BRAZIL, CHINA, FUNDS & SEASONALS

Overview

Grains mixed to close out the week as corn and wheat continue their rebound while soybeans get hit pretty hard today.

Despite the heavy selling today, beans only lost a nickel on the week while the wheat market rallied.

Here was the weekly price changes:

Weekly Price Changes

Why were beans lower today?

There were two reasons.

The first is fund repositioning. They are heavily short corn & wheat, while being long beans. So they are evening out their positions today buying corn & wheat, while selling beans.

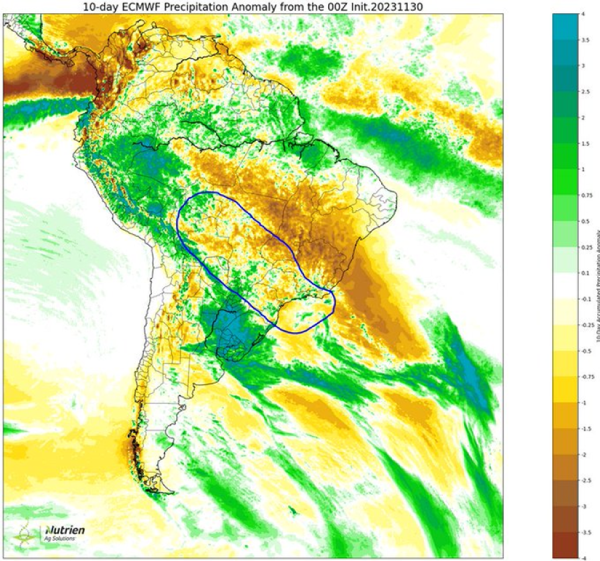

The other reason is that there is some "expected" showers over the next few weeks on certain models for Brazil.

Often times the thought of something in the markets will move the market more than an actual confirmation. They are called "futures" markets after all.

This is the 3rd Friday in a row soybeans have broken. What the market is trying to do here is see if Brazil will get rains or not.

Are they going to get rain or not?

The truth is not even the weather forecasts can decide.

Here is the difference between the two models.

From Darren Frye of Water Street Solutions:

"We are going higher if rains don’t confirm in the next 2 weeks. Models keep rolling forward drier. Root zone soil moisture is getting tapped!"

From World Weather Inc:

Brazil rains for the next week seem a little weaker than advertised.

"There is still no sign of 'normal' monsoon pattern in Brazil for the next 2 weeks."

Diego Meurer (Producer in Mato Grosso):

"Producers are already preparing to plant cotton in January, disregarding the soybeans."

From Farms.com Risk Management

"The mid-day weather model had no serios changes through day 10 for Brazil and it increased the rains for Northeastern Brazil in the 11-15 day forecast but it remains too wet. The better chances of rain are again for a small region in Brazil the weather pattern does not look like its changing at all! (Please see chart below)"

BIGGEST OFFER OF THE YEAR GONE IN 48 HOURS

Take advantage of our massive sale. Become a price maker. Get over half off on our audios, market updates, and more.

Today's Main Takeaways

Corn

Corn trades higher for the 3rd day in a row, sitting 14 cents off those new lows from Wednesday.

The main reason for corn being higher these past few days is mainly the funds. As there wasn’t a ton of new news. More than anything it was just repositioning.

The funds are the shortest they have been since July of 2020. Sitting short over 200k contracts.

So what happened the last time the funds were this short?

If you take a look at this chart from Roger Wright, we continued lower and made a new contract low in August. However, we then rallied over $1 over the course of the following 4 months.

When the funds decide to unwind their shorts, there is a lot of unwinding that will need to be done.

Just some food for thought.

We also saw strong exports and demand. As weekly exports for corn came in at a marketing year high. It was also the highest for this week in the past 8 years.

The largest purchaser was "Unknown". Typically this means China. If it was China, why do you think they are purchasing our corn?

Because they think these price levels are a great value. Meaning they think this is a bargain. If China is buying, it's not the time we want to be puke selling. Now there is nothing wrong with rewarding a rally if that is what your operation needs.

I just simply see prices higher from here into next year. Could we make a new low? Of course, that is still a definite possibility. I have said multiple times the past few months, a major rally will be difficult without an external factor because of our large carry out here in the US.

However, the technical situation has started to turn around on the charts. I look at the Brazil situation as a bullish long term factor, given that it is going to be very difficult for them to have a good crop given that the rainy season has still not started and the first crop will always be the soybeans, not corn.

Soybean planting is late, which is only going to push back their corn crop to an even hotter time frame with talk they there will be less acres planted.

Will this be an immediate factor? No probably not. So keep that in mind. But this could very well start to catch more attention and become a bigger problem looking to early next year.

Along with this, I see China stepping in as a buyer. If Brazil doesn’t produce a great corn crop, that business should shift to the US. Increasing demand.

So the risk in the corn market is that we don’t see that demand. Demand will need some help from Brazil. But all of the potential factors for an increase in demand are there.

Recommendation

For those that need cash flow or to make sales in the next 30-60 days, we recommend being pro-active. If you need help or want to talk over things give Jeremey a call at 605-295-3100.

As we rally if you need sales you want to have hedge accounts open so you can protect the rally.

For those that don’t need to make sales we want to be patient and wait until you are questioning how much you will yield as are the buyers. When the fear is the highest, so typically is the price.

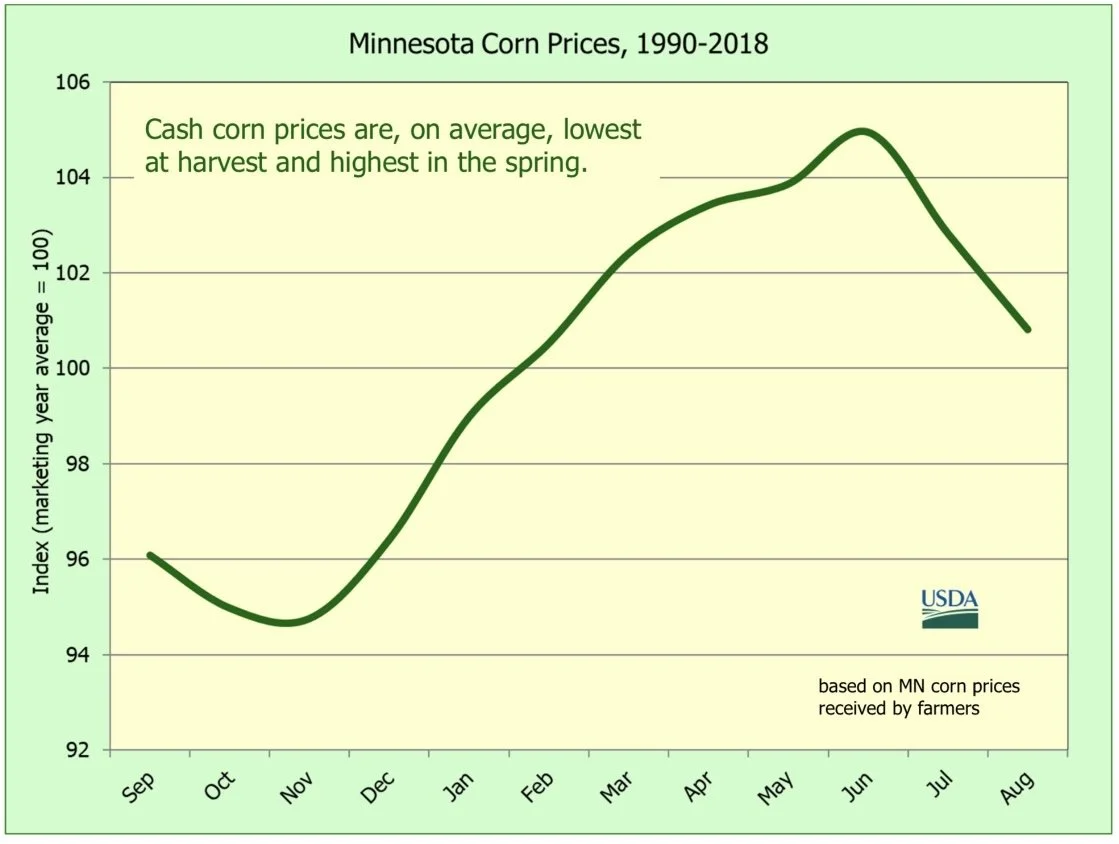

Seasonally we want to be making sales in May to June most years for corn.

The other thing that seasonally we want to watch for is what to sell.

Farmers plant around the same time of the year, harvest around the same time of the year. So prices tend to follow patterns year after year. This is referred to as a seasonal pattern. One thing that price makers do is they know what seasonal patterns are.

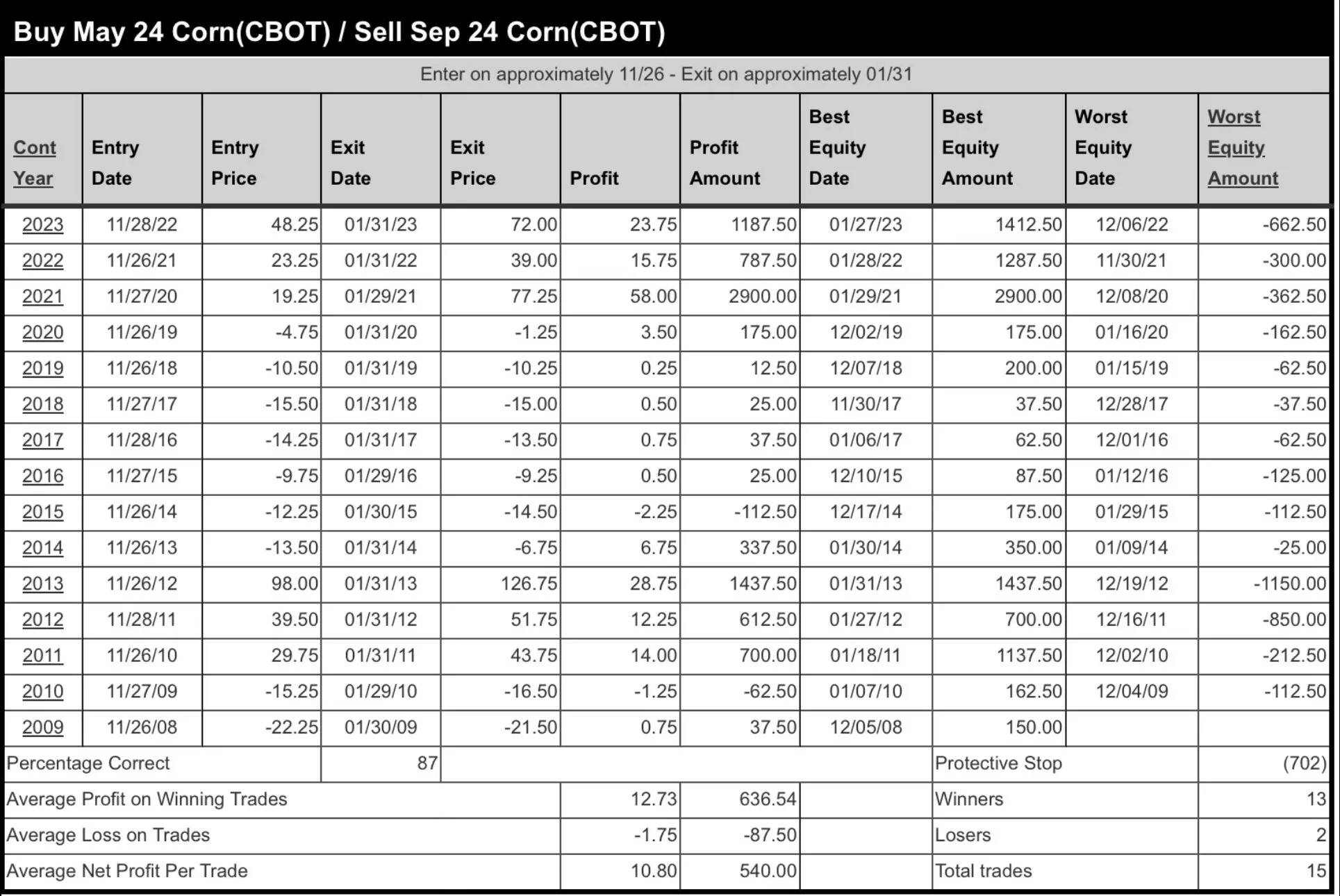

Right now there is a seasonal pattern for September corn losing value to May corn. As I mentioned in yesterday's audio, I would be selling September corn vs selling March or May if I need to sell something. Because seasonally it tends to lose value nearby.

Yesterday's Audio If You Missed It - Listen Here

Below are some spread trades that I watch from MRCI. When I see two commodities that I have, I want to make sure I am selling the same one that they are recommending while holding the one that they are buying, during that seasonal period.

Taking a look at the charts, these 3 days of gains have gave us a pretty bullish turn on the weekly charts. We poked out head above that downtrend from late October by failed to close above it. I think we have found a solid floor here, but we will still need a bullish catalyst to break out of this downtrend and lower range we have been stuck in since August.

Corn March-23

Soybeans

Soybeans take it on the chin while both corn and beans trade higher, as beans look to test their November lows.

On the bright side, yesterday corn wasn’t the only one who had a good week of sales. Weekly export sales for beans were the best for this week in the past 7 years. We also had some more flash sales to China this morning.

As we mentioned, the main reason for the lower price action today was fund repositioning, as well as the market trying to decide whether Brazil is going to get rain or not.

So essentially the market is just taking out some Brazil weather premium here with the risk that Brazil does get rain. From what the forecasts are showing, it looks like they added a few rains 1-2 weeks out.

We have said that the weather in November is not as important as December when it comes to Brazil production. But we have already started seeing some adjustments being made lower.

The USDA has Brazil pegged at 163 million metric tons, I am already hearing numbers in the 155 to 160 range.

I do think the USDA will ultimately have to lower their number, but there is still a slight chance that Brazil produces a decent bean crop. Do I think it shakes out that way? No I do not, but it's a possibility.

If Brazil comes up short and this dry weather continues, the upside in beans is massive.

Short term, when I look at the rains in the forecasts that pressured beans today, I do not think they are a trend changer. They will need a lot of timely rain to fix the hot and dry they've seen. Not to mention, the southern states are still far too wet. Neither are good for production.

From Farms.com Risk Management:

"This could be the year we break records. If the next set of rains from this Sunday to Tuesday of next week and the week of December 11th to 15th are a bust, it's a game changer as Brazil soybean production falls below sub 150 MMT."

What the trade did today was simply push us to that strong support level of $13.25 which is exactly where we closed out today.

Weather updates over the weekend will be a deciding factor as to whether we go higher or lower come Monday.

Looking at the charts, we have given back 50% of our $1.30 rally from October and November. This is a pretty strong support level here. Our downside risk here is that trendline which we could look to test, then the next big support sits right above that $13 level. Bulls need a break out of this wedge to confirm more upside.

Soybeans Jan-23

BLACK FRIDAY SALE

Ends in 48 hours.

AUDIO & UPDATES

Lock in this offer. Could be the best investment you will ever make.

PRICE MAKER PROGRAM

One of a kind program. Limited spots.

Wheat

Following contract lows earlier this week, the wheat market has put together 4 strong days in a row for wheat. This is the biggest 4 day rally we have seen since July. We are now almost +40 cents off those contract lows.

Why was wheat higher?

It was a similar story to the rest of the grains. The funds were heavily short wheat, and they decided maybe they have pushed wheat lower enough for now as they look to even out their positions.

Bulls were also happy to see strong weekly exports for wheat as well, as it was the best we have seen for this week in 5 years.

The global story is more of the same. Bulls point out the problems in Australia while bears point out the cheap abundant supply from Russia.

It finally feels like maybe wheat is trying to find some footing and break out of this brutal downtrend.

As we have mentioned for a while now, the wheat market still has a ton of potential upside. The question is more "when" rather than "if" we go higher.

I don’t necessarily think this was the start to this massive bull run, but it was definitely a step in the right direction as we start to get the funds to unravel those shorts.

Bottom line, being patient and knowing that there is a ton of "potential" upside. Weather or war wildcards could still catch some of the big players and funds on the wrong side of things, leading to more short covering. But time will tell.

Taking a look at the chart, we had an outside up week on the weekly charts which is friendly, as March Chicago closed above $6. We are now inching closer to that $6.21 target I've had. IF we can get a break above that level and hold, it could open up a lot of more upside and short covering.

Chicago March-23

KC March-23

Check Out Our Price Maker Program

Become a price maker and take your marketing to the next level.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Past Updates

11/30/23

LOWS FINALLY IN OR ANOTHER SELLING OPPORTUNITY?

11/29/23

RISK & UPSIDE FACTORS

11/28/23

WHAT COULD CAUSE THE FUNDS TO COVER?

11/27/23

WHAT IS CORN BASIS CONTRACT DILEMMA TEACHING US?

11/24/23

POST THANKSGIVING MELT DOWN

11/22/23

WHAT’S THE BRAZIL STORY?

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23

DO THESE BRAZIL RAINS MATTER?

11/16/23

WAYS TO OUTPERFORM THE MARKET

11/15/23

FINDING THE RIGHT GAME PLAN

11/14/23