HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Overview

Grains lower for the 6th day in a row. Intially, grains were higher despite the phenomenal corn crop ratings, but we gave back all of the gains ending the day lower.

Part of this recent rally was due to the idea of us being too wet which brought uncertainty. That uncertainty is gone now.

Yes a good chunk of crops were not planted in good conditions. But the market does not care "yet".

The effects of a crop planted in the mud, the nitrogen losses, compaction issues, poor root structure. The true impact of those issues will not be known until later in the growing season.

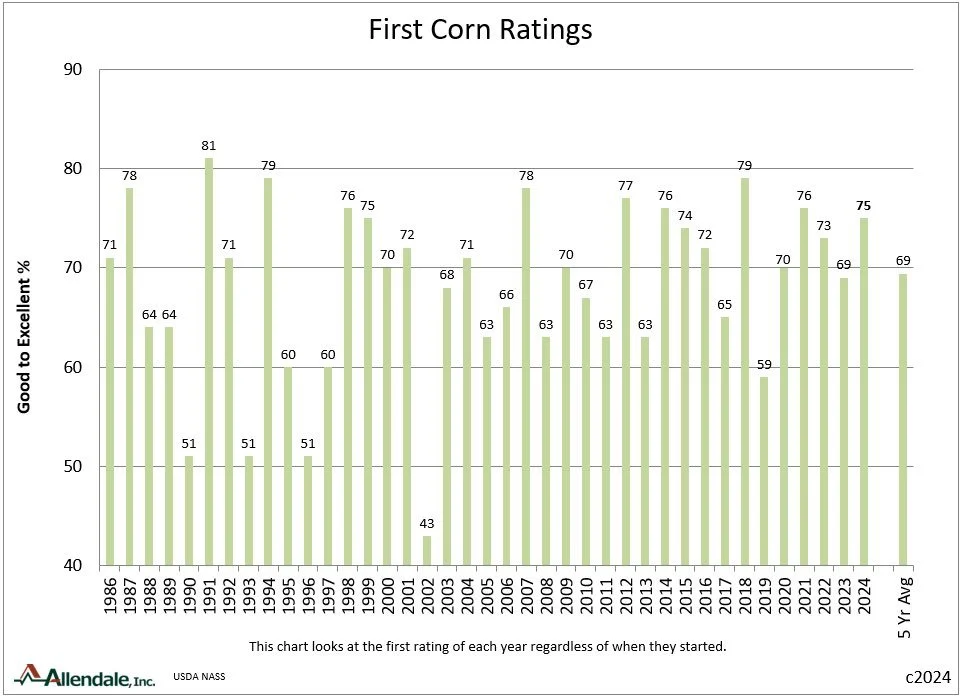

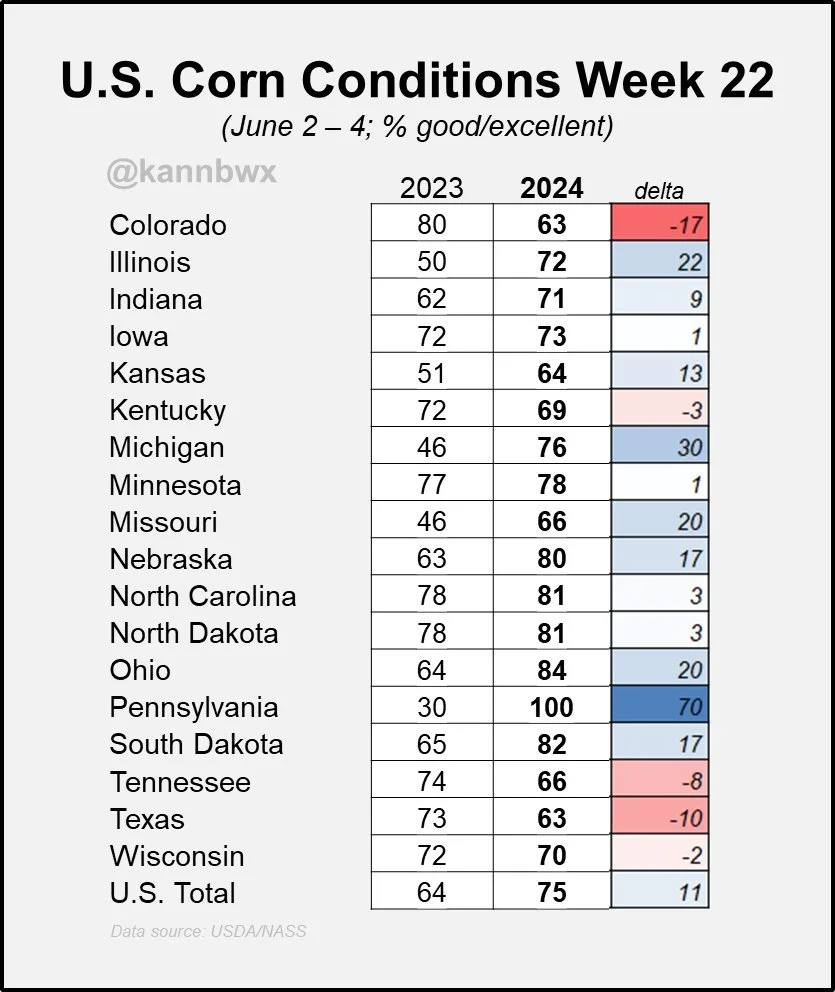

Corn crop ratings came in at 75% G/E. The 6th best in the past 20 years.

Above the 70% estimates and last years 69%. The 5 year avg is 69% as well.

(Chart Credti: Karen Braun & Rich Nelson)

Right now the market is pricing in the possibility of a trendline yield crop.

What is often more important than crop ratings themselves is the price action after. Yes, we had a poor close on the charts and the charts do look vulnerable. But the fact that corn opened lower then was trading higher after these numbers provides some optimism.

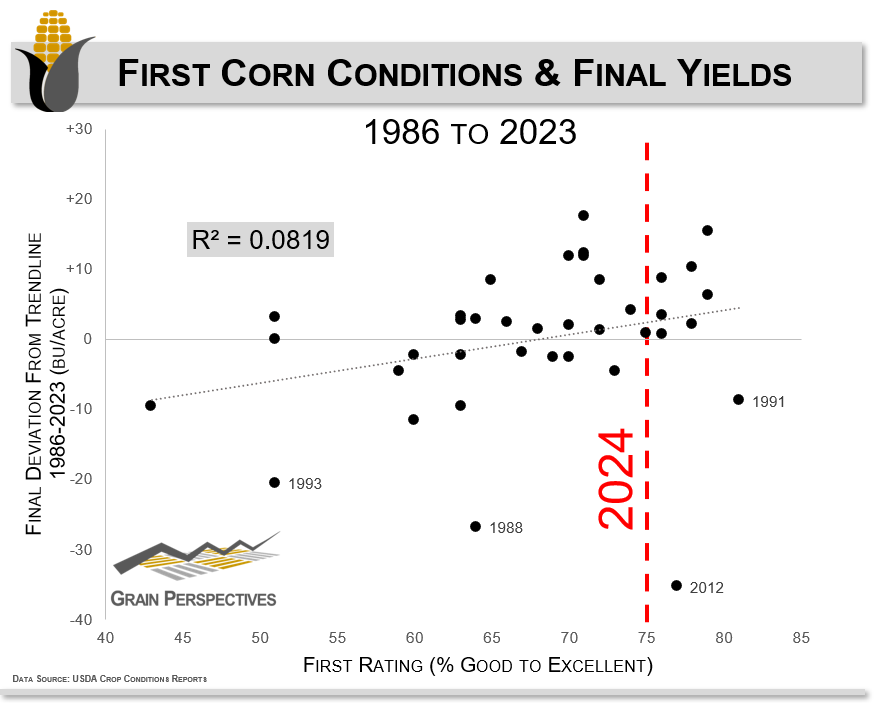

Do these strong initial ratings matter?

75% is good, but it's not amazing. We have seen a lot of years where we are at 70% and there isn’t really any direct correlation from initial ratings to final yields.

I mean these numbers are calculated by local experts. Just 2-3 people per county using an eye test on the crops and sending back the results. They don’t use anything scientific. No satellites, no surveys, no hard data. But this is what the market trades.

However, what history shows is that when crop ratings are 75% or better to start, we have seen near or above trendline yield every year except 2012 and 1991.

(Chart Credti: Mathew Pott)

On the flip side, we have never seen a record yield when corn planting was less than 50% as of May 12th. This year we were not at 50% as of May 12th.

Personally, I don’t put too much into these initial ratings. The initial ratings don’t provide any hard data and we have an ENTIRE growing season ahead where anything can happen.

From Karen Braun:

"US corn crop health is better than average, but overall conditions in Crop Watch 24 fields are below average, mostly due to emergence issues related to spring rains. The best conditions are in Indiana and Ohio, but Nebraska isn’t looking great"

Short term no, there is no reason for this market to magically see a major rally. That would take a weather or demand event. But this downside move was overdone.

For now, a majority of this bearishness in corn and soybeans is priced in. I don’t see how or why traders would continue to push this thing lower and lower. It is simply too early and the market knows the potential problems we could have later this year. Still too much possible uncertainty. It is going to be hard for big money to find a bullish story right this second, but we all know how quickly the tides can change especially when you plant these crops in the mud...

Today's Main Takeaways

Corn

Corn planting is 91% complete.

Which means rain now is bearish. There will be 0 more discussion of delayed planting. Only the impact this wet spring had.

Wet springs bring a ton of potential problems from an agronomy standpoint.

Although yes, this……..

The rest of this is subscriber only. Subscribe to keep reading & get every update along with 1 on 1 market plans.

IN TODAYS UPDATE

Will wet spring effects happen later this year?

Brutally hot summer on the way?

Russia concerns

Will we get another Russia scare?

And more…

TRY OUR UPDATES FREE

Try our daily updates completely free for 30 days. Be comfortable no matter what direction the markets go. Comes with 1 on 1 market plans.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24