RAIN OR NO RAIN FOR EAST CORN BELT?

Overview

Grains absolutely destroyed today. Down double digits across the board, trading to our lowest levels since April for most of the grains. Taking out some technical support along the way.

Why did we get hammered so hard?

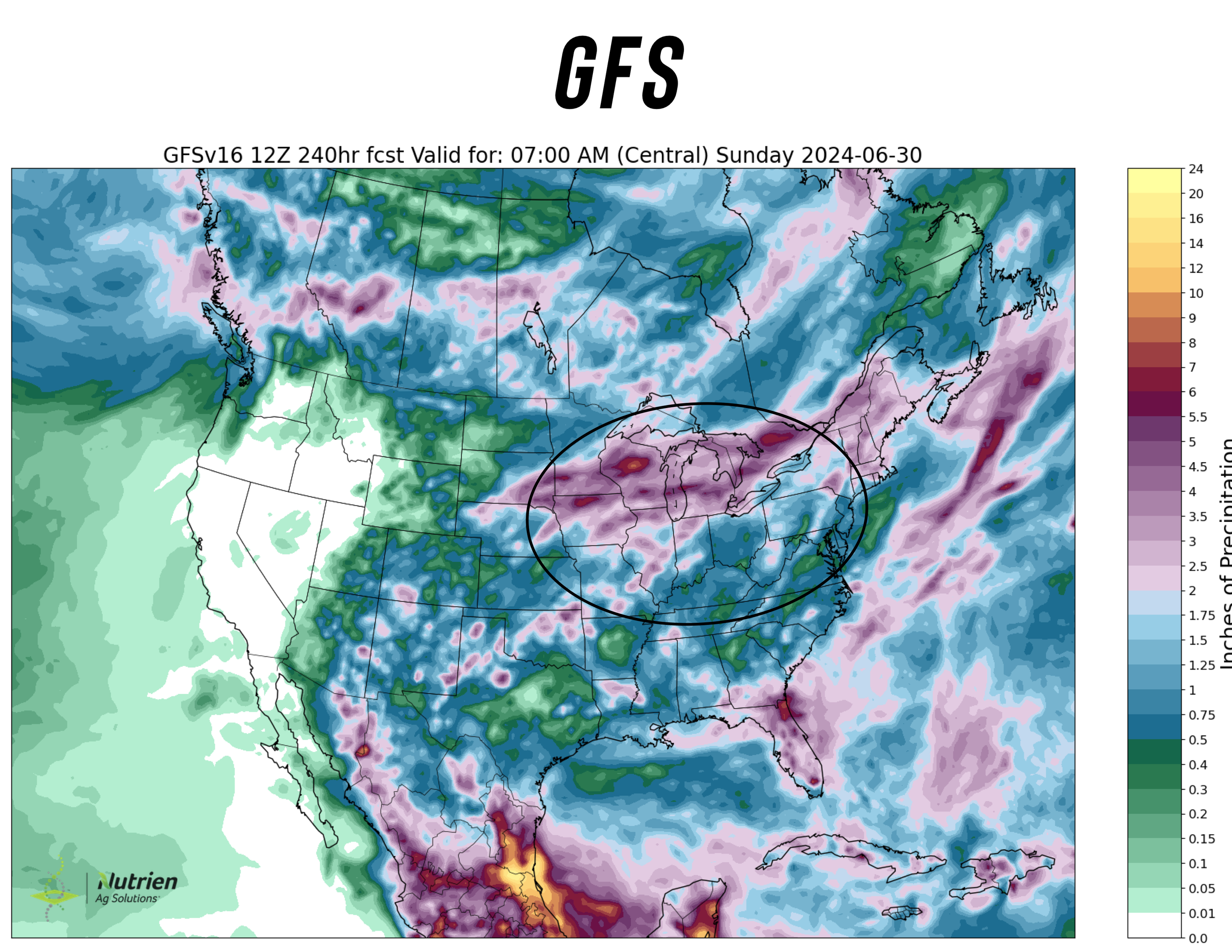

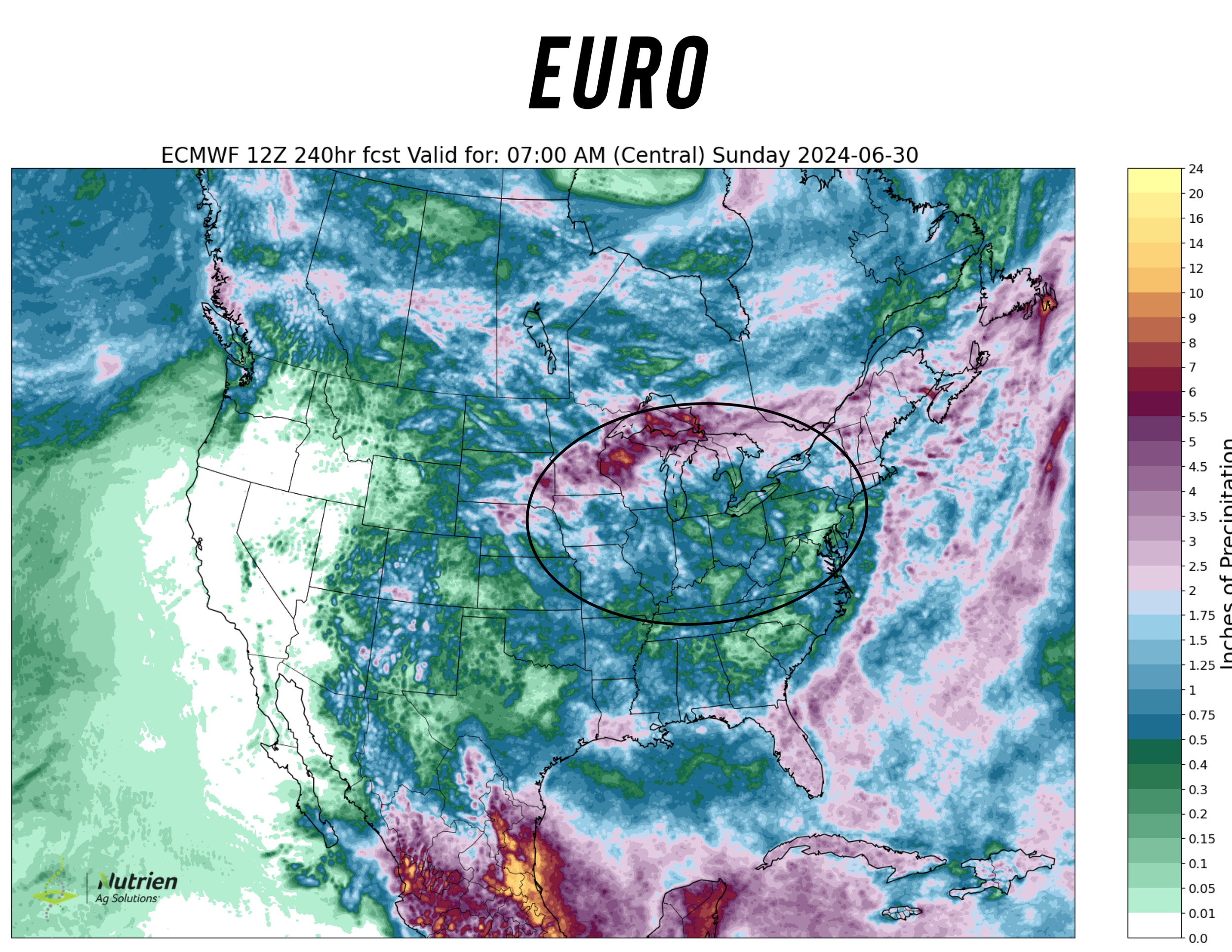

There are always two forecasts. The GFS and the Euro model.

Right now the GFS is saying that the eastern corn belt is in for some rain, while the Euro model says the eastern corn belt will stay dry.

The trade seems convinced that the GFS is the more accurate one.

Here is the difference between the two:

Whether that rain falls or not, will determine if we get that weather scare.

If the rain stays away or misses, corn prices will go probably go higher as it will likely create a scare.

If those rains hit like the GFS predicts, it becomes more unlikely that we will get a weather scare at all.

These rains (or lack there of) will be VERY IMPORTANT.

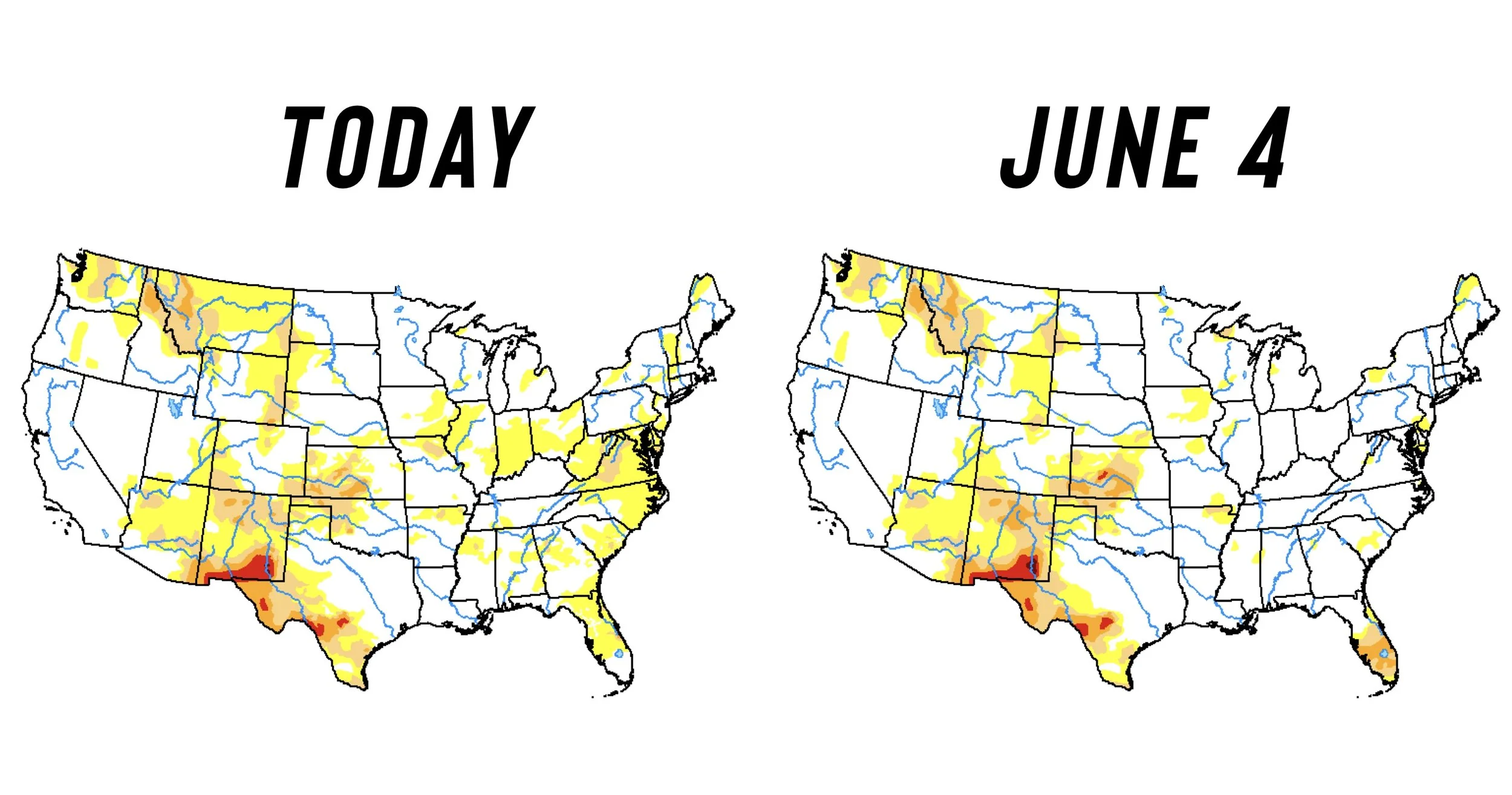

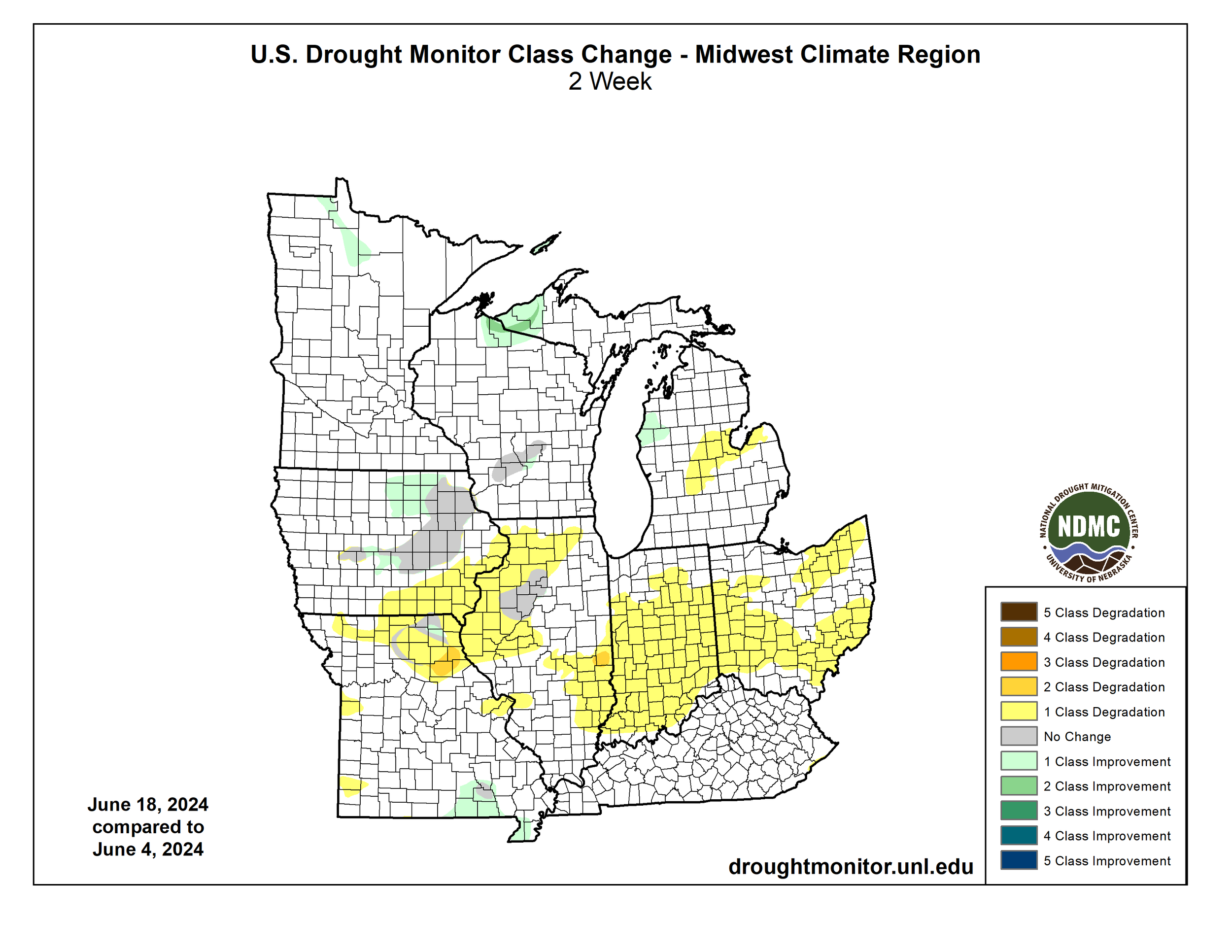

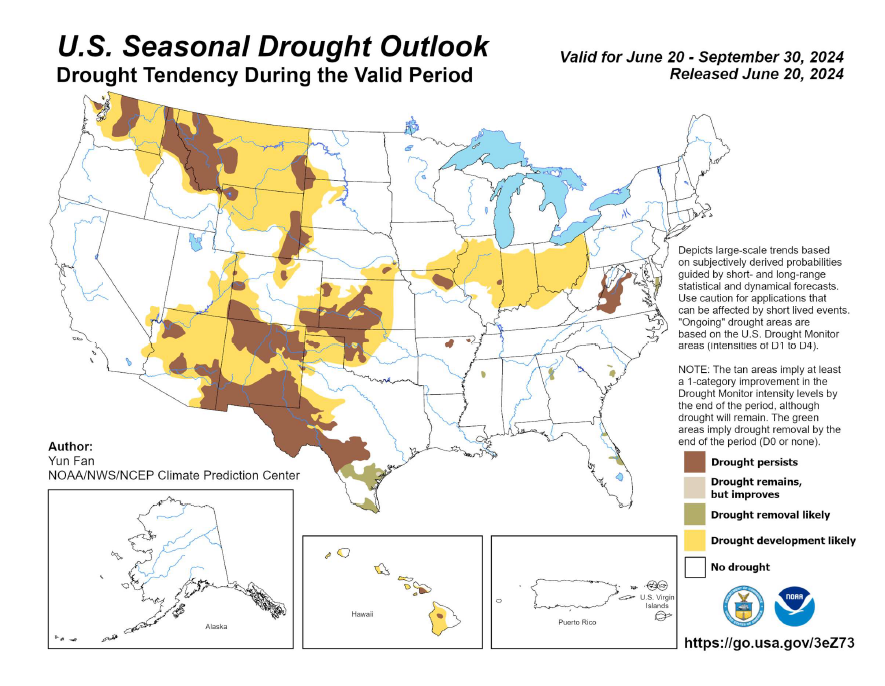

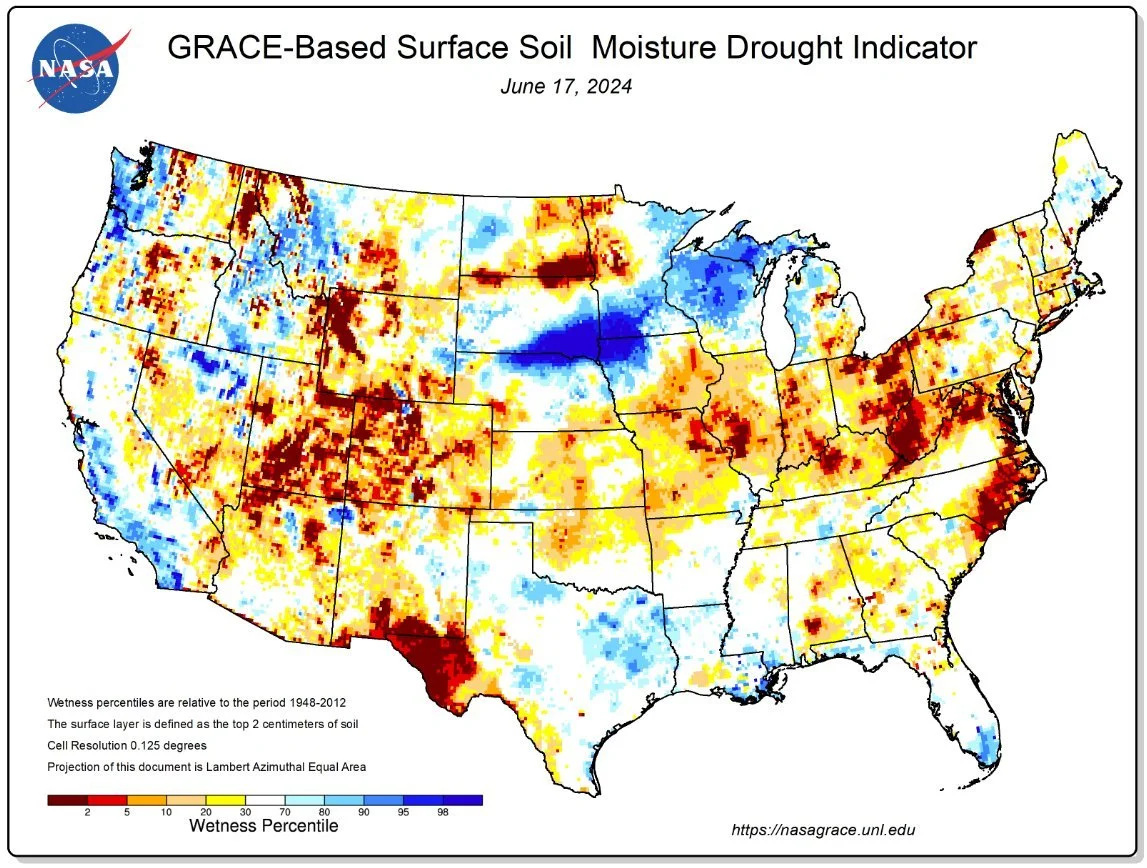

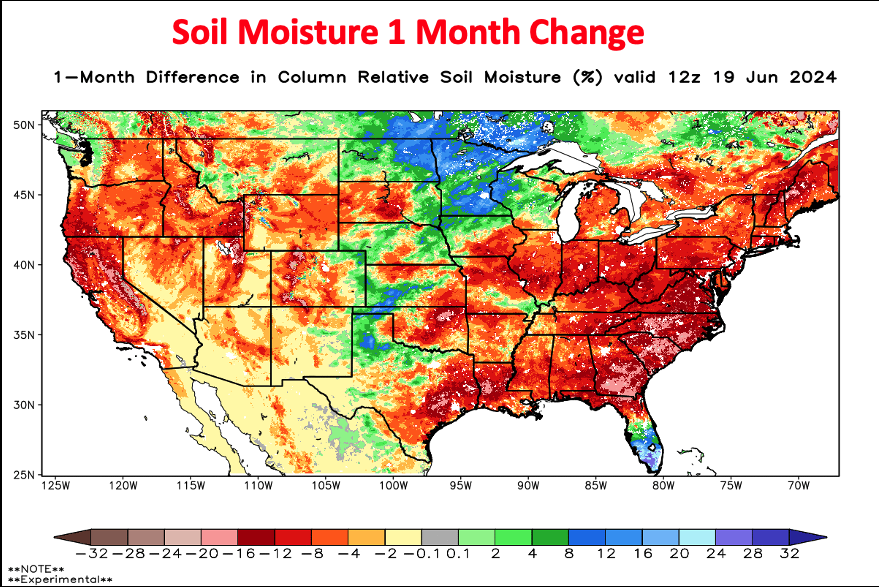

After being completely removed, drought has already started to pop back up in the eastern corn belt. It has only been a week or so..

Illinois crop ratings dropped 8% and 9% last week. The #1 bean & #2 corn growing state. IF that were to continue, the market would get excited.

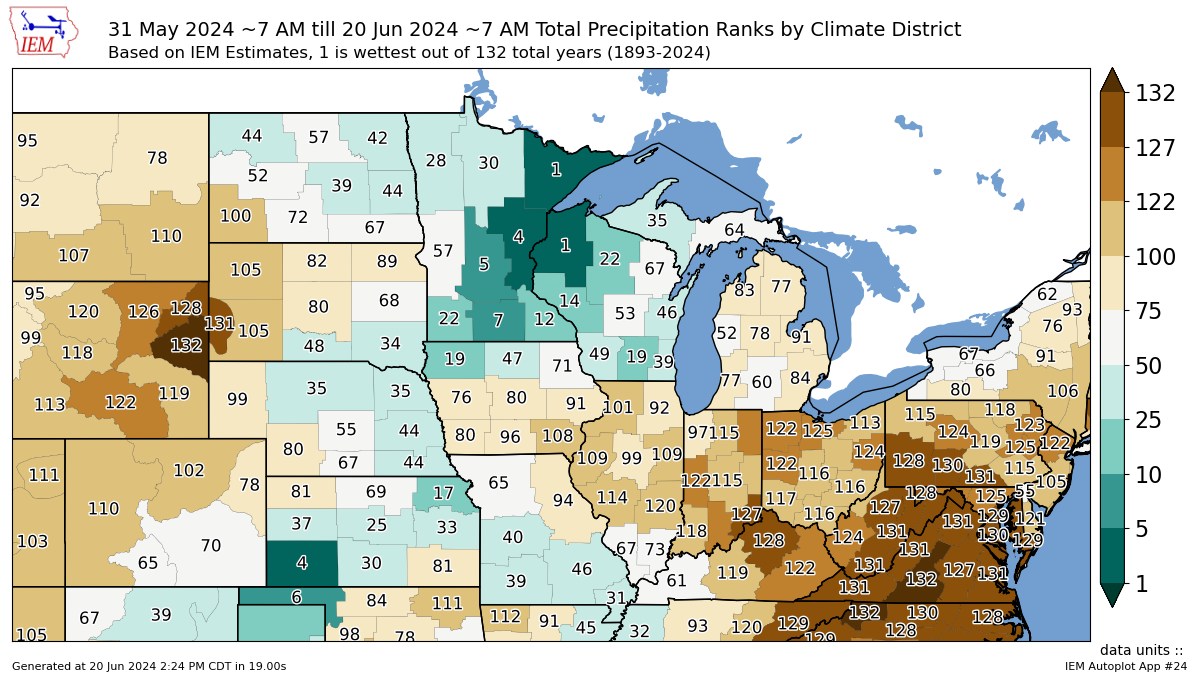

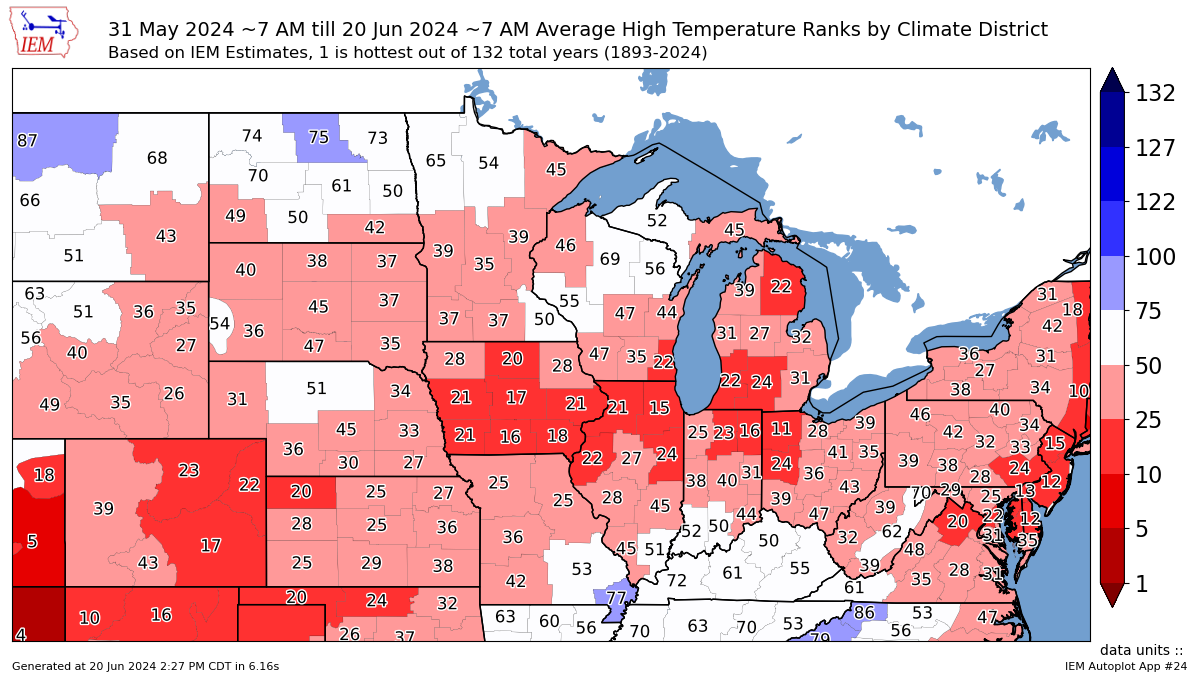

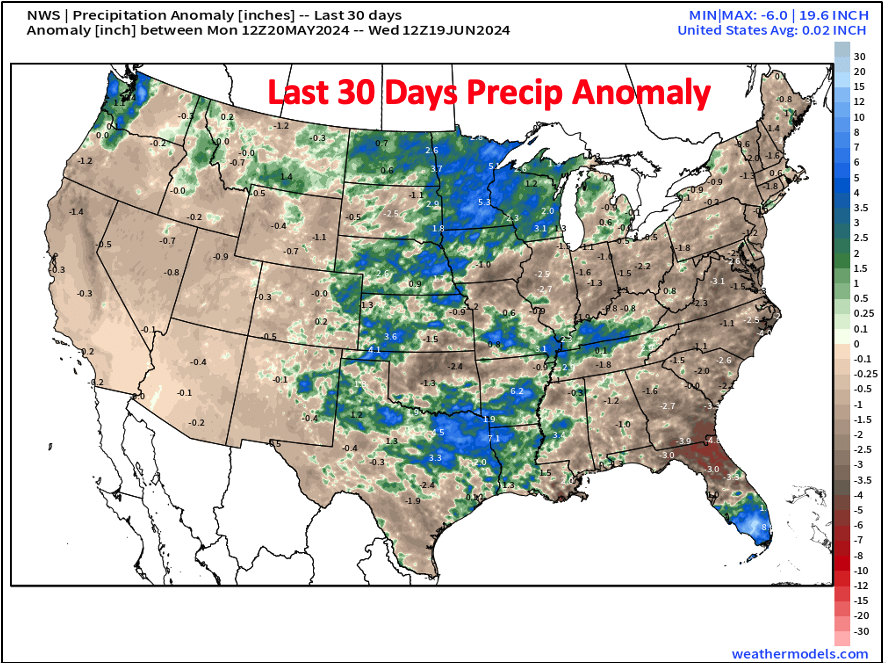

Here is how the month of June has shaped up so far.

This is the average precip & avg high temp.

Very dry & hot for the eastern belt.

Not only that, but July is expected to be even hotter and drier.

The eastern corn belt may be dry, but many other key growing areas are receiving a TON of rain.

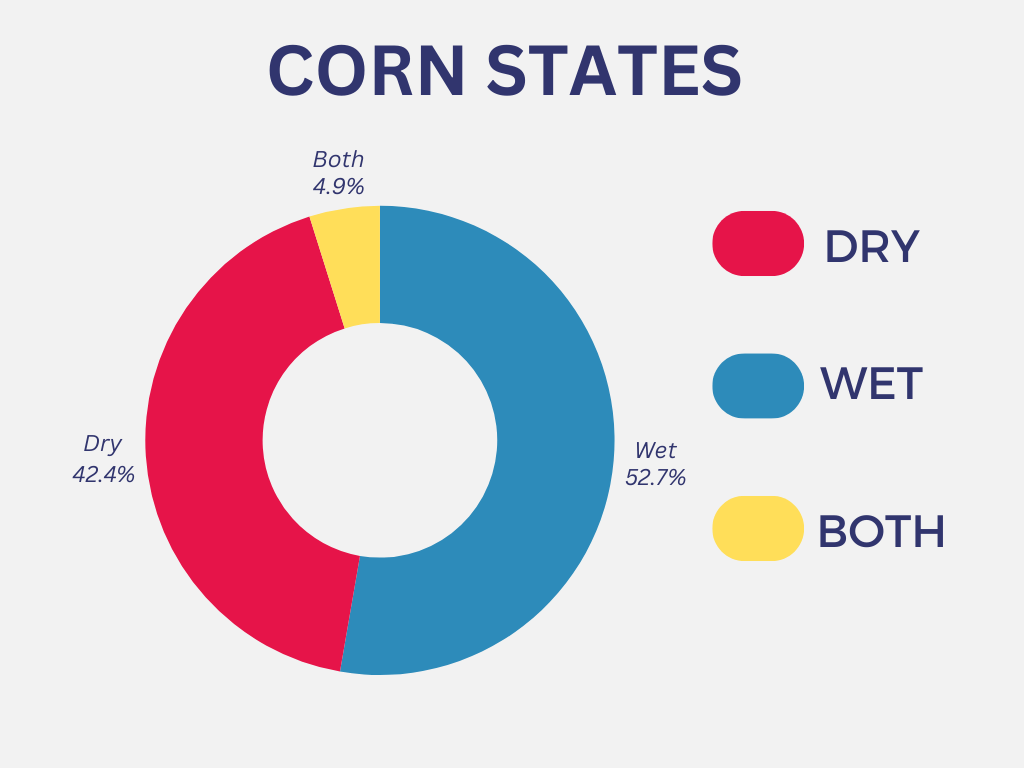

Dry vs Wet

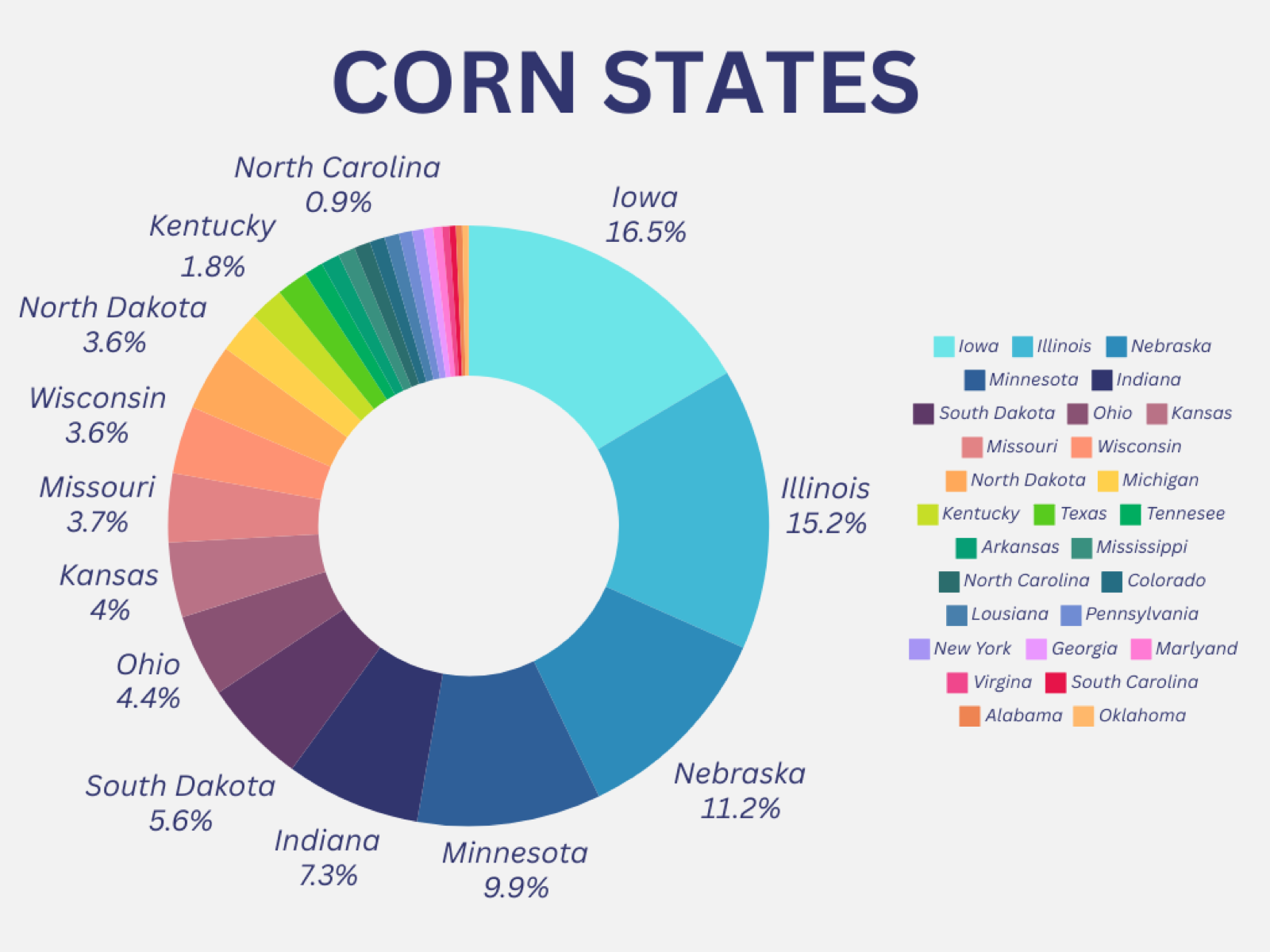

Take a look at these charts below.

They give you an idea of what % of production each state produces

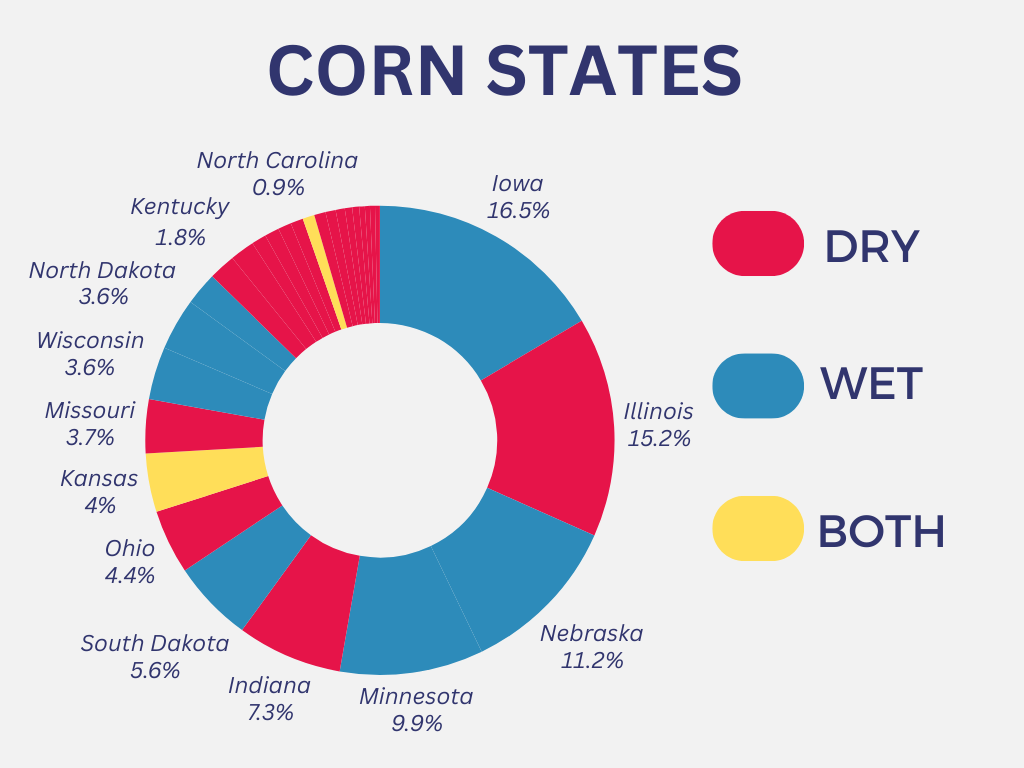

Here is that same chart categorized by wet, dry, or both.

As you can see, it is a lot of the bigger producing states that are receiving rain. Such as Iowa who accounts for nearly 17% of all production. Then you have Minnesota, Nebraska, and South Dakota.

4 of the top 6 producing states are receiving great amounts of rain.

Meanwhile, it is a lot of the smaller producing states that make up for the production areas that are dry.

Here is the last chart. It breaks down the dry vs wet areas based on % of production.

Nearly 53% of corn production is wet, where as 42% is dry.

Part of the reason why the market has……….

The rest of this is subscriber-only. Subscribe to keep reading & get every update along with 1 on 1 market plans.

IN REST OF TODAYS UPDATE

Fundamental & technical outlooks

Bullish vs bearish factors

Managing risk

Taking advantage of inverse in beans

And more

KEEP READING FREE

Comes with our daily updates, sell signals, & 1 on 1 tailored market plans. Turn challenging prices into opportunities. Try 30 days free

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24