Black Sea. I am skeptical about any support coming from the war, because war rallies have been sold every single time.

BUT we did see Putin get re-elected once again. This could give him the power to now do basically anything he wants. Always the potential for a war wild card, but not holding my breathe on one.

The wheat crop here in the US is a mixed bag. The crops are better than last year still though. Here is the updated G/E ratings.

Kansas: 55% vs 53% last week

Oklahoma: 61% vs 65% last week

Texas: 46% vs 44% last week

Colorado: 65% vs 56%

Overall, a great start to the week for wheat. Is this the bottom? I don’t like catching a falling knife.

I like the recent price action but we need a close above $5.56 to confirm more upside (which was last week's highs).

Long term, as I have been saying for a long time. Wheat is a sleeper long term. Nobody knows exactly when, but the day for higher wheat is coming.

May-24 Chicago

May-24 KC

Cattle

As has been the case for a week or so now, not much has changed with the cattle market. We continue to chop near these recent highs.

I still think this market could be stalling or potentially topping.

I am not saying the highs are in, but for some of you I think it would make sense to consider taking risk off the table.

If you want to discuss different strategies to use please give us a call (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/18/24

ARE YOU PREPARED FOR 160 OR 190 BU CORN?

3/15/24

BULLISH & BEARISH FACTORS DRIVING GRAINS

3/14/24

ARE YOU COMFORTABLE WITH THIS VOLATILITY?

3/13/24

RALLY TAKES A PAUSE

3/12/24

CONAB A LOT SMARTER & SMALLER THAN USDA

3/11/24

CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24