RAINS & BRAZIL ESTIMATES

Overview

We had a blood bath yesterday where soybeans made their lowest close since June and corn made yet another new low.

Both were slightly higher today while the wheat market trades lower for the 3rd day in a row, testing that $6 support level.

Why has the market been pressured so heavily to start the new year?

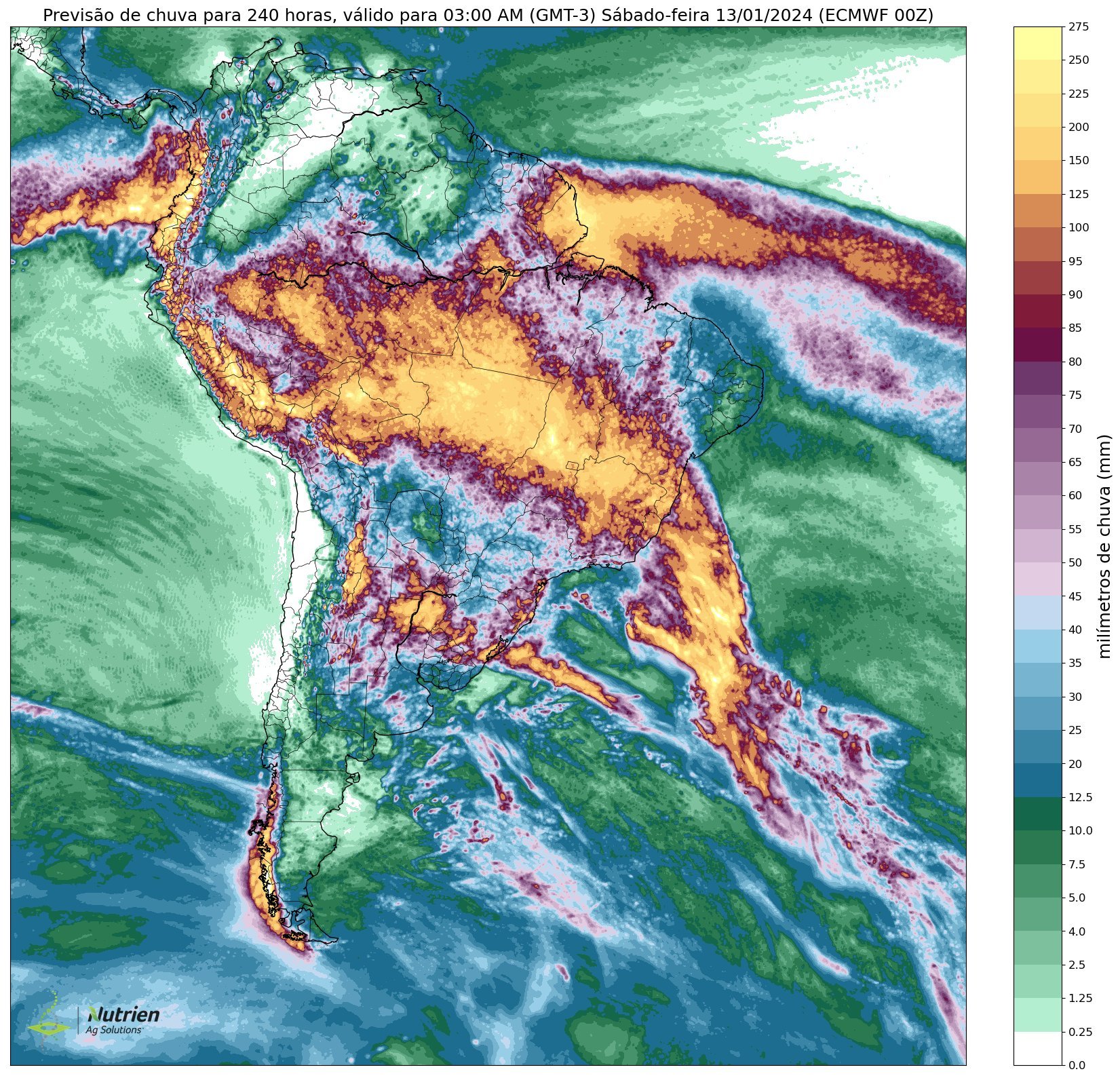

Well Brazil got some rain, however these rains were actually LESS than expected. So if they were less than expected why did beans just get smacked -25 cents yesterday?

Simply the forecasts, as the forecasts are almost all in agreement that they will continue to get rain and remain cooler.

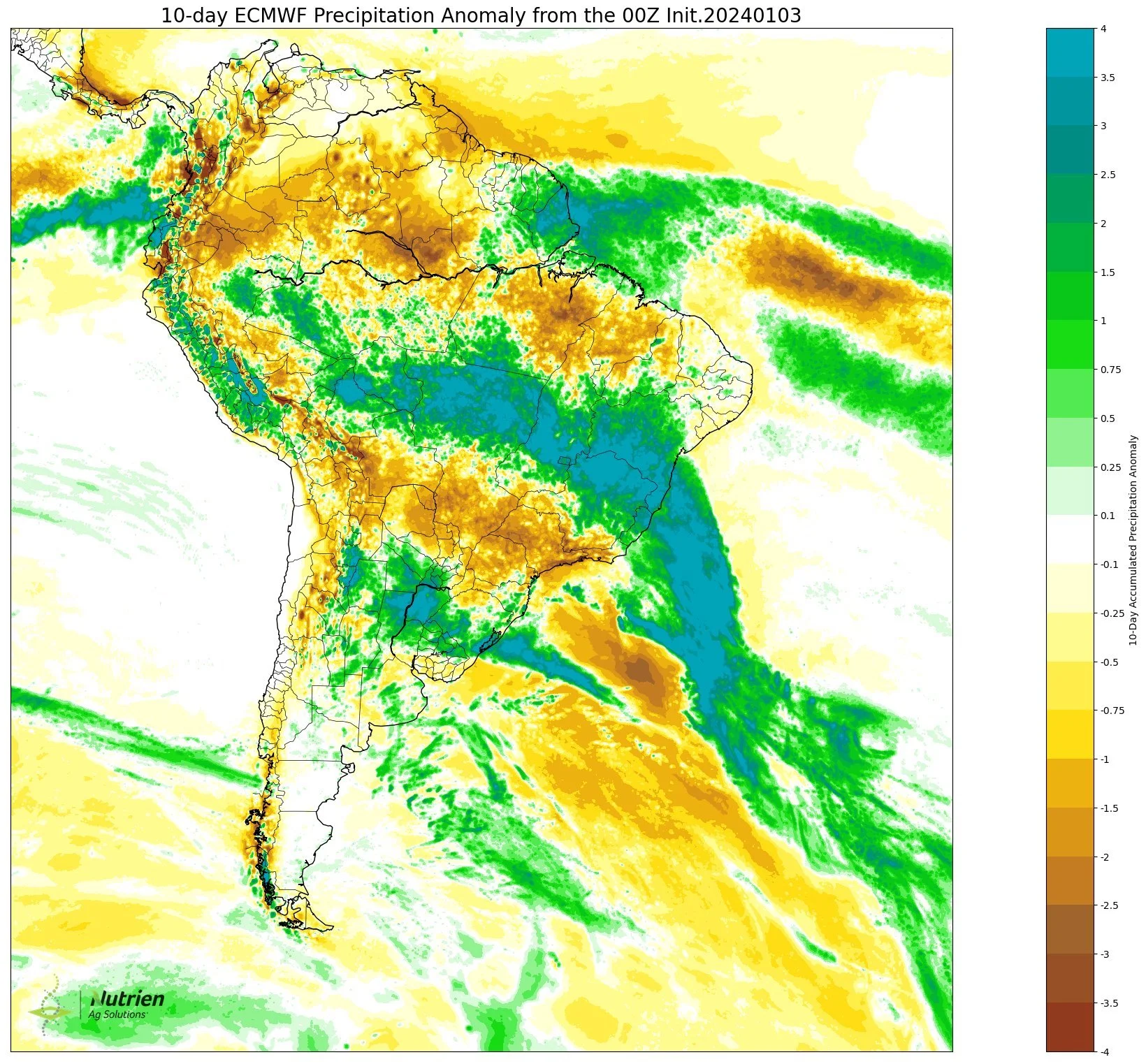

Here is the 10-day forecasts, they do look awfully wet.. the question is how late is too late to make a major difference?

Another thing to note, after this week of rains, some forecasters believe the pattern will again shift to hot and dry.

Even with the weather shifting more favorable, it hasn’t stopped analysts and experts from dropping their Brazil yield estimates.

We saw StoneX Brazil drop their number by 9 million metric tons from last month to 152.8 which is well below last year's crop and far below what the USDA's current 161 number.

Dr. Cordonnier cut his estimates another 2 million. He now has his number at 151. Citing low yields on the early harvested beans.

So here is what current Brazil estimates look like,

USDA

Corn: 129

Beans: 161

Dr. Cordonnier

Corn: 117

Beans: 151

StoneX Brazil

Corn: 124.6

Beans: 152.8

What yield is the market pricing in for Brazil beans?

If I had to guess, I'd say we are priced into that 150 to 155 range.

Corn? Probably priced into that 115 to 120 range.

We used several artificial intelligence tools to take a deeper dive into yield probabilities and what prices these different yields could send futures prices to. We plugged in a ton of data and history and this is what they came up with.

So let's take a look at beans for example. They believe that if the yield were to come into where the USDA currently has it (161) we could possibly see $10 beans or lower.

However, I do not think 161 is even remotely close to possible at this point. If we come in right at 150, they would suggest we see beans around $12, then on the other hand if we fall down to the 135 area, we could be looking at $14+ beans.

Nobody knows where yield will come in at. It looks like they are supposed to get more rain, so it might come down to just how much damage was done these past three months. To put things into perspective, Brazil just had their driest October, November, and December on record. This would be like the US having their driest June, July, and August on record. With maybe some rains towards the end of August. Guess we will have to see how it all shakes out.

This little snippet was from an article we had AI put together, we also included different hedging strategies amongst some other info. You can check out the full thing HERE.

-

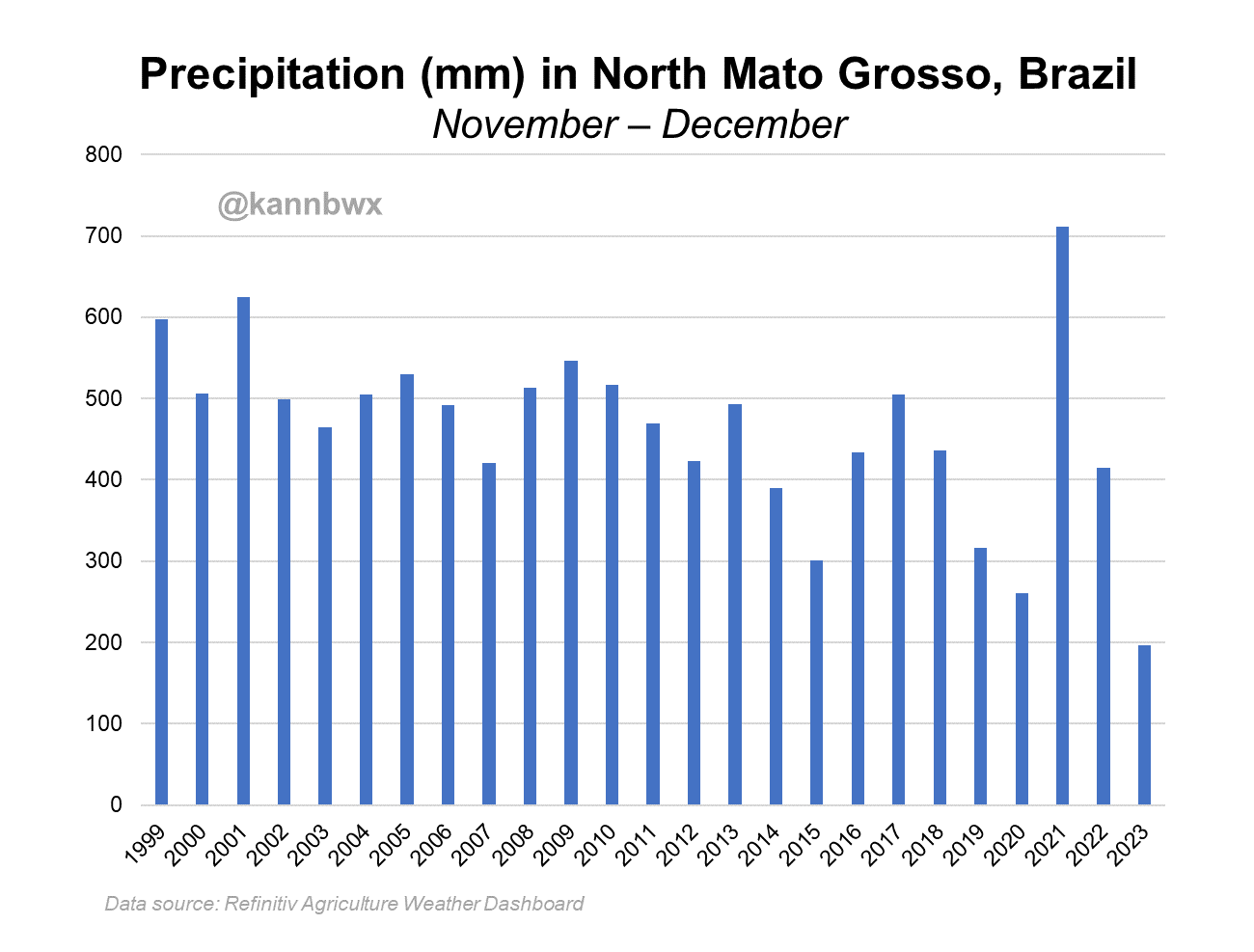

How light was rain in December for Brazil?

These next two charts from Karen Braun tells you everything you need to know.

This December was both the hottest and the driest on record. It wasn’t even close.

Rain came in a whopping 54% below average.

This comes after their driest October and November on record..

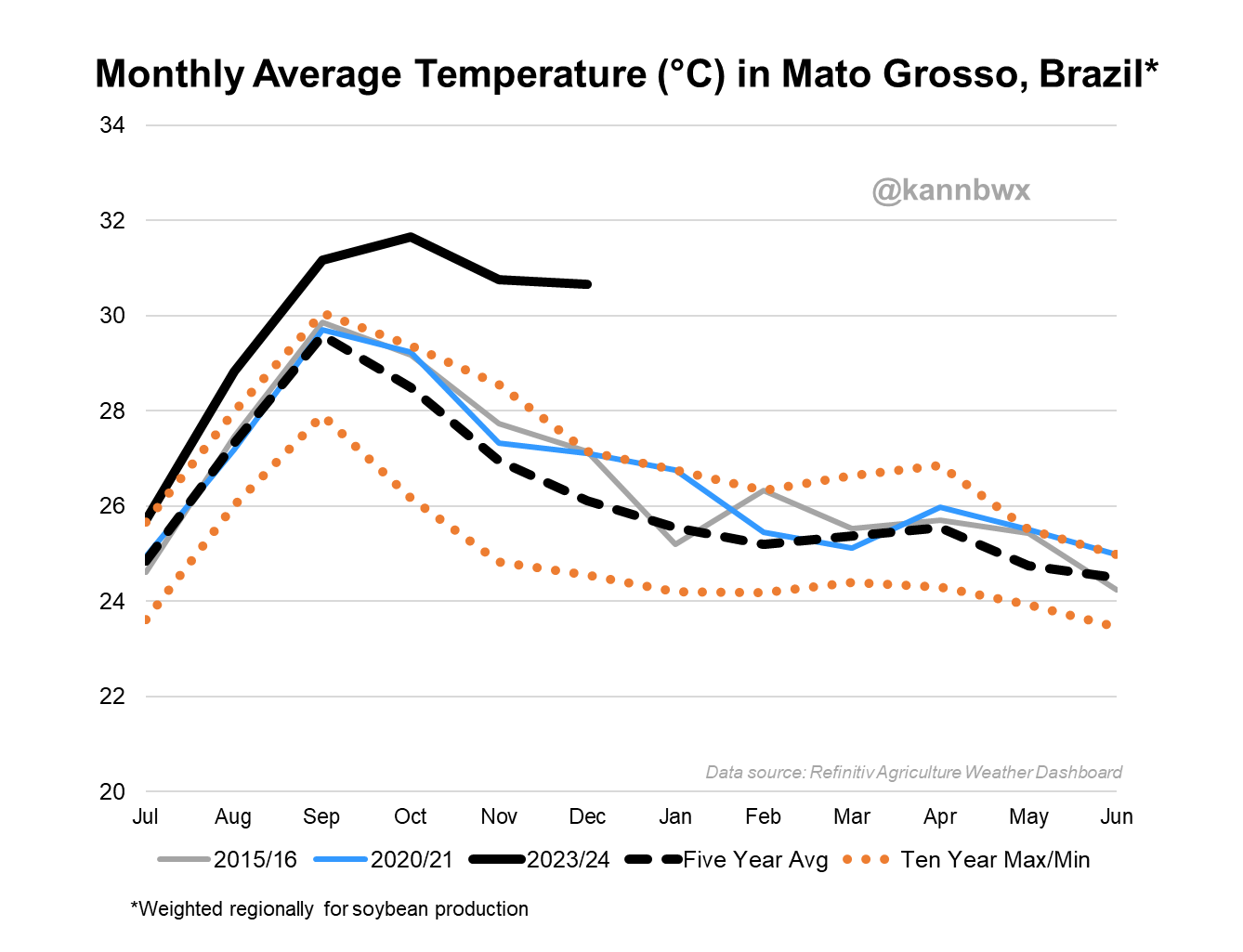

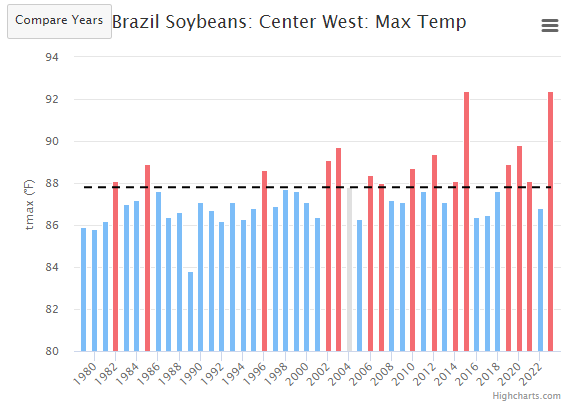

Here is a chart from Arland Suderman of StoneX. It showcases just how brutally hot 2023 was for central Brazil.

The average max temp was tied for the hottest on record at just over 92 degrees which is similar to what Nebraska saw this past August.

It is normally not this hot in Brazil due to the clouds during the rainy season, but this rainy season hasn’t been rainy at all.

Now let's dive into today's update..

LAST CHANCE FOR HOLIDAY SALE

This will be one of your last chances to lock in our biggest sale of the year that ended Sunday. Don’t miss it. Make this the year you beat Big Ag at their own game.

Everything: $399 vs $800 a year

Today's Main Takeaways

Corn

Yesterday corn got beat up and from a technical standpoint it doesn’t look great.

As mentioned, the rains in the forecasts are pressuring both corn and beans.

I believe the Brazil situation has a ton of "potential" and is a major bullish wild card that could happen.

I have been talking about this since November. I said that the market probably won’t realize the severity of the situation until mid January or perhaps even February or later.

Why do we think this corn situation in Brazil could potentially be a bullish wildcard?

For starters, we had very late soybean planting which pushed back the second corn crop. Soybeans will always be the first crop in, not corn. Acres are going away daily from the late planting of beans or from producers switching crops.

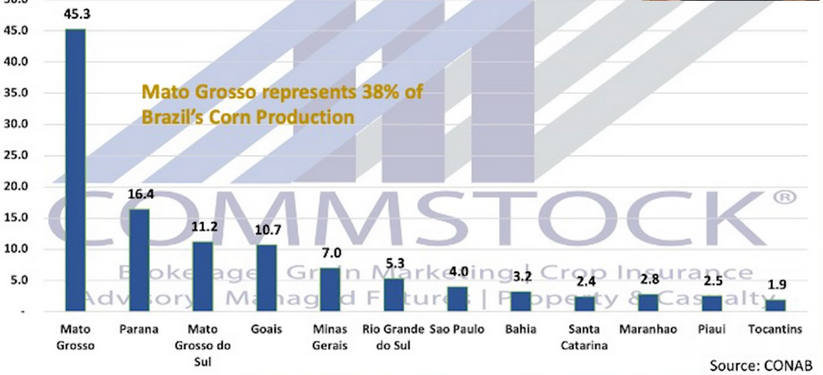

Just take a look at this next chart. It shows that Mato Grosso accounts for nearly 40% of Brazil's corn production. The same area that just went through their worst 3 month drought period on record.

The soybean crop has a "chance" to produce a somewhat reasonable crop, but I simply don’t think the corn acres will be there when it's all said and done.

Unlike soybeans who's production is somewhat split between the north and the south, around 80% or so of corn production takes place up north.

Even though yes, I do think this situation will come to light within the next month or two, does not mean there is not still risk in our corn market.

We do not like making sales at mutli year lows, but the risk in our corn crop is that here in the US we produce this bumper crop to go along with our already massive 2 billion bushel carryout.

Bottom line, I do believe we are in for higher prices as we get closer to spring, but we need to keep in mind all of the possibilities. Because we would be lying if there wasn’t potential risk.

As always, every situation is different so we don’t like giving our generic recommendations. If you have questions, want to know if you should be re owning, etc. please give us a call free of charge and we would be more than happy to help. 605-295-3100.

Corn March-23

Soybeans

Soybeans get a small bounce following multi-month lows yesterday.

Yesterday we saw the spreads firm up despite the heavy selling, this is bullish and gives me a little bit of hope. As it makes zero sense for spreads to firm up in a market that is trading -25 cents lower.

The funds are actually now net short on their position. On one hand, this makes the most logical decision to continue to add shorts, but also gives us all the more power to go higher and see more buying when they decide to get long if we get more Brazil worries.

Crush came out at 200.1 million bushels. Which was above the estimates and just shy of a record for any month. So a strong number there.

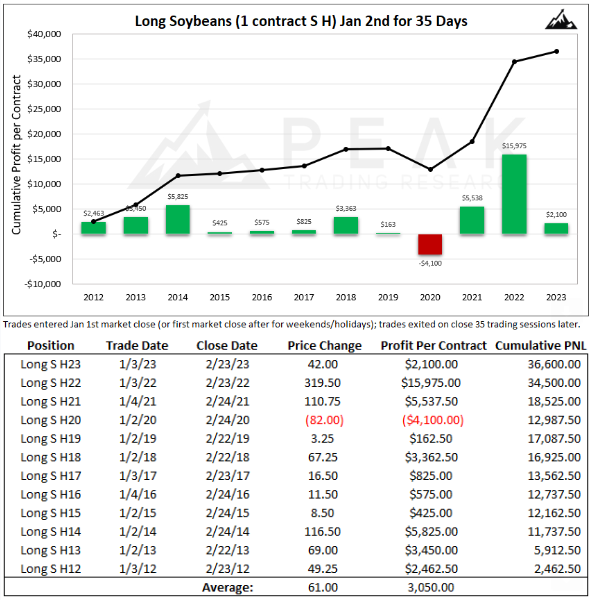

Here is a great chart from Peak Trading Research.

It displays the fact that March soybean futures have rose 11 of the past 12 years (which is 92% of the time) for the 35 trading sessions starting on yesterday’s market close. With the average rally being +61 cents.

The only year we did rally? 2020, which was due to the COVID year.

So this just points out that history is on our side, and by the end of February we statistically should be looking at higher prices. But of course, Mother Nature and money flow will be the true dictators.

Yes soybeans still have the potential to trade $14 or higher. I am not saying it will happen. I am saying there is a clear and distinct possible scenario that could cause it. For example, $7 corn isn’t very realistic here at least short term especially with our somewhat bearish situation and carryout here in the US. But for soybeans, the path to much higher prices is there and $14 or even $15 isn’t all that unreasonable if Brazil's crop fails miserably. Will the cards fall right is the million dollar question.

We have had the driest and hottest 3 month time frame in Brazil on record. Yet, the market has sold off since November 15th.. Doesn’t make much sense. Guess the market will need actual proof that a lot of these crops are toast if we want higher prices.

Taking a look at the chart, we managed to hold that $12.61 support level which is good. A break below could look ugly, as we have a gap of air down to $11.45.

Bottom line, we will have to see what rain falls, what doesn’t, and how much damage is already done. Then we have the highly anticipated USDA report in just over a week.

If you want tailored advice shoot us a call or text at 605-295-3100.

Soybeans March-23

Wheat

Wheat futures lower again, as Chicago closed just above that $6 psychological support level.

The wheat situation is a little different than corn and beans as they haven't been pressured from the Brazil rains.

Wheat is being pressured from the funds as well as the winter wheat being in better shape than it was a month ago.

Kansas winter wheat conditions improved from 36% to 43% rated good to excellent, while Oklahoma improved from 53% to 67%. So it looks like the rains definitely helped those there.

The funds continue to beat up wheat as they just simply don’t have a major reason to get long here.

Sure we have the war situations, but most of that is old news and unless it is something ground breaking, they will likely throw it out the window and the mini war rallies will be sold.

The recent surge in the dollar hasn’t helped either, as the dollar has rallied 2 points the past 4 days.

Some things bulls are keeping their eyes on and want to see:

A continuation of problems in Russia and Ukraine.

More buying interest from China.

A potential artic cold cycle blasting through Russia next week which could affect their winter wheat crop.

Bulls will certainly need a catalyst here if they want to spook the funds into covering.

Our winter wheat crop here at home is looking good.

Long term, I still believe we have a lot of "potential" upside and still view the wheat market as a sleeper. But that doesn’t mean it has to go up anytime soon.

Seasonally we go higher. Currently remaining patient waiting for a bullish catalyst to catch the funds off guard and give them a reason to cover.

Taking a look at the chart, we need to hold this $6 level or we likely make another leg lower. Bulls would really like to clear last week's highs of $6.40 to bring more upside, but then again we are still 40 cents away.

Chicago March-23

KC March-23

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23