TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

Overview

Grains mixed with soybeans leading the way to the upside while corn and wheat take it on the chin. Soybeans higher after their 25 cent correction the past two sessions. Corn trades lower for the 3rd session in a row, down 20 cents since Thursday.

Short story short, corn and wheat see technical selling pressure with some macroeconomic concerns while soybeans trade higher with the rally in bean meal and drier South America forecasts.

Meal closed at it's highest levels since March, and the market is up 18.5% the past 3 weeks now.

Harvest progress came in yesterday, moving along slightly faster than average. Corn is 59% complete while beans are 76% harvested.

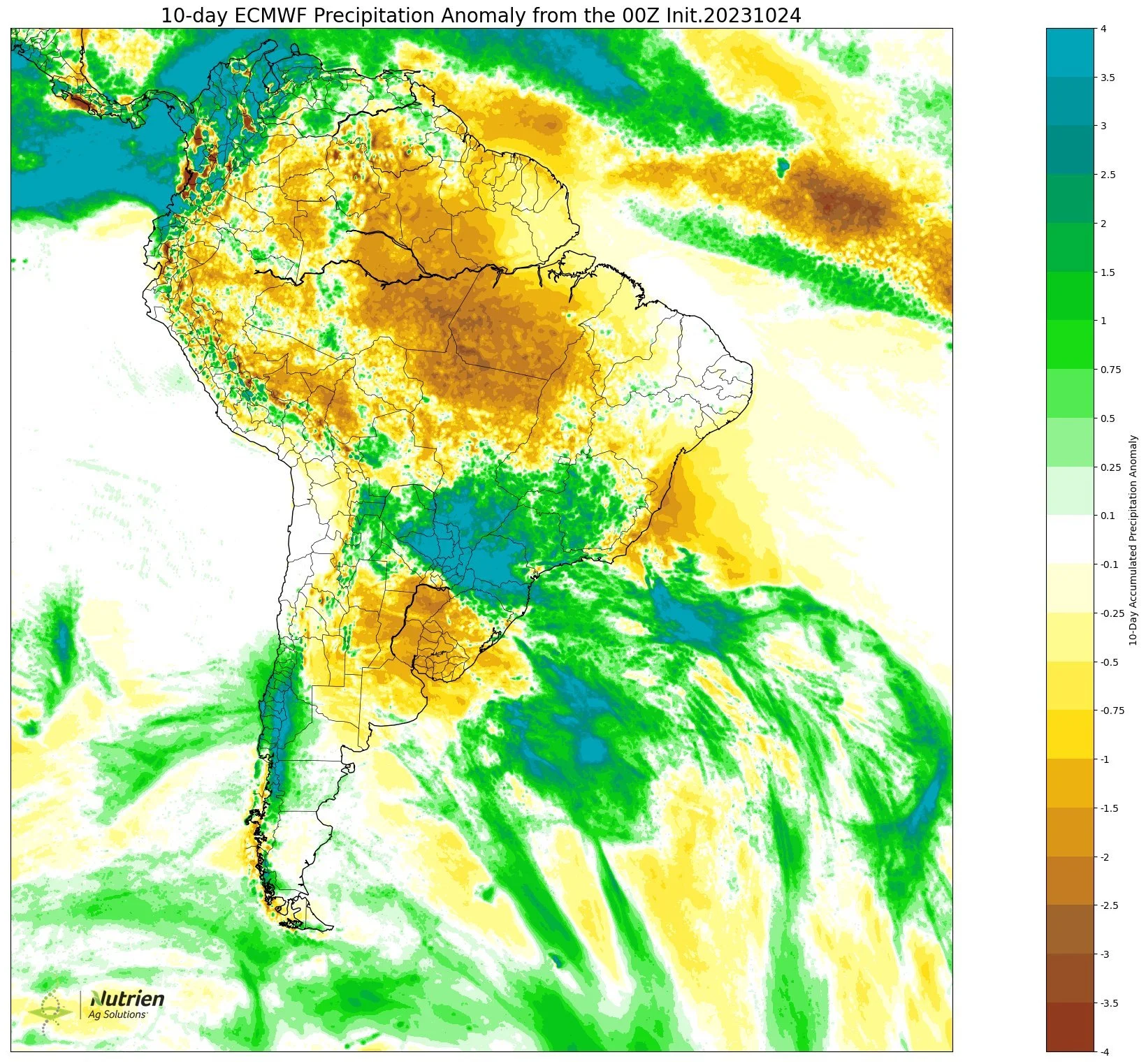

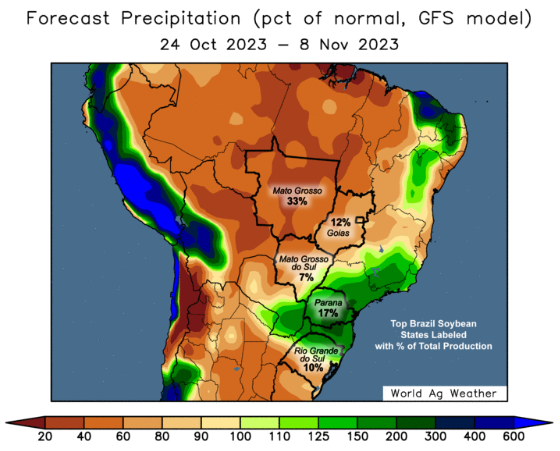

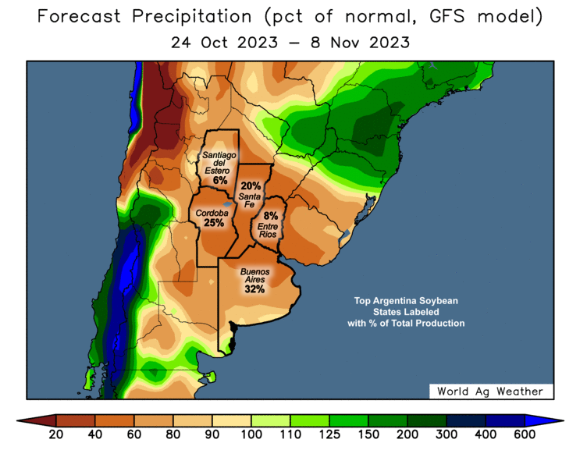

Argentina had some good rains recently which has added some pressure, but if we take a look at the forecasts, they have turned considerably drier for both Argentina and Brazil.

ADM CEO says he expects Argentina to run out of soybeans to crush in November.

Here's the outlook for South America.

Enjoy Your Trial? Get 50% OFF Today

Before your trial expires, lock in this half off discount & save $400 per year. Available exclusively using the link below.

Become a Price Maker.

Today's Main Takeaways

Corn

Corn lower here for the 3rd session in a row, now 25 cents off their highs from Friday of $5.09 as corn makes it's lowest close since September 29th.

Just some food for thought, corn hasn’t had 4 consecutive red days since our July sell off where we traded lower 8 straight sessions from July 25th to August 8th. Since then, we have seen 6 different times where we have traded red for 3 straight days, trading green on the 4th day each time. Will tomorrow be the 7th? Guess we will have to see.

In yesterday's audio we said the $4.90 level was key, and if we couldn’t hold we could likely make another leg lower due to technical selling, which have now done.

Why the correction? For starters, Argentina received some pretty rains. However, the future outlook still looks dry, this added pressure. We have the recent correction in crude oil, down $6 a barrel the past 3 sessions. Then we have harvest pressure, but with harvest reaching 59%, harvest pressure will mostly be in the rear view mirror.

But more than anything, it's really just a risk off mentality from the funds and algos. We failed to hold $5, then we failed $4.90, and the funds just haven’t had a major reason to cover their shorts.

I agree that it is hard to see a bullish enough story right now to cause a major short covering rally. We have mentioned several times that the path higher will not be an easy one for corn with our 2 billion carryout.

What could cause a bullish enough story for the funds to decide to reduce their exposure? One that will be closely monitored is South America weather. If they see any problems in the weeks ahead it will push both corn and beans higher. Still too early, but it's looking dry.

Another potential factor is China. Will they start to have a bigger appetite for US corn? It's possible but still an unknown.

Overall, I still see higher prices from here. Could we look to retest those harvest lows? It's possible. But I'm leaning towards the thought that we will slowly move higher from here. Remember, corn likely won’t take off and rally to $5.30 right away out of nowhere. It's going to be a marathon.

How should you be managing your risk? If you have to decide whether to sell or store corn vs beans. It might make sense to sell beans and hold corn. Beans have so much more upside, but they also have far more downside. Another main reason would be cash flow and interest expenses.

If you made sales, consider some calls. If you will be having to make sales, consider putting in a floor with puts.

Taking a look at the charts, bulls need a bounce very soon. The downside risk is $4.77. We need a close back above the 20-day moving average of $4.90.

Corn Dec-23

Basis Outlook Tools

Before deciding what tool is best for you to use, make sure you consider your local basis outlook.

If you know your local basis outlook, and don't know what the right tool is give us a call and we will walk you through the benefits of using the correct tool based on your basis outlook.

Soybeans

Soybeans find some life following their 30 cent correction from Friday's highs. Now right back up near that key $13 level once again.

From Duane Lowry, Producer Marketing Consultant:

"Soybean prices are back to "too cheap" levels. South American weather themes/patterns are not bearish and the current 10-day moisture outlook doesn't change that situation. Whether focusing on big SA production expectations or just complacent "non bullish" sentiment, the trade is way too bearish when it considers what the future might hold."

I agree with Duane here. Forecasts have started shifting more bullish in South America. Of course, still too early to jump on the South America headline rocket, bit if weather remains that way, it is a factor that has "potential" to result in $15 beans later in the year and into next.

The point is, beans have a ton of upside "potential". The two key factors? South America and demand. Kevin Van Trump summed up the potential Brazil situation pretty well,

"Bulls are also pointing to extreme heat and dryness in part of Brazil with temps in some areas exceeding +110 degrees Fahrenheit, which is bringing about more talk of possible replants. If the trade starts hearing more talk of "replanting soybean acres" in parts of Brazil, bulls will start to talk more about fewer second-crop bean acres and fewer second-crop corn acres. In other words, with lower prices and higher input costs, producers in Brazil might be much less willing to take the risk on second-crop acres, especially if their planting window is pushed back too far by being forced to replant the first-crop."

Demand is the other factor, which doesn’t seem to be going away anytime soon and has the potential to be an even greater bull story with the sustainable aviation fuel story.

So yes, $14 and $15 beans are very real possibilities. But how should you manage your risk? Although beans have a ton of upside, they also have a ton of downside risk. So like I said in the corn section, if you have to decide between corn or beans if you only have room for one, it might make sense to give the nod to beans with them still being near $13. If you have made sales, you can then look to put your risk on paper with calls. If you are behind on sales, consider locking in a floor with puts.

Taking a look at the chart, we bounced perfectly off that $12.81 level, closing at our 20-day moving average. Good sign. Bulls need back over $13, then our targets are $13.11 and $13.30.

Soybeans Nov-23

Wheat

The wheat market takes it on the chin again, continuing to chop around our recent range, struggling to hold and put together a meaningful rally.

Like has been the case for the past few weeks, aside from war there just isn’t a ton going on in the wheat market. Lack of news or fresh things for either side to chew on can often to lead to choppy sideways trade which we have seen.

Bears continue to point at the cheap abundant wheat coming our of Russia. We also saw some slightly better global weather forecasts such as Argentina and Australia getting some rain which pressured the wheat market.

The funds continue to pile on their shorts. What could make them cover? One potential factor is still global weather, this has been a bullish wild card for months that hasn’t mattered much but very could in the future. We could start to see India start becoming a big importer. We could see Russia run into production problems or start to limit exports. These are all "what ifs" but very possible scenarios to be aware of.

Like I said, not a ton going on in the wheat market for now. Bulls are waiting for one of these factors to matter to start to get the funds to lift their gas off the shorts.

Long term, still plenty of reasons to think we’ll see higher prices. Short term, it's anyone's guess.

On Chicago, bulls would like to hold $5.70 to prevent more technical selling. Bulls still need a break and close above $6 to get excited and see more upside.

KC is sitting right at it's lows, a break below could cause more selling.

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Hedging Account

If you are forced to make sales and you need help, make sure to give Jeremey a call to help you come up with a strategy that fits to your situation.

(605) 295-3100

Check Out Past Updates

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?

10/10/23

BEANS BREAK THEN BOUNCE - USDA PREVIEW

10/9/23

WILL YOU BE FORCED TO SELL ANYTHING AT HARVEST?

10/6/23

CORN & WHEAT HOLD LAST WEEK’S LOWS

10/5/23

UPSIDE BREAKOUT IN CORN

10/4/23

ARE YOU A PRICE MAKER OR PRICE TAKER THIS HARVEST?