WHAT’S NEXT FOLLOWING DISAPPOINTING USDA REPORT?

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

Another disappointing week for the grain markets. Overall the grain markets didn’t bleed as bad as they have the previous couple of weeks. As our markets stabilized trying to find possible bottoms.

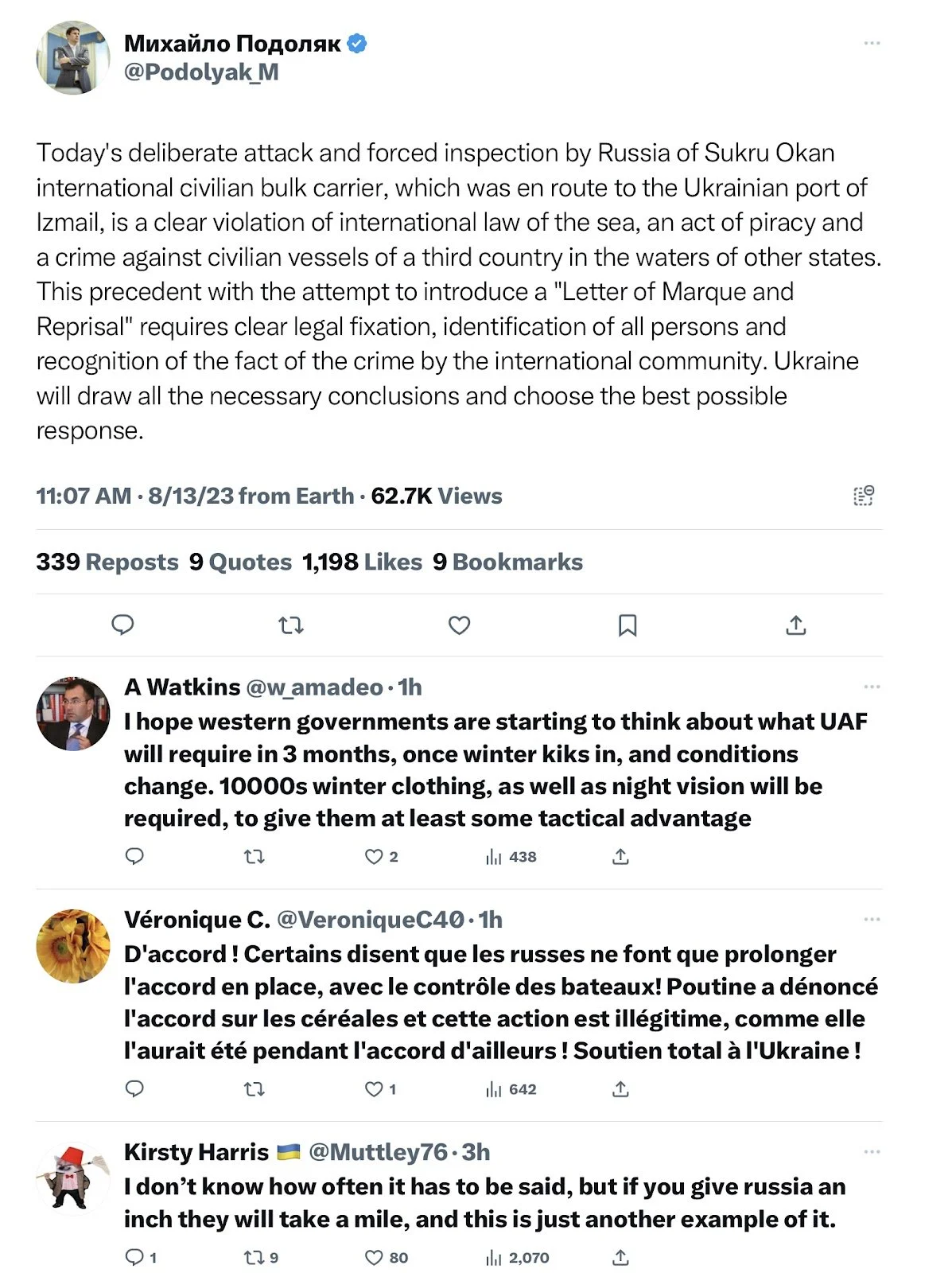

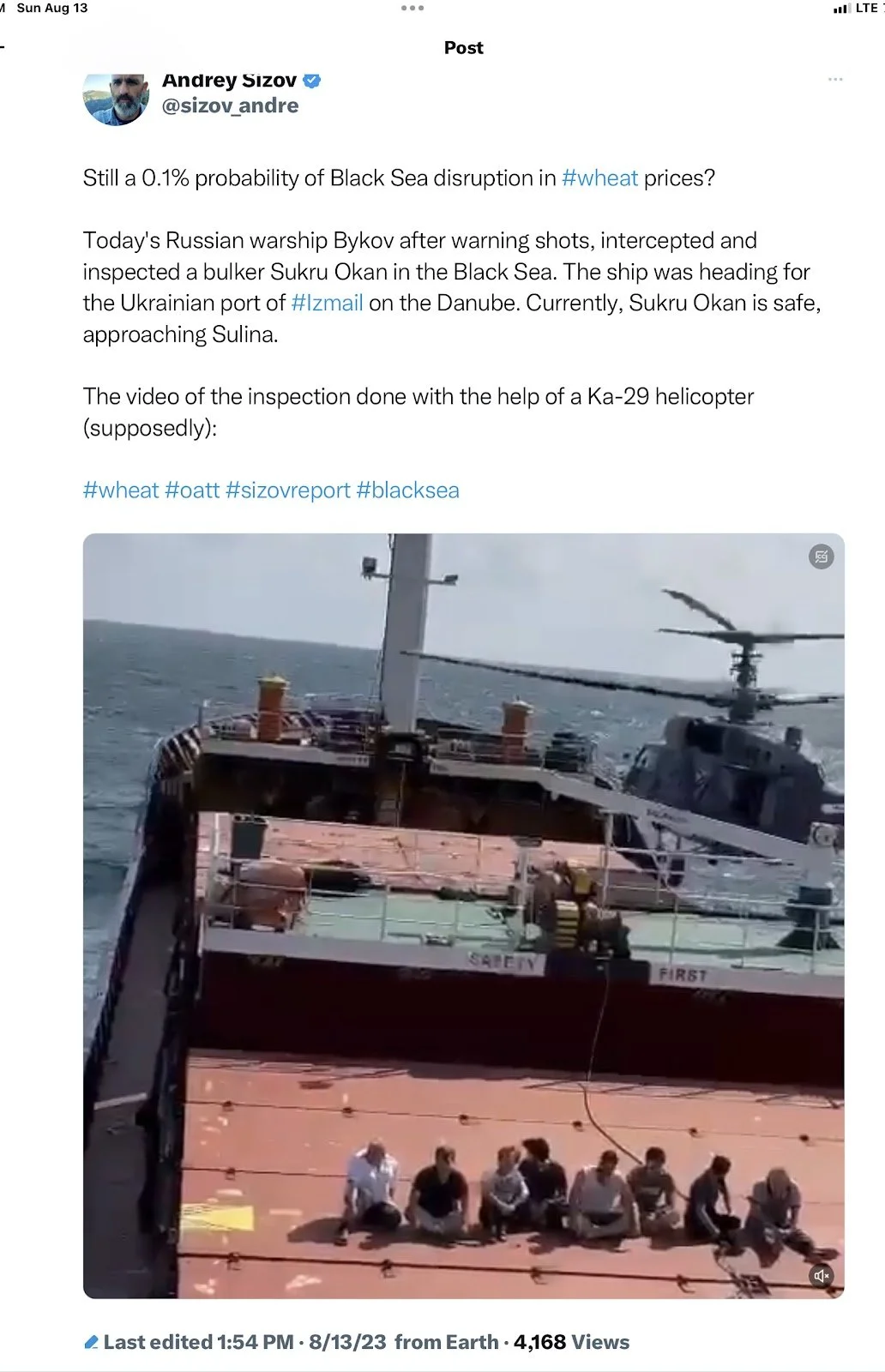

But we had a week filled with disappointment. It started with wheat starting the week on the firm side on the Russian/Ukraine news over the weekend that we had an escalation in the Black Sea. Wheat failed to follow through as the war news continues to be the boy crying wolf type of news.

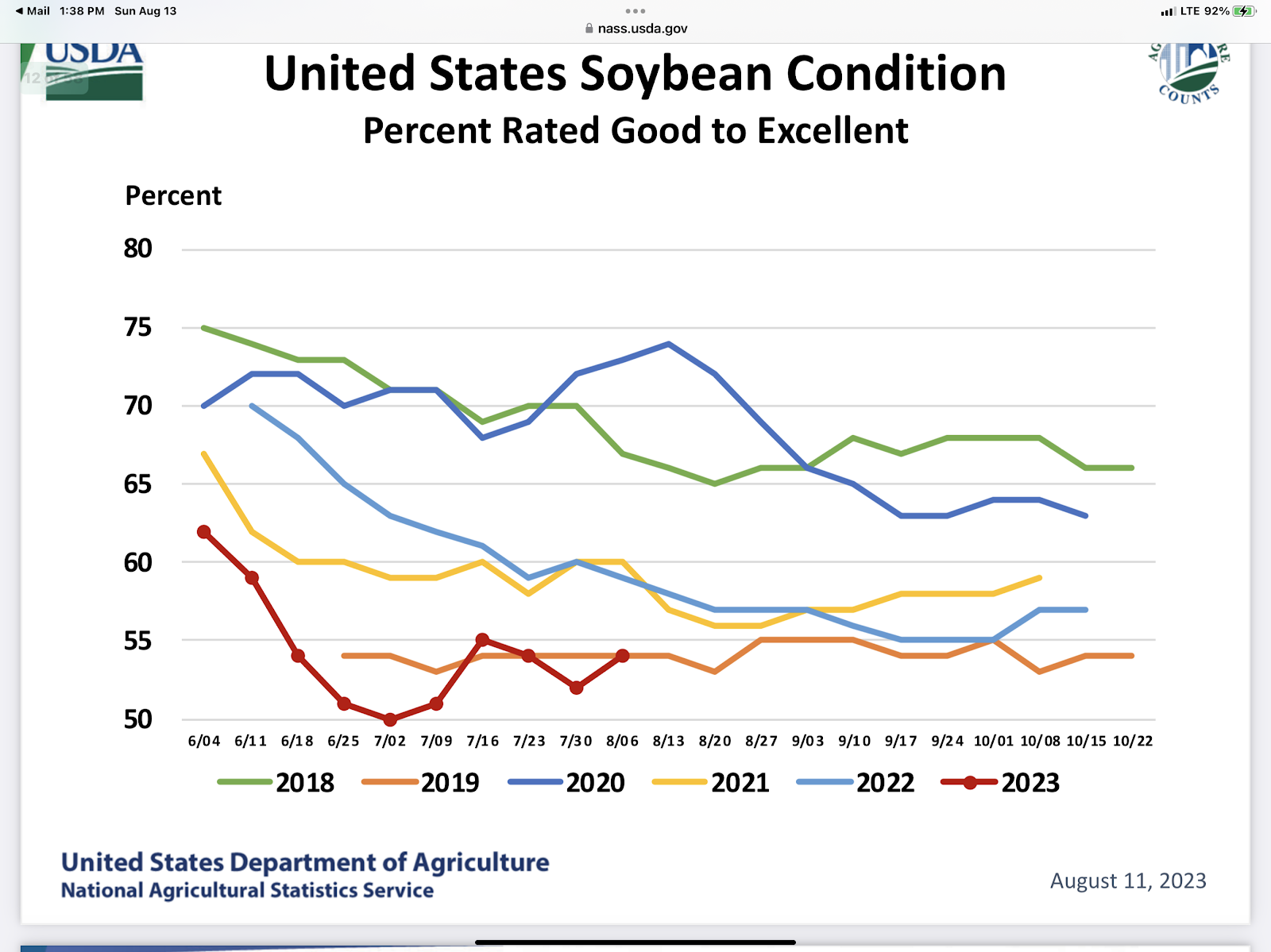

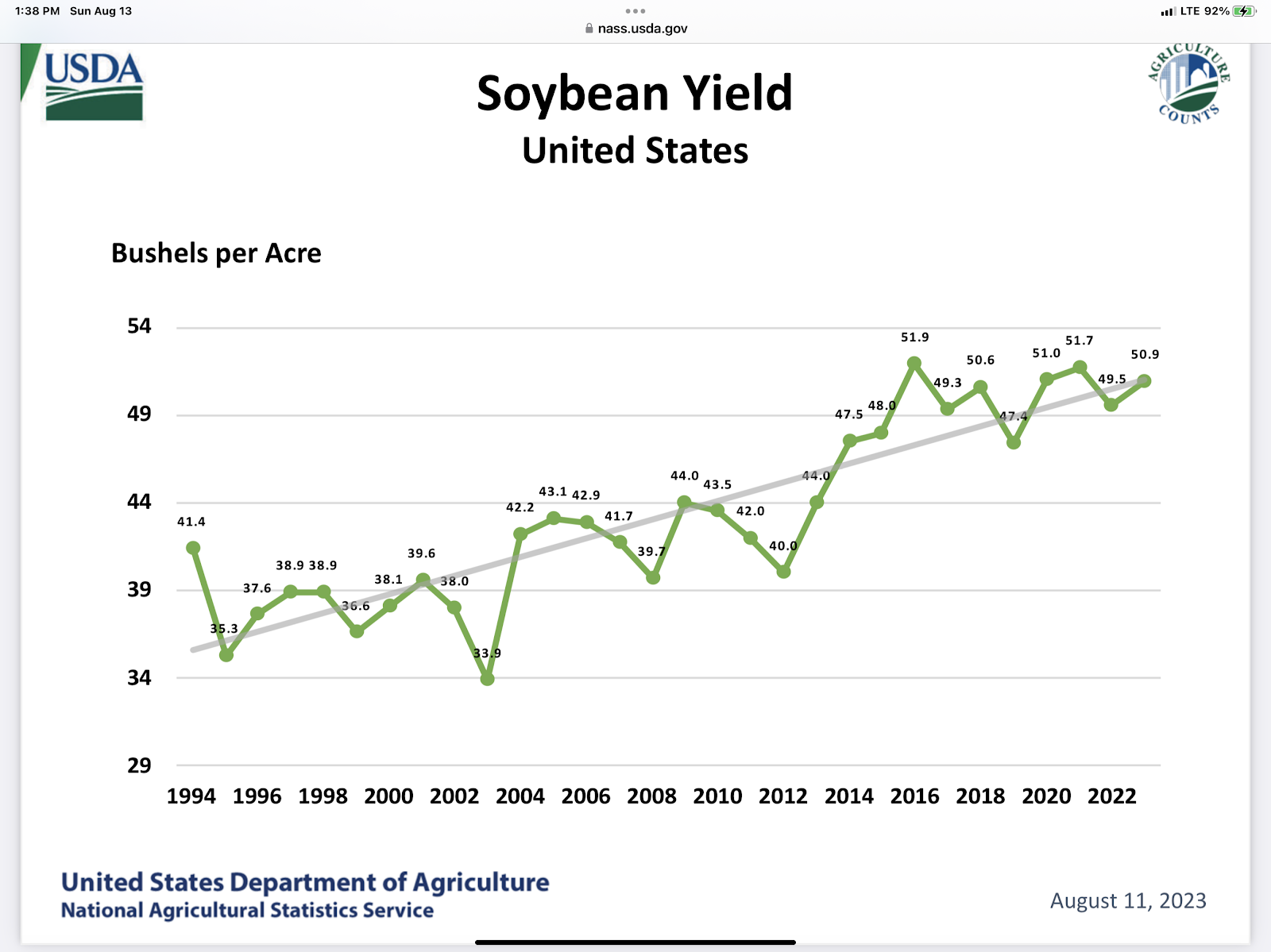

We followed that up with soybeans having a nice reversal on Tuesday bouncing off of technical support from both the 200 day moving average and fibonacci support. The disappointment for beans was the reversal left on the charts on Friday as we spiked higher from the USDA report initial reaction only to close in the red leaving an outside bearish day on the charts after a 46 cent bounce from Tuesday’s low.

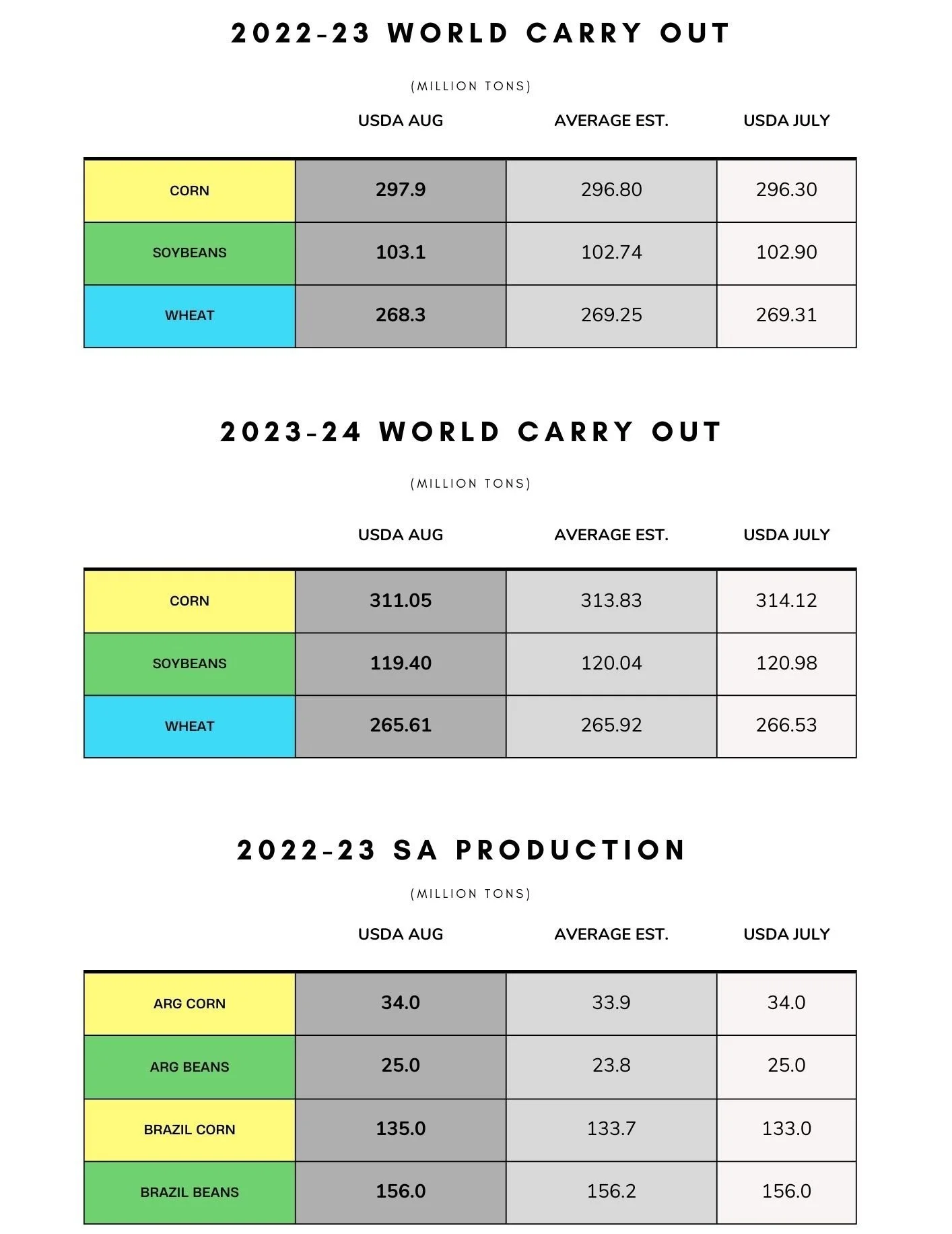

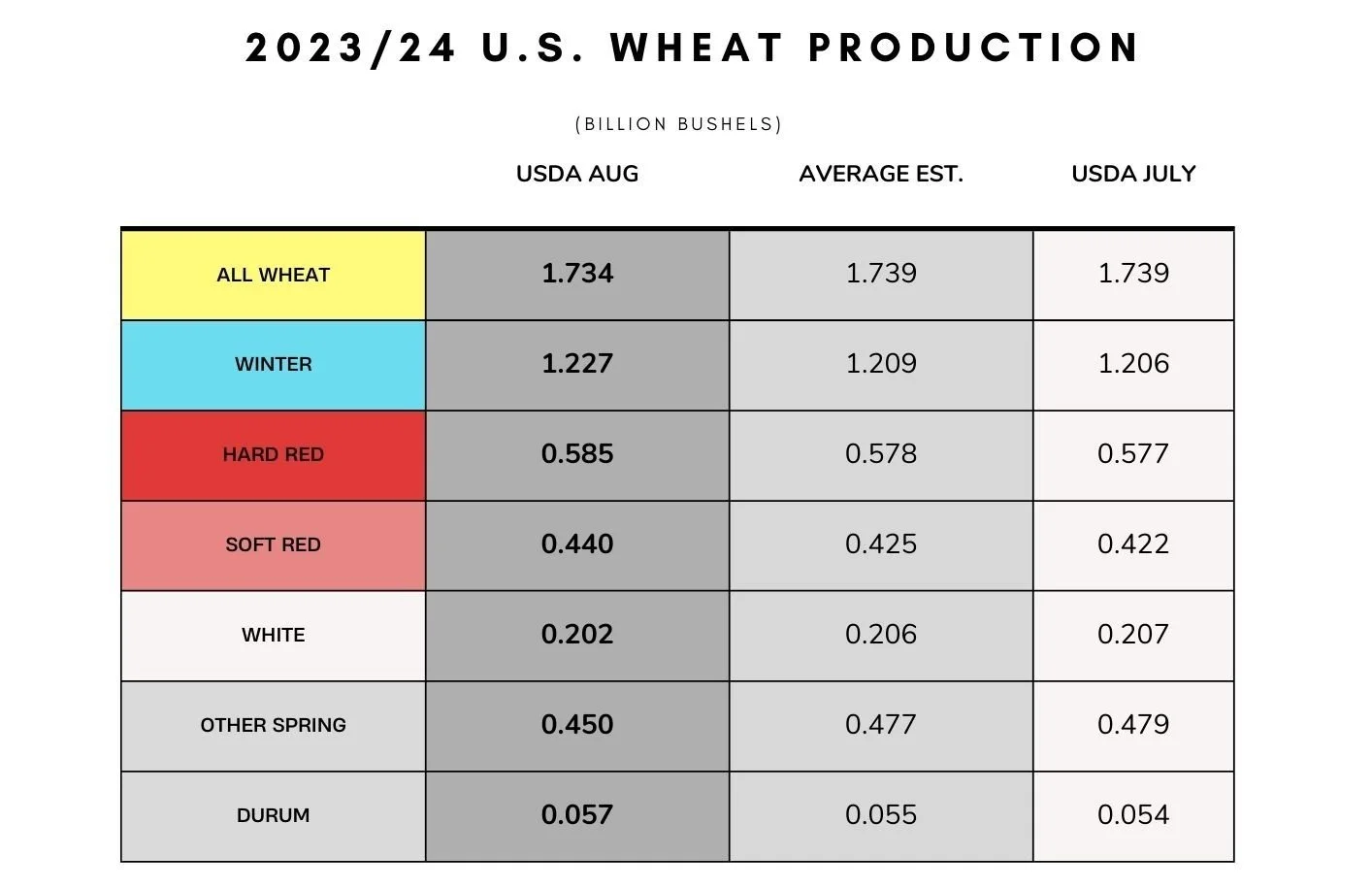

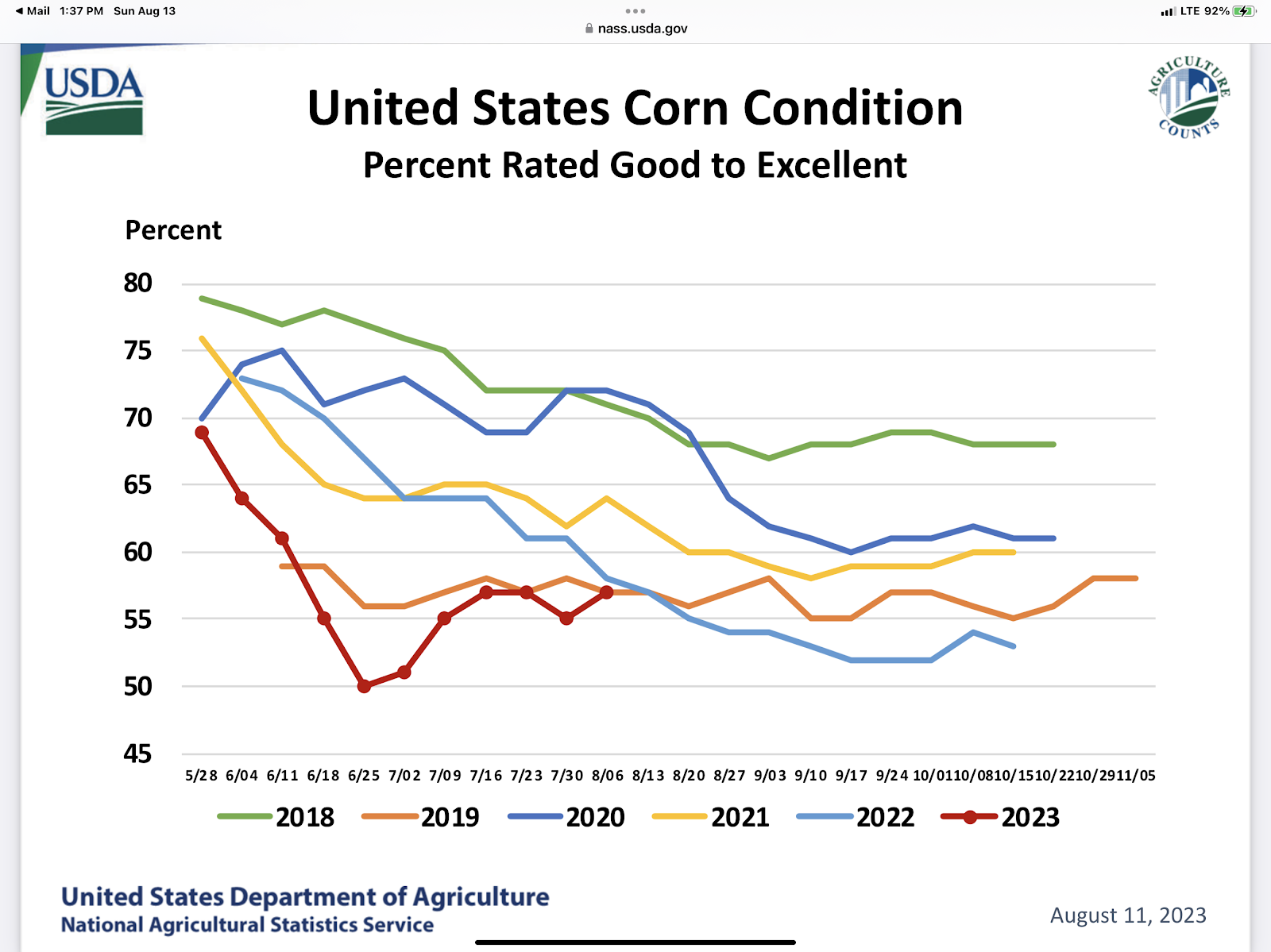

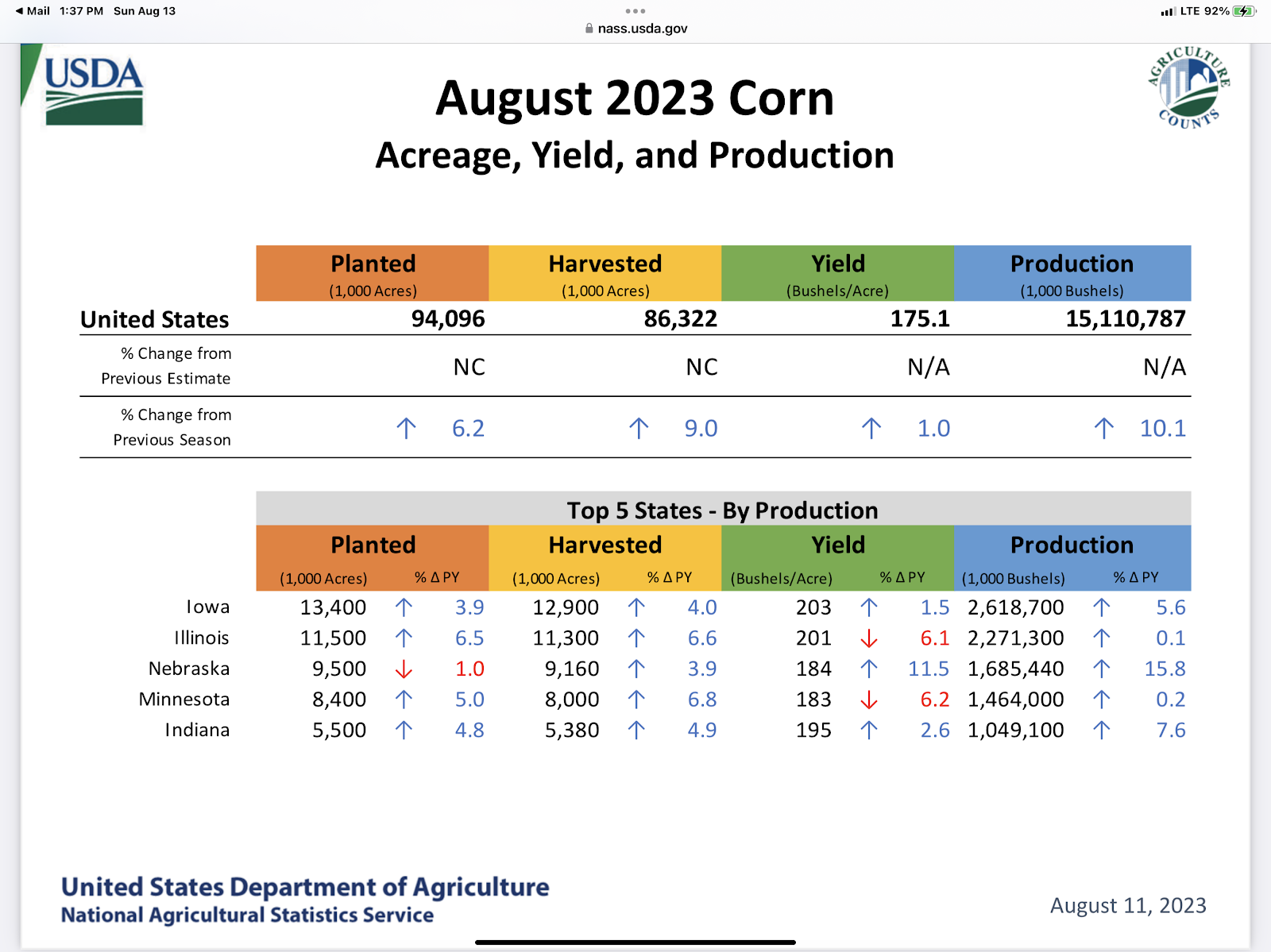

The biggest disappointment of all was the price action we got on Friday after the USDA report came out. Here is a recap of the numbers.

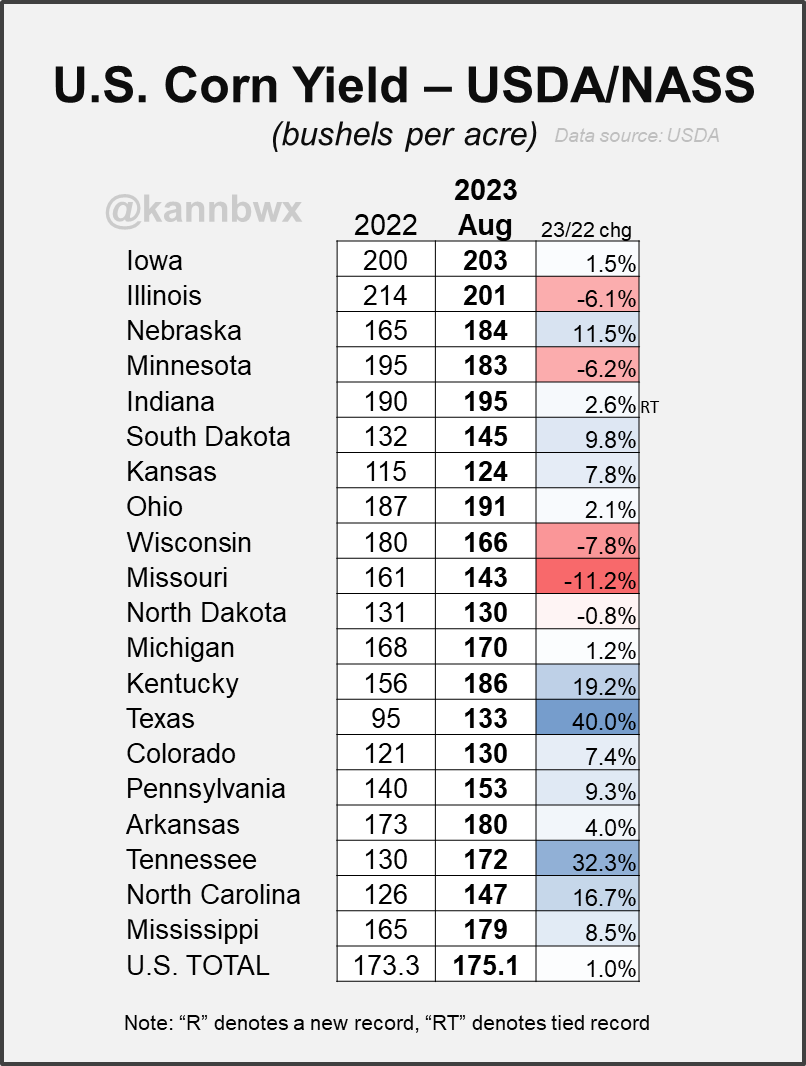

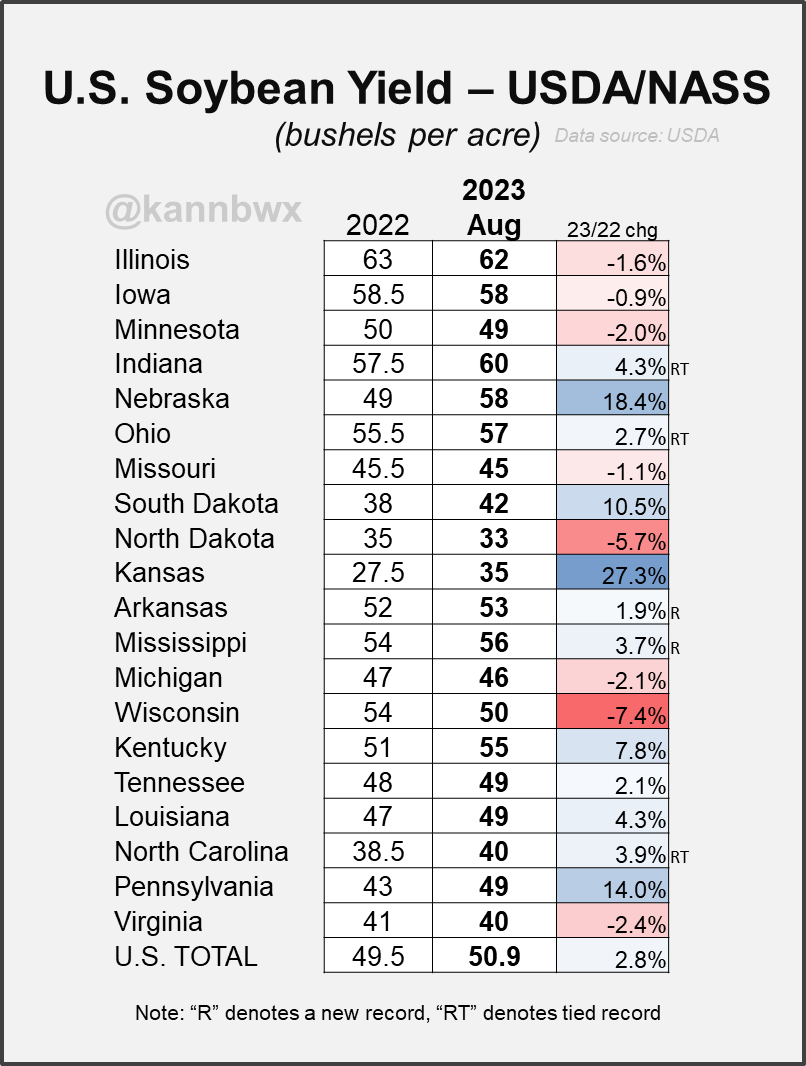

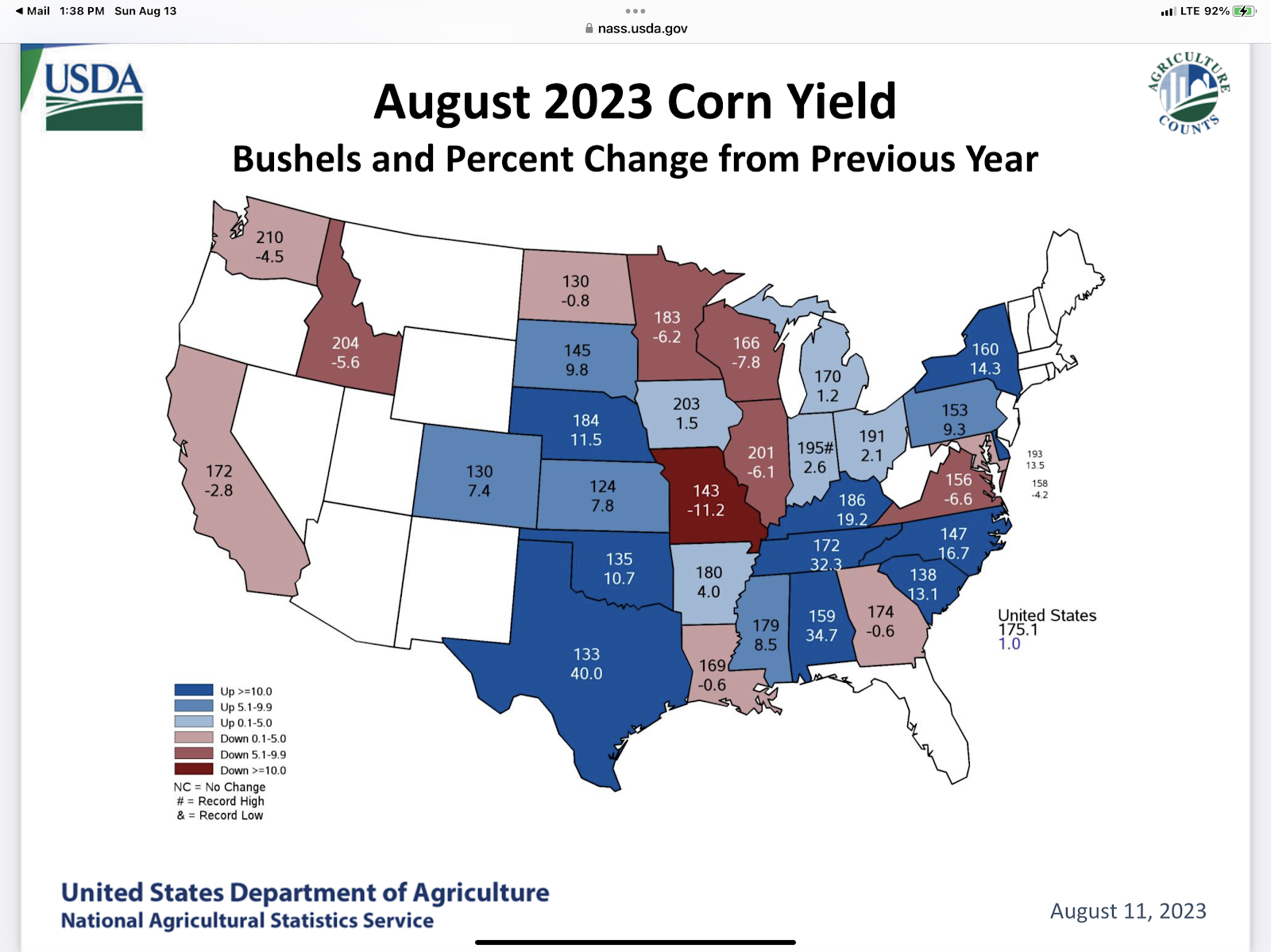

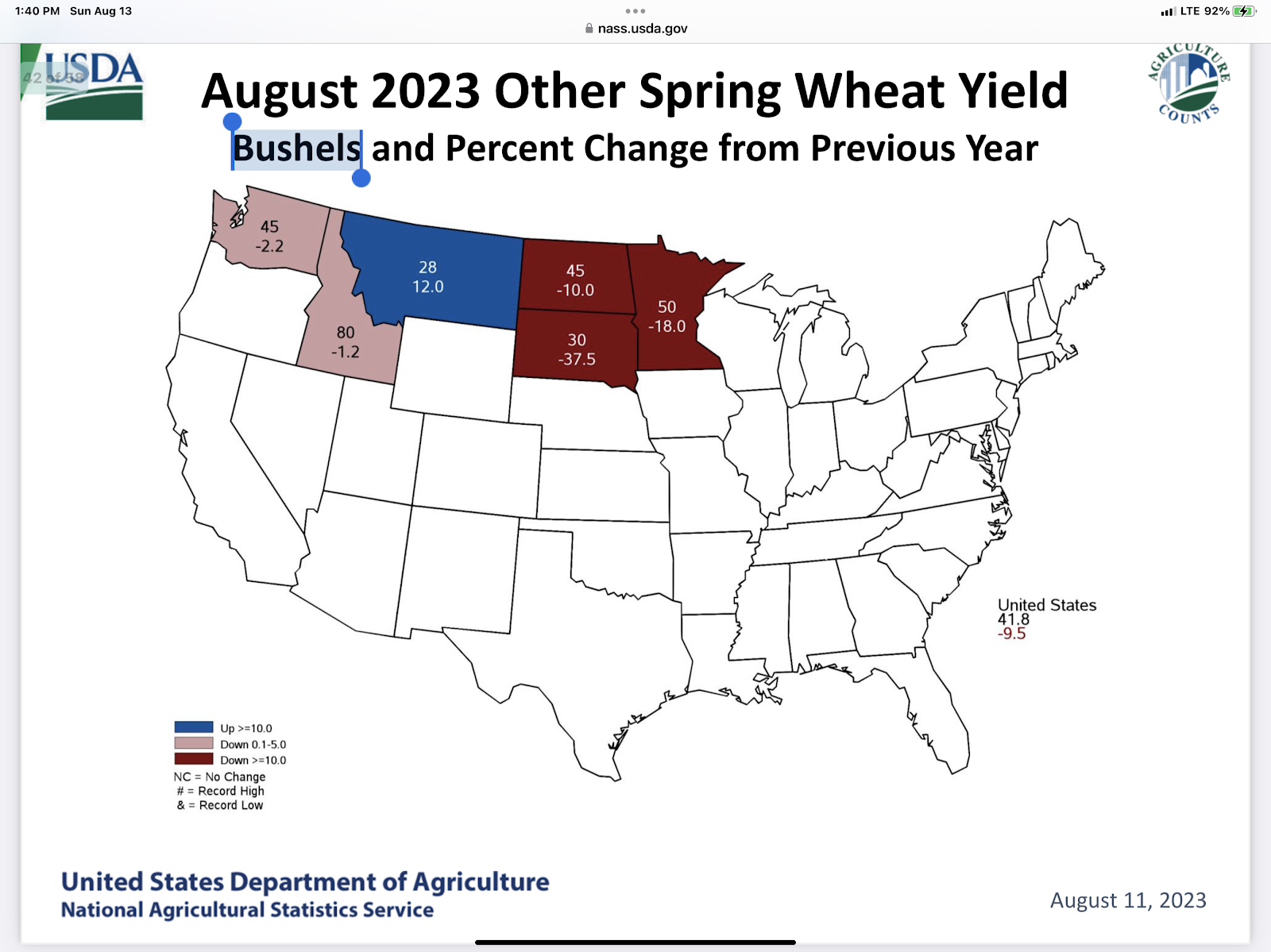

State By State Yield

- From Karen Braun -

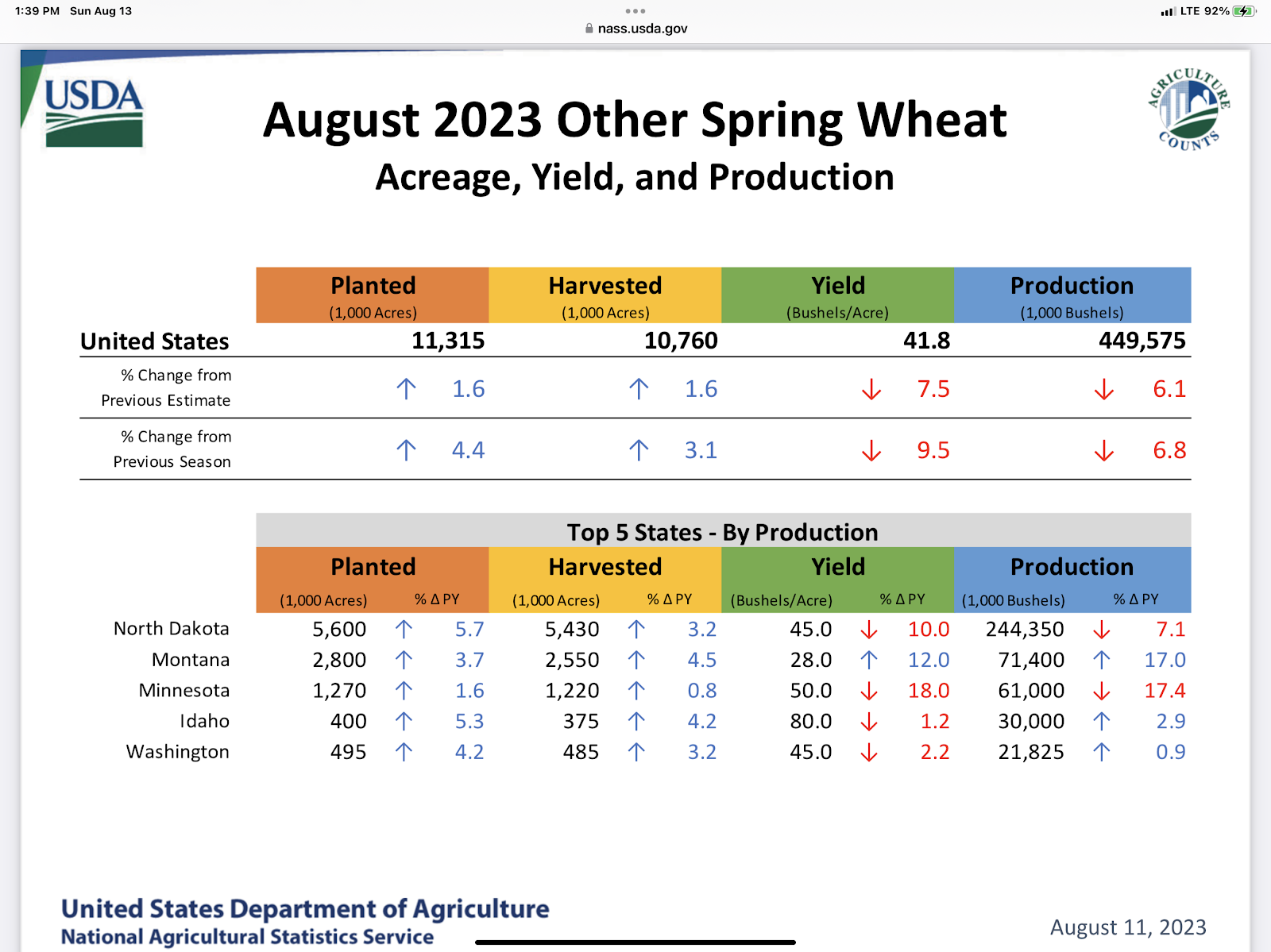

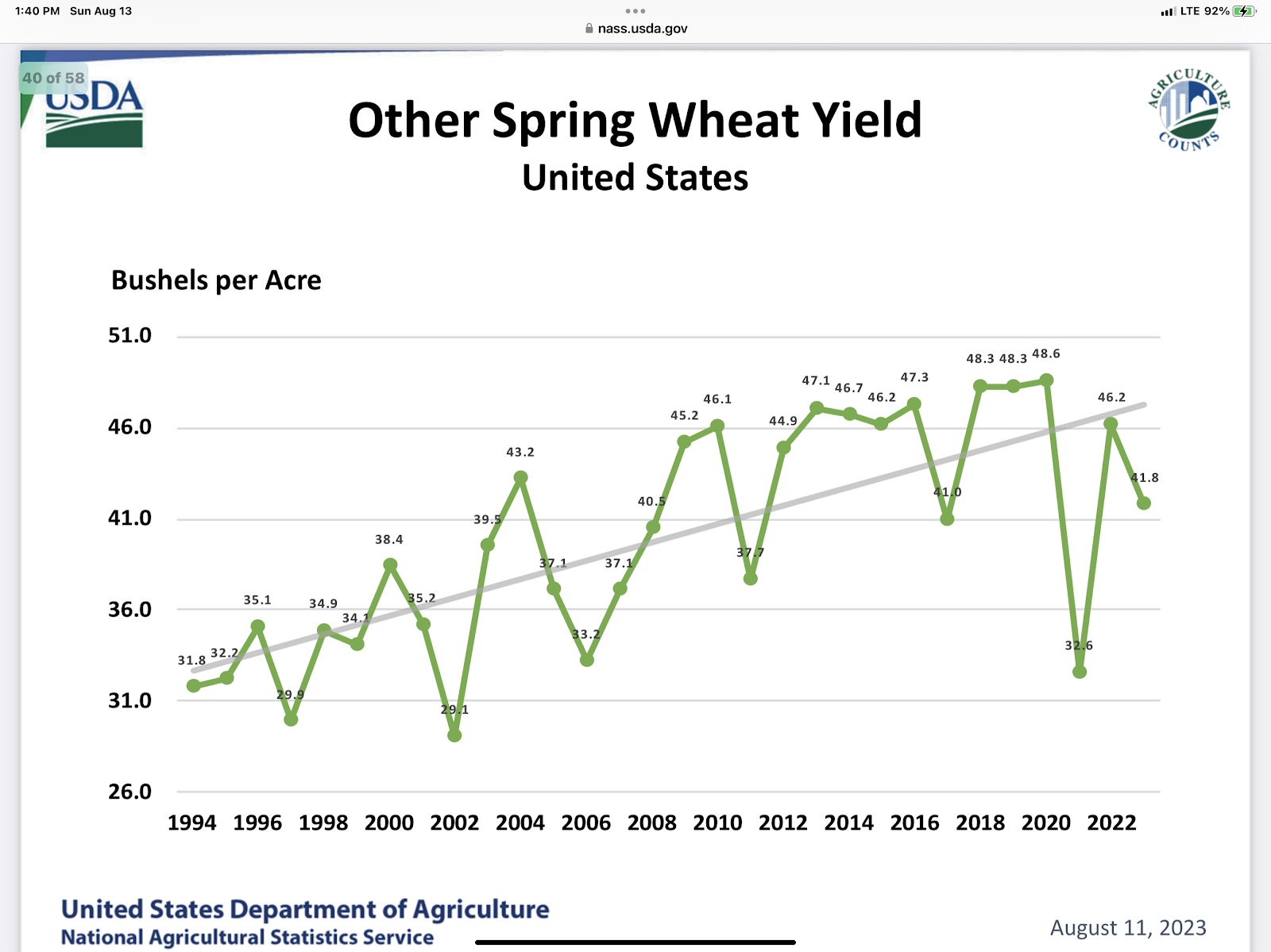

Here are some more screenshots of slides from the USDA.

Notice in particular the sample size. The smaller the sample size the more volatile future reports can be.

As you can see above the USDA report really wouldn't be considered bearish. Neutral to maybe friendly is what most call the numbers. But the price action was not positive.

Sometimes USDA reports will have lagging price action. So that is a little hope that as we analyze the report that more buyers might get interested.

One other possibility is that we can see a technical bounce as the charts are near some support levels and despite Friday’s negative price action we did have markets close above those support levels.

September corn made a new low but right at July 13th low. December corn held the July 13th low but also closed below the 4.91 level which has acted as major support. With the markets oversold giving buy signals on RSI and STOCH we have a possible bear trap set but we will need some sort of catalyst to start the bounce. Perhaps the Black Sea War, perhaps the Pro Farmer Crop Tour next week, or perhaps solid demand, or perhaps other production issues in the world such as the Chinese flooding?

For soybeans the key level to watch will be last week’s lows. If we can hold that level don’t be surprised if we rally going into harvest as the market has priced in a lot of bearish information, the market is still trading a yield higher then what the USDA printed on Friday. Weather forecasts are hot and dry. I don’t expect any more weather rallies to come from US weather unless we get an early freeze. Overall the weather market for the US crop is over or shortly will be as the time runs out on the weather clock.

If demand can continue for soybeans like it has the previous couple of weeks soybeans can and should rally on demand. Demand driven markets are much different then fear of supply shortage rallies. The fear of production rallies typically go straight up and then one of a couple things happen. We go straight back down if the fear isn’t realized, such as the corn drought scare this year. Or we have to get to price levels that curb demand. Sometimes this is done with basis and future spreads.

While a demand driven market tends to be one that just builds momentum that eventually leads to a massive move once the market realizes demand is outpacing supply.

The bean market feels like we have solid demand that wants to grow and grow substantially while at the same time we have the USDA printing lower demand numbers to help offset the lower supply. Don’t be surprised at all if the soybean market goes running straight back up if we get some positive price action via breaking some resistance on the charts. I.E. if we can close back above Friday’s highs I think we will have the buyers running back to the door.

LAST CHANCE FOR OUR USDA SALE

This is your last chance to lock in this offer and save over $500 before your trial expires. Don’t miss all our future updates.

OFFER: $299/yr or $29/mo

WILL BE: $800/yr or $80/mo

Become a Price Maker. Not a Price Taker.

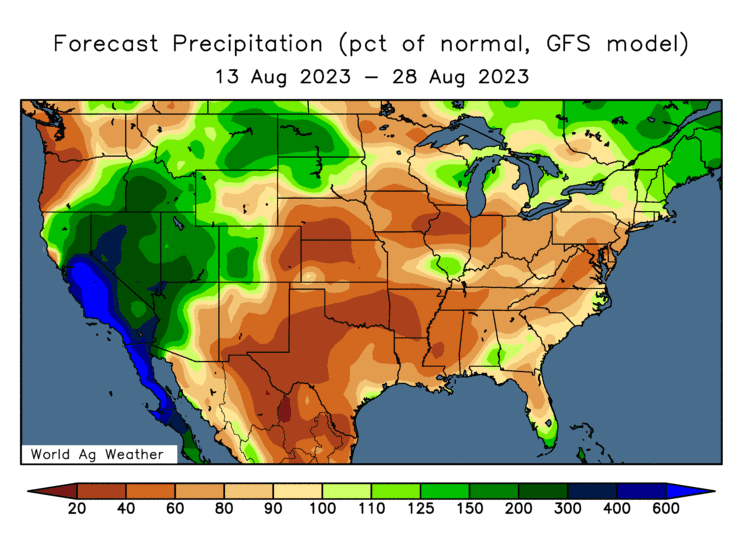

Take a look at the below weather maps.

These are much more friendly then what we had late last week.

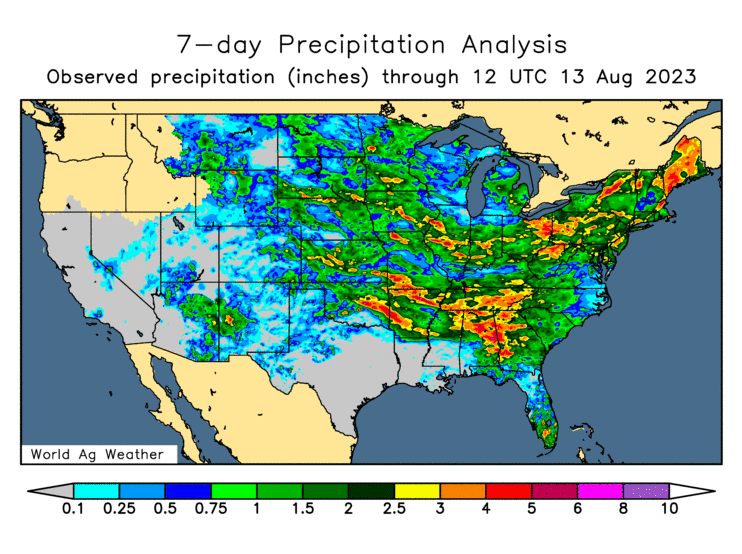

Here is the map that makes one wonder if the heat and dryness will really matter. Looking at this you can tell that most of soybean area has got some decent moisture the past week.

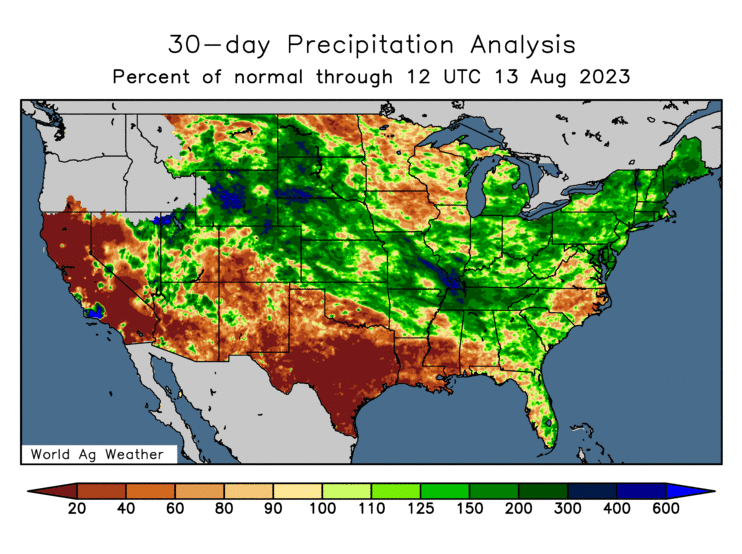

This map shows pockets that have been dry the past 30 days, but the majority of corn/soybean production areas have got decent moisture. Combined with the past 7 days map above you will notice that plenty of the dry areas got moisture such as Iowa/MN. The question becomes: did we get enough to make a soybean crop? Or will the dry and hot forecasts lower the yield?

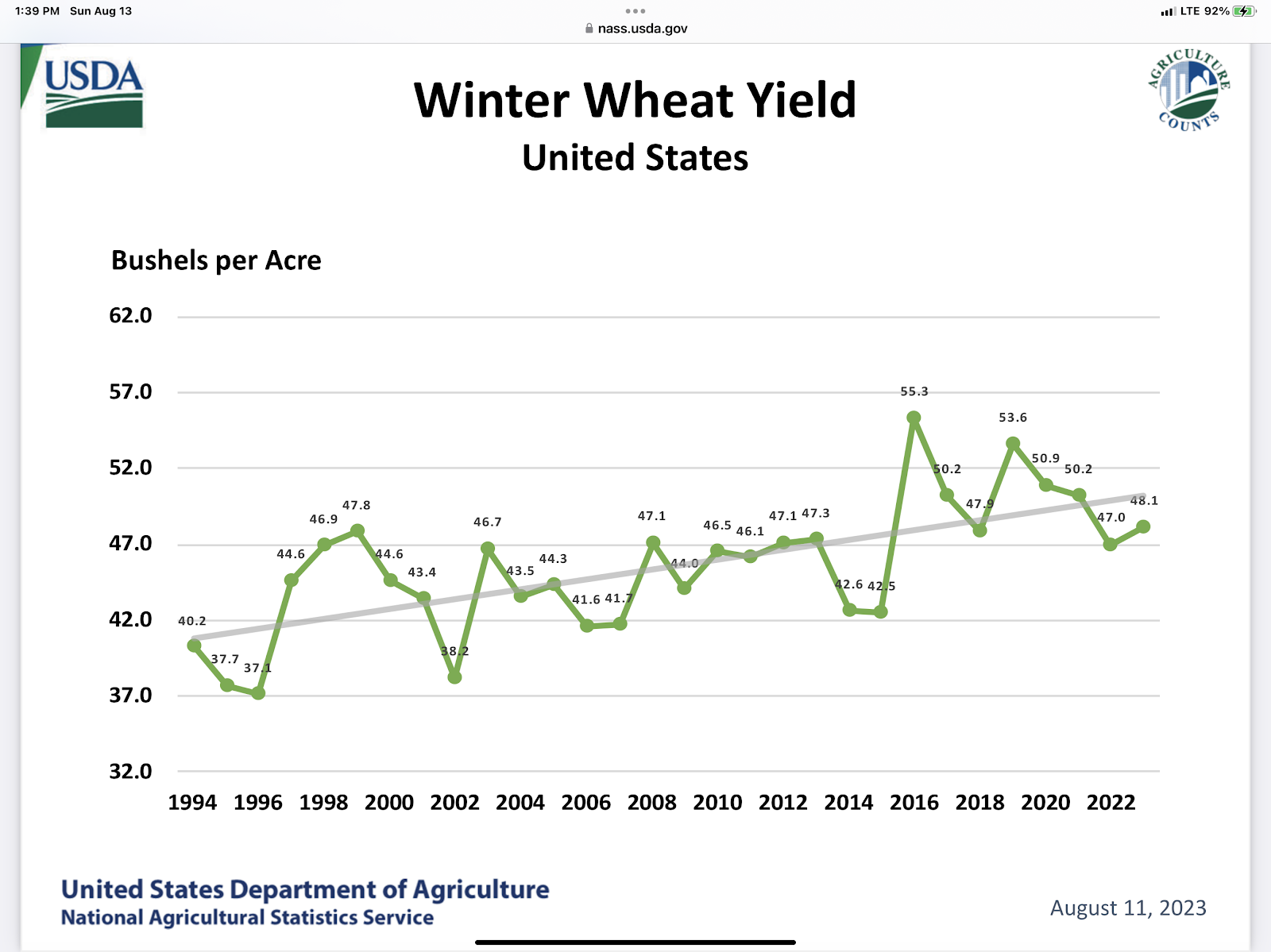

As for our wheat market I look for that market to remain very volatile. Technically last week was just a sideways week and charts look that they could be forming a base.

I don’t know that wheat will see a 2022 rally, but I still believe it is possible. Options are still very expensive giving the recent price action. Overall chart looks like it could easily hold these levels and bounce back up the highs we had a couple weeks ago.

If you have wheat sold and are wanting to buy it back or use a re-ownership strategy do so before we bounce. Don’t chase it and re-act. If you want to own it, remember it is buy low and sell high. It is buying fear and selling greed.

Looking at the chart below I think we will have another bounce up towards the top side of the bollinger bands. It wouldn't be a surprise at all because that is what our markets like to do. They like to do lots of head fakes and then they like to go and find stops. It could also be said that the funds like to take us to the top of the elevator and then take us back down to the bottom.

It can almost feel like a conspiracy the way that emotions drive grain marketing. Meaning when we get down to levels such as we presently are on CBOT Sept wheat as an example. It feels like the bottom just wants to fall out of it. Which causes farmer fear selling as well as flushes out the weak longs.

It can be a very vicious circle.

The main thing is to be comfortable ahead of time. So when we rally you have to make sales, buy puts, sell calls, sell futures, or something that allows you to be comfortable when we get back down towards the bottom of the range. You have to be proactive enough on the bounces that you are not forced to sell on the down hard times.

Because what you really want to be doing at the bottom end of the ranges is buying back sales, buying futures, selling puts, buying calls etc. Depending on your grain marketing style for risk management. If you need help or want to learn more about how to use a hedge account in your grain marketing risk management, please give me a call at 605-295-3100. You may also click on this link to open a hedge account.

https://www.dormanaccounts.com/eApp/user/register?brokerid=332

The world wheat situation does also continue to tighten. Much like typical USDA fashion you will notice that demand was cut because of the supply cut.

With the rice situation one has to wonder if we will really see usage slip from last month’s forecast.

I also believe that the Canadian wheat crop will get smaller as we get more updates.

The bottom line is for our markets that we are at price levels that should help increase demand, levels that technically have some merit or reasons to have a bounce. We are at the bottom of the recent ranges we have had.

Could the grain markets all fail to hold support levels and trade much lower to end out the year. It is possible, but what is more probable is that we find buying value at these levels while creating more demand.

If you get forced to sell we strongly encourage most operations to consider some re-ownership strategies if they align with your risk/reward profile and staying power.

We are big into giving individualized grain marketing recommendations, not so much blanket one size fits all recommendations. One thing that I never like to do is to put myself in a spot where I am forced to sell at whatever basis/cash price that my local delivery spot will give me. At minimum those “must sell” or “must deliver at harvest” bushels are bushels that really need to be treated much differently than bushels that one has the flexibility of pre selling ahead of harvest or storing into the next year.

That is why taking blanket recommendations isn’t strongly encouraged. I believe that every operation has a different correct move for their unique situation. So please if you have questions on what we would recommend to you given your situation give me a call at 605-295-3100

Here are a couple of tweets talking about possible increased risk in Black Sea.

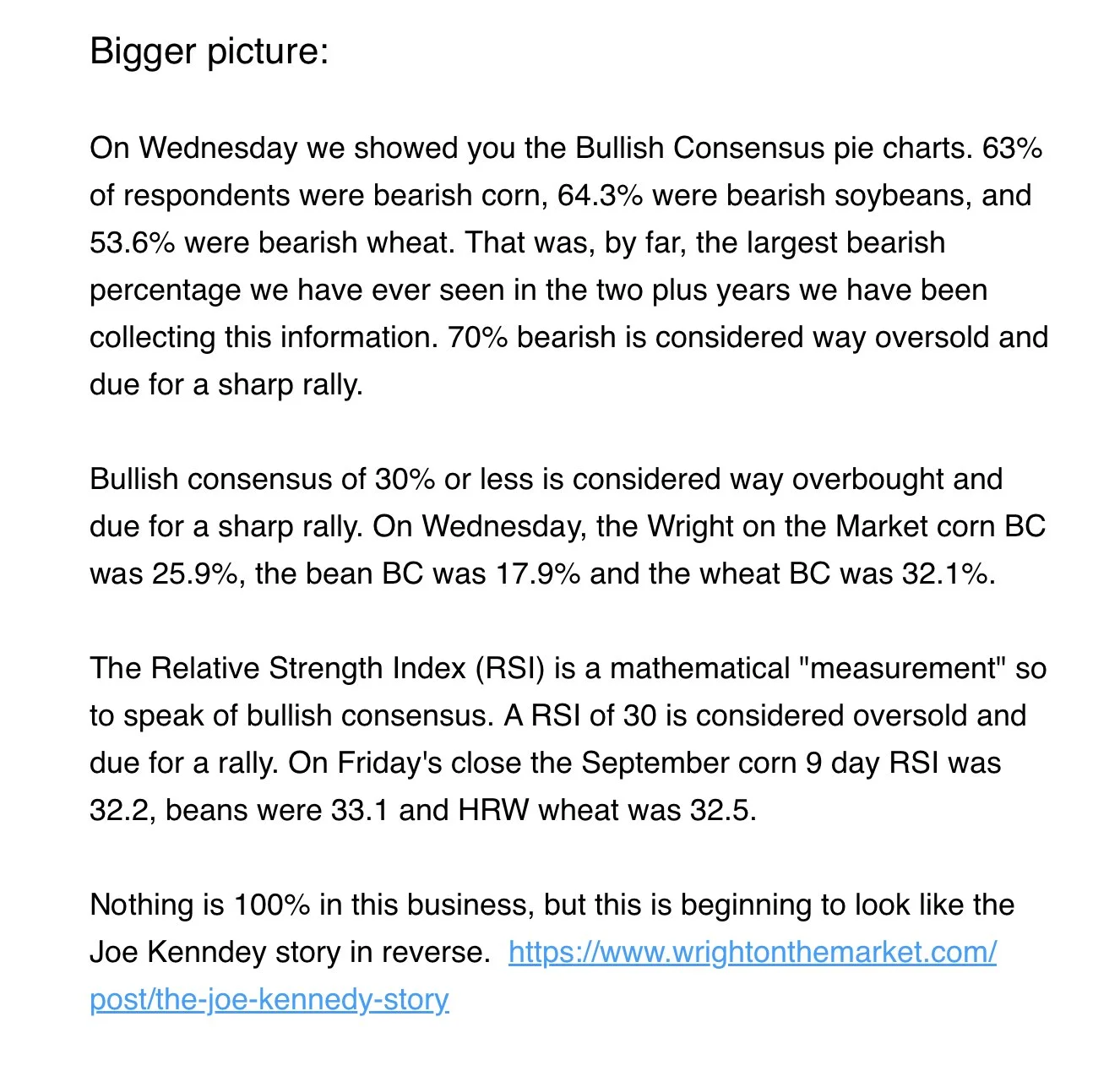

The below is from Wright on the Market. The comment that sticks out the most to me is the comments regarding bullish consensus. Meaning typically when everyone is bullish you put in your highs, when everyone is bearish you put in your lows. He mentions that we are the most extreme on the bearish side as we have been since he starting collecting that data a couple years ago. That doesn’t mean we have to go straight up right away. But the doors are open for a reversal.

This is also from Wright on the Market. Notice the comments about price action from USDA report versus information on the USDA report.

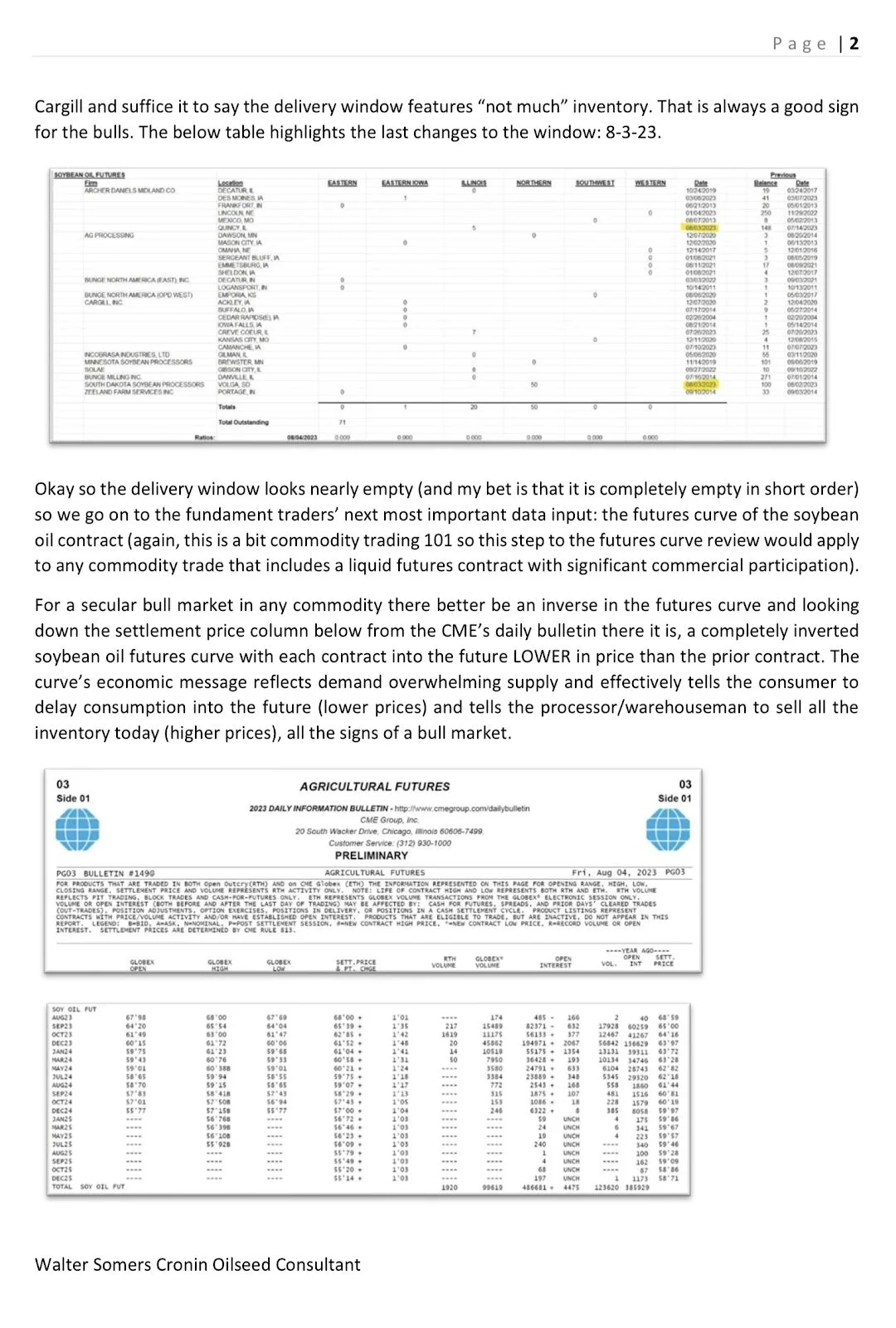

The below is from Walter Cronin it speaks to the fundamental situation for soybeans and bean oil. The biggest comment to take away from this is “the vegetable oil market is and remains in a secular bull market for the foreseeable future…….remain in a bull market for the foreseeable future due to new demand overwhelming available supply.”

Check Out Past Updates

8/11/23 - Audio & Report Recap

USDA REPORT BREAKDOWN

Read More

8/10/23 - Audio

PREPARING FOR THE USDA REPORT

8/9/23 - Market Update

TRADE PREPARES FOR USDA REPORT

8/8/23 - Audio

MARKETS PUT BANDAID ON THE BLEEDING

8/7/23 - Market Update

BEANS SELL OFF WHILE WHEAT RALLIES

8/7/23 - Audio

NAVIGATING WEATHER & WAR YOYO

8/6/23 - Weekly Grain Newsletter