BUYING OPPORTUNITIES

Overview

Grains finish the day mostly higher, with corn leading the way up 6 cents, beans up 4/12, and Chicago wheat up almost a nickle.

This morning we saw another sale of 120k metric tons of beans to unknown. This was likely to China.

We have gotten some pretty good rains for the Midwest. Getting rain now is actually bullish and far from bearish. Bears point out that we need to raise the river levels. Rain isn’t going to improve crops here, we are passed that window. If anything it just slows down harvest, worries crushers, and allows the US to sell more beans to China.

Wheat a little stronger today on the idea that we may start to see an uptick in global demand. As it looks like Russian wheat may not be the cheapest on the market anymore. Long term this is friendly, but short term the US may not get a ton of the business.

StoneX's most recent yield estimates showed 175 corn and 50.1 beans. However, the Chief Commodities Economist, Arlan Suderman said that his yield models had corn dropping another 2 bushels this week, down to 171. His bean estimates were left unchanged at 50, however he said more yield loss was highly likely.

The highly respected Dr. Cordonnier has his estimates set at 173 for corn and 49.5 for beans, with a neutral to lower bias moving forward.

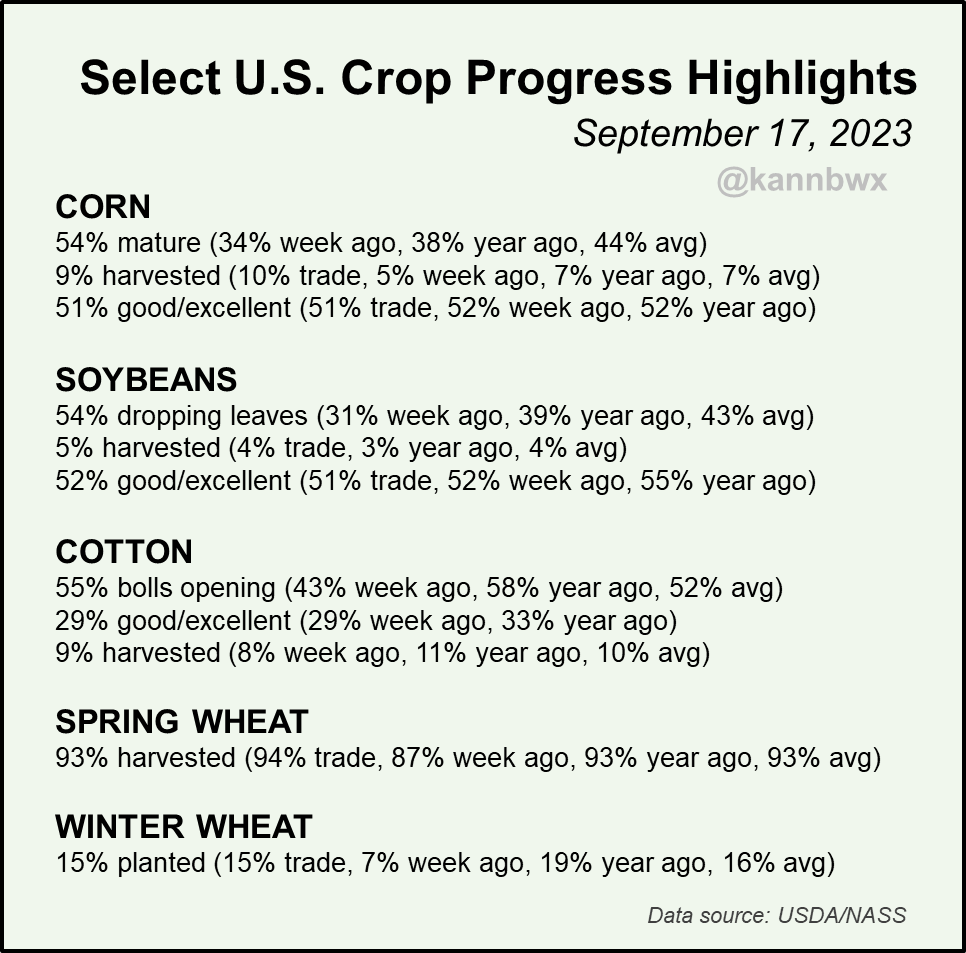

If we take a look at the crop progress report from Monday. Corn maturity is running 16% ahead of last year and 10% ahead of our average. While 54% of beans are dropping leaves compared to 39% last year. This confirms the brutal heat and dryness we saw to close out August and start September resulted in some early plant death, which helps speed up harvest.

Chart Credit: Karen Braun

Like we mentioned in yesterday's audio, the areas that are harvesting at a fast pace and showing some better results than normal, are the same areas who usually lack. The areas that were hit with that brutal heat and dryness are the areas that usually carry our yields, such as Iowa. So I’m expecting more disappointing results when the combines get rolling in those areas.

Looking short term here, we could be in for some more harvest pressure over the course of the next week or so. So currently I’m remaining patient as we will likely be getting a very good buying opportunity over the next 1 to 2 weeks.

Just a reminder that CBOT options expire this Friday. The day before and the day of option expiration often results in down days for futures. So keep that in mind and don’t be surprised to see a little bit of pressure to close out the week.

We also got yet another wild 2023 headline rumor. The rumor is that the government may be shutting down at midnight on September 30th, the end of their fiscal year. If that happens we may not get the USDA production and supply & demand report on October 12th. The markets usually don’t like uncertainty, so if this happens it could lead to uncertainty and a little more selling rather than buying. Just something to look out for.

The next big market mover is September 29th, 9 days from today. Where we get the USDA quarterly stocks report. Will have to see if we get any surprises.

Bottom line here, don’t be surprised if we see more pressure over the course of the next week or so. We will be getting some great buying opportunities very soon if they are not already there.

Now let's dive into today's update.

LOCK IN 50% OFF BEFORE YOUR TRIAL ENDS

Make sure you take advantage of this offer before your free trial ends. You don’t want to miss all of our future updates & audio.

Become a Price Maker.

OFFER: $399/yr or $39/mo

NORMALLY: $800/yr or $80/mo

Today's Main Takeaways

Corn

Corn futures lead the way here today. Now up around 15 cents from yesterday's lows.

CONAB released it's first estimates for Brazil's new crop corn production. They see planted corn acres dropping by -5%, leading to next year's production dropping by -9% from this year.

The USDA currently has Brazil old crop production at an all time high of 137 MMT. With Brazil new crop production at 129 vs CONAB's recent 119.8 MMT. This is great for bulls, as bears are always seeming to point out South America taking export space and of course we have the poor demand. Brazil producing less is very friendly looking long term.

As we mentioned earlier, we haven’t yet got much results from the major players in terms of early yield results. The market knows the states down south have seen some strong early numbers, but just wait until they get into states like Iowa, Minnesota, etc.

I am hearing more and more people as well as experts agree that yield is likely below 170 bpa.

Short term, I expect mostly some choppy price action until we start to see more results from the fields. To close out the week I wouldn’t be surprised to see some slightly lower prices but I'm not expecting anything too crazy.

Lows will be in very soon. Only 1 time out of the past decade have the harvest lows not be made in August or September. That was in 2014 where we made our lows on October 1st.

Short term we may not go up a ton, but the downside is somewhat limited. The funds would have to pile on another 100k shorts to push us down to $4.50, which is certainly a possibility but I don’t think that's the most likely scenario. Perhaps they do look to defend their short position until we get more results, but eventually I think they look to liquidate.

If you are worried about the downside, keeping a cheap put under your unsold bushels just in case is never a bad idea. I think we are entering a phenomenal buying opportunity here. But who knows how long the funds will want to ignore the bullish fundamentals and strong arm their position. If you have questions or want specific advise shoot us a call at (605)295-3100.

A major rally short term will be tough with the demand issues. But looking long term I think we start to find that demand and I think yield is eventually sub-170. The harvest lows should be in sooner than later, and we will be looking at higher prices later in the year and into 2024.

We have had a nice little reversal from our lows yesterday, but we got stopped out right at our 20-day moving average.

That $4.63 level is the level to be aware of. That level goes all the way back from April to September of 2021. We had 6 months from April to July of 2021 where it was resistance, then it became support.

Upside targets if we can continue to hold that $4.63? (which I believe we will). First we have the 20-day moving average at $4.83 which was our residence today. Next target is $5.

If we can break that 20-day moving average, that would be huge and could lead to some more upside. We also have a falling wedge pattern that we may be looking to break out from. Often a bullish pattern.

Bottom line, don’t be shocked to see some pressure to close out the week or even for the next week or two. Don’t be surprised to see some choppy action. Patiently waiting for the harvest lows to be carved out and for more results from the fields. A buying opportunity is coming, if it's not already here.

Corn Dec-23

Soybeans

Beans finally seeing a little bounce and some life following the recent sell off.

CONAB forecasts a 5% bigger Brazillian bean crop next year. Which isn’t adding any support to prices. However, I'm not too confident that they will again produce a record crop.

Here is what Kory Melby, a Brazil Ag Consultant had to say:

"If the maps I received are correct for Brazil rain the next 90 days, it is not if, but when the market takes notice."

In yesterday's audio we mentioned that soybeans had the potential for $15 to $16 or perhaps even new all-time highs if the dominos fall right. We are not saying that will happen. We are saying there is a pathway for that to happen.

We aren't the only ones who realize that soybeans have the "potential" for all time highs.

Darren Frye, who was one of the biggest bears not too long ago has shifted bullish.

A Nebraska Producer said:

"Early yield results are in. Irrigated short season bean yields are... disappointing."

Darren's reply was:

"Sure they are and the disappointments will keep coming. Not making light of this disaster. Farmers have losses. Soybeans are going back to $15 to $16 minimum and if South America has issues they will challenge all-time highs. It is real."

Jason Bohlke, a commodity trader had this to say:

"Hearing a lot of disappointed irrigated soybeans in Nebraska in the 60's. It just seems like these soybean yields are not there. I am not shocked, but anyone who believes we are 50+ might be. Too many holes and not enough good soybeans to make up."

Kevin Van Trump had this to say,

"I've heard some big bulls talking about a final US bean yield in the 45 to 47 bushel range, arguing that large portions of the US crops have been devastated by extreme heat and inadequate moisture."

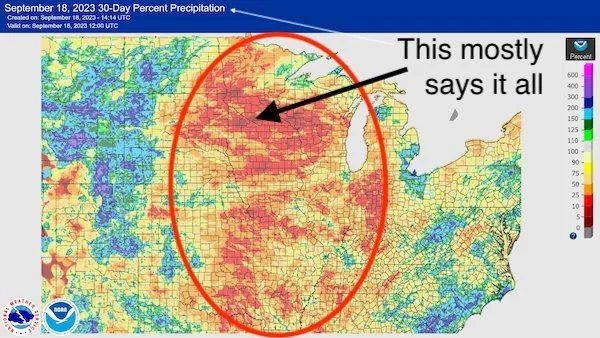

He then included this map below. It is the past 30 days of precipitation, with the title "This mostly says it all".

So bottom line, I am hearing nearly everyone agree that soybean yield is sub-50. I am even hearing some throw out numbers in the 45 to 47 range. IF yield were to come in that low, the sky is the limit. We are already in such a tight situation for beans and simply can’t afford to lose even a few bushels.

Now there is the possibility that the USDA doesn’t drop the yield that seriously until January. By that time, the main focus will be South America's crop. If their crop disappoints, we will be going so much higher.

Now of course, there are a lot of "if's" at play. Nobody knows how it will all shake out. I am just pointing out that if these scenarios happen, we are in for higher prices.

Similar to the corn market, I think we could be in for some more pressure or perhaps just a chop the next week or so. But when these combines get rolling into the big production states like Iowa, I think the people who say we are over 50+ yield will be in for a surprise and ultimately we should see higher prices. Which leads me to look at this as a good buying opportunity, but we do need to realize there is the risk for downside in beans as we are still $2 over our May lows. If you want specific advise on your operation give us a ring anytime. (605)295-3100 and we'd be more than happy to help.

Level we need to watch? Bulls need to hold $13 or we could fall into the $12.82 range.

Soybeans Nov-23

Wheat

The wheat market ends the day mixed with Chicao and Minneapolis trading higher while KC trades 2 cents lower.

As mentioned, it looks like world demand may starting to be picking up and Russia might not be the cheapest place to buy from anymore. This added a little bit of support today and long term could be a very supportive factor.

Here in the US we are looking at some better rainfall in some important growing areas. But the wheat market and it's concerns are far more of a global one.

We are seeing Russia join the long list of countries that may be experiencing some weather worries.

We have the obvious problems in Canada and Argentina, and we might be seeing some supply issues in India.

We have Australia's wheat crop that might be in worse shape than the trade currently thinks.

These are all factors that have been at play for quiet some time and we have continued to point them out. Do they matter today? Not necessarily. But they will.

Russia wheat prices will likely start to move higher, creating less competition for exports.

Of course, the funds remain heavily short as they have been for a very long time now. Eventually they will look to liquidate these. The question is when?

Short term, I'm not looking for a crazy rally. But I do think we have put in our lows for Chicago wheat, the same lows we pointed out last week following the report ($5.70).

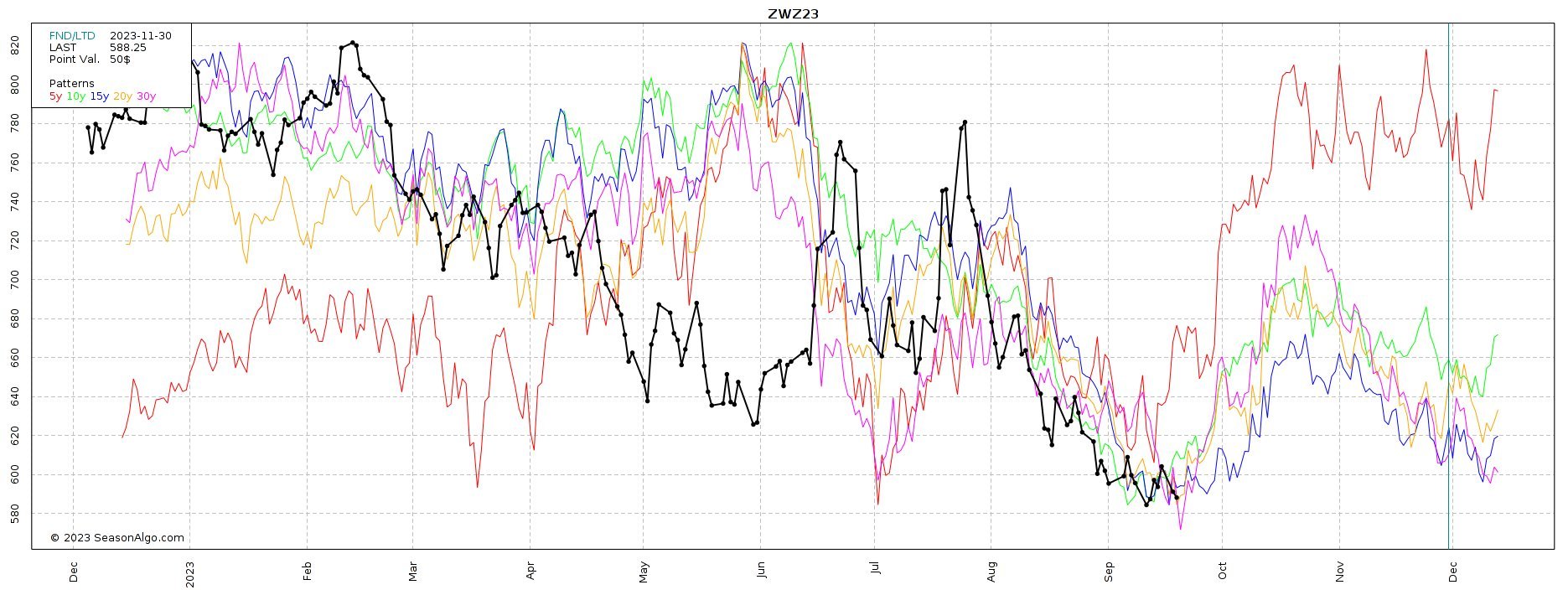

Seasonally this is when we also put in our lows, which helps the argument that we believe the lows are in. Here is a seasonal chart from SeasonAlgo.com

Bottom line, the long term wheat outlook is bullish. We believe the bottom is in, and think global weather and an overall increase to demand will help us see higher wheat prices in the future, and we should get much better pricing windows later in the year.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Updates You Might’ve Missed

9/19/23 - Audio Commentary

CAN WE FIND DEMAND?

9/18/23 - Market Update

HARVEST PRESSURE

9/15/23 - Audio

BECOMING COMFORTABLE IN THE MARKETS

9/14/23 - Market Update

YIELDS, DROUGHT, & CHINESE APPETITE

9/13/23 - Audio Commentary

$10 WHEAT/$6 CORN/$15 BEANS BY THE END OF THE YEAR?

Read More

9/12/23 - Audio & Report Recap

BEARISH REPORT, BUT SETS THE STAGE FOR HIGHER PRICES

9/11/23 - Audio Commentary

CHEAP PRICES CURE CHEAP PRICES

9/10/23 - Weekly Grain Newsletter

PREPARING FOR THE USDA REPORT

9/8/23 - Audio Commentary

WILL USDA REPORT BOOM OR BUST?

Read More

9/7/23 - Market Update

BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

9/6/23 - Audio Commentary