SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

Overview

Grains hammered again despite what most would consider somewhat bullish weather forecasts.

Sell off was led by technical and fund selling in soybeans & wheat, as the charts continue to fall apart and turn bearish with wheat breaking below $6.00. The funds are already heavily short over 200k contracts of corn, hence more weakness in the beans & wheat.

We also saw sharply lower Russian wheat cash prices continue to drive wheat lower. Wheat is now -$1.10 off of it's highest close.

Despite a record May NOPA crush, soybeans seeing some pressure from Brazil's new export tax change being temporary put on hold.

The charts are all looking weak, with this the funds and algos continue to hit the sell button. As the funds are now once again heavily short across the board.

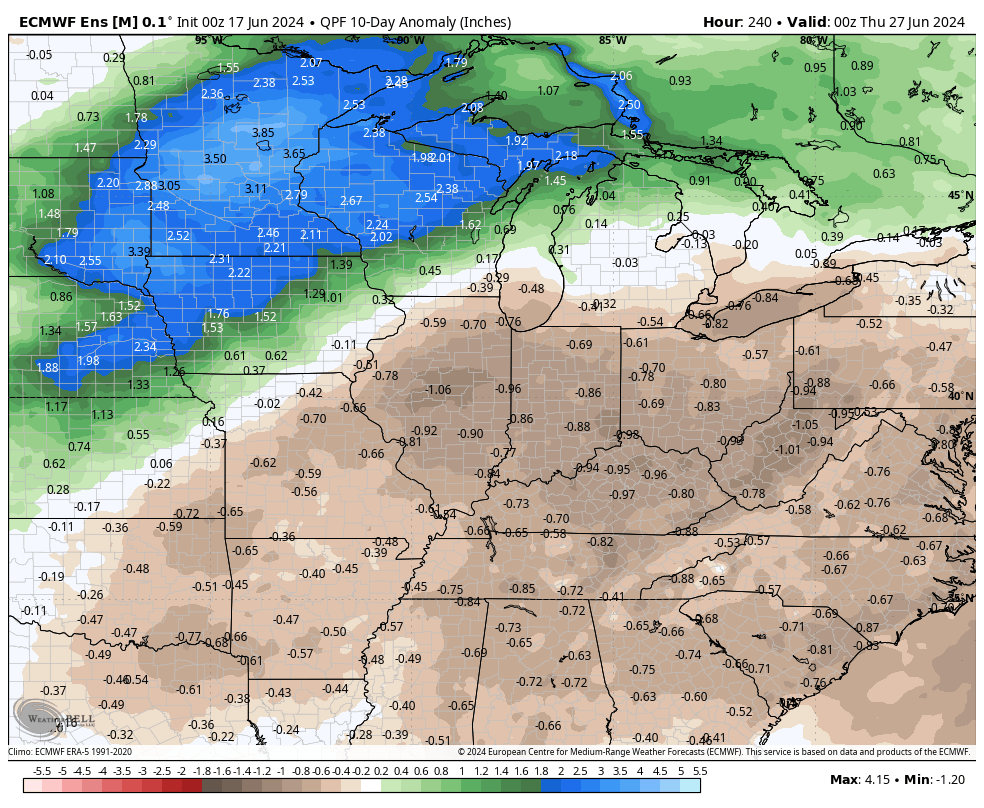

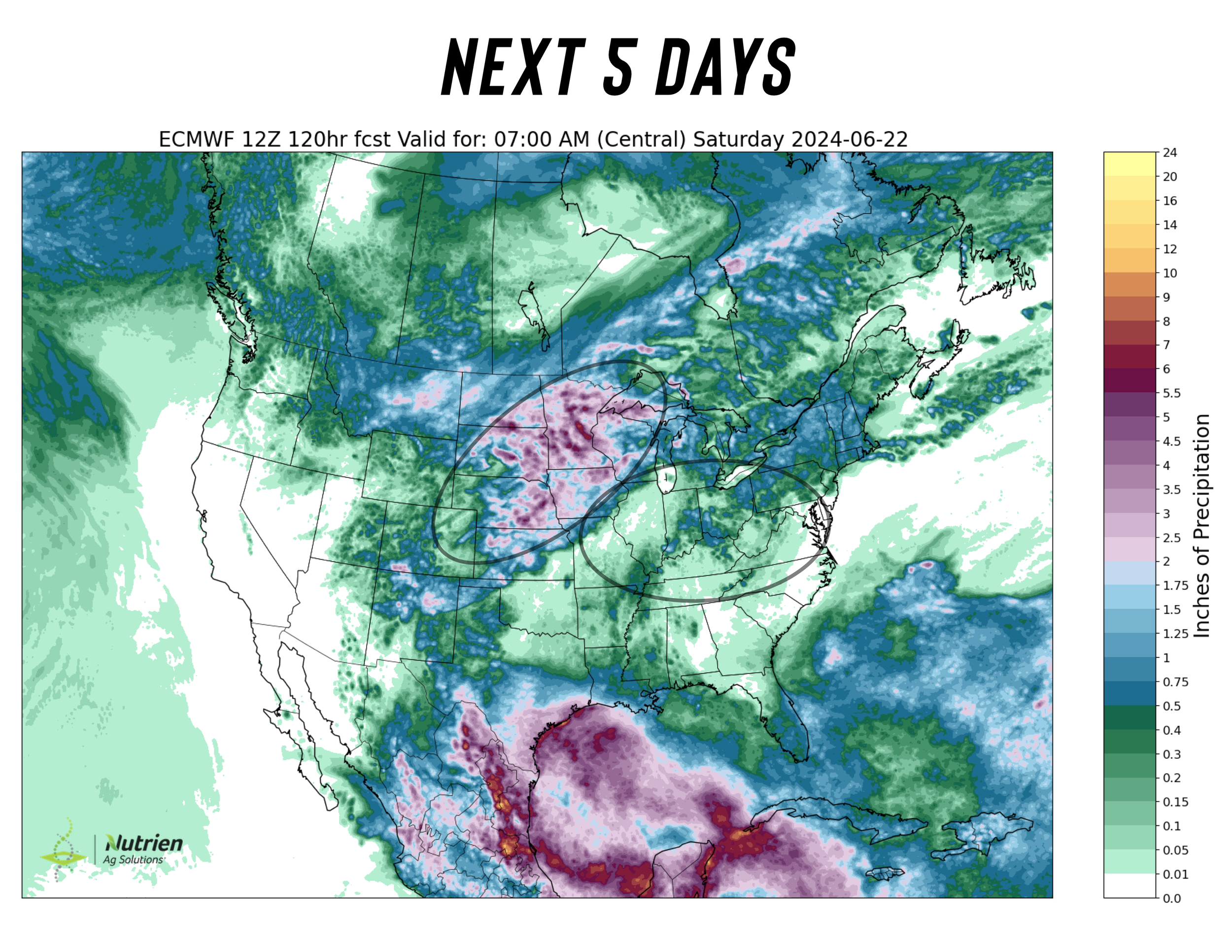

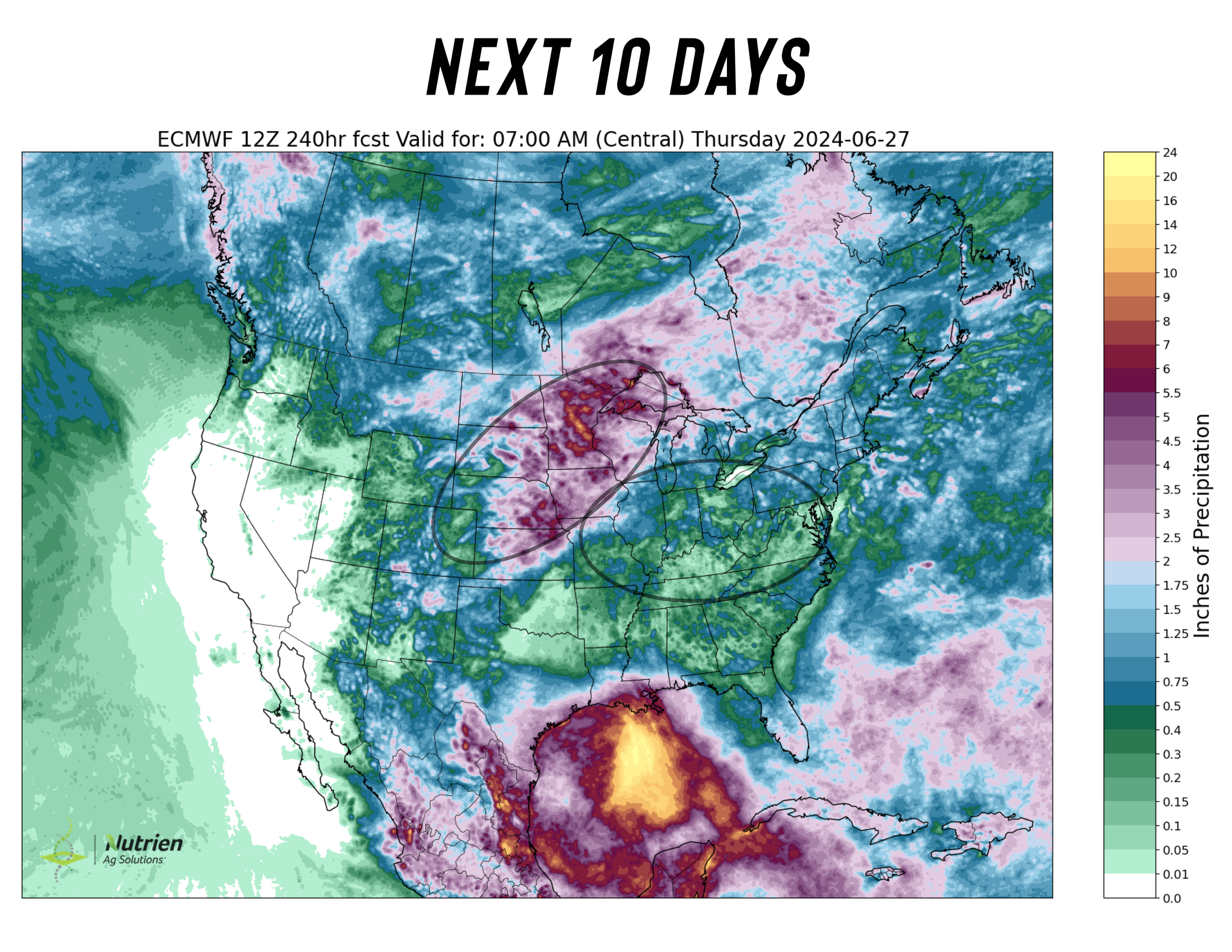

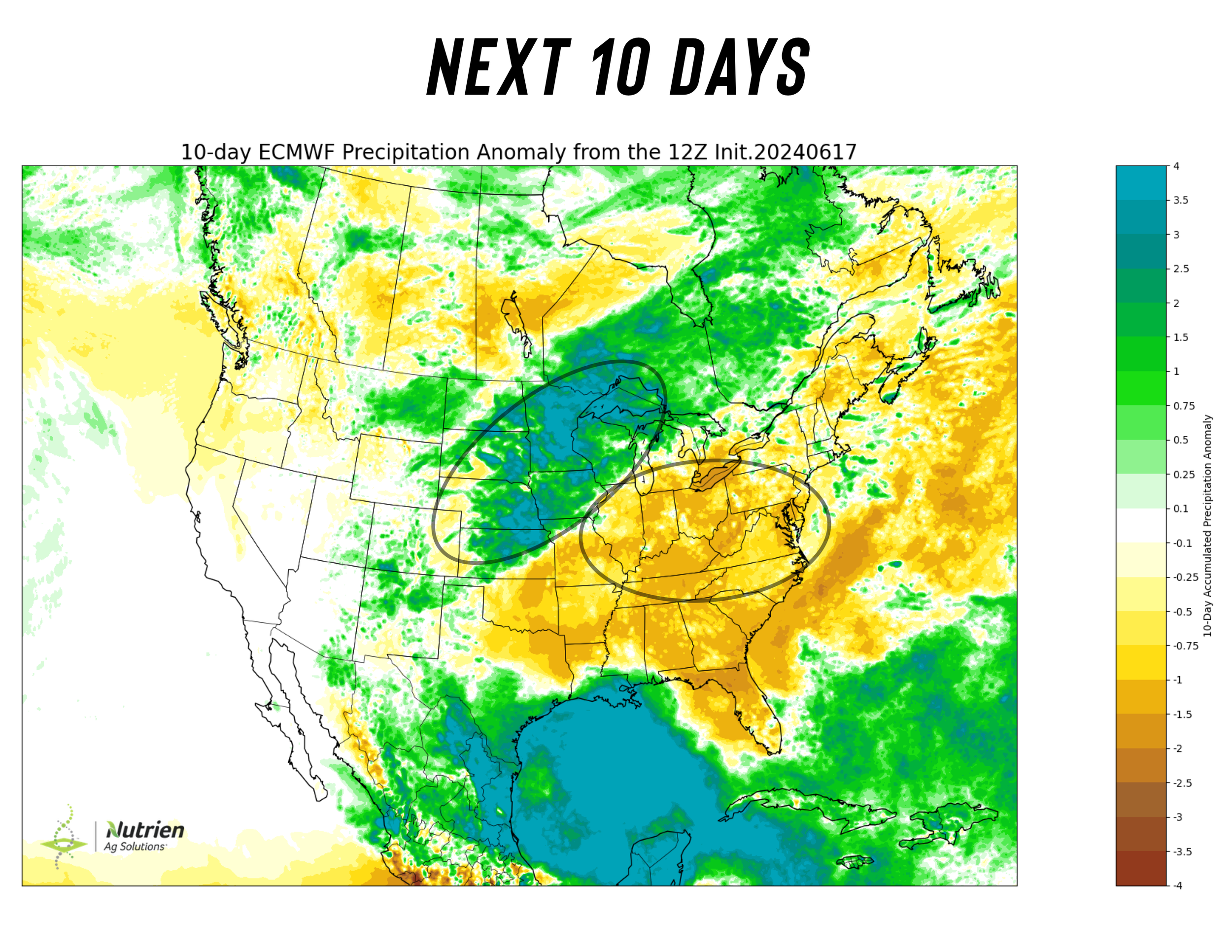

Looking at the weather, currently the western and NW corn belt is being hit with HEAVY rains across Iowa, Nebraska, Minnesota, South Dakota, Wisconsin, and northern Kansas.

On the other hand, the eastern corn belt from SE Iowa to Ohio is looking very dry.

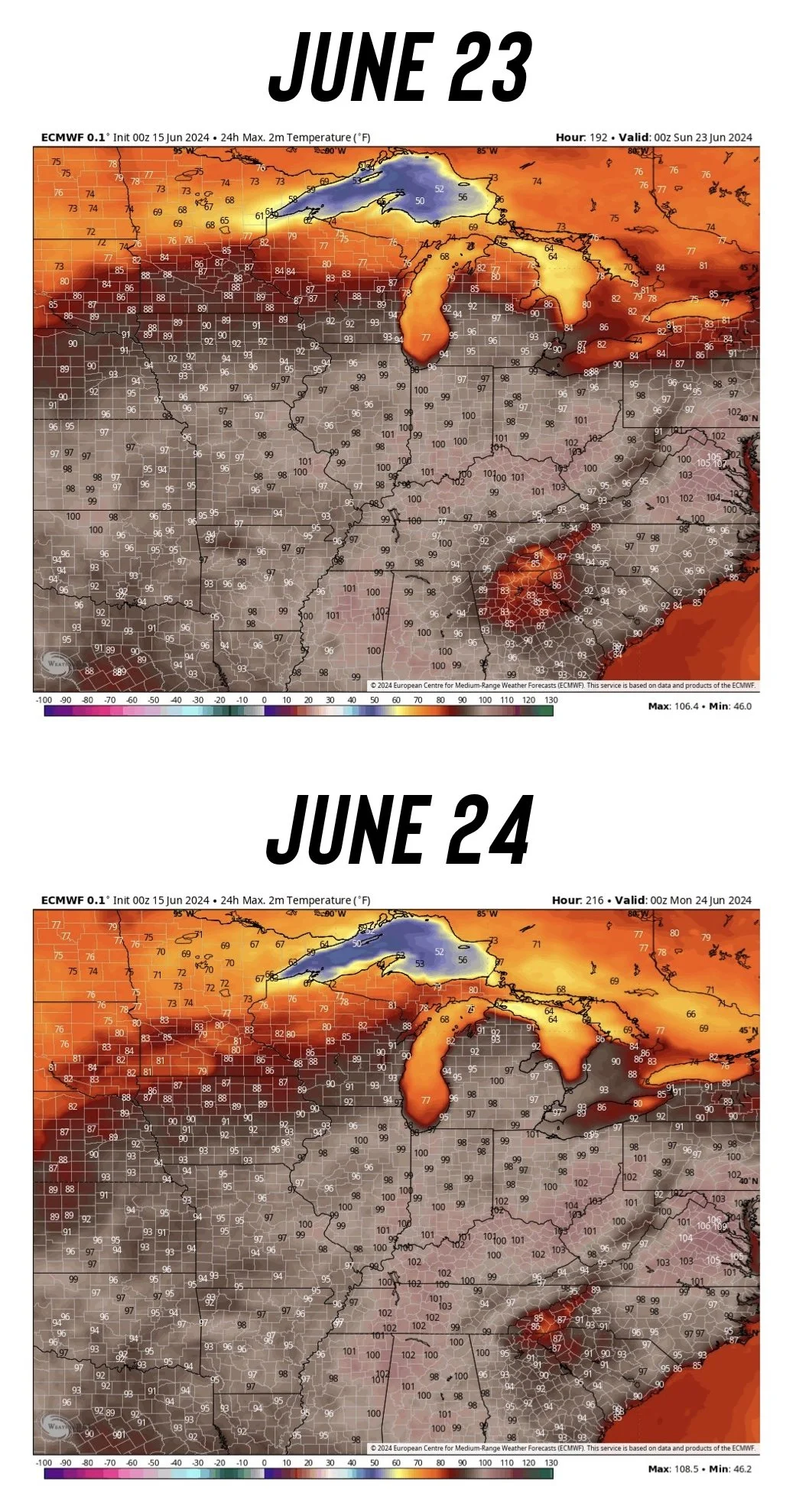

On top of this, the entire corn belt is expected to see some massive heat, with many areas 10 to 15 degrees hotter than normal.

These forecasts do actually look pretty friendly when looking at how dry and hot the eastern corn belt will be.

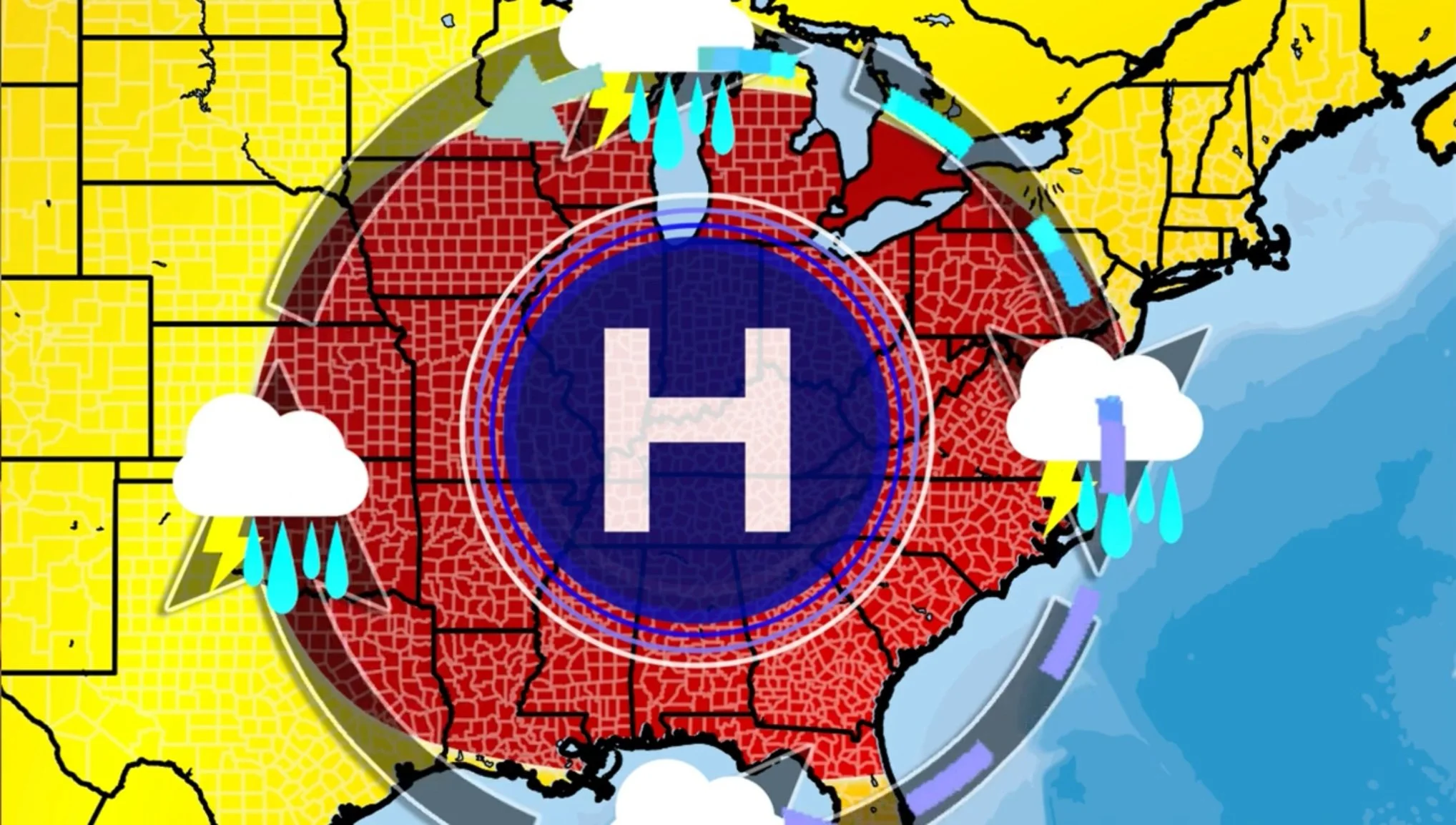

Here is some weather info from BAM Weather.

They are calling this weather pattern the "Ring of Fire".

The Ring of Fire is an area of thunderstorms that circulate clockwise around and area of high pressure. Creating a heat dome.

Around the outside of this dome there will be those wild thunderstorms that come with rain and wind.

Inside the dome it will be very hot and very dry. In this case, the dome is over the eastern corn belt.

Here is an example of what that looks like:

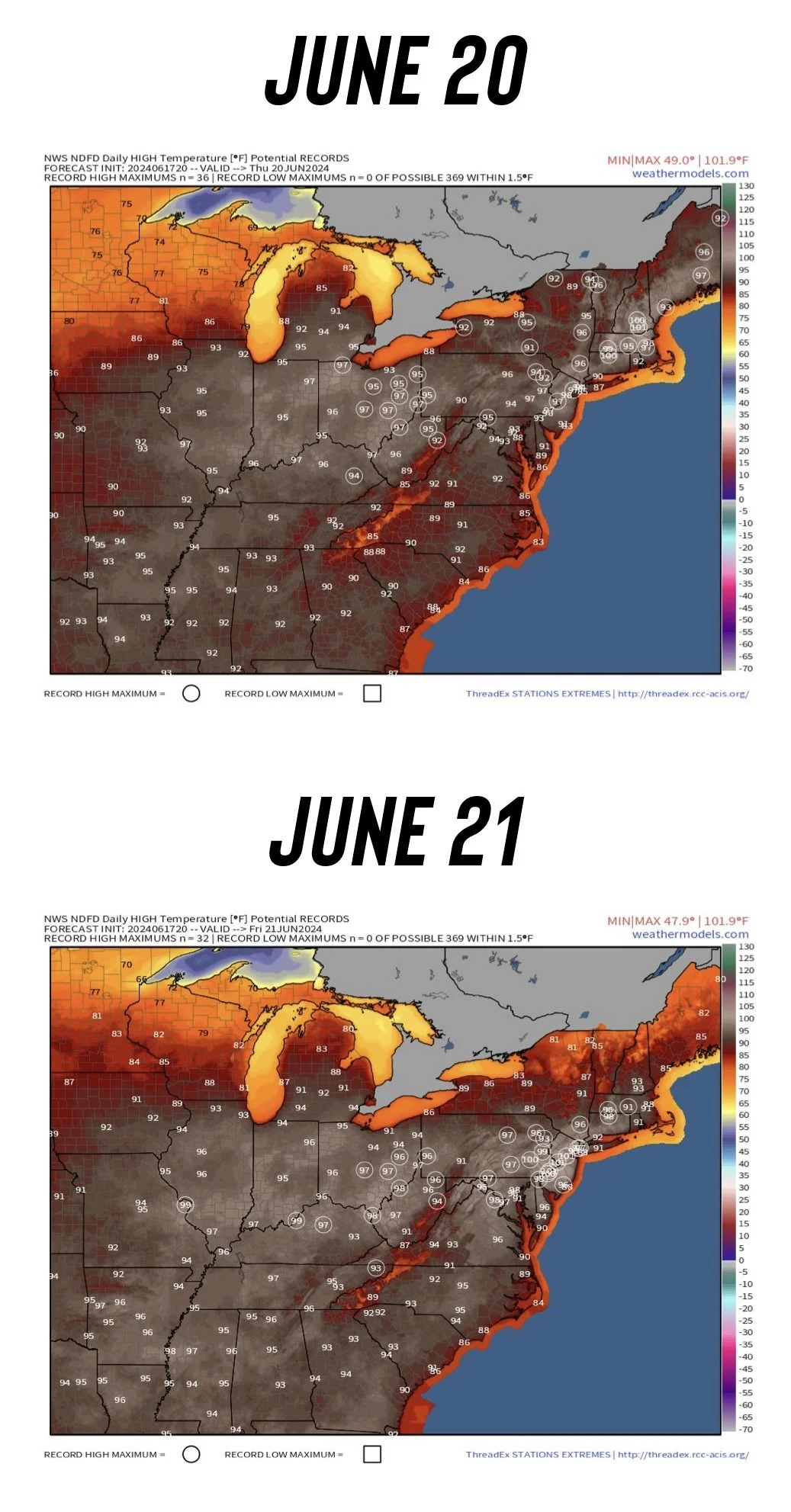

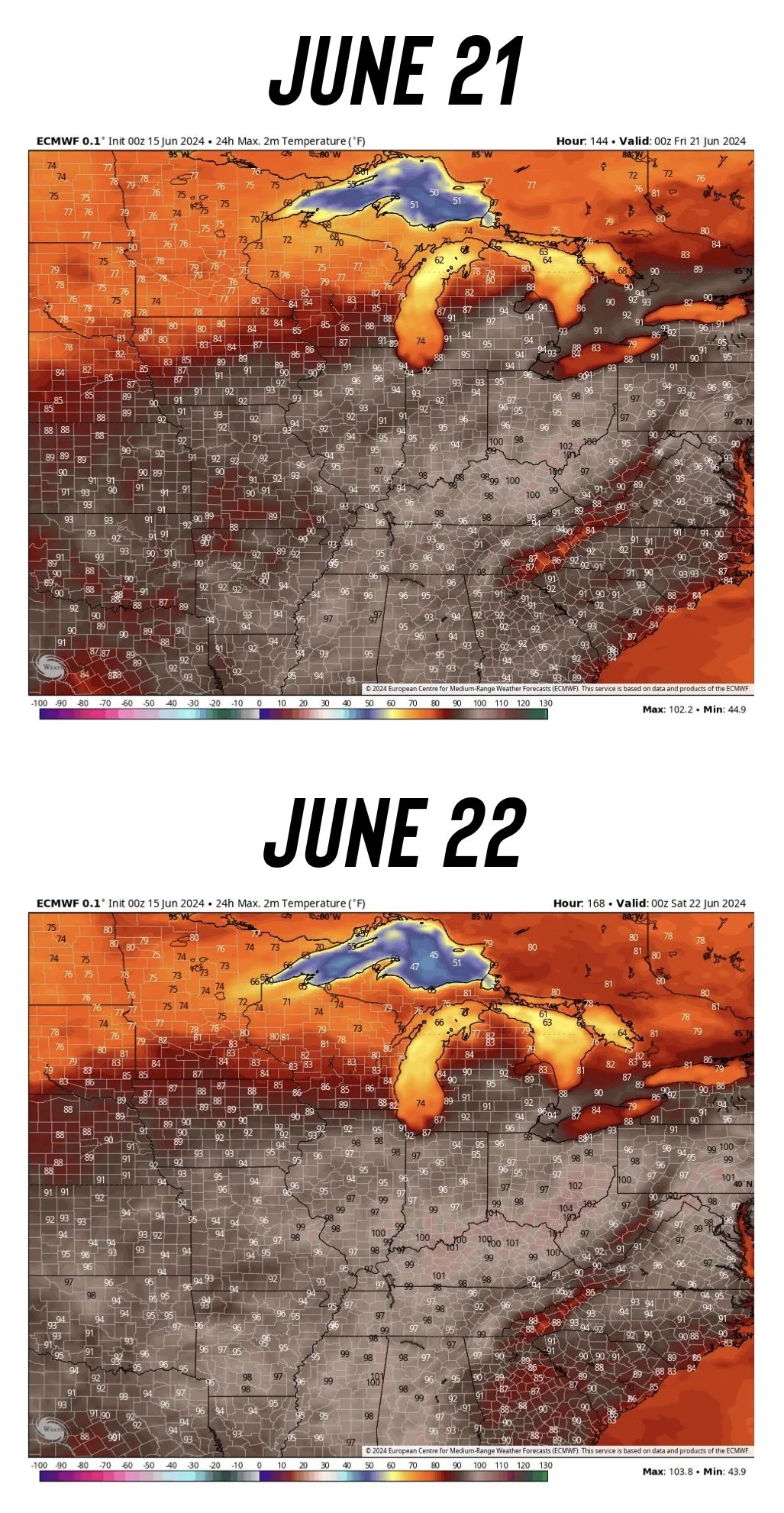

They said this dome will likely have a brief relax late June, but will come back quickly into July.

"Right back to excessive heat by July 1st. I think July 5th to 15th could be record heat for the grain belt with risks for several 100+ degree high temp days."

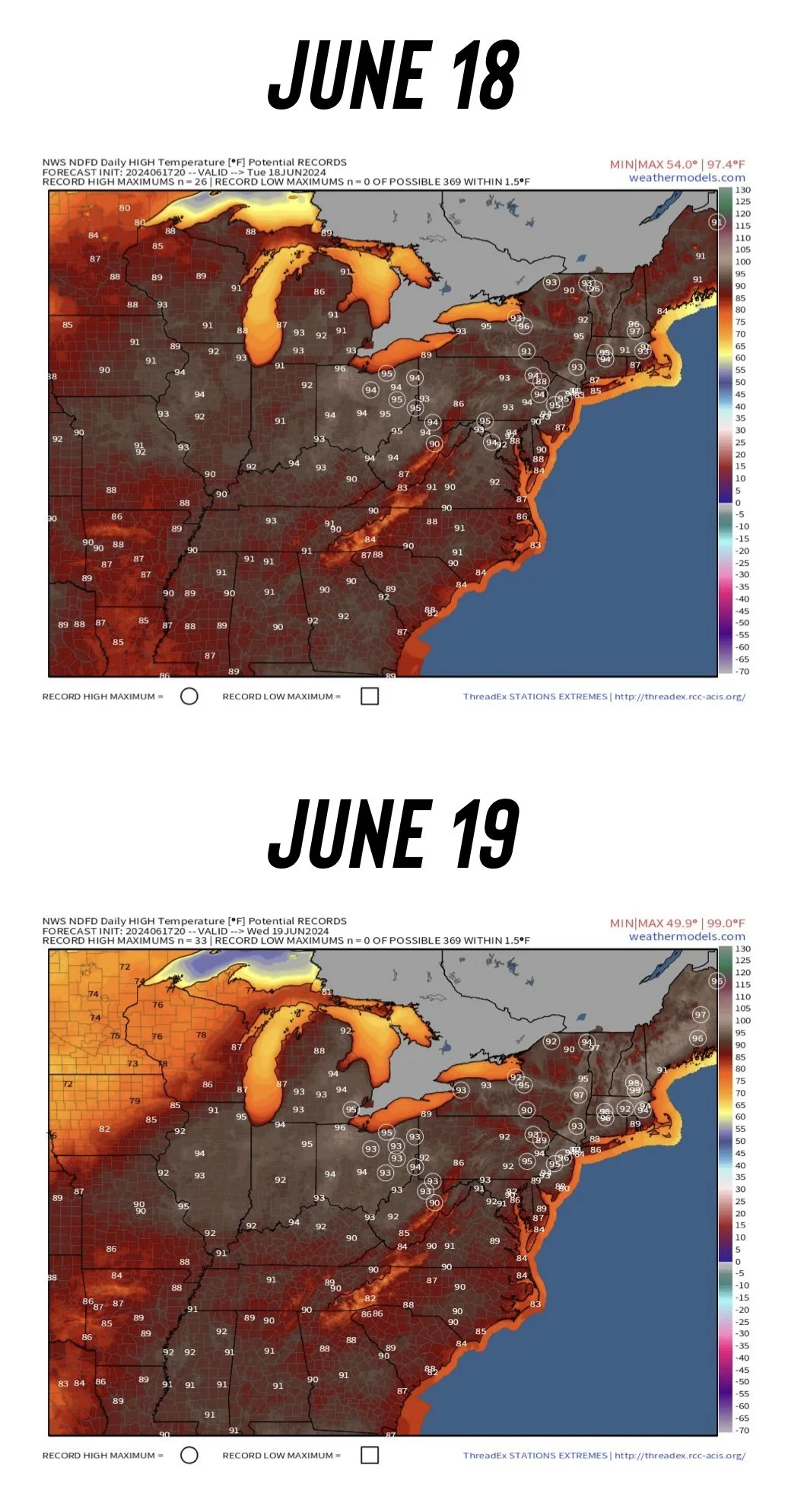

If you take a look at these upcoming daily high temps, every white circle indicates a record temp for that day.

You can check out their weather info at bamwx.com.

However, the markets don’t seem to concerned yet. As they seem to think the crop is made. However, we all know the crops are made in July not June..

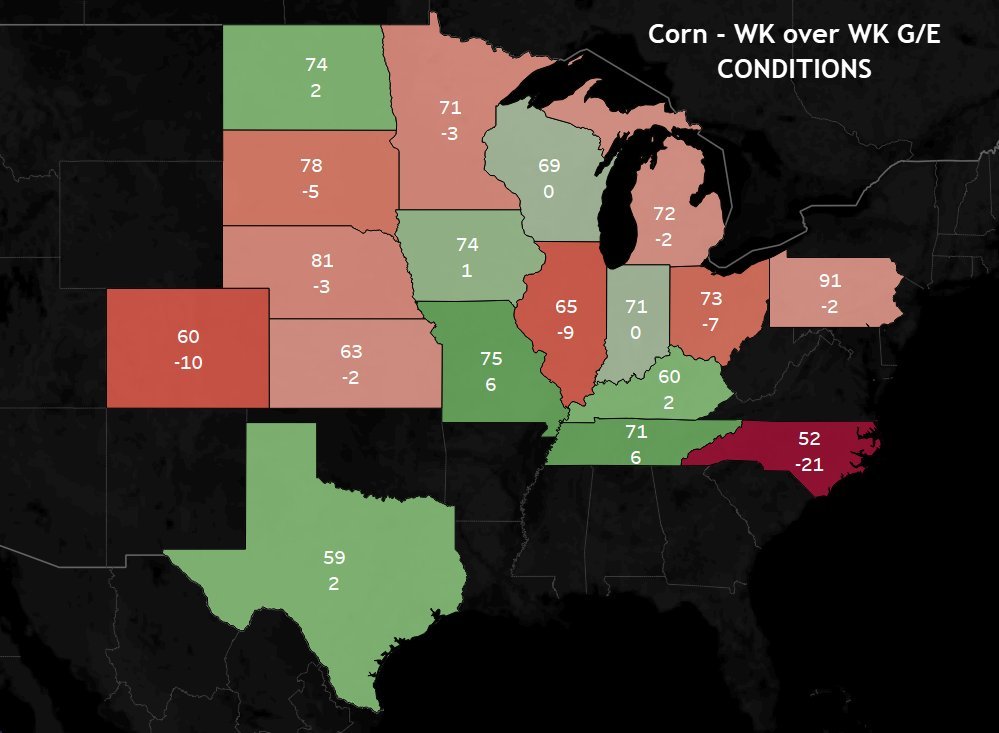

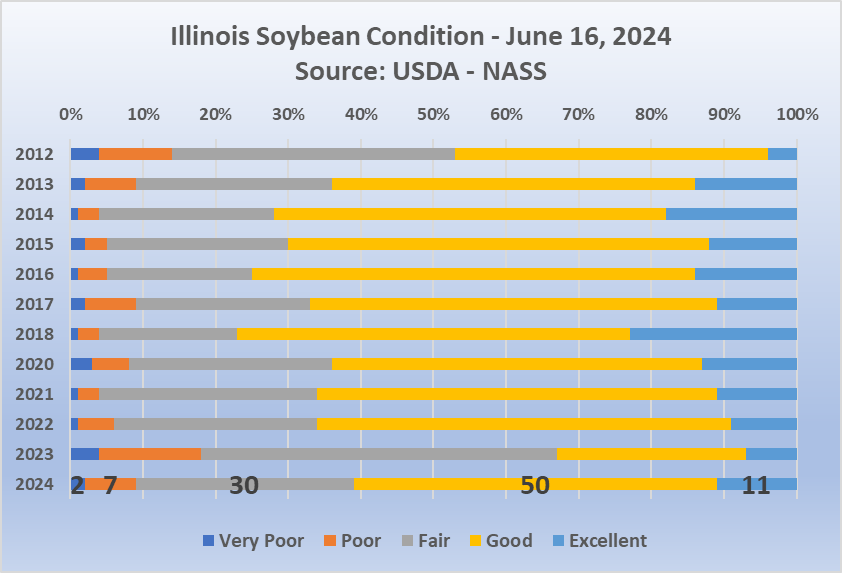

Crop Conditions Today

Corn and soybeans both fall -2% G/E vs the expected -1% drop.

Spring wheat came in at 76% G/E vs the expected 71%.

National Corn:

72% G/E (-2% vs Last Week)

Top 5 Corn Growing States:

Iowa: 74% (+1%)

Illinois: 65% (-10%)

Nebraska: 81% (-3%)

Minnesota: 71% (-3%)

Indiana: 71% (+/- 0%)

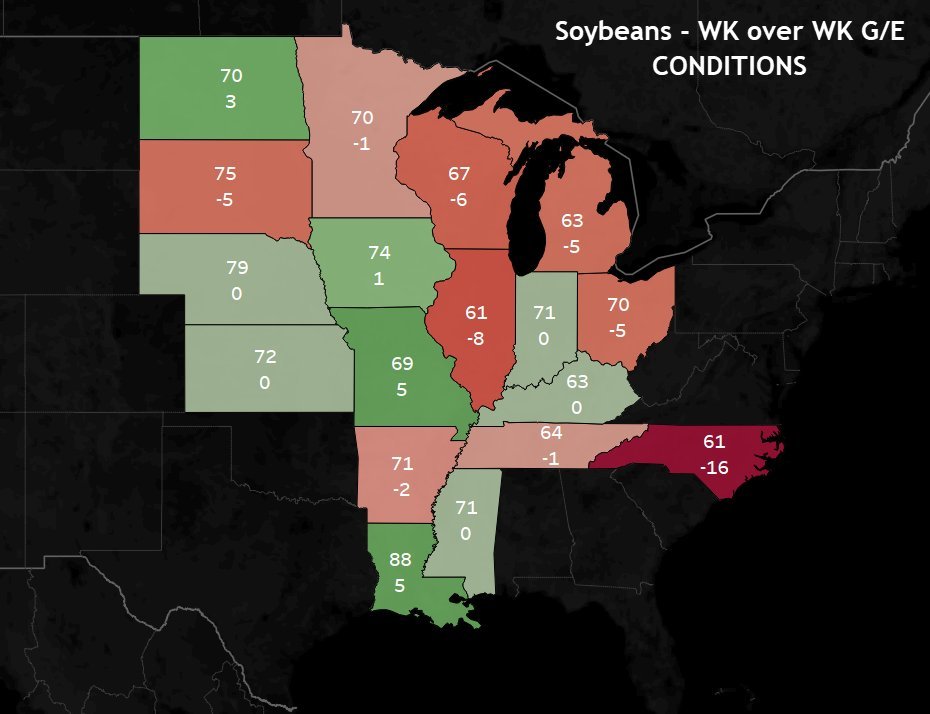

National Beans:

70% G/E (-2% vs Last Week)

Top 4 Bean Growing States (50% of total beans):

Iliinois: 61% (-8%)

Iowa: 74% (+1%)

Minnesota: 70% (-1%)

Indiana: 71% (+/- 0%)

Map Credit: Darrin Fessler

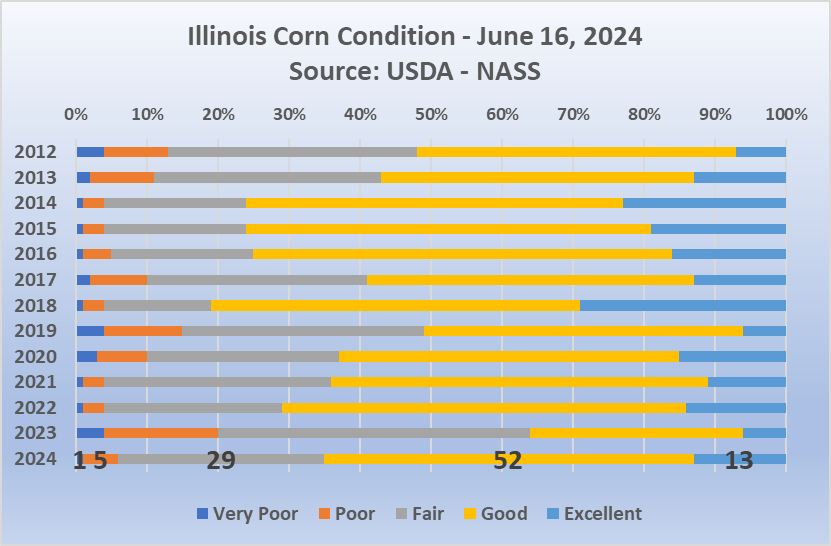

The big drop this week was Illinois. The #2 corn and #1 bean state.

Illinois corn about on par with 2020 and 2021. Worse than 2022 but far better than 2023.

Illinois beans, aside from last year are the worst since 2012.

Let's dive into the rest of todays update where we go over everything you need to know..

BEFORE YOUR TRIAL ENDS..

Since you are on a trial, here is extended access to our sale that ended yesterday. Don’t miss the opportunity. Comes with our daily updates, alerts, and 1 on 1 market plans.

JUST: $399/yr or $39/mo

Today's Main Takeaways

Corn

Corn was mainly drug lower by the heavy sell off in wheat and soybeans despite the forecasts looking somewhat friendly.

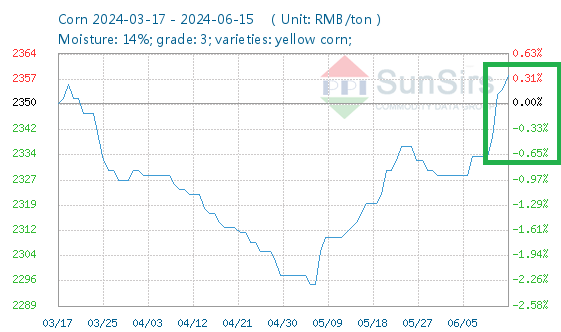

One small headline we are seeing is the China drought.

From World Grain:

"Drought in China is expected to drop wheat & corn output, which could increase imports from China that hasn’t made major purchases recently due to oversupply & declining consumption."

China is in a similar time frame as the US in terms of their growing season. 30-40% of their corn is in a drought. Not a huge issue yet, but has the potential to prompt more imports & buying if their crop starts shrinking.

Right now China's Government is talking about another bumper crop.. smokescreen to buy cheap imports..?

The China drought is true. Look at China corn prices.

Chart Credit: Wright on the Market

Right now the US weather doesn’t look bearish.

From Karen Braun:

"A week plus of dry weather can quickly turn corn from pretty to ugly, especially on sandier soils like this field in SE Illinois.

Is this a disaster? No. It it highly unusual? Also no, but it's stressful for a producer to see especially with another dry (and now hot) week ahead."

"It is clear this corn is thirsty and won’t care much for a week of 90+ degree temps, especially with no rain."

That is how fast a crop can change with just a week or two of hot temps & missing rain.

Right now the forecasts call for exactly that in the eastern corn belt.

Bottom line, I do think we will get a weather driven rally. I have been talking about this summer heat for months, and the forecasts still suggest record heat.

Remember, all it takes is a week or two of believing we have a problem. The impact does not have to materialize but it creates opportunity.

This heat is expected to continue into that key pollination time frame and heading into the 4th of July.

Yes we WILL need a weather story to go back to those recent highs. If we do not get one, we will struggle to go higher. However, the weather isn’t bearish so there isn’t a reason for prices to just continue falling from here.

Could we test those April lows? Absolutely. Perhaps we even break them. But I don’t see us going much lower than that before a weather rally and opportunity.

Remember, a wet spring NEEDS a wet summer. If you get that summer rain, you can raise a hell of a crop. If not, you will run into problems.

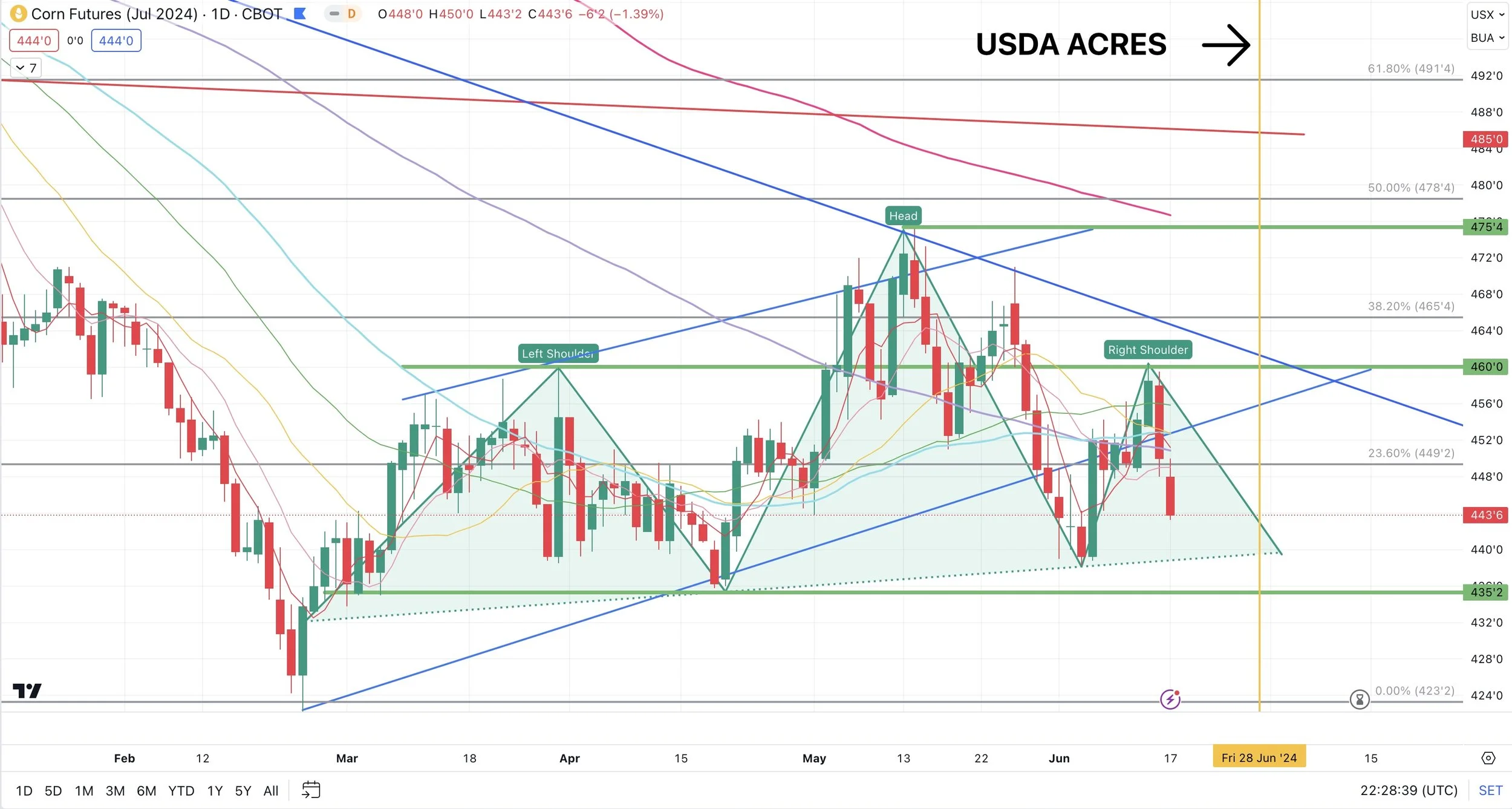

Keep an eye on the June 28th report. The acre estimates range from 87 to 93 million. That is a ONE BILLION bushel swing. Could send us much higher, or much lower.

If you are undersold, consider short term puts.

If you are oversold, then consider some courage calls.

If you have a bunch of old crop corn, look at basis. If your basis is inverted, consider a sale. If you want to re-own that sale then grab a call option after.

If you are uncomfortable or think we going to $4 corn, protect yourself with a put or go ahead and make some small sales. I myself and waiting for a trigger to scale heavier into sales.

Listen to yesterdays audio where we go over a few different scenarios you might be in and how to manage your risk accordingly: LISTEN HERE

Give us a call to create a 1 on 1 market plan. It's free and doesn’t cost you anything. (605)295-3100

Purely based on technicals, I’d be bearish corn with this head & shoulders pattern. But weather will trump technicals in a weather market.

July Corn

Dec Corn

Soybeans

Soybeans continue to fall. Beans have now completely wiped out the entire May gains.

The USDA hasn’t confirmed the losses in Brazil, prevent plant concern is pretty much gone, China isn’t interested in new crop beans, the charts look bearish, and the funds are now back to selling.

The recent Brazil tax changed initially brought some interest from China as they bought old crop beans 4 days recently, but China still has no new crop on the books. The Brazil tax change is also being temporarily put on hold from what I've found.

The only friendly demand news we got today was NOPA coming in at a new record for May at 183.625 MBU. While soyoil stocks fell more than expected. The SAF & biodiesel demand is starting to show up.

Could this bean market randomly rally out of nowhere?

Yes very possible.

Export sales have been strong the past month or so. Crush continues to be strong with new records month after month. US old crop beans are some of the cheapest in the world.

Just like corn, this upcoming heat could provide some support. This soybean crop is made in August and we have a massive heat wave coming. The old crop bean market is also heavily inverted still, which is a bullish sign.

Now this does not mean you shouldn’t manage risk. If China decides they don’t want US beans and weather magically cooperates, we could go a lot lower. I don’t see that happening, but that is the risk.

The chart also looks awful. If we can’t hold those lows, things could ugly and the funds and algos might continue selling this thing.

A lot of you should keep cheap puts under unpriced grain, especially if you are undersold. I think we bounce relatively soon, but do what makes you comfortable. It is called hedging, not guessing.

If you have made sales near the highs, we are nearing some good support, so not the worst spot for courage calls.

Basis contracts for most will have to be priced or rolled by June 27th, so rolling to August or September isn’t a bad idea.

Beans are made in August. Right now the outlook for later this year is still hot and dry as La Nina is expected to arrive in July.

Give us a call if you have questions. (605)295-3100.

July Beans

Nov Beans

Wheat

Wheat continues to fall. Now $1.30 off the highs and $1.10 off the highest close. From yearly highs to 8-week lows in just 2 weeks.

The funds and algos are hammering wheat because the charts look awful and the Russia headlines are gone for now.

Short story short, if we do not see another Russia headline, there is no reason for us to magically rally back to those highs.

I do not think we have seen the last of a Russia headline rally, but I doubt it will be nearly the size of the last one if do get one. If Russia's crop continues to shrink, it could be somewhat of a game changer looking long term and help US wheat demand, but is going to take some time for the full effects to show up and have an effect. Short term, we will need an actual headline for it to provide any support. A headline like that is impossible to predict.

Outside of the Russia situation, the US situation is fairly bearish.

Spring wheat ratings for example came in far better than they thought it would.

The US winter wheat is also in far better shape than recent years. Along with that we are seeing harvest pressure.

On May 22nd we alerted our sell signal, which was 7 cents from the highest close.

If you did not make any sales, remain patient or consider puts for protection.

I think we will get another small opportunity and bounce, but I don’t think we will see those highs again relatively soon unless something crazy happens in Russia. Long term, I see a lot more pricing opportunities.

If you did follow the sell signal, this is not the worst spot to consider re-owning some of those sales if you think we will bounce back. As we are approaching some key support. But of course, never anything wrong with walking away from a sale you are happy with.

If we do not hold that $5.87 support area, it will not be a good look. The chart already looks extremely bearish. But we are probably due for at least a dead cat bounce.

July Chicago

July KC

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24