IF YOU HAVEN’T PANICKED YET, WHY WOULD YOU NOW?

Overview

Grains take it on the chin hard, especially in the wheat and bean market. As with Fridays's bearish report, soybeans break that key $12.82 level we had talked about. With the bearish report, the wheat market prints fresh new lows as they tumble over 6%, their largest one day losee since March of 2022.

With Friday's losses, corn is only down -1 1/2 cents for the month of September. However, it's not the same story for beans and wheat. For the month of September, beans lost over -90 cents while Chicago wheat lost over -60 cents.

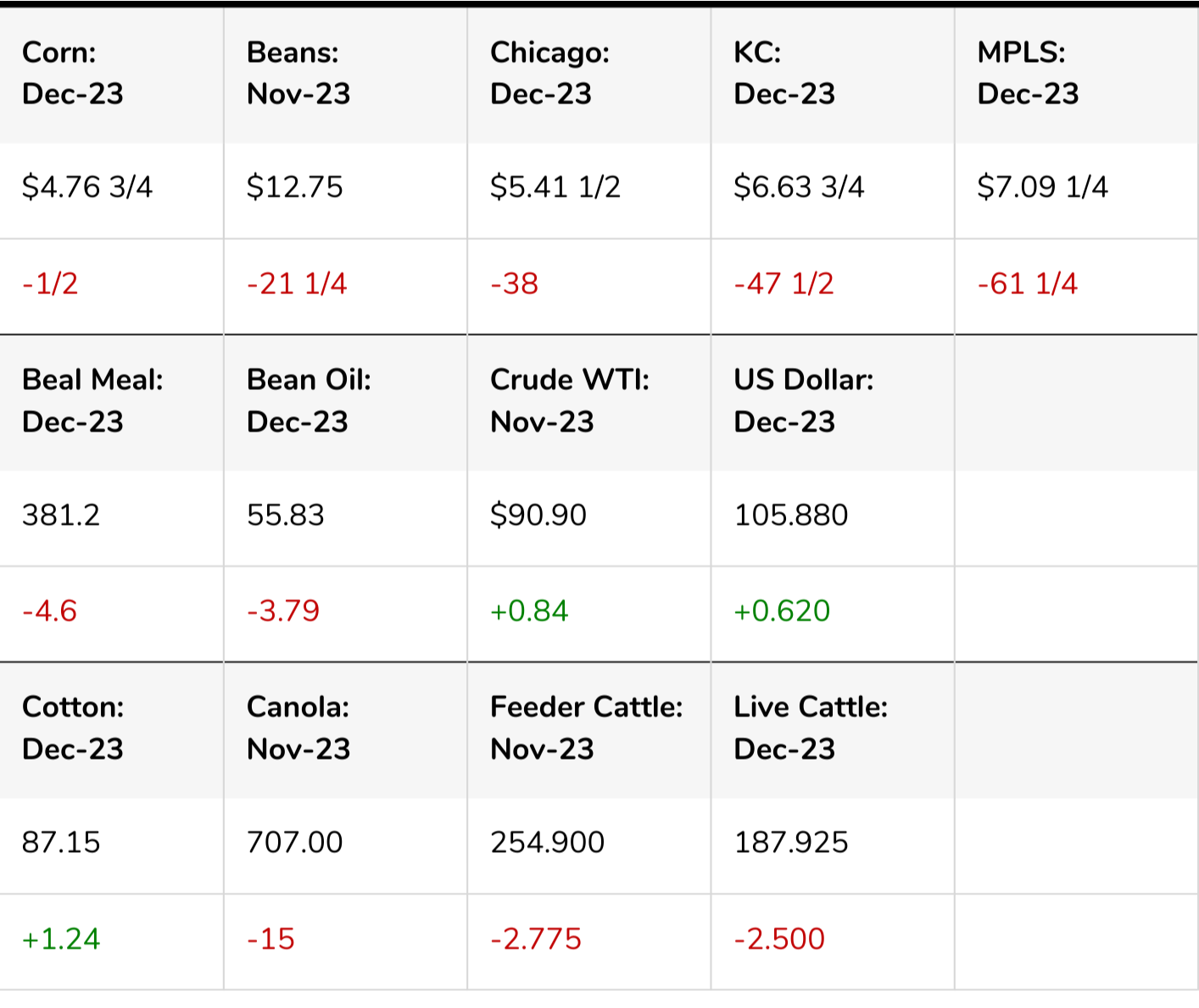

Here was the price changes for this week:

Weekly Price Change

USDA Report

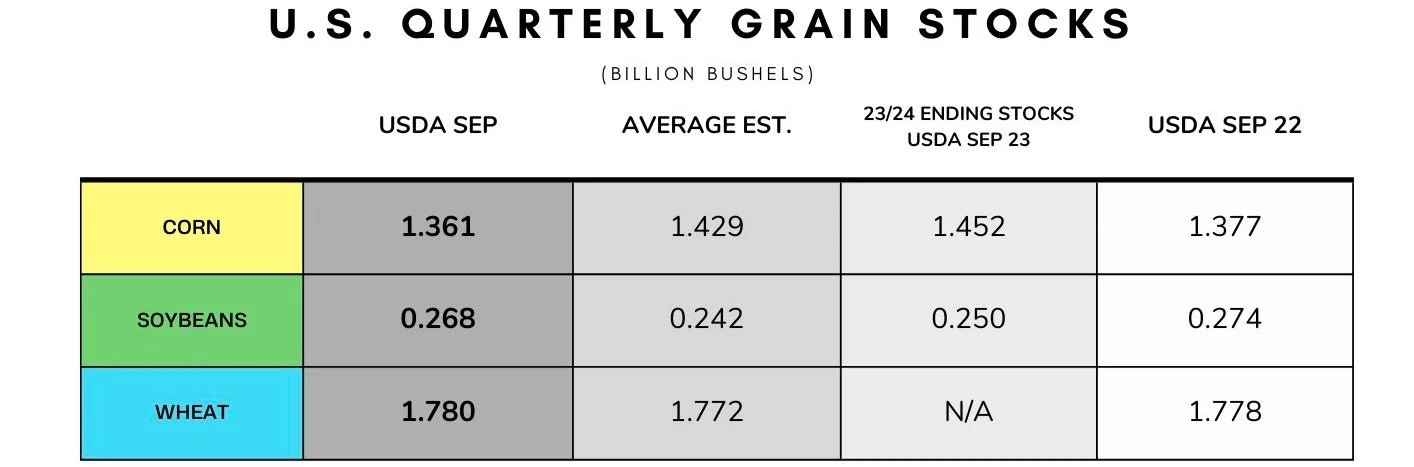

Overall, the report had a very bearish reaction. To sum up the USDA report, both bean and wheat stocks came in higher than expected, while corn came in lower. However, even though corn's report wasn’t bearish, it was dragged down by the pressure in the bean and wheat markets.

Overall, the wheat market had the most bearish report, and that is where the biggest surprise came in. As we saw a sharp increase to 2023 wheat production. With stocks above the estimates as well as last year for nearly every class of wheat. The bean number came in 26 million bushels above the estimates, but was still slightly lower from year.

This was the first time since 2016 that both corn and soybeans numbers came within the ranges of the trade estimates.

If you would like to listen to our report recap audio with our thoughts after the report you can do so below

From Commodity Trader Brian Wilson:

"Grain stocks lower than year ago wheat the same. What have prices done?

Wheat down $3.50

Corn down $1.34

Beans down.65

Must be the inflation. Fundamentals have been tossed out the window"

HARVEST SALE

Lock in this sale before it’s gone & your trial expires.

Effects of Government Shutdown

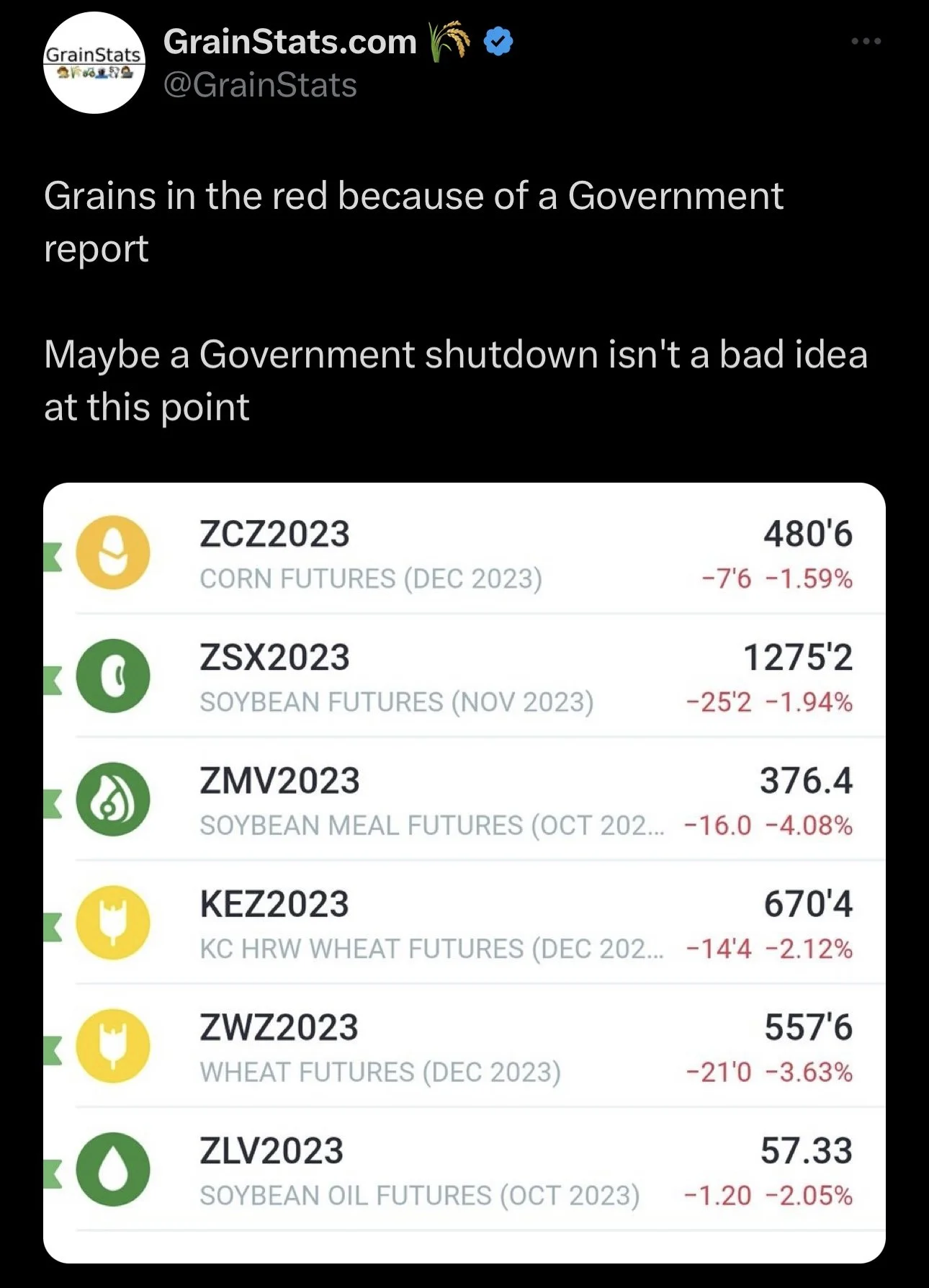

Not only did we have a bearish report, but the uncertainty of the potential government shutdown also added pressure and helped push prices lower.

This was my biggest concern heading into the weekend.

However, the government passed a last minute funding bill to prevent this shutdown. Which will keep the government open until November 17th. This also means we will indeed get our USDA reports.

As mentioned, the looming concerns of the shutdown caused even more fund selling across the grains.

A government shutdown would have been very negative for grain prices.

Well why is this? When the government shuts down, so does the sampling and data collections for the upcoming WASDE report. Which means no report at all.

Now some of you may be thinking, "Good now they can’t continue to push prices down." Which is an argument to be made. But grain markets do NOT like uncertainty. With no USDA report, there is a ton of uncertainty. Uncertainty often leads to lower prices.

The government not shutting down is a good thing for grain prices.

With the government shutdown being averted, perhaps this entices money to want to come back into the commodities.

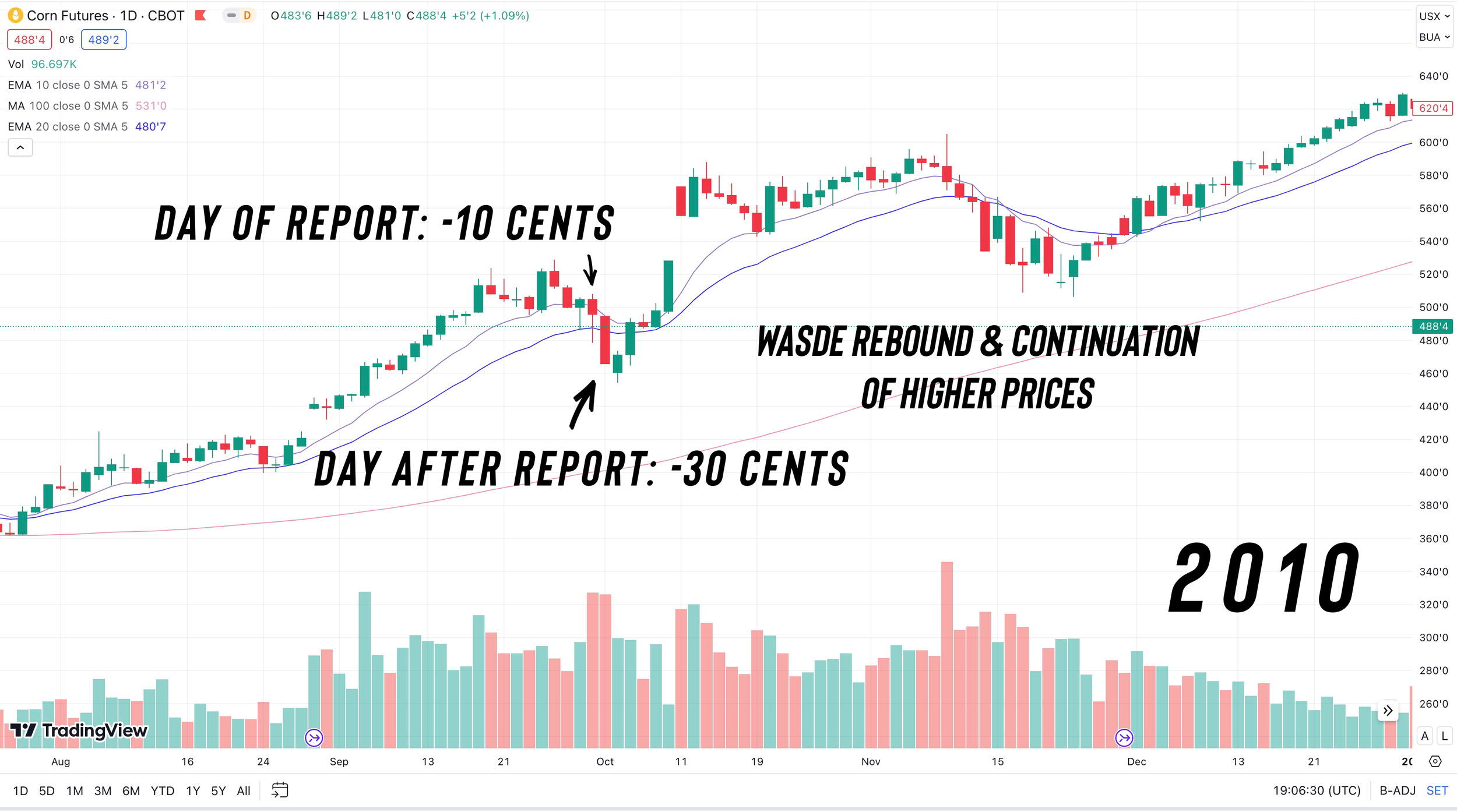

If we take a look back at 2010, which we touched on Thursday. It was actually the October WASDE which caused corn to come roaring back. The day of the report, we lost 10 cents, the day after the report, we lost 30 cents. For a combined 40 cent loss. But then the October WASDE came out and corn regained it's losses and then some. Continuing higher until spring. Here is the corn chart from 2010.

The last time we didn’t have an October report due to a government shutdown?

2013. If we take a look at the price action in 2013 for corn, prices continued to trickle lower the entire year before finally rebounding in the spring.

Coincidence? Perhaps. But we should be thankful we avoided the shutdown.

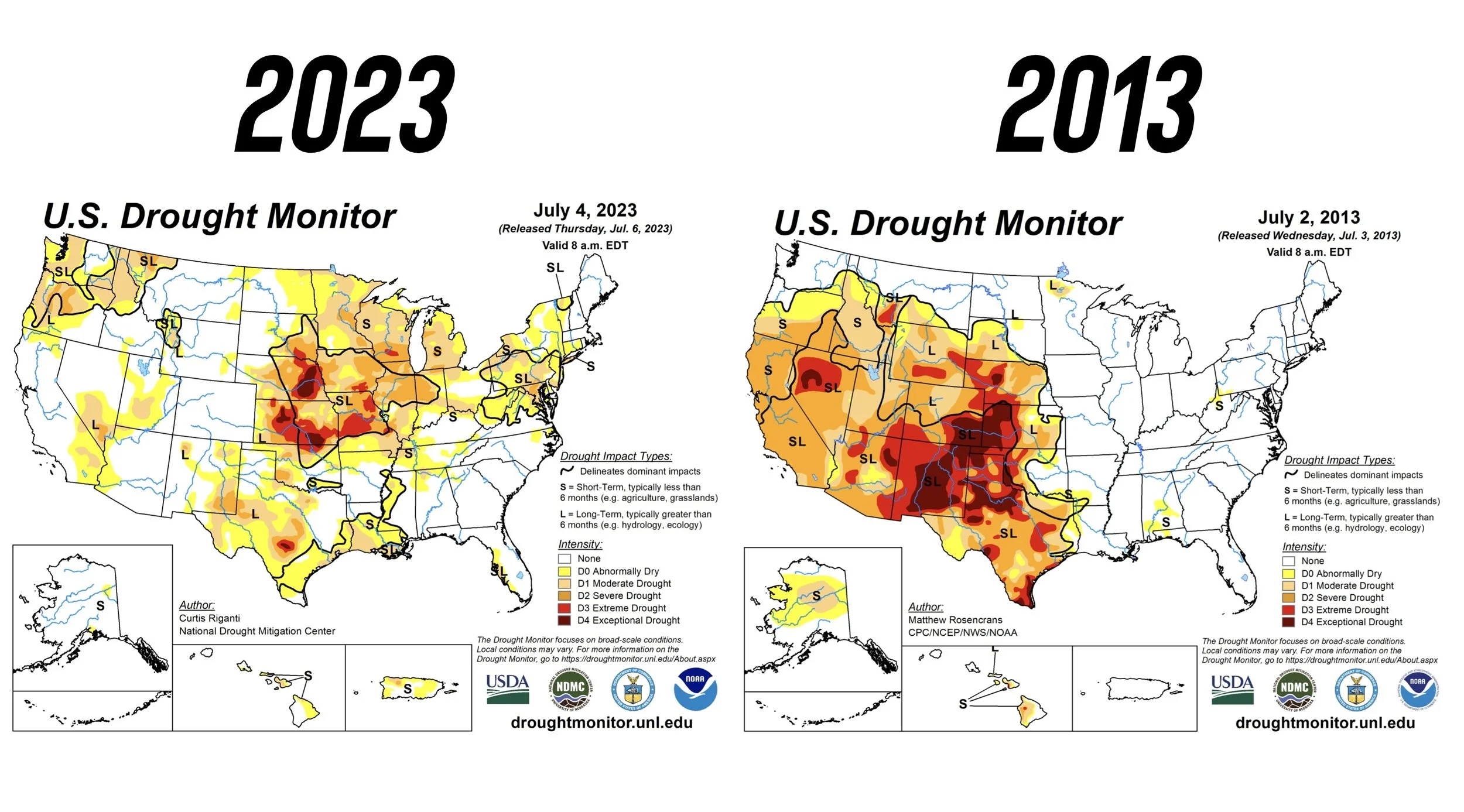

However, even if the government were to have gotten shut down, I still didn’t believe this year would have been a repeat of 2013. We are simply in a completely different situation when we take a look at yields, drought, etc.

Take a look at how our drought situation back in early July compared to that of 2013.

Now is there a possibility we do continue lower and don't make our lows until December? Of course it is a possibility. But I doubt it.

I again wanted to include these historical charts from Wright on the Market. He points out that the last 6 years, we have made our lows past the first week of October only 1 single time. That was in 2017.

Why did we make our lows so late that year? Because yields were better than the market and USDA were expecting. I don’t believe that is the case for this year.

Wright included this with his charts:

"If you are in the camp where you believe yields will be better than the current expectations, than wait to buy corn or corn calls to offset cash sales."

Bottom line for corn, the government not shutting is a big positive. The USDA report was actually pretty bullish for corn as well. The losses Friday were due to weakness in wheat and beans as well as the government concerns.

Ultimately, I think our seasonal lows will be printed sooner rather than later.

RECOMMENDATION

Livestock users need to cover all needs for the next 6 months ASAP. GIve us a call for which solution would fit best for your operation. 605-295-3100

THOSE MAKING CASH CORN SALES

For anyone that has been forced to make sales in the past 30 days or will have to make new sales in the next 30-45 days. Find a way to participate when China decides to come in and buy our corn, which will be happening before the end of the year.

We recommend utilizing a re-ownership strategy that fits with your operational risk/reward. Please give me a call to go over the different possible tools that might make the most sense for you. These recommendations are not one size fits all, it is imperative that you give us a call to make sure that you are utilizing the correct tool for your unique situation. 605-295-3100

Another tidbit from Wright on the Market:

"Compared to 3 months ago, crude oil is $25 higher, the ethanol crush is $1.50 higher, and the USDA projects corn yields will be 8 bushels less. The US has less corn, less beans, and just 0.11% more wheat compared to last year. Yet December corn is more than a dollar lower than it was 3 months ago.

Would you rather be the last one to sell corn or the first one to buy corn? The opportunity to do both is near."

Taking a look at our chart, we have still managed to hold our lows from two weeks ago. Bulls need to hold $4.68. The price we need to take out? Bulls still have their eyes on $5, as we haven’t gotten a close above in 2 months now.

HARVEST SALE

Limited time only.

$299/YR vs $800/YR

Soybeans

Now let's take a look at beans.

We had a bearish report. We took out our August lows of $12.82. What's next?

Historically, beans tend to form an uptrend immediately following this September report.

Overall, there is still "potential" for beans to go a lot higher. We have a tight US balance sheet. Current thoughts are that the USDA's estimates for the crop and yields will be getting smaller, not larger.

I do believe beans will be higher in the future, but how much lower will we go before putting in a bottom is the question. Will we continue that historic trend of putting in our lows the first week of October? We'll have to see.

The potential for $15 beans is still there. Yes, the "potential". That doesn’t mean it will happen, but there is a pathway for it to happen. Us getting our October WASDE could also be beneficial, as this means we don’t have to wait until January to get some numbers. But there is still that chance they do not make any big changes until then.

What happens if they come in in January and yield is sub 48, 47, etc. By that time, it is all about South America. If South America disappoints, and yields are not there, soybeans will be roaring higher. Now of course, these are 'what if" scenarios. But currently, southern Brazil is still facing a record heat wave that is expected to last throughout the end of October.

Those were the bullish possibilities, but here are some things that could add pressure to the bean market.

The funds have continued to liquidate their long positions. If they continue to do so, we could see pressure. The 26 million bushel larger than expected stocks today doesn’t help this outlook either.

The biggest risk to the bean market would be a monster South American crop. Still too early to tell. But if they do, we will have a large amount of supply and sellers in South America will discount their crop.

The river levels in the Mississippi river are driving export costs higher and increasing our shipping costs. This isn’t bullish for any of the grains.

Short term, harvest pressure could continue to have a negative impact.

Row crops typically make their lows when harvest reaches 50-60% complete. So I do believe we will be finding a bottom in the coming weeks, and upside for beans is there. But that doesn’t mean there isn’t a lot of downside risk in the bean market, because there is.

If we take a look at our chart, we broke through that key support level of $12.82 which was our August lows. It wouldn’t be surprising to see us test that next big support level. Our July lows of $12.56. Which bulls need to hold. We have bounced off that level in March, April, and July.

RECOMMENDATION

With the recent price break, we recommend have all feed needs cover for the next 6 months. Call us to go over strategies that might make the most sense for your operation.

For those forced to sell beans, if you want to give us a call and we can help you come up with some re-ownership strategies. We believe beans have tremendous upside no matter if our yield ends up being 46-48-50-51. Demand is strong as are margins and we are just money flow and a SAM production scare away from much higher prices.

In the short term we could continue to struggle because US producers are selling plenty of beans off of the combine. But longer term the bean complex is very supportive.

Wheat

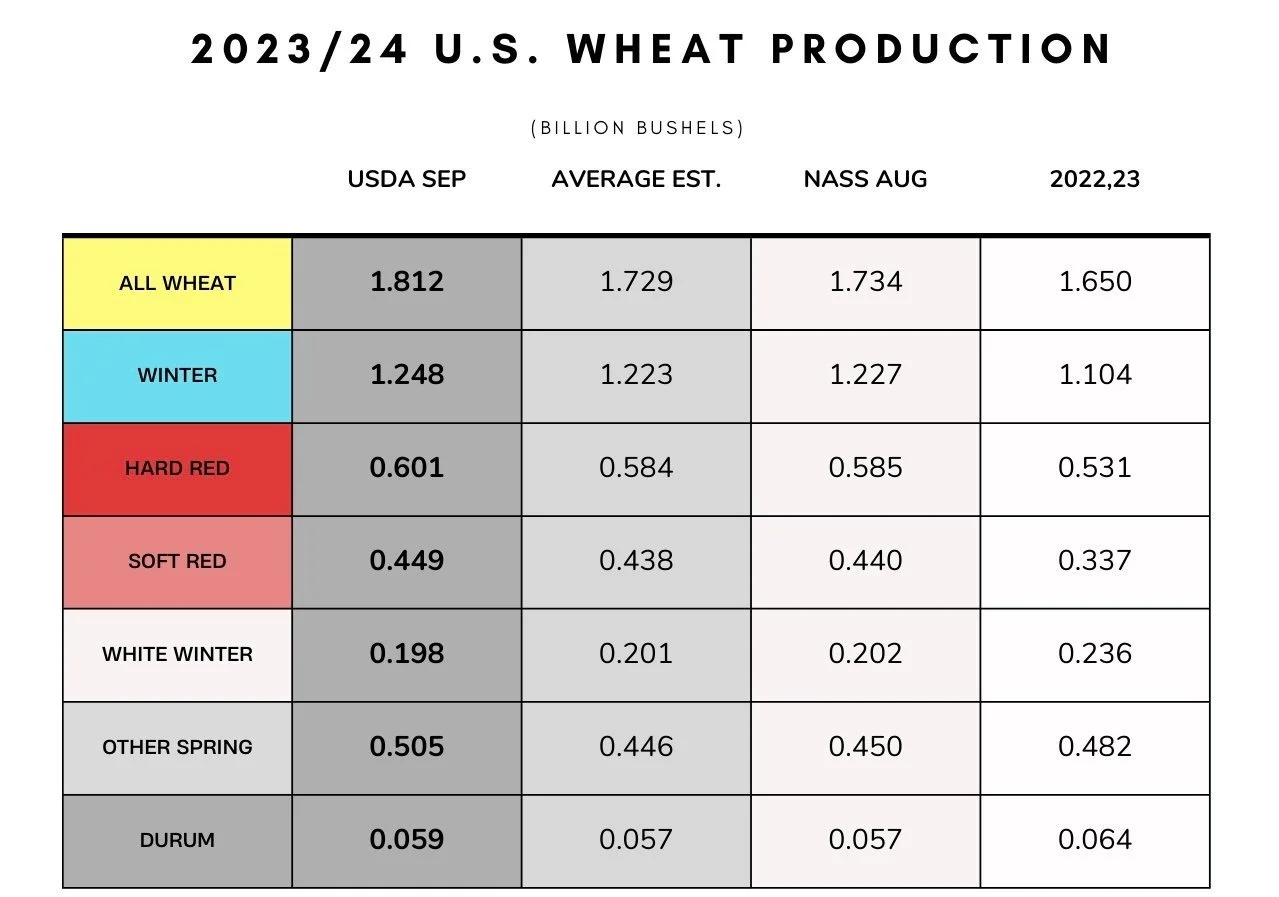

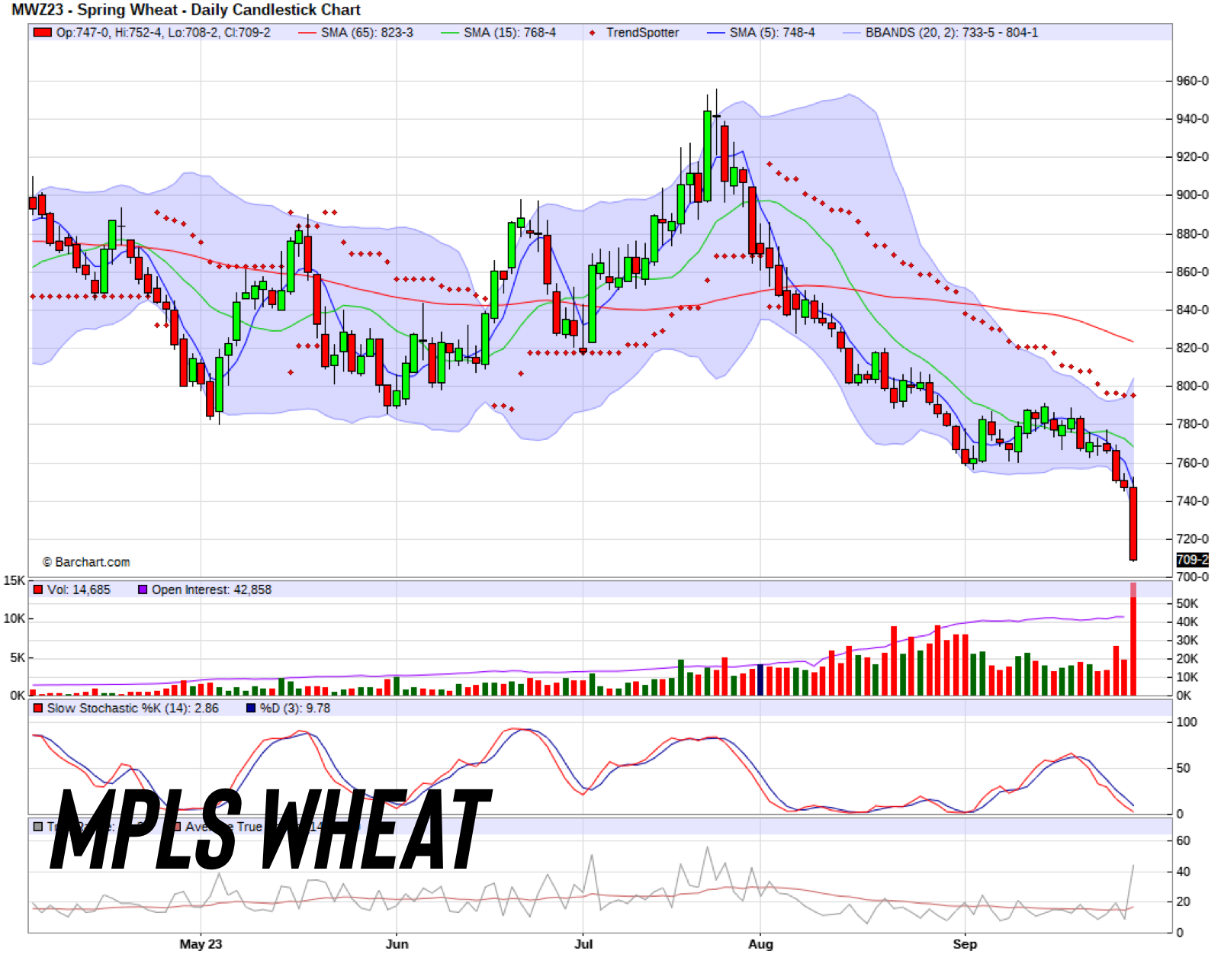

Lastly we have wheat, the funding bag of the funds and the grain that had the most brutal reaction to the report. As nearly every class of wheat came in above the trade estimates. US wheat production rose 10% on the year.

Up until the report, Chicago wheat had held it's lows from the last report. KC on the other hand continues to make new low after low.

Wheat is collapsing from lack of demand and a bigger supply here at home.

We thought $5.70 would hold for Chicago. But it didn’t. Fundamentally it is cheap, but new lows could lead to even more fund selling here.

However, we still don’t want to be selling at two year lows. If anything we want to be buying.

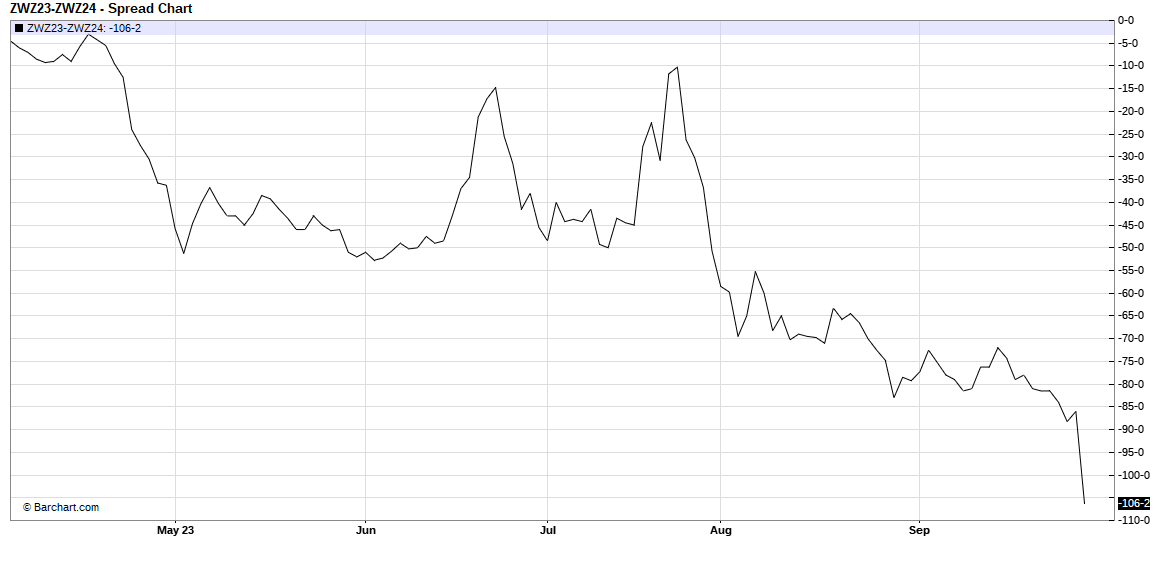

What is the biggest difference between now and a few months ago? It is the carry in the wheat market. Look at the below chart with Dec 2023 versus Dec 2024. Look at the price movement on Friday. Dec 2024 gained nearly 20 cents on the nearby contact.

This tells me that, A) the commercials are not getting any nearby business but they also know that wheat in the future is going to be much more valuable. Cheap wheat will fix itself.

RECOMMENDATION

Don’t sell wheat if you don’t have to. If you have to realize the huge discount you are selling it at. Very hard when one sell’s low and buy’s high. We want to do it the opposite.

If you have been forced to sell wheat, find a way to stay in the game but realize it is wheat and when you trade wheat sometimes you sleep on the street. With the huge carry that wheat has why would we have less nearby stocks? We should have huge stocks that are holding wheat to capture the carry. So if you are forced to sell it is going to be painful and very few re-ownership strategies will work until we get some excitement under the market. A few weeks ago it looks like we had made multi year lows in wheat. Then Friday came and once we hit the stops, it was watch out below. Was it enough?

I will sound like a broken record, but we have more upside then downside, wheat is a sleeper.

How do you position yourself without going broke if you are a wheat farmer? Or if your long on the board? Call me and we can discuss your situation as the reality is wheat will go much higher, when and from where is the billion dollar question.

In the meantime if you are making sales try to capture the carry in CBOT SRW if at all possible. Once farmers have stopped selling nearby and find a way to sell the carry we will be ready for a nuclear market.

From Chris Robinson of the Robinson Report,

"Downside risk from here? 5.25; $5.00 and then $4.68 On a more serious note-- The next time we see Wheat North of $10.00? 1) clean out your bins. and buy some 2 or 3 year out of the money puts to capture as much of that revenue as possible. I'll be here banging the pots and pans when we get there. I just hope we don't have to wait another 12 yrs to see it."

HARVEST SALE

For a limited time save over $500. Take advantage before your trial ends.

Check Out Past Updates

9/29/23

USDA REPORT RECAP

9/28/23

PREPARING FOR USDA REPORT & TAKING A LOOK AT HISTORY

9/27/23

PROTECTING YOUR INSURANCE GUARANTEE

9/26/23

GOVERNMENT CONCERNS & PREPARING FOR USDA REPORT

9/25/23

HAVING A PLAN OF ATTACK

9/22/23

WEEKLY WRAP