TURNAROUND TUESDAY & USDA PREVIEW

Overview

Corn and soybeans both under pressure early, making new lows before ending the day higher while the wheat market rallies, nearly erasing yesterday's heavy losses.

Overall there was no major news. Really just a turnaround Tuesday with most of the markets being in oversold territory, especially corn and beans. So mostly some fund short covering and pre report positioning.

Yesterday the sell off in wheat was due to moisture and snow cover in the plains. Today a little bit of strength is coming from ships avoiding the Red Sea as well as some talk about potential winter kill coming next week.

Tomorrow morning we will have the newest CONAB numbers out. So we will have to see what kind of cuts they make to Brazil production. The majority of people are expecting numbers in the 154 to 155 range for yield tomorrow.

Then we have the highly anticipated USDA report Friday. Most expect the USDA's numbers to be higher than that of the CONAB.

USDA Preview

Friday we will be getting a ton of new data for both bulls and bears to chew on.

We will be getting supply and demand numbers, stocks, final yields for the US crops, and updated South America yields.

First let's take a look at the US numbers. The trade is expecting yields to come in unchanged from last report. With corn at 174.9 and soybeans at 49.9 bushels an acre.

Typically, this report offers more excitement than what these estimates are showing.

Now South America. These are the most highly anticipated numbers and will likely have the largest impact on what direction the markets move Friday.

We have some wide ranges expected.

Argentina's crop is seem essentially steady to slightly higher from last month.

Brazil's crop is expected to take some hits. But how big of a cut is enough to ration demand is the question.

The USDA is expected to peg their soybean crop at 156.26 vs last month's 161 and last year's 160. However, the estimate ranges from 151 to 161, a very wide range. If we fall too heavily to either side of those estimates we could see a big move Friday.

The trade has their Brazil corn at 125.33 vs last month's 129 and last year's 137. Again, we have another huge range for this crop as well. Even larger than the soybean one as they the range stands at 117 to 129.

Let's take a look at what some of the others in the industry have their estimates pegged at.

Grupo Labhoro: 145 to 147

Agricomp: 149.5

Safras & Mercado: 151.4

Pine: 149.9

Ag Resource: 150.72

Dr. Cordonnier: 151

StoneX Brazil: 152.8

It is pretty clear that the USDA seems to have the most optimism for this crop.

With the pre report estimates at 156 for beans, we would likely have to have a number 155 or lower for the market to see any excitement. If we come in anywhere near the rest of the estimates above, we would be off to the races. However, I as well as nobody else excepts them to make that big of cut. We all know how they typically operate.

Here is what some others in the industry are saying:

Darren Frye of Water Street Solutions:

I have been at 140 mmt at the best for a long time which is a 15% decline from 165. I posted 130 a few months back but nobody think that could ever happen. Time will tell but the DI exploded higher on meal Friday inside the matrix, which is not bearish.

Kory Melby - Brazil Consultant:

I read that there are 3 firms at the 130 mmt area for Brazil soy. Still wide spread in crop sizes ranging from 125-151 and the USDA at 158/160. Difficult to wrap my brain around this spread.

We all know Mato Grosso has some major problems with their record drought. But what about Parana? The state to the south that had been getting good rains all year long? Parana is the 3rd largest producing soybean state in Brazil.

Reuters just reported that the newest crop evaluations dropped their crop conditions from 86% rated good to excellent last week, all the way down to 71% this week. This was due to the recent dry stretch. That is a major drop in just a week, and they actually received rains for a good chunk of the growing season. It just makes one wonder how these crops that didn’t get much rain the past 3 months are holding up, and how big of improvements the recent rains can bring.

It was also reported that Parana planted only 309k hectacres for their first crop corn. This is the smallest acreage on record for their first corn crop.

Now let's get into today's update..

BEFORE YOUR TRIAL EXPIRES

Since you were on a trial we are extending your access to our biggest sale of the year. Don’t miss the opportunity.

With a subscription you get access to call us 24/7 with questions and tailored recommendations.

Make this the year you beat Big Ag at their own game.

$399 vs $800 a year

Today's Main Takeaways

Corn

Corn made a new contract low early in the day but eventually bounced nearly +8 cents off those lows. Closing up +4 cents on the day. We missed a key reversal by just 2 cents.

Todays action was mostly short covering ahead of the report as the funds still hold a massive -200k position in corn. It just looks like they see this price level as a fair range going into the report and were trying to dilute some risk in case of a bullish surprise.

Tomorrow we will likely trade the CONAB numbers. Thursday will be all about pre report positioning from the funds. Friday will of course be all about the USDA report.

Aside from the report, these are the main things bears are looking at and reasons we continue to trade lower.

The biggest thing is a lack of demand. We also have a giant carryout here at home that certainly doesn’t help. We got the recent rains in Brazil as well as some better forecasts. We have had weaker crude oil. And lastly the funds, they just don’t see a real reason to want to cover here. Which I don’t blame them as there really isn’t reason to right now.

Perhaps down the road we can find that reason. Some things that "could" get the funds to cover would be if this Brazil corn situation is worse than what most seem to realize and it comes to light.

If China starts to come in and buy our corn. Which one would they think would very soon. We have some of the cheapest corn in the world aside from Ukraine who has obvious logistic issues. But Brazil for example has $6+ corn while we are $4.50. Who's corn will China be looking to buy when they hungry?

Here is a corn chart Dave Reiter. He said:

"Corn trading at lowest level in +3 years. Most likely, corn will drop to $4.19, which was the original bullish breakout during COVID. Corn will make an important low in 2024, followed by higher prices for the remainder of the decade."

He was then asked for his reasoning as to why he thinks that 2024 will be the low print for the bear cycle. This was his reply:

"The corn cycles have been fairly reliable since 2001. They worked well even during COVID. The next bear market low is scheduled for 2024."

Do I completely agree with Dave? Not entirely but he does make a good argument. There are plenty of factors that could lead to higher prices for years to come. Those would include demand, Mother Nature, money flow or inflation panic. I just found his thought process and outlook interesting.

Nonetheless, I also see prices higher from here long term. Could we look to test that $4.19 level he talked about? It's certainly possible. I think we will be a lot higher than these current price levels, whether we go down another 30 cents or not, and whether it takes weeks, months, a year or longer for this brutal bear market to end is to be determined.

Bottom line, don’t be surprised to see prices continue to trickle lower until we find a bottom or a reason for the funds to cover.

Friday's report could be that reason, or it could also be yet another reason for them to continue to push us even lower.

However there is a chance that we see a reversal off of this report even if it is negative simply because we may exhaust the sellers. If the market is down hard, will you and your neighbors still be selling corn? Eventually you run out of sellers at the bottom of the market and you run out of buyers ar the top of the market. Overextended conditions help stages get set for reversals and corrections.

I expect higher prices long term and looking towards spring, and seasonally we go higher. But that doesn’t mean it has to has to happen when I or anyone else thinks it will.

If you want specific advice going into the report or if you have questions on if you should be buying calls, puts, etc. Please give us a call and we will help you out completely free. Every operation needs a different approach. 605-295-3100.

We will talk more about strategies for specific situations in tomorrow’s audio.

Taking a look at the chart, the first target bulls need to break is still $4.69 if we want to break out of this slump. Then to get really excited our 100-day moving average sits at $4.90. If we continue lower, we have some support at $4.50.

Corn March-23

Soybeans

Soybeans make yet another new low, however we did manage to see a great bounce. Closing nearly +15 cents off the early lows.

The soybean market is the same old story it has been the past week. Brazil got rains with some more in the forecasts short term. However, after this next batch of rains it looks like it will start to dry up again. So the real questions then are how much of an impact did these rains make, and if the forecasts do turn dry again how will that impact the crops.

Another reason for the falling prices is Chinese demand just hasn’t been there recently.

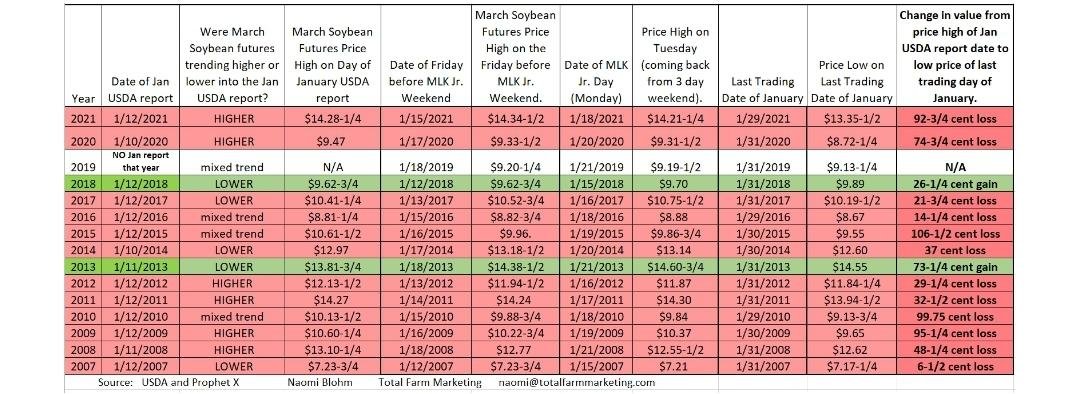

Here is an interesting chart from Naomi Blohm (from last year).

She points out that historically soybean futures have a tendency to drop the last 2 weeks of January following the January USDA report.

With the average price drop being 55 cents.

However if you take a look, there were only 2 years we traded higher following this report. In both of those years we were trending lower going into the report.

Similar to this year, we are trending lower right now.

Something to just be aware of, as historically we do trade lower the next two weeks.

So going into the report, nobody knows how it will shake out. The pre report estimates show 156. If we come in at 155 or lower, we probably see small little rally. If we come in at 153 or lower the market would likely take off. If we come in above estimates at 157 or higher we will take it on the chin yet again and there is a chance we go to test those June lows.

Personally I think they will come in around 155, but who really knows. Some argue that these rains are going to make future estimates get larger rather than smaller. I’m sure the rains could stabilize some of the falling estimates but I don't see this crop getting all that much larger with all of the damage we have seen. Nearly every single private estimate has their crop in the 150 range with some Brazil ones even in the 140's and lower.

Bottom line, be prepared for whatever the USDA decides to throw at us. As always, give us a call if you have questions or want to know what the best plan of attack for you would be. 605-295-3100. Because for some of you, the best thing would be calls, others it would be puts, and others it may be to do nothing. So please reach out.

I think we are in for higher prices especially long term. But short term you need to be aware of the risks to the downside. We are oversold here, but that doesn’t mean the funds can’t push this thing lower if the market sees a big crop out of Brazil to go along with a lack of demand.

Argentina's big crop is old news. US exports commitments below curve is old news. All of these factors are old news. But a Brazil crop in the 140 to 150 range is not priced in.

I mentioned this early, but Parana (the 3rd largest bean producer in Brazil) is getting cooked right now. All of the talk had previously been Mato Grosso, but don’t discount the effects the damage on this crop could have. They account for 14% of production and their conditions for their crop are dropping.

Taking a look at the chart, we made doji's on back to back days which offer bulls some hope. But we did not make a key reversal as we made new lows today, yet failed to take out yesterday's highs. So overall, the chart doesn’t look the best. Fist upside target is $12.53 but we really need to get back into the $12.80 range if we want to stop this horrendous downward spiral. If we can't find support soon, we need to be aware that the next major support could very well be $12.05.

Soybeans March-23

HOLIDAY SALE

Limited time.

Wheat

The wheat market rallies and takes out pretty much all of yesterdays blood bath.

The reason for the pressure recently has simply been the improved winter wheat crop here at home. As we have gotten moisture and seen some snow cover.

However, there has been a little bit of talk about potential winter kill. As next week it is supposed to get brutally cold, with temps below 0 degrees. So the areas that don’t have snow cover could see a little bit of damage, but most seem to agree that there won’t be a major problem.

Wheat also saw some support from international news. As ships are avoiding the Red Sea, which is causing delays in ships and making them have to go around Africa. This is a little friendly as it will cause less ships to be available and will increase the costs of the grains from those areas.

Aside from that we are still in a time period where we don’t see much wheat news, so often times we just chop back and forth.

As for the report Friday, they are looking for carryout to be down 1 million. So not many changes are expected on the wheat side of things.

However one of the factors for the report people aren’t mentioning a whole lot will be winter wheat seedings. The estimates for 2024/25 winter wheat seedings are 35.786 million acres in total.

The biggest thing keeping a lid on prices is the fact that Russian wheat is still the cheapest around.

We also saw Egypt making purchases but the US didn't get any of the business. And there is talk about potential cancellations of Chinese purchases, which if true would be not be supportive of this market.

Bottom line, I like the long term bull story in wheat. The problem is the nearby timing. Wheat will be higher, but who knows if it will be a week from now, a month, 6 months. And how much does the market give back until it finds that reason to rally?

So yes we still view the wheat market as a sleeper here. But that doesn’t mean prices can’t fall here short term, because they can. Currently remaining patient and waiting to see what kind of surprises Friday brings.

Taking a look at the charts, we are stuck right in the middle of the recent highs and recent lows. For bulls to get excited we need to take out those December highs. My first upside target if we can do so is $6.53 with some support sitting at $5.83 and then our old lows of $5.57.

Chicago March-23

KC March-23

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23