KC JOINS THE SELL OFF

Overview

Following the recent losses across the grains, KC and Minneapolis wheat decide to join in on the action lower. As they lead the grains lower today. Despite today’s 30 cent losses, KC is still well over $1 off its lows from the beginning of May.

As most of you know, yesterday morning we saw yet another cancellation of corn from China. As they cancelled 272k metric tons. Making it the 4th one since April 24th.

To add on to the pressure yesterday, we saw Turkey announce that Russia had indeed agreed to a 60-day extension of the Black Sea grain deal.

These two big headlines, to go along with fast planting and expectations for big crops out of Brazil have been the main factors driving us lower on this sell off.

Looking forward, bulls are imagining we get a weather scare to stop the bleeding. As the market hasn’t taken in much if anything weather premium.

***

In case you missed it, check out Sunday's Weekly Grain Newsletter where we went over the USDA report and the garbage assumptions. Read Here

Today's Main Takeaways

Corn

Corn lower again here today following yesterday's pressure from cancellations of corn sales from China.

The headline yesterday was another cancellation of corn from China, as they continue to play games in attempts to get things as cheap as possible. They are canceling these mainly due to the fact that they are anticipating this big crop out of Brazil. By doing this, one has to wonder if this could come back to bite them down the line, as it is a very real possibility that Brazil winds up being far too dry. If that happens they might have to come running back. We still have 2.54 million metric tons of corn sales to China on the books.

Not only did we have China playing games, but we also had Russia agree to an extension of the Black Sea deal after months of uncertainty as to whether they would or not. This of course has added additional pressure on top of those cancellations.

From Van Trump Report,

"The good news is overall trading volume is at levels we haven’t seen in over a year." "Experienced traders will often argue that a major jump in volume often means we are getting closer to a nearby high or low."

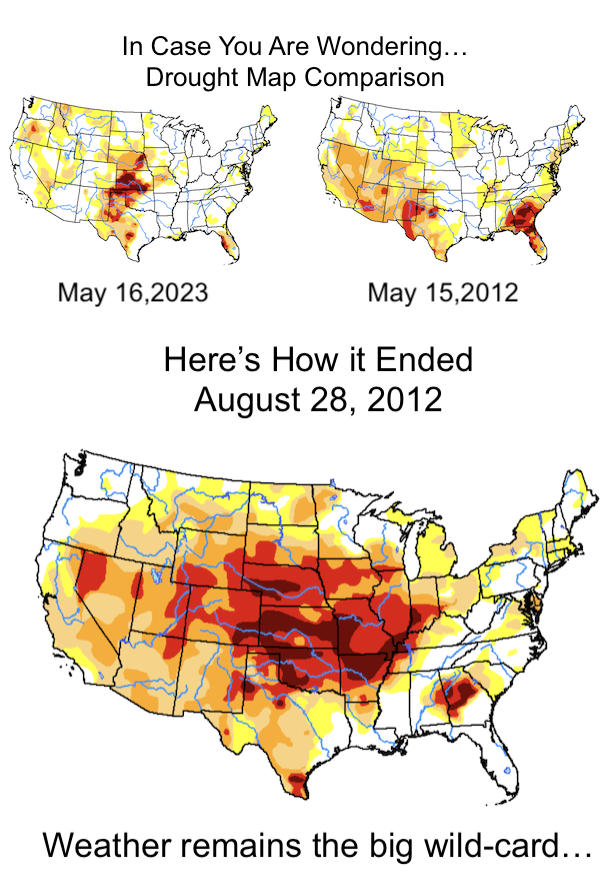

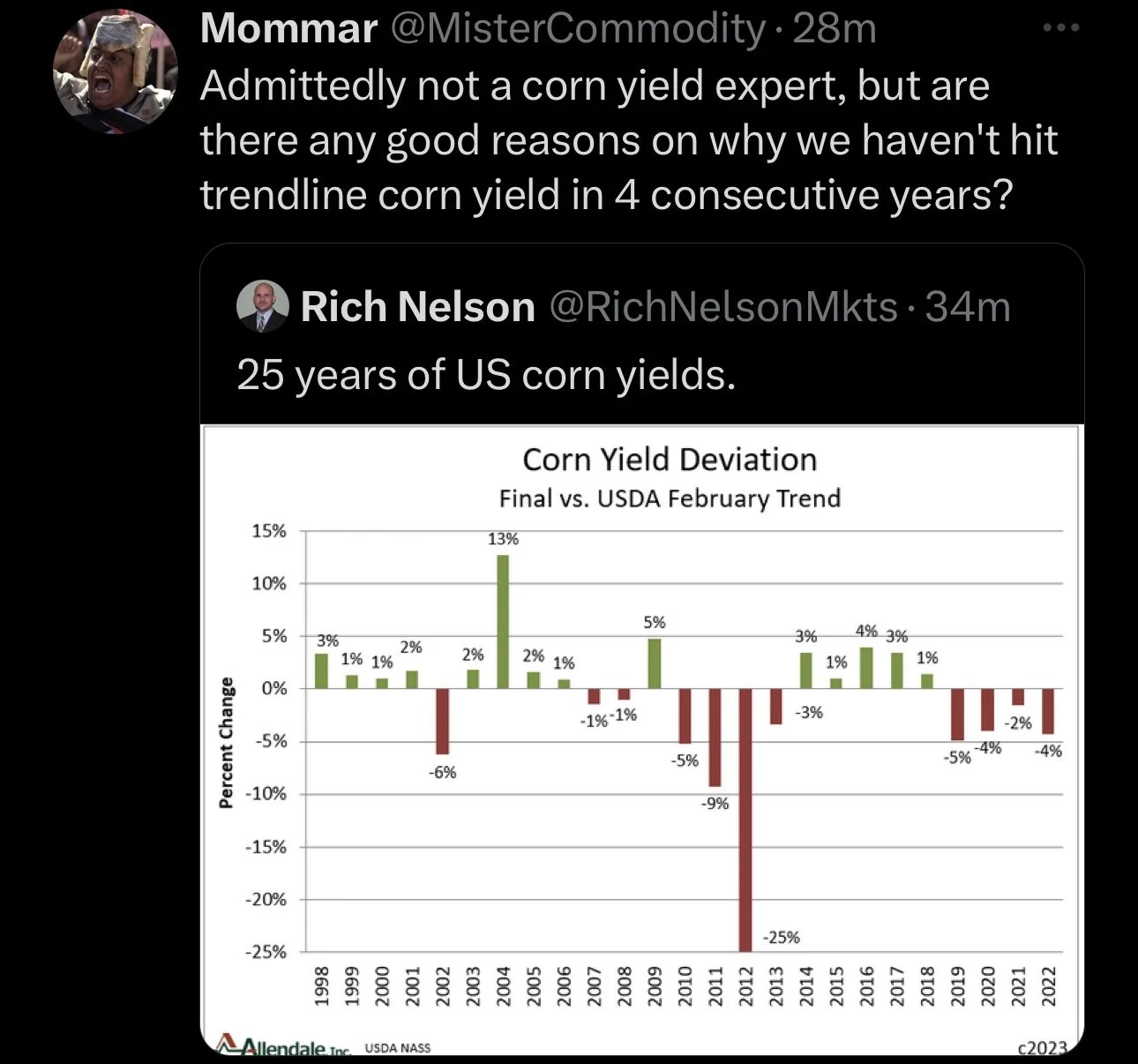

The funds remain heavily short corn, and have added to their shorts on this lower price action. But one thing to keep in mind when looking at the corn market is that we have virtually zero weather premium built in. It is incredibly hard to believe we won’t get a weather scare. Especially when we take a look at the dry areas where planting has been moving along at a fast pace. With prices being this low, I think the weather will eventually give us a nice rally. Taking a look to later this summer, if this drought continues we could very easily see this massive drought scare. I still think the trade is extremely undervaluing weather premium. Which gives us all the more power to go higher when they do realize the problems.

I don’t expect us just to take off from here. It might take some time for that reversal and bull run. I would not be surprised at all to see some choppy trade the next week or two. But still firmly believe we will make our bottom late May or at the latest early June.

Taking a look at the chart, we failed that double bottom. We are currently sitting right above support so we will have to see if this level holds.

Corn July-23

Soybeans

Soybeans continue to slip following their recent sell off. As beans are now trading at their lowest levels since last summer.

The main factors influencing this pressure are more of the same. We have a record crop over in Brazil, China demand has been lackluster, and the funds started to trim their long position.

Bulls are just struggling to find footing as the trade shifts its focus from South America weather headlines to US weather, and US weather just hasn’t provided anything at all as of yet. Thus leading to the market struggling to navigate higher. To get this thing to reverse bulls would like to see a bigger weather story here in the US.

The funds were long. The trade started to care less about Argentina's poor crop and South America's weather as a whole. Which took away one of the main things that had drove us higher in the past. That transition period has just left the bulls with not much to chew on here.

Even though the trade has put most of the Argentina problems in the rearview mirror, right around close today we did see BAGE again reduce their soybean crop. All the way down to 21 million metric tons. Bulls still think the whole Argentina problem could raise more concerns down the line, especially if Brazil has any problems considering their record crop.

Similar to corn, I don’t expect us to just shoot up and have this massive bull run out of nowhere. It is going to take some time. Again, I could see both corn and beans chop around until the end of the month before finding some firm footing. With beans, I also wouldn’t be totally surprised to see some additional downside before we do get that bottom.

Beans were one of the funds only long positions before this sell off. So one can imagine they are no longer very long if at all, which does open the door for them to add beans to their short positions across the grains. Nonetheless, the fundamentals are still very bullish looking long term. I still think we have a longer term bullish story developing. The question is just how much downside will we see from now until then.

Taking a look at the chart, I hope we don’t get there but our next major support would be at the $13 level. If we were to continue lower and hit that level, we could be possibly looking at a double bottom. As we would test our lows from last summer.

Soybeans July-23

Wheat

KC and Minneapolis wheat take it on the chin today, as they lead all grains lower. As they both lose around 30 cents.

The reason for the sell off here today was really just a result of profit taking. Which makes sense given that KC rallied $1.70 in just a two week span. Even with today’s losses it’s still sitting $1.25 off it’s early May lows.

We also had news that the EU is importing wheat to the east coast, so this added some extra pressure. Lastly, we are seeing a surge in the US dollar, which makes US less competitive in the world trade market.

Yesterday's weakness in Chicago was mainly due to the reports saying that the Black Sea deal was extended another 60 days. Here is a good summary and what Wright on the Markets had to say on the situation:

"No one has said anything about sanctions against Russia being lifted. It is illogical Russia would back down so easily. After all that tough talk that sanctions must be lifted to extend the grain deal, it appears Putin was willing to embarrass himself in order to keep his buddy, Turkey’s President Erdogan in office as he faces a run off election May 28th against a candidate who wants to shun Russia and buddy up with the EU."

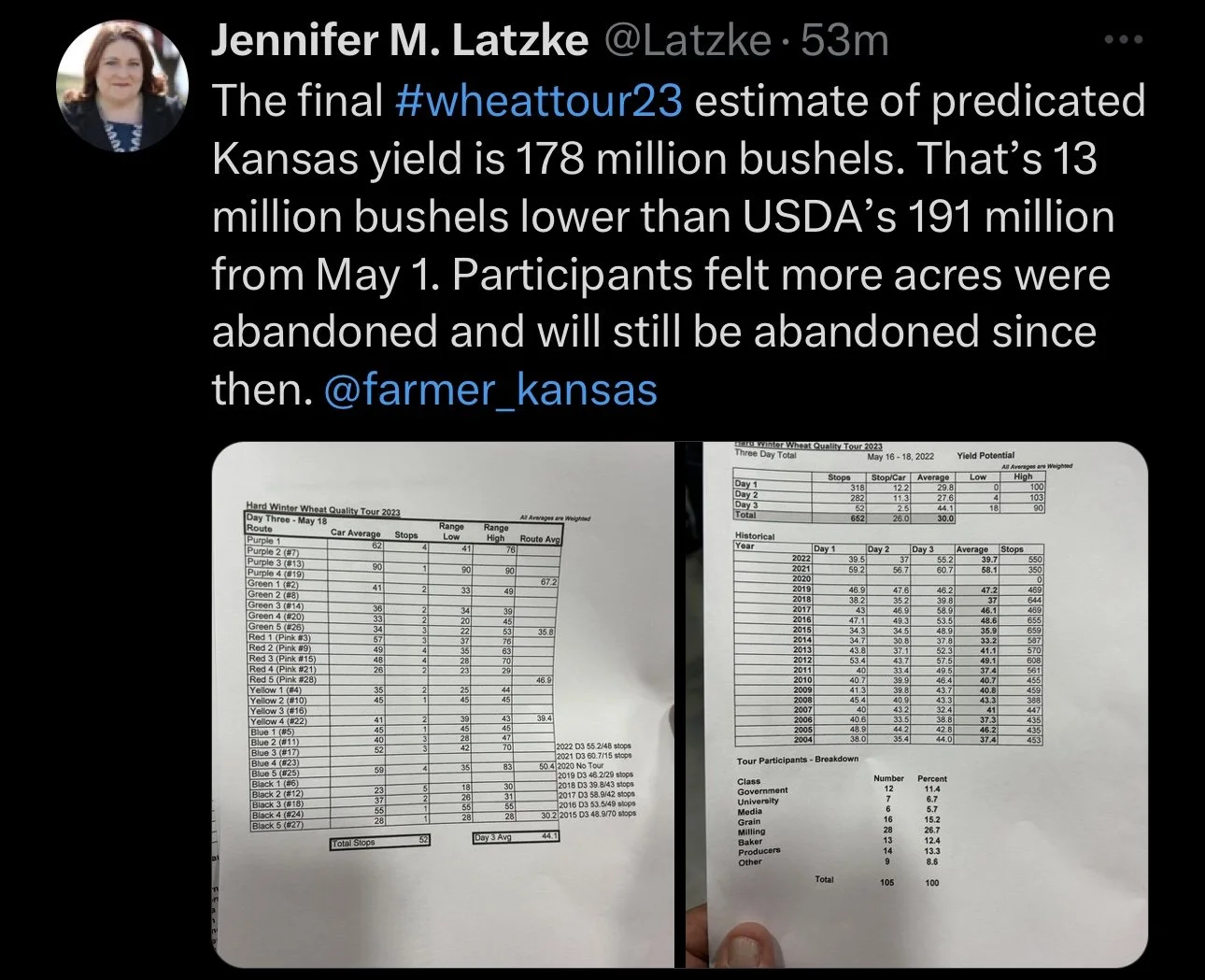

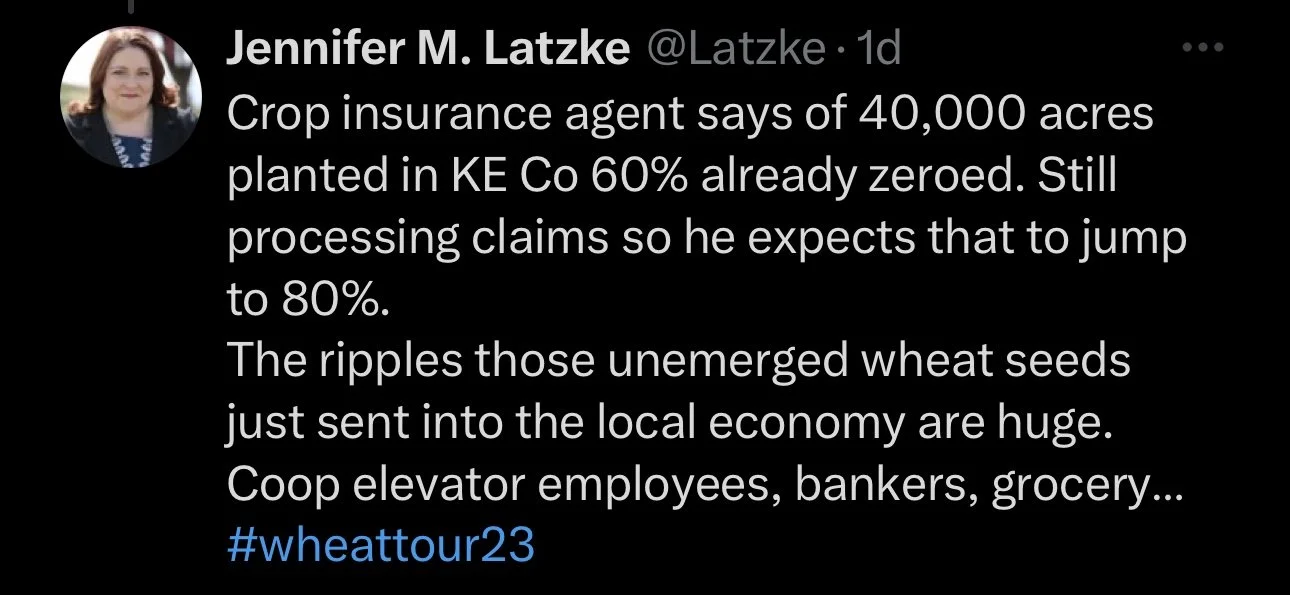

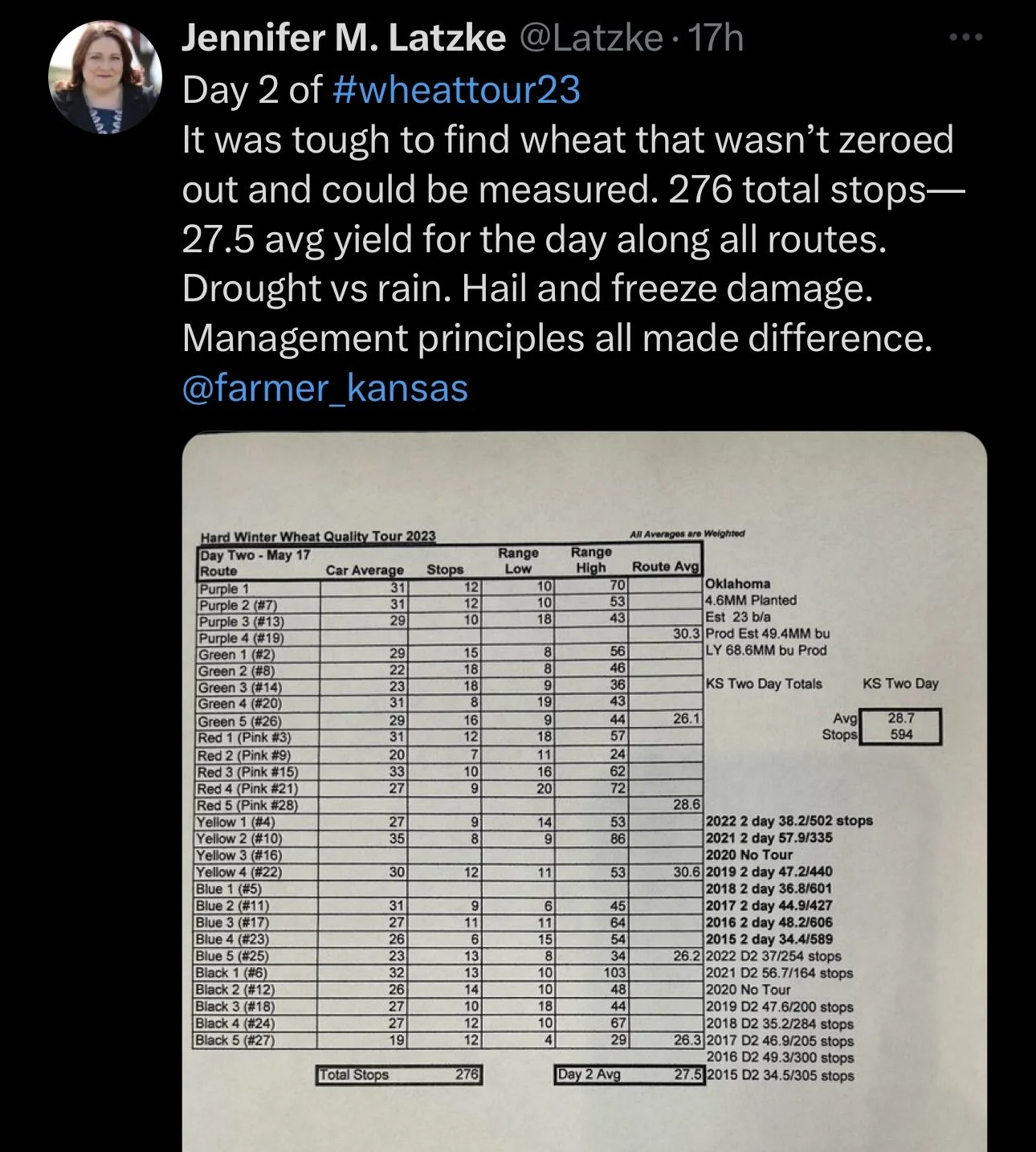

Day 2 of the Kansas wheat tours yesterday covered stops in western, central, and southern Kansas. As well as some areas of northern Oklahoma. The yield estimate for the second day of the tour was 27.5 bushels an acre. But keep in mind, these yield estimates do not take into account the huge number of abandoned fields, as it only includes harvestable wheat. The yield estimate for day 2 was down roughly 10 bushels an acre from last year and the lowest number in the last 20 years.

We are seeing a record for abandonment acres in Oklahoma and Kansas. The wheat tours are likely confirming that Kansas will have their smallest crop since 1963. The estimates from the tour today are predicting Kansas production at 178 million bushels, that is 13 million less than the 191 million the USDA had printed back on May 1st.

Going forward, it is still going to be all about the weather and the funds. Our winter wheat crop is one of the worst on record. With our biggest growing regions suffering from drought. Of course we could still get some more downside from here, but it's hard to imagine the wheat market isn’t going to be well supported from the drought issues alone. Especially when taking a look at KC wheat, as Kansas is looking at their worst crop in 50 years.

There is some forecasts showing potential rain for winter wheat areas, which the bears will quickly look at. But then again, bulls argue even if we do get rain, it is just simply too little too late to make any difference. I would have to agree that there are plenty of areas that even if they see rain, have essentially no chance at seeing improvement.

Taking a look at our charts, Chicago again failed to break out. That magic downward trend line has kept a lid on Chicago since last fall. Even with the losses, KC is still sitting above its trendline. Bulls would like a break above that $9 resistance.

Chicago July-23

KC July-23

MPLS July-23

When Are The Lows?

From Wright on the Market,

Our long term technician, Alan Bonifas issued this message at 12:41 PM Central time yesterday: "I exited my hedges (short futures) this morning. I might try buying futures lightly if it gives me the reversal wave pattern signal. I can advise when that happens. I had timing due now for lows. I don’t think we just blow out of here heading higher. I feel the corn/bean markets could just chop for a week or two."

Alan is the guy who said in early April he expected the lows for corn and beans to be in May, possibly the last half of May and all contracts would trade lower than they did in March. That is where we arrived Tuesday.

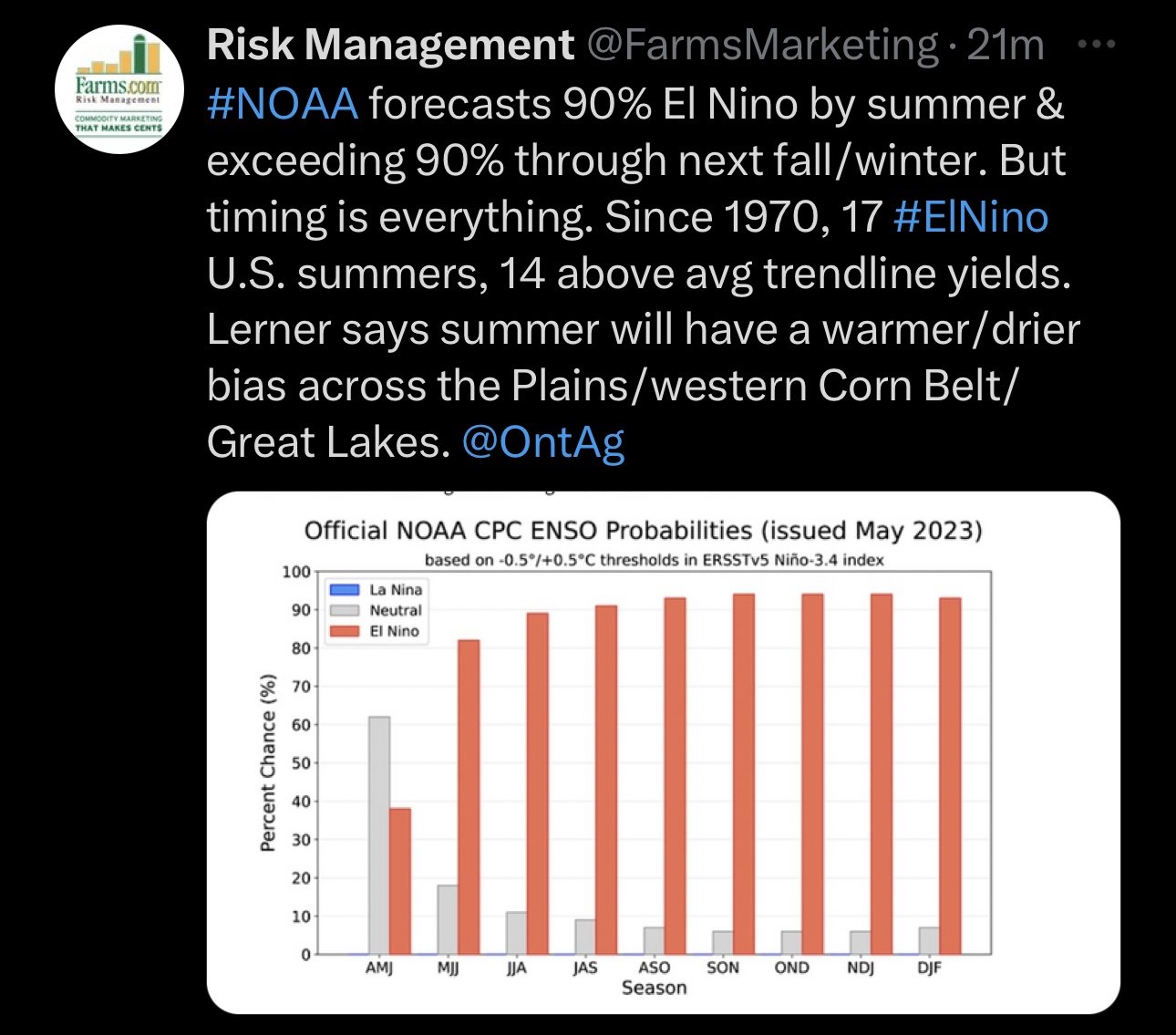

El Niño & Drought

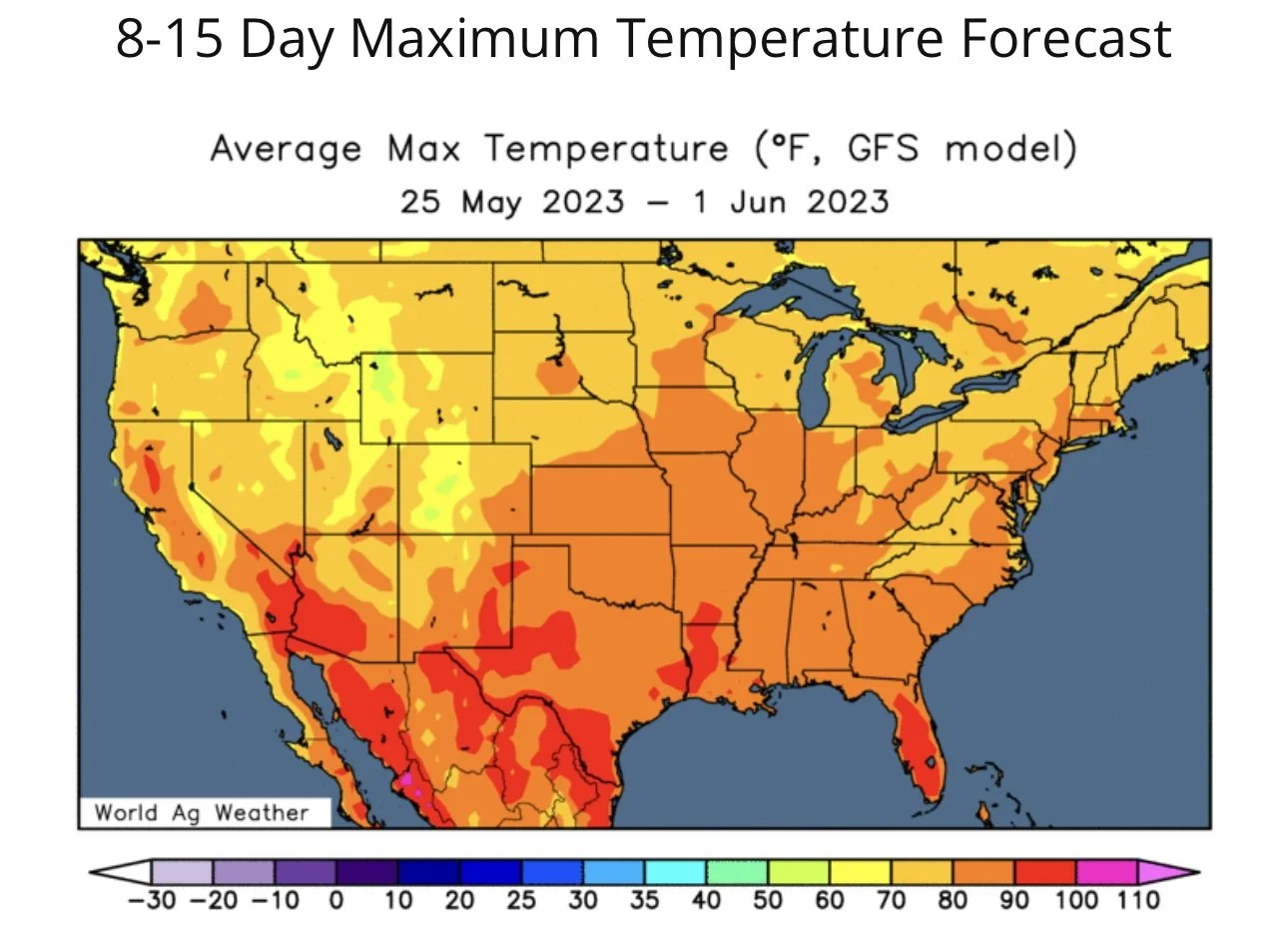

This year and the next four have a 98% chance of being the warmest world-wide on record, driven by heat-trapping greenhouse gases in the atmosphere and the El Niño episode. The forecast was in a report published yesterday by the World Meteorological Organization, which is an agency of the UN. It will be hot the next two weeks in the Corn Belt.

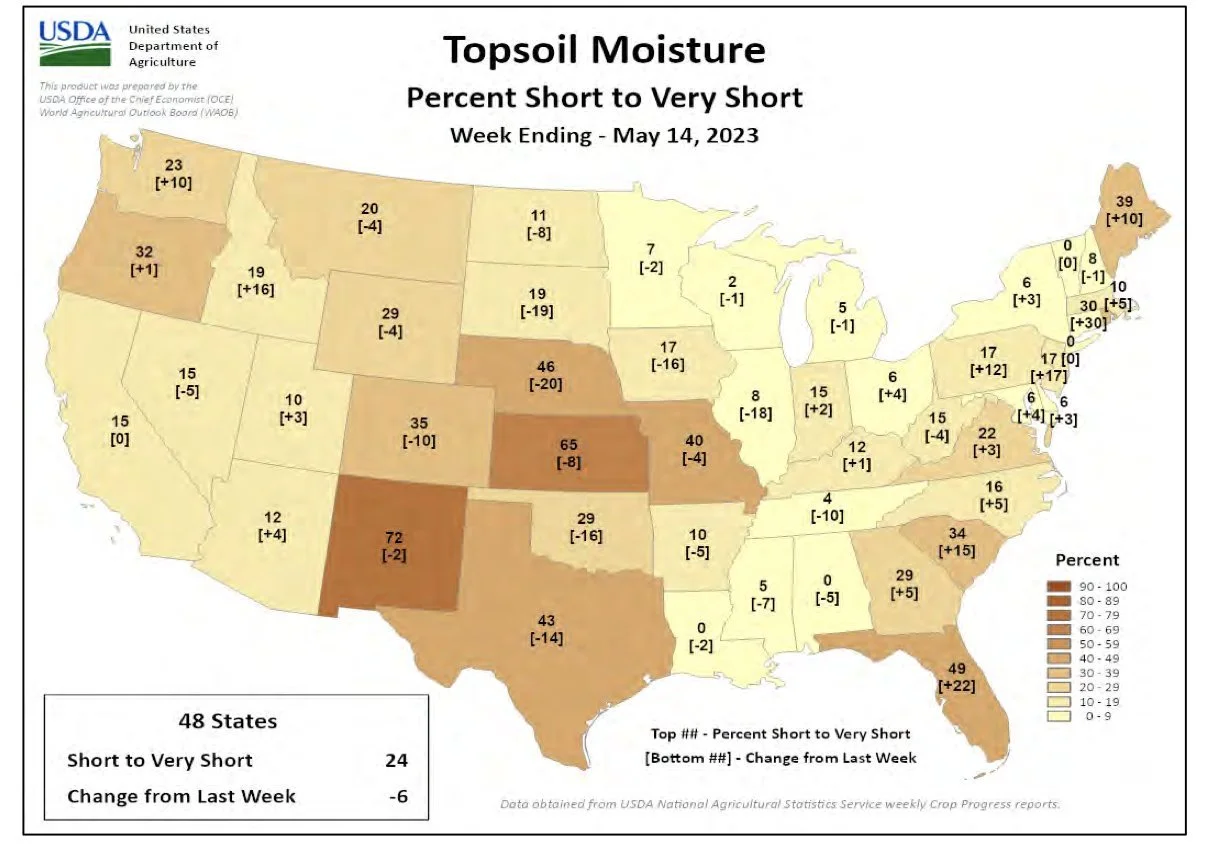

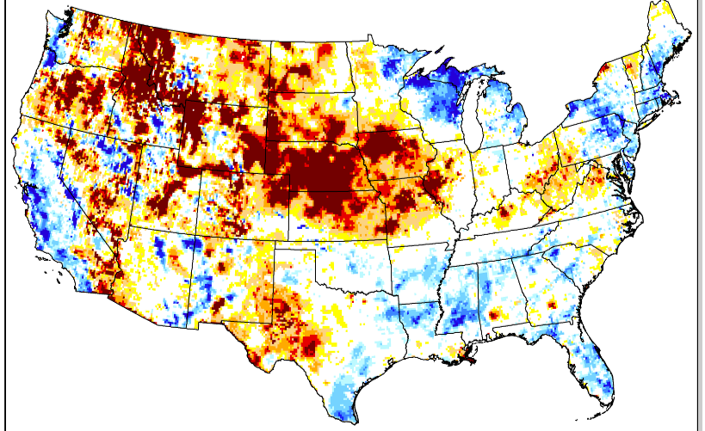

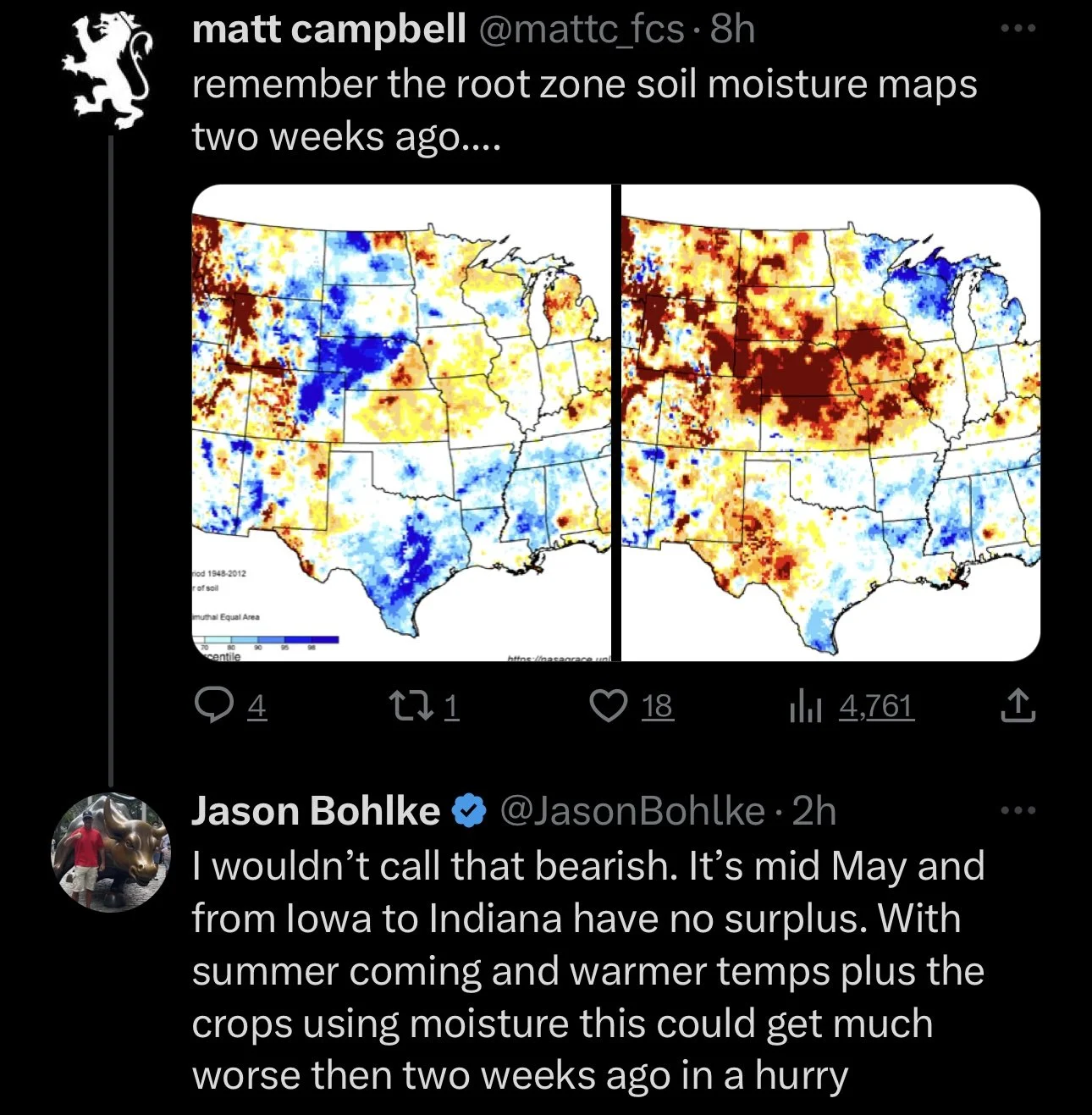

Soil Moisture

To add on to the previous points from Wright on the Market. Here is a few updated maps showcasing our soil moisture.

Drought Monitor

Here is a drought monitor comparison, just some food for thought.

Forecasts

Notice corn belt and the "I states".

Want to get every update like this?

Try a 30-day free trial. Get every single exclusive update sent via text & email.

Wheat Tours & Social Media

From Farms.com Risk Management,

"When compared to other past other analog years, the U.S. HRW crop gets smaller by September 30 in each of those years. Tour pictures to this point suggest much more abandonment and higher than the USDA estimate. Next target $10 as the record short position in ag as a percentage of total interest in mid-May will hit a low soon."

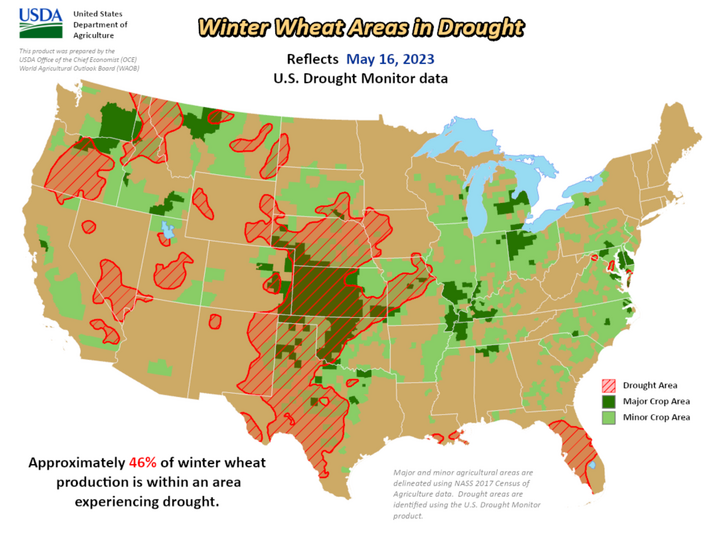

The first map is a winter wheat map showing areas in drought. As you can see, a good majority of our biggest growing regions are still experiencing drought.

Social Media from KC Tours

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

5/17/23 - Audio

Black Sea Pressure & Games From China

5/16/23 - Market Update

Beans Collapse

5/15/23 - Audio

If You're Short Wheat.. Be Ready to Sleep On Street

5/14/23 - Weekly Grain Newsletter

USDA Garbage Assumptions

5/12/23 - Report Recap Audio