CHINA IS BUYING, ARE YOU?

HARVEST SALE

Limited time only.

Get this discount before your trial expires.

$299/YR vs $800/YR

Overview

Grains end the day mixed following yesterday's higher price action. As the wheat market is slightly higher coming off of yesterday's double digit gains, while corn is slightly lower and soybeans test those July lows we mentioned the past few days that we would likely look to do so. However, beans managed to bounce 16 cents off those lows.

Chicago wheat is now 30 cents off the USDA report lows, and only a dime off of where we were before the report. Who would’ve thought that after seeing us drop 40 cents.

Supporting the wheat market, we saw China purchase 220k metric tons of SRW wheat. This is the largest SRW export to China since 2013. Now we know we have the cheapest wheat in the world.

They also bought 265k metric tons of beans. These sales are even more impressive given that China is on a national holiday which continues through the rest of the week.

Today’s price action was overall pretty positive for the grains. We had the dollar make yet another new high. Bonds made new lows, falling to their lowest levels since October of 2007. The stock market fear and greed index fell to it's most fearful it's been all year long.

Yet grains held their own. Beans closed 20 cents of their lows, corn is still nearly at it's highest level in a month, and the wheat market managed to find some life.

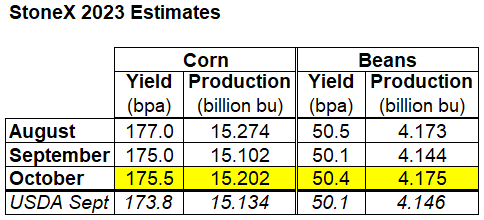

StoneX Yield Survey Estimates

The October StoneX survey showed corn yield at 175.5 up from 175 last month. Their soybean yield was 50.4 bpa.

The USDA's current estimates are 173.8 for corn, and 50.1 for beans.

Dr. Cordonnier has his estimates at 171.5 for corn, and 49 for beans with a lower to neutral bias moving forward.

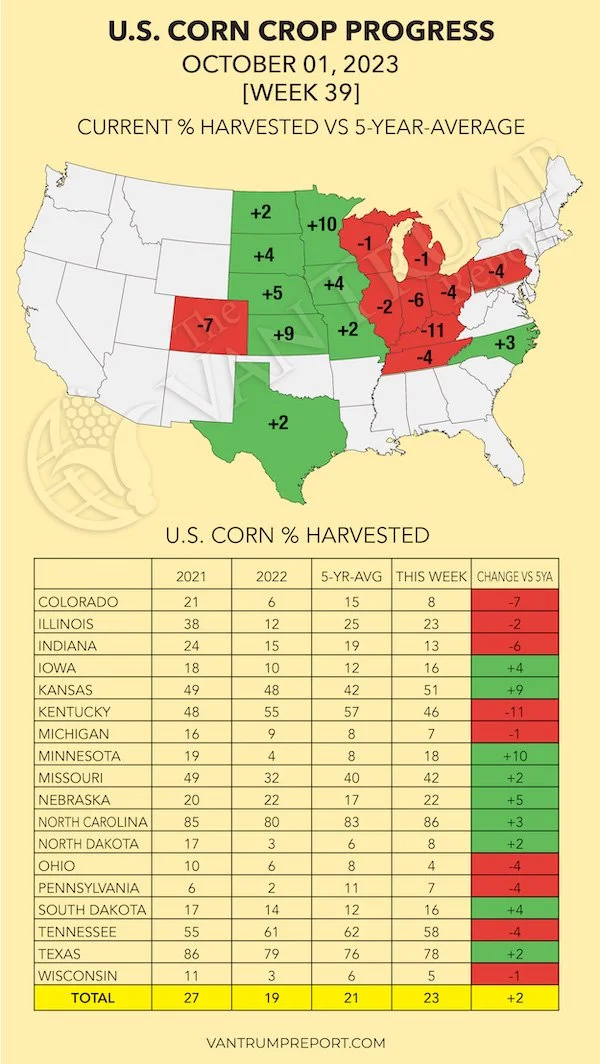

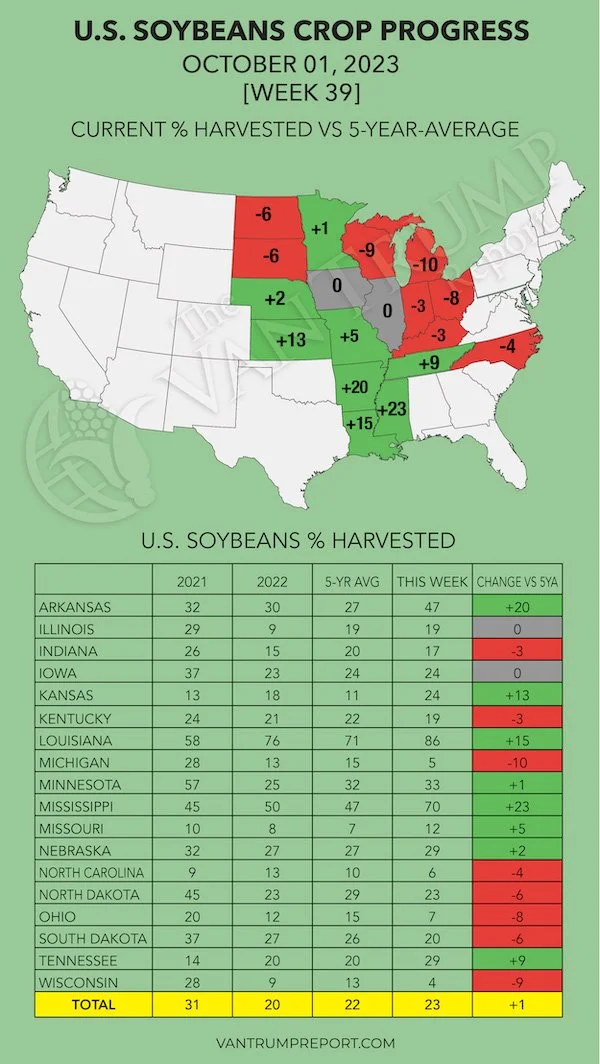

Crop Progress

Harvest is just ahead of our average pace but not as fast as last week or as the trade was expecting.

Here is a state by state breakdown of the current crop progress compared to our 5-year average from the Van Trump Report.

Today's Main Takeaways

Corn

Corn slightly lower in an extremely tight 5 cent trading range day, as we were unable to take out yesterday's highs.

Yesterday we did hit a 1 month high and high settlement.

StoneX Brazil pegged their first crop corn production at 27.5 million metric tons. Down from 28.2 last month. The second corn crop production was also lowered from 109.1 to 108.4 million.

With this, there is a lot of chatter that from multiple sources all saying that there could be less second crop corn acres planted in Brazil.

Typically row crops makes their lows when harvest reaches roughly 50% complete. Currently we are sitting at 23% complete. However, I think corn is already in the process of making these lows. Corn is 20 cents off our mid-September lows.

Funds are still short around 160k contracts of corn, yet we are at the highest levels we have been at in a month. When the funds decide to cover, there is a lot of buying to be made. If we can get a break past $4.92 1/2, I think that will give funds the green light and spark some buying.

Bottom line, I am pretty confident the lows are in. Now does that mean we are just going to see a straight up rally to the moon? Of course not. We could still be in for some choppy action. But I think we will start grinding and working our way higher from here.

What is really comes down to is this: If yields are better than expected, we likely see prices lower. If yields come in worse than expected or even just at expectations, the low for corn is in.

I need a break above $4.92 1/2, which is only a nickle away from here. After that, we have targets at our retracement levels of $5.07, $5.30, and our 50% retracement of $5.49 1/2.

Corn Dec-23

Soybeans

Beans fell to 14-week lows as we looked to test that June low of $12.56 we had mentioned yesterday and Friday that we would likely test. However, we closed 16 cents off those lows. At one point beans were down -20 cents, only to close -4 cents lower on the day. Overall, decent price action from beans.

Yesterday, the crop conditions showed a 2% increase to the good/excellent rating for beans. This as well as a little harvest pressure was the biggest reason for the early weakness we saw.

Harvest is 23% finished, slightly ahead of our average. So far, southern states such as Arkanas and Mississippi are running far ahead of pace and have been showing some pretty decent yields thus far. Some data out east is also showing some good yields. With this, some are saying that the current estimate for the USDA's soybeans of 50.1 might actually be too low.

Now I'm not in that camp. Is it possible? Yes. If yields are better than expected, prices will take it on the chin short. Long term, we feel the soybean market is a more demand-driven market rather than a supply-driven one.

Now harvest is running ahead of schedule, but I think we will be in for more a little worse results when we get closer to finishing the states that suffered from that massive heat and dryness.

However, I believe the early planted beans will show the best yields because of the rain we had in July and early August. Which would be these early harvest results. But the areas that planted later will suffer from the heat an dryness we saw to close out August and start September. Which would be our later harvest results. So I do think we will start to see a little more disappointing results the further we get into harvest. Currently, early results are mixed.

(We will be sending out a text to get harvest result updates from you guys. If you are not on our text list, please reply back to this email with your early results.)

The USDA confirmed Friday that our US bean inventory is the lowest supply has been in 2 years. We are also entering the most bullish seasonal time of the year for soymeal.

One thing of concern is if the USDA's balance sheet get bigger in the next report. Especially given the +25 million more bushels than expected in last week's report.

However, there is also a small possibility that the USDA has some other reasoning behind the bigger stock numbers. Such as the early harvest.

Short term, we could still see more downside. Long term, the outlook is still very bullish. The first factor will be the US yields, which we have said in the past might not see major adjustments until January. Second, we have Brazil. If they have hiccups in their production and don’t raise this "monster" crop everyone is always talking about, we would have a reason to go higher.

Taking a look at the chart, we bounced exactly off that June low of $12.56 like I mentioned we probably would in our past updates. After we tested it, we bounced nearly 20 cents. The question now is, will it hold?

I need a break above $12.81 1/2 to confirm more upside. Bulls absolutely need to hold today's low. If they don’t, there is a big air gap that could cause even more technical fund selling.

Soybeans Nov-23

Wheat

The wheat market pretty strong again today, following the rally yesterday. Chicago wheat is now only a dime off of where we were before the awful report that sent us tumbling 40 cents.

We would have probably traded even higher today, but the new highs in the dollar is limiting some of the gains

The biggest news today was China. They bought 220k metric tons of US wheat. The biggest SRW export to China in a decade.

Our wheat is so cheap on a world scale that even China couldn’t resist. This is exactly what the bulls needed to see.

Aside from that, we still have the global issues.

Here is the Australia concerns.

India just had their driest August in 100 years and over half of their farmland does not have access to irrigation.

On the other hand, bears still make the argument that Russia has a large crop which might be getting bigger. It is a valid argument. Bulls want to see Russia run out of their cheap wheat.

Seasonally, wheats in it's lows this time of year. We will have to see if we have finally found a bottom or if we will get more downside like we have after every recent rally.

I need Chicago wheat to close back above $5.70. Perhaps then we can look to test of our targets of $6 and $6.38 which are our 25% and 38% retracements from the July to now sell off.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Cattle Market

After trading in mainly a sideways range for the past 2 weeks, cattle futures saw some heavy pressure today as they took a nose dive.

Hedging Account

If you are forced to make sales and you need help, make sure to give Jeremey a call to help you come up with a strategy that fits to your situation.

(605) 295-3100

Check Out Past Updates

10/2/23

WHY YOU SHOULD BE EXCITED ABOUT TODAY’S RALLY

10/1/23

IF YOU HAVEN’T PANICKED YET, WHY WOULD YOU NOW?

9/29/23

USDA REPORT RECAP

9/28/23

PREPARING FOR USDA REPORT & TAKING A LOOK AT HISTORY

9/27/23

PROTECTING YOUR INSURANCE GUARANTEE

9/26/23