WHY BRAZIL COULD PUSH THE GRAINS HIGHER

Overview

Grains end of the week mixed following yesterday's bearish USDA report.

On today’s action, both corn and wheat were lower as corn finally broke below that $4.68 key support and old harvest low. Posting a new low today closing at $4.64.

Despite the bearishness, beans actually managed to trade higher today and were only down 4 cents on the week after falling over 20 cents yesterday after the report.

If you missed yesterday's USDA report audio recap, you can listen to it HERE

Here were the weekly price changes. Corn hit the hardest due to the report, beans barely lower due to the report, and wheat market was mixed.

Weekly Price Changes:

There are 2 main factors that have the ability to push both corn and beans higher. With corn's 2 billion carry out, it will likely need help from one or both of these factors if it wants to hold a sustainable rally.

The first factor is more Chinese demand. Which I think is reasonable. We just saw a great week of sales for both corn and beans. Why wouldn’t you they want to buy corn with our prices so cheap currently?

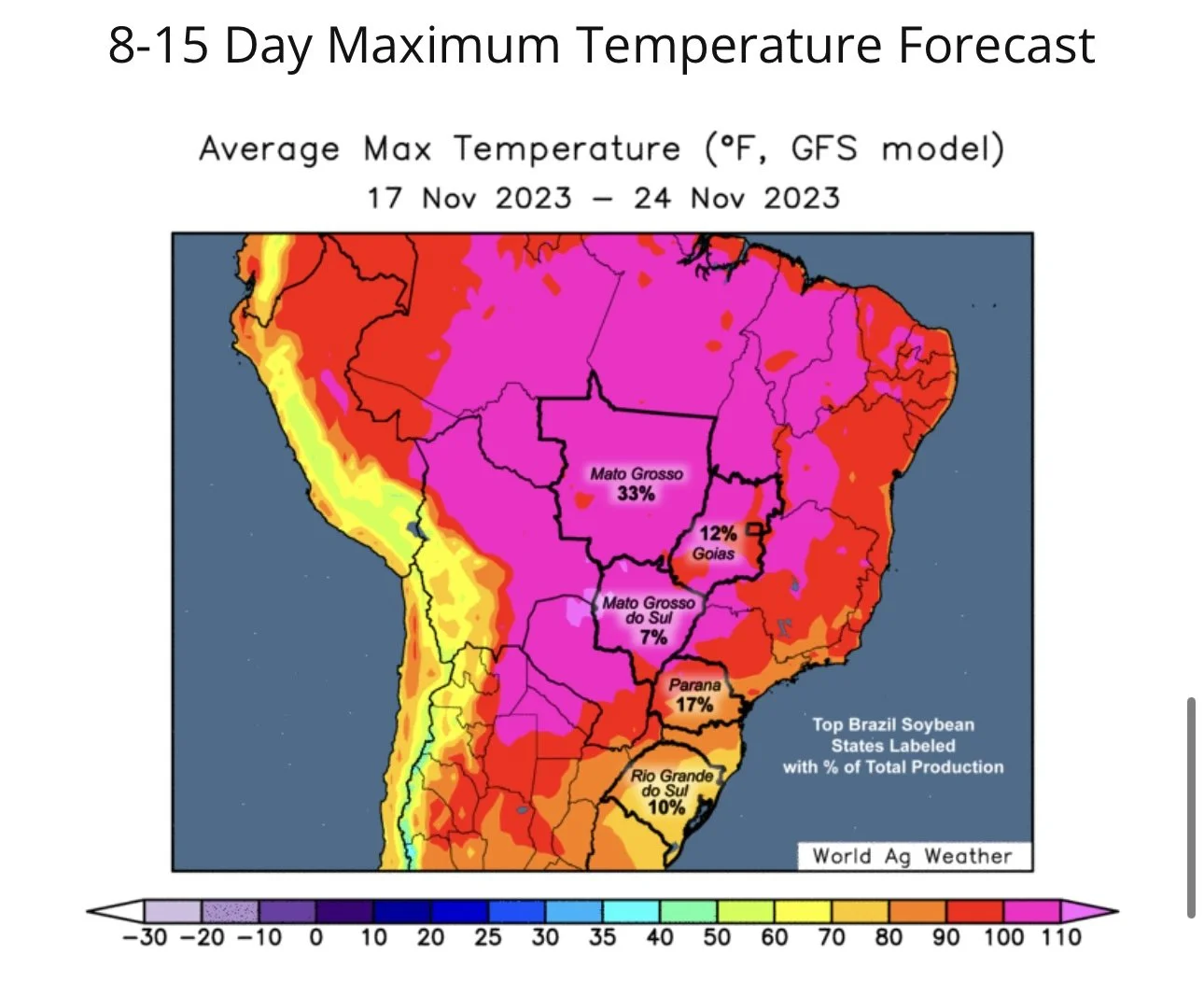

The second is Brazil. This factor alone has the power to overtake the bearishness from yesterday's report. It also has the potential to push us to $14 to $15 or perhaps higher beans if the cards all fall right. Again "potential".

We will be going over the report more later in today’s update. But first let's take a look at how Brazil's weather is shaping up.

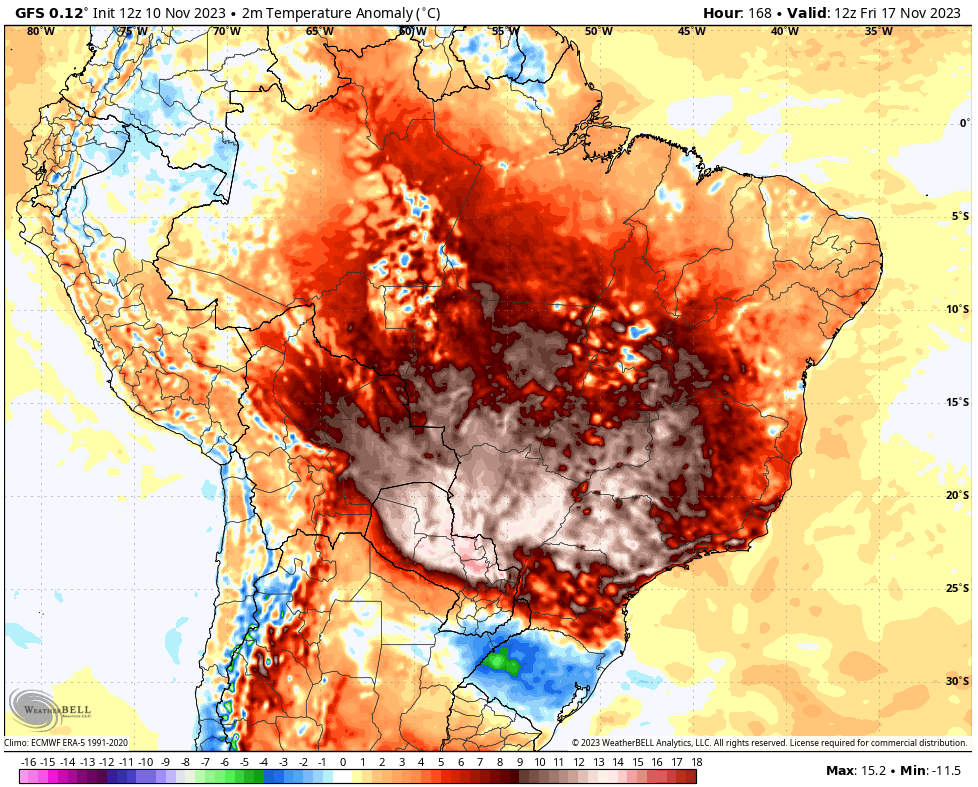

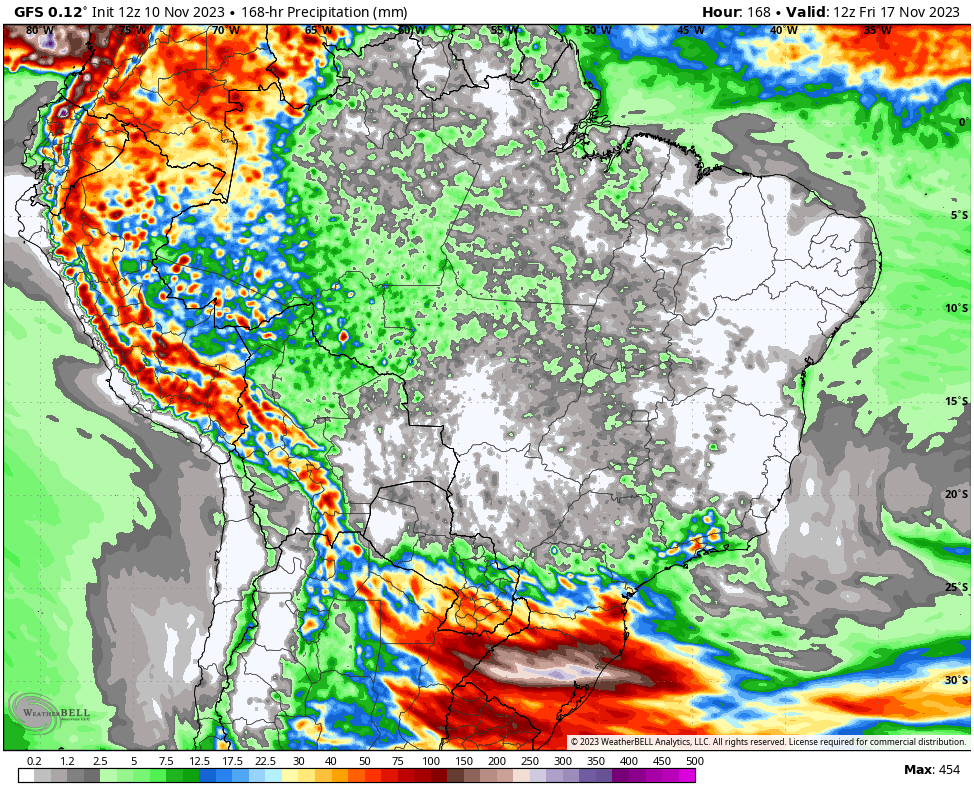

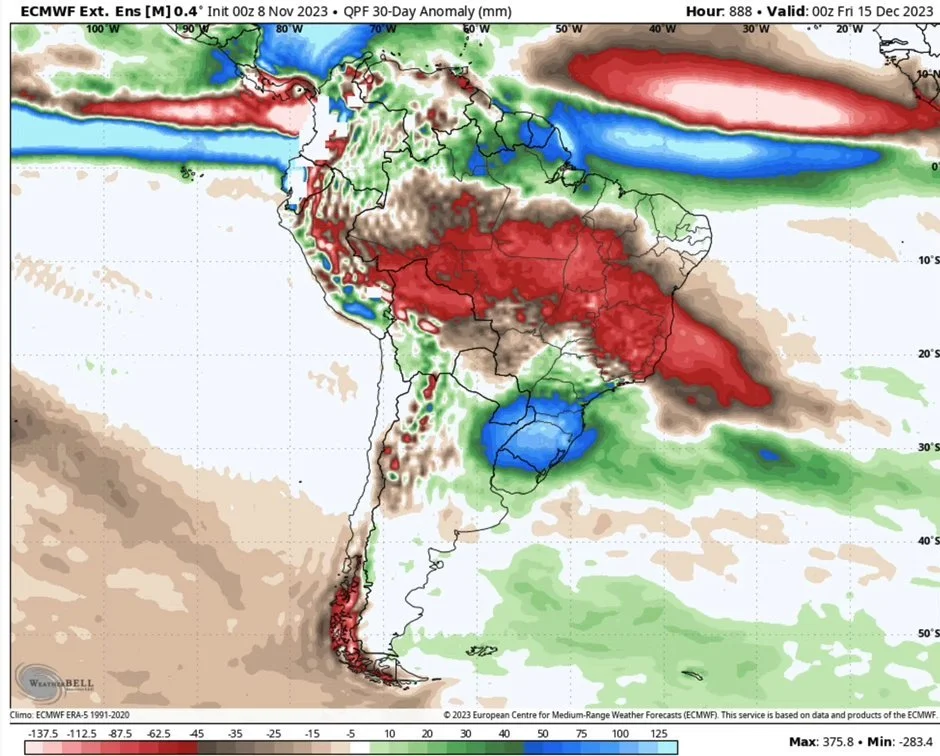

Currently, this still remains a bullish factor. It is far too wet down south, and brutally dry and hot to north. Not only is the north lacking rain, but they are also now facing record heat up there with temps of over 100 degrees.

Take a look at these forecasts and I’ll let you decide if you think this is favorable growing conditions.

Now weather can always change, but if this persists into December, Brazil could have a problem on their hands.

From Kory Melby, Brazil Ag Consultant:

"Massive replant needed the next 20 days. Doubt if enough seed and for sure wrong maturity for the cycle we are in now. Yield hit is a given."

From Wright on the Market:

"While the chatter about South American weather is much greater this week, the market is not yet investing money on it. That will happen soon, but maybe not until the first half of December, then again maybe next week. Rest assured, it will happen. Brazil is going to have little corn to export in 2024. Argentina will not have any until at least May and we know for sure Ukraine will have less corn to export for the 3rd consecutive year. Figure out a way to stay long corn & beans."

LAST CHANCES FOR 50% OFF

This will be one of your last opportunities to lock in this huge discount before your trial expires.

Become a Price Maker.

Today's Main Takeaways

Corn

Corn is 11 cents lower the past two days due to the USDA report. As mentioned, we took out that key support of $4.68 we have been talking about for weeks now. We did mention two weeks ago that there was a good possibility we looked to test or even break those lows. Now we have. So what now?

First let's look at the report. Overall, bearish.

Yield was increased nearly a large 2 bushels an acre. We have a large carryout, which we have said will make it difficult for corn to rally. But what they did do in the report was also increase our demand across the board. So that was somewhat of a silver lining, offsetting some of the production with demand. But overall, we still have a ton of corn which isn’t going to help corn rally.

What the market did not reflect in the price action the past two days is the fact that the USDA also raised their consumption of corn enough that the "bigger carryout" is still the same number of days' use as it was last report. That being 54 days.

For such a bearish report, one takeaway is that corn actually held in fairly well the past two days. We got a 2 bushel increase to yield, yet prices only fell 7 cents yesterday and another 4 today.

Yesterday for example, even with the obvious bearishness, we didn’t just completely fall apart. We held that key support. However, yes today we did finally break $4.68 which short term could very well lead to the funds trying to push us a little lower here in hopes of finding a new bottom.

As mentioned yesterday, it wouldn’t take much to have a pretty big buy signal for corn over the coming weeks. Other advisors also do currently have buy signals in for corn. Which I would agree, if you were forced to make sales now, I'd look to re-own. Give us a call at (605)295-3100 and we can go over what would be the best option for you. For the majority of you we aren’t doing anything except being patient.

On the bright side, it was a great week for demand in the corn market. As we had plenty of flash sales.

Bottom line, we could see a little more downside technical pressure here since we broke support. But with us near the bottom of the range, I don’t think we will see a ton of selling down here. There is simply more upside than downside currently in the corn market.

Biggest things to get corn to be able to hold a rally is some serious Brazil concerns or an uptick in Chinese appetite. We could reverse at any moment due to weather or demand, but a 2 billion carryout is a heavy weight.

Corn Dec-23

Soybeans

Soybeans get a small bounce following yesterday's bearish numbers. As expected with the bearish report, beans took a nose yesterday. Closing down over -20 cents lower.

In yesterday's report we saw the USDA bump yield by 0.3 bushels to 49.9 bushels an acre, increasing production by 25 million bushels. The USDA also did not make any changes to their demand numbers, which means that these extra bushels went straight to our carryout. The carryout went from 220 to 245 million.

Obviously not a good report, but could have certainly been worse.

Outside of the report, demand has been very strong for beans. We had multiple flash sales through out the week. Yesterday was a top-10 biggest daily export announcement ever.

The USDA opted to leave Brazil production unchanged yesterday, but CONAB actually increased their estimates to 162.42 million metric tons, but that is still slightly below the USDA's 163.

One big thing I wanted to show you is this chart from SLE Farms of Brazil. It shows the 6 professional organizations and their Brazil soybean estimates.

4 of them were private organizations. The other 2? The USDA and CONAB.

4 of those organizations reduced their Brazil crop estimates. 1 left it unchanged. 1 raised their estimate.

Yes, the 4 private organizations ALL lowered their estimates. But the 2 government organizations did not....

Short term, we could be in for a battle. Long term, if China keeps coming to buy it should help bulls get the edge.

Unless this Brazil problem just miraculously goes away out of nowhere, I believe higher prices are in store. It's still a tad early, so anything could happen. If they raise a good crop, we go lower. If this weather trend continues and they disappoint, we go higher. Looking long term, still not counting out $14 to $15 beans.

Taking a look at the chart, $13.27 is our first downside risk. We are currently sitting right above the $13.45 support line. First upside target is $13.63. A solid close above could bring $13.88 then $14+.

Soybeans Nov-23

SAVE $400 A YEAR - LIMITED TIME

Use this special discount link below to take advantage of this offer before your trial ends.

Wheat

The wheat market leads the downside to close out the week.

In yesterday's report we didn’t see any huge drastic changes, which was expected. The report wasn’t super bearish, but wasn’t bullish due to the increase in Russia's crop.

We saw the 2023 to 2024 production numbers left unchanged, but the USDA increased wheat imports which bumped up total supply. Demand was also slightly lowered.

We saw many countries such as Argentina, India, Brazil, and the UK all have their production lowered. But these were partly offset with the big increase to the Russian crop. Continuing to fuel the argument that Russia still has plenty of cheap grain to go around.

Bottom line, there are still factors floating around that could push wheat higher. I still hold a bullish tilt and view wheat as a sleeper. Knowing the funds could reverse this market anytime. As a producer I'm remaining patient.

Weather and war as always will be the headlines to watch.

Taking a look at the chart, if prices can break and hold above that 20-day moving average, which we are currently sitting on, we could expect to see the funds step in as buyers and lead to a short-covering rally. Myself and the bulls still have our eyes set on $6. Then we can get excited.

Chicago Dec-23

KC Dec-23

Check Out Past Updates

11/9/23

USDA REPORT RECAP

Read More

11/8/23

GRAINS FIRM AHEAD OF USDA REPORT

11/7/23

GRAINS LOWER AS TRADE PREPARES FOR USDA

11/6/23

BEANS CONTINUE BULL RUN AS HARVEST WRAPS UP

11/3/23

BEANS RALLY & CORN HOLDS OFF NEW LOWS

11/2/23

EVENING THE PLAYING FIELD

Read More

11/1/23

CORN CONTINUES LOWER & BRAZIL CONCERNS

10/30/23

HOW TO BEAT BIG AG AT THEIR OWN GAME

10/27/23