CORN FIGHTING NEW LOWS & BRAZIL RAINS

Overview

Grains mixed here as soybeans get hit the hardest while corn looks to test those late November lows of $4.70. Which is a must hold level on the charts.

The reason for corn trading lower the last few days isn’t because of anything negative, it is more a lack of any fresh bullish news.

Despite getting a new sale of beans this morning, soybeans were pressured heavily from Brazil forecasts. Rumor is that China is looking for another 4 to 6 cargoes of US beans.

Soybeans lower because of the Brazilian forecasts. As they are looking for roughly an inch of rain in northern Brazil the next couple of days.

The models don’t seem to completely agree, so we will have to see what actually falls. As of late, the models have shown a lot wetter forecasts than what actually fell.

Despite these showers in the forecast, they still don’t look like a total trend changer. If these rains fall, it will certainly help the crops. But they will still need a lot more rain to divert further issues.

Friday I said that this week for Brazil will be key. I still believe so. If these rains fall, the market will likely take it on the chin. If these rains fall there is still a chance they can produce a somewhat normal crop. However, if these rains miss or come up short, they are in for some major problems.

Here are what some others are saying:

Mark Gold from Top Third:

"One inch of rain isn't going to save this crop. The heat is anywhere from low 90s to 110 degrees. This is right in the middle of pod setting. I think it's going to be a major problem out here for the beans"

"One group lowered their Brazilian estimate by 2 MMT and I think that is going to be the pattern moving forward that we are going to see lower and lower projections. This new projection has it under last year's prouduction numbers even with the increase in acres. So I think this will be a little significant."

Jim Gerlach:

"While 2 to 4 inches of rain in central/northern Brazil sounds impressive over the next 14 days, that equates to just about 75% of normal and follows the driest October to December period since at least 1979."

Brazil Producer Diego Meurer:

"Third largest producer in Brazil, Goias on December 18th has two rains. One of 8 millimeters and another of 10, but there is no longer a solution. The soybeans have already surrendered and died."

Ag Strategy:

"Brazil is facing a soybeans disaster. The crop is heading towards 145 MMT. The market is in denail and will be shocked by the crop shortage."

Agricomp Commodities:

"A lot of people think 145 million is a crazy number. But it's not. It's just a 10.5% drop over the initial Brazil forecasts."

Juliano from Brazil:

"There will be a sequence of rains. For most areas these rains will only stall the losses, which are irreversible."

Dr. Cordonnier lowered his Brazil estimates. He lowered his corn by 1 million to 117 million metric tons vs the USDA's current 129. He lowered his bean crop to 155 million vs the USDA's current 161.

That is a pretty sizable cut from one of the most respected individuals in the space.

We also saw farmer group Aprosoja project that Mato Grosso will produce -9.16 million metric tons less than last year. That is a -20% drop. Keep in mind, Mato Grosso is far and away the leading growing state for both Brazil corn and beans. They are responsible for 29% of Brazil's annual soy exports and a whopping 66% of their corn exports..

Unless they get game changing rains, it does look like lower projections are going to continue to be the theme moving forward.

What are the forecasts saying?

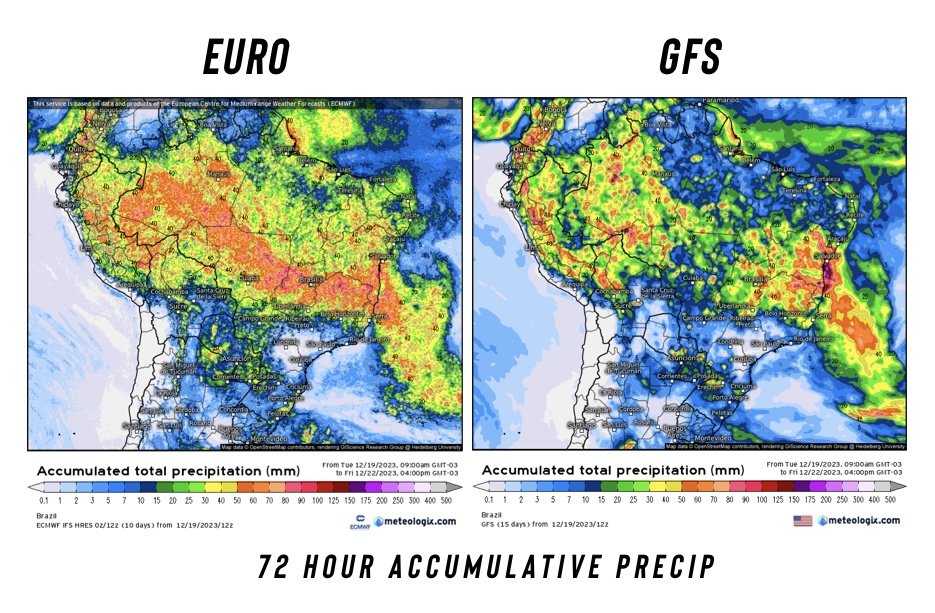

The GFS is drier and the Euro model is wetter for the next week. Something to note is that the GFS model has been a lot more accurate the past few months. Guess we will have to see who is right this time.

Here is some comparisons of the forecasts for the 2 models.

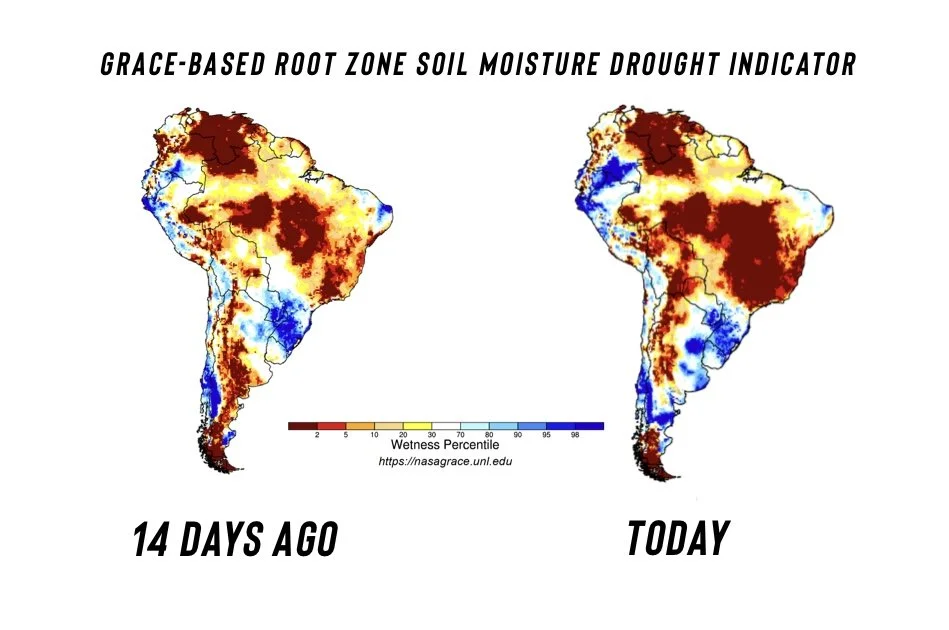

Brazil is hoping these rains in the euro model fall. If not, just look at the drastic change in root zone soil moisture the past 14 days alone.

I have been saying for weeks that December will be far more important than November for Brazil weather.

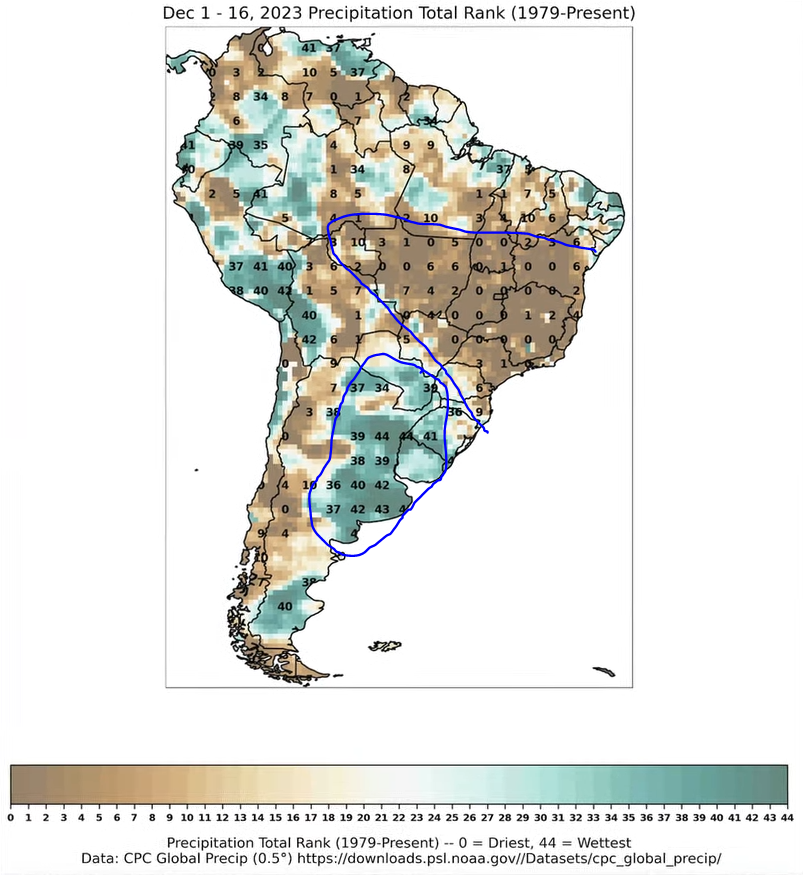

October and November was the driest on record. How is December shaping up so far?

Again, even just the beginning of December, driest on record for much of the producing states.

Now let's jump into today's update…..

The rest of this is subscriber only. Please subscribe to continue reading & receive every exclusive update. Since your trial ended, you no longer get access to our full updates.

IN TODAY’S UPDATE

Why there is a risk in the corn market heading into January

How you can get yourself comfortable with that risk

Can Brazil still produce a bumper crop?

Why Brazil drought isn’t the same as US drought

Managing your risk in all the markets

$12 or $14 beans?

DON’T MISS OUR HOLIDAY SALE

Take advantage before it’s gone. Get over 50% off. Become a price maker and learn the tools that will last a lifetime and teach you how to take back the power from Big Ag.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

12/18/23

THIN HOLIDAY TRADE & BECOMING COMFORTABLE

12/15/23

NEXT WEEK WILL BE KEY

12/14/23

WHY WE DON’T SELL FEAR

Read More

12/13/23

ARGENTINA, SAF, RISKS, & WILD CARDS

12/12/23

TURNAROUND TUESDAY

12/11/23

IS THE WHEAT PARTY OVER & BEANS JUST STARTING?

12/8/23

GARBAGE REPORT AS EXPECTED & CHINA STOCK PILES GRAIN

12/7/23

RALLY AHEAD OF USDA REPORT

12/6/23

RISKS, FACTORS, & WHAT TO WATCH

12/5/23

WHEAT CONTINUES RALLY & BEANS BOUNCE BACK

12/4/23