WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

MARKET UPDATE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

Overview: 0:00min

Trump Tariffs: 1:00min

Wheat Bull Story: 2:17min

Corn: 4:46min

Beans: 7:42min

Wheat: 9:12min

Want to talk or put together a market plan?

Here is 50% off before your trial ends:

Futures Prices Close

Overview

Corn and soybeans both lower today while wheat manages to trade higher for the 3rd day in a row and steal the show, posting new highs for 2025.

What changed from yesterday?

Like we said, expect extremely volatile markets moving forward here with all of the moving factors that are constantly changing like South America weather and tariff talk.

As for weakness in the soybean market, we had a few things.

For starters, export sales were disappointing. Down -70% from last week.

We also saw weakness in meal which added pressure to beans.

For corn, it looks like mostly just some profit taking and from a technical standpoint we are still overbought. To go along with no fresh news to keep bulls satisfied.

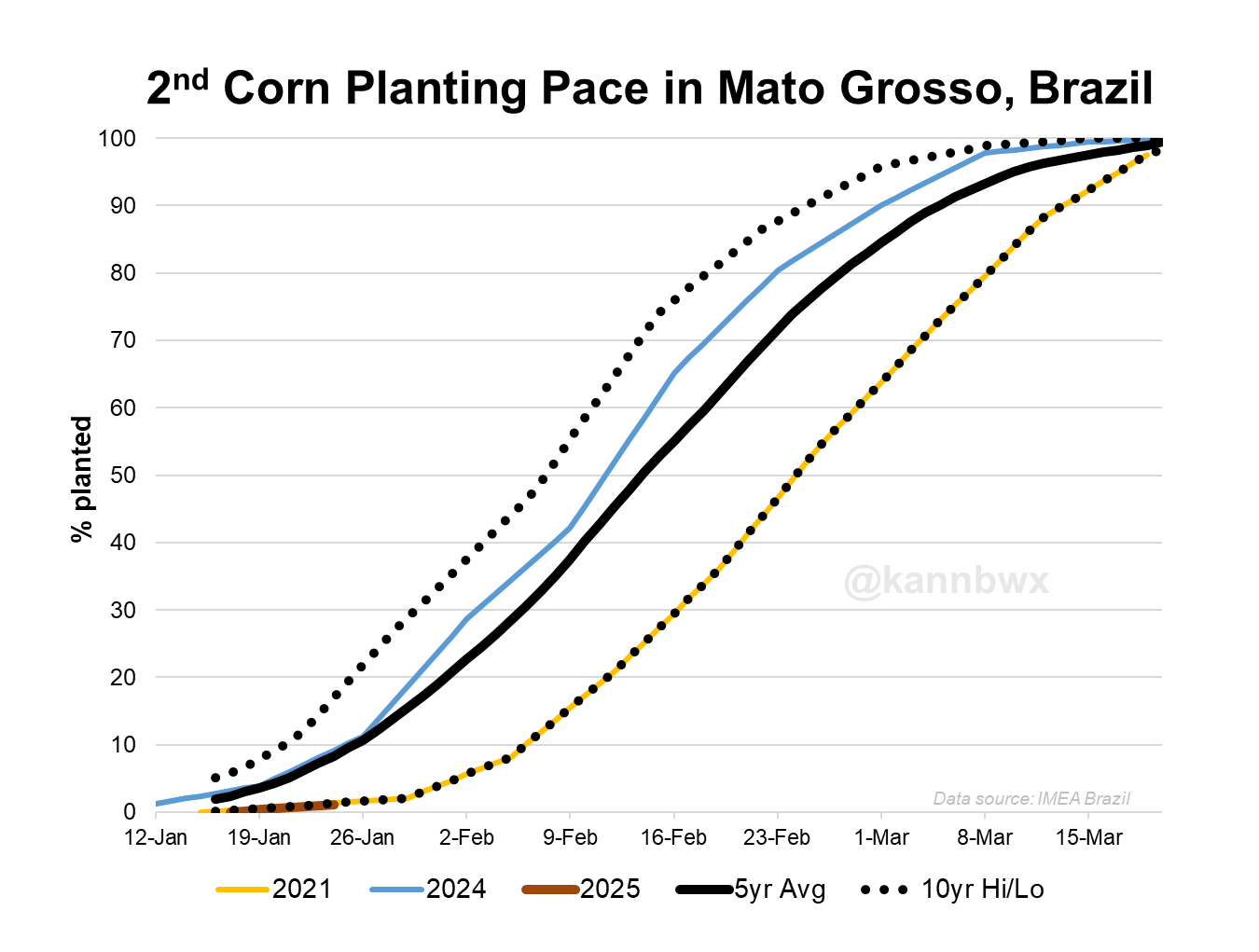

However, we are starting to see hard evidence that there is crop losses in South America and the planting of the 2nd corn crop in Brazil is the slowest of ALL-TIME currently. Which is helping add some support.

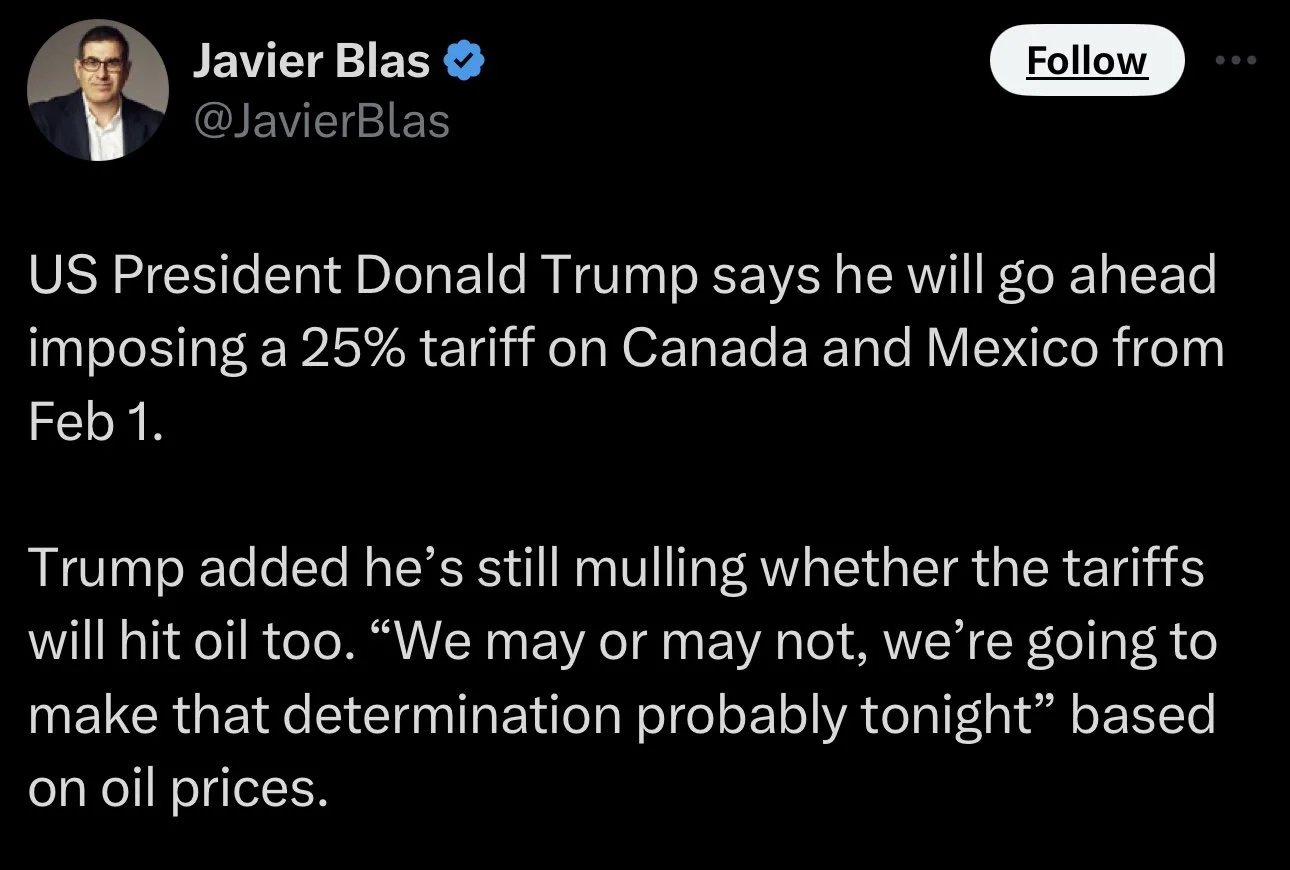

Trump Assures Tariffs

At 3pm CT today it was also announced that Trump plans to tariff both Mexico and Canada 25% on Saturday.

He said he is doing this because of fentanyl coming across the borders. Basically he is trying to force their hand into having more secure borders.

Trump also added that he is not yet sure if the tariff will hit oil too.

He also stated he is in the process of putting tariffs on China.

So this of course will likely pressure the grains tomorrow.

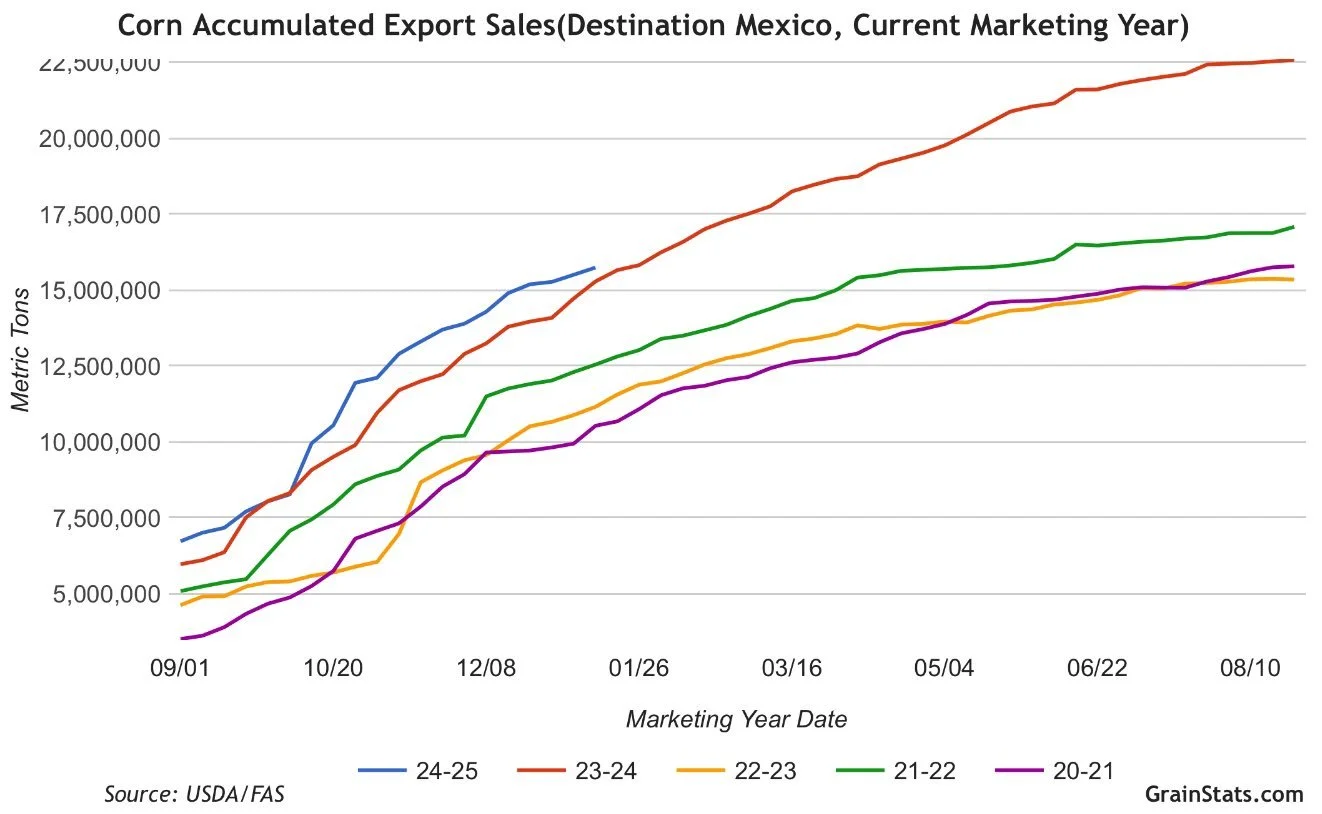

This is a very potential negative factor given that Mexico has been far and away the biggest buyer of US corn.

To this point, they have accounted for a whopping 40% of all US corn exports this year.

So far they have bought more corn than ever before.

Chart from GrainStats

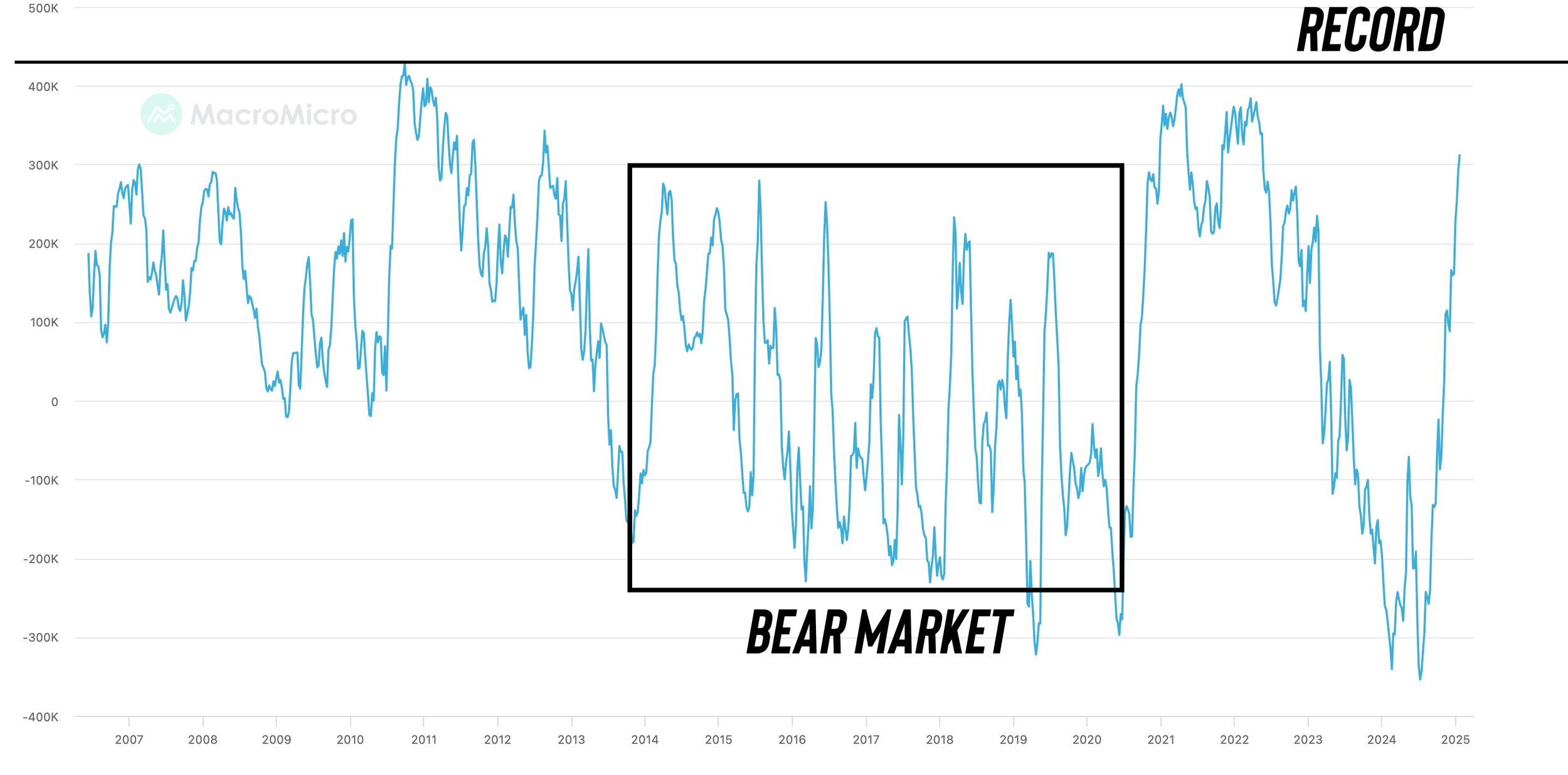

However, the trade hasn’t seemed too concerned with tariffs. As they are approaching an all-time record long position in corn.

Guess we will see their reaction from here and if that stance changes.

Then we had some friendly factors in the wheat market, so some potential fund shifting.

Here are some bullish wheat stories:

The Wheat Bull Argument

Russia Exports

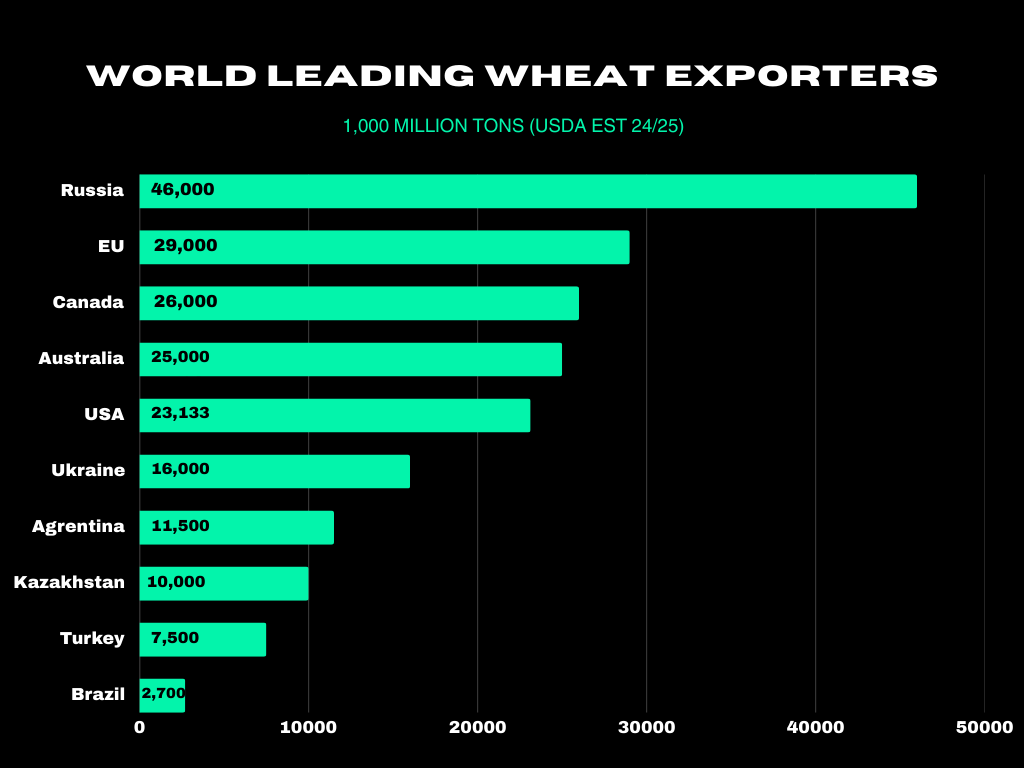

Russia is BY FAR the world's leading exporter of wheat.

SovEcon cut their Russian wheat export estimates by -900k MT. Down to 42.8 MMT.

This number is down from 57 MMT last year. A -25% decline.

The USDA is currently at 46 MMT.

Oh and Russia has their worst winter wheat crop on record. (based on condition ratings)

The size of their wheat crop is expected to be the smallest since 2021.

Wheat Weekly Export Sales

Wheat weekly export sales were +96% from the 4-week average.

Seems like a big number.

(Corn weekly exports were up +39% vs 4-week average)

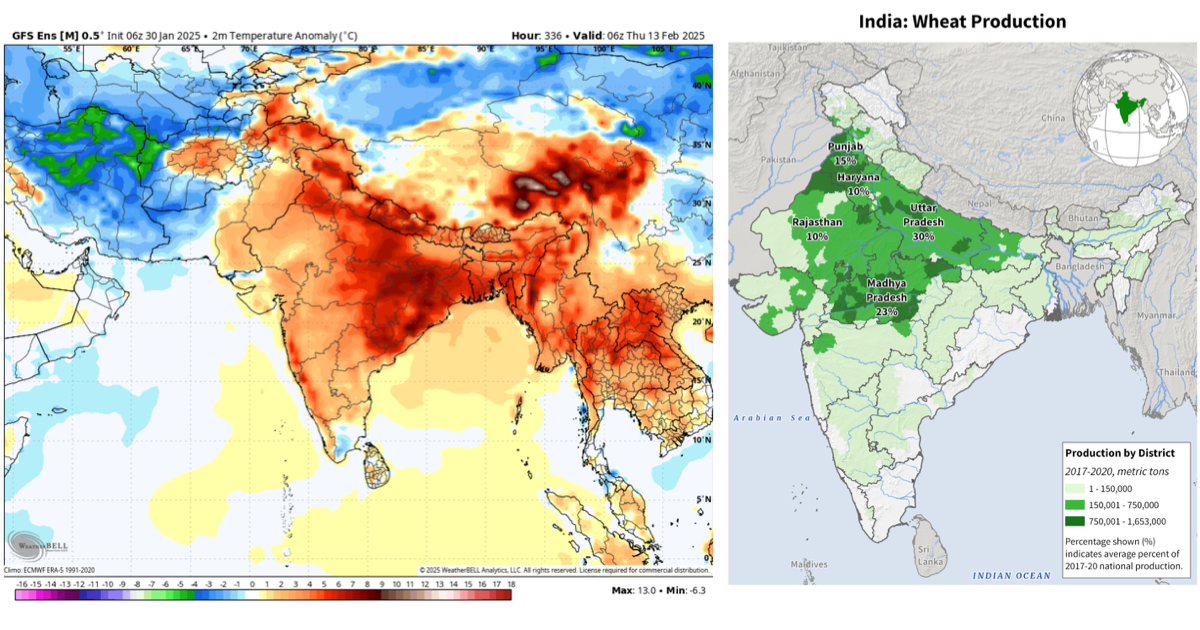

India

India is the world's #3 wheat exporter (#2 of cotton)

The weather bureau in India said they will likely be seeing above avg temps for the month of February.

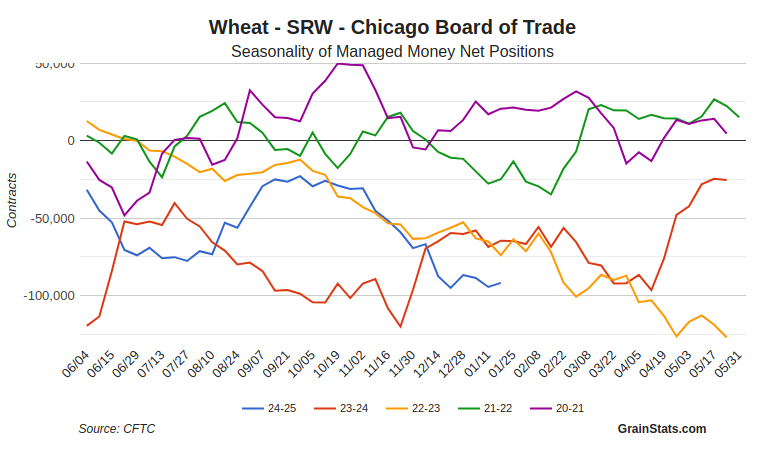

The Funds

The funds are short around -90k wheat.

Chart from GrainStats

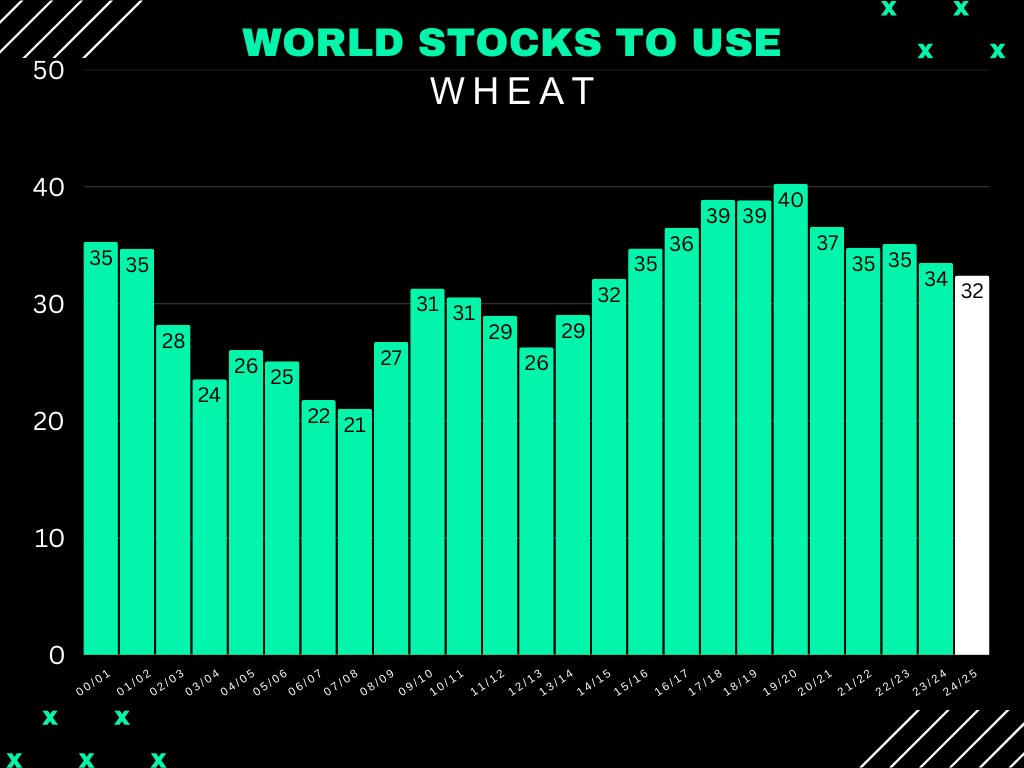

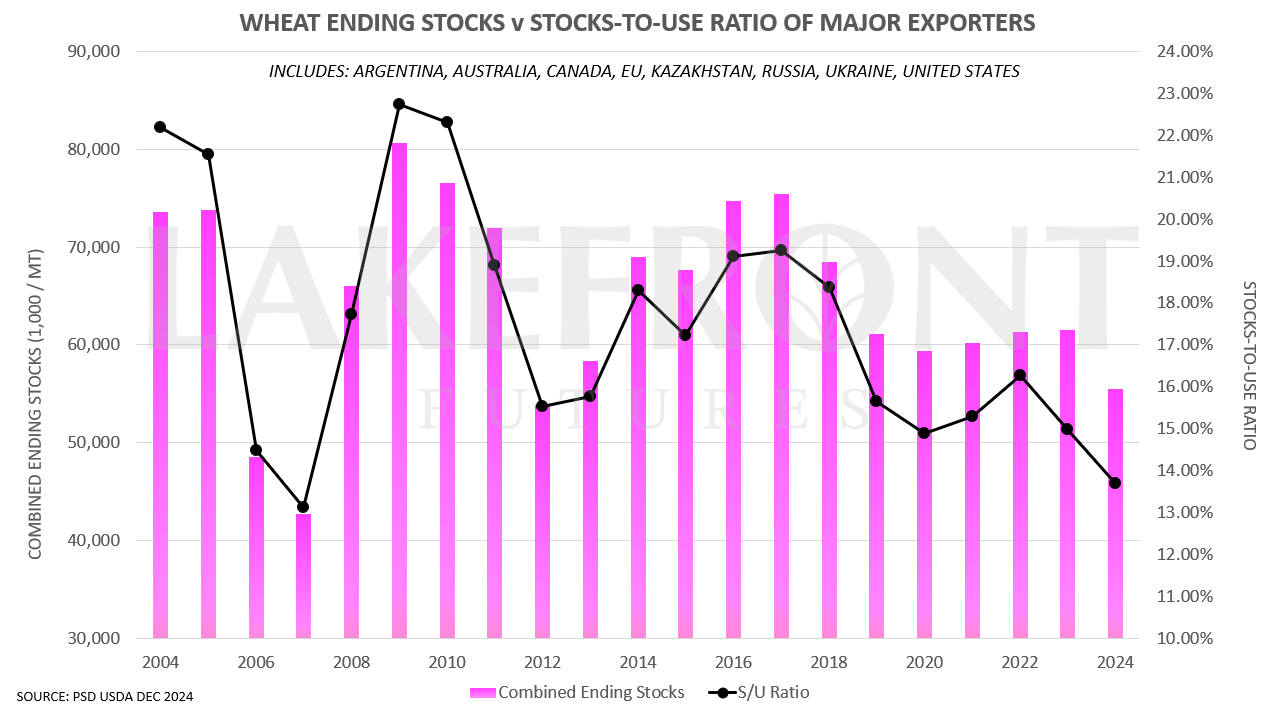

Tightest Global Balance Sheet in Decade

The global balance sheet for wheat has continued to shrink year over year for several years straight now.

Our ending stocks are the lowest since 2014/15.

The stocks to use ratio for the big major exporters is the lowest since 2008.

This is far from bearish.

Corn/Wheat Spread

It looks like this spread "could" be carving out a bottom.

Doesn’t mean that corn has to go lower, just simply means that wheat could start to outperform corn.

Weekly Wheat Chart

Looks like we could potentially finally be breaking this brutal downtrend from October.

Today's Main Takeaways

Corn

Short story short, I still wouldn’t be surprised to see a correction short term.

We've had a great rallied and more often than not they do not go up in straight lines.

We also now have the tariff tailwinds to face.

Long term, my bias still leans higher long term.

We have a Brazil crop that is getting smaller. We have solid exports. Solid ethanol numbers. We now have the funds behind us. The story is still there for corn.

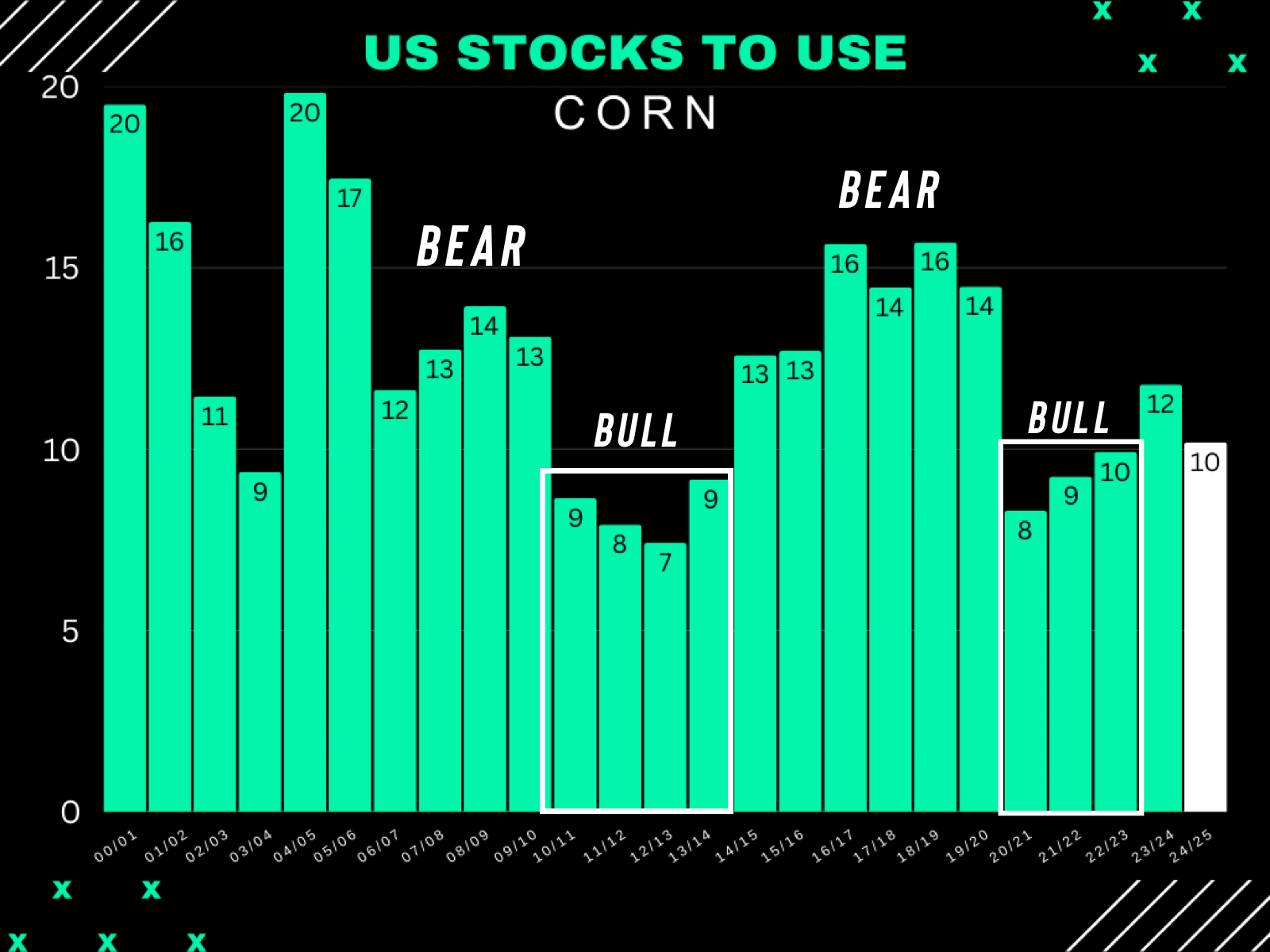

Here is the US stocks to use ratio for corn.

This is by far the best way to gauge how bullish or bearish the current US supply and demand situation is.

Under 10% is considered "bull market" territory.

Then 13% and higher is usually considered bear market territory.

Back in August when we were posting our lows, the balance sheet told us we had a ratio of almost 14% (pretty bearish).

That number has now dropped all the way down too 10.19%

Not "super bullish" but it's far from bearish now.

If we do get a pullback, I could easily see us dropping into the $4.65 to $4.73 range (green box).

We do not have to correct. That is simply where a standard correction would typically take us.

Looking long term, I still think we have plenty of upside.

The 38.2% retracement up to those $8.24 highs of April 2022 is going to be my longer term possible target for now.

Looking more short term, we of course are going to have resistance at the psychological wall of $5.00

Then we have the May highs of $5.08

If we can break those May highs, things could get fun and escalate higher.

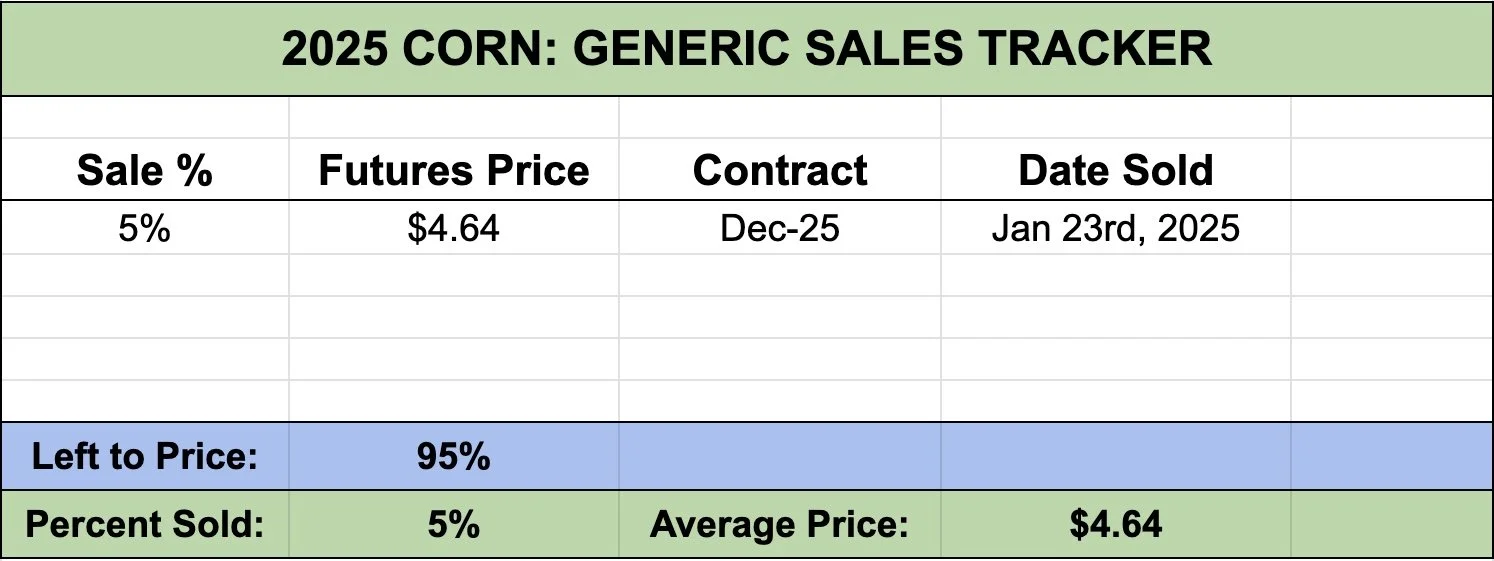

We hit my first new crop target at $4.64 last week

Next upside target is $4.72

Bottom Line & Risk Management

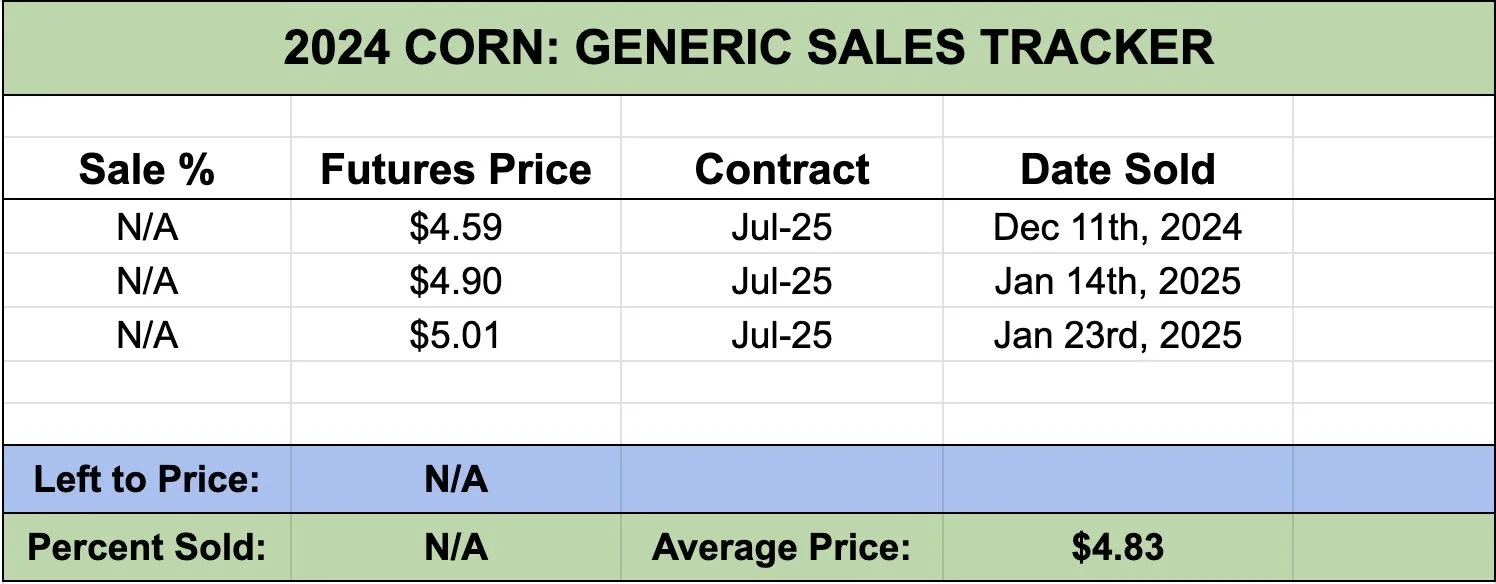

We alerted an old crop sell signal last week right around where we closed at today.

If you did not take advantage of the signal or feel like you are still behind, then take some risk off the table.

For new crop, I do not want to be oversold here. Personally I wouldn’t like to be much more than 10% sold or simply more sold than you usually are at this time of the year.

On my generic cash sales tracker that I started doing for you guys, I made my first sale of just 5% when we hit my $4.64 target in Dec-25. (the generic tracker will always be attached to the bottom of the update).

Moving forward, the US farmer is probably more sold than normal on old crop. Which means that there is going to be less sell pressure than usual. Which could accelerate future moves higher.

Soybeans

Just like corn I wouldn’t too surprised too a correction sometime in the near future, simply based off the tariff news and the fact that in February we will have a lot of harvest soybeans out of Brazil hitting the market.

Taking a bigger picture look, the chance for $9.00 beans isn’t really there anymore.

Yes we have an awfully bearish global balance sheet. But if we were going to $9.00 we would've already been there by now. The market is well aware of the monster crop out of Brazil.

Looking towards spring, we also have the chance to see a lot less acres in the US to corn, so that is a friendly factor.

I still think Trump could longer term be friendly for demand for both corn and beans, as he could potentially set trade agreements that make China live up to purchases. But short term it could of course cause a set back.

Nobody, even Trump himself knows how the tariffs will play out.

So that is your risk.

Just like corn, last week we had the old crop sell signal near the recent highs and do not love making new crop sales here.

Just like corn, in my "generic" sales tracker. I made a very small 5% sale when we hit my first Nov-25 target of $10.54.

My next target for Nov-25 is $10.82

I am seeing a potentially friendly set up here in Nov-25 beans with an inverse head and shoulders.

The implied move higher would take us to the $11.50 range. Which also happens to be the 78.6% retracement to the May highs. If we got up there, I would look to be more aggressive.

Looking at March beans, we are right back in the golden zone of the recent rally (top green box).

Bulls would like a bounce here. If we do not bounce, we are going to look at the bigger picture golden zone. Which is the 50-61.8% retracments of the entire rally off of the contract lows. Those sit at $9.96 to $10.11

Next upside objective is still a 3rd test of that black downward trendline.

Wheat

I already went over everything in wheat.

I still think wheat is very undervalued here. Whether that value shows tomorrow or months from now.

I have zero interest selling wheat here.

Looking at the continuous chart, it looks like we are finally breaking out of this range hopefully.

We have continued to find support in that green box for a year now.

In March wheat, we have resistance right here at $5.69

Then next stop is $5.84. If we claw above that level, I would start to feel pretty good about the wheat market.

KC wheat sitting right at this $5.89 resistance.

Really looks like we want to breakout soon.

Minneapolis wheat arguably looks the most bullish of all the wheat.

Good looking chart as well with a breakout.

Generic Cash Sales Tracker

Due to requests here is our generic cash sales trackers.

This does not include any hedge recommendations etc. Simply cash.

This is futures prices.

For old crop there is no percentages as we only recently started tracking our generic sell signals. Future new crop sales will have percentages as we continue to make sales.

This will be included at the bottom of every update.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25

LONG TERM CORN UPTREND? JANUARY DROP OFF IN BEANS? LONG TERM WHEAT FACTORS

1/2/25

CATTLE HEDGE ALERT

12/31/24

MASSIVE DAY FOR GRAINS. FLOORS? 2025 SALES? GAME PLAN? CHART BREAKDOWNS

12/30/24

GRAINS FADE EARLY HIGHS

12/27/24

STILL LONG TERM UPSIDE POTENTIAL, BUT TAKE ADVANTAGE OF 6 MONTH CORN HIGH

12/26/24

CORN ABOVE 200-DAY MA. ARGY DRY. BEANS +44 CENTS OFF LOWS

12/23/24

CORN & BEANS TALE OF 2 STORIES. BEANS REJECT OLD SUPPORT

12/20/24

PERFECT BOUNCE IN CORN. SIMPLE BEAN BACKTEST BEFORE LOWER?

12/19/24

THE SOYBEAN PROBLEM. NEW WHEAT LOWS. CORN UPTREND

12/18/24

BEANS BREAK SUPPORT & OPEN FLOOD GATES

12/17/24

SINK OR SWIM TIME FOR SOYBEANS

12/16/24

SOYBEANS & WHEAT FIGHTING LOWS. WILL CORN DEMAND CONTINUE

12/13/24

POST USDA COOL OFF

12/12/24

CORN CORRECTION. WHY WE ALERTED SELL SIGNAL YESTERDAY

12/11/24

USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

12/11/24

CORN SELL SIGNAL

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24