NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

Overview

Grains lower across the board as corn and soybeans give back yesterdays gains while Chicago wheat makes a new low.

Wheat was under heavy pressure as Russia continues to sell cheap wheat around the world while the US misses out on most of the business. Prices in Europe also continue to fall which negatively effects prices here in the US.

Some of the weakness from wheat spread over into corn, but overall there was just a lack of bullish news today.

Brazil weather is becoming less impactful for the soybean crop, as their harvest is roughly 50% complete.

There is still concerns with the second corn crop in Brazil however. They are supposed to get some rains here shortly, but the question is how big of an impact will this make on their already poor soil moisture situation.

Dr. Cordonnier left his estimates for Brazil unchanged. With 145 MMT for beans and 50 MMT for corn, but his bias remains neutral to lower moving forward.

The rumor yesterday was that China was back in the market. As they bought beans from Brazil and corn from Ukraine. But the US hasn’t seen any business thus far.

Friday we get the USDA report. Most are looking for the US numbers to be a non event, as there will be no production changes made until May, and we will likely not see any domestic changes made. As the USDA historically waits until April to do so. However, some think we will see slight cuts to export demand in beans and wheat.

The trade is expecting:

Corn carryout: 2.159

Bean carryout: 319

Wheat carryout: 657

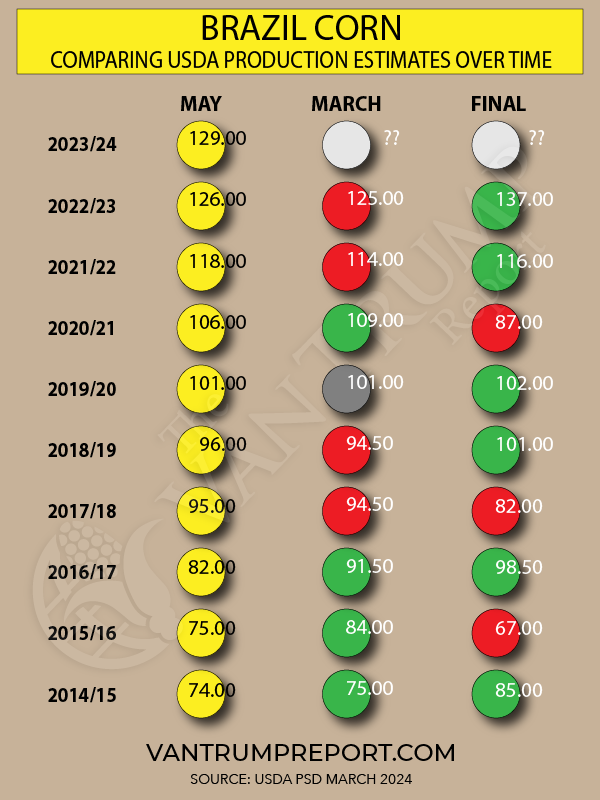

The South America numbers will be the ones to watch, as the USDA so far thinks the Brazil crop is bigger than everyone else on the planet does.

Expect the numbers to be lower. But will the USDA lower them as much as they should? Probably not. But at least it will show a trend that the crop is getting smaller.

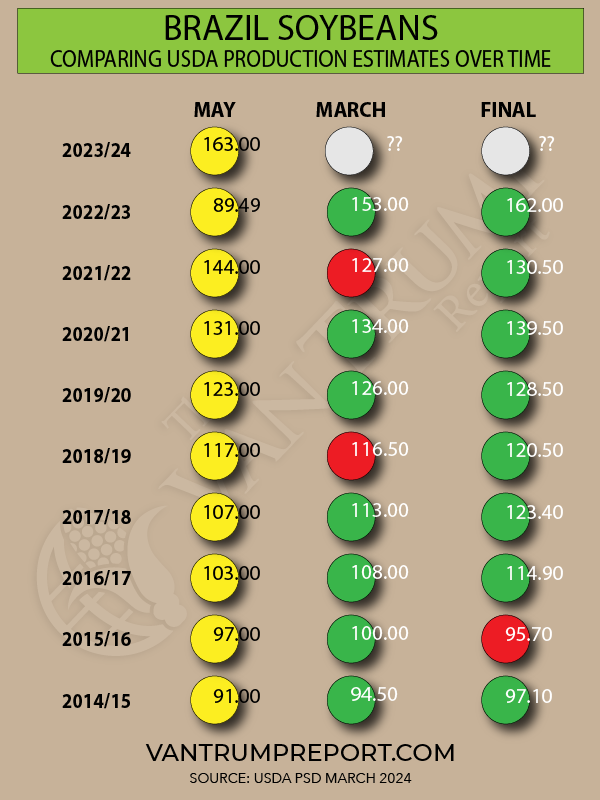

Here are two great charts from Kevin Van Trump. He shows how the USDA's production estimates for Brazil have shaped up. He compared May, to March, to the Final.

No clear pattern at all, but I found it interesting.

Let's jump into the rest of today's update..

USDA REPORT SALE

Ends after Friday’s report. Get 1 on 1 marketing planning & tailored recommendations. Take advantage before your trial ends.

Today's Main Takeaways

Corn

Corn lower today, but it was inside day. Meaning we did not take out yesterdays highs nor yesterday’s lows. So today's price action does not give much clarification. Was overall just a boring day.

We had some news yesterday that China is back in the global market buying more feed grain. So far it looks like they have been buying corn from Ukraine, and been looking at the US market but have not bought any from the US yet.

There are some that think China could possibly start buying ahead of the election this year, as some worry that if Trump were to get elected it could bring on another trade war and bigger tariffs. Nobody knows if this is true, but that is the talk.

From Van Trump Report:

"I'm hoping thoughts of a more aggressive Chinese buyer and an upcoming US weather season prompt the funds to cover some of their short positions."

Yesterday we mentioned that IF we do get early planting, this will more than likely be negative for prices when and if planting does get rolling early and smoothly.

If that were to happen, I would expect China to come in here and snatch up that cheap corn.

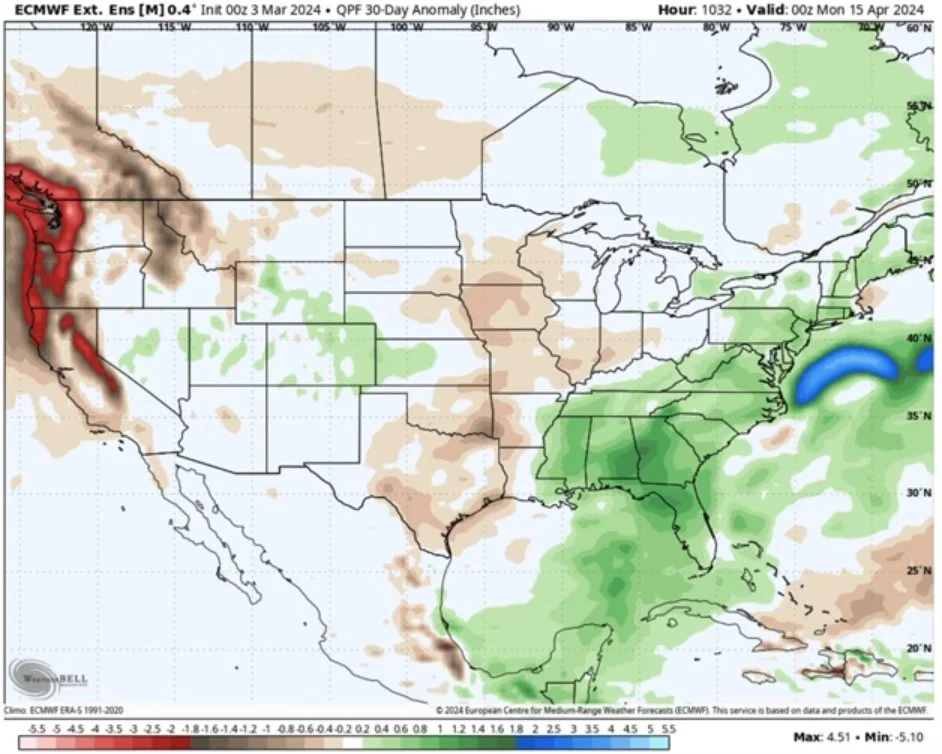

Here is the 30 day anomaly. Keep in mind, if these hold true, it will pressure prices. A fast planting pace also almost always means we will see higher corn acres than previously thought.

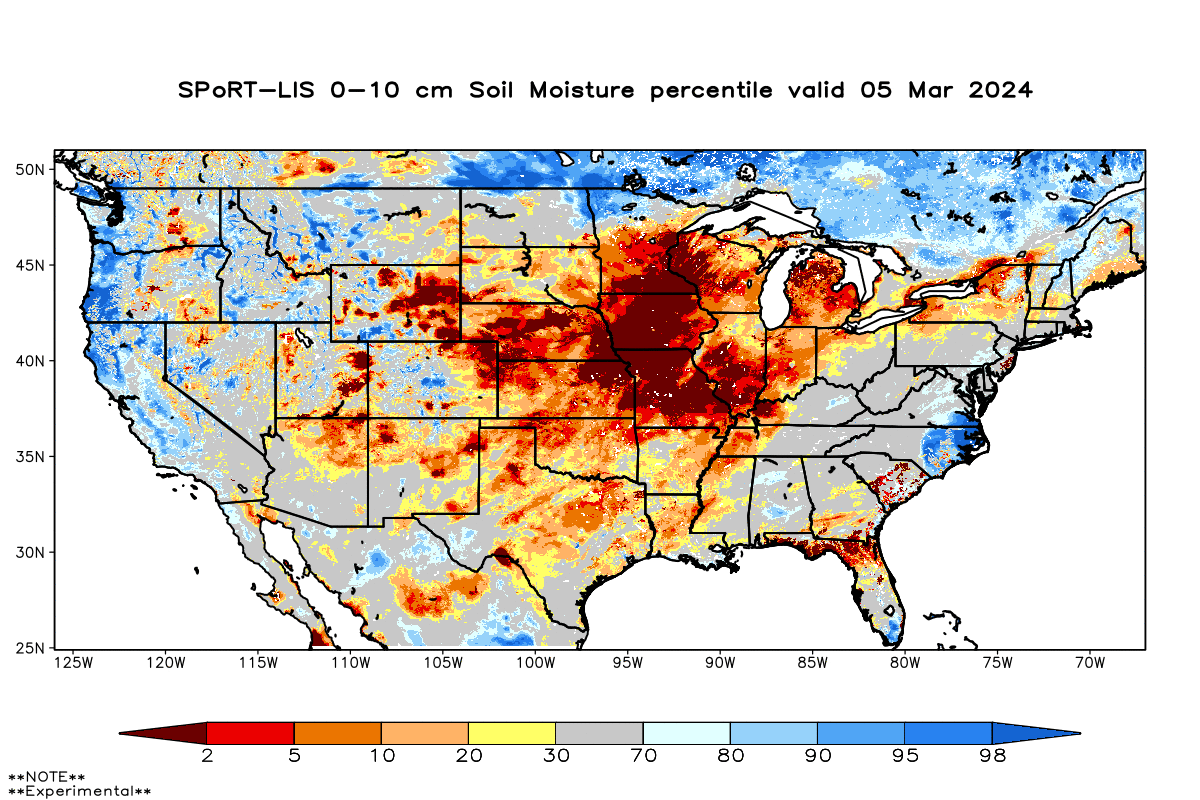

Just keep this soil moisture map in mind if we do not get rain.

Plenty of time for this to change, but that's the concern right now.

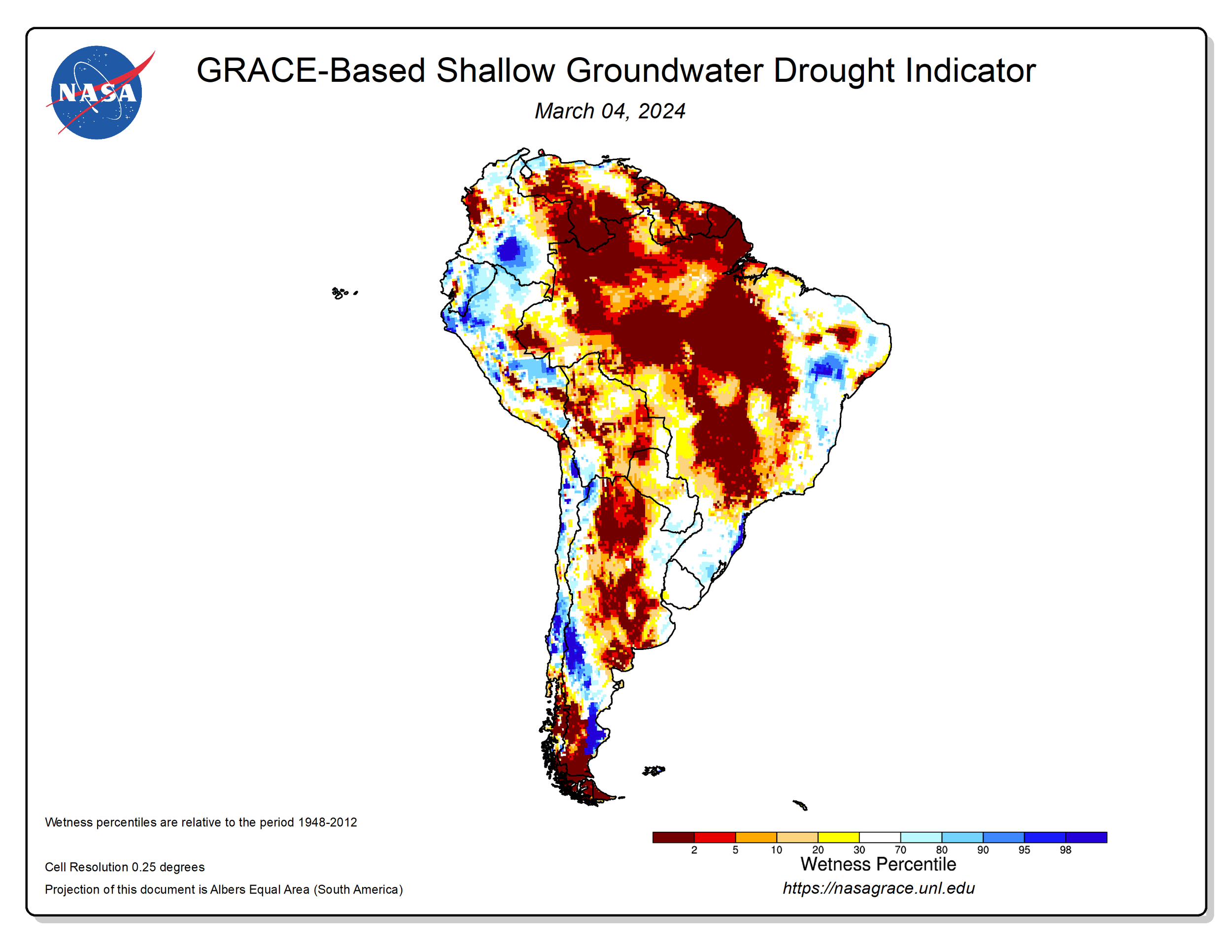

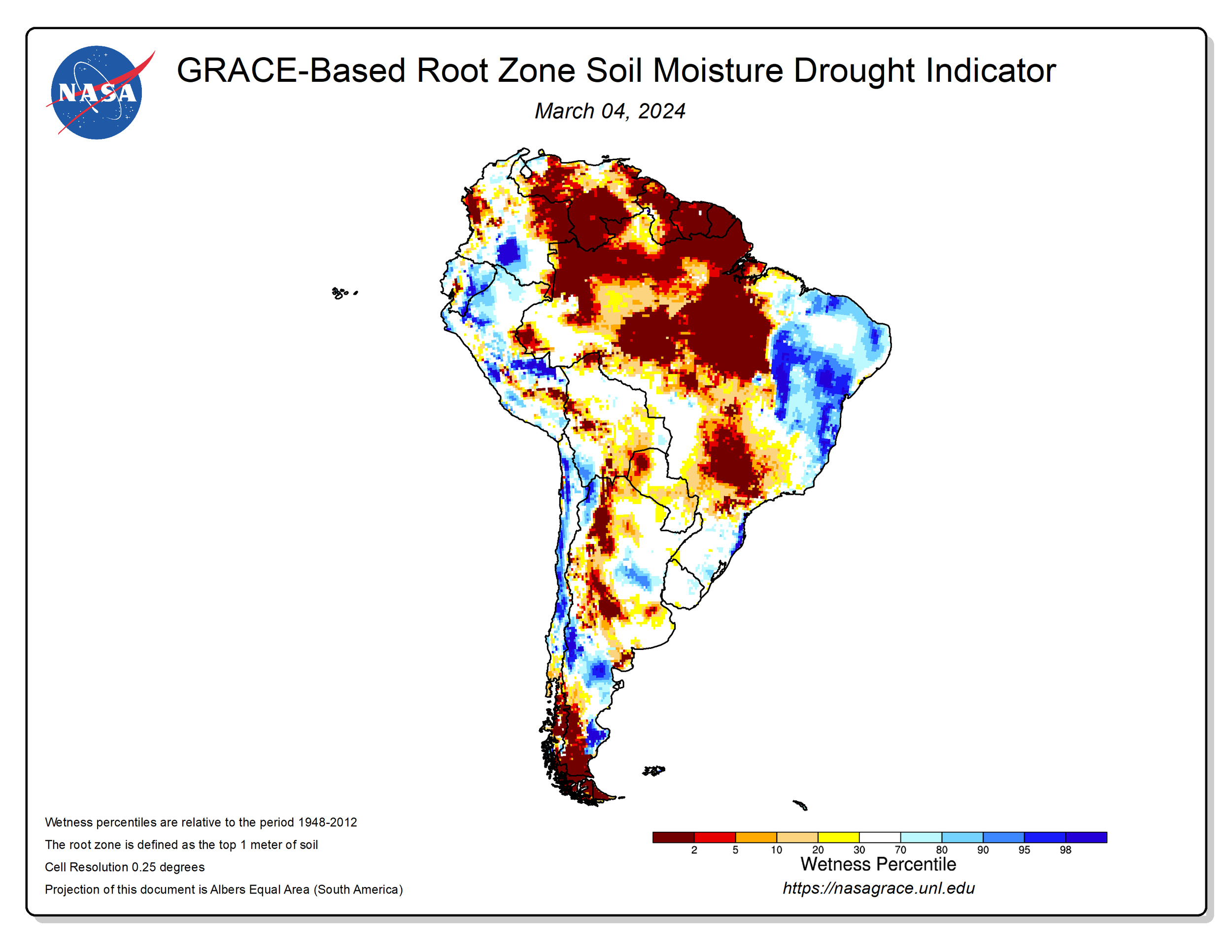

Then we also have Brazil. There is some definite concerns that this second corn crop could run into issues. We are entering a key pollination time frame shortly. If it doesn’t rain, their subsoil moisture situation is already very dry.

Short term, they do have forecasts for rain. But most are questioning if it will be enough to make much of a difference on the subsoil that is already suffering.

Personally, I see this crop getting smaller. I have been talking about the possibility for a smaller second corn crop since November.

World Weather Inc said that Brazil is supposed to get rain, but does not think it will be enough to restore the low subsoil moisture in the areas that really need it.

Take a look at the moisture situation. Doesn’t look at all that promising.

We have the USDA report out on Friday. Overall, I am not expecting huge changes. Which means I do not think it will be an overly bearish report. But we all know the USDA likes to surprise us.

I expect them to wait until they see the quarterly stocks numbers to make any huge changes to US numbers.

As for South America, this second corn crop is still in it's growing phase and too early to say if the crop is great or a disaster. Although this crop got planted very late and was pushed into an unfavorable window, the soil moisture is dry, and forecasts look pretty dry as well. It could happen, but the USDA probably won’t want to make many major changes to the Brazil corn that help our prices, but hopefully I'm wrong.

Bottom line, we mentioned this yesterday. But if the weather stays above normal temps and dry, this market could take it on the chin in spring. There is a real possibility we go back to $4 or even lower in spring if this happens.

However, if this is the case, it means it is dry. Which should bring up the drought talk. Drought talk leads to rallies typically, whether we get a real drought or not.

Short term, I could see the funds looking to cover a small amount the next few weeks. I think we have anywhere for +20 to +40 cents of upside before spring IF this planting scenario plays out the way I think it could.

There are plenty of ways to manage risk. One that we like right now is courage calls. These will give you the courage to make sales when we get that rally. Give us a call if you have questions.

Jeremey's number is (605)295-3100. Wade's is (605)870-0091.

Courage calls make the most sense for a lot of guys, but not all.

Lastly, we have mentioned this recently, but do not use accumulators or be selling options here. Implied volatility is low. Which decreases the price of options. There is a time and place for these strategies, but right now is not the time. Give us a call if you have questions.

First rallies, like first sell offs a lot of the time typically do not hold.

From 247 Ag:

"We look for prices to dip to the $4.15 range next week, If corn cannot reach $4.10 and test this support level before closing above $4.30, then the corn lows are in."

Personally, I need a weekly close above $4.34 to say the bottom is in for now. Then I think prices could pick up steam for a few weeks.

Corn May-24

Soybeans

Soybeans lower with the rest of the grains. Mostly just a risk off day with lack of bullish news.

South America weather is becoming less important as the beans in Brazil are roughly halfway done with harvest. The focus will now be the second corn crop.

However, since their harvest is moving along, this should relief some of the harvest pressure on both the Brazil and US bean markets. Which is supportive.

From Brazil Analyst Eduardo Vanin:

"Brazilian soybeans are becoming more expensive. The past week has seen a significant increase in activity, with farmer selling doubling compared to the previous week, along side an improvement in flat prices. May futures have rose +9 cents and the basis in the CFR China market has increased by +20 cents."

This is friendly, because right now this is a problem. We lack competitiveness with Brazil's cheap beans and have had an overall lack of demand from China. But right now it looks like China is in the market for Brazil beans. Hopefully the US can find some of that business.

As for the USDA report, no one is looking for any major changes to the US balance sheet.

One thing that could be a negative is higher ending stocks. As soybean export inspections are down and so are actual shipments. Both are down -20%.

There is also talk that perhaps the USDA is going to lower exports by -25 to -50 million bushels. If this happened it would be negative for our balance sheet.

Everyone is expecting the USDA to lower Brazil's crop. But by how much remains the biggest question.

Everyone thought the crop should’ve been 152 last month. But they only moved it to 156 down from 157. Of course they now lower the estimate to 152.3 for this report.

The trade range for estimates if 148 to 156. Guess we will see where they come in at.

Argentina's numbers on the other hand could come in a little higher. But most expect them to leave it unchanged at 50. I wouldn’t be surprised to see 51.

There is still risk in this bean market. For some, you should be getting puts. For others, you should be getting courage calls. Please give us a call if you'd like to walk through what would be best for you. (605)295-3100.

Overall, I still see higher prices long term. But I also would not be surprised to see us flirt with those recent lows. Remaining patient but trying not to catch a falling knife. Remember the funds are still holding near record shorts. They covered a lot of corn, but have not yet in beans. This is still one of the more friendly things the bean market has going for it.

Soybeans May-24

Wheat

New contract low and low close in Chicago wheat.

As I mentioned, the pressure continues to come from Russia. They continue to sell cheap wheat and we remain uncompetitive. It's just tough with them holding all this cheap wheat, and then it also looks like they could have another record sized crop.

Along with that, prices in Europe continue to fall. With Paris milling wheat dropping to new lows today.

We are approaching more of a weather market. This market has lacked news for a long time. Weather season could provide some footing.

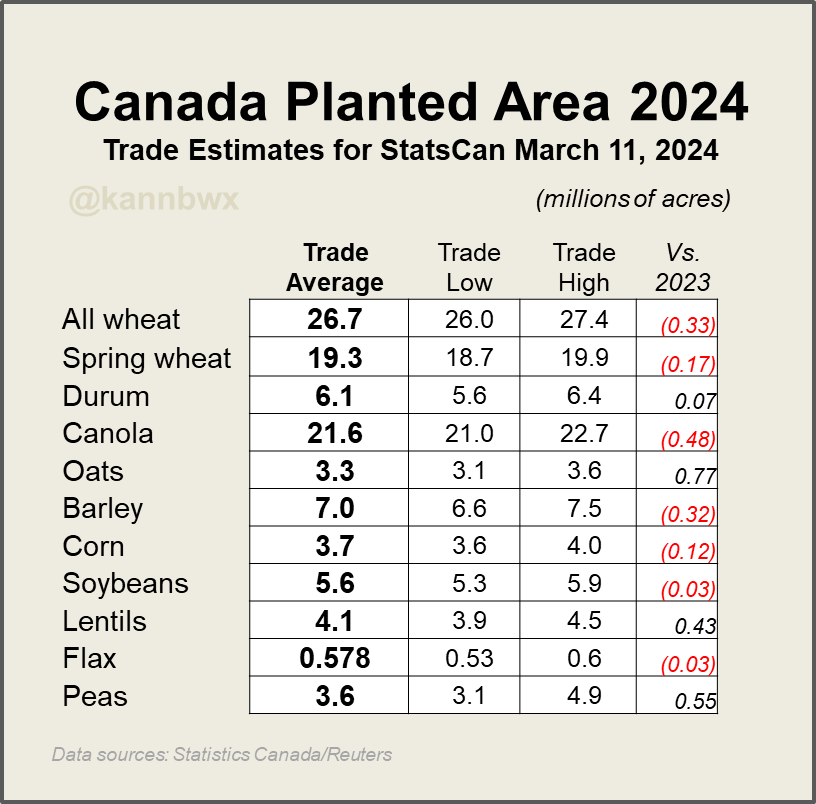

Traders are expecting farmers in Canada to reduce wheat, canola, and barley acres this year in favor of oats, lentils, and peas.

StatsCan will have it's intentions survey on Monday morning. Below are the estimates from Karen Braun.

The winter wheat crop in the US looks better than last year, but we did see the crops take a set back the past week.

Kansas down -4% to 53% G/E

Oklahoma down -5% to 65% G/E

Texas down -3% to 43% G/E

As for the report on Friday, there is not much changes expected to be made for the wheat US balance sheet or the world balance sheet. Most seem to think this report will overall be a non-factor for wheat. Which means wheat could very likely be a follower, not a leader. So it could very well follow the direction of the rest of the markets if it's a non-event.

Bottom line, this is not the time or place to be making sales. Could we go lower? Sure. But we do not want to be selling at lows.

Still remaining patient, waiting for wheat to make it's move.

$5.50 for Chicago is some heavy support. If that breaks, we could see anywhere from 20 to 30 cents more downside.

May-24 Chicago

May-24 KC

Cattle

Cattle trying to make new highs.

I think there is a decent chance we do make new highs, but I still like taking advantage of the rally on paper. There is nothing wrong with taking risk off the table or adding a floor if you are nervous of prices falling from here.

Give us a call if you want to discuss. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24

EARLY PLANTING, DROUGHT, & FINDING YOUR GRAIN MARKETING STRATEGY

2/23/24

MORE DOOM & GLOOM AS CORN BREAKS BELOW $4.00

2/22/24

HAVING A PLAN & DEFINING RISK

2/21/24

LOWER LOWS & DROUGHT TALK

2/20/24

HOPE ISN’T A MARKETING PLAN BUT HISTORY REPEATS ITSELF

2/16/24

HAVE ENOUGH OF YOUR NEIGHBORS THROWN IN THE TOWEL SO WE CAN BOTTOM?

2/15/24

BASIS CONTRACTS & USDA OUTLOOK

Read More

2/14/24

SELL OFF AHEAD OF USDA OUTLOOK: STRATEGIES TO CONSIDER

2/13/24

LA NINA, FUNDS, & USDA OUTLOOK FORUM

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24