ALL EYES ON USDA

MARKET UPDATE

Want every update & our next sell signal?

Don’t let the next opportunity like our Feb sell signal pass you by.

Here is extended access to last weeks sale.

Extended Access: CLICK HERE

You can scroll to read the usual update as well. As the written version is the exact same as the video.

Timestamps for video:

USDA Preview: 0:00min

Drought Gone?: 2:30min

Corn: 3:50min

Soybeans: 9:15min

Wheat: 11:00min

Want to talk about your situation?

(605)295-3100

Futures Prices Close

Overview

No real news as Monday's report is all that matters.

For corn, this week money (funds & traders) have just simply been stepping to the sidelines waiting for this report.

They have been talking risk off the table with the thought process that we are going to see massive corn acres.

This is the main reason corn has sold off.

USDA Preview & More History

Wednesday I went over the history of this report, how much acres usually move, and how much this typically moves the markets. If you missed it: Click Here

This report can be a massive market mover.

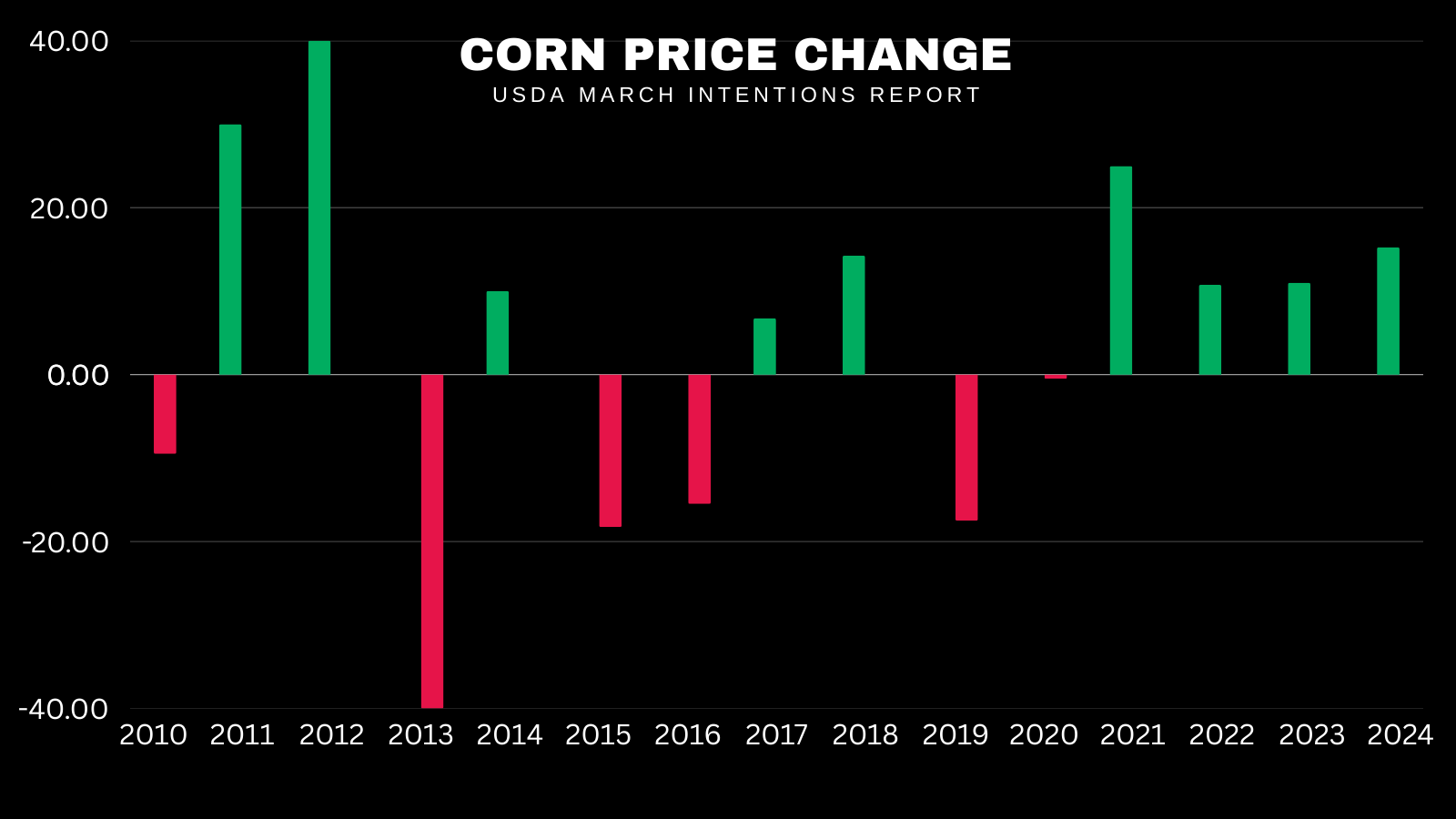

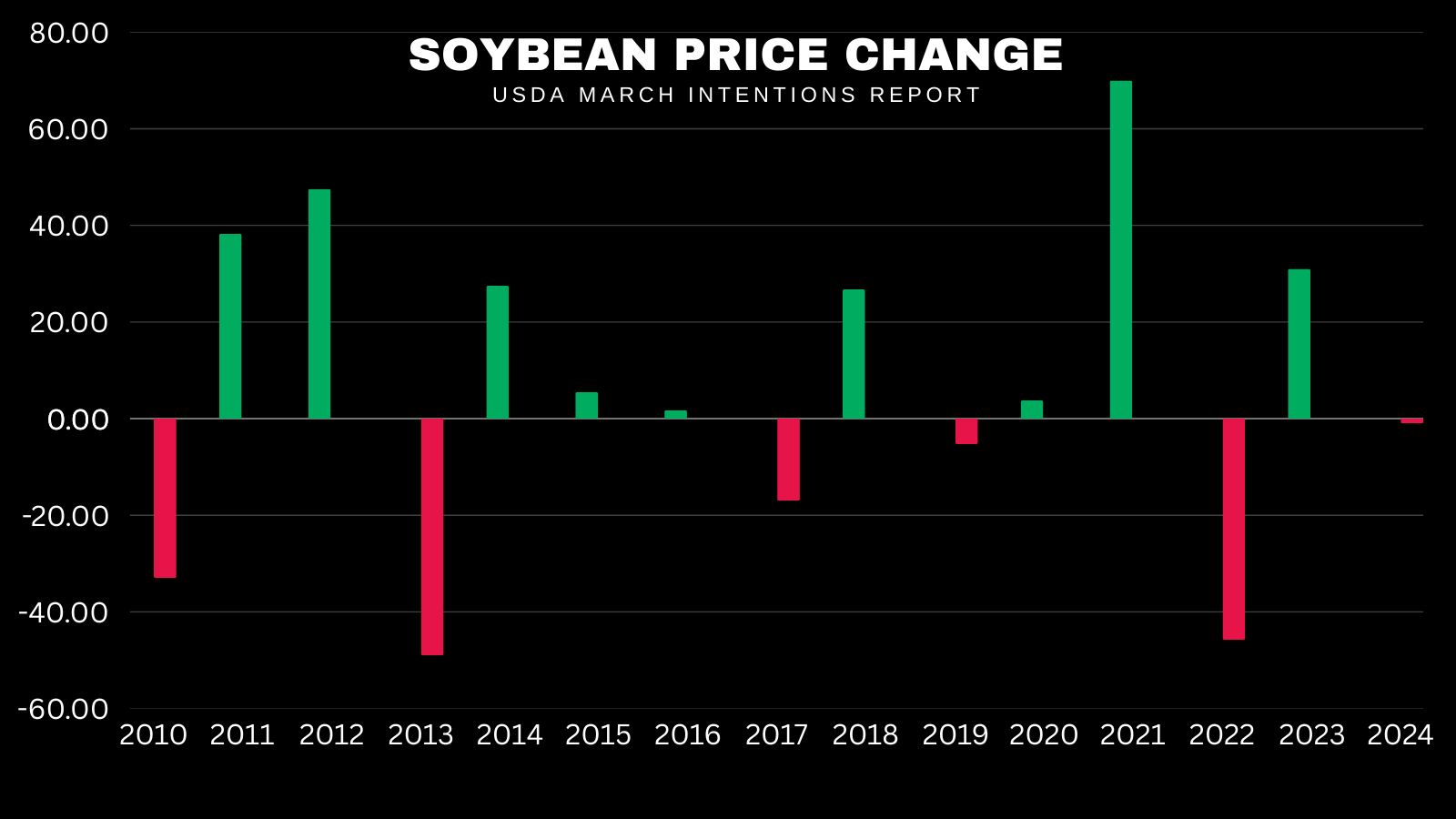

Average Price Changes for Day of Report:

Corn: 17 cents

Beans: 25 cents

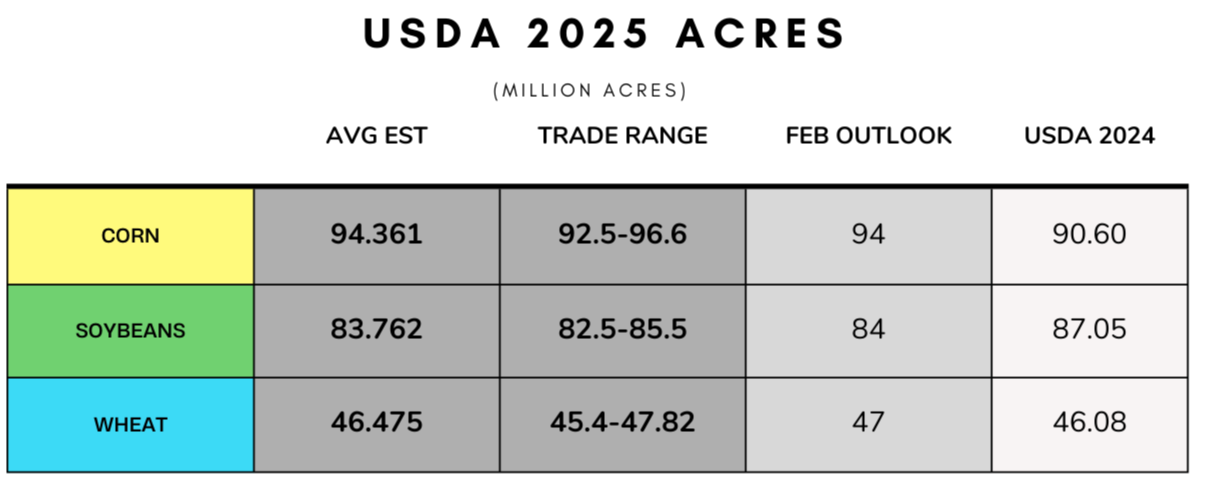

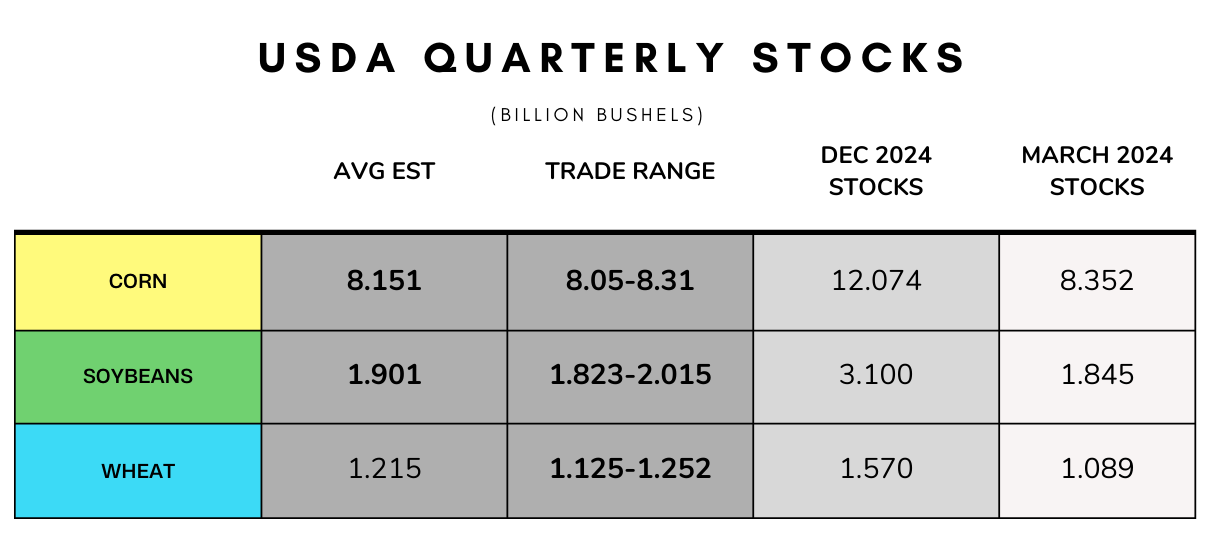

Here is the estimates.

Corn acres have a wider range of estimates than usual.

The estimates for corn stocks is the smallest range in 18 years and smallest for beans in 10 years.

Small ranges can bring surprises.

The argument for more corn acres and less soybean acres boils down to this simple chart.

The corn to soybean price ratio.

There have only been 5 years where the ratio was at these low of levels going into the report.

2009, 2011, 2012, 2013, and 2022.

(Each vertical line = USDA report) (Red line = ratio at these levels)

Here is how corn prices reacted in those reports.

The USDA corn acres came in higher than the estimates in 2009, 2011, and 2012.

USDA came in lower than expected in 2022 and right at the estimates in 2013.

Corn traded higher in 4 of these 5 years.

Having it's worst ever performance for this report of all-time in 2013.

I am not a genius. Corn could be limit down after this report.

The point is.. a bearish acre number doesn’t always result in a bearish reaction.

2009, 2011, and 2012 are good examples of the USDA coming in high yet prices going higher.

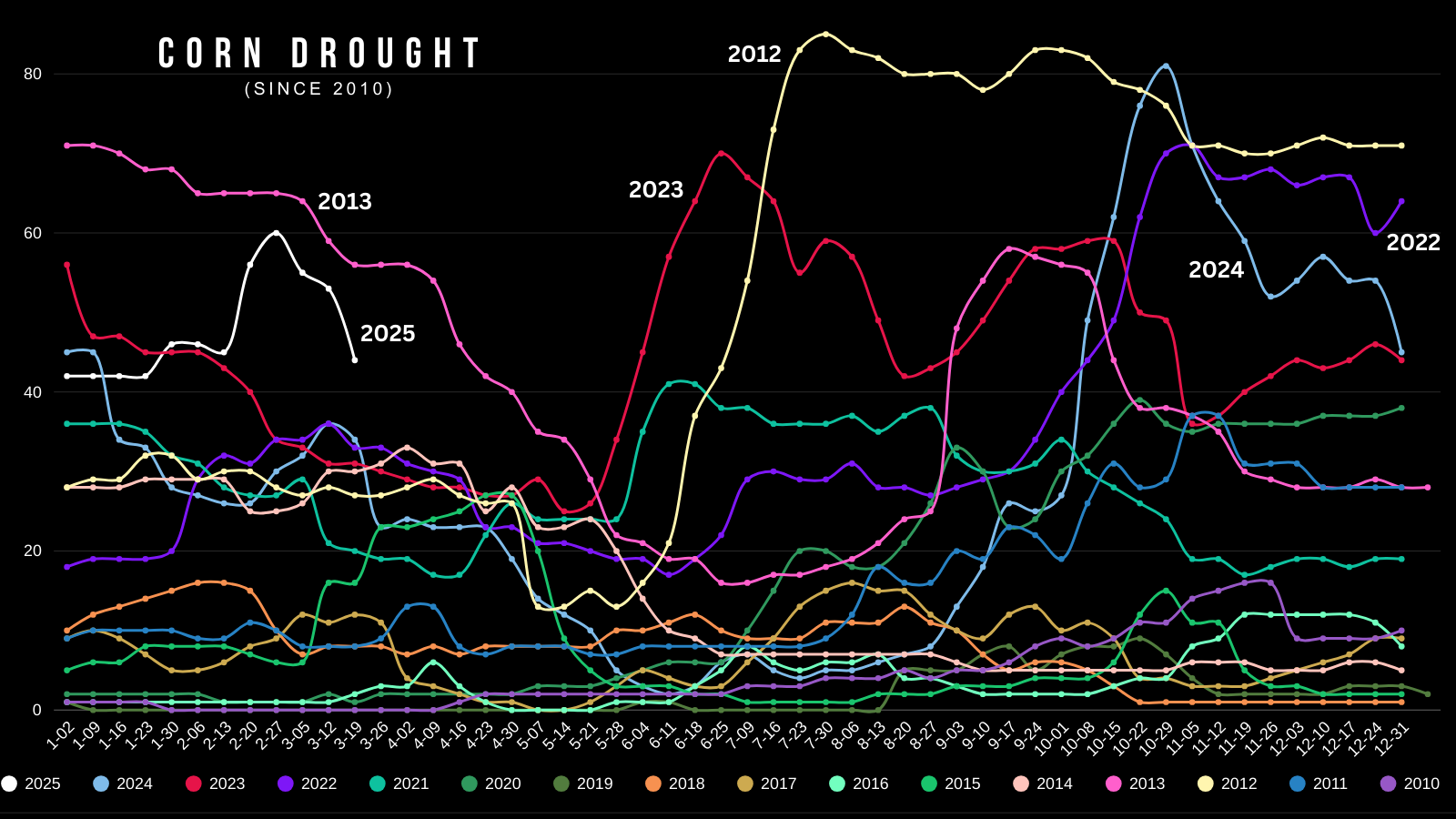

Drought Improves

Corn areas in drought dropped -11% vs last week. Now at 44% (down from 55% last week).

Is this still a lot?

Despite the drop, this is still relatively high for this time of year.

Here is how it shapes up vs past years.

4th most for this time of year. Highest since 2013.

Here is what this same chart looked like last week for reference.

Now here is a complete visualization of the drought story since 2010.

Again, this year is relatively high for this time of year despite the drop.

Typically we see drought ease in the spring, and pick up in June.

So no, drought isn’t "gone".

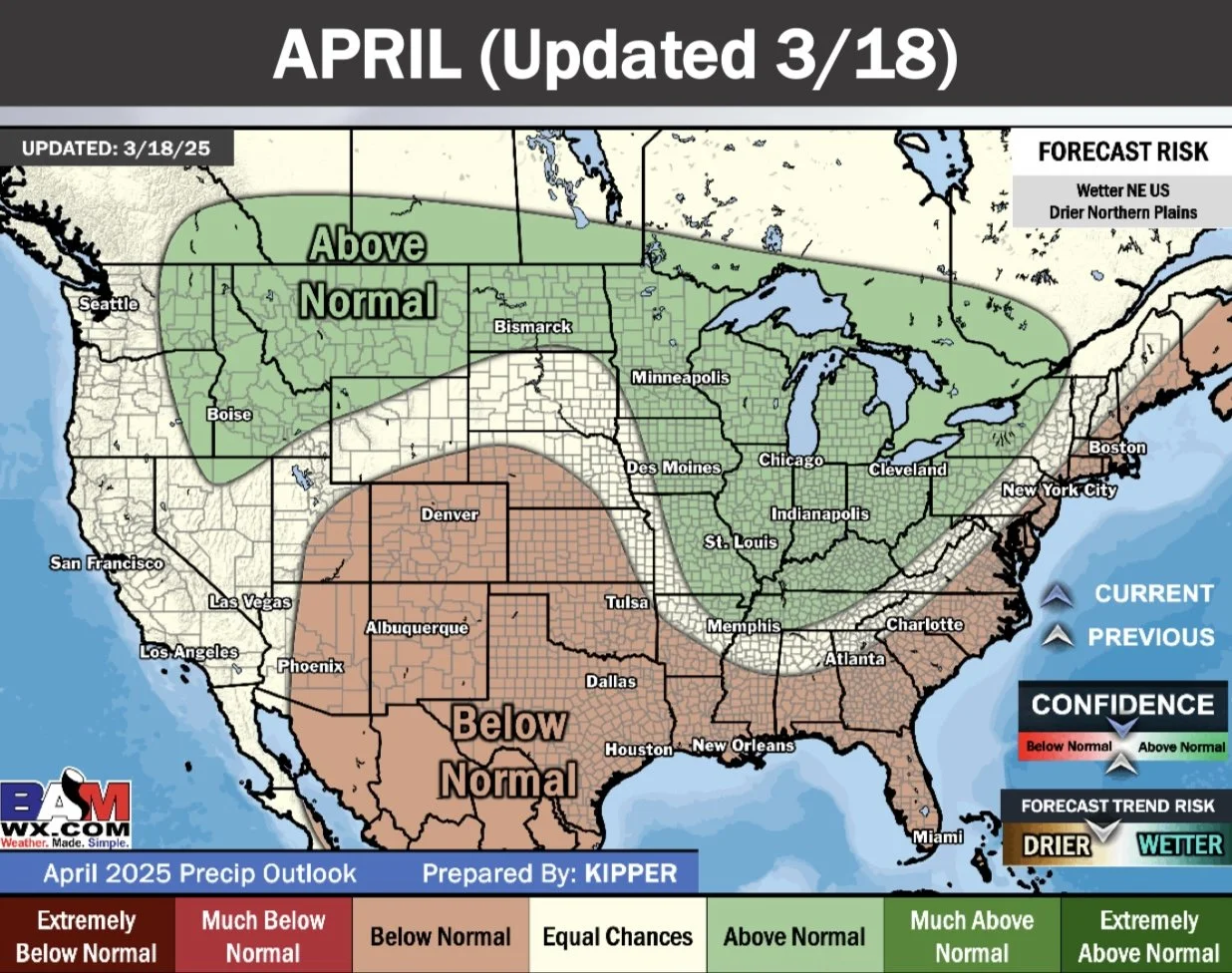

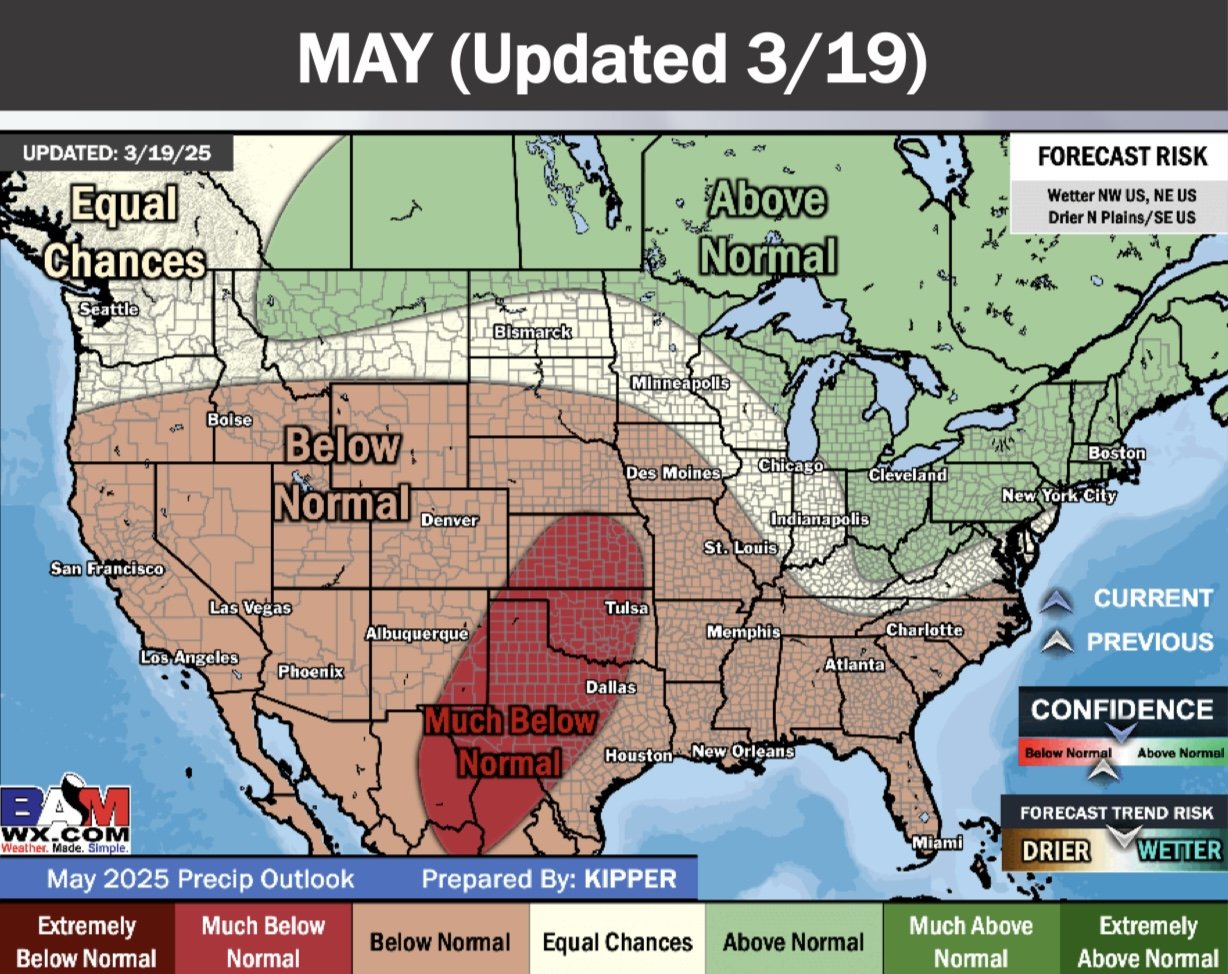

But if we look at the forecasts, April is still set to be wet.

So drought will likely continue to improve the next month and any sort of drought story will take a back seat until June if we do get one.

This could bring on wet planting and delays, but improves soil moisture so harms the summer drought story.

How Wet vs Dry Spring Impacts Prices:

Wet spring is bullish short term (planting delays) and bearish long term (improves drought).

A dry spring is bearish short term (fast planting pressure) and bullish long term (drought worsens).

Forecasts from BAM Weather

Today's Main Takeaways

Corn

Fundamentals:

Sell the rumor.. buy the fact?

Corn has dropped all week long with expectations of massive corn acres. Aka pricing in big acres. EVERYONE expects this report to be bearish.

I'd have to imagine the trade is currently trading around 95 million acres.

Meaning if acres come in at the estimates or even just above, it would make a good argument for this to be a sell the rumor buy the fact type of event.

Where the market sells off on the thought of bigger acres, then rebounds once we get confirmation. This is of course barring a number in the realm of 96 million. It will take a big acre number to get a bearish surprise.

Another thing to keep in mind: These acre numbers sound logical on paper due to the corn vs soybean price ratio, but at the same time they do not take into account several factors such as cost of production, working capital etc.

The stock numbers will be the wild card and arguably more important.

Reasons why I view corn as undervalued here and why I believe there is more potential upside vs downside:

Reason #1)

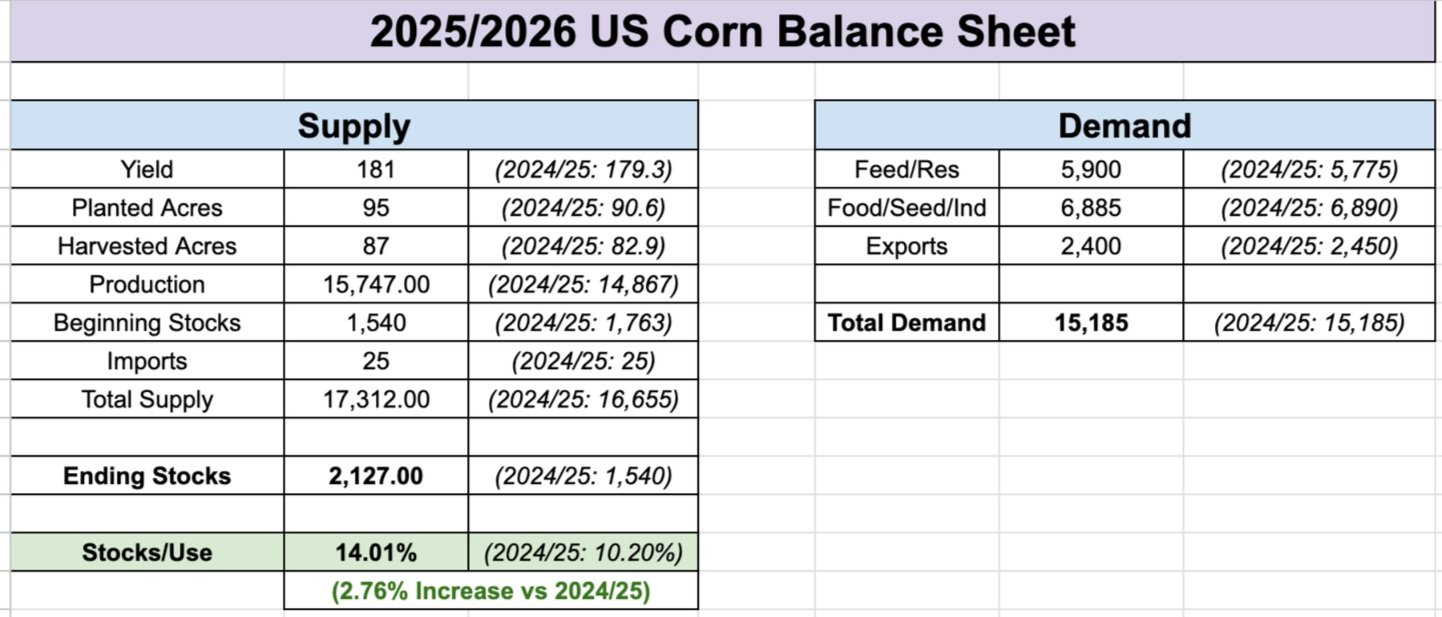

The market is pricing in 95 million acres and a +2 billion bushel carryout on new crop corn.

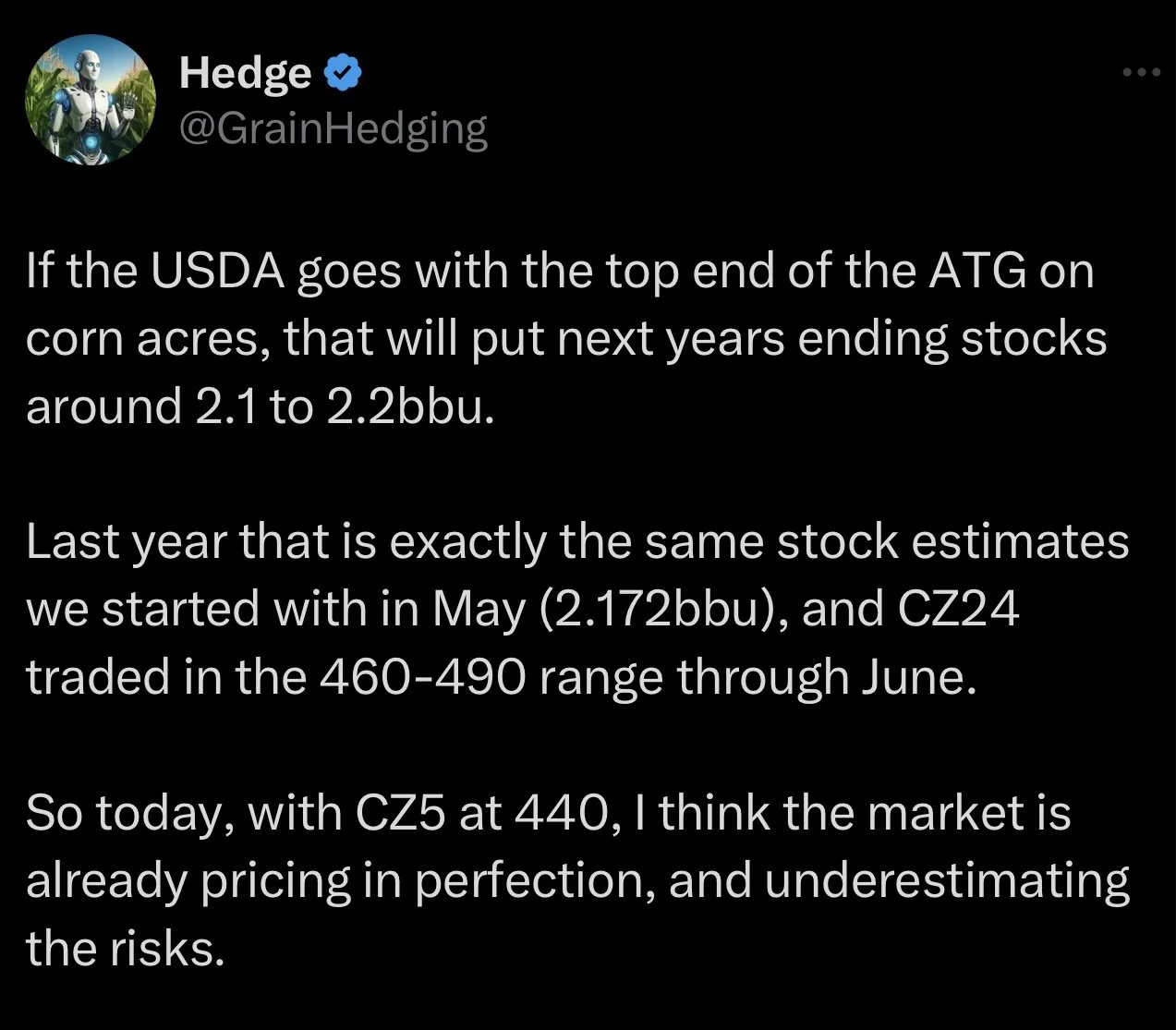

Here is a great thought that I agree with from Mr.Hedge on X.

If acres come in on the high side, that would put new crop corn carryout around 2.1 billion or so.

Here is the starting new crop balance sheet if we have 95 million acres to give you a visual.

Last year this was the exact same carryout we started with in May.

Yet, Dec-24 corn was trading anywhere from $4.60 to $4.90

Meanwhile Dec-25 corn is currently trading at $4.40.. seems undervalued.

The balance sheet above also uses a 181 yield. Which means the USDA and market must be expecting a perfect growing season.

Reason #2)

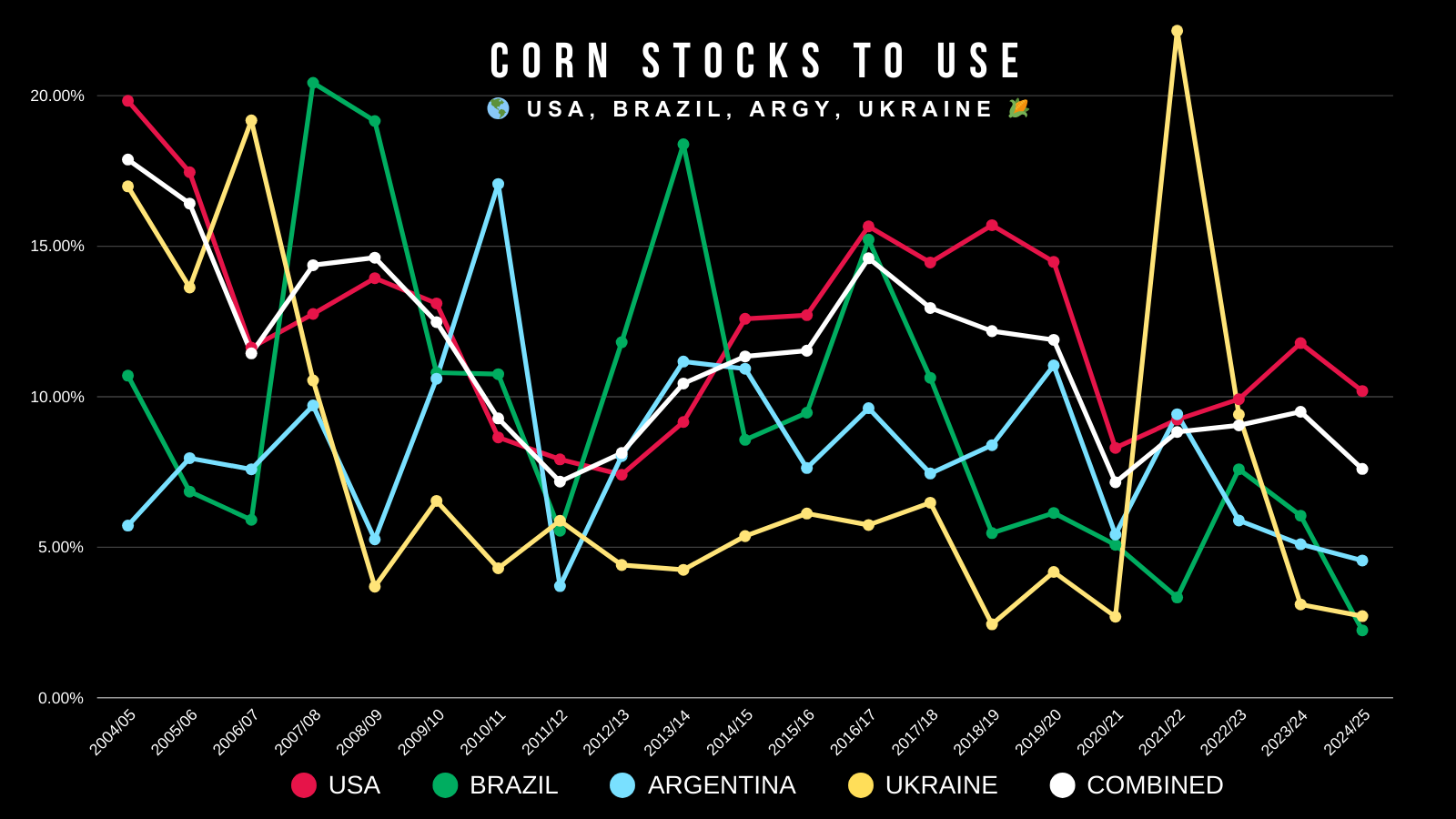

The world situation is the tightest in several years.

Here is the world corn carryout.

Just looking at corn exporting countries, their situation is the 3rd tightest ever behind 2012 and 2021.

This doesn’t mean corn "has" to go higher.

It means the US crop HAS to perform.. if not the world situation can’t afford it.

Reason #3)

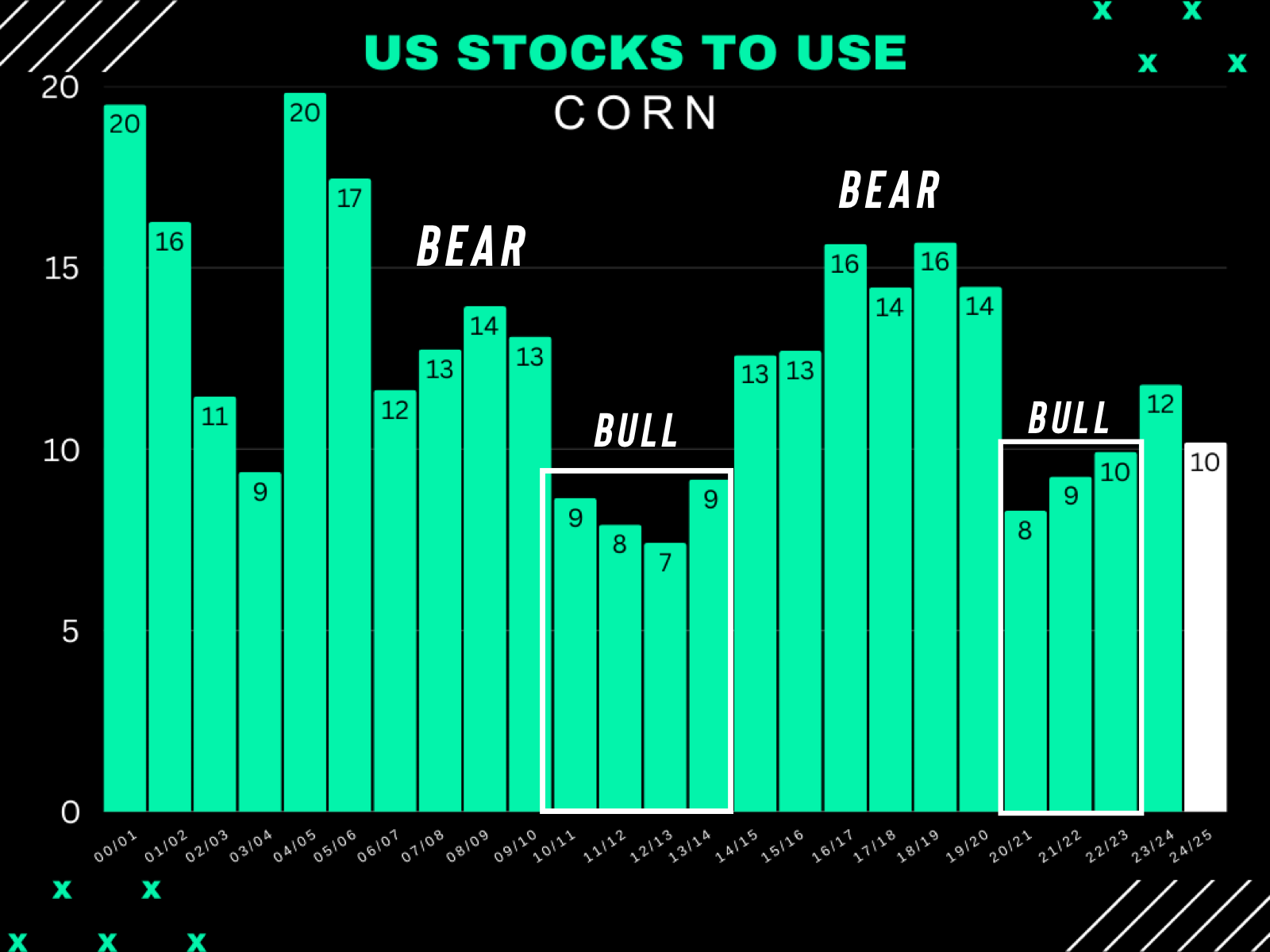

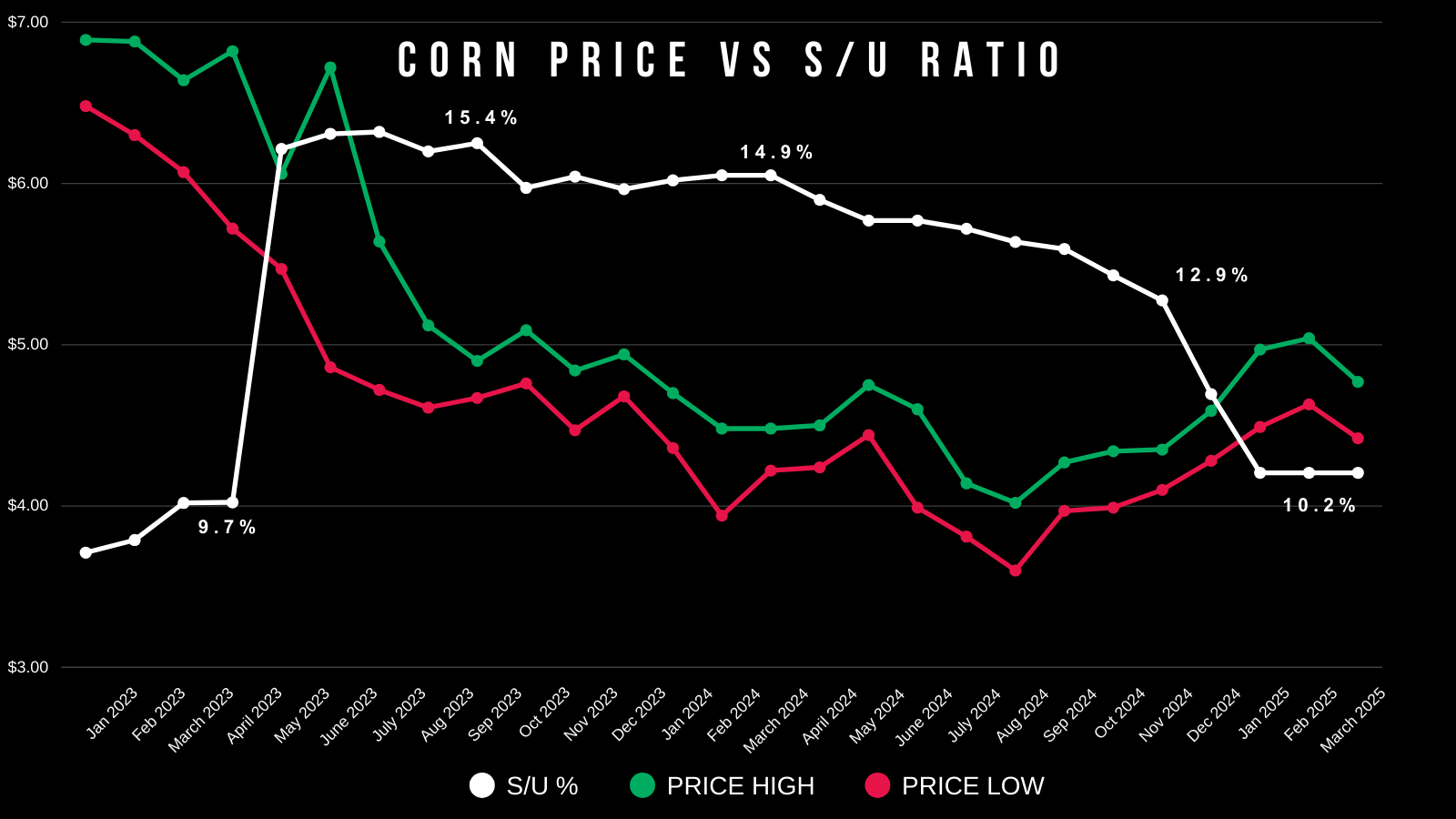

The old crop US situation is not $6-7 corn bullish, but it is not $3-4 corn bearish either.

I showed this Wednesday, but corn prices are at their same levels they were when the US stocks to use ratio was 15%.

It is now 10.20%.

Reason #4)

Export demand has been phenomenal. Up +24% vs last year.

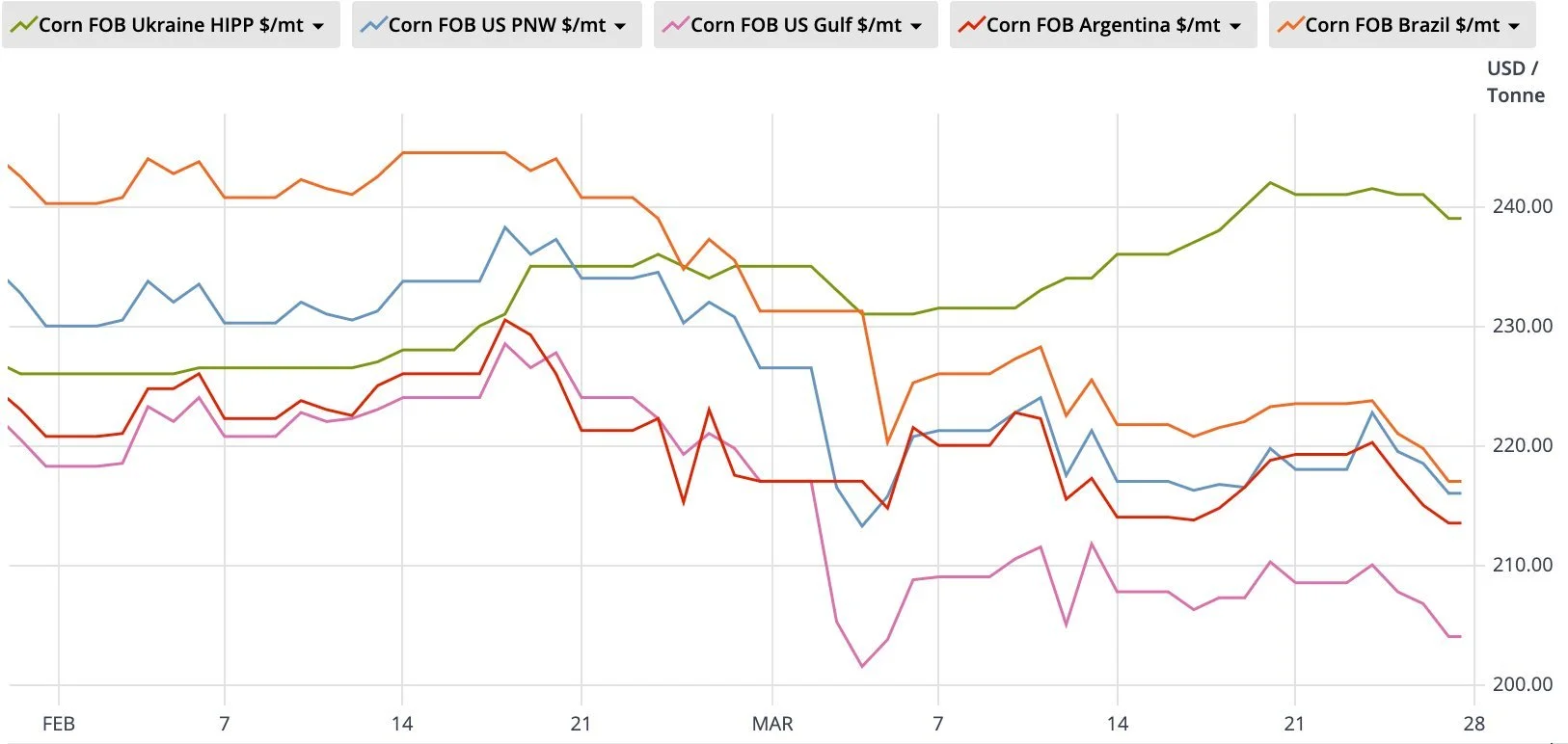

On the export market, US corn is the cheapest in the world..

Cash corn in Brazil hit +$5.80 and is at 3 year highs. There are rumors that Brazil (the #2 exporter in the world) is actually buying some corn from the US.

Again, refer back to Reason #2. The world is not sitting on all of this extra corn.

Technicals:

It was disappointing and surprising to see May corn broke below key support. I thought we would hold $4.54 and we did not.

But like I mentioned Wednesday.. this is not as concerning simply due to the fact we have this massive report on Monday.

This could very well be a "bear trap" or "head fake" unless we truly get a bearish report.

Today's price action was great. Yes.. we made new lows. But we closed +10 cents off the lows leaving a "potential" double bottom. As well as posting a bullish reversal (took out yesterdays lows, closed above yesterdays highs).

If we do continue lower, the next support is $4.36 to $4.34. I don’t see how corn could possibly not be undervalued if we dropped that low.

Bottom Line:

Even if we have not yet put in a low, I am not selling corn here when we have plenty of friendly factors and when we seasonally get opportunities. I think our downside is fairly limited compared to the upside. It makes no sense to sell into a -80 cent sell off.

This is why we take risk off the table and make sales when we hit targets. Just like on Feb 18th. It felt like corn was going to keep on going, but we alerted a sell signal because the charts said it was a good time to do, regardless if we went higher or not.

I am simply waiting to seize the next opportunity when it presents itself.

Dec corn found support at the 78.6% retracment of the entire rally.

Next upside objective is still $4.60

Soybeans

Fundamentals:

The only real bearish factor is the big crop out of Brazil. But it isn’t new news. The market has been pricing this in for months.

I haven’t been able to see the "bull case" for soybeans for several months.

But we are at the point where I think soybeans are too becoming undervalued here.

I am not $13 to $14 soybeans bullish by any stretch of the imagination, but I don’t see $11.50 to $12 soybeans being that far fetched.

The low for soybeans last year was $9.50. We will probably plant at least -3 million less acres this year with prices so far below cost of production.

This is one way low prices "eventually" cure low prices. Just like high prices cure high prices.

Less acres can drastically change the balance sheet with a less than perfect growing season. (We went over this Wednesday. If you missed it: Click Here)

It just seems like soybeans have already traded and priced in every possible bearish factor aside from a trade war with China.

Technicals:

Holding key support still.

If we can continue to do so, we have a massive inverse head & shoulders pattern to the upside.

To call a bottom, I need a close above the 100-day MA. That has been a pivotable spot several times.

Same set up in Nov beans but we did close above the 100-day MA so that is a great sign as long as the USDA doesn’t ruin the party.

Wheat

Fundamentals:

Nothing has changed for wheat, it is simply getting pounded by big money as they follow the trend lower and de-risk.

The algos have followed the headline "Russia & Ukraine war ending" so they have hit the sell button. Even though this materialistically doesn’t change anything.

The war hasn’t been a positive factor since the initial spike. No more war also means no more reasons for Russia to under cut the rest of the world and sell their wheat for pennies on the dollar to fund their war machine.

Looking long term, the bullish argument is still very realistic.

The global situation is the tightest in a decade. Russia has issues with their crop.

The forecasts for winter wheat country look dry for the next several months so that is also something to closely watch.

Simply have no interest selling any wheat down here.

Technicals:

Awful price action in wheat, but KC wheat is once again trying to find support in this green support box.

We have bounced in this box on 4 other major occasions over the past 7 months. Bulls want to do it again.

Makes sense to hold, if not it will trigger more selling and we will be trying to catch a falling knife.

Upside targets remain the same unless we post new lows, then the retracement change.

Chicago came all the way down to the bottom of the channel we had been talking about.

So far finding a little bit of life and close right above it after breaking below.

Makes sense we would find buyers here but don’t have to.

Next upside objective to look at taking risk off the table is a test of the top of the channel. Until then, remaining patient.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

March 19th: 🐮

Cattle hedge & sell signal.

Feb 18th: 🌽 🌾

Old crop KC wheat & old crop corn signal.

Jan 23rd: 🌽 🌱

Corn & beans old crop sell signal.

CLICK HERE TO VIEW

Jan 15th: 🌽 🌱

Corn & beans hedge alert/sell signal.

Jan 2nd: 🐮

Cattle hedge alert at new all-time highs & target.

Dec 11th: 🌽

Corn sell signal at $4.51 200-day MA

CLICK HERE TO VIEW

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

3/27/25

PRE-USDA POSITIONING. DON’T GIVE GRAIN AWAY

3/26/25

HISTORY OF MARCH INTENTIONS. SOYBEANS UNDERVALUED?

3/25/25

6 DAYS UNTIL MAJOR USDA REPORT

3/24/25

HOW TO POSITION YOURSELF BEFORE PLANTING

3/21/25

REASONS TO BE OPTIMISTIC IN GRAINS?

3/20/25

WAS THAT THE BOTTOM IN CORN?

3/19/25

THE PATH HIGHER & THE DOWNSIDE RISKS IN GRAINS

3/18/25

SEASONALS, CATTLE HEDGE, CHARTS & DROUGHT?

3/17/25

WHEAT RALLIES. DON’T GET BACKED INTO A CORNER

3/14/25

MARCH 31ST REPORT THOUGHTS & WHAT’S NEXT FOR GRAINS

3/13/25

EXPLAINING RE-OWNERSHIP VS COURAGE CALLS

3/12/25

TARIFF FEARS. EU, CANADA, & ETHANOL

3/11/25

USDA SNOOZE. RECORD FUND SELLING A CONCERN?

3/10/25

USDA TOMORROW. GETTING COMFORTABLE IN MARKETING

3/7/25

HOW TIGHT IS THE WORLD & US SITUATION?

3/6/25

TARIFFS PUSHED BACK. FUTURE OPPORTUNITIES?

3/5/25

IS GRAINS BIGGEST RISK WEAK CRUDE & DEFLATION?

3/4/25

TRADE WAR BEGINS. 8TH DAY OF PAIN FOR GRAINS

3/3/25

TARIFFS ON TOMORROW. BUY SIGNAL

3/3/25

BUY SIGNAL

2/28/25

WHEN WILL THE BLEEDING STOP?

2/27/25

CORN AT CRITICAL SPOT. USDA ACRE REPORT. WAY TOO EARLY DROUGHT TALK

2/26/25

HISTORY SUGGESTS CORN TOP ISN’T IN? ACRE OUTLOOK TOMORROW

2/25/25

POSITIVE CLOSE. WHAT TO KNOW ABOUT USDA OUTLOOK

2/24/25

USDA OUTLOOK, FIRST NOTICE DAY & BRAZIL

2/21/25

WHAT TO EXPECT MOVING FORWARD IN GRAINS

2/20/25

FIRST NOTICE DAY CONCERNS. MASSIVE CORN ACRES OR NOT?

2/19/25

HOW TIGHT IS THE CORN SITUATION?

2/18/25

MORE DETAILS ON TODAYS SELL SIGNAL

2/18/25

OLD CROP KC WHEAT & CORN SELL SIGNAL

2/14/25

WHEAT BREAKING OUT ON WEATHER RISK. TECHNICALS & FUNDAMENTALS

2/12/25

GLOBAL GRAIN SITUATION, ACRE TALK, CHARTS & MORE

2/11/25

USDA: NOT A BEARISH REPORT. DISAPPOINTING PRICE ACTION

2/10/25

USDA TOMORROW. LONG TERM PATH FOR SUB 10% CORN STOCKS TO USE?

2/7/25

WHY WOULD THE FUNDS EXIT THEIR LONGS?

2/6/25

WHEAT FINALLY CATCHING A BID

2/5/25

COMPLETE THOUGHTS ON MARKETS: BACK & FORTH DISCUSSION

2/4/25

STRONG JANUARY LEAD TO STRONG YEAR? TARIFFS, CHARTS & MORE

2/3/25

TARIFFS PUSHED BACK

1/31/25

TARIFF NEWS ALL OVER THE PLACE. ARE YOU PREPARED FOR POSSIBILITIES?

1/30/25

WHEAT BULL ARGUMENT. TRUMP ADDS TARIFFS

1/29/25

CORN APPROACHES $5.00

1/28/25

TARIFFS, CORN FUNDS, SOUTH AMERICA & MORE

1/27/25

HEALTHY CORRECTION WE TALKED ABOUT & TARIFF NEWS

1/24/25

GRAINS DUE FOR SHORT TERM CORRECTION?

1/23/25

OUR ENTIRE NEW CROP SALES THOUGHTS & OLD CROP SELL SIGNAL

1/22/25

GRAINS TAKE A BREATHER. IS CORN IN A BULL OR BEAR MARKET?

1/21/25

HUGE DAY IN GRAINS. WHAT TO DO WITH OLD CROP VS NEW CROP

Read More

1/20/25

VIDEO CHART UPDATE

1/17/25

TRUMP, CHINA, ARGY & USING THE SPREADS INVERSE

1/16/25

OLD CROP LEADS US LOWER. MARKETING THOUGHTS

1/15/25

SIGNAL & HEDGE ALERT QUESTIONS EXPLAINED. IS $6 CORN EVEN POSSIBLE?

1/14/25

MORE DETAILS ON TODAYS HEDGE ALERT & SELL SIGNAL

1/14/25

CORN & SOYBEANS HEDGE ALERT/SELL SIGNAL

1/13/25

USDA GAME CHANGER OR NOT?

1/10/25

BULLISH USDA FOR CORN & BEANS

1/9/25

USDA OUT TOMORROW

1/8/25

2 DAYS UNTIL USDA. BE PREPARED

1/7/25

THE HISTORY OF THE JAN USDA & MORE

1/6/25

MAJOR USDA REPORT FRIDAY

Read More

1/3/25

UGLY DAY ACROSS THE GRAINS

1/2/25