STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Harvest Sale Ends Soon: CLICK HERE

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains higher across the board led by technical buying along with strong demand. As we get a continuation of large daily sale announcements.

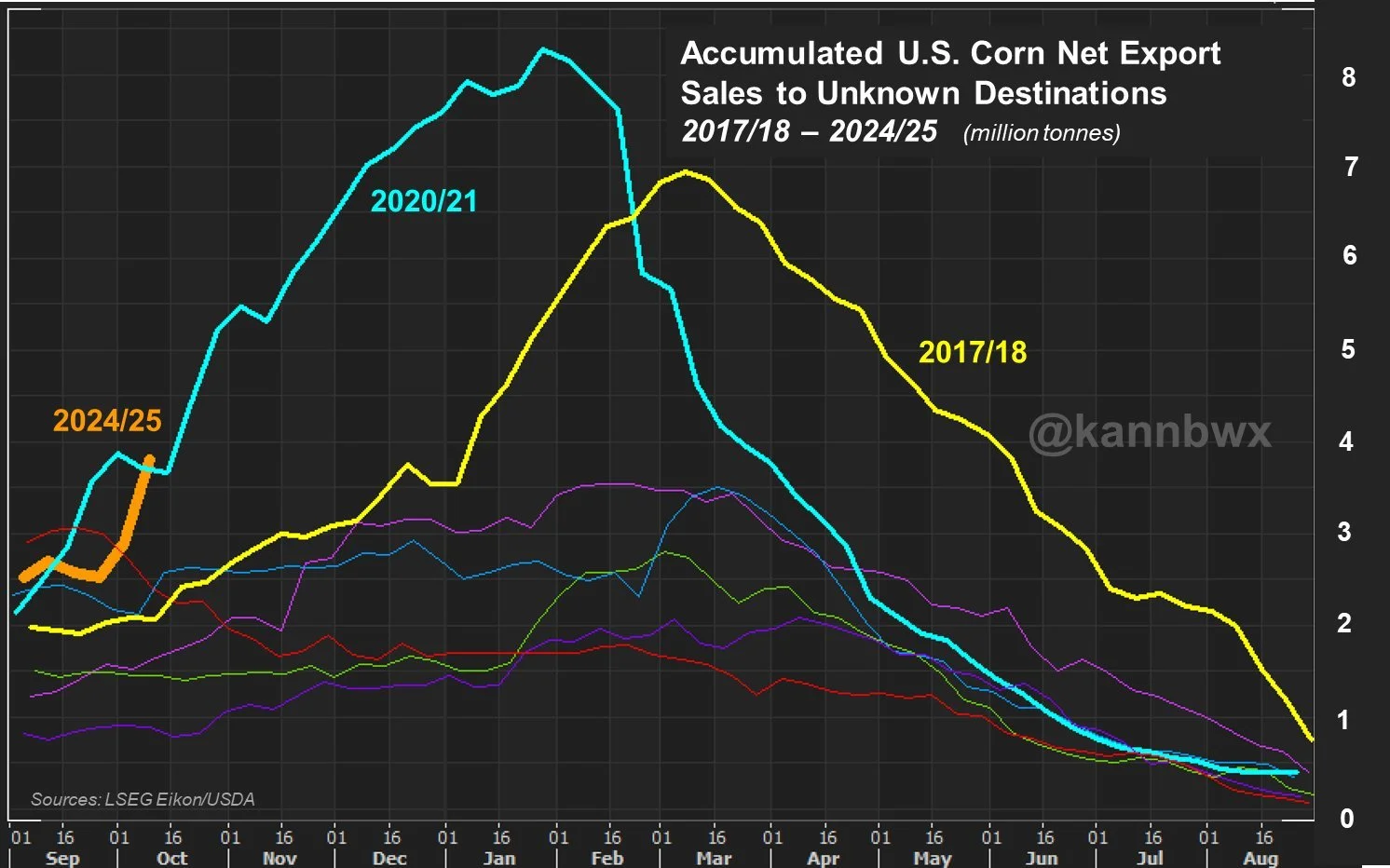

Corn has seen a lot of export buying interest here. Here is a recap of the recent sales the past week: (metric tons)

Today:

359k corn - Mexico

Yesterday:

500k corn - Mexico, South Korea, & unknown

380k beans - unknown

Last Friday:

292k beans - unknown

125k corn - unknown

Last Thursday:

197k corn - unknown

101k corn - Mexico

Last Wednesday:

1.62 million corn - Mexico

332k MT corn - unknown

175k beans - unknown

Last Tuesday:

131k beans - China

Total Past Week:

3.23 million corn

978k beans

Now we would love this "unknown" buyer to be China. But most do not think it is China for corn, as if it was China the board probably would’ve reacted more than it has. The market probably would’ve let you know if it was China.

For beans, unknown on the otherhand does usually mean China. But not always for corn.

However, last week we saw the largest weekly sales to unknown in a decade.

Chart from Karen Braun

Although this buying was not China, it is still friendly and a great sign.

It shows that the big buyers find value here. They wouldn’t be buying this big at these levels if they thought prices were going to go much lower. So this does add some support under this market, more so in corn rather than beans.

Spreads

The spreads have continued to rally in corn & beans.

Corn Dec 24 - March 25

Beans Nov 24 - Jan 25

This is very unusual especially for the middle of harvest when we have ample supply. It has really been a head scratcher.

Usually spreads firm when prices are in an uptrend, and spreads weaken when we are in a downtrend. But the opposite has been happening.

The spreads are rallying and taking that carry out of the market. (Usually don’t see this when we have a big supply of grain)

There is an old saying that says:

"First the spreads move, then basis, then futures"

We have also seen a nice surprise in basis from corn. As we've seen basis firm up in many areas. Basis is usually neutral or weak with harvest. But that hasn’t been the case.

Wheat basis has also improved. Especially higher quality wheat such as that spring wheat area in North Dakota or red wheat in western Canadian region.

Basis firms when demand strong.

So is this a sign or what is going on?

Something is going on in corn & wheat for sure.

Perhaps it's local demand. We aren’t out of grain but maybe the end user is. So they are paying a premium for it.

It could be export demand, or perhaps the crop isn’t quiet as big as everyone thought. (Although I do think the corn crop is likely there to an extend, soybeans might be on the small side)

In simplest terms, the spreads firming means that we have more demand than supply. So if you compare the spread today vs a few weeks ago, demand has increased vs supply.

Many people in the grain industry consider spreads as one of the biggest fundamental analysis’ of the market.

Spread thoughts from Pete Meyer:

"The spreads acting the way they are acting with the current interest rates, if you take them at face value, they are telling you the carryout is much lower than 2 billion bushels. That being said I don't think it is. In anticipation of a record harvest, maybe basis in a lot of places got pushed too low, and specs jumped in and shorted the spread. now they are kind of caught short here." he said on Standard Grain

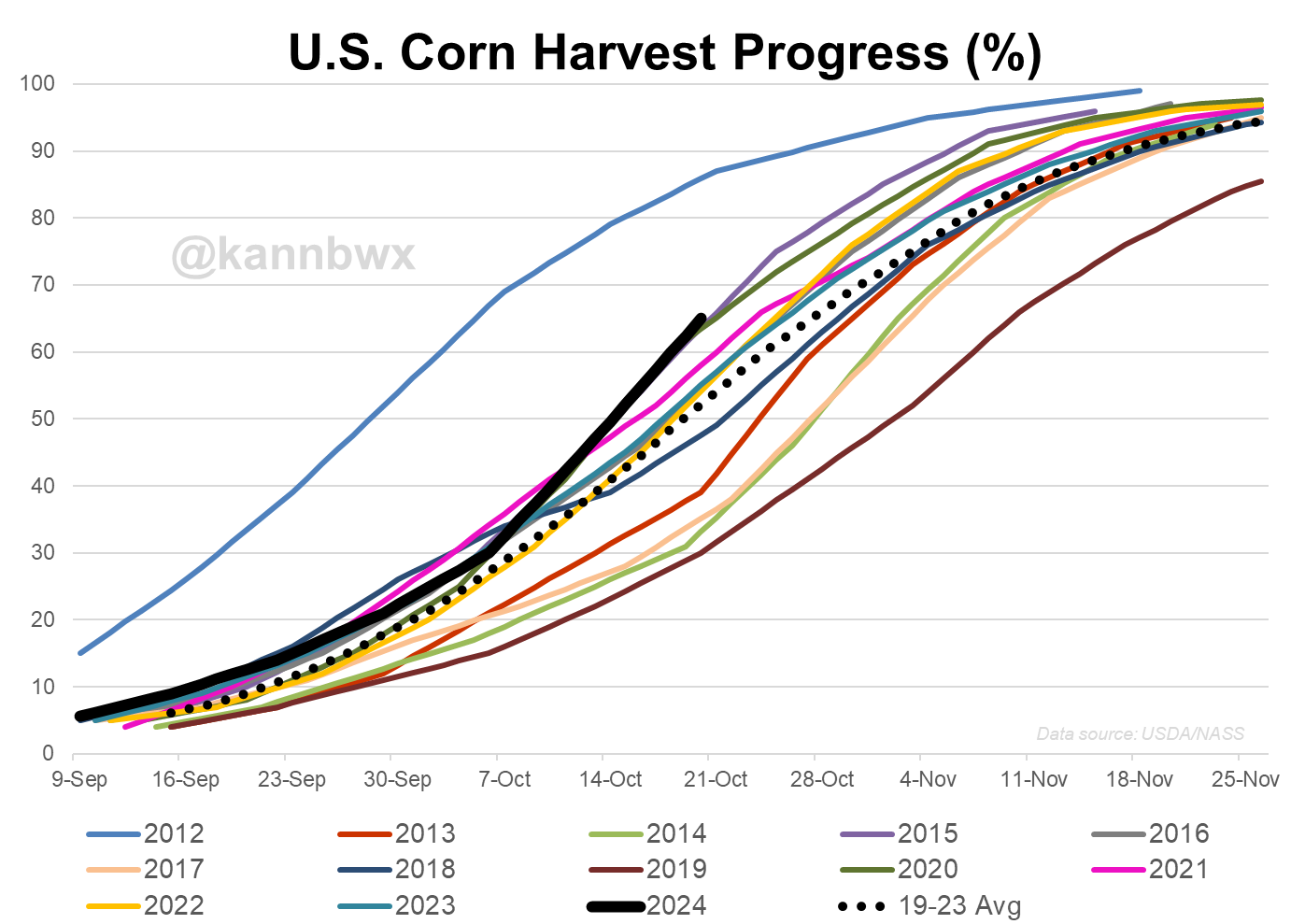

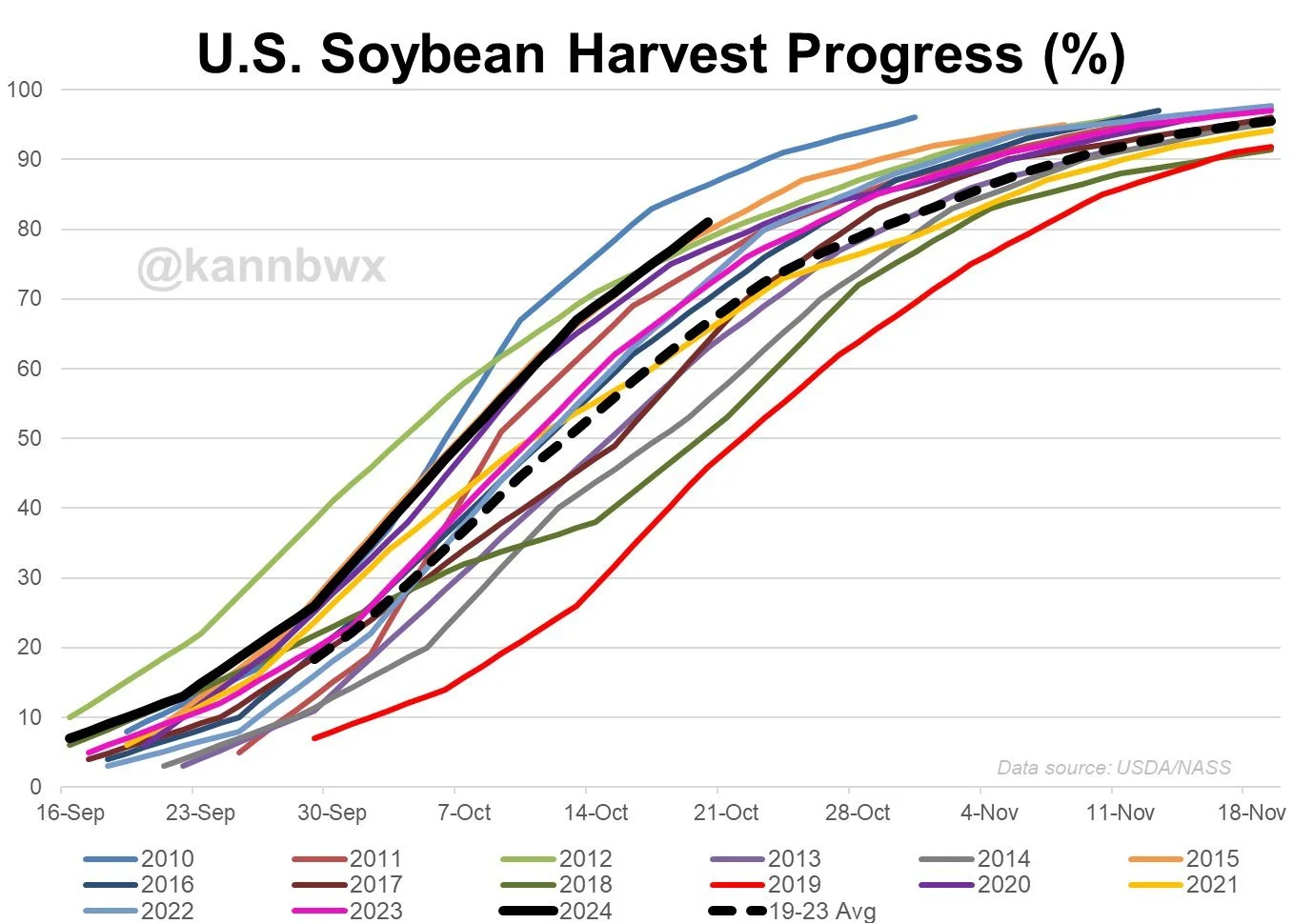

Harvest Progress

Harvest is now well past 50% complete. Which is good news for grain prices. As this means less "harvest pressure".

We had been seeing a lot of harvest pressure on the recent sell off, but usually once harvest is well over half way done you start seeing a lot less.

Harvest Complete:

Corn: 65% vs 52% avg (fastest since 2012)

Bean: 81% vs 67% avg (fastest since 2010)

Things will wrap up quick as there is not much rain in the forecasts.

From Craig Turner of StoneX:

"Usually when harvest is 50% complete, you make a secondary bottom. Seasonally the first coming at the end of August, then the second after harvest is 50% complete" when talking about grain prices."

Charts from Karen Braun

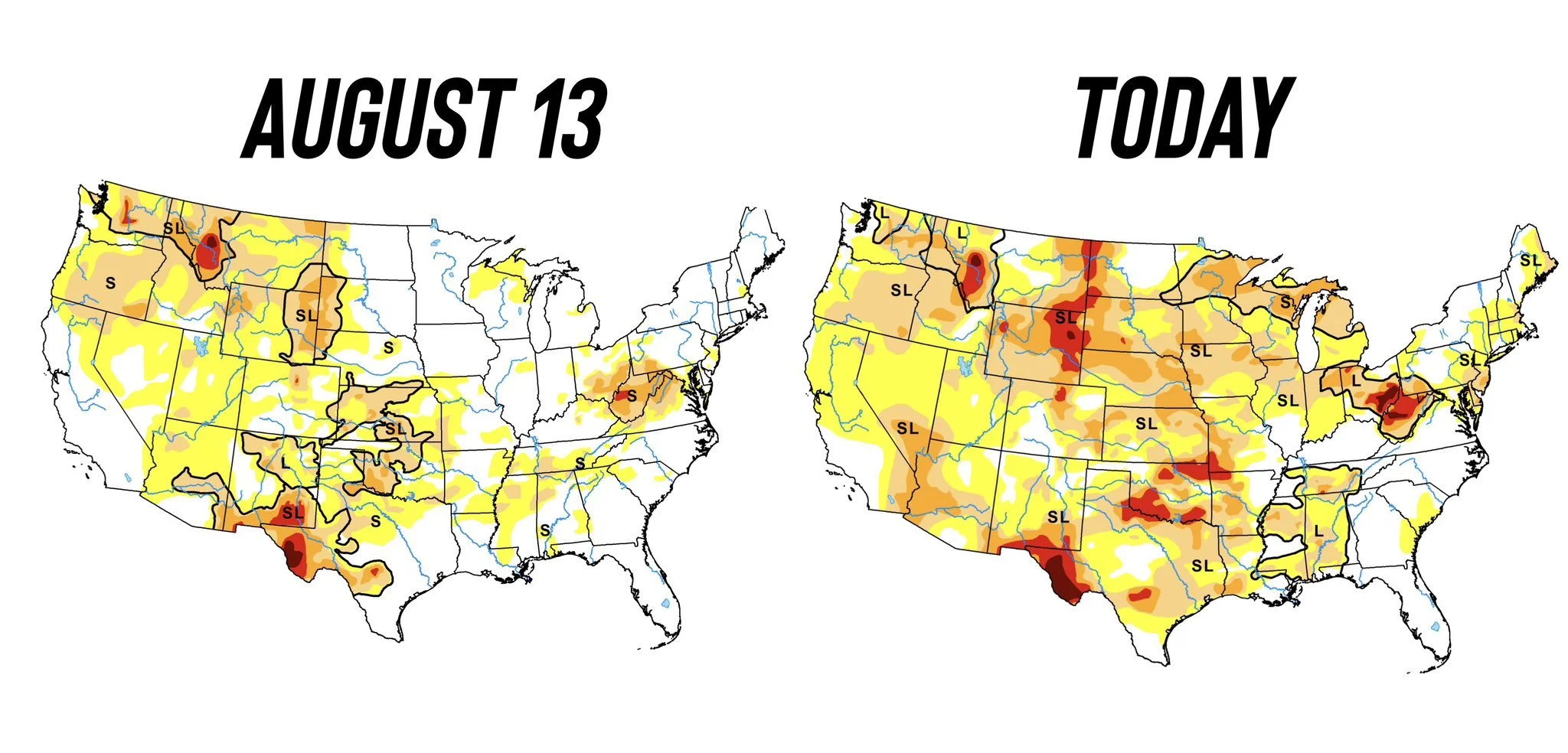

Drought Update

Drought Change Past 2 Weeks:

Corn: 27% -> 62% (+35%)

Beans: 26% -> 54% (+28%)

The forecasts also remain very dry.

It is far far far too early to talk about drought next year.. but this could result in us going into next year without a lot of soil moisture.

We all saw how quickly the drought vanished earlier this year, but it is something to keep in mind if it stays like this.

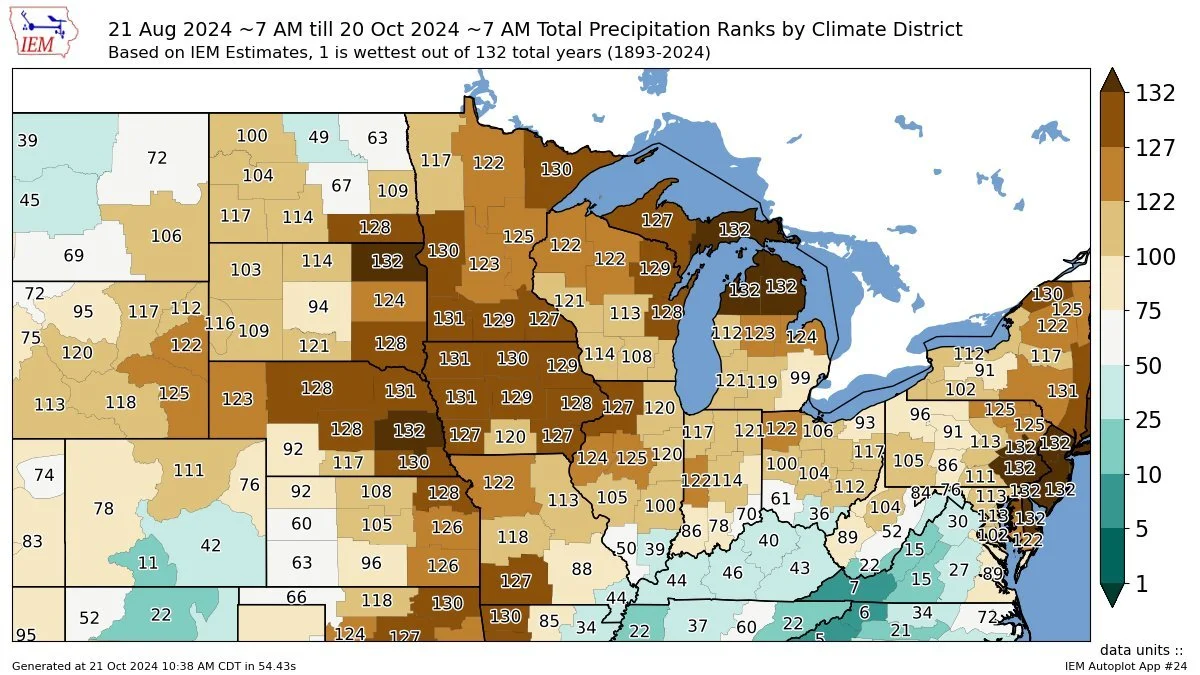

Past 2 Months

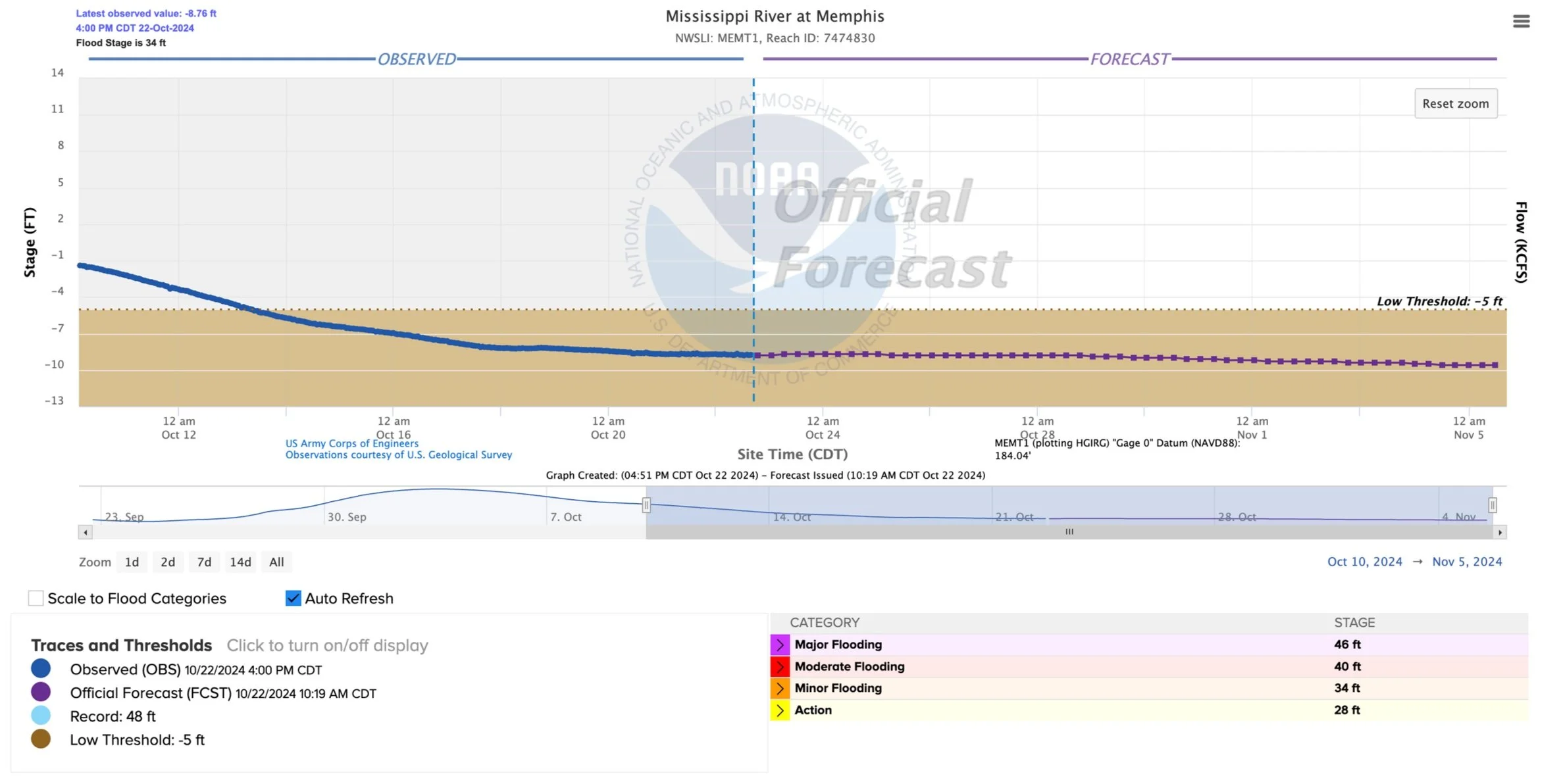

However, this could be negative for exports.

As it has made the river levels restrictive.

Not ideal situation for this being the prime soybean shipping time. (Brown box is restrictive levels)

Today's Main Takeaways

Corn

Fantastic day for corn on the charts. We closed above a huge $4.13 level that could offer more upside from a technical standpoint.

We have seen a ton of large daily announcements. So global buyers see corn as a value grab here.

Corn is really just doing it job I feel like. These cheap prices are curing cheap prices via creating demand.

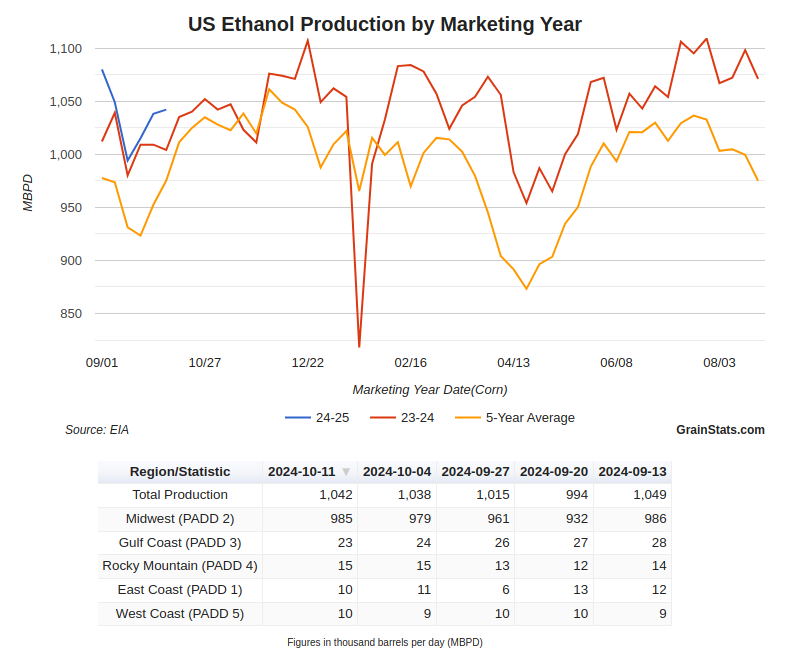

So we have very solid exports. We remain competitive globally. We have ethanol production well ahead of the USDA pace. They expect us to be below last year, but we are higher than last year currently.

Ethonol alone could very well add +100 million bushels of demand to our balance sheet all by itself if we keep up this pace.

Chart from GrainStats.com

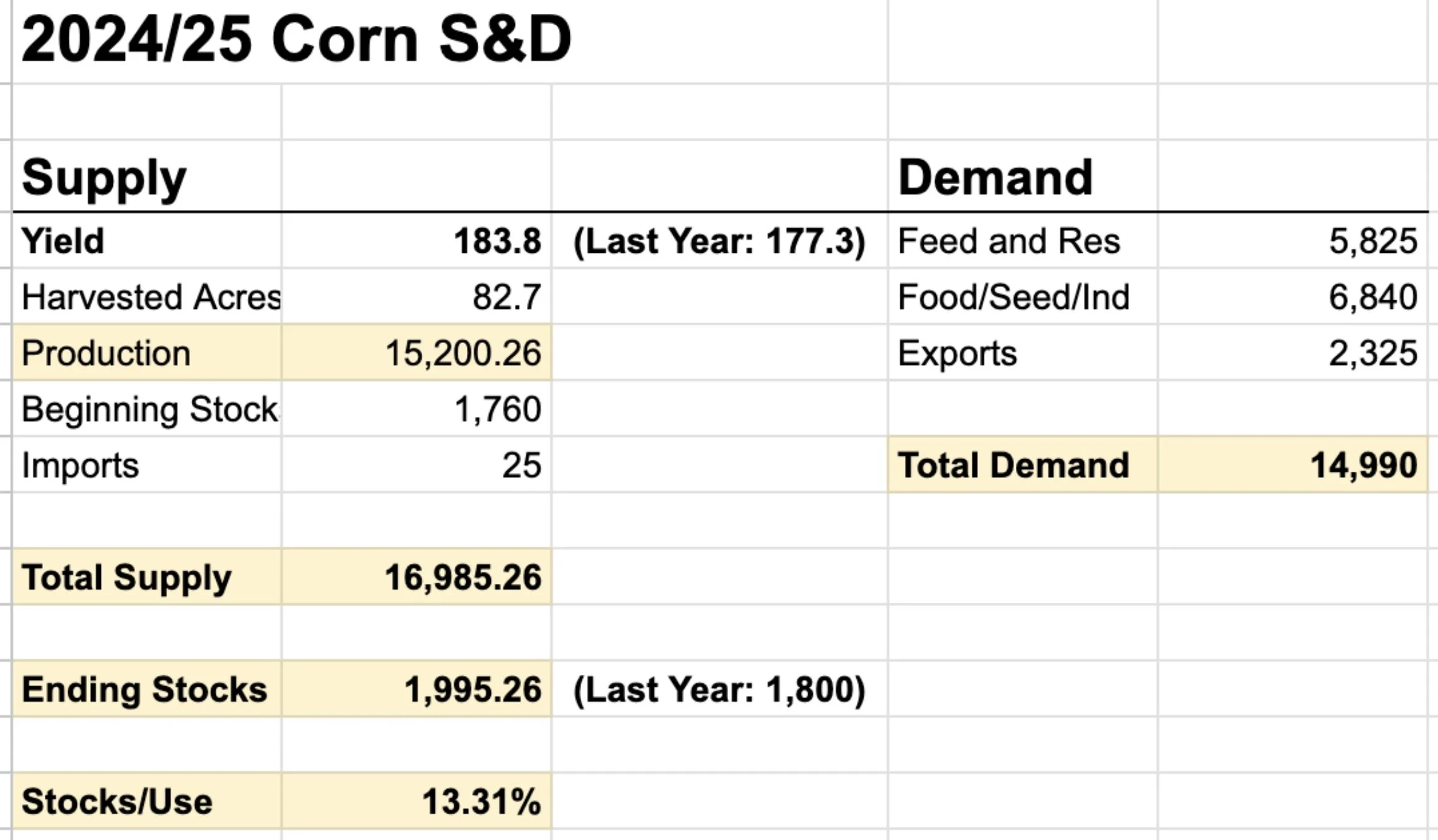

Our carryout could very well continue to shrink without yield falling and with yield being +7 bpa higher than the record. To me that speaks volume to our demand story.

As I have been saying, corn has a real demand story pushing for it longer term.

Not a whole lot else to say. The chart is finally starting to turn around. I think we can start to move higher once harvest is mostly out of the way. And I do believe there is a chance that this year puts in a long term bottom.

The big recent sales show there is value here, and we are creating demand.

Imagine what happens next year if acres fall, we have costs that won’t add acres, then we add all of this built up demand on top? Then there is always the potential for a weather scare to spice things up even further.

Looking at the chart, we cleared $4.13. That was my first sign to say "okay we might be done going down".

We still need to hold $4.00. If that breaks, not a lot of support beneath.

*Our $4.23-26 protection signal: (CLICK HERE TO VIEW)

Soybeans

Very strong action in soybeans today.

However, this chart has a lot more work to do than the corn one for me to be convinced we put in a bottom here.

From a fundamental standpoint, the global outlook is bearish.

Even if the USDA drops US yield by 1 bpa, it really won’t make a major dent in the big scheme of things.

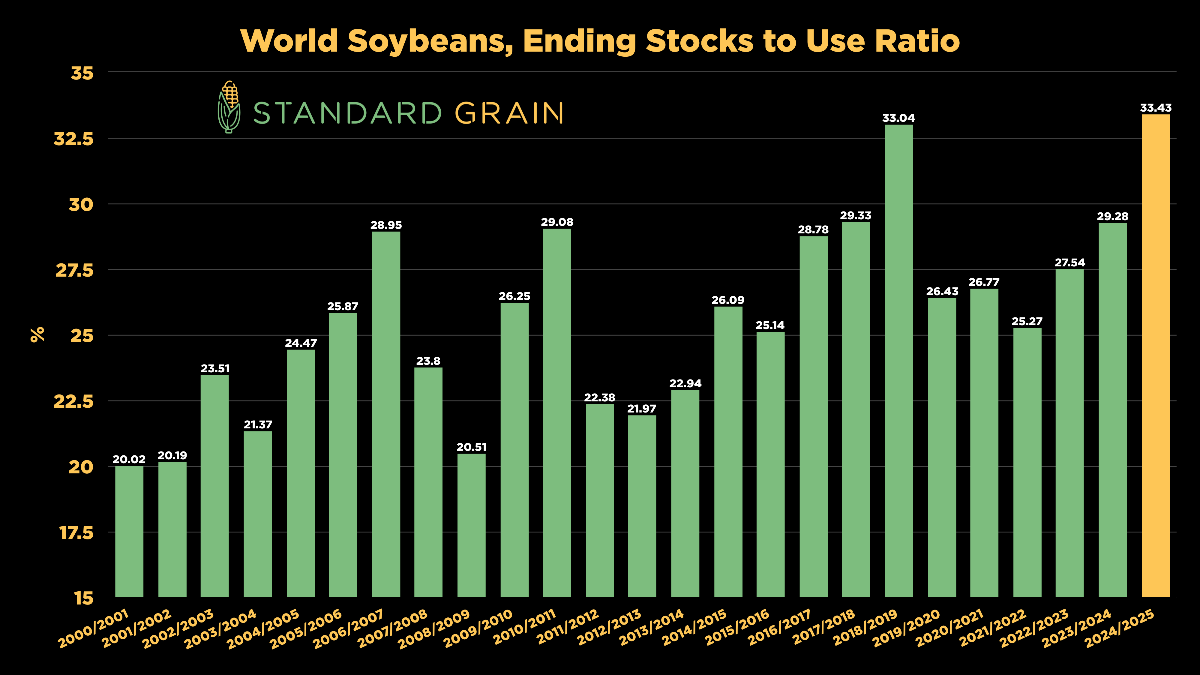

Chart from Standard Grain

If Brazil raises what the USDA thinks they will, soybeans could be in trouble. Right now, there is no weather threat in sight. But that can always change.

Brazil alone could drop beans another $1.00.. but if that crop fails we could be $2.00 higher. It really is that big of a game changer. Brazil is going to be the #1 thing to watch the next 2 months.

We might need a scare in Brazil if you want to save the bean market. If not, we are going to have to see China step in big and either dump more stimulus money into the markets or decide to buy a lot of soybeans out of nowhere.

Short term, I do not think we are going to be getting short covering from the funds. I also do not think they are going to be major sellers going into the election.

It makes the most sense for them to remain neutral to slightly short heading into the election. When there is uncertainty, no trader likes leaning too heavily to one direction or the other. They will probably keep their small short they have, simply given what happened last time Trump was elected.

Bottom line, I think we can go higher here short term, but I need to see us close above $10 first. If we close above $10 my bias will lean bullish short term.

We have spreads firming, which is either a friendly sign or maybe it's just wishful thinking.

Long term, it is going to heavily depend on Brazil & China where we go from here.

*Our $10.65 signal: (CLICK HERE TO VIEW)

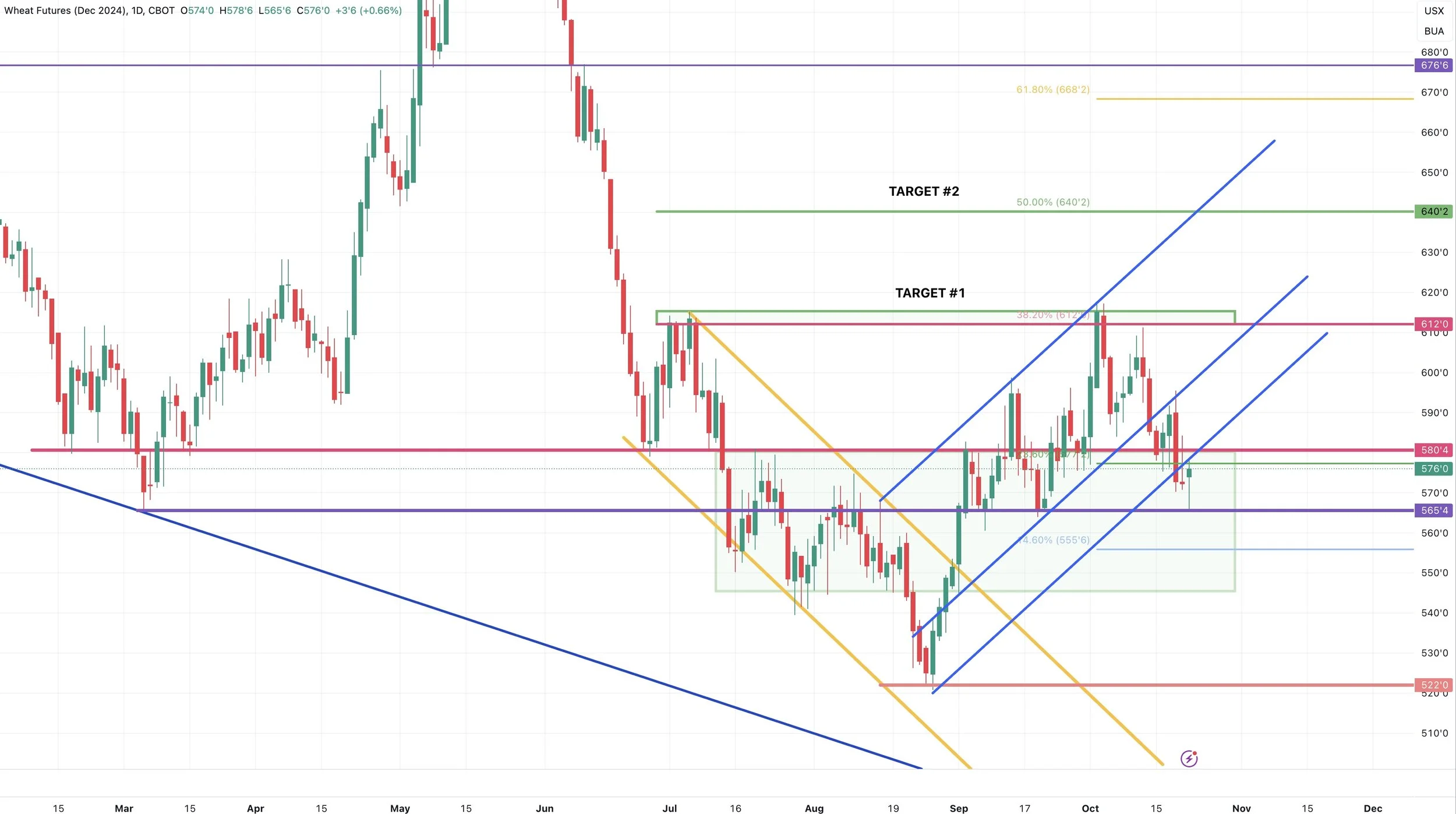

Wheat

Decent day for wheat, following yesterday's awful price action.

Looking long term, I still think wheat also has a story going for it.

Unlike soybeans, the global balance sheet is actually bullish for wheat.

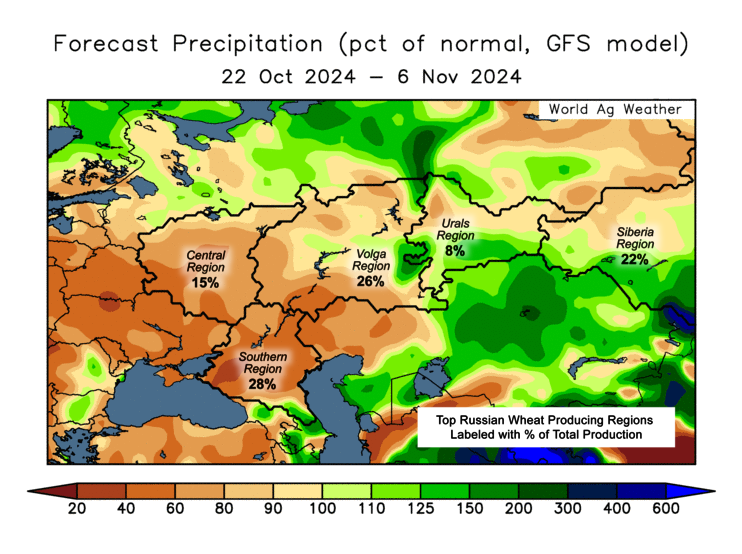

Russia is the largest wheat player in the world.

Historically in other years where Russia has added price floors, it is when their stocks to use ratio is below 10%. In the last USDA report Russia is already expected to be under 10% by May/June which is the end of the marketing year. It is only October, yet Russia is already seeing this and already adding price floors.

Russia has received rain recently which has added a little pressure, but overall it remains dry. If that continues, it is another possible bullish story for wheat.

I don’t have much else for wheat today.

I think the global situation is bullish enough to where it could wheat higher, but that doesn’t mean it has to be on my or your timetable. The global situation is more of a long term effect.

Taking a look at the chart, we bounced right off $5.65 where we needed to. We still need to hold that level to remain having an upside bias. If it breaks, we likely make a leg lower.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24

BULLISH USDA FOR CORN: RECOMMENDATION

9/27/24

UP-TOBER? SELL SIGNAL, TARGETS, & FACTORS

9/27/24

BEAN SELL SIGNAL

9/26/24

NEW HIGHS BUT CONCERNING CLOSE

9/25/24