WEEKLY WRAP

Overview

The seasonal harvest pressure continued to weigh on the grains this week. Not only do we have that harvest pressure, but grains have also been negatively effected by the funds selling, low river levels, and demand.

Grains all end the day slightly higher here on option experation day following our struggle yesterday and beans 20+ cent plunge. Here is the weekly price changes. Essentially a blood bath aside from corn who actually managed to close higher on the week despite hitting those 2-year fresh lows of $4.67 3/4, closing nearly a dime off those.

Today's price action wasn’t all bad. Most including myself thought we would see more pre-hedge pressure, as pre-hedges usually dominate late in the session on Friday's this time of year. So was positive we were able to close higher and hold the recent lows.

Why the sell off yesterday?

In Wednesday's update we said we should be expecting some short term pressure to close out the week. First off we had the Feds announcement. They paused rates but they also said rates will be higher for longer. This was negative for grains as higher interest rates makes grains a less appealing investment.

We also had options expiration today. Typically the last two days ahead of options expiration leads to lower futures prices. Which we mentioned Wednesday.

What to Watch Moving Forward

Harvest Results

Early results are showing some better than expected results. Which has had a negative effect on prices clearly. However, the areas that are getting these better results aren’t the major players that usually carry our nation's yield. The area's that we haven’t got a ton of results for are the areas that really felt that heat and struggle. We could be in for some surprises. I'm hearing more and more about a sub-170 corn crop and far sub-50 bean crop.

Quarterly Stocks & Wheat Acre Report

Friday we get this report. This will give an idea of how much demand is out here. Most people are looking for the stocks to be down a little bit. But we will have to see if the river levels have any effect on this. Could be in for a surprise one way or the other.

Demand

Will we see some export business? Demand has been one of the biggest things bears continue to point at.

US Weather

Weather here isn’t as major of factor as it once was. However, rain is now actually a bullish factor. For starters, it raises those river levels the bears have been talking about. It also has the chance to slow down harvest. An early freeze or snow would also be a potential factor in the next few months. The only crop that rain will improve here is winter wheat, thus rain is bullish most grains aside from winter wheat.

Government Shut Down?

This is one potential negative factor we need to be aware of. Rumors that Government may shut down on September 30th, the end of their fiscal year. If that happens we may not get the USDA production and supply & demand report on October 12th. The markets don’t like uncertainty.

South American Weather

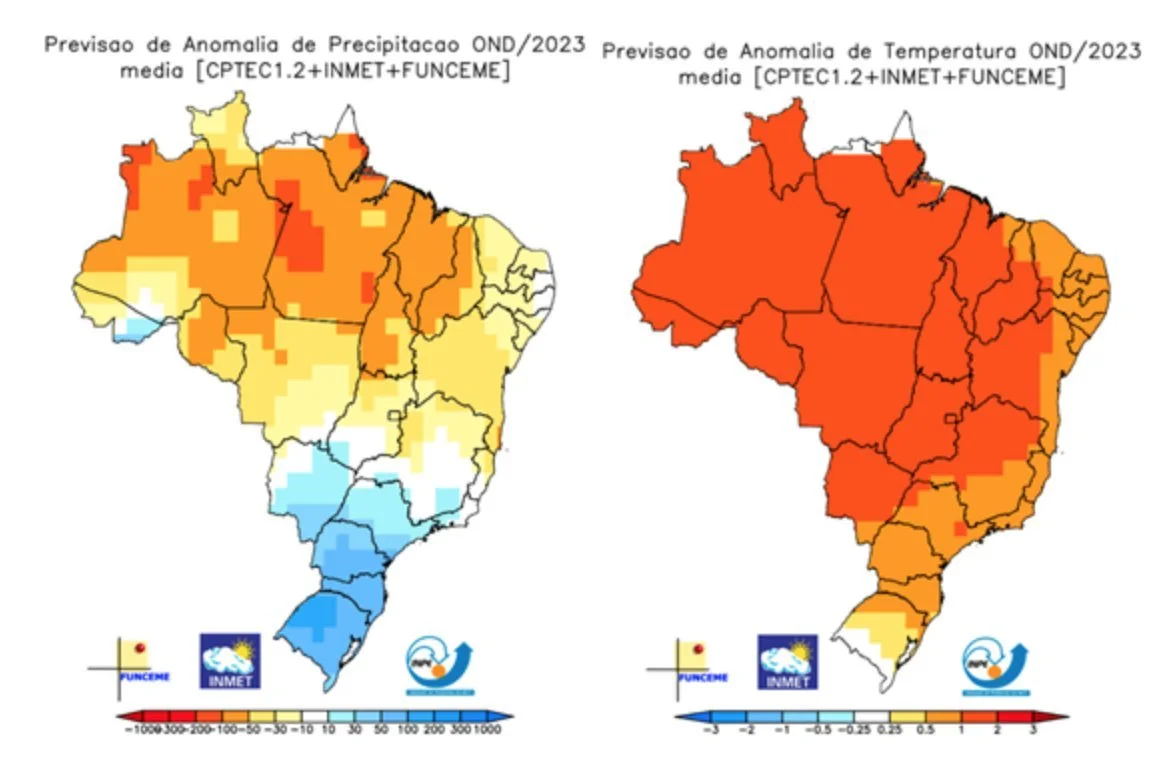

This will continue to play a bigger and bigger later in the year. The current outlook for the next 3 months? Overly dry north and 98% hitter than normal, while the south is simply too wet.

Currently Brazil is facing some extreme heat and lack of rain as the drought continues in major growing areas as their bean planting gets underway.

Typically wet season returns around September 26th. Farmers there heavily rely on these timely conditions. However, conditions have been dry and temps are 10 to 15 degrees hotter than normal.

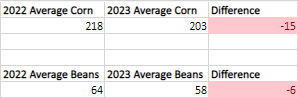

Darren Frye of Water Street Solutions in Peoria, Illinois (waterstreetag.com) had 33 growers report corn yields. 18 in Illinois, 7 in Iowa, 2 in Indiana, 4 in Nebraska, 1 in Ohio, and 1 in Kansas. Average yield for those growers came in at 203 bpa vs last year's 218, a -15 bushel decrease.

He also had 20 bean growers report. 5 in Iowa, 2 in Illinois, 5 in Indiana, 5 in Nebraska, 2 in South Dakota, and 1 in Ohio. Their average yield came in at 58 bpa vs last year's 64. A -6 bushel decrease.

From Mark Gold of Top Third:

"Overall Im looking for a spot to buy the grains. Is it this Monday or a week from Monday? I'm not sure, but I think somewhere in here you have to look at buying call options to keep the upside open on sales you've made. In addition we have the October time period for crop insurance, we've seen all too often that markets tend to rally in October and take away a lot of those payments. What you might have to do is look at buying a November call out here and try to keep the upside open."

Are The Lows In?

Is it hard to justify being bearish at these levels. But it's also hard to catch a falling knife. Seasonally, row crops make their seasonal lows between now and the start to October. Wheat's seasonal lows were a few days ago. Corn and beans are oversold.

Could we see more downside? Of course. We could definitely see more harvest pressure here short term. I believe we will be putting in bottoms soon if they are not already in place, but lower prices over the course of the next week or so shouldn’t surprise anyone if it happens. Especially with the stocks report Friday. When the combines get rolling, and if yields are not there like a vast majority are predicting, we will have a reason to rally. If yields are there, well it will take much more outside factors to justify a rally and keep these bottoms in place. We dive into each grain later in today's write up.

Today's Main Takeaways

Corn

Corn ends the day and the week higher, following our recent lows. Now roughly a dime off of those.

Bears argue that…..

The rest of this is subscriber only. Please subscribe to continue reading and receive every exclusive update.

In the rest of today’s update we go over historical trends for beans, should you be re-owning, and more.

Scroll to check out updates you would’ve received.

GET 50% OFF YEARLY OR MONTHLY

Get every exclusive update sent via text & email. Become a Price Maker.

NOT SURE? TRY 30 DAYS FREE

Check Out Past Updates

9/21/23

HARVEST BASIS THOUGHTS

9/20/23

BUYING OPPORTUNITIES

9/19/23

CAN WE FIND DEMAND?

9/18/23

HARVEST PRESSURE

9/15/23

BECOMING COMFORTABLE IN THE MARKETS

9/14/23