PREPARING FOR THE USDA REPORT

AUDIO COMMENTARY

How much will the USDA yield change yield?

Will demand numbers follow yield?

Remember: buy low, sell high

Chinese corn flooding

Do you have plan for the report? Hedge accounts open?

Strategies going into report (Scroll to read)

USDA SALE ENDS IN 2 DAYS

Make sure you take advantage. Don’t miss our future updates and takeaways from tomorrow’s report.

$299/yr vs $800/yr

Become a Price Maker. Not a Price Taker

USDA REPORT STRATEGIES

Here are a few ways to navigate things ahead of tomorrow’s report utilizing different tools.

Benefit of buying an option before the report is to make you feel comfortable, and doing it proactively instead of chasing the market.

Reasons you should buy calls?

If you are oversold because your yields are going to be light.

To re-own previous sales

As a courage call

Reasons you should buy puts?

If you are undersold to protect from lower prices

Corn 🌽

Buying Sept calls for re-ownerhsip seems to make sense. It looks like the 4.85 calls are 10-11 cents and the 5.00 calls are 5-6 cents.

If you are under protection or nervous about the USDA printing an increase you can buy 4.85 puts for around 12 cents and 4.70 puts for are 6 cents.

The options expire on 8-25 which covers one past the pro farmer crop tour

Beans 🌱

We like using the short dated new crop options that expire on Aug 25

For re-ownership we like buying anything from the 13.20 for 21 cents all the way up to the 14.00 for 3 cents.

For those of you needing protection you can look at the same short dated new crop sept bean puts with the 13.20 costing 24 cents and the 12.80 about 9 cents

If you want help utilizing one of these or specific advice, don’t hesitate to shoot us a call or text at (605)295-3100.

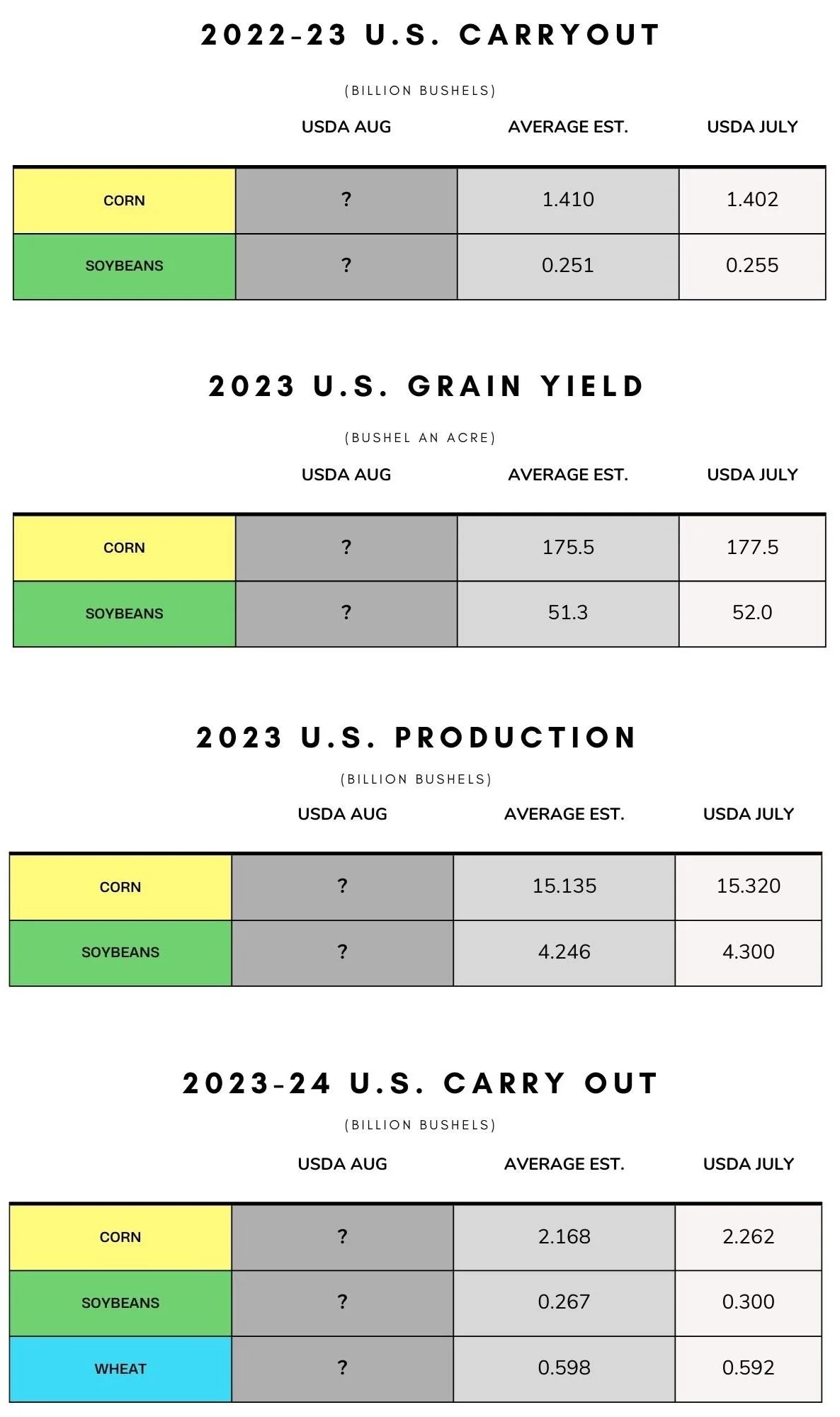

USDA REPORT ESTIMATES

Check Out Past Updates

8/9/23 - Market Update

TRADE PREPARES FOR USDA REPORT

8/8/23 - Audio

MARKETS PUT BANDAID ON THE BLEEDING

8/7/23 - Market Update

BEANS SELL OFF WHILE WHEAT RALLIES

8/7/23 - Audio

NAVIGATING WEATHER & WAR YOYO

8/6/23 - Weekly Grain Newsletter

ARE YOU READY FOR THE NEXT BIG MOVE?

8/4/23 - Audio

CAN OUR MARKETS BOUNCE ONE MORE TIME?

8/3/23 - Market Update

YIELD, DROUGHT UPDATE, TIME FOR CALLS?

8/3/23 - Audio

BUYING RECOMMENDATIONS

8/2/23 - Audio

WEATHER & WAR VOLATILITY CONTINUES

8/1/23 - Weekly Grain Newsletter