BEARISH WEATHER, RECORD SHORTS, & CHINA

Overview

Corn & beans slightly higher while wheat finishes lower. Overall quiet day with little volume in the markets as it is a holiday week. So expect the markets to stay quiet until next week.

Grains tried to rally early in the day off the back of some short covering, but ultimately closed well off our highs as weather in the US looks pretty ideal for the crops and bearish for the markets the next week or so.

Wheat was pressured from rains in Australia to go along with reports of better yields out in Russia.

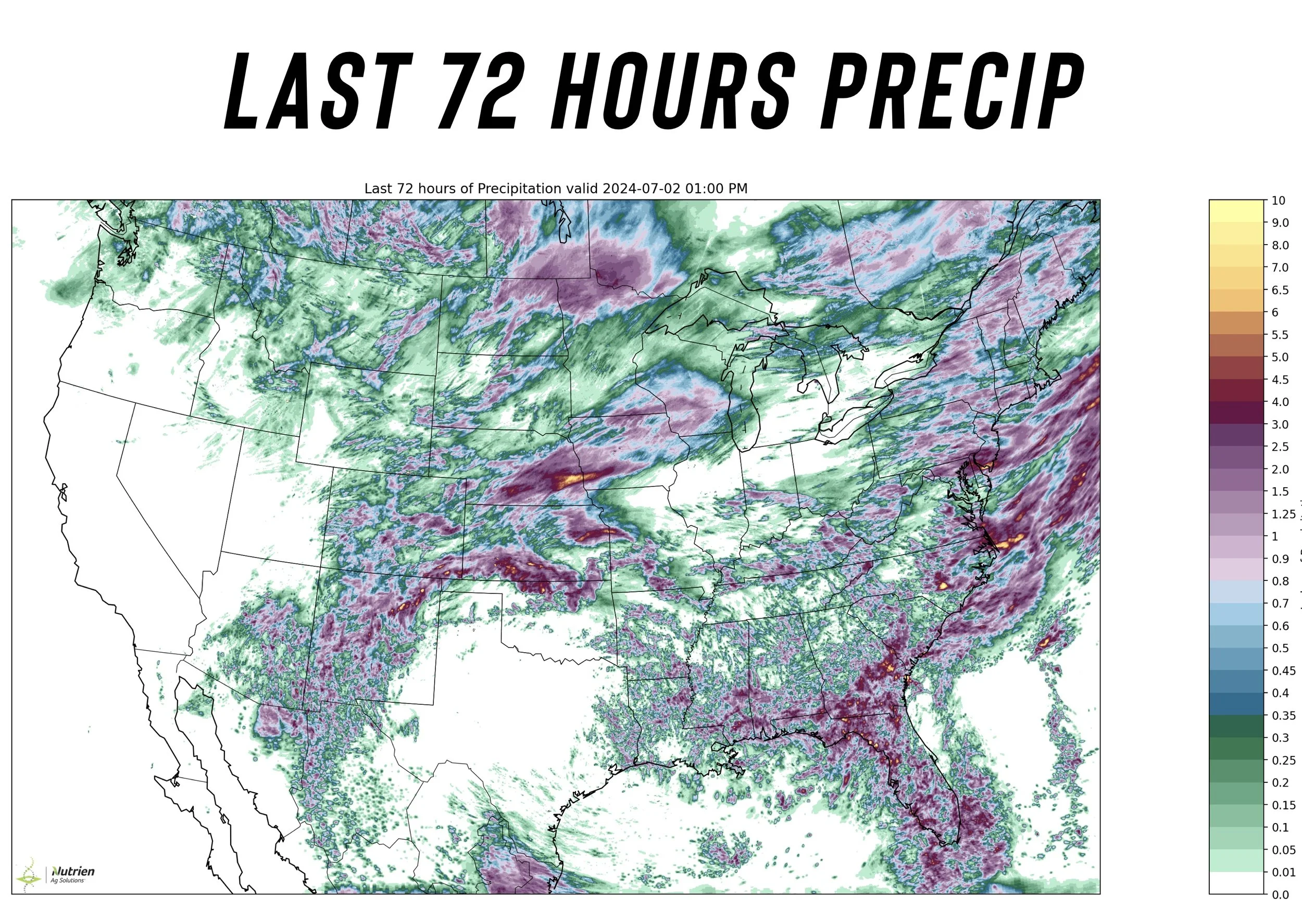

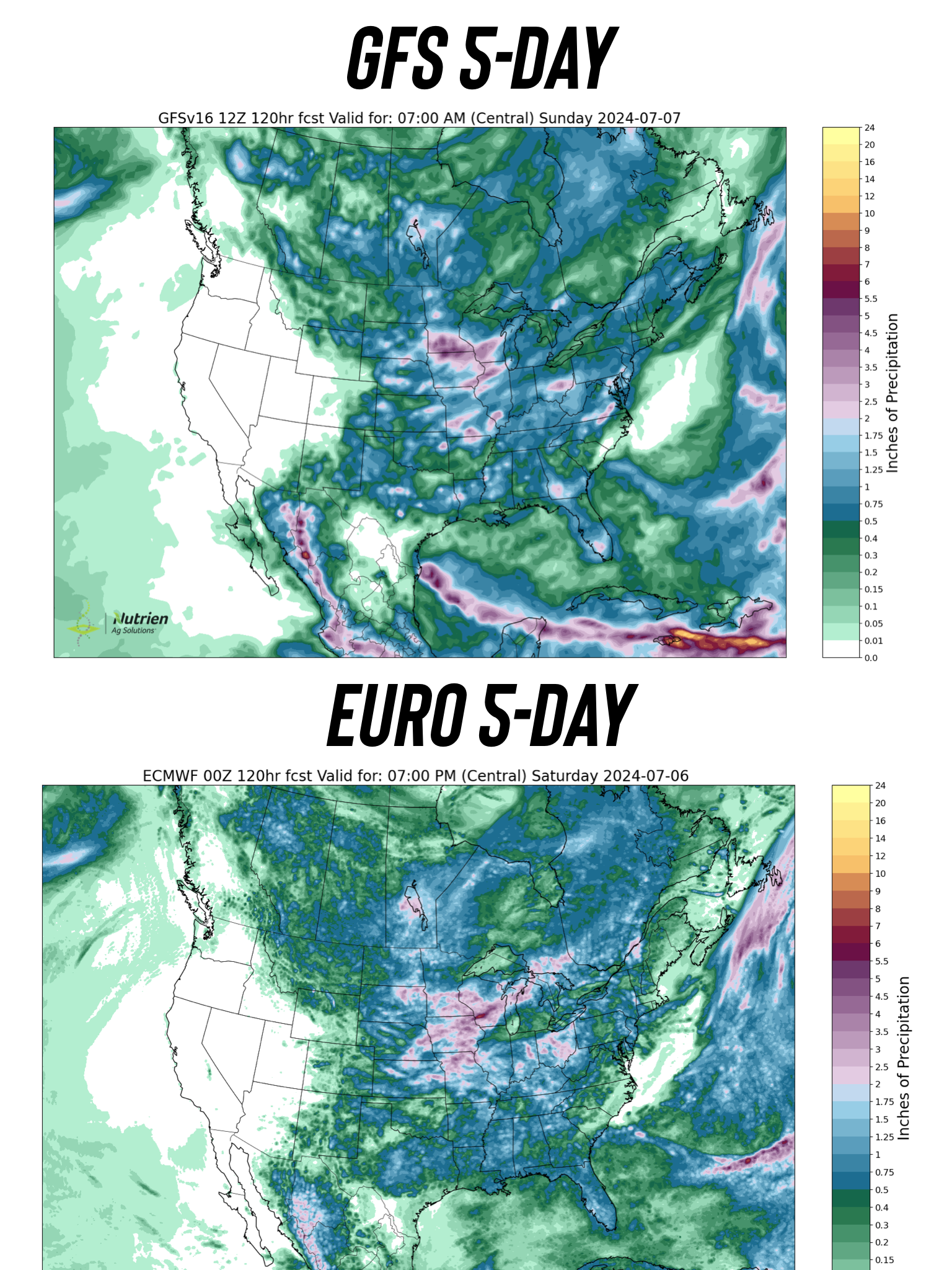

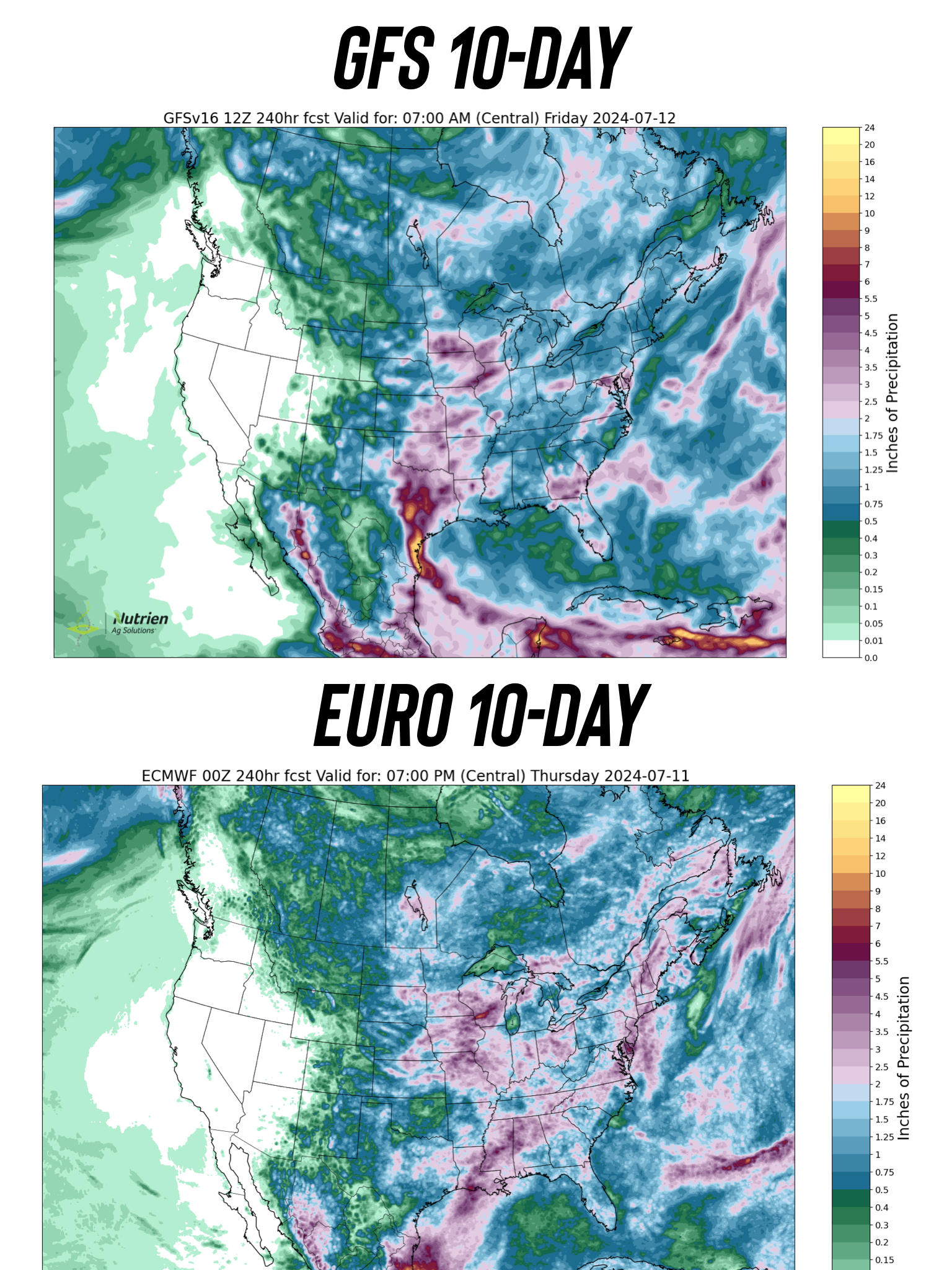

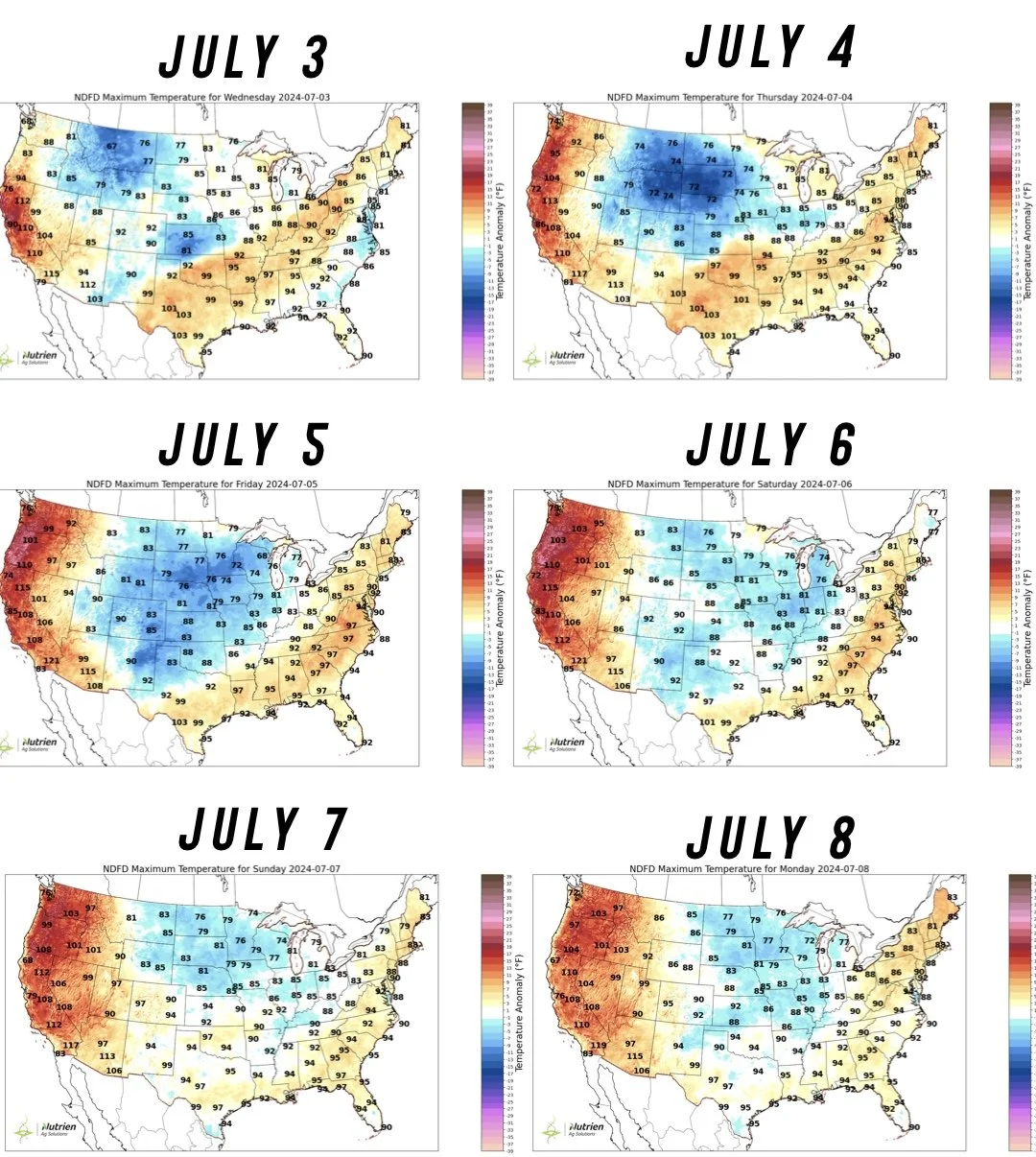

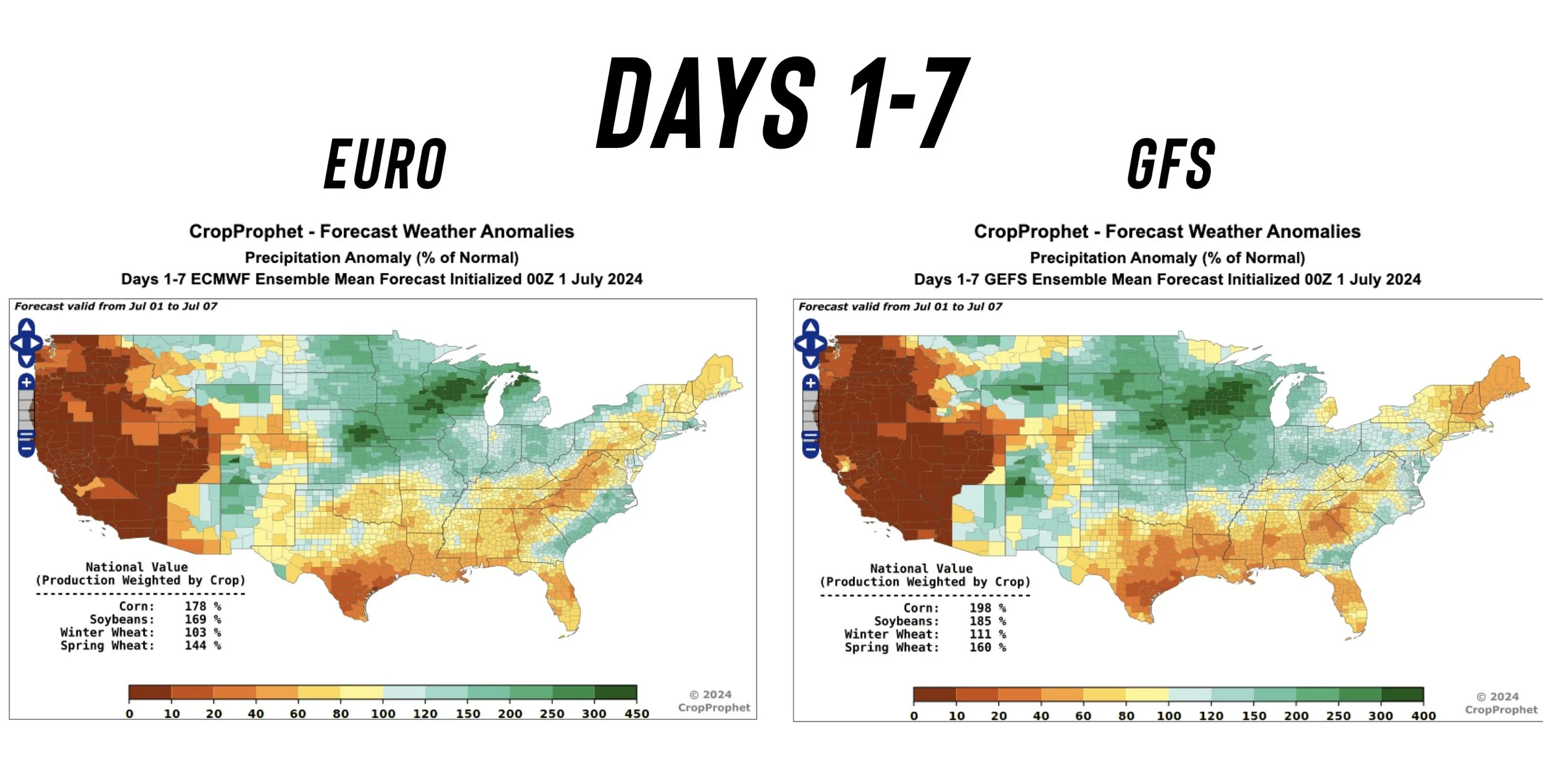

Here is the US forecasts.

They are pretty wet and are showing below average temps. Both of which are bearish for futures.

Despite areas such as Iowa, South Dakota, Minnesota getting even more unneeded rain, the markets thought process is that rain makes grain. Sure, some areas are getting too much. But even more areas are getting a perfect amount.

The eastern corn belt has been dry in comparison, but they too are expected to get decent rains.

Despite the bearish forecasts, the corn market has found some strength the past 2 days which is a friendly sign. Negative news but positive price action.

What might be even more important to the crops is that the next week is cooler than normal. Crops can handle some lack of moisture if the heat is not there.

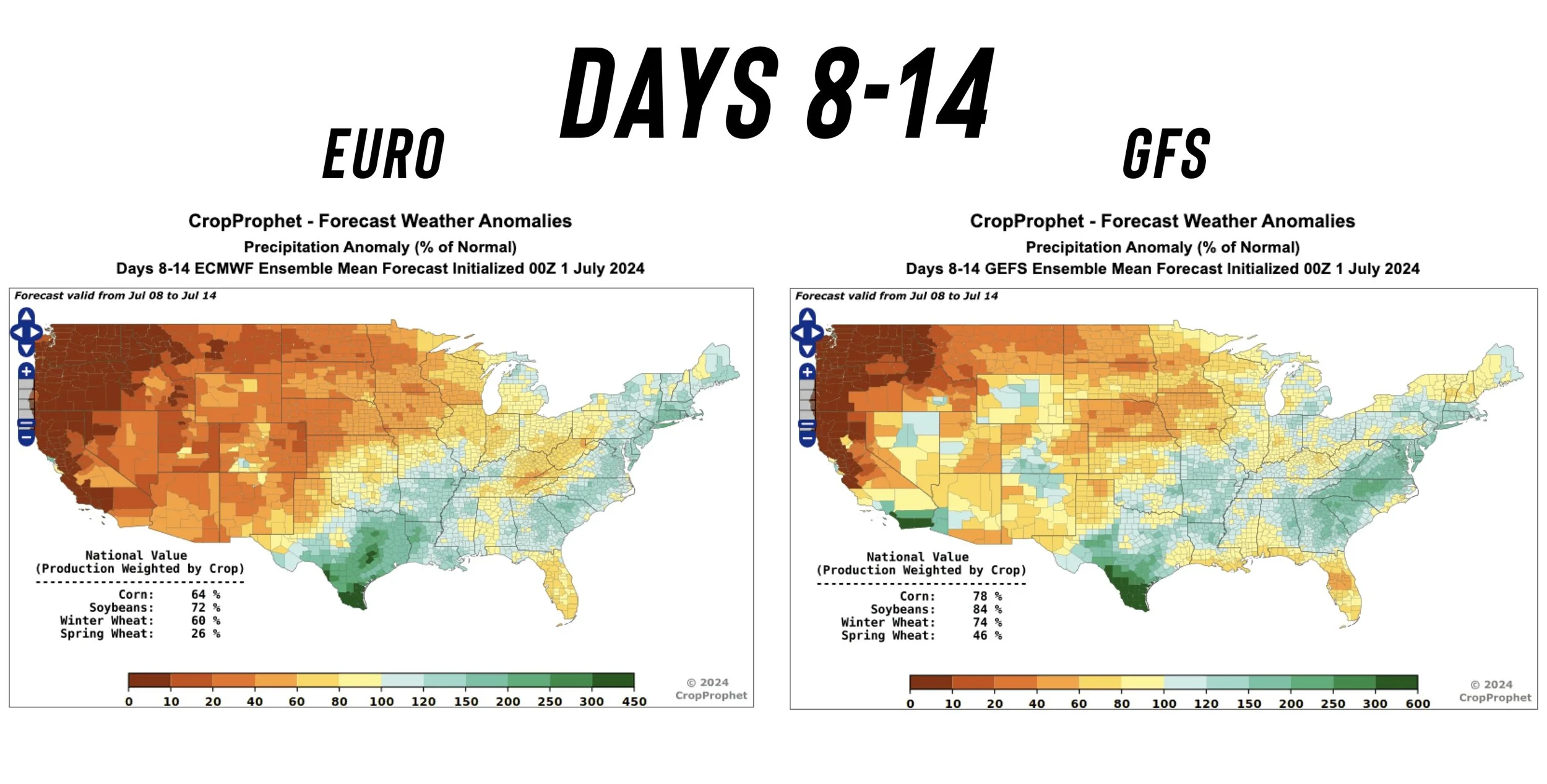

Here is a closer look from CropProphet. The next week is wet, after that it does look like it will dry out some.

These timely rains are making the likelihood of seeing that usual summer drought or weather driven scare very unlikely here. Which short term means unless we do get some weather event or demand story, we don’t have a reason to scream higher soon.

It is now July. Rain in the forecast is always going to be bearish.

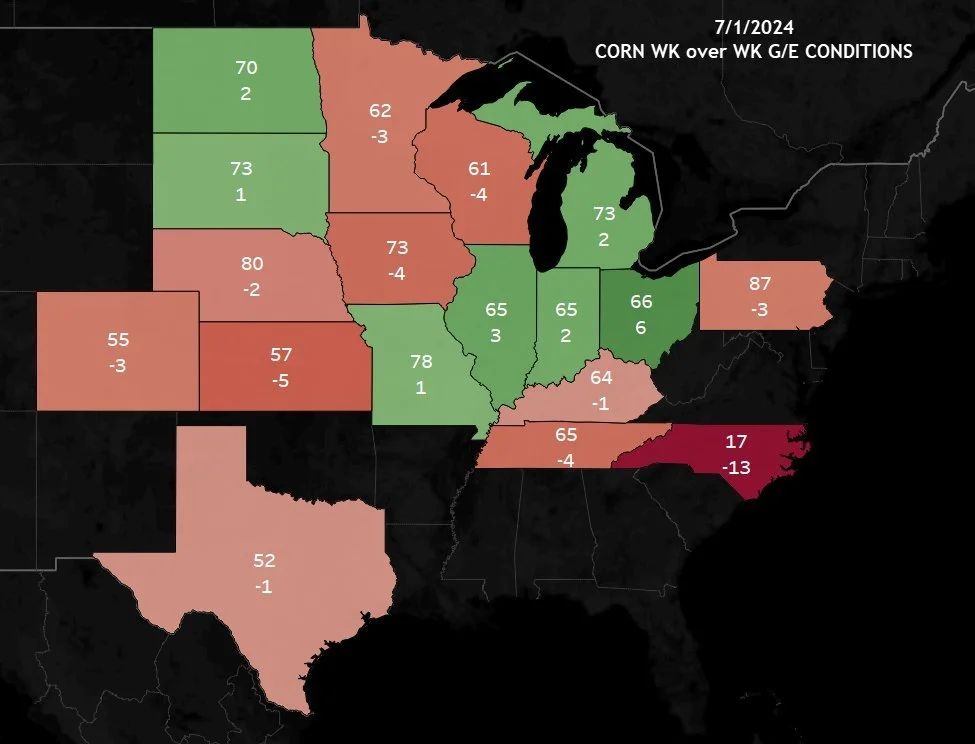

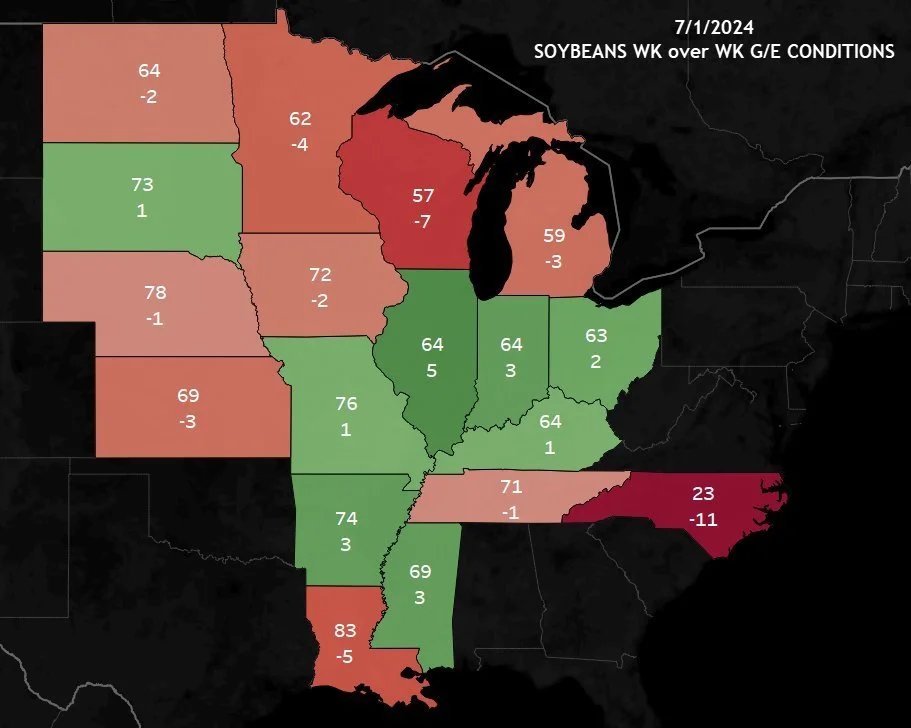

Crop Conditions

These were not much of a market mover.

Corn came in 1% worse than expected, beans 1% better than expected. Both came in at 67% G/E.

The areas that got too much rain such as Iowa and Minnesota are seeing some negative effects, while the eastern corn belt is seeing some improvements.

Both corn & bean ratings are the best for this week since 2020.

67% G/E is above average and is giving the markets some thoughts that perhaps trendline yield isn’t completely off the table. Although most would agree 180 isn’t happening.

Chart Credit: Darrin Fessler

The Funds

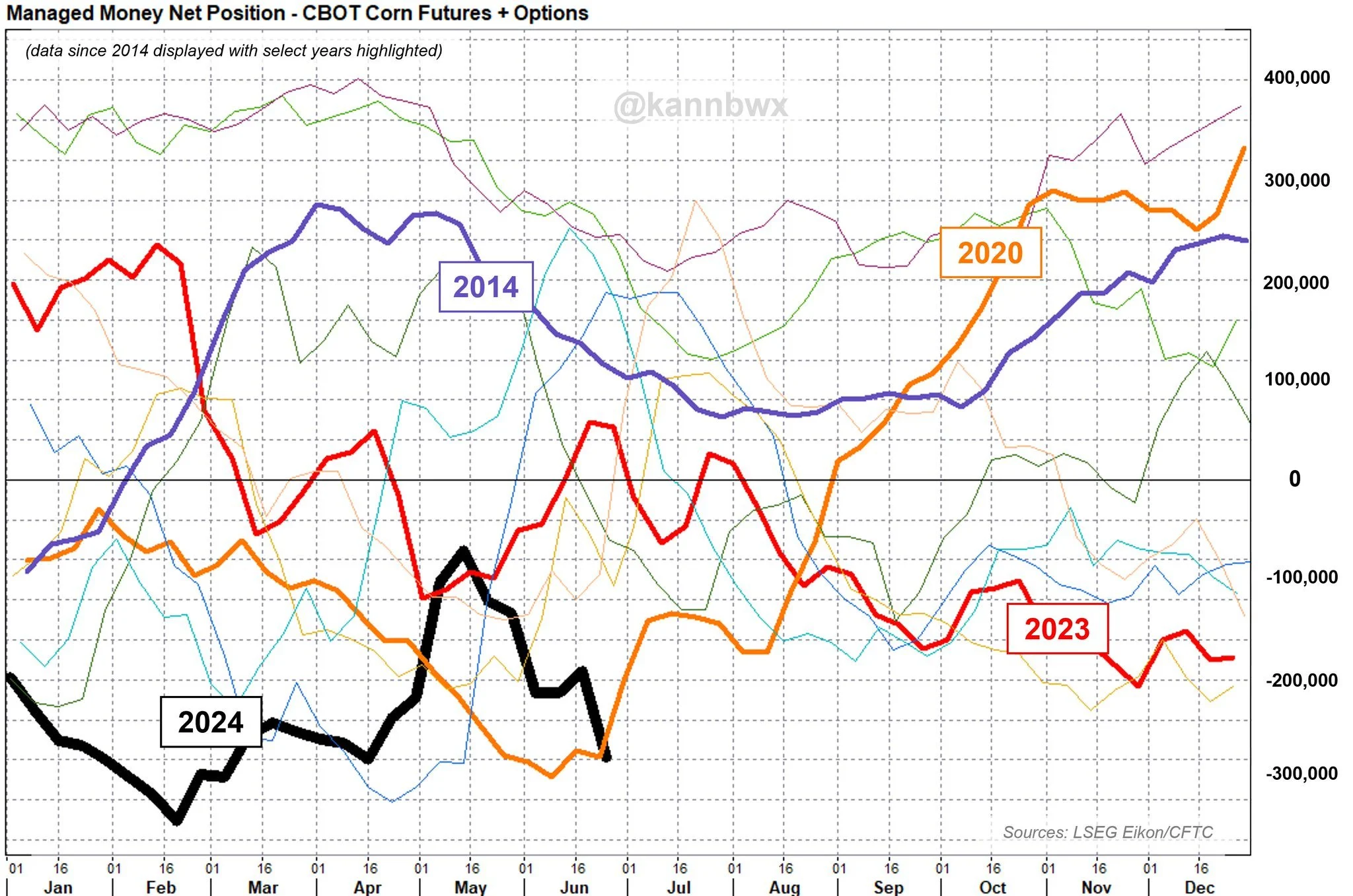

The funds are holding massive short positions.

Prior to the report this was the positions:

Corn: -300k contracts

Beans: -130k contracts

Wheat: -70k contracts

This was before the report. So the funds are a lot shorter than that today.

Reports are saying the funds could be as short as -350k contracts of corn. This is a RECORD SHORT.

The previous record is -344k back in 2019.

I am not saying we are going to rally, but most think this is about as short as they can get.

The problem is they simply have no risk here with weather not being a risk.

From Mark Gold of Top Third:

"The funds are short -500k contracts of corn & beans going into growing season, they feel comfortable about it because the US farmer is holding 3 billion bushels of corn. They are betting on the American farmer dumping this in July when they know they have a crop made. That's when they are going to start buying".

The last time the funds were this short corn for this time of year was 2020. It was about this time of the year where they started buying back. We all know what happened to prices at the end of 2020.

Chart Credit: Karen Braun

Today's Main Takeaways

Corn

Weather is bearish, with cool temps & rains. Yet, corn held in there to start the week. Which is a friendly sign.

However, right now the weather supply scare potential rally is likely out of the window.

This year has been a tough year. No one has even gotten the chance to sell corn above cost of production.

With the weather scare chances getting smaller and smaller, what's left?

A counter seasonal rally led by demand is a very real possibility.

We said that if this USDA report was negative, it would support prices longer term. Because it will create more demand.

At a certain point, low prices cure low prices.

Just take a look China's corn market prices vs the US. Unlike the US…………..

The rest of this is subscriber only. Subscribe to keep reading & get every update along with 1 on 1 market plans.

IN TODAYS UPDATE

Is China’s corn market telling us something?

Why we will struggle for a while

Why we could see counter seasonal rally

Will historical resistance turn into new support?

History doesn’t repeat, but it rhymes

Did corn find a bottom?

TRY 30 DAYS FREE

Try our full daily updates, signals, and 1 on 1 market plans.

Turn challenging price levels into opportunities.

Try completely free.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24