GARBAGE REPORT AS EXPECTED & CHINA STOCK PILES GRAIN

USDA REPORT RECAP: AUDIO & WEEKLY WRAP

We got garbage as expected

Report was overall neutral but markets lower

Corn & wheat carry out lower. More to come?

Kicked can on Brazil crops

Second corn crop problems

The Brazil situation could be resolved, but it’s worse than the USDA wants to admit. Will need a trend change

China is stock piling grain.. why?

What to do if you need to sell soon

Time to lock fuel needs in?

Make sure you read our Weekly Wrap below*

Listen to today’s audio below

You only got to listen to 3min of todays 9min audio. Subscribe to keep listening & receive every exclusive update.

LAST CHANCE

We are extending your access to our biggest offer of the year for a limited time. Don’t miss this opportunity. Become a price maker.

Overview

Today's weekly wrap will be shorter and different than our usual ones on Friday due to to the USDA report today.

Make sure you check out today's audio above as well to get a full breakdown of the numbers, what it means, and our current outlooks moving forward.

As for the USDA report, you can probably guess what happened..

The USDA decided to kick the can down the road on the Brazil crop. No surprise, as we mentioned that would likely be the case yesterday.

Brazil beans came in down 2 million metric tons from last month, but 1 million higher than the trade was anticipating. Coming in at 161 million vs 160 estimates and last months 163.

Brazil corn unchanged from last month at 129 million, which was 2 million higher than the trade guesses as they were predicting 127.

Argentina crop for both corn and beans were unchanged from last month.

Brazil Producer Diego Meurer:

“While USDA and CONAB continue to report a super harvest, Mato Grosso and other areas are decimating the main soybean areas in Brazil due to severe drought and the south due to excess water. Which sharks are financing these reports?”

Jason Britt, President of Central States Commodities:

"Report out of the way and they still need to get the rain or no way they will be even close on these numbers. They will be way too high, but that's par for the course with the USDA. They over estimate production over and over again."

I completely agree with Jason, if this trend remains dry, which it looks like it will. Them not making major cuts today gives us all the more power to see an even larger cut down the road.

Outside of South America, there wasn’t anything major. However, the surprise of the report was that US wheat ending stocks saw a big cut.. yet the market sold off.

Bulls were also happy to see the USDA raise corn exports by +25 million bushels. which reduced ending stocks by -25 million

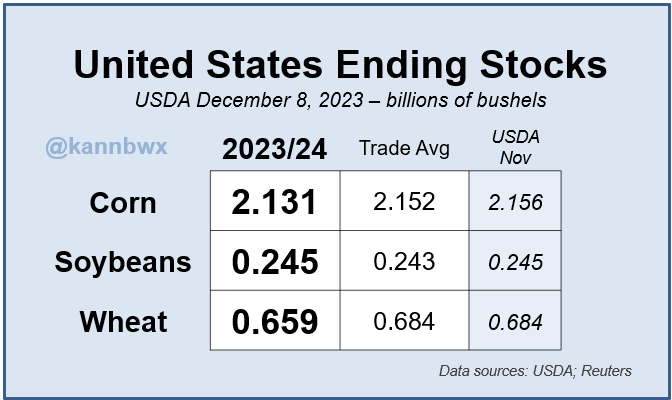

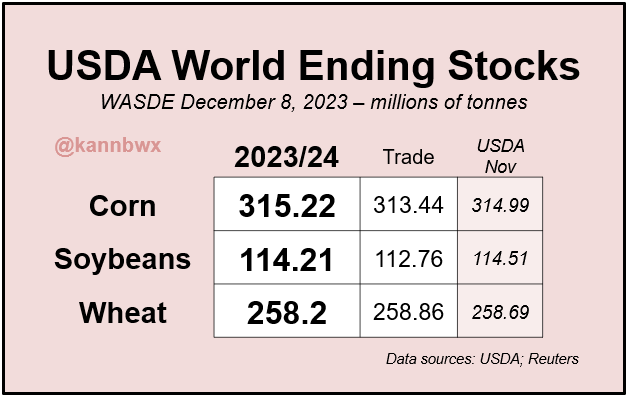

Here were the US and World ending stock numbers:

Corn and wheat came in below expectations while the balance sheet for soybeans remained the same.

Charts from Karen Braun

So why did wheat sell off despite the cut to ending stocks?

Mostly just profit taking. We said yesterday we should be expecting this rally to take a breather, which has happened. That is completely natural after an +85 cent rally. It's not healthy for markets to go up and up in a straight line.

Even with the sell off today, prices Chicago wheat is still up nearly +30 cents on the week and +75 cents off their lows from last week alone.

Now back to Brazil.

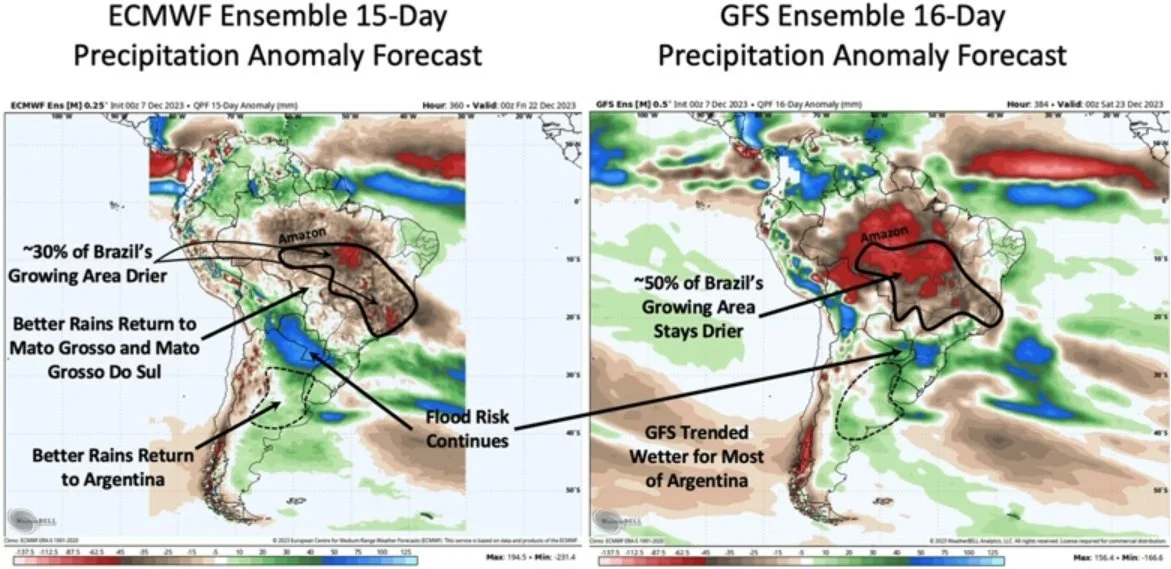

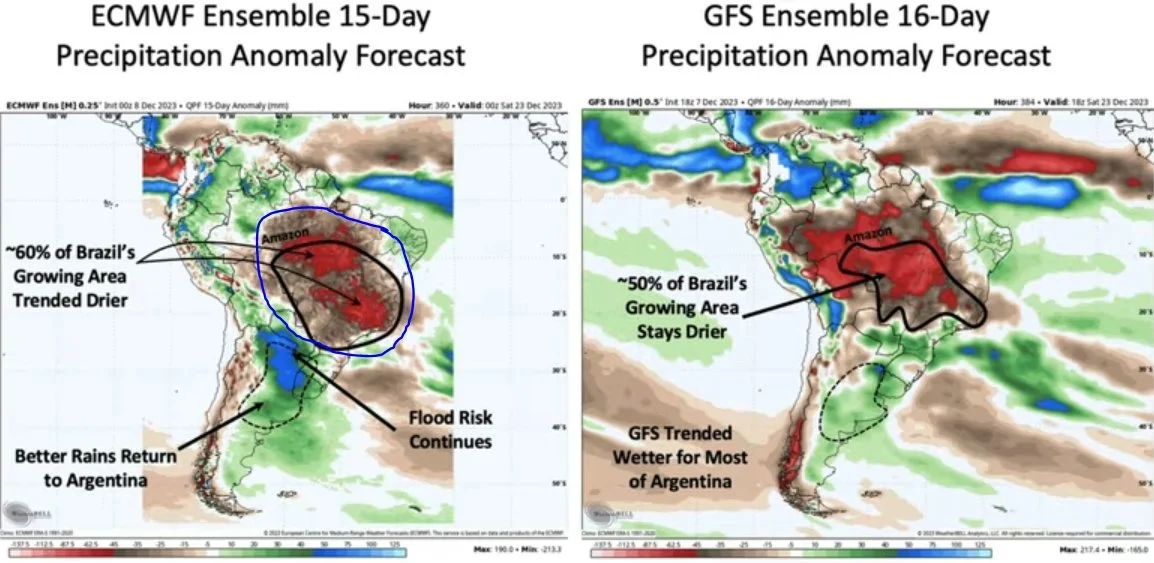

I just want to show you how off some of these rains in the forecasts have been and how they changed in 24 hours, the same ones that have pressured our markets from time to time.

These are from 247 Ag. He went on to say:

"The ECMWF forecast changed how much in 1 day? Beginning to come in line with the GFS model. Beans not planted or replanted by December 15th, begin to drastically change the Safrinha production outlook. More bullish for corn than soybeans. Soybeans will get planted, not corn."

I have been saying this for a while now.. the Safrinha corn situation is a major bullish wild card flying under the radar.

The first crop planted will always be the beans, not the corn. I simply think we could be looking at a lot less acres when the time comes.

When will the market come to realize this?

It might not be……

The rest of this is subscriber-only. Subscribe to get access to every full update.

DON’T MISS THIS..

Miss our sale last weekend? This will be one of your last chances to lock in this huge deal. Don’t miss all our future updates.

Become a price maker.

Check Out Our Price Maker Program

Become a price maker and take your marketing to the next level.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Past Updates

12/7/23

RALLY AHEAD OF USDA REPORT

12/6/23

RISKS, FACTORS, & WHAT TO WATCH

12/5/23

WHEAT CONTINUES RALLY & BEANS BOUNCE BACK

12/4/23

IF CHINA IS BUYING, I’M NOT SELLING

Read More

12/1/23

BRAZIL, CHINA, FUNDS & SEASONALS

11/30/23

LOWS FINALLY IN OR ANOTHER SELLING OPPORTUNITY?

11/29/23

RISK & UPSIDE FACTORS

11/28/23

WHAT COULD CAUSE THE FUNDS TO COVER?

11/27/23

WHAT IS CORN BASIS CONTRACT DILEMMA TEACHING US?

11/24/23

POST THANKSGIVING MELT DOWN

11/22/23

WHAT’S THE BRAZIL STORY?

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23