WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

Overview

Grains higher to end the week ahead of the 3-day weekend. Soybeans lead the way, making a new high close and highest close since January 24th. While corn and wheat both bounce well off their early lows. Wheat manages to close above $7 for the first time in 287 days.

Weekly Price Change (July Contracts):

Corn: +12 1/4 (+2.71%)

Soybeans: +20 (+1.63%)

Chicago Wheat: +51 (+7.23%)

KC Wheat: +59 1/2 (+8.99%)

MPLS Wheat: +41 1/4 (+5.80%)

The long weekend added some uncertainty to the funds. As we have plenty of factors. We have US planting, with some nasty storms on the way in areas such as Iowa who have been hammered with rain.

This weekend is going to bring some rains, but after that the outlook turns a little more favorable. We are quickly approaching the point where weather for the crops in the ground is going to matter more than the ones not yet planted.

Wheat continues to find support from the supply scares with Russia and Ukraine's wheat crop. As estimates continue to fall for both. Weather in Russia is expected to remain dry for essentially most of June in the key growing areas. There is plenty of talk that this crop could wind up sub-80 MMT. The estimates back in March were 93. From a technical standpoint this close over $7 opens the door to higher prices.

Soybeans look very strong. Today we posted our highest close since January. Almost breaking past that key $12.50 resistance. Once we break above that, I think we run higher fast.

Earlier this week, China beans traded to new highs equivalent to $15.27. The rumors now are that China is looking for US soybeans, and that loads of US beans are on their way to China. Nothing yet confirmed.

Those were some of the things going on. Now let's jump into the good stuff…

Today's Main Takeaways

Corn

Corn didn’t scream higher, but the recent price action has been very friendly.

Today they tried to pound us lower but we crawled back. Now posting 5 straight days of higher lows.

Did you know that if you bought corn today and sold it on June 9th, you would’ve had a winning trade the past 12 of 15 years?

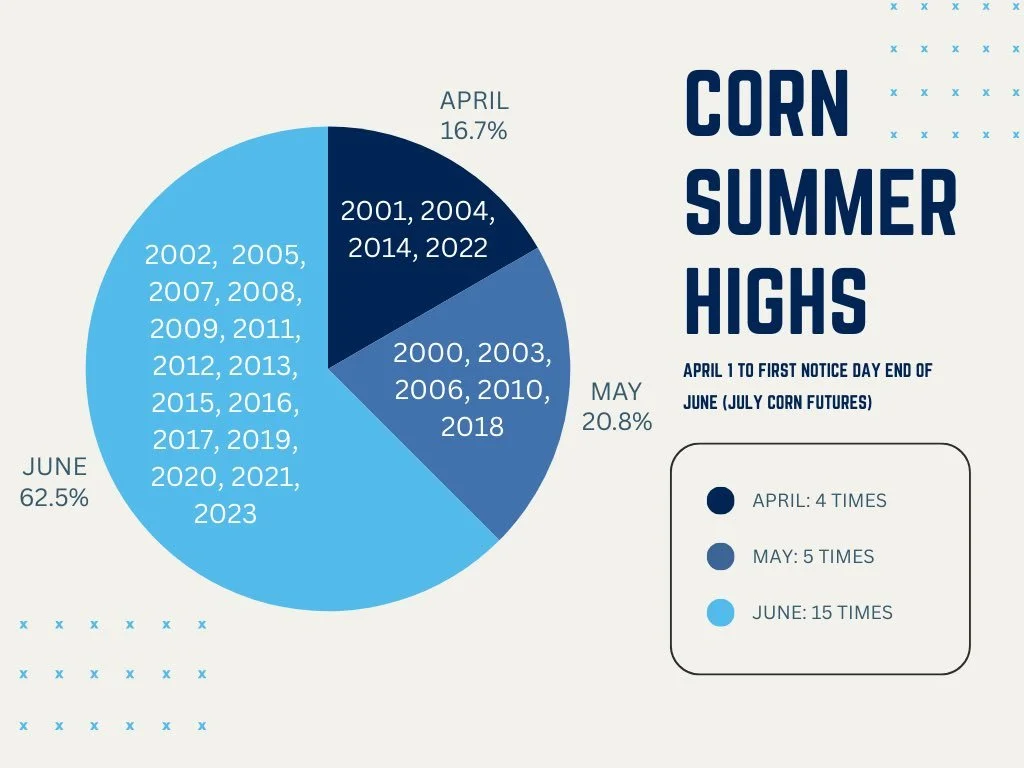

Let's look at when July corn typically makes it's summer highs (from April 1st until first notice day in June).

We have made our highs in June the past 15 of 24 years (63%). 7 times in the past decade (70%).

We have only made them in May 5 times since 2000 (21%). And ONLY ONE time in the past 14 years (7%). That being 2018.

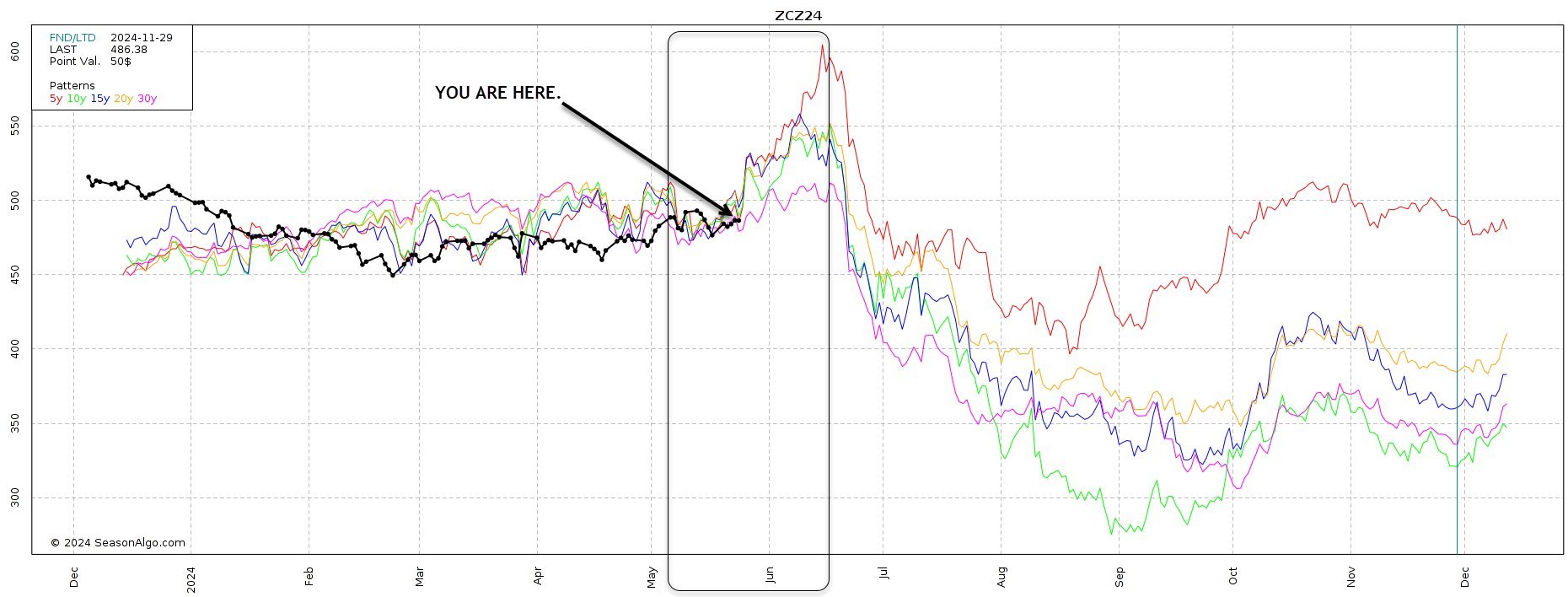

Now here is a seasonal chart from Darrin Fessler. As you can see, the 5yr, 10yr, 15yr, 20yr, and 30yr averages all point higher into June.

Do seasonals always work? Of course not. There will be years where corn doesn’t go higher in June.

But why do I think this year will not be one of those?

Just look at…….

The rest of this is subscriber-only content. Please subscribe to keep reading & get every update along with 1 on 1 market plans.

IN TODAYS UPDATE

Why I believe we will see corn higher

Why wet springs don’t make great crops

Price targets to layer off risk

Are soybeans ready to take off?

What is driving beans?

Why Russia & Ukraine situation could be a game changer

Wheat has tremendously upside, but manage risk. Ways to do so

KEEP READING FOR FREE

Try our daily updates & audio completely free for 30 days. Become a price maker.

SALE ENDS IN 3 DAYS

Our Memorial Day sale ends Monday. Comes with 1 on 1 market plans. Be prepared for every opportunity & get comfortable no matter where the markets go.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24