3-DAY SELL OFF CONTINUES

Overview

Grains take it on the chin again today, with their third straight day of losses.

One of the biggest things in the market lately has been the major correction we have seen in KC wheat due to the wetter forecasts. Now will these forecasts come to frution? We will have to wait and see, as recently they the long term forecasts have really been hit or miss. Mother nature will continue to play the biggest role in the direction of our markets.

Now on the surface, yes today was an ugly day. But if we take a deeper look the price action really might not have been as bearish as it looks on the surface. Spreads continue to tighten, as old crop continues to gain on new crop, which is actually typically a very bullish indicator of higher prices in the future.

If you scroll toward the end of today’s update, I included a very good write up from Roger over at Wright on the Market where he explains why the spreads are the most bullish indicator in the markets, especially on days like today.

If you missed it, listen to today's audio from earlier. In this audio we talk about spread action, what is going on with the markets, opportunities, risk management and more. Listen Here

***

Sunday's Weekly Grain Newsletter

Why We Could See New All-Time Highs

Read Here

Today's Main Takeaways

Corn

Corn futures lower again along with the rest of the grains for the third day in a row. When we take a look at the spreads though however, we see that July closed down nearly 11 cents but May was down just half a penny. Old crop gaining on new crop like this is usually a very bullish indicator that we have strength in our markets and we could be looking at higher prices in the future.

Recently corn has suffered from a lack of export business and there just isn't a huge demand story there right now. The weakness in crude has also added a bearish tone, although crude is higher here today.

A few other things bears have been looking at on these past three days of losses is a slightly improved weather forecast here in the US which currently shows less rain which could help planting, but we will have to see how these shake out. We also have the Russia and Ukraine situation, which hasn't provided any bullish surprises like bulls would have hoped. As we saw some resolutions for Ukraine grain to travel though countries such as Poland and Romania.

Right now we just don’t have that huge demand headline bulls would like to see. Previously we had south America headlines providing support but a lot of that is priced in for the time being.

Going forward, bulls would like to see some additional weather premium built in here to help break out of this recent slump. The market will start caring a lot more about planting delays if we aren’t 50% or so planted by the second weekend in May. Mother nature is really the biggest thing going forward. Bulls would also like to see Chinese demand pick up again to help support a seasonal rally. Our bias still remains to the upside as we expect our seasonals to carry us higher into late spring and summer. But we could definitely run into some pressure next week if the forecasts turn favorable for the crops so that is something to be aware of.

Corn July-23

Soybeans

Soybeans continue to fall from their recent highs, seeing the most pressure of the grains on today’s sell off across the board. With May closing down 14 cents and July down 19 1/2 cents.

The bean complex continues to suffer from a lack of exports and demand, with some concerns over possible weakening demand from China. As we had some weaker than expected export sales.

Brazil's bean harvest is the biggest thing weighing on beans. With Brazil beans being a lot cheaper than that of the US. Their massive crop is a concern for bulls as its wrapping up soon. Sitting around 90% complete.

But bulls also make the logistics argument and question if they will see problems down the road with actually getting the crop out of the country. Currently it takes about 3 months to get a shipload of Brazil's beans delivered.

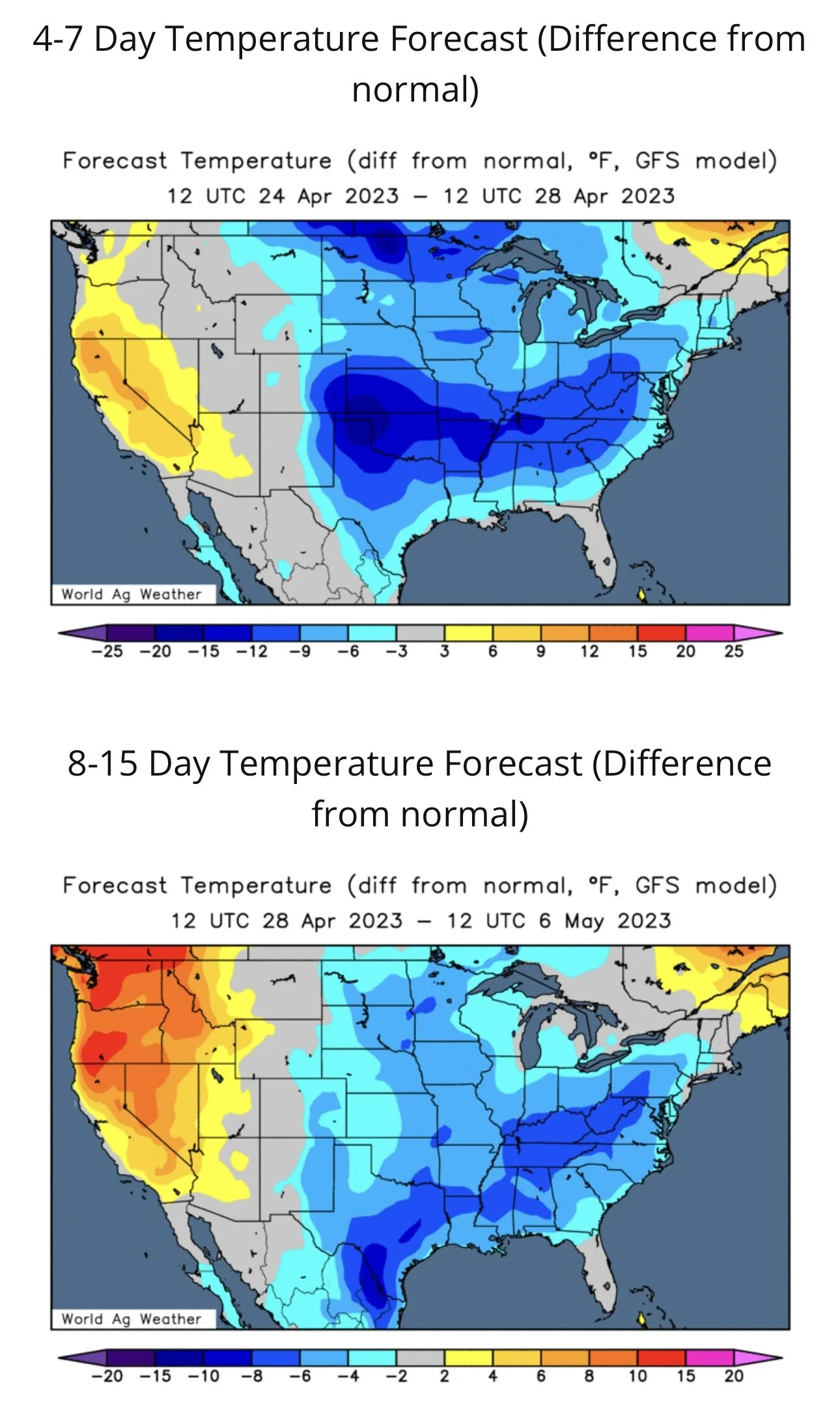

We do have some cool weather and late snow in areas of the upper midwest that are affecting planting areas. But similar to corn, the forecasts have shifted slightly more favorable which could look to pressure beans.

Soybeans July-23

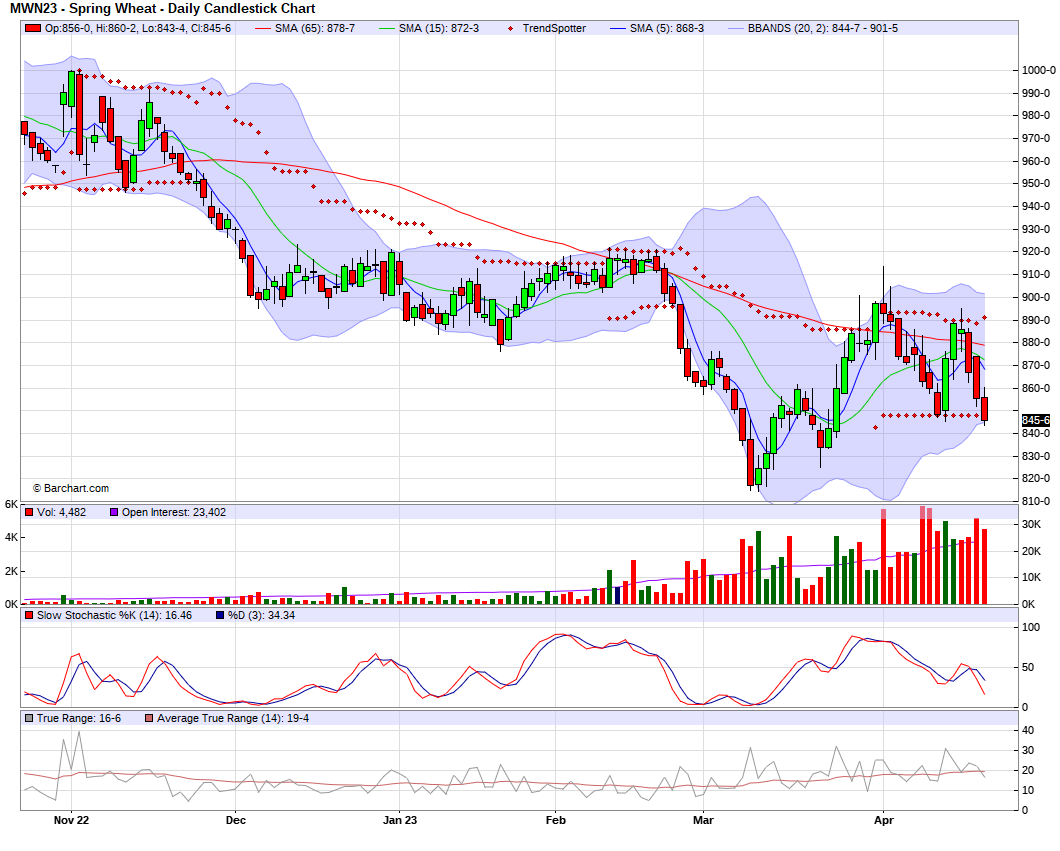

Wheat

Wheat continues to trickle lower, now back to right around its recent lows. As As Chicago and Minneapolis see losses of 7 to 9 cents, while KC holds up fairly well following yesterday's blood bath. Closing just a penny lower.

The biggest thing in the wheat market right now is the rain forecasted for Kansas growing regions, which has had KC wheat under pressure for the past few days. The forecasts show rain, but lately these forecasts haven't been the most reliable. So we will have to see what actually comes of these forecasts and how big of an impact it makes.

Nonetheless, the market is trading like these rains will make Kansas have a record crop. I think this downward move was a little overdone given just how poor the crop is.

Additionally adding pressure, we have vessels continuing to be shipped in the Black Sea. With Russia looking somewhat cooperative (for now). However, they are still threatening to not extend the deal when the time comes. Most think Russia is bluffing, and think we do see the deal renewed. But I think there is still a chance for a few wild cards left to be played.

Weather and war are still the biggest things that will continue to dominate the wheat market, and sadly they just haven't been there to provide a ton of support or create that bullish catalyst we've been looking for.

We have a terrible winter wheat crop. One of the worst on record, yet when there is rain in the forecast the market panics. Of course, there is always the chance for headlines to read, "Russia backs out of Black Sea agreement". I wouldn’t bank on that happening but its a real possibility. Or perhaps we get some more weather scares to provide support. With the funds being as short as they are, we are always one catalyst away from seeing things shift higher.

Chicago July-23

KC July-23

MPLS July-23

Inverted Market & Bullish Spreads

From Wright on the Market,

Early Tuesday, 19 April 2023:

"Good morning, Roger,

I have two basis contracts on old corn at Poet.

One 17¢ over July delivered in March.

One 23¢ over July to be delivered in April, which is nearly half delivered.

Now the basis is at 40¢ over the July if I did the same contract today. Is there a way I can improve the basis on my current contract?

Also, the carry from now to July is nearly 34¢ inverse. I have not kept up very well on your emails, but I did notice you have been talking about the carry. Am I correct in thinking they want corn now not later? And so that signals a higher demand or strong demand later, therefore strong prices later?"

-

Greg, once the basis is set, there is no cost-effective way you can change the basis without costing you the difference between your locked-in basis and the current basis and only then, if the merchandiser will let you, which he probably will not do. He is making money on the basis appreciation instead of you. Your merchandiser wants to keep it that way.

The only way you could have captured that basis appreciation is to leave the corn in the bin or put it on DP with your merchandiser, in which case, he would charge you a DP fee that eats up the basis appreciation. That is why there are DP charges. If a merchandiser offers free DP, it means he expects the basis to improve very little or none at all and is quite content to have an interest free, unsecured loan from a farmer. That is what a DP contract is.

That money lost on the basis appreciation can be recovered indirectly, but you will need to use a futures trading account to do it.

Yes, you are correct, the merchandisers across the country want corn now, not later. That is why, on the close Tuesday, May corn was 33¢ premium to the July. The futures market (the world market) is so eager to buy corn, it is paying a large premium for corn delivered in May rather than July. Storing corn has been a loser so far this year. Not only is the market not going to pay farmers to store corn, on Tuesday, the market was going to pay farmers 33¢ less for corn after storing it for two months! This is what is called an inverted market, which simply means there is no return to storage. Inverted markets are unusual, not rare, but unusual.

Yes, an inverted market is very likely to see higher futures prices or a firmer basis or both in the coming weeks or months. Today (Wednesday 19 April 2023), everything was lower. Bummer! It was very disappointing given the weather and recent export sales of corn. Is anything a better indication of market outlook than the net change in price?

Yes.

Today, corn futures were smartly lower. Bearish!

The acid test to measure the probability of higher prices in the coming weeks or months is the spread relationship between the futures contract months. It is the most reliable indicator of overall market strength (or weakness). The price change of May corn in relation to July corn is what to keep an eye on.

May corn was down 5¼¢ today. July corn was down 8¢. The May to July corn spread inversion went to 35¾¢, 2¾¢ more than yesterday. What does that mean?

Even though the market was lower today, the market is willing to pay an even larger premium for corn in May than July. That is, by far, a much more reliable longer-term indicator of price direction than the net change in futures prices.

Futures markets go up and they go down. It is called profit-taking by the speculators, who trade futures to make profit. Grain buyers and sellers trade futures to reduce risk. The buyers and sellers of cash grain know what they need to buy and what they need to sell to meet inventory and cash flow needs.

There is nothing more bullish than an inverted market getting even more inverted during a down day. So, yes, corn is going higher, probably much higher. Why else would the market increase the premium for nearby delivery over deferred delivery? The only reason is they expect when the deferred delivery dates become nearby delivery dates, the price will be even higher than it is now.

Want to Receive Every Update?

Try our 30 day trial to receive every single one of our updates, audios, and weekly grain newsletters with all of our thoughts on the grains. Every update sent via text & email.

The Bottom Line

From Farms.com Risk Management,

The negative macro environment and dark clouds continue to cast a shadow on the grain/commodity complex. U.S. export sales were flat out unimpressive, which added to the macro pressure on grain markets today, following through on yesterday's lower performances. It does not take a whole lot to turn market sentiment at the moment and after a strong start to the week in the grains, trade has turned very defensive resulting in more uncertainty and volatility, but new crop grain futures remain undervalued all trading below the mean/average or the 200-day moving average including cotton now after today’s move lower. This negative macro sentiment could turn for the better but its up to U.S. Fed Powell the other “Gospel Truth” and his post narrative at the May 2-3 meeting.

USDA is currently forecasting 47 mmt in 22/23 corn sales; this may suddenly look a little high again considering continued competition out of South America along with trickles of grain flowing out of the Black Sea (but perhaps not after mid-May?).

U.S. soybeans are expensive compared to other origins, especially vs. Brazil. There’s a shift in demand from U.S. to Brazil if U.S. export sales keep weakening over next few weeks? Shipping line-up data shows Brazil is set to export two vessels chartered by Bunge and The Andersons with at least 79,000 mt of soybeans to the U.S. between April 25 and May 1 but the USDA says we have plenty with 22/23 U.S. soybean ending stocks at 210 million bushels????

A resumption of export inspections out of the Black Sea was announced yesterday after a couple days' pause, which is adding to the price pressure. Forecasts for better rain opportunities for a portion or HRW country could is also a headwind although it is likely too late to do much good for this battered crop. The 2023 Wheat Quality Council Tour from May 15th – 18th will provide more insight.

There is no need to panic, let’s not get caught up in the noise and headline risk. The U.S. stock market was forecasting a recession last October at 29,000 now 34,000. Q1 earnings will be better than expected. The grain markets continue to ignore the fundamentals but will start to worry about planting delays if we are not 50% planted by Mother’s Day weekend May 14th.

Check Out Past Updates

4/21/23 - Audio Commentary

Ugly Day On the Surface, but Spreads Tell Different Story

4/20/23 - Audio Commentary

Patience & Seasonal Opportunities in the Market

4/19/23 - Market Update

Grains Pressured Across Board

4/18/23 - Audio Commentary

Mother Nature & Seasonal Trends

4/17/23 - Audio & Market Update

Money Flowing Into Grains?

4/16/23 - Weekly Grain Newsletter