WHAT’S THE BRAZIL STORY?

MARKET UPDATE

Futures Prices Close

Overview

Grains mostly lower ahead of the holiday tomorrow. Remember the market is closed tomorrow, and Friday is a short day (markets close at noon CT).

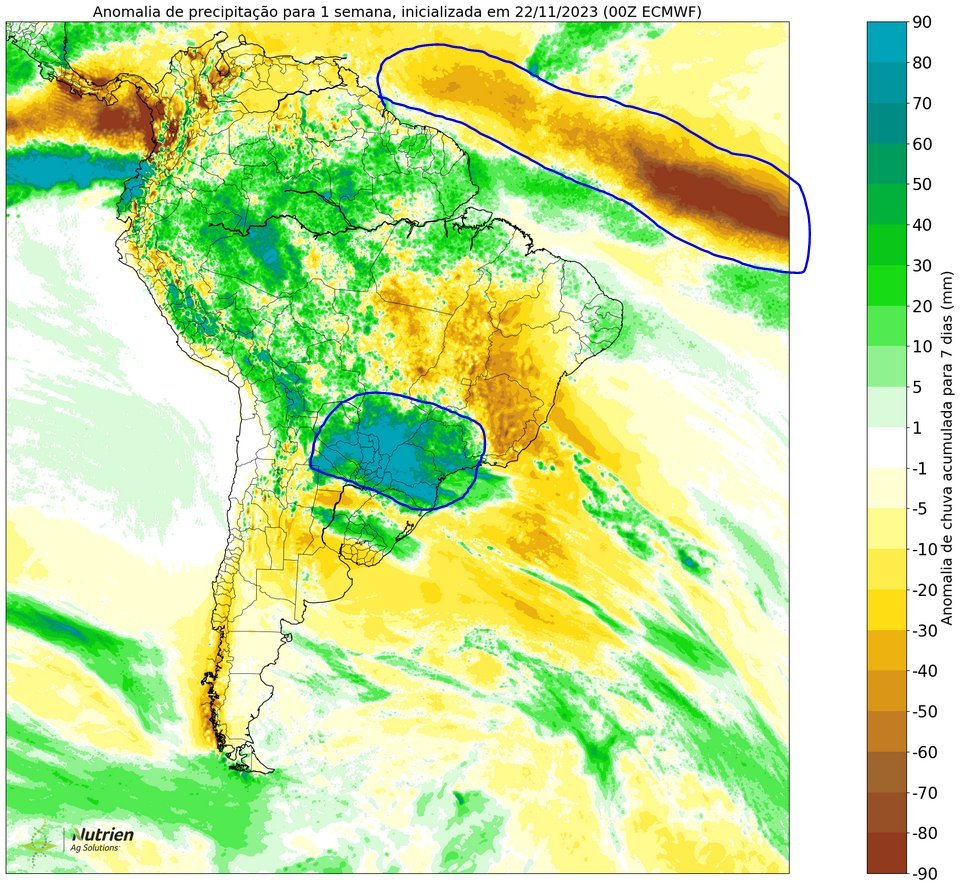

Beans were pressured the hardest. Most of the selling came from the forecasts adding a few showers to northern Brazil over the few days. These rains are not a trend changer, but are providing a little bit of relief. Enough to see some profit taking here, given that beans are up nearly $1 since October 11th.

We had a few flash sales this morning. Usually we get corn or bean sales, but today it was China buying wheat. We also saw some corn get sold to unknown. There is some chatter about China making bean purchases as well but nothing has been confirmed.

The funds remain heavily short corn and wheat, while long beans. Looks like they wanted to reduce some risk in their long bean position ahead of what will be a near 4 day weekend.

We all know the biggest headline out there right now is Brazil weather.

Even with the obvious concerns, Agroconsult just pegged Brazil to have a record 161.6 million metric ton crop this year. Above last year's 159.7 million. This of course added more pressure to beans today.

Why did they raise their number despite the concerns?

They said it was largely due to the near 3% increase in planted areas as well as the belief that there will be greatly improved yields down south where they have been receiving an awful lot of rain. So their thought process here is that the improvements south will outweigh the losses more north.

However, I wouldn’t be so sure that this heavy rain will "improve" yields.

Here is what 247 Ag had to say:

"We call this a wet sandwich. Nearing 80 days of too much rain in Southern Brazil. Most chatter has been about the drought to the north. Significant losses will be seen where it is too wet in the South. Together, very significant. These are nasty trends."

Jason Britt - President of Central States Commodities:

"Totally agree that this is being overlooked big time. I have more farmers tell me they have lost more yield in wet years than dry. (excluding an all out drought of course)."

We have been saying for the past few weeks that December weather will be FAR more important than this November weather we have seen. If December is anything like November, Brazil will be in for a major problem.

But then again, I’m far from a weather man. Here is what Darren Frye of Water Street Consulting had to say:

"December in my opinion will worsen and continue into early January. 40% of the crop in Brazil has been battered by drought conditions. While the other 25% of the crop has been pummeled by too much rain. If the weather veriies that I expect then yield losses will surpass 20% (33 million metric tons). World balance sheet will tighten to 85 to 90 million and US acres have a battle in the spring of 2024. Stay tuned."

Not a bad argument. It is still a tad early to say their crop is made or destroyed. Anything can happen from now until January. But what we do know is that so far, growing conditions have been anything but favorable. Too much rain, the crops drown. Not enough, they die. Would hate to see what happens if this trend continues in the months it actually matters (December & January).

So what's the current outlook for Brazil?

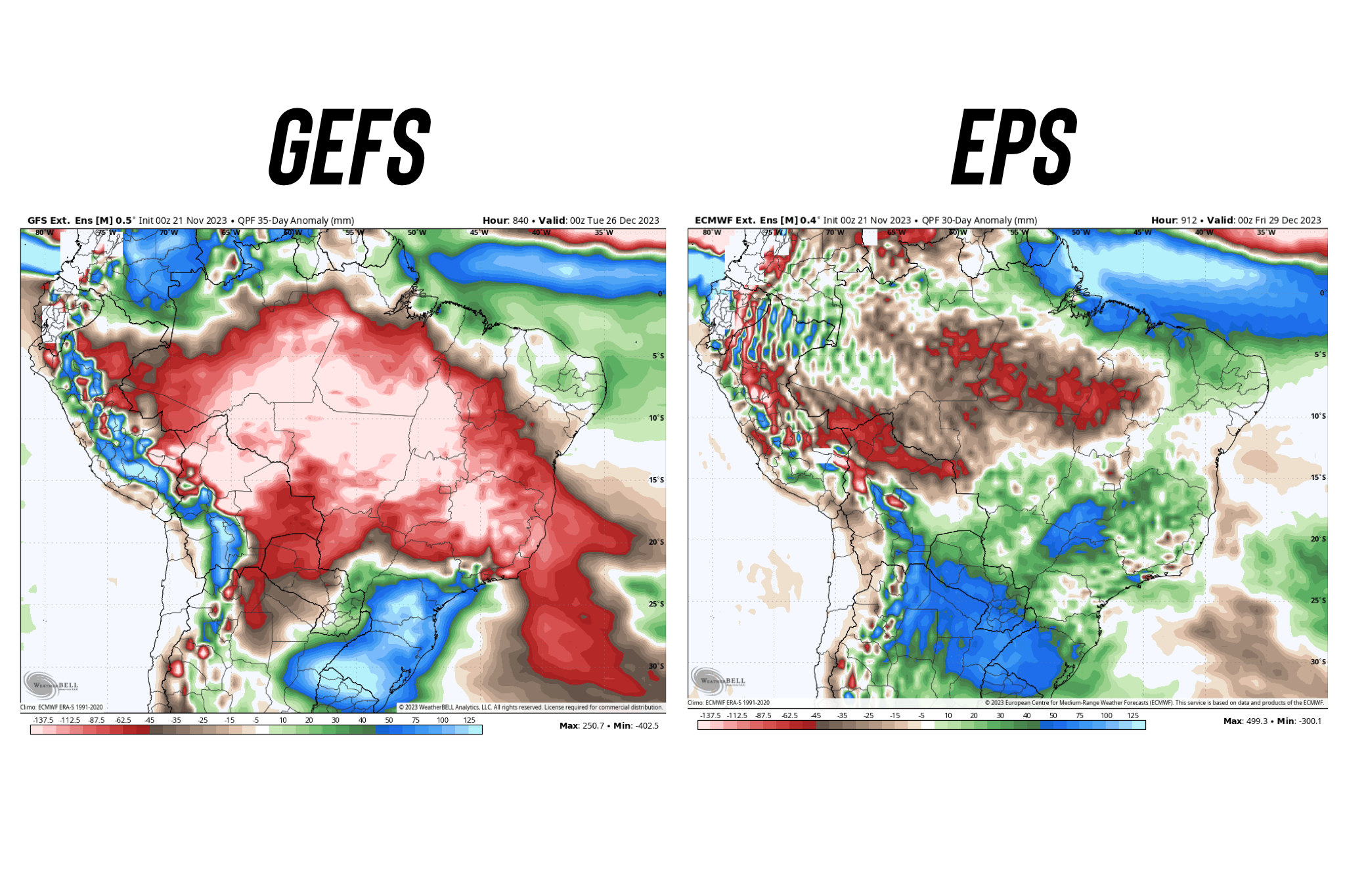

Well, it's a tale of two stories. If we take a look at these forecasts, one is the GEFS and the other is the EPS.

The GEFS suggests it will be much drier while the EPS suggests we are in for a wet pattern change.

Who knows which one will be more accurate. But if the last few weeks tell us anything, the GEFS has been far more accurate.

Today's Main Takeaways

Corn

Corn continues to chop around near the bottom of it's recent range.

The biggest thing….

The rest of this is subscriber-only. Subscribe to keep reading & receive every exclusive update.

TRY FOR FREE

Check Out Our Junior Price Maker Program

Become a Price Maker. Limited spots.

Check Out Past Updates

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23

DO THESE BRAZIL RAINS MATTER?

11/16/23

WAYS TO OUTPERFORM THE MARKET

11/15/23

FINDING THE RIGHT GAME PLAN

11/14/23

DEMAND & SOUTH AMERICA

11/13/23

CORN & BEANS RALLY. WHY THERE IS MORE UPSIDE

11/10/23