EXPECT BIG PRICE SWINGS & VOLATILITY

Overview

Grains higher across the board as wheat leads the rally taking back the losses from yesterday. Much like yesterday when there wasn’t any real fundamental news driving us down, we didn't have much driving us up today. We are in a time where volatility is only going to increase. Whether that move is up or down, and sometimes the funds are going to move this market for no rhyme or reason.

Big price swings should not be a surprise here as this volatility is just getting started. Do not be surprised if we go screaming higher one day only to come crashing back down the next for no particular reason. Just like how corn roared higher after the USDA report only to come back down to pre-report levels just two days later. Short term this market is going to be driven by big money and the algos.

Overall there is no real fresh news in the grains. They threw some rains in the forecasts for Brazil, but dryness is still a concern and the outlook for April and May leans dry. Brazil will be a wild card.

We also got that bird flu headline. Where bird flu hit cows, chickens, and now humans. The fear there is that when these birds migrate north they could bring this disease with them. This could be a problem for the chicken market and has some thinking it could lead to corn demand and bean meal demand seeing a downtick.

When we get headlines like that, sometimes the market can take it on the chin initially even if this doesn’t fundamentally change anything at all. The market will quickly go back to trading fundamentals and weather.

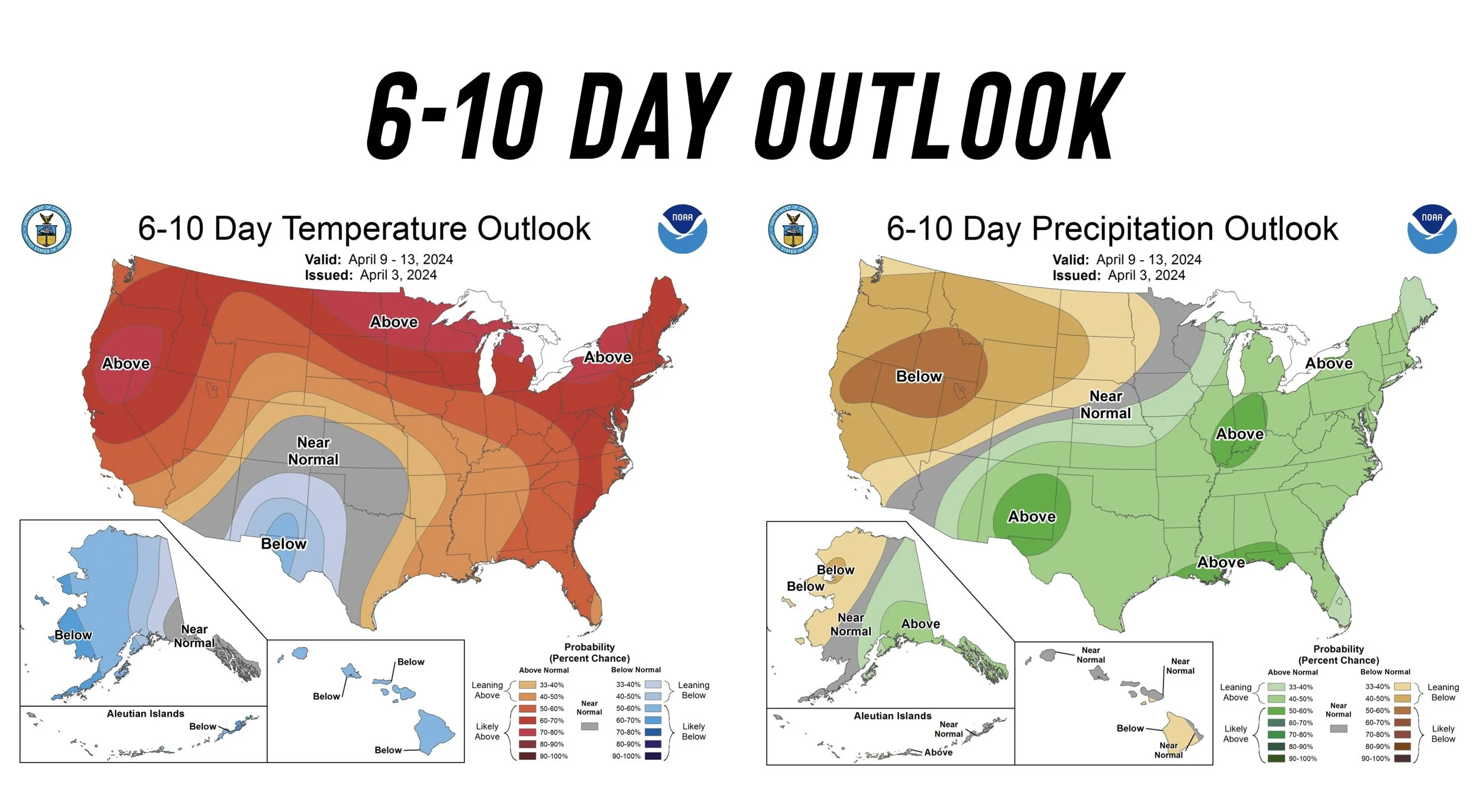

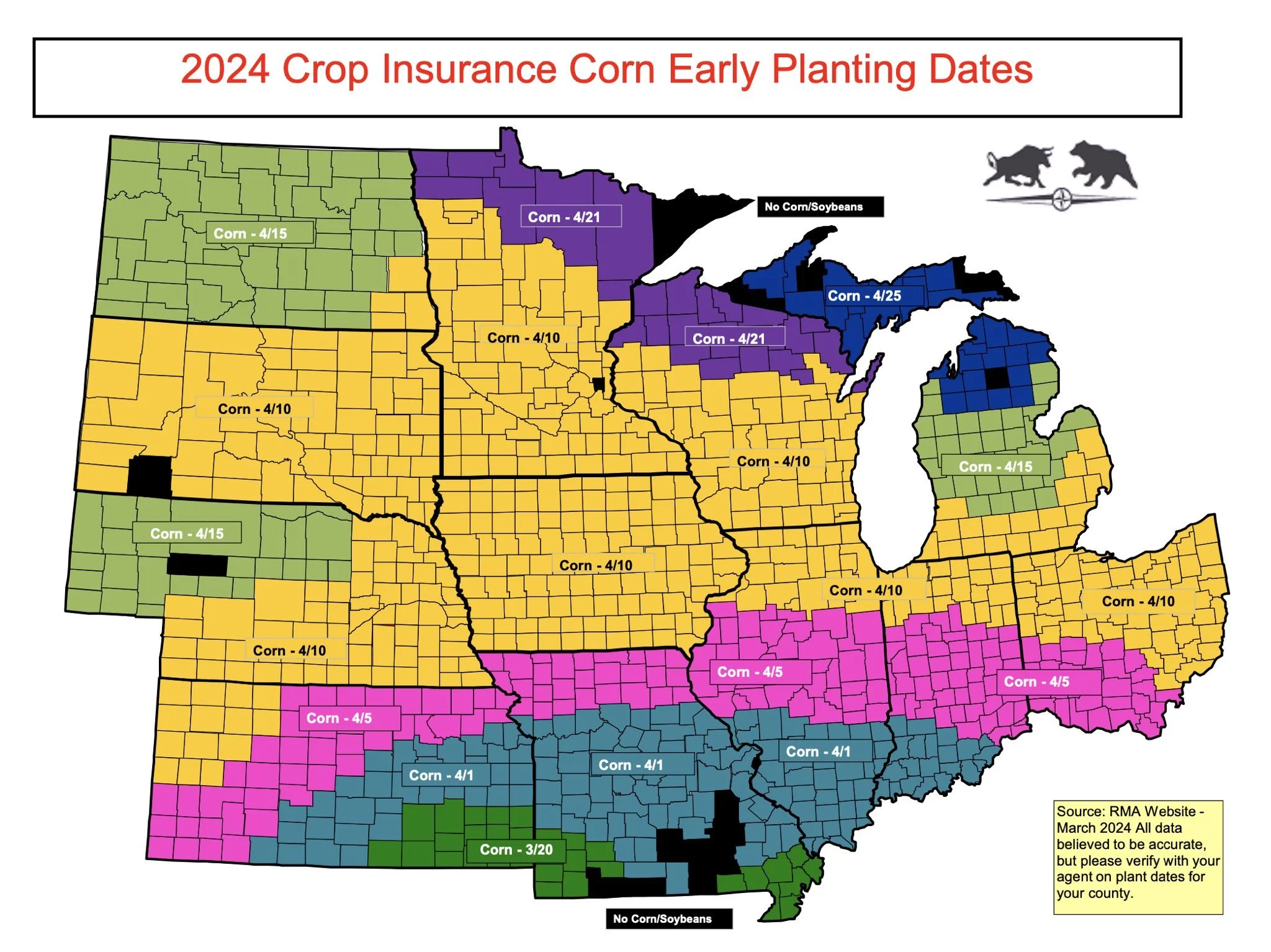

As for weather in the US, initially we heard all this talk about early planting. Now the talk is possible late planting. As the corn belt has got good rains this week and there is more in the forecasts for April. This has some thinking we could see slow field work, but this will be much needed for that soil moisture.

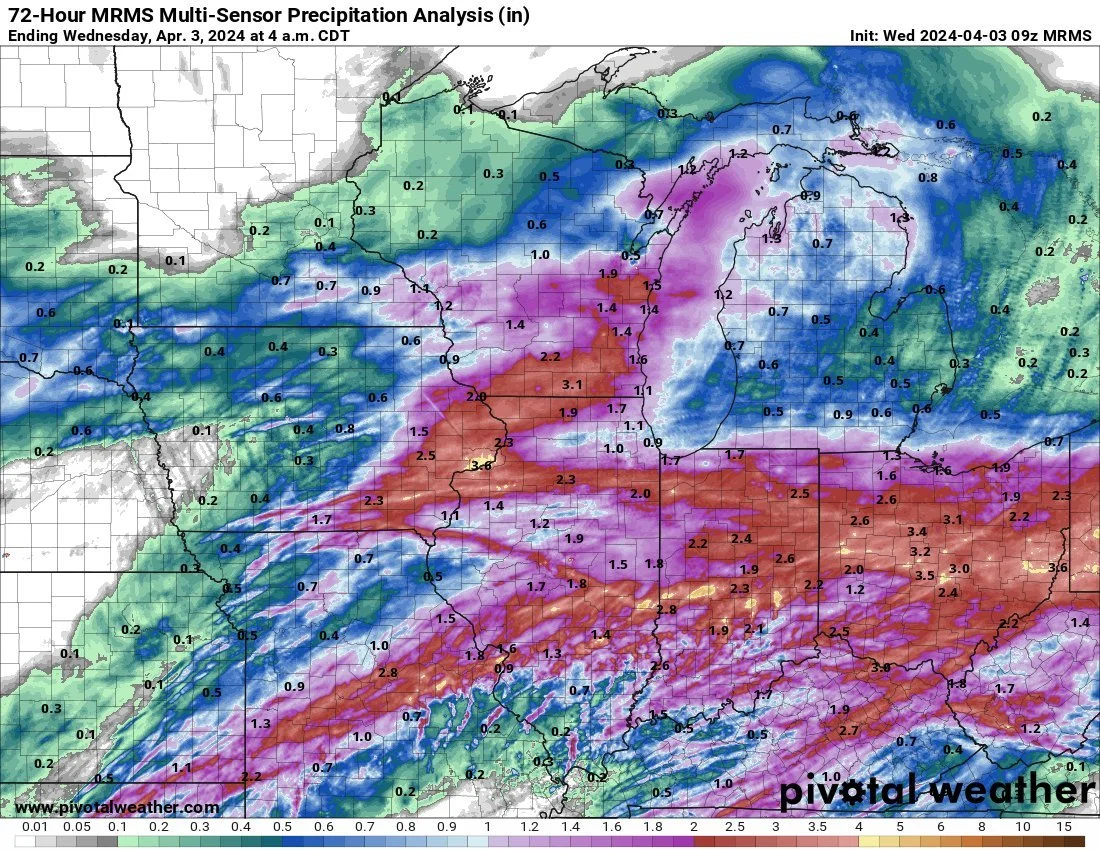

Here is the past 72 hours of rain.

It is cold right now so a lot of that rain is not being absorbed, however it is suppose to warm right back up next week.

So 10 days from now could offer a decent planting window.

Things might go quicker west of those rains.

However many corn growers might wait for the insurance dates as well.

Today's Main Takeaways

Corn

Corn follows the rest of the market higher as we are exactly where we were last Tuesday after giving up the entire rally from Thursdays report.

Most of the recent sell off was due to farmer selling as well as fund selling.

Going into that report it felt horrible like all hope was lost. But then the report gave us a bullish surprise so some farmers took advantage, even though that rally only put us where we were just a week prior.

Taking a look at the acres, of those acres we lost in the report, a lot of them were from fringe areas which makes sense given the low prices and lower profitability lately.

Could we see acres higher come June? Absolutely. However I do not expect acres to climb much higher than 91.

The economics of planting soybeans just makes more sense than it does to throw extra money at corn right now.

Based on prices alone we should naturally be seeing more bean acres. Keep in mind that we are coming off of years where in comparison we planted a lot more corn than beans.

Along with beans, cotton is one who could gain a lot more acres. Cotton has outperformed corn by a mile the past year. Adding to this, our cotton acres are still down dramatically from a few years ago.

Now yes, corn acres do have a tendency to see come up from March to June. The acres have came in higher the past 15 of 20 years, with the average being 1.4 million acres higher from March to June. Which would bring us to 91.4 million this year.

This survey was also done right around the time where corn made its lows. Lower prices mean lower incentives. We could likely see higher acres but not A TON in my opinion. Like I said, maybe around that 91 area. Maybe if we would’ve gotten that dry spring like many thought we would it would’ve been a different story.

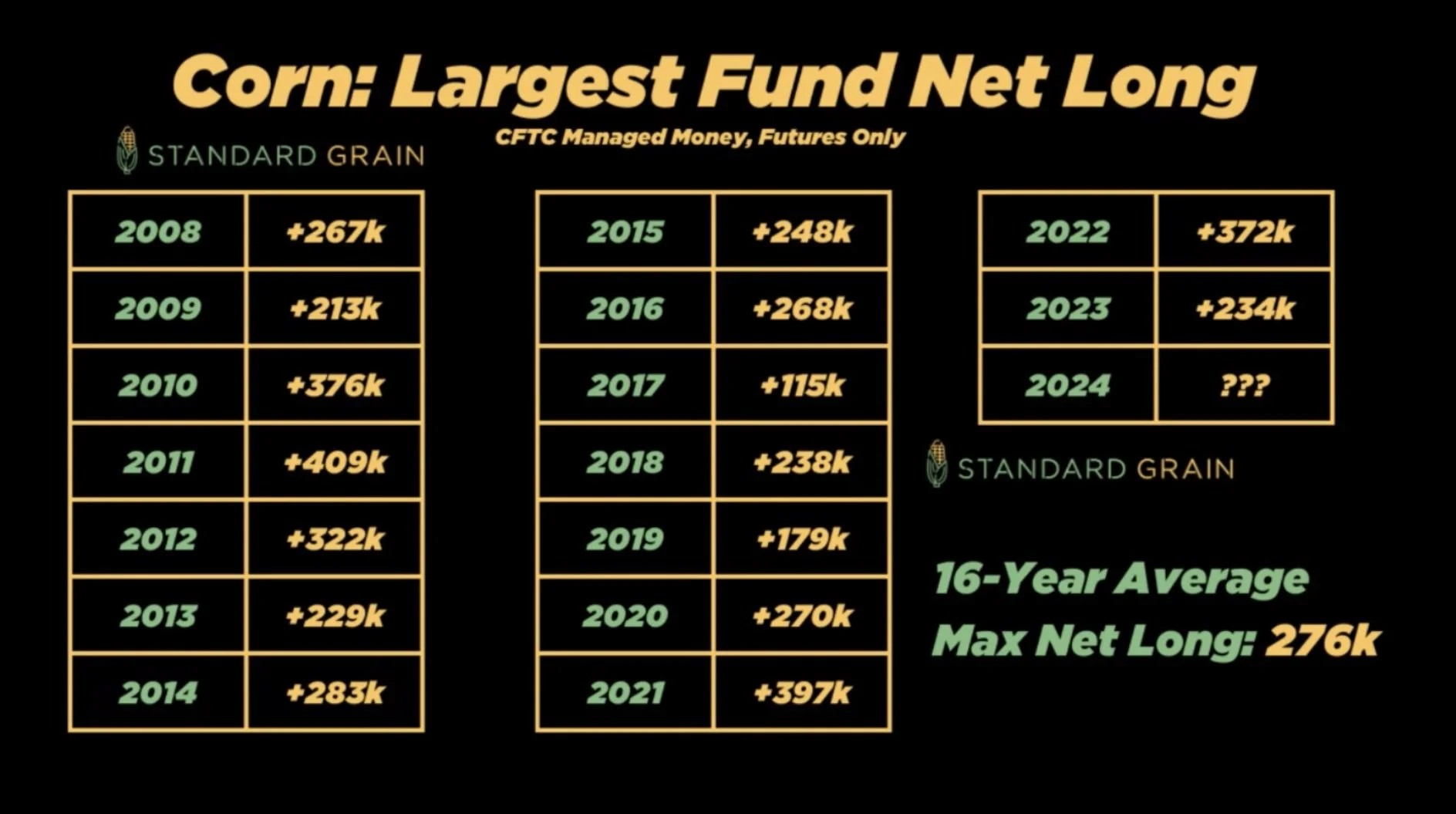

Here is a chart from Standard Grain. He points out that every single year since 2008 the funds have at one point been long corn. Will this be the first they don’t? I'd lean towards no but it is a possibility.

For the funds to get long we will probably have to have a weather scare.

The good news? We "almost" always get one. Every single year.

Now I am not saying we will get a magical $1.00 rally, but we will get one. We are going to get weather volatility. Some of it will be higher, some lower.

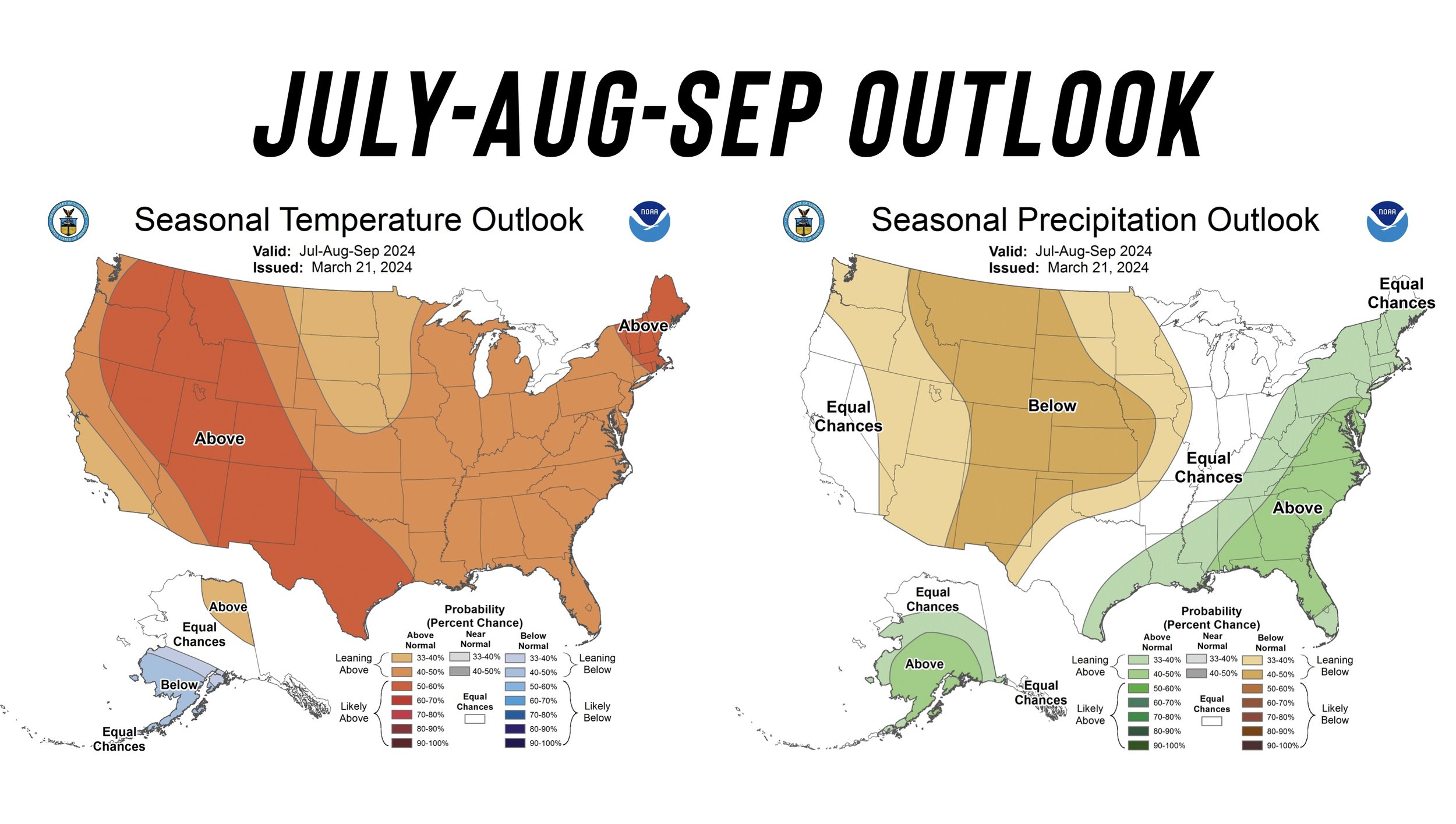

We are more likely to get this weather scare in summer rather than spring unless we get a planting scare. Because growing season is the single most important thing that impacts corn prices. Right now the outlook is hot and dry for summer in the western corn belt.

If you were to compare how our carryout changes based on yield, this is what it would look like given demand stays the same. The USDA currently predicts a 181 yield, which would far and away be a record.

181 yield with 90 million planted acres = 2.24 billion bushel carryout

172 yield with 90 million planted acres = 1.50 billion bushel carryout

If yield dropped to 172 and our carryout dropped to 1.5 billion, it would cause a major rally. It would take off nearly -800 million bushels. Now this might be an extreme example, but this number doesn’t even have to happen. It just has to be a thought. All it takes is a few weeks of the market believing this could be a possibility. Take last year for example.

It would be better to get this rally before the June 30th acre report due to the possibility that we see acres bumped higher. But if we get a weather scare before that report, the market might think "oh dang we only planted 90 million acres of corn and yield might be 174 or lower". This would bring excitement and push the market higher.

Bottom line, short term I see very choppy very volatile markets. Up one day, down the next. We will likely go down and test the recent lows then go up and test the recent highs and be stuck in a sideways range for a little while.

The market will likely not pay much attention to late planting IF we get any until mid-May. If planting is going good the market could go lower. Then the market won’t pay attention to drought scares until June likely.

As we get further into spring and early summer we should get a weather scare that will provide a better pricing opportunity. If you are forced to make sales here, I like the idea of some sort of re-ownership strategy for some of you. Give us a call if you have questions. (605)295-3100.

Corn May-24

Miss Our USDA Report Sale?

Since you are on a free trial, here is access to our USDA sale that ended Saturday. Comes with 1 on 1 grain marketing planning to create a plan of attack for your operation along with 24/7 access to discuss your situation.

Soybeans

Soybeans higher, but much like rest of the market there was no fundamental reason outside of technical and fund buying.

However we did see some strength in palm oil which helped pull bean oil higher.

As I mentioned in the corn section, more bean acres is a possibility. So that is one potential risk this market could face later this year.

Overall there is a lack of news for soybeans. Brazil is done with harvest. The market is still debating at how big or small that crop is. The crop has the potential to be smaller than some think, but it's an unknown wild card.

We are also not yet into the US planting season. When we start to get going, this volatility is going to only get worse. Beans can go up double digits and then back down double digits, back and forth.

Despite the possibility for higher acres, one thing beans have that corn does not is a friendly balance sheet. Our bean situation is far tighter. If we get any hiccup in weather this growing season things could get even tighter.

If acres stay at 86.5 million and our yield comes in at 50, that would give us a carryout in the realm of 200 million bushels. I am not saying that will happen, just pointing out what would happen.

To go along with that I don’t see crush demand going away and we have seen strong recent crush reports each month.

The soybean crop is made in August. If you take a look at the longer term forecasts, things are suppose to get hot and dry from July until September.

Bottom line, seasonally April is a friendly month for soybeans. However just like corn I could see some brutal sideways action short term.

Long term I do believe we will get better pricing opportunities. $13 to $14 beans is not a far fetched reality.

Looking at the chart, a clean break above $12.17 should bring more upside.

Soybeans May-24

Wheat

Wheat leads the way higher.

One factor that may have helped wheat was Russia news.

From Market Screener:

"Russian authorities have halted grain exports on some ships belonging to Aston, one of the biggest local grain trading houses, widening a quality probe which has already curbed the exports of another major trader. As the world's top wheat exporter, any disruption to Russian shipments can drive up global prices."

Then we had a weaker dollar which added support, but overall no real news outside of that.

As has been the case recently, there is not much new for bulls or bears to chew on in the wheat market.

The biggest thing keeping a lid on wheat is of course cheap ample supply from Russia.

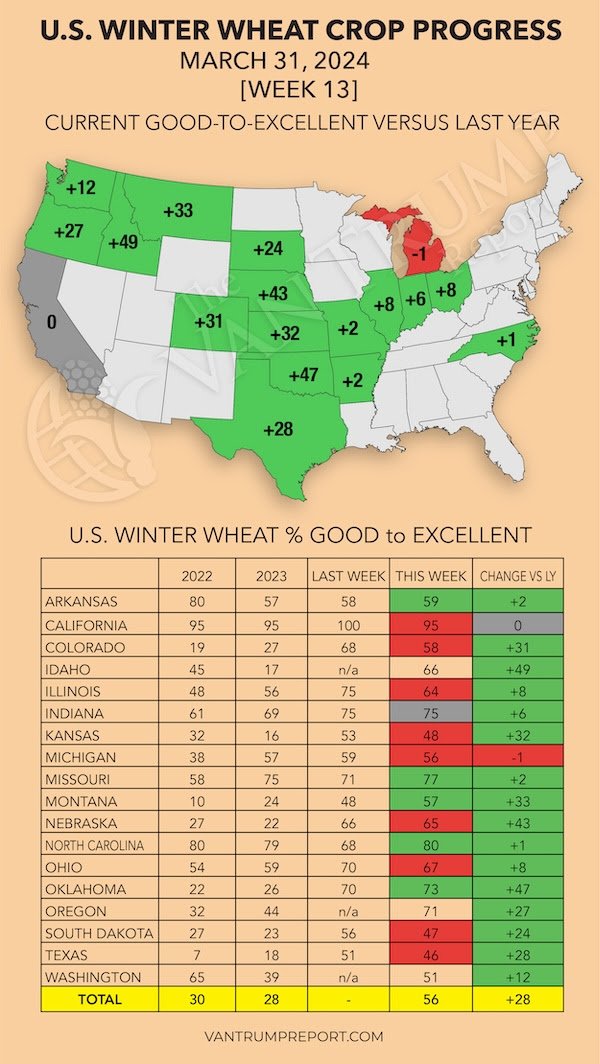

Secondly the winter wheat crop here is a lot better than last year.

Take a look at the comparisons from last year from Kevin Van Trump.

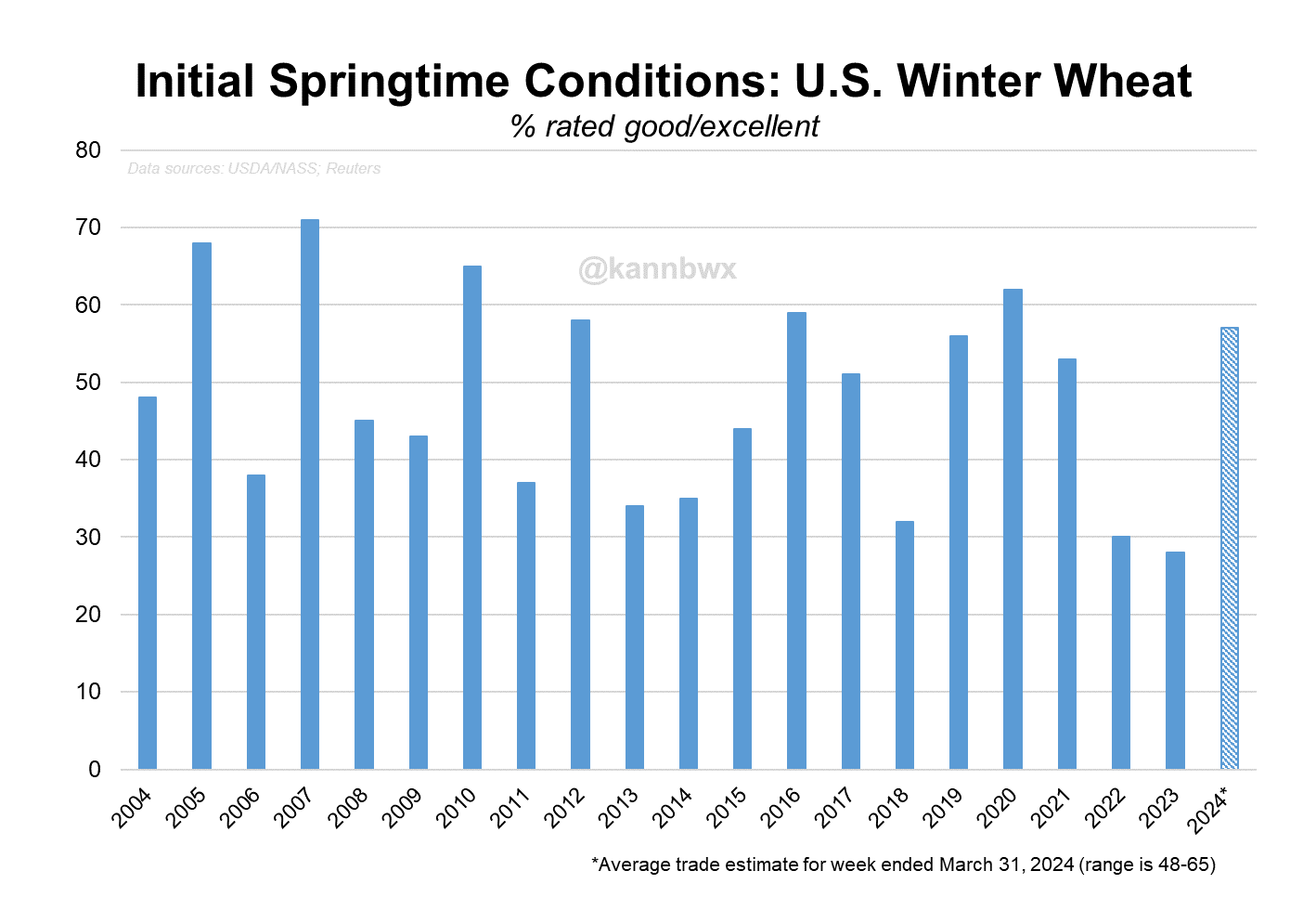

This wheat crop is rated 57% good to excellent. Well above the last two years, but about on par with where we were for the 3 years prior.

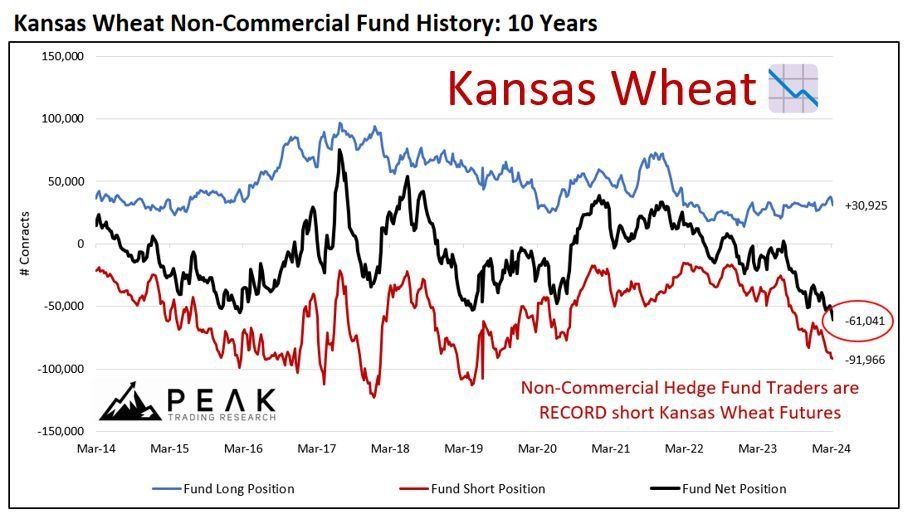

One friendly thing wheat has going for it is the fact that funds are record short KC wheat this week.

Bottom line, I am remaining patient in wheat. I don’t expect us to go screaming higher out of nowhere. Seasonally we go higher into June.

Taking a look at the KC wheat chart, we got a key reversal higher. Right now we are battling for our first break above that downward trendline since August of last year. A break above would look friendly.

May-24 Chicago

May-24 KC

Cotton

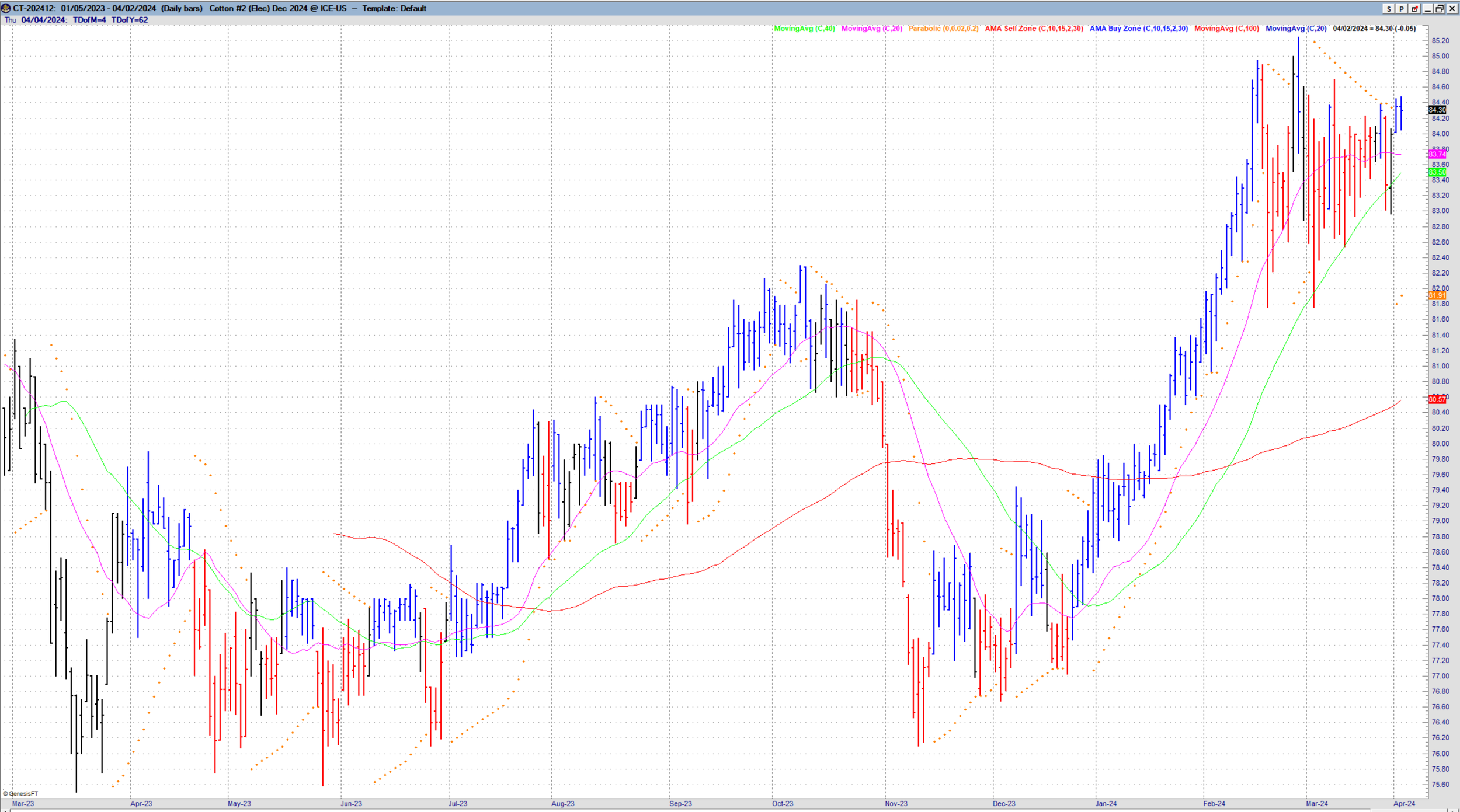

From Lauren Urbanczyk of Texas Hedge Risk Management:

The cotton market had been range bound from October 2022 through January of 2024, breaking out of the sideways range in February to the upside. When interest rates started to increase, mills wanted to keep as little inventory on hand as possible. The 2023 growing season resulted in lower production, and the effects were finally felt when mills had to move past the bare minimum of supply inventory and find cotton in the cash market. (May Cotton chart below.) The fireworks for old crop cotton have subsided and may be coming to an end. While new crop cotton acres are expected to be up 4% from last year, December cotton is consolidating at the upper end of the range. Due to the higher cost of inputs, most growers are still looking for higher new crop prices before getting serious about selling or forward contracting, especially as we have not entered planting season yet. There is a large gap on the daily continuous cotton contract at $1.34, and it remains to be seen what year we can expect that gap to be filled. The good news is that cotton seems to have awoken from its 18 month slumber and hopefully will provide more pricing opportunities over the coming growing season. We have recommended getting a floor under at least 25% of your cotton production for the 2024 season with puts before planting. (This is not a trade solicitation.)

May Cotton

Dec Cotton

Weekly Continuous Chart

Cattle

Cattle market continues lower with the bird flue news.

I had been saying for weeks that this market looked toppy and could be nearing it's highs.

The charts look pretty negative and could certainly bring on more downside from here.

If you want to discuss different strategies to use please give us a call (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24

ARE YOU READY FOR USDA CRAP SHOW?

3/26/24

WHAT TO DO AHEAD OF THIS POSSIBLE TREND CHANGING USDA REPORT

3/25/24

USDA ACRES & STOCKS REPORT IN 3 DAYS

3/22/24

PRE-USDA REPORT POSITIONING

3/21/24

GRAINS FAIL TO HOLD OVERNIGHT RALLY

3/20/24

MORE SHORT COVERING LEADS TO MORE SHORT COVERING

3/19/24

WHEAT LEADS WITH RUSSIA TARIFF RUMORS

3/18/24

ARE YOU PREPARED FOR 160 OR 190 BU CORN?

3/15/24